Noticias del mercado

-

23:57

Schedule for today, Friday, Dec 4’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Retail Sales, M/M October 0.4% 0.5%

05:00 Japan Consumer Confidence November 41.5 41.8

07:00 Germany Factory Orders s.a. (MoM) October -1.7% 1.2%

08:00 United Kingdom Halifax house price index November 1.1%

08:00 United Kingdom Halifax house price index 3m Y/Y November 9.7%

08:15 Switzerland Consumer Price Index (MoM) November 0.1% 0%

08:15 Switzerland Consumer Price Index (YoY) November -1.4% -1.3%

13:30 Canada Trade balance, billions October -1.73 -1.7

13:30 Canada Unemployment rate November 7.0% 7%

13:30 Canada Employment November 44.4 -10

13:30 U.S. Average workweek November 34.5 34.5

13:30 U.S. Average hourly earnings November 0.4% 0.2%

13:30 U.S. International Trade, bln October -40.81 -40.5

13:30 U.S. Nonfarm Payrolls November 271 200

13:30 U.S. Unemployment Rate November 5% 5%

15:00 Canada Ivey Purchasing Managers Index November 53.1 55.3

-

21:00

Dow -1.46% 17,470.42 -259.26 Nasdaq -1.78% 5,031.94 -91.28 S&P -1.49% 2,048,45 -31.06

-

18:37

Fed Chairwoman Janet Yellen: the U.S. labour market is close to full employment

The Fed Chairwoman Janet Yellen testified before the Joint Economic Committee of U.S. Congress on Thursday. She said that the U.S. labour market is close to full employment.

"I currently judge that U.S. economic growth is likely to be sufficient over the next year or two to result in further improvement in the labour market," she said.

Yellen expects inflation to pick up toward the Fed's 2% inflation target as "the disinflationary effects of declines in energy and import prices wane".

The Fed chairwoman noted that if the Fed delays its interest rate for a longer period, it could lead to a recession.

"Were the FOMC to delay the start of policy normalization for too long, we would likely end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of our goals. Such an abrupt tightening would risk disrupting financial markets and perhaps even inadvertently push the economy into recession," Yellen said.

"Moreover, holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and thus undermine financial stability;" she added.

Yellen also said that the interest rate hike will depend on the incoming economic data.

-

18:00

European stocks closed: FTSE 100 6,275 -145.93 -2.27% CAC 40 4,730.21 -175.55 -3.58% DAX 10,789.24 -400.78 -3.58%

-

17:25

Asian Development Bank upgrades growth forecast for China

The Asian Development Bank (ADB) upgraded growth forecast for China on Thursday. According to the ADB, China is expected to expand by 6.9% in 2015, up from the previous estimate of a 6.8% rise, and 6.7% in 2016, unchanged from the previous estimate.

The economic growth of developing Asia is expected to be 5.8% this year and 6% in 2016, both unchanged from the previous estimates.

Southeast Asia is expected to grow 4.4% in 2015 and 4.9% in 2016, both unchanged from the previous estimates.

"Although we have seen some softening in a number of economies, the broader regional outlook is for continued steady growth," ADB Chief Economist Shang-Jin Wei said.

-

17:08

Australia's trade deficit widens to A$3.30 billion in October

The Australian Bureau of Statistics released its trade data on Thursday. Australia's trade deficit widened to A$3.30 billion in October from A$2.40 billion in September, missing expectations for a rise to a deficit of A$2.67 billion. September's figure was revised down from a deficit of A$2.32 billion.

Exports dropped by 3.0% in October, while imports were flat.

-

17:00

San Francisco Fed President John Williams: the Fed should start raising its interest rate “sooner rather than later”

San Francisco Fed President John Williams said in a speech on Wednesday that the Fed should start raising its interest rate "sooner rather than later".

"The first step in bringing policy closer to normal was when we ended QE. The next appropriate step is to raise rates. My preference is sooner rather than later," he said.

Williams noted that if the Fed waits longer to raise its interest rates, the economy could generate imbalances, "leading to either excessive inflation or an economic correction and recession".

-

16:49

Final Markit/Nikkei services purchasing managers' index for Japan falls to 51.6 in November

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan fell to 51.6 in November from 52.2 in October.

A reading below 50 indicates contraction of activity.

The decline was driven by a weaker growth in activity and new business.

"Business activity at Japanese services firms increased at a slower rate in November, underpinned by a softer expansion in new orders. Subsequently, employment levels fell for the second month running," economist at Markit, Amy Brownbill, said.

