Noticias del mercado

-

23:46

Schedule for today, Wednesday, Jan 03’2018 (GMT0)

00:01 Japan Bank holiday

08:15 Switzerland Retail Sales (MoM) November -1.5%

08:15 Switzerland Retail Sales Y/Y November -3.0%

08:30 Switzerland Manufacturing PMI December 65.1 64.6

08:55 Germany Unemployment Rate s.a. December 5.6% 5.5%

08:55 Germany Unemployment Change December -18 -14

09:30 United Kingdom PMI Construction December 53.1 53.2

15:00 U.S. Construction Spending, m/m November 1.4% 0.8%

15:00 U.S. ISM Manufacturing December 58.2 58.2

19:00 U.S. FOMC meeting minutes

20:00 U.S. Total Vehicle Sales, mln December 17.48 17.4

22:30 Australia AIG Services Index December 51.7

-

22:09

Major US stock indexes finished trading in positive territory

Major US stock indexes rose on the first trading day of 2018, helped by a rise in the price of shares in the commodity sector and the services sector.

In addition, data for December showed a marked improvement in the production conditions in the US. The latest growth was confirmed by a faster increase in output and new orders, supported by demand from customers. In accordance with the stronger production growth, employment has grown at the fastest pace since September 2014. Incomplete production has grown at the fastest rate since October 2015. Delays in the supply chain and an increase in the global demand for resources pushed up costs, while the inflation of procurement prices remains high overall. The inflation of the selling prices, however, is relaxed. Business confidence remained strong, due to more favorable demand conditions. The seasonally adjusted final index of purchasing managers in the US industry from IHS Markit (PMI) rose to 55.1 in December, compared with 53.9 in November. The last value of the index was the highest since March 2015, indicating a better health sector.

Most components of the DOW index recorded a rise (20 out of 30). The leader of growth was the shares of The Walt Disney Company (DIS, + 3.87%). Outsider were the shares of The Travelers Companies, Inc. (TRV, -2.76%).

Almost all sectors of the S & P index finished trading in positive territory. The commodities sector grew most (+ 2.2%). The decrease was shown only by the utilities sector (-0.6%).

At closing:

DJIA + 0.42% 24,823.53 +104.31

Nasdaq + 1.50% 7.006.90 +103.51

S & P + 0.83% 2,695.80 +22.19

-

21:00

DJIA +0.25% 24,780.46 +61.24 Nasdaq +1.31% 6,994.08 +90.69 S&P +0.65% 2,690.93 +17.32

-

18:00

European stocks closed: FTSE 100 -39.67 7648.10 -0.52% DAX -46.25 12871.39 -0.36% CAC 40 -23.96 5288.60 -0.45%

-

15:45

U.S.: Manufacturing PMI, December 55.1 (forecast 55)

-

15:31

U.S. Stocks open: Dow +0.53% Nasdaq +0.52%, S&P +0.47%

-

15:25

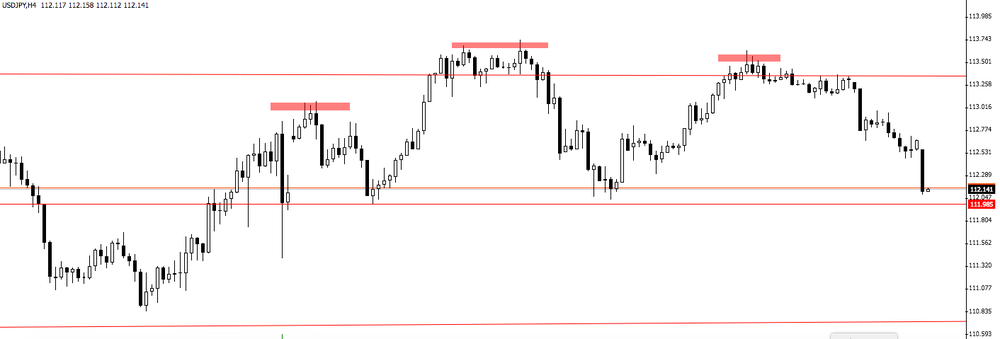

USD/JPY 4 hour time frame chart

USD/JPY has been following a bearish movement on the last few days.

