Noticias del mercado

-

21:00

S&P 500 2,045.69 -4.34 -0.21%, NASDAQ 4,729.71 +1.97 +0.04%, Dow 17,714.89 +48.49 +0.27%

-

18:00

European stocks closed: FTSE 100 6,860.02 -11.78 -0.17%, CAC 40 4,696.3 +18.40 +0.39%, DAX 10,911.32 +20.37 +0.19%

-

18:00

European stocks close: most stocks closed higher as concerns over Greece's bailout policy eased

Most stock indices closed higher as concerns over Greece's bailout policy eased. The International Monetary Fund (IMF) rejected comments on Wednesday that it has discussed with Athens a new debt strategy.

Earlier, Greek Finance Minister Yanis Varoufakis said in a newspaper interview to La Repubblica that his government has proposed to the IMF a debt renegotiation.

Retail sales in the Eurozone rose 0.3% in December, beating expectations for a 0.1% decrease, after a 0.7% gain in November. November's figure was revised up from a 0.6% rise.

On a yearly basis, retail sales in the Eurozone surged 2.8% in December, after a 1.6% increase in November. November's figure was revised up from a 1.5% gain.

Eurozone' final services purchasing managers' index (PMI) climbed to 52.7 in January from a preliminary reading of 52.3. Analysts had expected the final index to remain at 52.3.

Germany's final services PMI rose to 54.0 in January from a preliminary reading of 52.7. Analysts had expected the final index to remain at 52.7.

France's final services PMI decreased to 49.3 in January from a preliminary reading of 49.5. Analysts had expected the final index to remain at 49.5.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. climbed to 57.2 in January from 55.8 in December, exceeding expectations for a rise to 56.6.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,860.02 -11.78 -0.17%

DAX 10,911.32 +20.37 +0.19%

CAC 40 4,696.3 +18.40 +0.39%

-

16:02

IMF rejected comments it has discussed with Athens a new debt strategy

The International Monetary Fund (IMF) rejected comments on Wednesday that it has discussed with Athens a new debt strategy.

Greek Finance Minister Yanis Varoufakis said in a newspaper interview to La Repubblica that his government has proposed to the IMF a debt renegotiation.

An IMF spokesperson said that there has been no discussion with the authorities on a change in the framework for dealing with debt.

-

15:34

U.S. Stocks open: Dow -0.25%, Nasdaq -0.48%, S&P -0.39%

-

15:28

Before the bell: S&P futures -0.31%, Nasdaq futures -0.35%

U.S. stock-index futures fell as pharmaceutical companies declined amid corporate earnings and energy shares slumped with oil.

Global markets:

Nikkei 17,678.74 +342.89 +1.98%

Hang Seng 24,679.76 +124.98 +0.51%

Shanghai Composite 3,175.08 -29.82 -0.93%

FTSE 6,825.79 -46.01 -0.67%

CAC 4,671.02 -6.88 -0.15%

DAX 10,861.01 -29.94 -0.27%

Crude oil $51.19 (-3.15%)

Gold $1267.70 (+0.62%)

-

15:14

Stocks before the bell

(company / ticker / price / change, % / volume)

Intel Corp

INTC

33.53

+0.21%

14.2K

Cisco Systems Inc

CSCO

27.18

+0.22%

0.4K

Ford Motor Co.