-

16:44

U.S. factory orders climb 1.5% in October

The U.S. Commerce Department released factory orders data on Thursday. Factory orders in the U.S. climbed 1.5% in October, exceeding expectations for a 1.4% rise, after a 0.8% drop in September. September's figure was revised up from a 1.0% fall.

The increase was partly driven by higher demand for transportation equipment, which jumped 7.9% in October.

Durable goods orders increased by 2.9% in October, while orders for nondurable goods were flat.

Factory orders excluding transportation rose 0.2% in October, after a 0.6% decline in September.

-

16:07

Final U.S. services PMI increases to 56.1 in November

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Thursday. Final U.S. services purchasing managers' index (PMI) increased to 56.1 in November from 54.8 in October, down from the preliminary reading of 56.5.

The increase was driven by a stronger rise in business activity and new business.

"Growth is being fuelled by rising domestic demand, which propelled growth in the vast service economy higher and more than offset an export-led weakening of manufacturing growth," Chief Economist at Markit Chris Williamson said.

-

16:01

U.S.: Factory Orders , October 1.5% (forecast 1.4%)

-

16:00

U.S.: ISM Non-Manufacturing, November 55.9 (forecast 58)

-

15:50

European Central Bank President Mario Draghi: the asset-buying programme will be extended until the end of March 2017

The European Central Bank (ECB) President Mario Draghi on Thursday said at a press conference after the release of the central bank's interest rate decision:

- The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016;

- The volume of the monthly purchases remained unchanged;

- The ECB will buy not only euro-denominated regional and local debt in its purchases but it will also reinvest principal payments on the securities;

- There are continued downside risks to the inflation outlook;

- New measures should support significant positive effects on financing conditions, credit and the real economy from the previous measures;

- The central bank could add further stimulus measures if needed: "The Governing Council will closely monitor the evolution in the outlook for price stability and, if warranted, is willing and able to act by using all the instruments available within its mandate in order to maintain an appropriate degree of monetary accommodation";

- The Eurozone's recovery is expected to continue, but there are downside risks from the slowdown in emerging economies;

- Geopolitical risks increased;

- The economic recovery should be supported by structural reforms and fiscal policies.

- The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016;

-

15:45

U.S.: Services PMI, November 56.1 (forecast 56.5)

-

15:25

Spain’s services PMI increases to 56.7 in November

Markit Economics released final services purchasing managers' index (PMI) for Spain on Thursday. Spain's final services purchasing managers' index (PMI) increased to 56.7 in November from 55.9 in October.

The index was driven by an increase in business activity and new business.

"The Spanish service sector looks set for a positive end to the year after rates of expansion in both activity and new business accelerated for the second month running in November. This provides further evidence that the slowdown in growth at the end of Q3 won't develop into a period of stagnation," Senior Economist at Markit Andrew Harker said.

-

14:57

Italy’s services PMI remains unchanged at 53.4 in November

Markit/ADACI's services purchasing managers' index (PMI) for Italy remained unchanged at 53.4 in November.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in new business and employment.

"The services PMI has settled at a near-constant level over the past three months, indicating a phase of steady growth in the sector," an economist at Markit Phil Smith said.

-

14:49

European Central Bank raises its economic growth forecasts, but cuts its inflation forecasts

The European Central Bank (ECB) upgraded its economic growth forecasts, but lowered its inflation forecasts. Eurozone's economy is expected to expand 1.5% in 2015, up from the previous estimate of a 1.4% gain, 1.7% in 2016, in line with the previous estimate, and 1.9% in 2017, up from the previous estimate of a 1.8% increase.

Eurozone's inflation is expected to rise 0.1% in 2015, in line with the previous estimate, 1.0% in 2016, down from the previous estimate of a 1.1% rise, and 1.6% in 2017, down from the previous estimate of a 1.7% increase.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (E1.3BLN), 1.0430 (E800M), 1.0450 (E1.4BLN), 1.0500 (E2.7BLN), 1.0555 (E850M), 1.0600 (E2BLN), 1.0625 (E711M), 1.0650 (E1.2BLN)1.0700 (E785M)

USD/CHF: Chf1.0130 ($476M), Chf1.0180 ($256M)

GBP/USD: 1.5020 (Gbp329M)

USD/CAD: C$1.3225 ($280M)

AUD/USD: 0.7200 (A$779M), 0.7225 (A$351M), 0.7375 (A$778M)

USD/JPY: Y122.50 ($475M), Y123.00 ($260M), Y123.25 ($805M)

EUR/JPY: Y129.00 (E602M), Y131.00 (E300M)

-

14:42

Initial jobless claims rise to 269,000 in the week ending November 28

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending November 28 in the U.S. rose by 9,000 to 269,000 from 260,000 in the previous week, exceeding expectations for an increase to 268,000.