However, as we can see on 4-hour time frame chart, the price is forming a chart pattern (head and shoulder) which can bring a more downside movements in this pair.

-

15:16

Before the bell: S&P futures +0.35%, NASDAQ futures +0.42%

U.S. stock-index futures signaled higher open on Tuesday, the first trading day of 2018.

Global Stocks:

Nikkei -

Hang Seng 30,515.31 +596.16 +1.99%

Shanghai 3,349.05 +41.88 +1.27%

S&P/ASX 6,061.30 -3.80 -0.06%

FTSE 7,646.12 -41.65 -0.54%

CAC 5,279.13 -33.43 -0.63%

DAX 12,822.62 -95.02 -0.74%

Crude $60.32 (-0.17%)

Gold $1,315.40 (+0.47%)

-

14:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

236.05

0.68(0.29%)

275

ALCOA INC.

AA

54.74

0.87(1.62%)

1746

ALTRIA GROUP INC.

MO

71.47

0.06(0.08%)

7202

Amazon.com Inc., NASDAQ

AMZN

1,173.50

4.03(0.34%)

13098

Apple Inc.

AAPL

170.09

0.86(0.51%)

144085

AT&T Inc

T

38.96

0.08(0.21%)

18273

Barrick Gold Corporation, NYSE

ABX

14.69

0.22(1.52%)

19993

Boeing Co

BA

295.8

0.89(0.30%)

4619

Caterpillar Inc

CAT

158.3

0.72(0.46%)

7093

Chevron Corp

CVX

125.75

0.56(0.45%)

2985

Cisco Systems Inc

CSCO

38.35

0.05(0.13%)

1443

Citigroup Inc., NYSE

C

74.9

0.49(0.66%)

12278

Exxon Mobil Corp

XOM

84.04

0.40(0.48%)

4302

Facebook, Inc.

FB

177.1

0.64(0.36%)

56829

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.01

0.05(0.26%)

39026

General Electric Co

GE

17.52

0.07(0.40%)

216565

General Motors Company, NYSE

GM

41.17

0.18(0.44%)

6114

Goldman Sachs

GS

255.1

0.34(0.13%)

1651

Home Depot Inc

HD

190.25

0.72(0.38%)

892

Intel Corp

INTC

46.3

0.14(0.30%)

1880

International Business Machines Co...

IBM

154

0.58(0.38%)

1239

Johnson & Johnson

JNJ

139.4

-0.32(-0.23%)

2242

JPMorgan Chase and Co

JPM

107.5

0.56(0.52%)

25146

McDonald's Corp

MCD

173.28

1.16(0.67%)

1337

Merck & Co Inc

MRK

56.65

0.38(0.68%)

286

Microsoft Corp

MSFT

85.9

0.36(0.42%)

21946

Nike

NKE

62.64

0.09(0.14%)

2283

Pfizer Inc

PFE

36.26

0.04(0.11%)

10636

Procter & Gamble Co

PG

92.24

0.36(0.39%)

813

Starbucks Corporation, NASDAQ

SBUX

57.26

-0.17(-0.30%)

302

Tesla Motors, Inc., NASDAQ

TSLA

311.55

0.20(0.06%)

23216

The Coca-Cola Co

KO

45.9

0.02(0.04%)

595

Travelers Companies Inc

TRV

136.2

0.56(0.41%)

275

Twitter, Inc., NYSE

TWTR

24.1

0.09(0.37%)

27818

UnitedHealth Group Inc

UNH

221.56

1.10(0.50%)

279

Verizon Communications Inc

VZ

53.01

0.08(0.15%)

2739

Wal-Mart Stores Inc

WMT

98.91

0.16(0.16%)

5498

Walt Disney Co

DIS

108.5

0.99(0.92%)

