Noticias del mercado

-

18:37

Fed Chairwoman Janet Yellen: the U.S. labour market is close to full employment

The Fed Chairwoman Janet Yellen testified before the Joint Economic Committee of U.S. Congress on Thursday. She said that the U.S. labour market is close to full employment.

"I currently judge that U.S. economic growth is likely to be sufficient over the next year or two to result in further improvement in the labour market," she said.

Yellen expects inflation to pick up toward the Fed's 2% inflation target as "the disinflationary effects of declines in energy and import prices wane".

The Fed chairwoman noted that if the Fed delays its interest rate for a longer period, it could lead to a recession.

"Were the FOMC to delay the start of policy normalization for too long, we would likely end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of our goals. Such an abrupt tightening would risk disrupting financial markets and perhaps even inadvertently push the economy into recession," Yellen said.

"Moreover, holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and thus undermine financial stability;" she added.

Yellen also said that the interest rate hike will depend on the incoming economic data.

-

18:24

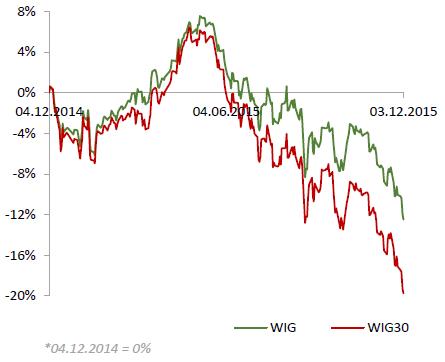

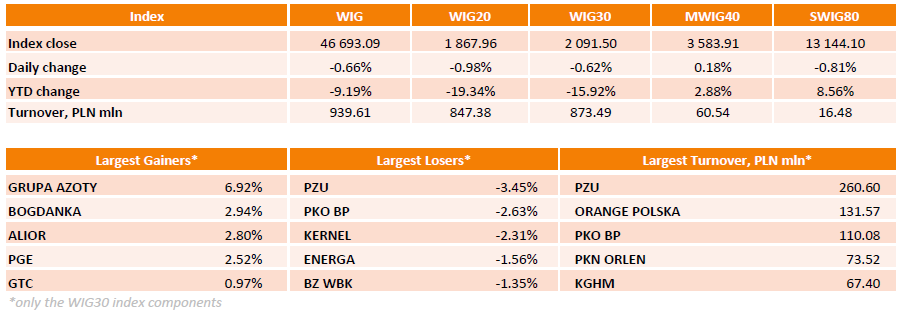

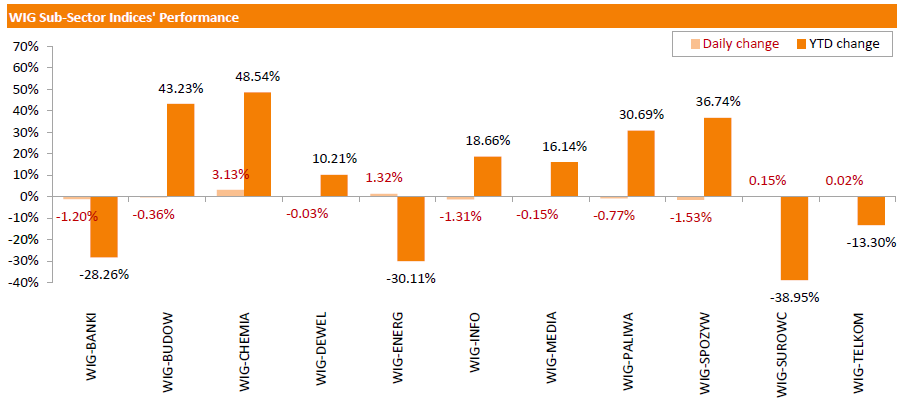

WSE: Session Results

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, posted a 0.66% drop. Within the index performance was mixed, with chemicals (+3.31%) outperforming and food sector (-1.53%) lagging.

The large-cap stocks' measure, the WIG30 Index, fell by 0.62%. Insurer PZU (WSE: PZU) was the index's sharpest decliner, tumbling by 3.45% on news that Poland's parliamentarians returned to discussion on whether to impose an asset tax on insurers as well as banks. It was followed by banking name PKO BP (WSE: PKO) and agricultural company KERNEL (WSE: KER), losing 2.63% and 2.31% respectively. On the other side of the ledger, chemical producer GRUPA AZOTY (WSE: ATT) gained the most, up 6.92%, erasing losses from two days earlier.