Jobless claims remained below 300,000 the 39th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 6,000 to 2,161,000 in the week ended November 21.

-

14:30

U.S.: Initial Jobless Claims, November 269 (forecast 268)

-

14:30

U.S.: Continuing Jobless Claims, November 2161 (forecast 2187)

-

14:23

European Central Bank keeps its interest rate unchanged at 0.05% in December, but cuts its deposit rate

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

The interest rate remains unchanged since September 2014.

But the ECB lowered its deposit rate to -0.3% from -0.2%.

The central bank will announce further measures at its press conference at 13:30 GMT.

-

14:20

Foreign exchange market. European session: the euro higher against the U.S. dollar after the European Central Bank’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m October -4.0% -3.0%

00:30 Australia Trade Balance October -2.40 Revised From -2.32 -2.665 -3.30

01:45 China Markit/Caixin Services PMI November 52.0 53.1 51.2

08:50 France Services PMI (Finally) November 52.7 51.3 51.0

08:55 Germany Services PMI (Finally) November 54.5 55.6 55.6

09:00 Eurozone Services PMI (Finally) November 54.1 54.6 54.2

09:30 United Kingdom Purchasing Manager Index Services November 54.9 55 55.9

10:00 Eurozone Retail Sales (MoM) October -0.1% 0.2% -0.1%

10:00 Eurozone Retail Sales (YoY) October 2.9% 2.7% 2.5%

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded mixed to lower against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 8,000 to 268,000 last week.

The ISM non-manufacturing purchasing managers' index is expected to decline to 58.0 in November from 59.1 in October.

The U.S. factory orders are expected to climb 1.4% in October, after a 1.0 decline in September.

The Fed Chairwoman Janet Yellen will speak at 15:00 GMT.

The euro higher against the U.S. dollar after the European Central Bank's (ECB) interest rate decision. The ECB kept its interest rate unchanged at 0.05%, but lowered its deposit rate to -0.3% from -0.2%.

The ECB President Mario Draghi will speak at 13:30 GMT.

Meanwhile, the economic data from the Eurozone was weaker than expected. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.2 in November from 54.1 in October, down from the preliminary reading of 54.6.

The index was driven by arise in business activity rise across the countries.

Eurozone's final composite output index rose to 54.2 in November from 53.9 in October, down from the preliminary reading of 54.4.

"With the exception of France, growth rates are moving higher, but the ECB's concerns over price stability are given further credence by the survey showing average prices charged for goods and services dropping for a second successive month. As yet, it seems faster growth is not showing any signs of generating inflation," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy is likely to grow at 0.4% in the fourth quarter.

Germany's final services purchasing managers' index (PMI) rose to 55.6 in November from 54.5 in October, in line with the preliminary reading.

France's final services purchasing managers' index (PMI) dropped to 51.0 in November from 52.7 in October from 51.9 in September, down from the preliminary reading of 51.3.

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.1% in October, missing expectations for a 0.2% rise, after a 0.1% decline in September.

The decline was driven by lower food, drinks and tobacco sales and automotive fuel sales.

On a yearly basis, retail sales in the Eurozone climbed 2.5% in October, missing forecasts of a 2.7% gain, after a 2.9% increase in September.

The British pound traded higher against the U.S. dollar after the better-than-expected services PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 55.9 in November from 54.9 in October, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in new business and a moderate rise in backlogs.

"A welcome upturn in service sector expansion helped counter slower growth in manufacturing and construction in November, suggesting the UK continues to enjoy the 'Goldilocks' scenario of solid economic growth and low inflation," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is likely to expand 0.6% in the fourth quarter of 2015.

