Noticias del mercado

-

17:30

Retail sales in Australia climb 0.5% in October

The Australian Bureau of Statistics released its retail sales data on Friday. Retail sales in Australia rose 0.5% in October, in line with expectations, after a 0.4% gain in September.

The increase was mainly driven by higher household goods sales and department stores sales. Household goods sales were up 1.1% in October, while department stores sales increased 3.5%.

On a yearly basis, retail sales climbed 3.9% in October.

-

17:21

Philadelphia Fed President Patrick Harker: the Fed should start its interest rate sooner rather than later

Philadelphia Fed President Patrick Harker said on Friday that the Fed should start its interest rate sooner rather than later.

"I would like to see rates raised sooner rather than later. With an early start, we can better ensure that monetary accommodation is removed gradually and that inflation returns to the Fed's 2 percent target smoothly. My fear is that the Federal Reserve risks losing its credibility and only adds uncertainty to the economic landscape the longer the Committee waits to begin normalizing policy," he said.

"Raising rates this year will, in my view, serve to reduce monetary policy uncertainty and to keep the economy on track for sustained growth with price stability," Harker added.

Philadelphia Fed president expects steady and modest growth in the U.S.

-

17:14

ECB President Mario Draghi’s speech will begin later

The European Central Bank (ECB) President Mario Draghi's speech in Economic Club of New York will begin later. The speech will begin at 17:20 GMT, not at 16:45 GMT.

-

17:04

Eurozone's retail PMI slides to 48.5 in November

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Friday. Eurozone's construction purchasing managers' index (PMI) dropped to 48.5 in November from 54.2 in July.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in Germany, France and Italy declined.

"The eurozone retail PMI posted its lowest reading for nine months in November as sales fell across each of three largest euro area nations. Italy and France recorded the sharpest decreases, though the German PMI's return to contraction territory after reaching an eight-and-a-half year high in July perhaps rings the loudest alarm bells," an economist at Markit, Phil Smith, said.

-

17:00

Germany's retail PMI falls to 49.6 in November

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Friday. Germany's retail purchasing managers' index (PMI) declined to 49.6 in November from 52.4 in October.

The decline was driven by a fall in retail sales.

"It is too early to say whether the fractional drop in sales was an outlier or whether November's survey results are the start of a downturn," an economist at Markit, Oliver Kolodseike, said.

-

16:54

The European Central Bank (ECB) Vice President Vitor Constancio: markets misunderstood the central bank’s action

The European Central Bank (ECB) Vice President Vitor Constancio said in an interview with CNBC that markets misunderstood the central bank's action.

"We have to recognize that the markets got it wrong in forming their expectations. They did indeed have higher expectations than were there and that's why they reacted like they reacted but that was not our intention," he said.

The euro jumped after yesterday's interest rate decision by the ECB, while stock markets dropped. Market participants were disappointed because they hoped for more stimulus measures by the ECB. The ECB kept its interest rate unchanged at 0.05% on Thursday, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. The volume of the monthly purchases remained unchanged.

-

16:33

Bundesbank upgrades its growth forecasts for 2017 for Germany

Bundesbank upgraded its growth forecasts for 2017 for Germany. The economic growth is expected to be 1.7% in 2015, up from the previous estimate of 1.0%, in line with the previous estimate, and 1.8% in 2016, in line with the previous estimate, and 1.7% in 2017, up from the previous estimate of 1.5%.

"The German economy is currently following a growth path that is primarily underpinned by domestic demand," the Bundesbank said in its statement.

Inflation is expected to be 0.2% in 2015, down from the previous estimate of 0.5%, 1.1% in 2016, down from the previous estimate of 1.8%, and 2.0% in 2017, down from the previous estimate of 2.2%.

Inflation forecasts were downgraded by a further drop in oil prices.

"The main drivers are the favourable labour market situation and substantial increases in households' real disposable income, though foreign trade is currently being hampered by frail demand from the emerging market economies," Bundesbank President Jens Weidmann said.

