Noticias del mercado

-

23:58

Schedule for today, Tuesday, Oct 6’2015:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

00:30 Australia Trade Balance August -2.46 -2.55

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2%

03:30 Australia RBA Rate Statement

06:00 Germany Factory Orders s.a. (MoM) August -1.4% 0.5%

07:15 Switzerland Consumer Price Index (MoM) September -0.2% 0.1%

07:15 Switzerland Consumer Price Index (YoY) September -1.4% -1.4%

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone Eurogroup Meetings

12:30 Canada Trade balance, billions August -0.59 -1.2

12:30 U.S. International Trade, bln August -41.86 -45.30

14:00 Canada Ivey Purchasing Managers Index September 58

17:00 Eurozone ECB President Mario Draghi Speaks

20:30 U.S. API Crude Oil Inventories September 4.6

21:30 U.S. FOMC Member Williams Speaks

22:30 Australia AiG Performance of Construction Index September 53.8

-

18:24

Final Markit/Nikkei services purchasing managers' index for Japan decreases to 51.4 in September

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan decreased to 51.4 in September from 53.7 in August.

A reading below 50 indicates contraction of activity.

The index was driven by a weaker rise in new orders.

"Despite a weaker expansion in the Japanese service sector, forecasts of output over the next year remained positive," economist at Markit, Amy Brownbill, said.

-

18:19

Italy’s services PMI declines to 53.3 in September

Markit/ADACI's services purchasing managers' index (PMI) for Italy decreased to 53.3 in September from 54.6 in August.

A reading above 50 indicates expansion in the sector.

The decline was driven by a weaker rise in new business and by a drop in employment.

"In both manufacturing and services new business growth eased once more, to the weakest in seven months, while backlogs of work posted renewed contractions. These give some warnings about growth prospects in the final few months of the year," an economist at Markit Phil Smith said.

-

18:15

Spain’s services PMI drops to 55.1 in September

Markit Economics released final services purchasing managers' index (PMI) for Spain on Thursday. Spain's final services purchasing managers' index (PMI) dropped to 55.1 in September from 59.6 in August.

The index was driven by a weaker increase in new work and employment.

"Combined with a growth slowdown in the manufacturing sector, this suggests that the upturn in Spain may have peaked during the third quarter of the year. The rest of the year will be crucial in determining whether the Spanish economy continues to improve or eases back towards stagnation," Senior Economist at Markit Andrew Harker said.

-

18:10

ISM non-manufacturing purchasing managers’ index falls to 56.9 in September

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Monday. The index fell to 56.9 in September from 59.0 in August, missing expectations for a decrease to 58.0.

A reading above 50 indicates a growth in the service sector.

The decline was driven by falls in prices, business activity/production and new orders indices.

The business activity/production index declined to 60.2 in September from 63.9 in August.

The ISM's new orders index decreased to 56.7 in September from 63.4 in August.

The ISM's employment index rose to 58.3 in September from 56.0 in August.

The prices index dropped to 48.4 in September from 50.8 in August.

-

18:00

European stocks closed: FTSE 100 6,287.73 +157.75 +2.57% CAC 40 4,616.9 +158.02 +3.54% DAX 9,814.79 +261.72 +2.74%

-

17:54

Final U.S. services PMI declines to 55.1 in September

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Monday. Final U.S. services purchasing managers' index (PMI) declined to 55.1 in September from 56.1 in August, down from the preliminary reading of 55.6.

The decline was partly driven by a weaker rise in output and new business.

"The US economic growth slowed in the third quarter according the PMI surveys, down to around 2.2%. But this largely represents a payback after growth rebounded in the second quarter, suggesting that the economy is settling down to a moderate rate of growth in line with its long term average," Chief Economist at Markit Chris Williamson said.

-

16:30

Standard & Poor’s upgrades Spain’s credit rating to BBB+

Standard & Poor's (S&P) upgraded Spain's credit rating to BBB+ to BBB on Friday. The outlook is stable.