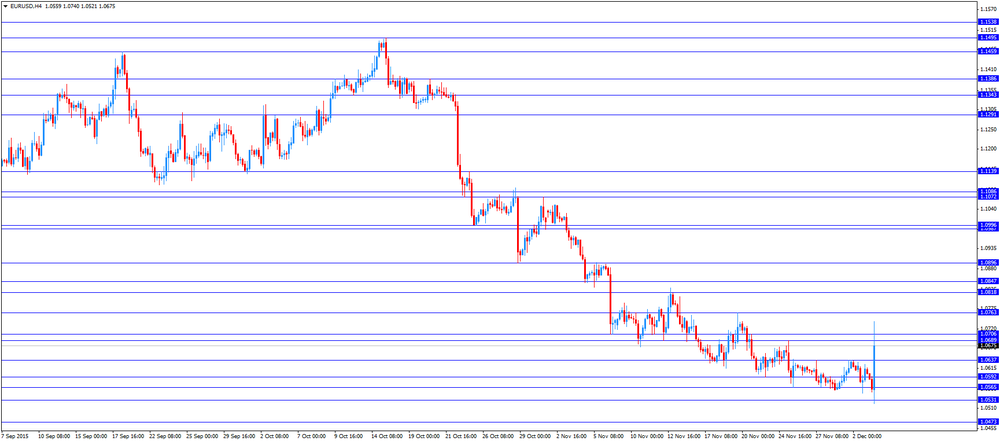

EUR/USD: the currency pair rose to $1.0740

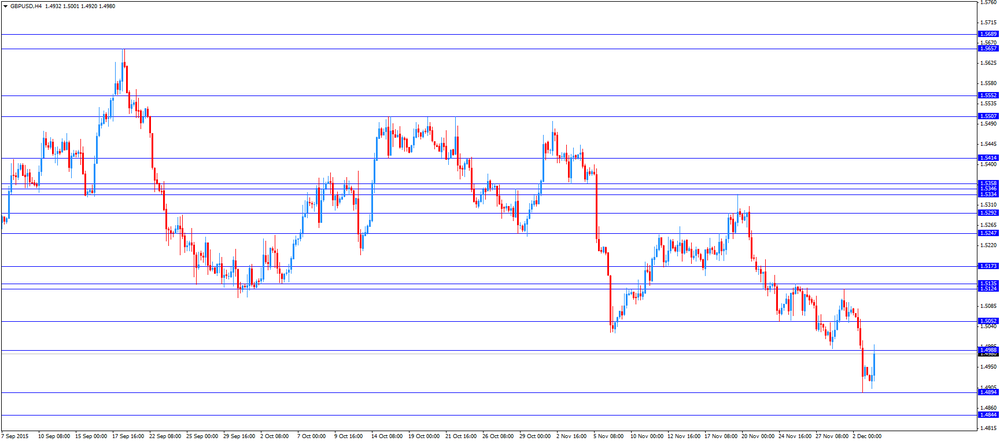

GBP/USD: the currency pair climbed to $1.5001

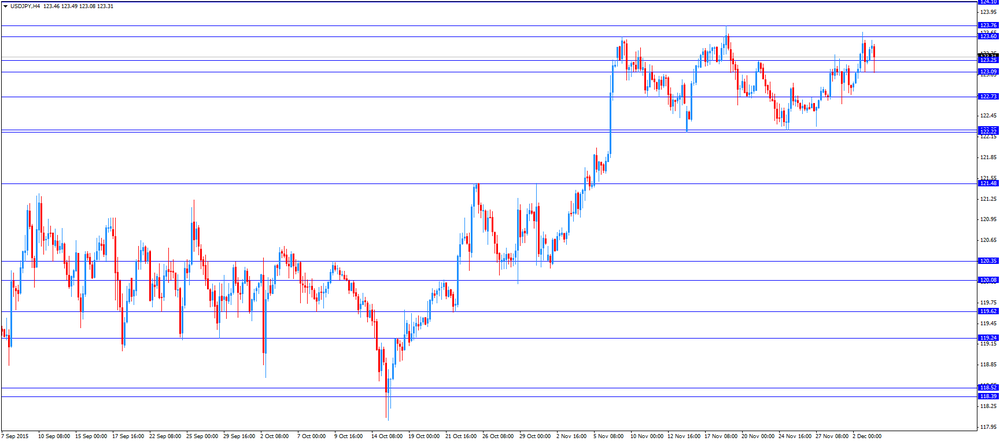

USD/JPY: the currency pair decreased to Y123.08

The most important news that are expected (GMT0):