F

15.74

+0.58%

105.1K

Yahoo! Inc., NASDAQ

YHOO

44.98

+0.62%

13.8K

Pfizer Inc

PFE

32.00

+0.82%

83.3K

Barrick Gold Corporation, NYSE

ABX

12.83

+1.18%

8.6K

Twitter, Inc., NYSE

TWTR

40.48

+1.73%

236.3K

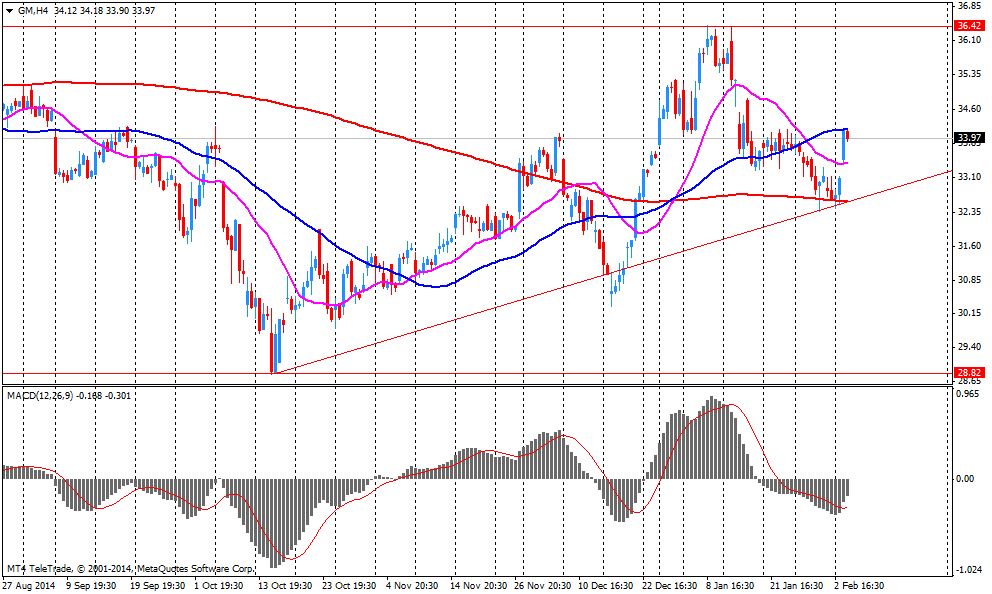

General Motors Company, NYSE

GM

35.43

+4.27%

801.5K

Walt Disney Co

DIS

98.37

+4.54%

216.2K

Procter & Gamble Co

PG

85.93

-0.02%

0.2K

United Technologies Corp

UTX

118.84

-0.04%

0.1K

Google Inc.

GOOG

528.97

-0.05%

5.5K

Microsoft Corp

MSFT

41.57

-0.07%

24.6K

Visa

V

259.50

-0.11%

0.5K

ALTRIA GROUP INC.

MO

54.18

-0.15%

1.4K

General Electric Co

GE

24.43

-0.16%

8.7K

Verizon Communications Inc

VZ

47.71

-0.25%

3.2K

AT&T Inc

T

34.25

-0.26%

4.6K

American Express Co

AXP

83.50

-0.27%

3.5K

Home Depot Inc

HD

106.90

-0.32%

0.3K

Citigroup Inc., NYSE

C

48.70

-0.37%

0.1K

JPMorgan Chase and Co

JPM

56.50

-0.39%

0.2K

Apple Inc.

AAPL

118.17

-0.40%

135.5K

Tesla Motors, Inc., NASDAQ

TSLA

217.45

-0.42%

9.7K

Johnson & Johnson

JNJ

102.00

-0.45%

0.3K

Caterpillar Inc

CAT

83.50

-0.50%

1.1K

Facebook, Inc.

FB

75.01

-0.52%

65.9K

Amazon.com Inc., NASDAQ

AMZN

361.61

-0.53%

8.1K

Starbucks Corporation, NASDAQ

SBUX

88.01

-0.54%

0.6K

Boeing Co

BA

146.49

-0.58%

0.4K

ALCOA INC.

AA

16.47

-0.66%

1.1K

Exxon Mobil Corp

XOM

91.45

-0.87%

23.3K

Chevron Corp

CVX

108.50

-0.94%

9.8K

Yandex N.V., NASDAQ

YNDX

15.40

-1.47%

6.6K

Hewlett-Packard Co.

HPQ

37.19

-1.54%

1.4K

FedEx Corporation, NYSE

FDX

170.00

-1.72%

0.2K

Merck & Co Inc

MRK

59.80

-2.00%

10.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.50

-2.53%

46.7K

-

15:04

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Ford Motor (F) target lowered from $22 to $19 Stifel

Walt Disney (DIS) target raised from $100 to $110 at RBC Capital Mkts, from $120 to $124 at FBR Capital, from $88 to $98 at Wunderlich

-

14:56

Company News: Merck (MRK) reported better than expected fourth quarter profits

Merck (MRK) earned $0.87 per share in the fourth quarter, beating analysts' estimate of $0.86. Revenue in the fourth quarter decreased 7.4% year-over-year to $10.48 billion, but exceeding analysts' estimate of $10.47 billion.

The company released its forecasts for 2015. EPS is expected to be $3.32-$3.47 (analysts' estimate: $3.48). Revenue is expected to be $38.3-$39.8 billion (analysts' estimate: $40.95 billion).