-

16:23

Canada’s Ivey purchasing managers’ index jumps to 63.6 in November

Canada's seasonally adjusted Ivey purchasing managers' index jumped to 63.6 in November from 53.1 in October. Analysts had expected the index to increase to 55.3.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was up to 53.4 in November from 51.9 in October, while employment index climbed to 53.8 from 48.3.

The prices index was decreased to 55.2 in November from 61.8 in October, while inventories increased to 58.4 from 46.6.

-

16:15

Bank of France upgrades its growth forecasts

The Bank of France released its growth forecasts on Friday. France's central bank expects the French economy to expand at an average 1.2% in 2015, 1.4% in 2016, down from the previous estimate of 1.8%, and 1.6% in 2017, down from the previous estimate of 1.9%.

Effects from low oil prices and a weaker euro are expected to fade in the coming year, according to the Bank of France.

Inflation is expected to be 0.1% in 2015, down from the previous estimate of 0.3%, 1.0% in 2016, down from the previous estimate of 1.4%, and 1.5% in 2017, down from the previous estimate of 1.7%.

-

16:00

Canada: Ivey Purchasing Managers Index, November 63.6 (forecast 55.3)

-

15:38

U.S. trade deficit widens to $43.89 billion in October

The U.S. Commerce Department released the trade data on Friday. The U.S. trade deficit widened to $43.89 billion in October from a deficit of $42.64 billion in September. September's figure was revised down from a deficit of $40.81 billion.

Analysts had expected a trade deficit of $40.5 billion.

The rise of a deficit was driven by a drop in exports. A stronger U.S. dollar weighed on exports.

Exports fell by 1.4% in October, while imports decreased by 0.6%.

-

15:26

U.S. unemployment rate remains unchanged at 5.0% in November, 211,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 211,000 jobs in November, exceeding expectations for a rise of 200,000 jobs, after a gain of 298,000 jobs in October. October's figure was revised up from a rise of 271,000 jobs.

The increase was partly driven by a rise in construction, professional and technical services, and health care. Health care sector added 32,200 jobs in November, professional and business services sector added 27,000 jobs, while construction added 46,000.

The manufacturing sector lost 1,000 jobs in November, while mining sector shed 11,000 jobs.

The U.S. unemployment rate remained unchanged at 5.0% in November, in line with expectations.

Average hourly earnings rose 0.2% in November, in line with forecasts, after a 0.4% increase in October.

The labour-force participation rate increased to 62.5% in November from 62.4% in October.

These figures indicate that the Fed will likely raise its interest rate this year.

-

15:10

Canada’s unemployment rate rises to 7.1% in November

Statistics Canada released the labour market data on Friday. Canada's unemployment rate rose to 7.1% in November from 7.0% in October.

Analysts had expected the unemployment rate to remain unchanged at 7.0%.

The labour participation rate declined to 65.8% in November from 66.0% in October.

The number of employed people slid by 35,700 jobs in November, missing expectations for a decline of 10,000 jobs, after a 44,400 increase in October.

The decrease was driven by a drop in part-time work. Full-time employment was up by 36,600 in November, while part-time employment decreased by 72,300 jobs.

The Bank of Canada monitors closely the labour participation rate.

-

15:00

Canada's trade deficit widens to C$2.76 billion in October

Statistics Canada released the trade data on Friday. Canada's trade deficit widened to C$2.76 billion in October from a deficit of C$2.32 billion in September. September's figure was revised down from a deficit of C$1.73 billion.

Analysts had expected a trade deficit of C$1.7 billion.

The rise in deficit was driven by a drop in exports. Exports dropped 1.8% in October.

Exports of farm, fishing and intermediate food products declined by 7.3% in October, exports of metal ores and non-metallic minerals fell by 9.4%, while exports of metal and non-metallic mineral product were down 2.2%.

Imports fell 0.8% in October.