7251

-

14:43

Target price changes before the market open

McDonald's (MCD) target raised to $200 from $175 at BTIG Research

-

14:42

Downgrades before the market open

Johnson & Johnson (JNJ) downgraded to Neutral from Overweight at JP Morgan

-

14:42

Upgrades before the market open

Walt Disney (DIS) upgraded to Outperform from Neutral at Macquarie

Int'l Paper (IP) upgraded to Buy at BofA/Merrill

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , December 56.3 (forecast 58)

-

10:28

EUR/USD Daily time frame chart

On daily time frame chart, we can see that there is a chart pattern (Head and shoulders) which the price has already broken the neckline.

However, it may be interesting to trade when the price starts to correct its movement.

Therefore, our suggestion is to wait for the retest of that neckline in order to enter long in this pair.

-

10:00

Eurozone: Manufacturing PMI, December 60.6 (forecast 60.6)

-

09:55

Germany: Manufacturing PMI, December 63.3 (forecast 63.3)

-

09:50

France: Manufacturing PMI, December 58.8 (forecast 59.3)

-

07:39

Global Stocks

Asian stock markets are mostly higher on Tuesday, the first trading day of 2018, as investors digested upbeat China manufacturing PMI data for the month of December. Sentiment was also boosted after North Korean leader Kim Jong Un said he is open to talks with South Korea. China Caixin manufacturing PMI showed a December reading of 51.5, beating expectations and also touching a four-month high. The Australian market recovered from a weak start and is edging higher. Gains by mining stocks helped offset weakness in oil stocks.

-

06:47

Options levels on tuesday, January 2, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2130 (4380)

$1.2105 (3711)

$1.2076 (4165)

Price at time of writing this review: $1.1998

Support levels (open interest**, contracts):

$1.1944 (2317)

$1.1897 (4792)

$1.1849 (4677)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 98603 contracts (according to data from December, 29) with the maximum number of contracts with strike price $1,2200 (6158);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3597 (2965)

$1.3578 (4730)

$1.3562 (2514)

Price at time of writing this review: $1.3499

Support levels (open interest**, contracts):

$1.3440 (1987)

$1.3395 (2416)

$1.3348 (2087)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 33479 contracts, with the maximum number of contracts with strike price $1,3500 (4730);

- Overall open interest on the PUT options with the expiration date January, 5 is 34511 contracts, with the maximum number of contracts with strike price $1,3250 (2803);

- The ratio of PUT/CALL was 1.03 versus 1.02 from the previous trading day according to data from December, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:45

China: Markit/Caixin Manufacturing PMI, December 51.5 (forecast 50.6)

-

00:26

Commodities. Daily history for Dec 29’2017:

(raw materials / closing price /% change)

OIL 60.25 -0.28%

GOLD 1305.00 -0.33%

-

00:26

Stocks. Daily history for Dec 29’2017:

(index / closing price / change items /% change)

Nikkei -19.04 22764.94 -0.08%

TOPIX -1.47 1817.56 -0.08%

Hang Seng +55.44 29919.15 +0.19%

CSI 300 +11.96 4030.86 +0.30%

Euro Stoxx 50 -20.35 3503.96 -0.58%

FTSE 100 +64.89 7687.77 +0.85%

DAX -62.30 12917.64 -0.48%

CAC 40 -26.86 5312.56 -0.50%

DJIA -118.29 24719.22 -0.48%

S&P 500 -13.93 2673.61 -0.52%

NASDAQ -46.77 6903.39 -0.67%

S&P/TSX -12.82 16209.13 -0.08%

-

00:25

Currencies. Daily history for Dec 29’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1998 +0,47%

GBP/USD $1,3500 +0,44%

USD/CHF Chf0,97418 -0,44%

USD/JPY Y112,66 -0,17%

EUR/JPY Y135,19 +0,30%

GBP/JPY Y152,107 +0,26%

AUD/USD $0,7802 +0,44%

NZD/USD $0,7086 -0,02%

USD/CAD C$1,25668 0,00%

-