Merck (MRK) shares decreased to $60.02 (-1.64%) prior to the opening bell.

-

14:50

Company News: General Motors (GM) reported better than expected fourth quarter profits

General Motors (GM) earned $1.19 per share in the fourth quarter, beating analysts' estimate of $0.80. Revenue in the fourth quarter increased 2.2% year-over-year to $39.60 billion, exceeding analysts' estimate of $38.09 billion.

General Motors (GM) shares increased to $35.64 (+4.89%) prior to the opening bell.

-

12:50

European stock markets mid-session: indices slightly decline after yesterday’s rally

European indices are extending early losses as concerns over Greece continue to weigh. Solid data on PMI and Retail Sales failed to bring markets in positive territory.

France and Germany, the biggest economy in the Eurozone, reported final data on Services PMI for January. France's PMI came in at 49.3, below estimates of 49.5 declining 0.2 point from the previous period. German Services PMI rose more-than expected from 52.7 to 54.0 in January. In December the index came in at 52.7.

Eurozone's Service PMI was above estimates with a reading of 52.7 compared to forecasts of 52.3 and a previous reading of 52.3.

The U.K. Service Manager Index climbed unexpectedly from 55.8 to 57.2 points, beating estimates of 56.6 points signalling a solid start in 2015 for the British economy.

Retail Sales in the Eurozone rose more-than-expected in December giving a brighter picture on the economic outlook for E.U.'s economy. Eurostat reported an increase of +0.3% on a monthly basis, analysts expected a decline by -0.1% in December. Data in the previous month showed an increase by +0.7% after being revised. Year over year Retail Sales Increased at a rate of 2.8% (annualized) in December beating estimates of an increase of 2.0%.

The commodity heavy FTSE 100 index is currently trading -0.59% quoted at 6,831.46 points, hit by falling oil prices. Germany's DAX 30 lost -0.20% trading at 10,868.85. France's CAC 40 is currently trading at 4,669.93 points, -0.17%.

-

10:40

Press Review: Greece Seeks Third Debt Restructuring: Who’s on the Hook?

BLOOMBERG

Greece Seeks Third Debt Restructuring: Who's on the Hook?

(Bloomberg) -- Greece's anti-bailout governing coalition wants to reduce the country's debt burden. Who's on the hook if they succeed?

Prime Minister Alexis Tsipras has pledged to repay in full obligations to the International Monetary Fund and the European Central Bank. Finance Minister Yanis Varoufakis outlined plans to swap some debt into new securities and link repayment with economic growth. Both have said private investors won't be asked to shoulder additional losses after taking the hit in two restructurings since the start of the euro financial crisis.

Euro-region governments and the crisis-fighting fund they set up in 2010 are owed almost 195 billion euros ($221 billion) by Greece, mostly in emergency loans. That's about 62 percent of the total debt and compares with 17 percent held by private investors.

Governments and national central banks are also contributors to the ECB and the IMF so taxpayers would be exposed should Greece go back on its pledge to make those creditors whole.

REUTERS

China January HSBC services PMI at six-month low, more stimulus expected(Reuters) - China's services sector grew at the slowest pace in six months in January as growth in new business weakened, a private survey showed, raising expectations that policymakers may unveil more stimulus steps to avert a sharper slowdown in the world's second-largest economy.

The HSBC/Markit Services Purchasing Managers' Index(PMI) slowed to 51.8 last month - the weakest since July 2014 - from December's 53.4, but remained above the 50-point level that separates growth from contraction in activity on a monthly basis.

The weakening performance of the services sector, which has helped cushion the broader impact of a cooling manufacturing sector, could fan market concerns about China's economic slowdown in 2015.

Source: http://in.reuters.com/article/2015/02/04/china-economy-pmi-services-idINKBN0L804020150204

REUTERS

Japan government delays BOJ nomination, stirs worries about political battle(Reuters) - Japan's government unexpectedly delayed a widely expected nomination to the Bank of Japan's policy board on Wednesday, raising concerns the appointment could become ensnared in a political battle with opposition parties.

The Nikkei business daily reported earlier that academic Yutaka Harada, a proponent of aggressive steps to end deflation, was expected to be nominated on Wednesday to the central bank's nine-member board.

Harada, 64, was intended to replace Ryuzo Miyao, a 50-year-old former academic and a policy dove whose five-year term expires in March. Miyao supported additional monetary easing in a 5-4 vote in October.