The agency noted that Spain' economy benefited from labour market reforms.

"The upgrade reflects our view of Spain's strong, balanced economic performance over the past four years, which is gradually benefiting public finances," S&P said.

-

16:00

U.S.: ISM Non-Manufacturing, September 56.9 (forecast 58)

-

15:45

U.S.: Services PMI, September 55.1 (forecast 55.6)

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200($1.7bn)

USD/JPY: Y119.50($580mn),Y120.00($120mn), Y121.00($300mn)

USD/CAD: Cad1.3000($445mn), Cad1.3150($1.0bn)

USD/CHF: Chf0.9900(300mn)

AUD/USD: $0.7000(A$1.0bn)

EUR/JPY: Y135.70(E400mn)

-

14:20

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) September 1.3% Revised From 1.0% 3.9%

01:30 Japan Labor Cash Earnings, YoY August 0.9% Revised From 0.6% 0.5%

07:50 France Services PMI (Finally) September 50.6 51.2 51.9

07:55 Germany Services PMI (Finally) September 54.9 54.3 54.1

08:00 Eurozone Services PMI (Finally) September 54.4 54 53.7

08:30 Eurozone Sentix Investor Confidence October 13.6 11.7

08:30 United Kingdom Purchasing Manager Index Services September 55.6 56 53.3

09:00 Eurozone Retail Sales (MoM) August 0.6% Revised From 0.4% -0.1% 0.0%

09:00 Eurozone Retail Sales (YoY) August 3.0% Revised From 2.7% 1.8% 2.3%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic market data. Markit's final services purchasing managers' index (PMI) is expected to decline to 55.6 in September from 56.1 in August.

The ISM non-manufacturing PMI for the U.S. is expected to fall to 58 in September from 59 in August.

Friday's U.S. labour market data weighed on the greenback. According to the U.S. Labor Department, the U.S. economy added 142,000 jobs in September, missing expectations for a rise of 203,000 jobs, after a gain of 136,000 jobs in August. The U.S. unemployment rate remained unchanged at 5.1% in September, in line with expectations. It was the lowest level since April 2008.

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. Eurostat released its retail sales data for the Eurozone on Monday. Retail sales in the Eurozone were flat in August, beating expectations for a 0.1% decline, after a 0.6% increase in June. July's figure was revised up from a 0.4% rise.

The increase was driven by higher gasoline sales, which rose 1.8% in August.

Food, drinks and tobacco sales were up 0.8% in August, while non-food sales decreased 0.3%.

On a yearly basis, retail sales in the Eurozone climbed 2.3% in August, exceeding forecasts of a 1.8% gain, after a 3.0% increase in July. July's figure was revised up from a 2.7% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 2.0% in August, gasoline sales increased 3.6%, while food, drinks and tobacco sales rose 2.5%.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final services purchasing managers' index (PMI) decreased to 53.7 in September from 54.4 in August, up from the preliminary reading of 54.0.

New orders rose at slower pace in September.

Eurozone's final composite output index declined to 53.6 in September from 54.3 in August, down from the preliminary reading of 53.9.

"The weakening of the pace of expansion in September raises the risk of growth fading further in the fourth quarter, which would in turn boost the likelihood of the ECB opening the QE taps further," Chief Economist at Markit Chris Williamson said.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index dropped to 11.7 in October from 13.6 in September. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

Markit Economics released final services purchasing managers' index (PMI) for Germany on Monday. Germany's final services purchasing managers' index (PMI) decreased 54.1 in September from 54.9 in August, down from the preliminary reading of 54.3.

Markit Economics released final services purchasing managers' index (PMI) for France on Monday. France's final services purchasing managers' index (PMI) increased to 51.9 in September from 50.6 in August, up from the preliminary reading of 51.2.

The increase was partly driven by a stronger rise in new business.