13:30 Eurozone ECB Press Conference

13:30 U.S. Continuing Jobless Claims November 2207 2187

13:30 U.S. Initial Jobless Claims November 260 268

14:45 U.S. Services PMI (Finally) November 54.8 56.5

15:00 U.S. ISM Non-Manufacturing November 59.1 58

15:00 U.S. Factory Orders October -1.0% 1.4%

15:00 U.S. Fed Chairman Janet Yellen Speaks

18:10 U.S. FED Vice Chairman Stanley Fischer Speaks

-

14:00

Orders

EUR/USD

Offers 1.0600 1.0625-30 1.0650 1.0665 1.0685-90 1.0700 1.0720-25 1.0745 1.0760 1.0780-85 1.0800 1.0850

Bids 1.0575 1.0560 1.0550 1.0525-30 1.0500 1.0485 1.0465 1.0450 1.0425-30 1.0400 1.0385 1.0365 1.0350 1.0330 1.0300

GBP/USD

Offers 1.4960 1.4980-85 1.5000 1.5025-30 1.5050 1.5085 1.5100 1.5120-25 1.5135 1.5150-55

Bids 1.4900 1.4885-90 1.4865 1.4850 1.4835 1.4800 1.4785 1.4750 1.4725-30 1.4700

EUR/GBP

Offers 0.7100 0.7125-30 0.7150 0.7165 0.7185 0.7200 0.7220 0.7235 0.7250

Bids 0.7075-80 0.7060 0.7035-40 0.7020 0.7000 0.6980-85 0.6965 0.6950

EUR/JPY

Offers 130.80 131.00131.20 131.50 131.85 132.00 132.30 132.50

Bids 130.50 130.20 130.00 129.80 129.65 129.50 129.35 129.00

USD/JPY

Offers 123.50 123.75 124.00 124.30 124.50 124.75 125.00

Bids 123.25-30 123.00 122.85 122.65-70 122.50 122.20-25 122.00

AUD/USD

Offers 0.7335 0.7350 0.7375 0.7400 0.7425-30 0.7450

Bids 0.7300 0.7285 0.7265-70 0.7250 0.7235 0.7200 0.7185 0.7165 0.7150

-

13:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

11:45

France’s unemployment rate climbs to 10.6% in the third quarter

The French statistical office Insee released its unemployment data on Thursday. The unemployment rate in France climbed to 10.6% in the third quarter from 10.4% in the second quarter. The second quarter's figure was revised up from 10.3%.

The number of unemployed people in metropolitan France increased by 75,000 to 2.9 million in the third quarter.

The number of unemployed people under 24 years rose to 24.6% in the third quarter from 23.6% in the second quarter.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment.

-

11:39

France's final services PMI declines to 51.0 in November

Markit Economics released final services purchasing managers' index (PMI) for France on Thursday. France's final services purchasing managers' index (PMI) dropped to 51.0 in November from 52.7 in October from 51.9 in September, down from the preliminary reading of 51.3.

Terrorist attacks in Paris weighed on the index.

"French service sector activity growth slowed in November, with some impact from the Paris attacks reported by hotels and restaurants in particular. However, new business growth picked up to a five month high, offering encouragement that underlying demand conditions remained reasonably firm," Senior Economist at Markit Jack Kennedy said.

-

11:30

Germany's final services PMI rises to 55.6 in November

Markit Economics released final services purchasing managers' index (PMI) for Germany on Thursday. Germany's final services purchasing managers' index (PMI) rose to 55.6 in November from 54.5 in October, in line with the preliminary reading.

The index was driven by a rise in new business.

"Germany's service sector roared back to health in November, with business activity rising at the strongest rate in over a year and new business flooding in at a pace not seen since mid-2011. Moreover, companies continued to add to their payroll numbers at a healthy rate despite the unemployment rate in Germany already ultra-low," an economist at Markit, Oliver Kolodseike, said.

-

11:18

Eurozone’s retail sales fall 0.1% in October

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.1% in October, missing expectations for a 0.2% rise, after a 0.1% decline in September.

The decline was driven by lower food, drinks and tobacco sales and automotive fuel sales. Food, drinks and tobacco sales slid 0.5% in October, while automotive fuel sales declined 0.4%.

Non-food sales increased 0.1% in October.

On a yearly basis, retail sales in the Eurozone climbed 2.5% in October, missing forecasts of a 2.7% gain, after a 2.9% increase in September.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 3.5% year-on-year in October, gasoline sales increased 3.1%, while food, drinks and tobacco sales rose 1.1%.