Source: http://www.reuters.com/article/2015/02/04/us-japan-boj-idUSKBN0L80B320150204

-

10:10

France Services PMI below and German and Eurozone's PMI above estimates

France and Germany, the biggest economy in the Eurozone, reported final data on Services PMI for January. France's PMI came in at 49.3, below estimates of 49.5 declining 0.2 point from the previous period. German Services PMI rose more-than expected from 52.7 to 54.0 in January. In December the index came in at 52.7.

Eurozone's Service PMI was above estimates with a reading of 52.7 compared to forecasts of 52.3 and a previous reading of 52.3.

-

10:00

European Stocks. First hour: Indices decline after yesterday’s rally

European stocks decline in early trading after rallying yesterday. Concerns over Greece weigh. The new Greek government yesterday retreated from a plan for a write-off of its debt and proposed a new debt arrangement to reach a compromise with its international creditors on the terms of its bailout. Yesterday Finance Minister Varoufakis reassured in London that Greece is not seeking a standoff with the European Union.

France and Germany, the biggest economy in the Eurozone, reported final data on Services PMI for January. France's PMI came in at 49.3, below estimates of 49.5 declining 0.2 point from the previous period. German Services PMI rose more-than expected from 52.7 to 54.0 in January. In December the index came in at 52.7.

Eurozone's Service PMI was above estimates with a reading of 52.7 compared to 52.3.

Later in the day U.K's Purchasing Manager Index will be in the focus at 09:30GMT followed by Eurozone's Retail Sales at 10:00 GMT. Later market participants await U.S. data on the ADP Unemployment Report, Services PMI and the ISM Non-Manufacturing.

The commodity heavy FTSE 100 index is currently trading -0.21% quoted at 6,857.66 points. Germany's DAX 30 declined by -0.28% trading at 10,860.41. France's CAC 40 lost -0.04%, currently trading almost flat at 4,676.10 points.

-

09:00

Global Stocks: Wall Street post second day of gains despite mixed data

U.S. markets posted a second day of gains on Tuesday despite the weaker-than-expected U.S. factory orders, led by energy shares as oil continued to rise and better-than-expected car sales. Hopes on a Greek debt deal further supported the bullish sentiment. Factory orders in the U.S. dropped 3.4% in December, missing expectations for a 1.8% decrease, after a 1.7% decline in November. That was the fifth straight decline. November's figure was revised down from a 0.7% fall. Manufacturing in the U.S. is cooling due to weak global demand and falling oil prices. The data added to concerns over the economic outlook of the U.S. after data showed that the world's biggest economy expanded at a slower pace in the fourth quarter, growing at 2.6%. Today data on the ADP Unemployment Report, Services PMI and the ISM Non-Manufacturing will be in the focus.

The DOW JONES index added +1.76% after yesterday's gains of +1.14%, closing at 17,666.4 points. The S&P 500 rose by +1.44% with a final quote of 2,050.30 points.

Hong Kong's Hang Seng is trading +0.47% at 24,669.06 points. China's Shanghai Composite closed at 3,175.08 points -0.93% reversing early gains as financial and health-care stocks were under pressure. China's HSBC Services Index declined from 53.4 points in December to 51.8 in January. Yesterday the index halted a five-day decline.

Japan's Nikkei rallied on Wednesday, closing +1.98% with a final quote of 17,678.74 supported by strong corporate earnings reports in the financial sector. Labor Cash Earnings rose in line with expectations by 1.6% in December, a 10th straight gain after adding +0.1% in the previous period.

-

03:02

Nikkei 225 17,655.73 +319.88 +1.85%, Hang Seng 24,683.17 +128.39 +0.52%, Shanghai Composite 3,211.61 +6.70 +0.21%

-

00:32

Stocks. Daily history for Feb 3’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,707.37 +82.03 +1.46%

TOPIX 1,392.39 -16.36 -1.16%

SHANGHAI COMP 3,205.55 +77.25 +2.47%

HANG SENG 24,554.78 +70.04 +0.29%

FTSE 100 6,871.8 +89.25 +1.32%

CAC 40 4,677.9 +50.23 +1.09%

Xetra DAX 10,890.95 +62.94 +0.58%

S&P 500 2,050.03 +29.18 +1.44%

NASDAQ Composite 4,727.74 +51.05 +1.09%

Dow Jones 17,666.4 +305.36 +1.76%

-