-

18:11

European stocks close: stocks closed lower as market participants were disappointed because they hoped for more stimulus measures by the European Central Bank

Stock indices closed lower as market participants were disappointed because they hoped for more stimulus measures by the European Central Bank (ECB). The ECB kept its interest rate unchanged at 0.05%, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016. The volume of the monthly purchases remained unchanged.

Meanwhile, the economic data from the Eurozone was weaker than expected. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.2 in November from 54.1 in October, down from the preliminary reading of 54.6.

The index was driven by arise in business activity rise across the countries.

Eurozone's final composite output index rose to 54.2 in November from 53.9 in October, down from the preliminary reading of 54.4.

"With the exception of France, growth rates are moving higher, but the ECB's concerns over price stability are given further credence by the survey showing average prices charged for goods and services dropping for a second successive month. As yet, it seems faster growth is not showing any signs of generating inflation," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy is likely to grow at 0.4% in the fourth quarter.

Germany's final services purchasing managers' index (PMI) rose to 55.6 in November from 54.5 in October, in line with the preliminary reading.

France's final services purchasing managers' index (PMI) dropped to 51.0 in November from 52.7 in October from 51.9 in September, down from the preliminary reading of 51.3.

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.1% in October, missing expectations for a 0.2% rise, after a 0.1% decline in September.

The decline was driven by lower food, drinks and tobacco sales and automotive fuel sales.

On a yearly basis, retail sales in the Eurozone climbed 2.5% in October, missing forecasts of a 2.7% gain, after a 2.9% increase in September.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 55.9 in November from 54.9 in October, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in new business and a moderate rise in backlogs.

"A welcome upturn in service sector expansion helped counter slower growth in manufacturing and construction in November, suggesting the UK continues to enjoy the 'Goldilocks' scenario of solid economic growth and low inflation," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is likely to expand 0.6% in the fourth quarter of 2015.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,275 -145.93 -2.27 %

DAX 10,789.24 -400.78 -3.58 %

CAC 40 4,730.21 -175.55 -3.58 %

-

17:25

Asian Development Bank upgrades growth forecast for China

The Asian Development Bank (ADB) upgraded growth forecast for China on Thursday. According to the ADB, China is expected to expand by 6.9% in 2015, up from the previous estimate of a 6.8% rise, and 6.7% in 2016, unchanged from the previous estimate.

The economic growth of developing Asia is expected to be 5.8% this year and 6% in 2016, both unchanged from the previous estimates.

Southeast Asia is expected to grow 4.4% in 2015 and 4.9% in 2016, both unchanged from the previous estimates.

"Although we have seen some softening in a number of economies, the broader regional outlook is for continued steady growth," ADB Chief Economist Shang-Jin Wei said.

-

17:08

Australia's trade deficit widens to A$3.30 billion in October

The Australian Bureau of Statistics released its trade data on Thursday. Australia's trade deficit widened to A$3.30 billion in October from A$2.40 billion in September, missing expectations for a rise to a deficit of A$2.67 billion. September's figure was revised down from a deficit of A$2.32 billion.

Exports dropped by 3.0% in October, while imports were flat.

-

17:00

San Francisco Fed President John Williams: the Fed should start raising its interest rate “sooner rather than later”

San Francisco Fed President John Williams said in a speech on Wednesday that the Fed should start raising its interest rate "sooner rather than later".

"The first step in bringing policy closer to normal was when we ended QE. The next appropriate step is to raise rates. My preference is sooner rather than later," he said.

Williams noted that if the Fed waits longer to raise its interest rates, the economy could generate imbalances, "leading to either excessive inflation or an economic correction and recession".

-

16:49

Final Markit/Nikkei services purchasing managers' index for Japan falls to 51.6 in November

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan fell to 51.6 in November from 52.2 in October.

A reading below 50 indicates contraction of activity.

The decline was driven by a weaker growth in activity and new business.

"Business activity at Japanese services firms increased at a slower rate in November, underpinned by a softer expansion in new orders. Subsequently, employment levels fell for the second month running," economist at Markit, Amy Brownbill, said.

-

16:44

U.S. factory orders climb 1.5% in October

The U.S. Commerce Department released factory orders data on Thursday. Factory orders in the U.S. climbed 1.5% in October, exceeding expectations for a 1.4% rise, after a 0.8% drop in September. September's figure was revised up from a 1.0% fall.