Imports of consumer products declined by 3.3% in October, and imports of electronic and electrical equipment and parts dropped 3.1%, while imports of energy products slid 6.8%.

-

14:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0500(E1.93bn), $1.0600(E4.36bn), $1.0625(E2.48bn), $1.0700(E5.36bn), $1.0750(E1.49bn), $1.0800(E2.39bn), $1.0900(E2.39bn), $1.0950(E2.09bn), $1.1000(E3.22bn), $1.1050(E1.07bn), $1.1100(E2.24bn)

USD/JPY: Y122.70($421mn), Y122.95-123.00($745mn), Y123.20-25($682mn), Y123.40-55($1.04bn), Y125.00($666mn)

EUR/JPY: Y133.50(E254mn), Y135.10(E200mn)

GBP/USD: $1.4900(Gbp359mn), $1.5000(Gbp276mn), $1.5100(Gbp209mn), $1.5300(Gbp301mn)

EUR/GBP: Gbp0.7100(E500mn)

USD/CHF: Chf1.000($280mn), Chf1.0050($220mn)

AUD/USD: $0.7195-0.7200(A$686mn), $0.7375($249mn)

AUD/NZD: NZ$1.0805(A$150mn), NZ$1.0900(A$207mn)

USD/CAD: C$1.3300($280mn), C$!.3360($210mn), C$1.3420-25($595mn), C$1.3500($395mn)

-

14:31

Canada: Trade balance, billions, October -2.76 (forecast -1.7)

-

14:31

U.S.: International Trade, bln, October -43.89 (forecast -40.5)

-

14:30

U.S.: Unemployment Rate, November 5% (forecast 5%)

-

14:30

U.S.: Nonfarm Payrolls, November 211 (forecast 200)

-

14:30

Canada: Unemployment rate, November 7.1% (forecast 7%)

-

14:30

U.S.: Average hourly earnings , November 0.2% (forecast 0.2%)

-

14:30

U.S.: Average workweek, November 34.5 (forecast 34.5)

-

14:30

Canada: Employment , November -35.7 (forecast -10)

-

14:18

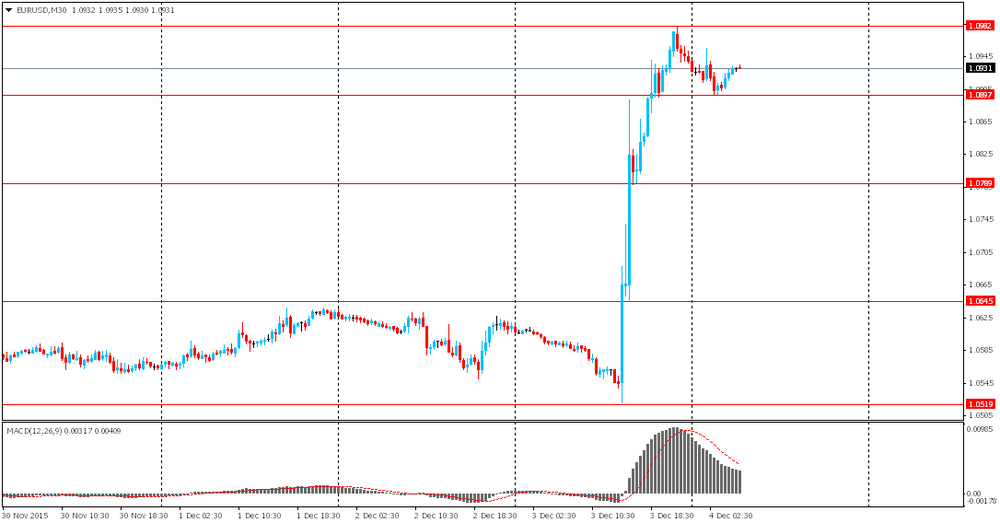

Foreign exchange market. European session: the euro lower against the U.S. dollar as market participants continued to eye the European Central Bank's (ECB) interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail Sales, M/M October 0.4% 0.5% 0.5%