-

11:00

Eurozone: Retail Sales (MoM), October -0.1% (forecast 0.2%)

-

11:00

Eurozone: Retail Sales (YoY), October 2.5% (forecast 2.7%)

-

10:55

Eurozone's final services PMI increases to 54.2 in November

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.2 in November from 54.1 in October, down from the preliminary reading of 54.6.

The index was driven by arise in business activity rise across the countries.

Eurozone's final composite output index rose to 54.2 in November from 53.9 in October, down from the preliminary reading of 54.4.

"With the exception of France, growth rates are moving higher, but the ECB's concerns over price stability are given further credence by the survey showing average prices charged for goods and services dropping for a second successive month. As yet, it seems faster growth is not showing any signs of generating inflation," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy is likely to grow at 0.4% in the fourth quarter.

-

10:44

UK’s services PMI rises to 55.9 in November

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 55.9 in November from 54.9 in October, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in new business and a moderate rise in backlogs.

"A welcome upturn in service sector expansion helped counter slower growth in manufacturing and construction in November, suggesting the UK continues to enjoy the 'Goldilocks' scenario of solid economic growth and low inflation," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is likely to expand 0.6% in the fourth quarter of 2015.

-

10:37

Beige Book: the U.S. economic activity continued to grow modestly from early-October through mid-November

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity continued to grow modestly from early-October through mid-November.

The Districts of Cleveland's, Richmond's, Atlanta's, Chicago's, St. Louis', Dallas' and San Francisco's activity grew modestly, the Minneapolis District's economy expanded moderately, the Kansas City District's growth was steady, Boston's activity was "somewhat slower", while the New York District's economic conditions levelled off.

The Fed noted that labour markets tightened in most districts, while "wage pressures increased only for skilled occupations and for workers that were in short supply".

Consumer spending rose in nearly all Districts since the previous report.

Conditions in the manufacturing sector were mixed as the strong dollar, low commodity prices, and weak global demand weighed on the sector's activity.

-

10:30

United Kingdom: Purchasing Manager Index Services, November 55.9 (forecast 55)

-

10:21

Chinese Markit/Caixin services PMI falls to 51.2 in November

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 51.2 in November from 52.0 in October, missing expectations for an increase to 53.1.

The index was driven by a slower growth in total new work.

Employment continued to rise in November, while outstanding business continued to decline.

"The macro economy has moved further toward stable growth and the economic structure is improving. Future fiscal and monetary policies must be coordinated and large-scale stimulus should be avoided as much as possible," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:11

Fed Chairwoman Janet Yellen: the U.S. economy is ready for an interest rate hike

The Fed Chairwoman Janet Yellen said in a speech on Wednesday that the U.S. economy is ready for an interest rate hike.

"I currently judge that U.S. economic growth is likely to be sufficient over the next year or two to result in further improvement in the labour market. Ongoing gains in the labour market, coupled with my judgment that longer-term inflation expectations remain reasonably well anchored, serve to bolster my confidence in a return of inflation to 2 percent as the disinflationary effects of declines in energy and import prices wane," she said.

Yellen noted that downside risks from abroad declined.

"Although developments in foreign economies still pose risks to U.S. economic growth that we are monitoring, these downside risks from abroad have lessened since late summer," the Fed chairwoman said.

She added that the Chinese economy will continue to expand moderately and gradually, and the government could add further stimulus measures if needed.

-

10:00

Eurozone: Services PMI, November 54.2 (forecast 54.6)

-

09:56

Germany: Services PMI, November 55.6 (forecast 55.6)

-

09:50

France: Services PMI, November 51.0 (forecast 51.3)

-

09:00

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (E1.3BLN), 1.0430 (E800M), 1.0450 (E1.4BLN), 1.0500 (E2.7BLN), 1.0555 (E850M), 1.0600 (E2BLN), 1.0625 (E711M), 1.0650 (E1.2BLN)1.0700 (E785M)

USD/CHF: Chf1.0130 ($476M), Chf1.0180 ($256M)

GBP/USD: 1.5020 (Gbp329M)

USD/CAD: C$1.3225 ($280M)

AUD/USD: 0.7200 (A$779M), 0.7225 (A$351M), 0.7375 (A$778M)

USD/JPY: Y122.50 ($475M), Y123.00 ($260M), Y123.25 ($805M)

EUR/JPY: Y129.00 (E602M), Y131.00 (E300M)