The increase was partly driven by higher demand for transportation equipment, which jumped 7.9% in October.

Durable goods orders increased by 2.9% in October, while orders for nondurable goods were flat.

Factory orders excluding transportation rose 0.2% in October, after a 0.6% decline in September.

-

16:07

Final U.S. services PMI increases to 56.1 in November

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Thursday. Final U.S. services purchasing managers' index (PMI) increased to 56.1 in November from 54.8 in October, down from the preliminary reading of 56.5.

The increase was driven by a stronger rise in business activity and new business.

"Growth is being fuelled by rising domestic demand, which propelled growth in the vast service economy higher and more than offset an export-led weakening of manufacturing growth," Chief Economist at Markit Chris Williamson said.

-

15:50

European Central Bank President Mario Draghi: the asset-buying programme will be extended until the end of March 2017

The European Central Bank (ECB) President Mario Draghi on Thursday said at a press conference after the release of the central bank's interest rate decision:

- The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016;

- The volume of the monthly purchases remained unchanged;

- The ECB will buy not only euro-denominated regional and local debt in its purchases but it will also reinvest principal payments on the securities;

- There are continued downside risks to the inflation outlook;

- New measures should support significant positive effects on financing conditions, credit and the real economy from the previous measures;

- The central bank could add further stimulus measures if needed: "The Governing Council will closely monitor the evolution in the outlook for price stability and, if warranted, is willing and able to act by using all the instruments available within its mandate in order to maintain an appropriate degree of monetary accommodation";

- The Eurozone's recovery is expected to continue, but there are downside risks from the slowdown in emerging economies;

- Geopolitical risks increased;

- The economic recovery should be supported by structural reforms and fiscal policies.

- The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016;

-

15:34

U.S. Stocks open: Dow +0.22%, Nasdaq +0.33%, S&P +0.20%

-

15:27

Before the bell: S&P futures -0.20%, NASDAQ futures -0.12%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 19,939.9 +1.77 +0.01%

Hang Seng 22,417.01 -62.68 -0.28%

Shanghai Composite 3,585.43 +48.53 +1.37%

FTSE 6,355.6 -65.33 -1.02%

CAC 4,777.39 -128.37 -2.62%

DAX 10,849.81 -340.21 -3.04%

Crude oil $40.68 (+1.85%)

Gold $1054 60 (+0.08%)

-

15:25

Spain’s services PMI increases to 56.7 in November

Markit Economics released final services purchasing managers' index (PMI) for Spain on Thursday. Spain's final services purchasing managers' index (PMI) increased to 56.7 in November from 55.9 in October.

The index was driven by an increase in business activity and new business.

"The Spanish service sector looks set for a positive end to the year after rates of expansion in both activity and new business accelerated for the second month running in November. This provides further evidence that the slowdown in growth at the end of Q3 won't develop into a period of stagnation," Senior Economist at Markit Andrew Harker said.

-

14:57

Italy’s services PMI remains unchanged at 53.4 in November

Markit/ADACI's services purchasing managers' index (PMI) for Italy remained unchanged at 53.4 in November.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in new business and employment.

"The services PMI has settled at a near-constant level over the past three months, indicating a phase of steady growth in the sector," an economist at Markit Phil Smith said.

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Tesla Motors, Inc., NASDAQ

TSLA

234.58

1.12%

20.3K

Barrick Gold Corporation, NYSE

ABX

7.50

1.08%

32.8K

Johnson & Johnson

JNJ

103.03

0.96%

0.8K

Procter & Gamble Co

PG

76.47

0.90%

0.1K

Hewlett-Packard Co.

HPQ

12.05

0.84%

16.2K

Chevron Corp

CVX

91.00

0.83%

1.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.89

0.77%

37.6K

Ford Motor Co.

F

14.36

0.70%

3.0K

Wal-Mart Stores Inc

WMT

58.75

0.69%

0.2K

Exxon Mobil Corp

XOM

80.08

0.67%

1.3K

Visa

V

79.56

0.66%

0.8K

Cisco Systems Inc

CSCO

27.60

0.58%

2.6K

International Business Machines Co...