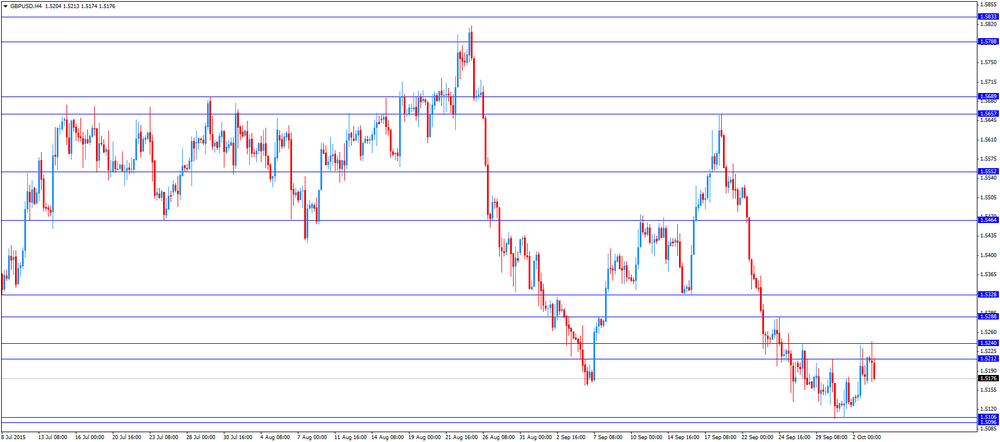

The British pound traded lower against the U.S. dollar after the weaker-than-expected services PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 53.3 in September from 55.6 in August, missing expectations for a rise to 56.0. It was the lowest level since April 2013.

The decline was partly driven by a slower growth in new business.

"Weakness is spreading from the struggling manufacturing sector, hitting transport and other industrial-related services in particular. There are also signs that consumers have become more cautious and are pulling back on their leisure spending, such as on restaurants and hotels," the Chief Economist at Markit Chris Williamson said.