-

08:33

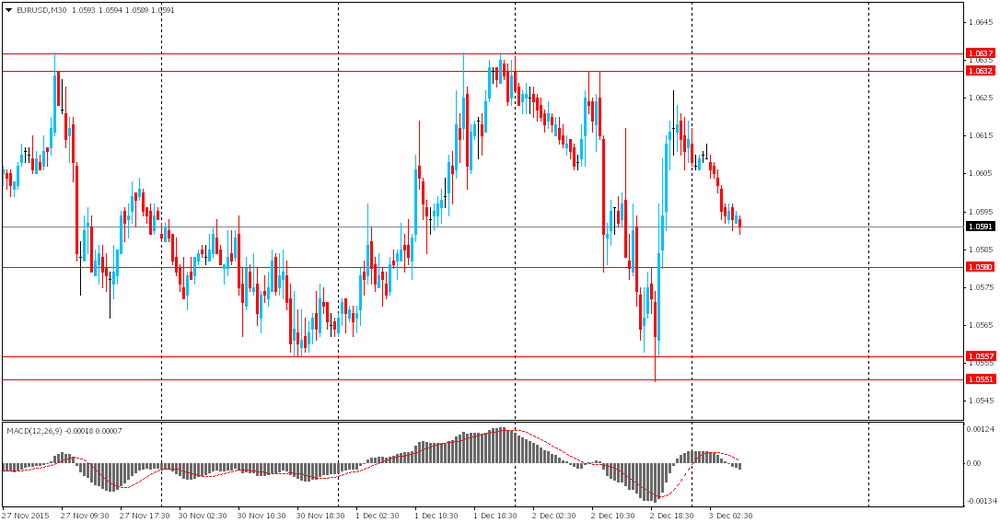

Options levels on thursday, December 3, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0762 (4434)

$1.0704 (3482)

$1.0664 (1289)

Price at time of writing this review: $1.0587

Support levels (open interest**, contracts):

$1.0557 (6878)

$1.0515 (6088)

$1.0455 (10174)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 107453 contracts, with the maximum number of contracts with strike price $1,0900 (6305);

- Overall open interest on the PUT options with the expiration date December, 4 is 119095 contracts, with the maximum number of contracts with strike price $1,0500 (10174);

- The ratio of PUT/CALL was 1.11 versus 1.17 from the previous trading day according to data from December, 2

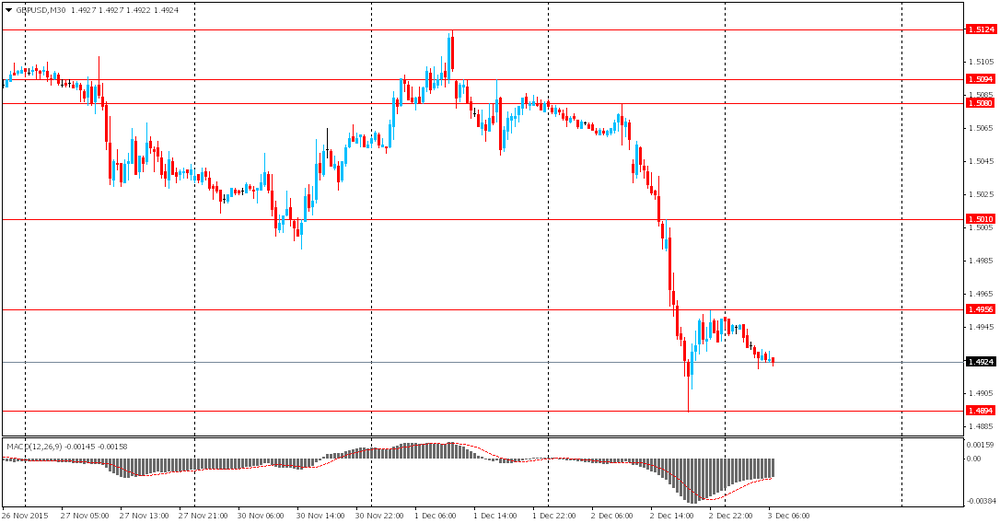

GBP/USD

Resistance levels (open interest**, contracts)

$1.5200 (1203)

$1.5101 (1446)

$1.5003 (509)

Price at time of writing this review: $1.4927

Support levels (open interest**, contracts):

$1.4896 (2620)

$1.4799 (540)

$1.4600 (784)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 29507 contracts, with the maximum number of contracts with strike price $1,5600 (3574);