IBM

140.50

0.57%

0.4K

Caterpillar Inc

CAT

71.40

0.52%

0.3K

Amazon.com Inc., NASDAQ

AMZN

679.42

0.50%

15.0K

The Coca-Cola Co

KO

42.98

0.49%

0.3K

McDonald's Corp

MCD

114.24

0.46%

0.5K

Intel Corp

INTC

34.97

0.40%

6.6K

Google Inc.

GOOG

765.00

0.34%

8.1K

ALCOA INC.

AA

9.38

0.32%

15.7K

Home Depot Inc

HD

134.18

0.28%

0.6K

Apple Inc.

AAPL

116.59

0.27%

154.1K

Nike

NKE

133.00

0.26%

0.1K

Walt Disney Co

DIS

114.30

0.26%

3.7K

Citigroup Inc., NYSE

C

54.28

0.26%

3.1K

ALTRIA GROUP INC.

MO

57.98

0.24%

0.5K

Deere & Company, NYSE

DE

79.51

0.23%

0.4K

3M Co

MMM

156.01

0.20%

0.2K

Verizon Communications Inc

VZ

45.00

0.18%

1.2K

Yahoo! Inc., NASDAQ

YHOO

35.71

0.17%

23.5K

JPMorgan Chase and Co

JPM

66.75

0.14%

1.2K

AT&T Inc

T

33.60

0.12%

2.5K

General Electric Co

GE

29.98

0.03%

19.0K

General Motors Company, NYSE

GM

35.73

0.00%

1.0K

Twitter, Inc., NYSE

TWTR

25.40

0.00%

3.2K

Yandex N.V., NASDAQ

YNDX

16.36

-0.06%

10.2K

Facebook, Inc.

FB

106.00

-0.07%

71.2K

Pfizer Inc

PFE

32.87

-0.09%

3.3K

Microsoft Corp

MSFT

55.13

-0.14%

11.9K

Starbucks Corporation, NASDAQ

SBUX

61.03

-0.31%

2.3K

Travelers Companies Inc

TRV

114.00

-0.62%

1.4K

-

14:49

European Central Bank raises its economic growth forecasts, but cuts its inflation forecasts

The European Central Bank (ECB) upgraded its economic growth forecasts, but lowered its inflation forecasts. Eurozone's economy is expected to expand 1.5% in 2015, up from the previous estimate of a 1.4% gain, 1.7% in 2016, in line with the previous estimate, and 1.9% in 2017, up from the previous estimate of a 1.8% increase.

Eurozone's inflation is expected to rise 0.1% in 2015, in line with the previous estimate, 1.0% in 2016, down from the previous estimate of a 1.1% rise, and 1.6% in 2017, down from the previous estimate of a 1.7% increase.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Travelers (TRV) downgraded to Neutral from Buy at BofA/Merrill

Other:

-

14:42

Initial jobless claims rise to 269,000 in the week ending November 28

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending November 28 in the U.S. rose by 9,000 to 269,000 from 260,000 in the previous week, exceeding expectations for an increase to 268,000.

Jobless claims remained below 300,000 the 39th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 6,000 to 2,161,000 in the week ended November 21.

-

14:23

European Central Bank keeps its interest rate unchanged at 0.05% in December, but cuts its deposit rate

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

The interest rate remains unchanged since September 2014.

But the ECB lowered its deposit rate to -0.3% from -0.2%.

The central bank will announce further measures at its press conference at 13:30 GMT.

-

12:00

European stock markets mid session: stocks traded higher ahead of the European Central Bank’s monetary policy meeting results

Stock indices traded higher ahead of the European Central Bank's (ECB) monetary policy meeting results. Market participants speculate that the ECB will add further stimulus measures.

Meanwhile, the economic data from the Eurozone was weaker than expected. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.2 in November from 54.1 in October, down from the preliminary reading of 54.6.

The index was driven by arise in business activity rise across the countries.

Eurozone's final composite output index rose to 54.2 in November from 53.9 in October, down from the preliminary reading of 54.4.

"With the exception of France, growth rates are moving higher, but the ECB's concerns over price stability are given further credence by the survey showing average prices charged for goods and services dropping for a second successive month. As yet, it seems faster growth is not showing any signs of generating inflation," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy is likely to grow at 0.4% in the fourth quarter.

Germany's final services purchasing managers' index (PMI) rose to 55.6 in November from 54.5 in October, in line with the preliminary reading.

