Noticias del mercado

-

18:12

Reserve Bank of New Zealand Governor Graeme Wheeler: interest rates will remain on hold "for some time"

The Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler said in a speech in Christchurch on Wednesday that interest rates will remain on hold "for some time". He added that the country's economic prospects were good, but the risks were "more complex".

Wheeler reiterated that the high New Zealand dollar remained "unjustified and unsustainable", despite the recent decline.

The RBNZ governor noted that the central bank expects a further significant depreciation.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies ahead of the better-than-expected ISM non-manufacturing purchasing managers' index

The U.S. dollar traded higher against the most major currencies ahead of the better-than-expected ISM non-manufacturing purchasing managers' index. The Institute for Supply Management's non-manufacturing purchasing managers' index for the U.S. climbed to 56.7 in January from 56.5 in December, exceed expectations for a rise to 56.6.

A reading above 50 indicates a growth in the service sector.

Private sector in the U.S. added 213,000 jobs in January, according the ADP report on Wednesday. December's figure was revised up to 253,000 jobs from a previous reading of 241,000 jobs.

Analysts expected the private sector to add 221,000 jobs.

The euro traded lower against the U.S. dollar as concerns over Greece's bailout policy weighed on the euro.

Retail sales in the Eurozone rose 0.3% in December, beating expectations for a 0.1% decrease, after a 0.7% gain in November. November's figure was revised up from a 0.6% rise.

On a yearly basis, retail sales in the Eurozone surged 2.8% in December, after a 1.6% increase in November. November's figure was revised up from a 1.5% gain.

Eurozone' final services purchasing managers' index (PMI) climbed to 52.7 in January from a preliminary reading of 52.3. Analysts had expected the final index to remain at 52.3.

Germany's final services PMI rose to 54.0 in January from a preliminary reading of 52.7. Analysts had expected the final index to remain at 52.7.

France's final services PMI decreased to 49.3 in January from a preliminary reading of 49.5. Analysts had expected the final index to remain at 49.5.

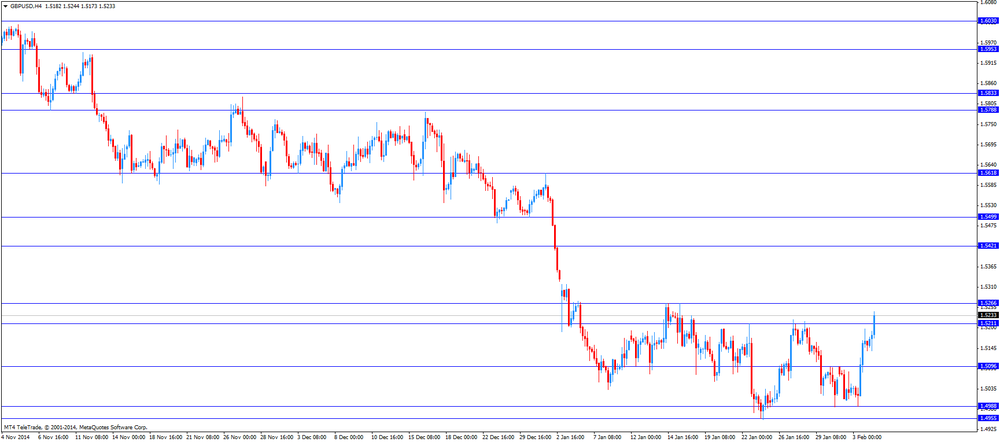

The British pound traded lower against the U.S. dollar. In the morning trading session, the pound rose against the greenback after the better-than-expected services data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. climbed to 57.2 in January from 55.8 in December, exceeding expectations for a rise to 56.6.

The Canadian dollar fell against the U.S. dollar after the weaker-than-expected Canadian Ivey purchasing managers' index. Canada's seasonally adjusted Ivey purchasing managers' index fell to 45.4 in January from 55.4 in December. Analysts had expected the index to increase to 55.9.

That was the lowest level since May 2009.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback after the mixed labour market data from New Zealand and on comments by the Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler.

The unemployment rate in New Zealand increased to 5.7% in the fourth quarter from 5.4% in the third quarter, missing forecasts for a decline to 5.3%.