01:30 Japan Labor Cash Earnings, YoY October 0.4% 0.4% 0.7%

05:00 Japan Consumer Confidence November 41.5 41.8 42.6

07:00 Germany Factory Orders s.a. (MoM) October -0.7% Revised From -1.7% 1.2% 1.8%

08:15 Switzerland Consumer Price Index (MoM) November 0.1% 0% -0.1%

08:15 Switzerland Consumer Price Index (YoY) November -1.4% -1.3% -1.4%

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the U.S. economic data. The U.S. unemployment rate is expected to remain unchanged at 5.1% in November.

The U.S. economy is expected to add 200,000 jobs in November, after adding 271,000 jobs in October.

The U.S. trade deficit is expected to narrow to $40.5 billion in October from $40.81 billion in September.

The euro lower against the U.S. dollar as market participants continued to eye the European Central Bank's (ECB) interest rate decision. Market participants were disappointed because they hoped for more stimulus measures by the ECB. The ECB kept its interest rate unchanged at 0.05% on Thursday, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. The volume of the monthly purchases remained unchanged.

Meanwhile, the economic data from Germany was positive. Destatis released its factory orders data for Germany on Friday. German seasonal adjusted factory orders climbed 1.8% in October, exceeding expectations for a 1.2% increase, after a 0.7% fall in September. September's figure was revised up from a 1.7% drop.

The rise was driven by an increase in foreign and domestic orders. Foreign orders increased by 1.8% in October, while domestic orders rose by 1.7%.

New orders from the Eurozone jumped 2.7% in October, while orders from other countries climbed 1.4%.

Orders of the intermediate goods increased by 0.1% in October, capital goods orders were up 2.7%, while consumer goods orders soared 3.8%.

The ECB President Mario Draghi will speak at 16:45 GMT.

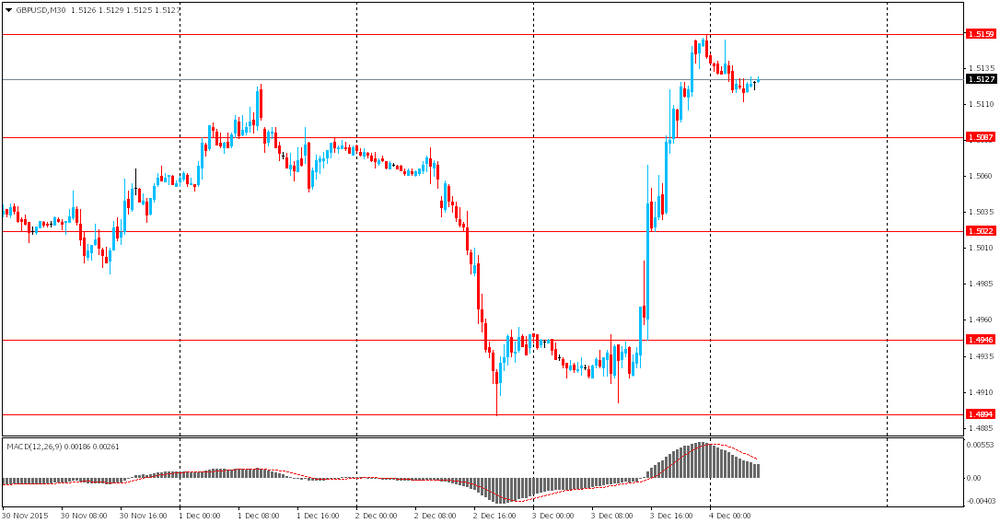

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 7.0% in November.

Canada's economy is expected to lose 10,000 jobs in November.

The Canadian trade deficit is expected to narrow to C$1.7 billion in October from C$1.73 billion in September.

The Swiss franc traded lower against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index fell 0.1% in November, missing expectations for a flat reading, after a 0.1% increase in October.

The decline was partly driven by lower prices for clothing. Prices for clothing and shoes declined 0.7% in November.