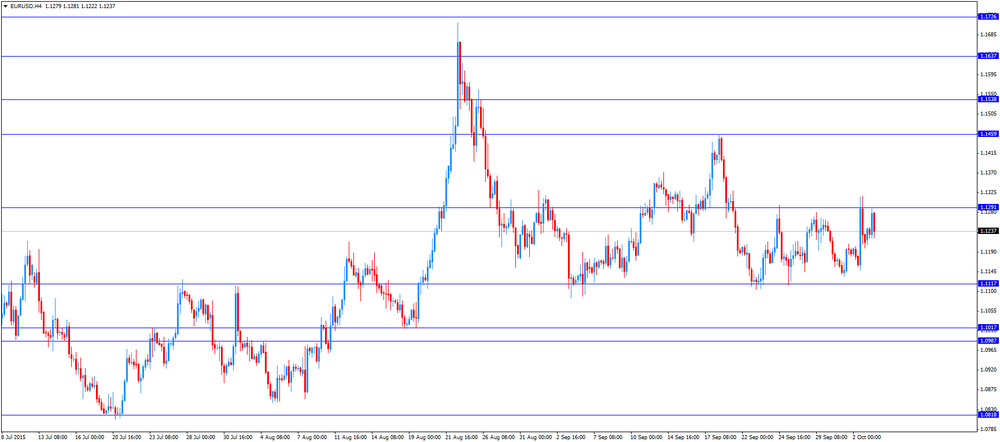

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5171

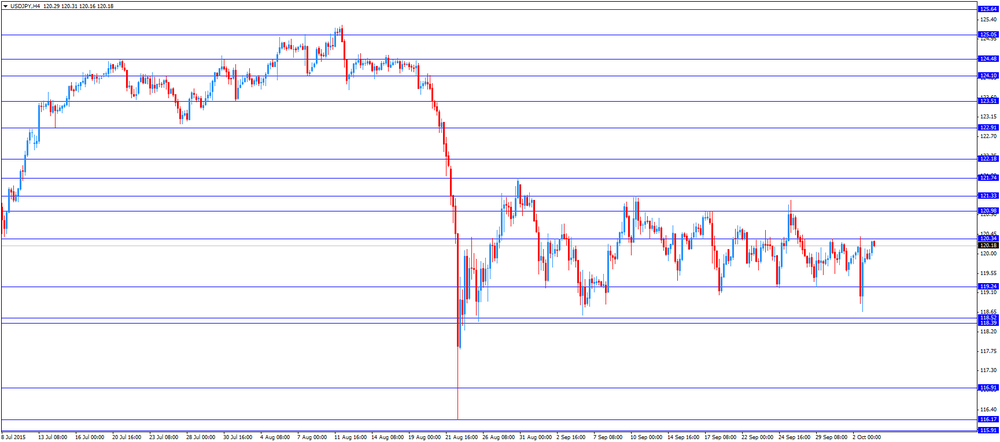

USD/JPY: the currency pair increased to Y120.31

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Finally) September 56.1 55.6