The participation rate rose to 69.7% in the fourth quarter from 69.0% in the previous three months, the highest rate since March 1986.

Employment increased 1.2% in the fourth quarter, beating expectations for 0.8% rise, after a 0.9% gain in the third quarter. The third quarter's was revised up from 0.8% increase.

The RBNZ Governor Graeme Wheeler said on Wednesday that interest rates will remain on hold "for some time".

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie dropped against the greenback after the solid services data from Australia. The Australian Industry Group's performance of services index rose to 49.9 in January from 47.5 in December.

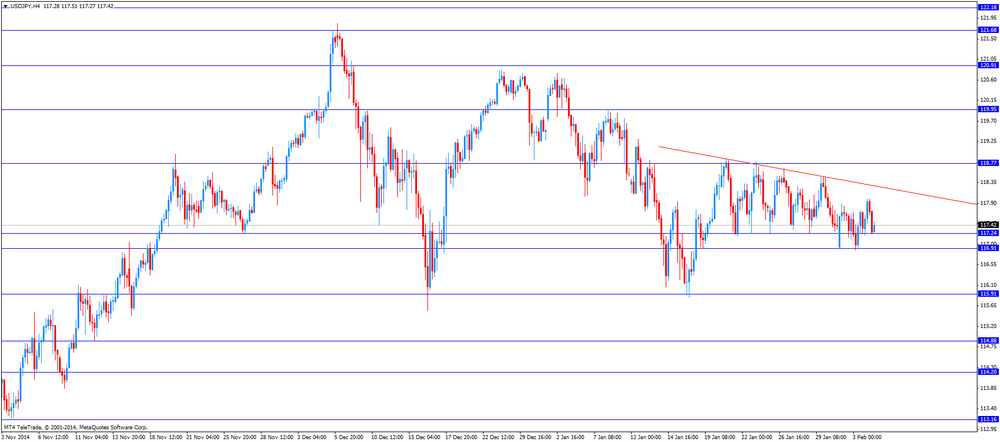

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback. Labour cash earnings in Japan climbed 1.6% in December, in line with expectations, after a 0.1% gain in November.

-

17:00

ISM non-manufacturing purchasing managers’ index climbed to 56.7 in January

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index climbed to 56.7 in January from 56.5 in December, exceed expectations for a rise to 56.6.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index rose to 59.5 in January from 59.2 in December.

The ISM's business activity/production index increased to 61.5 in January from 58.6 December.

The ISM's employment index fell to 51.6 in January from 55.7 in December.

-

16:33

Canada’s Ivey purchasing managers’ index fell to the lowest level since May 2009

Canada's seasonally adjusted Ivey purchasing managers' index fell to 45.4 in January from 55.4 in December. Analysts had expected the index to increase to 55.9.

That was the lowest level since May 2009.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index fell to 47.9 from 54.2, while employment index declined to 50.0 from 51.8.

Inventories index dropped to 46.4 from 41.7.

-

16:30

U.S.: Crude Oil Inventories, January 6.3

-

16:02

IMF rejected comments it has discussed with Athens a new debt strategy

The International Monetary Fund (IMF) rejected comments on Wednesday that it has discussed with Athens a new debt strategy.

Greek Finance Minister Yanis Varoufakis said in a newspaper interview to La Repubblica that his government has proposed to the IMF a debt renegotiation.

An IMF spokesperson said that there has been no discussion with the authorities on a change in the framework for dealing with debt.

-

16:00

Canada: Ivey Purchasing Managers Index, January 45.4 (forecast 55.9)

-

16:00

U.S.: ISM Non-Manufacturing, January 56.7 (forecast 56.6)

-

15:45

U.S.: Services PMI, January 54.2 (forecast 54.3)

-

15:32

ADP report: private sector added 213,000 jobs in January

Private sector in the U.S. added 213,000 jobs in January, according the ADP report on Wednesday.

December's figure was revised up to 253,000 jobs from a previous reading of 241,000 jobs.