France's final services purchasing managers' index (PMI) dropped to 51.0 in November from 52.7 in October from 51.9 in September, down from the preliminary reading of 51.3.

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.1% in October, missing expectations for a 0.2% rise, after a 0.1% decline in September.

The decline was driven by lower food, drinks and tobacco sales and automotive fuel sales.

On a yearly basis, retail sales in the Eurozone climbed 2.5% in October, missing forecasts of a 2.7% gain, after a 2.9% increase in September.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 55.9 in November from 54.9 in October, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in new business and a moderate rise in backlogs.

"A welcome upturn in service sector expansion helped counter slower growth in manufacturing and construction in November, suggesting the UK continues to enjoy the 'Goldilocks' scenario of solid economic growth and low inflation," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is likely to expand 0.6% in the fourth quarter of 2015.

Current figures:

Name Price Change Change %

FTSE 100 6,440.56 +19.63 +0.31 %

DAX 11,299.78 +109.76 +0.98 %

CAC 40 4,965.01 +59.25 +1.21 %

-

11:45

France’s unemployment rate climbs to 10.6% in the third quarter

The French statistical office Insee released its unemployment data on Thursday. The unemployment rate in France climbed to 10.6% in the third quarter from 10.4% in the second quarter. The second quarter's figure was revised up from 10.3%.

The number of unemployed people in metropolitan France increased by 75,000 to 2.9 million in the third quarter.

The number of unemployed people under 24 years rose to 24.6% in the third quarter from 23.6% in the second quarter.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment.

-

11:39

France's final services PMI declines to 51.0 in November

Markit Economics released final services purchasing managers' index (PMI) for France on Thursday. France's final services purchasing managers' index (PMI) dropped to 51.0 in November from 52.7 in October from 51.9 in September, down from the preliminary reading of 51.3.

Terrorist attacks in Paris weighed on the index.

"French service sector activity growth slowed in November, with some impact from the Paris attacks reported by hotels and restaurants in particular. However, new business growth picked up to a five month high, offering encouragement that underlying demand conditions remained reasonably firm," Senior Economist at Markit Jack Kennedy said.

-

11:30

Germany's final services PMI rises to 55.6 in November

Markit Economics released final services purchasing managers' index (PMI) for Germany on Thursday. Germany's final services purchasing managers' index (PMI) rose to 55.6 in November from 54.5 in October, in line with the preliminary reading.

The index was driven by a rise in new business.

"Germany's service sector roared back to health in November, with business activity rising at the strongest rate in over a year and new business flooding in at a pace not seen since mid-2011. Moreover, companies continued to add to their payroll numbers at a healthy rate despite the unemployment rate in Germany already ultra-low," an economist at Markit, Oliver Kolodseike, said.

-

11:18

Eurozone’s retail sales fall 0.1% in October

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.1% in October, missing expectations for a 0.2% rise, after a 0.1% decline in September.

The decline was driven by lower food, drinks and tobacco sales and automotive fuel sales. Food, drinks and tobacco sales slid 0.5% in October, while automotive fuel sales declined 0.4%.

Non-food sales increased 0.1% in October.

On a yearly basis, retail sales in the Eurozone climbed 2.5% in October, missing forecasts of a 2.7% gain, after a 2.9% increase in September.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 3.5% year-on-year in October, gasoline sales increased 3.1%, while food, drinks and tobacco sales rose 1.1%.

-

10:55

Eurozone's final services PMI increases to 54.2 in November

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.2 in November from 54.1 in October, down from the preliminary reading of 54.6.

The index was driven by arise in business activity rise across the countries.

Eurozone's final composite output index rose to 54.2 in November from 53.9 in October, down from the preliminary reading of 54.4.

"With the exception of France, growth rates are moving higher, but the ECB's concerns over price stability are given further credence by the survey showing average prices charged for goods and services dropping for a second successive month. As yet, it seems faster growth is not showing any signs of generating inflation," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's economy is likely to grow at 0.4% in the fourth quarter.

-

10:44

UK’s services PMI rises to 55.9 in November

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 55.9 in November from 54.9 in October, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in new business and a moderate rise in backlogs.

"A welcome upturn in service sector expansion helped counter slower growth in manufacturing and construction in November, suggesting the UK continues to enjoy the 'Goldilocks' scenario of solid economic growth and low inflation," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is likely to expand 0.6% in the fourth quarter of 2015.