14:00 U.S. ISM Non-Manufacturing September 59 58

21:00 New Zealand NZIER Business Confidence Quarter III 5

-

14:00

Orders

EUR/USD

Offers 1.1260 1.1280 1.1300 1.1330 1.1350 1.1380 1.1400

Bids 1.1220 1.1200 1.1185 1.1155-60 1.1135 1.1120 -25 1.1100

GBP/USD

Offers 1.5235 1.5250 1.5265 1.5280 1.5300 1.5325-30 1.5350 1.5380 1.5400

Bids 1.5200 1.5185 1.5170 1.5150 1.5125-30 1.5100 1.5080-85 1.5060 1.5030 1.5000

EUR/GBP

Offers 0.7400 0.7420 0.7435 0.7450 0.7485 0.7500

Bids 0.7375 0.7360 0.7350 0.7330-35 0.7300

EUR/JPY

Offers 135.50 135.85 136.00 136.30 136.50 136.80 137.00

Bids 135.00 134.80 134.50 134.25 134.00 133.75 133.50 133.30 133.00

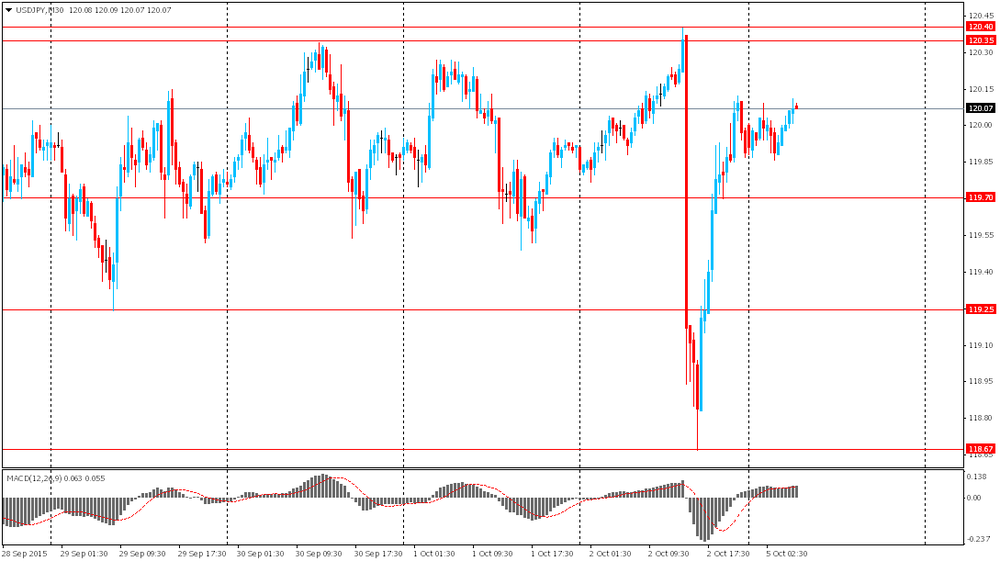

USD/JPY

Offers 120.20 120.30-35 120.50 120.65 120.85 121.00 121.30 121.50

Bids 119.80-85 119.65 119.40 119.25 119.10 119.00 118.85 118.65 118.50

AUD/USD

Offers 0.7100 0.7120 0.7150 0.7185 0.7200 0.7225-30 0.7250

Bids 0.7060 0.7040 0.7020-25 0.7000 0.6980 0.6965 0.6950

-

11:57

Sentix investor confidence index for the Eurozone is down to 11.7 in October

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index dropped to 11.7 in October from 13.6 in September. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

The current conditions index fell to 13.0 in October from 15.0 in September.

The expectations index plunged to 10.5 in October from 12.3 in September, the lowest level since December 2014.

German investor confidence index declined to 17.8 from 20.5, the lowest level since December 2014.

-

11:49

France's final services PMI rises to 51.9 in September

Markit Economics released final services purchasing managers' index (PMI) for France on Monday. France's final services purchasing managers' index (PMI) increased to 51.9 in September from 50.6 in August, up from the preliminary reading of 51.2.

The increase was partly driven by a stronger rise in new business.

"The French service sector recorded slightly firmer activity growth in September, underpinned by a pick-up in new business inflows. Over the third quarter as a whole, Composite PMI data are consistent with a modest expansion of GDP, following stagnation in the second quarter," Senior Economist at Markit Jack Kennedy said.

-

11:45

Germany's final services PMI declines to 54.1 in September

Markit Economics released final services purchasing managers' index (PMI) for Germany on Monday. Germany's final services purchasing managers' index (PMI) decreased 54.1 in September from 54.9 in August, down from the preliminary reading of 54.3.

"Output continued to rise at a robust rate as service providers benefitted from increased demand. Some panellists also mentioned that the need to build shelters for refugees had led to higher activity," an economist at Markit, Oliver Kolodseike, said.

-

11:42

Eurozone's final services PMI falls to 53.7 in September

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final services purchasing managers' index (PMI) decreased to 53.7 in September from 54.4 in August, up from the preliminary reading of 54.0.

New orders rose at slower pace in September.

Eurozone's final composite output index declined to 53.6 in September from 54.3 in August, down from the preliminary reading of 53.9.

"The weakening of the pace of expansion in September raises the risk of growth fading further in the fourth quarter, which would in turn boost the likelihood of the ECB opening the QE taps further," Chief Economist at Markit Chris Williamson said.

-

11:34

UK’s services PMI falls to 53.3 in September, the lowest level since April 2013

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 53.3 in September from 55.6 in August, missing expectations for a rise to 56.0. It was the lowest level since April 2013.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in new business.

"Weakness is spreading from the struggling manufacturing sector, hitting transport and other industrial-related services in particular. There are also signs that consumers have become more cautious and are pulling back on their leisure spending, such as on restaurants and hotels," the Chief Economist at Markit Chris Williamson said.

-

11:28

Eurozone’s retail sales are flat in August

Eurostat released its retail sales data for the Eurozone on Monday. Retail sales in the Eurozone were flat in August, beating expectations for a 0.1% decline, after a 0.6% increase in June. July's figure was revised up from a 0.4% rise.

The increase was driven by higher gasoline sales, which rose 1.8% in August.

Food, drinks and tobacco sales were up 0.8% in August, while non-food sales decreased 0.3%.

On a yearly basis, retail sales in the Eurozone climbed 2.3% in August, exceeding forecasts of a 1.8% gain, after a 3.0% increase in July. July's figure was revised up from a 2.7% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 2.0% in August, gasoline sales increased 3.6%, while food, drinks and tobacco sales rose 2.5%.