Analysts expected the private sector to add 221,000 jobs.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.6% in January. The U.S. economy is expected to add 231,000 jobs in January.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1500 (E208mn)

USD/JPY: Y117.45-50($325mn), Y118.00($1.1bn)

EUR/JPY: Y133.20(E200mn)

AUD/USD: $0.7800(A$200mn), $0.7870(A$807mn), $0.7900(A$244mn)

NZD/USD: $0.7300(NZ$200mn), $0.7350(NZ$201mn), $0.7390(NZ$300mn), 0.7400(NZ$418mn)

-

14:15

U.S.: ADP Employment Report, January 213 (forecast 221)

-

14:00

Orders

EUR/USD

Offers $1.1700, $1.1670/80, $1.1600, $1.1540

Bids $1.1350, $1.1300, $1.1260, $1.1220, $1.1200

GBP/USD

Offers $1.5300, $1.5265

Bids $1.5100, $1.5080, $1.4990, $1.4955, $1.4900

AUD/USD

Offers $0.8025, $0.8000, $0.7900, $0.7850

Bids $0.7700, $0.7625, $0.7600, $0.7500

EUR/JPY

Offers Y137.70, Y137.30, Y136.00, Y135.75

Bids Y133.35, Y132.35, Y132.00

USD/JPY

Offers Y119.00, Y118.50, Y118.00

Bids Y116.90, Y116.50, Y115.85

EUR/GBP

Offers stg0.7715, stg0.7700, stg0.7600

Bids stg0.7490, stg0.7440, stg0.7400

-

14:00

Foreign exchange market. European session: the British pound increased against the U.S. dollar after the better-than-expected services data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Japan Labor Cash Earnings, YoY December +0.1% +1.6% +1.6%

01:45 China HSBC Services PMI January 53.4 51.8

08:50 France Services PMI (Finally) January 49.5 49.5 49.3

08:55 Germany Services PMI (Finally) January 52.7 52.7 54.0

09:00 Eurozone Services PMI (Finally) January 52.3 52.3 52.7

09:30 United Kingdom Purchasing Manager Index Services January 55.8 56.6 57.2

10:00 Eurozone Retail Sales (MoM) December +0.7% Revised From +0.6% -0.1% +0.3%

10:00 Eurozone Retail Sales (YoY) January +1.6% Revised From +1.5% +2.8%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. economy is expected to add 221,000 jobs in January, according to the ADP employment report.

The ISM non-manufacturing purchasing managers' index is expected to rise to 56.6 in January from 56.2 in December.

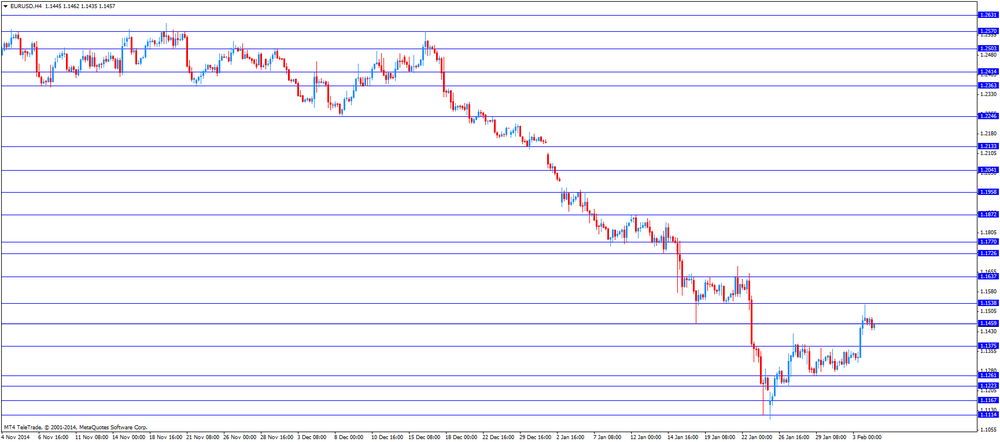

The euro traded lower against the U.S. dollar despite the mostly better-than-expected economic data from the Eurozone. Retail sales in the Eurozone rose 0.3% in December, beating expectations for a 0.1% decrease, after a 0.7% gain in November. November's figure was revised up from a 0.6% rise.

On a yearly basis, retail sales in the Eurozone surged 2.8% in December, after a 1.6% increase in November. November's figure was revised up from a 1.5% gain.