On a yearly basis, Switzerland's consumer price index remained unchanged at -1.4% in November, missing forecasts for a 1.3% drop. It was the biggest fall since July 1959.

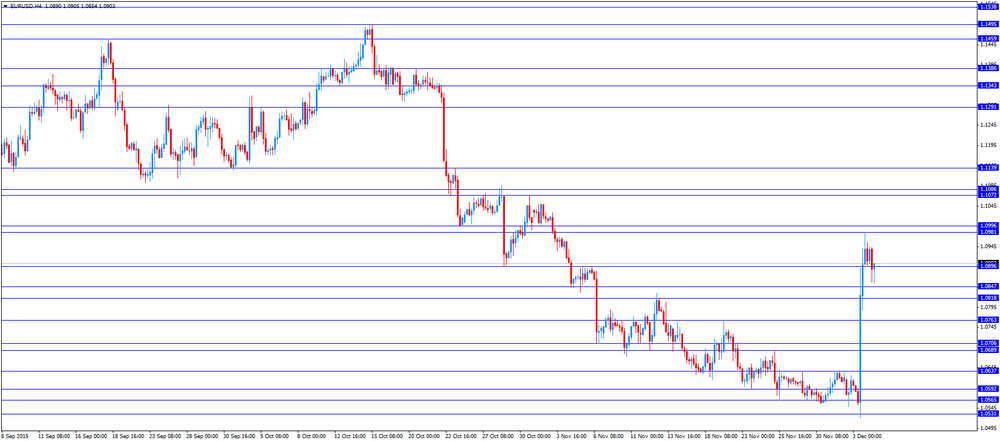

EUR/USD: the currency pair fell to $1.0854

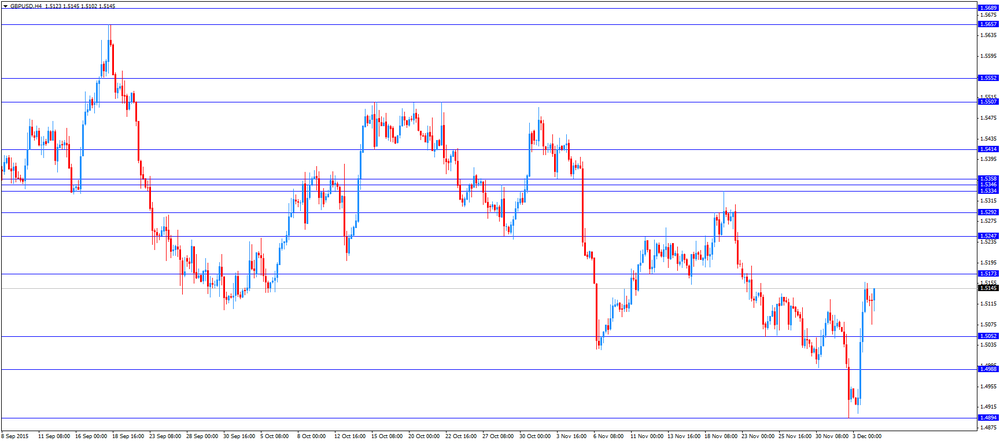

GBP/USD: the currency pair traded mixed

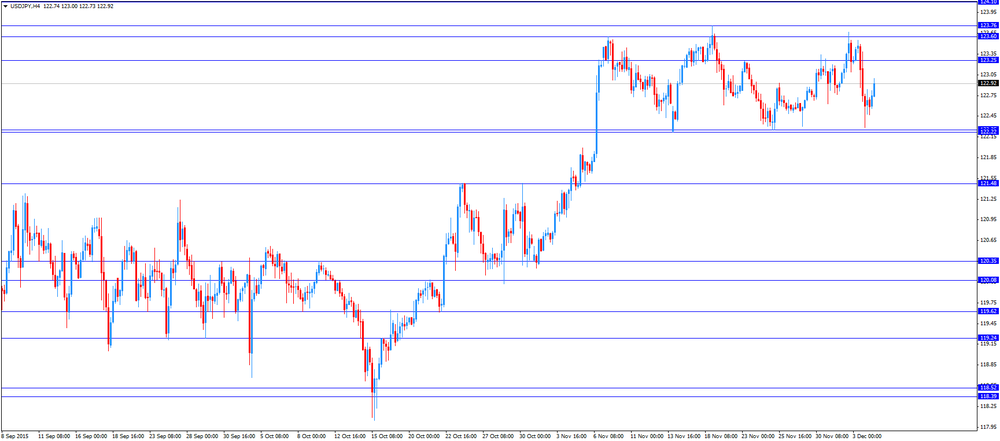

USD/JPY: the currency pair increased to Y123.00

The most important news that are expected (GMT0):

13:30 Canada Trade balance, billions October -1.73 -1.7

13:30 Canada Unemployment rate November 7.0% 7%

13:30 Canada Employment November 44.4 -10

13:30 U.S. Average workweek November 34.5 34.5

13:30 U.S. Average hourly earnings November 0.4% 0.2%

13:30 U.S. International Trade, bln October -40.81 -40.5

13:30 U.S. Nonfarm Payrolls November 271 200

13:30 U.S. Unemployment Rate November 5% 5%

15:00 Canada Ivey Purchasing Managers Index November 53.1 55.3

16:45 Eurozone ECB President Mario Draghi Speaks

17:00 U.S. FOMC Member Dudley Speak

-

11:47

Germany's construction PMI increases to 52.5 in November

Markit Economics released construction purchasing managers' index (PMI) for Germany on Friday. Germany's construction purchasing managers' index (PMI) increased to 52.5 in November from 51.8 in October.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in all three categories of construction activity.

"November data signalled accelerated growth of construction activity in Germany, highlighted by the headline index reaching an eight-month high. A closer look at the underlying data shows that the upturn was broad-based, with growth reported across all three categories of building activity monitored by this survey," an economist at Markit, Oliver Kolodseike, said.