-

11:20

Fed Vice Chairman Stanley Fischer said on Friday that there are no risks to short-term financial stability

Fed Vice Chairman Stanley Fischer said on Friday that there are no risks to short-term financial stability.

"Banks are well capitalized and have sizable liquidity buffers, the housing market is not overheated and borrowing by households and businesses has only begun to pick up after years of decline or very slow growth," he said.

Fischer directly said nothing about the Fed's monetary policy.

"The limited macroprudential toolkit in the United States leads me to conclude that there may be times when adjustments in monetary policy should be discussed as a means to curb risks to financial stability. A more restrictive monetary policy would, all else being equal, lead to deviations from price stability and full employment," he noted.

-

11:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200($1.7bn)

USD/JPY: Y119.50($580mn),Y120.00($120mn), Y121.00($300mn)

USD/CAD: Cad1.3000($445mn), Cad1.3150($1.0bn)

USD/CHF: Chf0.9900(300mn)

AUD/USD: $0.7000(A$1.0bn)

EUR/JPY: Y135.70(E400mn)

-

11:00

Eurozone: Retail Sales (MoM), August 0.0% (forecast -0.1%)

-

11:00

Eurozone: Retail Sales (YoY), August 2.3% (forecast 1.8%)

-

10:56

Portuguese Prime Minister Pedro Passos Coelho’s Social Democrat party wins the parliament election

Portuguese Prime Minister Pedro Passos Coelho's Social Democrat party won the parliament election on Sunday. The ruling coalition, Social Democrat and Christian Democrat, had around 38.5% of the vote. It is not enough for an absolute majority in the parliament. Coelho could form a minority government.

The final results will be available on late Monday evening.

-

10:46

ISM current business conditions index drops to 44.5 in September

The Institute for Supply Management (ISM) released its current business conditions index on Friday. The index dropped to 44.5 in September from 51.1 in August, reaching a six-year low.

The decline was mainly driven by a fall in the employment subindex, which plunged to 44.9 from 65.8.

-

10:30

United Kingdom: Purchasing Manager Index Services, September 53.3 (forecast 56)

-

10:10

Bloomberg Consumer Comfort Index: consumers' expectations for U.S. economy rose to 43.0 in in the week ended September 27

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 43.0 in in the week ended September 27 from 41.9 the prior week.

All indices were up as lower energy prices and a stronger U.S. labour market supported consumer spending.

The measure of views of the economy increased to 33.2 from 32.6.

The buying climate index climbed to 38.4 from 36.6.

The personal finances index was up to 57.4 from 56.4.

-

10:00

Eurozone: Services PMI, September 53.7 (forecast 54)

-

09:55

Germany: Services PMI, September 54.1 (forecast 54.3)

-

09:50

France: Services PMI, September 51.9 (forecast 51.2)

-

08:28

Foreign exchange market. Asian session: the euro continued climbing

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia ANZ Job Advertisements (MoM) September 1.3% Revised From 1.0% 3.9%

01:30 Japan Labor Cash Earnings, YoY August 0.9% Revised From 0.6% 0.5%

The euro continued rising against the U.S. dollar amid weak data on U.S. employment, which were released on Friday. The Department of Labor reported that the number of employed outside the farming sector rose by seasonally adjusted 142,000 compared to expectations for 200,000 new jobs. July and August readings were revised down to 233,000 from 245,000 and to 136,000 from 173,000 respectively. That's why many investors believe that a rate hike would not be justified.

Market participants are waiting for Germany's industrial production data due tomorrow. Analysts expect the index to fall. Slower growth in China and the scandal around Volkswagen might have weighed on the country's exports.

The Australian dollar rose amid favorable inflation data. The index published by the University of Melbourne came in at 0.3% in September compared to 0.1% reported previously. Meanwhile the ANZ Jobs Advertisements index rose to 3.9% in September from 1% prior. Experts said that a positive trend in the labor market means that the country's economy recovers gradually after a negative impact of lower commodity prices and weaker mining investments.