Eurozone' final services purchasing managers' index (PMI) climbed to 52.7 in January from a preliminary reading of 52.3. Analysts had expected the final index to remain at 52.3.

Germany's final services PMI rose to 54.0 in January from a preliminary reading of 52.7. Analysts had expected the final index to remain at 52.7.

France's final services PMI decreased to 49.3 in January from a preliminary reading of 49.5. Analysts had expected the final index to remain at 49.5.

Concerns over Greece's bailout policy weighed on the euro.

The British pound increased against the U.S. dollar after the better-than-expected services data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. climbed to 57.2 in January from 55.8 in December, exceeding expectations for a rise to 56.6.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian Ivey purchasing managers' index. The Ivey purchasing managers' index is expected to increase to 55.9 in January from 55.4 in December.

EUR/USD: the currency pair declined to $1.1435

GBP/USD: the currency pair rose to $1.5244

USD/JPY: the currency pair decreased to Y117.23

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report January 241 221

15:00 Canada Ivey Purchasing Managers Index January 55.4 55.9

15:00 U.S. ISM Non-Manufacturing January 56.2 56.6

-

13:35

New Zealand’s labour market is mixed in the fourth quarter, while the participation rate reaches the highest level since March 1986

Statistics New Zealand released its labour market data on late Tuesday. The unemployment rate in New Zealand increased to 5.7% in the fourth quarter from 5.4% in the third quarter, missing forecasts for a decline to 5.3%.

The participation rate rose to 69.7% in the fourth quarter from 69.0% in the previous three months, the highest rate since March 1986.

Employment increased 1.2% in the fourth quarter, beating expectations for 0.8% rise, after a 0.9% gain in the third quarter. The third quarter's was revised up from 0.8% increase.

-

12:30

Eurozone Retail Sales rise +0.3%

Retail Sales in the Eurozone rose more-than-expected in December giving a brighter picture on the economic outlook for E.U.'s economy.

Eurostat reported an increase of +0.3% on a monthly basis, analysts expected a decline by -0.1% in December. Data in the previous month showed an increase by +0.7% after being revised.

Year over year Retail Sales Increased at a rate of 2.8% (annualized) in December beating estimates of an increase of 2.0%.

-

11:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1500 (E208mn)

USD/JPY: Y117.45-50($325mn), Y118.00($1.1bn)

EUR/JPY: Y133.20(E200mn)

AUD/USD: $0.7800(A$200mn), $0.7870(A$807mn), $0.7900(A$244mn)

NZD/USD: $0.7300(NZ$200mn), $0.7350(NZ$201mn), $0.7390(NZ$300mn), 0.7400(NZ$418mn)

-

11:08

U.K.: Upbeat service sector activity data signalling a solid start in 2015

After Upbeat data on U.K.'s Service Manager Index the British pound trades slightly higher against the greenback but gains are limited as worries over Greece weigh.

The Index climbed unexpectedly from 55.8 to 57.2 points, beating estimates of 56.6 points signalling a solid start in 2015 for the British economy.

-

11:00

Eurozone: Retail Sales (MoM), December +0.3% (forecast -0.1%)

-

11:00

Eurozone: Retail Sales (YoY), January +2.8%

-

10:40

Press Review: Greece Seeks Third Debt Restructuring: Who’s on the Hook?

BLOOMBERG

Greece Seeks Third Debt Restructuring: Who's on the Hook?

(Bloomberg) -- Greece's anti-bailout governing coalition wants to reduce the country's debt burden. Who's on the hook if they succeed?

Prime Minister Alexis Tsipras has pledged to repay in full obligations to the International Monetary Fund and the European Central Bank. Finance Minister Yanis Varoufakis outlined plans to swap some debt into new securities and link repayment with economic growth. Both have said private investors won't be asked to shoulder additional losses after taking the hit in two restructurings since the start of the euro financial crisis.

Euro-region governments and the crisis-fighting fund they set up in 2010 are owed almost 195 billion euros ($221 billion) by Greece, mostly in emergency loans. That's about 62 percent of the total debt and compares with 17 percent held by private investors.

Governments and national central banks are also contributors to the ECB and the IMF so taxpayers would be exposed should Greece go back on its pledge to make those creditors whole.