-

10:37

Beige Book: the U.S. economic activity continued to grow modestly from early-October through mid-November

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity continued to grow modestly from early-October through mid-November.

The Districts of Cleveland's, Richmond's, Atlanta's, Chicago's, St. Louis', Dallas' and San Francisco's activity grew modestly, the Minneapolis District's economy expanded moderately, the Kansas City District's growth was steady, Boston's activity was "somewhat slower", while the New York District's economic conditions levelled off.

The Fed noted that labour markets tightened in most districts, while "wage pressures increased only for skilled occupations and for workers that were in short supply".

Consumer spending rose in nearly all Districts since the previous report.

Conditions in the manufacturing sector were mixed as the strong dollar, low commodity prices, and weak global demand weighed on the sector's activity.

-

10:21

Chinese Markit/Caixin services PMI falls to 51.2 in November

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 51.2 in November from 52.0 in October, missing expectations for an increase to 53.1.

The index was driven by a slower growth in total new work.

Employment continued to rise in November, while outstanding business continued to decline.

"The macro economy has moved further toward stable growth and the economic structure is improving. Future fiscal and monetary policies must be coordinated and large-scale stimulus should be avoided as much as possible," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:11

Fed Chairwoman Janet Yellen: the U.S. economy is ready for an interest rate hike

The Fed Chairwoman Janet Yellen said in a speech on Wednesday that the U.S. economy is ready for an interest rate hike.

"I currently judge that U.S. economic growth is likely to be sufficient over the next year or two to result in further improvement in the labour market. Ongoing gains in the labour market, coupled with my judgment that longer-term inflation expectations remain reasonably well anchored, serve to bolster my confidence in a return of inflation to 2 percent as the disinflationary effects of declines in energy and import prices wane," she said.

Yellen noted that downside risks from abroad declined.

"Although developments in foreign economies still pose risks to U.S. economic growth that we are monitoring, these downside risks from abroad have lessened since late summer," the Fed chairwoman said.

She added that the Chinese economy will continue to expand moderately and gradually, and the government could add further stimulus measures if needed.

-

07:09

Global Stocks: U.S. stock indices fell

U.S. stock indices closed lower on Monday after Federal Reserve Chairwoman Janet Yellen signaled she prefers tighter monetary policy. She also expressed her confidence in the ongoing gradual expansion of the economy. Yellen expects unemployment to decline further and inflation to start approaching the central bank's target level of 2%. These comments boosted expectations for a rate hike this month.

The Dow Jones Industrial Average fell 158.67 points, or 0.9%, to 17,729.68. The S&P 500 lost 23.12 points, or 1.1%, to 2,079.51 (all of its 10 sectors declined; the energy sector fell 3.1%). The Nasdaq Composite fell 33.08 points, or 0.6% to 5,123.22.

Investors also eyed Fed's Beige Book, which showed that the U.S. economy improved at a moderate pace in the period between mid-October and November 20. Ten out of twelve districts reported growth. This means that economic conditions were quite favorable.

This morning in Asia Hong Kong Hang Seng declined 0.15%, or 33.47, to 22,446.22. China Shanghai Composite Index rose 0.53%, or 18.59, to 3.555.50. The Nikkei climbed 0.05%, or 10.60, to 19,948.73.

Asian indices traded mixed. Chinese stocks mostly rose, however stocks of energy companies fell amid declines in oil prices.

Japanese stocks posted modest gains as investors remained concerned over the country's economy. The latest data have shown that foreign investors sold a net $443 million in shares last week.

-

03:02

Nikkei 225 19,905.72 -32.41 -0.16 %, Hang Seng 22,360.06 -119.63 -0.53 %, Shanghai Composite 3,525.73 -11.18 -0.32 %

-

00:32

Stocks. Daily history for Sep Dec 2’2015:

(index / closing price / change items /% change)

Nikkei 225 19,938.13 -74.27 -0.37 %

Hang Seng 22,479.69 +98.34 +0.44 %

Shanghai Composite 3,536.8 +80.49 +2.33 %

FTSE 100 6,420.93 +25.28 +0.40 %

CAC 40 4,905.76 -8.77 -0.18 %

Xetra DAX 11,190.02 -71.22 -0.63 %

S&P 500 2,079.51 -23.12 -1.10 %

NASDAQ Composite 5,123.22 -33.08 -0.64 %

Dow Jones 17,729.68 -158.67 -0.89 %

-