-

11:34

Industrial production in Spain rises 0.2% in October

Spanish statistical office INE released its industrial production figures for Spain on Friday. Industrial production in Spain was up 0.2% in October, after a 1.1% gain in September.

On a yearly basis, industrial production in Spain climbed at adjusted 4.0% in October, after a 3.7% increase in September. September's figure was revised down from a 3.8% gain.

Output of capital goods jumped at seasonally adjusted 10.4% year-on-year in October, output of intermediate goods climbed 4.4%, energy production was down 2.3%, while consumer goods output rose 3.6%.

-

11:21

Switzerland’s consumer price inflation declines 0.1% in November

The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index fell 0.1% in November, missing expectations for a flat reading, after a 0.1% increase in October.

The decline was partly driven by lower prices for clothing. Prices for clothing and shoes declined 0.7% in November.

On a yearly basis, Switzerland's consumer price index remained unchanged at -1.4% in November, missing forecasts for a 1.3% drop. It was the biggest fall since July 1959.

-

11:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0500(E1.93bn), $1.0600(E4.36bn), $1.0625(E2.48bn), $1.0700(E5.36bn), $1.0750(E1.49bn), $1.0800(E2.39bn), $1.0900(E2.39bn), $1.0950(E2.09bn), $1.1000(E3.22bn), $1.1050(E1.07bn), $1.1100(E2.24bn)

USD/JPY: Y122.70($421mn), Y122.95-123.00($745mn), Y123.20-25($682mn), Y123.40-55($1.04bn), Y125.00($666mn)

EUR/JPY: Y133.50(E254mn), Y135.10(E200mn)

GBP/USD: $1.4900(Gbp359mn), $1.5000(Gbp276mn), $1.5100(Gbp209mn), $1.5300(Gbp301mn)

EUR/GBP: Gbp0.7100(E500mn)

USD/CHF: Chf1.000($280mn), Chf1.0050($220mn)