- Overall open interest on the PUT options with the expiration date December, 4 is 31439 contracts, with the maximum number of contracts with strike price $1,5050 (4213);

- The ratio of PUT/CALL was 1.07 versus 1.11 from the previous trading day according to data from December, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:39

Foreign exchange market. Asian session: the euro weakened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m October -4.0% -3.0%

00:30 Australia Trade Balance October -2.40 Revised From -2.32 -2.665 -3.30

01:45 China Markit/Caixin Services PMI November 52.0 53.1 51.2

The euro declined against the U.S. dollar ahead of an ECB meeting later today. Many investors expect the bank to decide to expand its quantitative easing program. Speaking earlier at a European Banking Congress in Frankfurt ECB President Maria Draghi said that at the next meeting the central bank will assess the degree of stability of factors, which hold back inflation. He added if the 2% inflation target was at risk the central bank would use all tools available to support it.

The New Zealand dollar rose after Fonterra, New Zealand-based biggest dairy company in the world, said it would make payments to shareholders on December 10. The company noted that the latest GlobalDairyTrade auction highlighted growing milk powder prices. Fonterra's representatives said they wished to believe that dairy prices were on their way up, but concerns remained. These comments have supported the NZD today.

The Australian dollar declined at the beginning of the session amid weak trade balance data. The country's trade deficit came in at A$3.3 billion in October. The deficit has widened compared to -A$2.4 billion reported previously. Economists had expected a deficit of -A$2.67 billion. Imports were unchanged in October, while exports fell by 3%. Nevertheless the AUD rebounded later in the session.

EUR/USD: the pair fell to $1.0585 in Asian trade

USD/JPY: the pair rose to Y123.45

GBP/USD: the pair fell to $1.4920

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:50 France Services PMI (Finally) November 52.7 51.3

08:55 Germany Services PMI (Finally) November 54.5 55.6

09:00 Eurozone Services PMI (Finally) November 54.1 54.6

09:30 United Kingdom Purchasing Manager Index Services November 54.9 55

10:00 Eurozone Retail Sales (MoM) October -0.1% 0.2%

10:00 Eurozone Retail Sales (YoY) October 2.9% 2.7%

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Continuing Jobless Claims November 2207 2187

13:30 U.S. Initial Jobless Claims November 260 268

14:45 U.S. Services PMI (Finally) November 54.8 56.5

15:00 U.S. ISM Non-Manufacturing November 59.1 58

15:00 U.S. Factory Orders October -1.0% 1.4%

15:00 U.S. Fed Chairman Janet Yellen Speaks

18:10 U.S. FED Vice Chairman Stanley Fischer Speaks

-

02:45

China: Markit/Caixin Services PMI, November 51.2 (forecast 53.1)

-

01:30

Australia: Trade Balance , October -3.3 (forecast -2.665)

-

01:00

Australia: HIA New Home Sales, m/m, October -3.0%

-

00:31

Currencies. Daily history for Dec 2’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0614 -0,16%

GBP/USD $1,4950 -0,87%

USD/CHF Chf1,0182 -0,74%

USD/JPY Y123,24 +0,31%

EUR/JPY Y130,81 +0,11%

GBP/JPY Y184,23 -0,55%

AUD/USD $0,7307 -0,19%

NZD/USD $0,6638 -0,56%

USD/CAD C$1,3341 -0,12%

-

00:01

Schedule for today, Thursday, Dec 3’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m October -4.0%

00:30 Australia Trade Balance October -2.32 -2.665

01:45 China Markit/Caixin Services PMI November 52.0 53.1

08:50 France Services PMI (Finally) November 52.7 51.3

08:55 Germany Services PMI (Finally) November 54.5 55.6

09:00 Eurozone Services PMI (Finally) November 54.1 54.6

09:30 United Kingdom Purchasing Manager Index Services November 54.9 55

10:00 Eurozone Retail Sales (MoM) October -0.1% 0.2%

10:00 Eurozone Retail Sales (YoY) October 2.9% 2.7%

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Continuing Jobless Claims November 2207 2187

13:3 U.S. Initial Jobless Claims November 260 268

14:45 U.S. Services PMI (Finally) November 54.8 56.5

15:00 U.S. ISM Non-Manufacturing November 59.1 58

15:00 U.S. Factory Orders October -1.0% 1.4%

15:00 U.S. Fed Chairman Janet Yellen Speaks

18:10 U.S. FED Vice Chairman Stanley Fischer Speaks

-