REUTERS

China January HSBC services PMI at six-month low, more stimulus expected(Reuters) - China's services sector grew at the slowest pace in six months in January as growth in new business weakened, a private survey showed, raising expectations that policymakers may unveil more stimulus steps to avert a sharper slowdown in the world's second-largest economy.

The HSBC/Markit Services Purchasing Managers' Index(PMI) slowed to 51.8 last month - the weakest since July 2014 - from December's 53.4, but remained above the 50-point level that separates growth from contraction in activity on a monthly basis.

The weakening performance of the services sector, which has helped cushion the broader impact of a cooling manufacturing sector, could fan market concerns about China's economic slowdown in 2015.

Source: http://in.reuters.com/article/2015/02/04/china-economy-pmi-services-idINKBN0L804020150204

REUTERS

Japan government delays BOJ nomination, stirs worries about political battle(Reuters) - Japan's government unexpectedly delayed a widely expected nomination to the Bank of Japan's policy board on Wednesday, raising concerns the appointment could become ensnared in a political battle with opposition parties.

The Nikkei business daily reported earlier that academic Yutaka Harada, a proponent of aggressive steps to end deflation, was expected to be nominated on Wednesday to the central bank's nine-member board.

Harada, 64, was intended to replace Ryuzo Miyao, a 50-year-old former academic and a policy dove whose five-year term expires in March. Miyao supported additional monetary easing in a 5-4 vote in October.

Source: http://www.reuters.com/article/2015/02/04/us-japan-boj-idUSKBN0L80B320150204

-

10:30

United Kingdom: Purchasing Manager Index Services, January 57.2 (forecast 56.6)

-

10:10

France Services PMI below and German and Eurozone's PMI above estimates

France and Germany, the biggest economy in the Eurozone, reported final data on Services PMI for January. France's PMI came in at 49.3, below estimates of 49.5 declining 0.2 point from the previous period. German Services PMI rose more-than expected from 52.7 to 54.0 in January. In December the index came in at 52.7.

Eurozone's Service PMI was above estimates with a reading of 52.7 compared to forecasts of 52.3 and a previous reading of 52.3.

-

10:00

Eurozone: Services PMI, January 52.7 (forecast 52.3)

-

09:56

Germany: Services PMI, January 54.0 (forecast 52.7)

-

09:51

France: Services PMI, January 49.3 (forecast 49.5)

-

08:30

Foreign exchange market. Asian session: U.S. dollar mixed against the most major currencies

The U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. factory orders. Factory orders in the U.S. dropped 3.4% in December, missing expectations for a 1.8% decrease, after a 1.7% decline in November. That was the fifth straight decline. November's figure was revised down from a 0.7% fall. Manufacturing in the U.S. is cooling due to weak global demand and falling oil prices. The data added to concerns over the economic outlook of the U.S. after data showed that the world's biggest economy expanded at a slower pace in the fourth quarter, growing at 2.6%. Today data on the ADP Unemployment Report, Services PMI and the ISM Non-Manufacturing will be in the focus.

The Australian dollar further recovered today after slumping more than 1% yesterday to a six-year low. Yesterday the Reserve Bank of Australia cut benchmark interest rates unexpectedly to a record low to 2.25% by 25 basis points to support the economy and to keep the aussie low. Reserve Bank of Australia Governor Glenn Stevens said in a statement in a statement that lower interest rates are expected to add some further support to demand, help to achieve sustainable growth and to assure that inflation is consistent with the target. Yesterday data on the AIG Services Index showed an increase to 49.9 in January, close to expansion territory, after a reading of 47.5 in December.

China's HSBC Services Index declined to from 53.4 points in December to 51.8 in January. China is Australia's biggest trade partner.

New Zealand's dollar continued to rise sharply against the greenback in Asian trade hitting lows at USD0.7175 in yesterday's volatile session and climbing to as high as USD0.7476 today. New Zealand's Unemployment Rate rose to 5.7% from 5.4% in the previous period. Economist expected the Unemployment rate to decline to 5.3%. RBNZ Governor Wheeler said that a change in benchmark interest rates is not scheduled and that a period of OCR stability is the most prudent option.