AUD/USD: $0.7195-0.7200(A$686mn), $0.7375($249mn)

AUD/NZD: NZ$1.0805(A$150mn), NZ$1.0900(A$207mn)

USD/CAD: C$1.3300($280mn), C$!.3360($210mn), C$1.3420-25($595mn), C$1.3500($395mn)

-

11:10

German seasonal adjusted factory orders jump 1.8% in October

Destatis released its factory orders data for Germany on Friday. German seasonal adjusted factory orders climbed 1.8% in October, exceeding expectations for a 1.2% increase, after a 0.7% fall in September. September's figure was revised up from a 1.7% drop.

The rise was driven by an increase in foreign and domestic orders. Foreign orders increased by 1.8% in October, while domestic orders rose by 1.7%.

New orders from the Eurozone jumped 2.7% in October, while orders from other countries climbed 1.4%.

Orders of the intermediate goods increased by 0.1% in October, capital goods orders were up 2.7%, while consumer goods orders soared 3.8%.

-

10:55

The European Central Bank (ECB) Governing Council member Jens Weidmann: further stimulus measures by the ECB were not needed

The European Central Bank (ECB) Governing Council member Jens Weidmann said on Thursday that further stimulus measures by the ECB were not needed.

"Considering the dominant role of the energy-price decline for the price development in the Eurozone and earlier comprehensive monetary policy measures, that also can have risks and side effects, I did not believe a further loosening of policy was necessary," he said.

-

10:46

The European Central Bank Executive Board member Yves Mersch: the central bank’s decision to extend its asset-buying programme was justified

The European Central Bank (ECB) Executive Board member Yves Mersch said on Thursday that the central bank's decision to extend its asset-buying programme was justified.

"Today's decision is reasonable and justified," he said.

Mersch noted that the Eurozone's economy was recovering, and inflation was picking up toward the 2% target.

-

10:35

The European Central Bank lowers the amount of emergency funding (ELA) to Greek banks by €7.8 billion

According to the Bank of Greece on Thursday, the European Central Bank (ECB) lowered the amount of emergency funding (ELA) to Greek banks by €7.8 billion to €77.9 billion.

"The reduction of €7.8 billion in the ceiling reflects an improvement of the liquidity situation of Greek banks amid a reduction of uncertainty and the stabilization of private sector deposits flows, as well as the progress achieved in the recapitalisation process of Greek banks," the Bank of Greece said in its statement.

-

10:23

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 39.6 in in the week ended November 29

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 39.6 in in the week ended November 29 from 40.9 the prior week. The decline was driven by a less favourable assessment of buying climate.

The measure of views of the economy was little changed.

The buying climate declined to 34.5 last week from 37.3.

The personal finances index fell to 53.7 from 54.8.

-

10:13

ISM non-manufacturing purchasing managers’ index drops to 55.9 in November

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Thursday. The index dropped to 55.9 in November from 59.1 in October, missing expectations for a decrease to 58.0.

A reading above 50 indicates a growth in the service sector.

The decrease was mainly driven by declines in the business activity, new orders, and employment sub-indexes.

The ISM's new orders index decreased to 57.5 in November from 62.0 in October.

The business activity/production index slid to 58.2 in November from 63.0 in October.

The ISM's employment index was down to 55.0 in November from 59.2 in October.

The prices index climbed to 50.3 in November from 49.1 in October.