EUR/USD: the pair rose to $1.1245 in Asian trade

USD/JPY: the pair traded around Y119.85-20

GBP/USD: the pair rose to $1.5220

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:50 France Services PMI (Finally) September 50.6 51.2

07:55 Germany Services PMI (Finally) September 54.9 54.3

08:00 Eurozone Services PMI (Finally) September 54.4 54

08:30 Eurozone Sentix Investor Confidence October 13.6

08:30 United Kingdom Purchasing Manager Index Services September 55.6 56

09:00 Eurozone Retail Sales (MoM) August 0.4% -0.1%

09:00 Eurozone Retail Sales (YoY) August 2.7% 1.8%

13:45 U.S. Services PMI (Finally) September 56.1 55.6

14:00 U.S. Labor Market Conditions Index September 2.1

14:00 U.S. ISM Non-Manufacturing September 59 58

21:00 New Zealand NZIER Business Confidence Quarter III 5

-

07:05

Options levels on monday, October 5, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1333 (2780)

$1.1303 (1939)

$1.1264 (1218)

Price at time of writing this review: $1.1238

Support levels (open interest**, contracts):

$1.1161 (5506)

$1.1127 (1942)

$1.1087 (3450)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 55416 contracts, with the maximum number of contracts with strike price $1,1500 (5105);

- Overall open interest on the PUT options with the expiration date October, 9 is 68213 contracts, with the maximum number of contracts with strike price $1,1000 (5896);

- The ratio of PUT/CALL was 1.23 versus 1.25 from the previous trading day according to data from October, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5500 (1701)

$1.5401 (1484)

$1.5302 (657)

Price at time of writing this review: $1.5211

Support levels (open interest**, contracts):

$1.5097 (1816)

$1.4999 (2026)

$1.4900 (1066)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 24362 contracts, with the maximum number of contracts with strike price $1,5500 (1701);

- Overall open interest on the PUT options with the expiration date October, 9 is 23072 contracts, with the maximum number of contracts with strike price $1,5200 (2805);

- The ratio of PUT/CALL was 0.95 versus 0.97 from the previous trading day according to data from October, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Japan: Labor Cash Earnings, YoY, August 0.5%

-

02:30

Australia: ANZ Job Advertisements (MoM), September 3.9%

-

01:32

Australia: AIG Services Index, September 52.3

-

01:32

Australia: MI Inflation Gauge, m/m, September 0.3%

-

00:29

Currencies. Daily history for Oct 2’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1212 +0,24%

GBP/USD $1,5180 +0,34%

USD/CHF Chf0,9711 -0,61%

USD/JPY Y119,89 -0,03%

EUR/JPY Y134,42 +0,22%

GBP/JPY Y182,02 +0,34%

AUD/USD $0,7046 +0,21%

NZD/USD $0,6445 +0,78%

USD/CAD C$1,3153 -0,78%

-

00:00

Schedule for today, Monday, Oct 5’2015:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) September 1.0%

01:30 Japan Labor Cash Earnings, YoY August 0.6%

07:50 France Services PMI (Finally) September 50.6 51.2

07:55 Germany Services PMI (Finally) September 54.9 54.3

08:00 Eurozone Services PMI (Finally) September 54.4 54

08:30 Eurozone Sentix Investor Confidence October 13.6

08:30 United Kingdom Purchasing Manager Index Services September 55.6 56

09:00 Eurozone Retail Sales (MoM) August 0.4% -0.1%

09:00 Eurozone Retail Sales (YoY) August 2.7% 1.8%

13:45 U.S. Services PMI (Finally) September 56.1 55.6

14:00 U.S. Labor Market Conditions Index September 2.1

14:00 U.S. ISM Non-Manufacturing September 59 58

21:00 New Zealand NZIER Business Confidence Quarter III 5

-