The Japanese yen traded slightly higher against the greenback on Wednesday. Labor Cash Earnings rose in line with expectations by 1.6% in December, a 10th straight gain after adding +0.1% in the previous period.

EUR/USD: the euro traded almost flat against the greenback

USD/JPY: the U.S. dollar lost against the yen

GPB/USD: Sterling traded slightly weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 United Kingdom Halifax house price index January +0.9% +0.2%

08:00 United Kingdom Halifax house price index 3m Y/Y January +7.8% +7.8%

08:50 France Services PMI (Finally) January 49.5 49.5

08:55 Germany Services PMI (Finally) January 52.7 52.7

09:00 Eurozone Services PMI (Finally) January 52.3 52.3

09:30 United Kingdom Purchasing Manager Index Services January 55.8 56.6

10:00 Eurozone Retail Sales (MoM) December +0.6% -0.1%

10:00 Eurozone Retail Sales (YoY) January +1.5%

13:15 U.S. ADP Employment Report January 241 221

14:45 U.S. Services PMI (Finally) January 54.0 54.3

15:00 Canada Ivey Purchasing Managers Index January 55.4 55.9

15:00 U.S. ISM Non-Manufacturing January 56.2 56.6

15:30 U.S. Crude Oil Inventories January 8.9

-

07:26

Options levels on wednesday, February 4, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1664 (1495)

$1.1589 (2253)

$1.1538 (3513)

Price at time of writing this review: $1.1476

Support levels (open interest**, contracts):

$1.1403 (2985)

$1.1331 (1650)

$1.1243 (2293)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 88315 contracts, with the maximum number of contracts with strike price $1,2100 (6528);

- Overall open interest on the PUT options with the expiration date February, 6 is 77474 contracts, with the maximum number of contracts with strike price $1,1700 (6637);

- The ratio of PUT/CALL was 0.88 versus 0.91 from the previous trading day according to data from February, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.5401 (568)

$1.5302 (724)

$1.5205 (1178)

Price at time of writing this review: $1.5163

Support levels (open interest**, contracts):

$1.5096 (1731)

$1.4998 (1519)

$1.4899 (2031)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 17995 contracts, with the maximum number of contracts with strike price $1,5150 (1323);

- Overall open interest on the PUT options with the expiration date February, 6 is 17930 contracts, with the maximum number of contracts with strike price $1,4900 (2031);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from February, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:46

China: HSBC Services PMI, January 51.8

-

02:33

Japan: Labor Cash Earnings, YoY, December +1.6% (forecast +1.6%)

-

00:29

Currencies. Daily history for Feb 3’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1481 +1,23%

GBP/USD $1,5165 +0,84%

USD/CHF Chf0,9235 -0,47%

USD/JPY Y117,56 +0,01%

EUR/JPY Y134,95 +1,19%

GBP/JPY Y178,28 +0,84%

AUD/USD $0,7789 -0,17%

NZD/USD $0,7357 +0,72%

USD/CAD C$1,2413 -1,20%

-

00:00

Schedule for today, Wednesday, Feb 4’2015:

(time / country / index / period / previous value / forecast)

01:30 Japan Labor Cash Earnings, YoY December +0.1% +1.6%

01:45 China HSBC Services PMI January 53.4

08:00 United Kingdom Halifax house price index January +0.9% +0.2%

08:00 United Kingdom Halifax house price index 3m Y/Y January +7.8% +7.8%

08:50 France Services PMI (Finally) January 49.5 49.5

08:55 Germany Services PMI (Finally) January 52.7 52.7

09:00 Eurozone Services PMI (Finally) January 52.3 52.3

09:30 United Kingdom Purchasing Manager Index Services January 55.8 56.6

10:00 Eurozone Retail Sales (MoM) December +0.6% -0.1%

10:00 Eurozone Retail Sales (YoY) January +1.5%

13:15 U.S. ADP Employment Report January 241 221

14:45 U.S. Services PMI (Finally) January 54.0 54.3

15:00 Canada Ivey Purchasing Managers Index January 55.4 55.9

15:00 U.S. ISM Non-Manufacturing January 56.2 56.6

15:30 U.S. Crude Oil Inventories January 8.9

-