-

09:16

Switzerland: Consumer Price Index (YoY), November -1.4% (forecast -1.3%)

-

09:16

Switzerland: Consumer Price Index (MoM) , November -0.1% (forecast 0%)

-

08:41

Options levels on friday, December 4, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1036 (7130)

$1.0995 (5533)

$1.0975 (3455)

Price at time of writing this review: $1.0888

Support levels (open interest**, contracts):

$1.0793 (6392)

$1.0746 (5721)

$1.0697 (8425)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 106959 contracts, with the maximum number of contracts with strike price $1,1000 (7130);

- Overall open interest on the PUT options with the expiration date December, 4 is 123290 contracts, with the maximum number of contracts with strike price $1,0500 (10674);

- The ratio of PUT/CALL was 1.15 versus 1.11 from the previous trading day according to data from December, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.5400 (1914)

$1.5300 (2535)

$1.5202 (1238)

Price at time of writing this review: $1.5088

Support levels (open interest**, contracts):

$1.5000 (2509)

$1.4900 (2667)

$1.4800 (615)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 30229 contracts, with the maximum number of contracts with strike price $1,5600 (3574);

- Overall open interest on the PUT options with the expiration date December, 4 is 31758 contracts, with the maximum number of contracts with strike price $1,5050 (4294);

- The ratio of PUT/CALL was 1.05 versus 1.07 from the previous trading day according to data from December, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Foreign exchange market. Asian session: the euro retreated

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Retail Sales, M/M October 0.4% 0.5% 0.5%

05:00 Japan Consumer Confidence November 41.5 41.8 42.6

The euro declined against the U.S. dollar after yesterday's rally, which was triggered by the European Central Bank meeting. The ECB left its benchmark interest rate unchanged at 0.05%, but cut its deposit facility rate by 20 basis points to -0.30% (efficient on December 9). The bank also extended its asset purchase program till March 2017 and announced that it will buy regional and local government debt as well. The ECB left its asset-purchase plan at €60 billion, though many analysts had expected the bank to expand it by €15 billion.

Today market participants are waiting for the U.S. non-farm payrolls report. A median forecast suggests non-farm sectors of the U.S. economy created 200,000 jobs in November compared to 271,000 new jobs in October. Analysts also expect the unemployment rate to remain at 5%.

The Australian dollar declined against the greenback partly due to retail sales data. Retail sales rose by 0.5% in October on a seasonally adjusted basis. The reading was in line with expectations. Department stores saw a 3.5% gain in sales. Sales of household goods rose by 1.1%. Meanwhile sales of clothing and footwear fell 0.1% and spending for dining out declined by 0.6%.

EUR/USD: the pair fluctuated within $1.0895-55 in Asian trade

USD/JPY: the pair traded within Y122.50-85

GBP/USD: the pair fell to $1.5110

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Factory Orders s.a. (MoM) October -1.7% 1.2%

08:00 United Kingdom Halifax house price index November 1.1%

08:00 United Kingdom Halifax house price index 3m Y/Y November 9.7%

08:15 Switzerland Consumer Price Index (MoM) November 0.1% 0%

08:15 Switzerland Consumer Price Index (YoY) November -1.4% -1.3%

13:30 Canada Trade balance, billions October -1.73 -1.7

13:30 Canada Unemployment rate November 7.0% 7%

13:30 Canada Employment November 44.4 -10

13:30 U.S. Average workweek November 34.5 34.5

13:30 U.S. Average hourly earnings November 0.4% 0.2%

13:30 U.S. International Trade, bln October -40.81 -40.5

13:30 U.S. Nonfarm Payrolls November 271 200

13:30 U.S. Unemployment Rate November 5% 5%

15:00 Canada Ivey Purchasing Managers Index November 53.1 55.3

-

08:00

Germany: Factory Orders s.a. (MoM), October 1.8% (forecast 1.2%)

-

06:02

Japan: Consumer Confidence, November 42.6 (forecast 41.8)

-

01:30

Australia: Retail Sales, M/M, October 0.5% (forecast 0.5%)

-

00:30

Currencies. Daily history for Dec 3’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0939 +2,97%

GBP/USD $1,5143 +1,27%

USD/CHF Chf0,9932 -2,52%

USD/JPY Y122,60 -0,52%

EUR/JPY Y134,11 +2,46%

GBP/JPY Y185,63 +0,75%

AUD/USD $0,7338 +0,42%

NZD/USD $0,6686 0,72%

USD/CAD C$1,3352 +0,08%

-