Noticias del mercado

-

21:00

Dow +1.83% 16,773.22 +300.85 Nasdaq +1.50% 4,778.34 +70.56 S&P +0.78% 1,986.68 +15.28

-

18:24

Final Markit/Nikkei services purchasing managers' index for Japan decreases to 51.4 in September

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan decreased to 51.4 in September from 53.7 in August.

A reading below 50 indicates contraction of activity.

The index was driven by a weaker rise in new orders.

"Despite a weaker expansion in the Japanese service sector, forecasts of output over the next year remained positive," economist at Markit, Amy Brownbill, said.

-

18:19

Italy’s services PMI declines to 53.3 in September

Markit/ADACI's services purchasing managers' index (PMI) for Italy decreased to 53.3 in September from 54.6 in August.

A reading above 50 indicates expansion in the sector.

The decline was driven by a weaker rise in new business and by a drop in employment.

"In both manufacturing and services new business growth eased once more, to the weakest in seven months, while backlogs of work posted renewed contractions. These give some warnings about growth prospects in the final few months of the year," an economist at Markit Phil Smith said.

-

18:15

Spain’s services PMI drops to 55.1 in September

Markit Economics released final services purchasing managers' index (PMI) for Spain on Thursday. Spain's final services purchasing managers' index (PMI) dropped to 55.1 in September from 59.6 in August.

The index was driven by a weaker increase in new work and employment.

"Combined with a growth slowdown in the manufacturing sector, this suggests that the upturn in Spain may have peaked during the third quarter of the year. The rest of the year will be crucial in determining whether the Spanish economy continues to improve or eases back towards stagnation," Senior Economist at Markit Andrew Harker said.

-

18:10

ISM non-manufacturing purchasing managers’ index falls to 56.9 in September

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Monday. The index fell to 56.9 in September from 59.0 in August, missing expectations for a decrease to 58.0.

A reading above 50 indicates a growth in the service sector.

The decline was driven by falls in prices, business activity/production and new orders indices.

The business activity/production index declined to 60.2 in September from 63.9 in August.

The ISM's new orders index decreased to 56.7 in September from 63.4 in August.

The ISM's employment index rose to 58.3 in September from 56.0 in August.

The prices index dropped to 48.4 in September from 50.8 in August.

-

18:00

European stocks close: stocks closed higher on speculation that the Fed will delay its interest rate hike after the release of the weak U.S. labour market data on Friday

Stock indices closed higher on speculation that the Fed will delay its interest rate hike after the release of the weak U.S. labour market data. According to the U.S. Labor Department, the U.S. economy added 142,000 jobs in September, missing expectations for a rise of 203,000 jobs, after a gain of 136,000 jobs in August. The U.S. unemployment rate remained unchanged at 5.1% in September, in line with expectations. It was the lowest level since April 2008.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its retail sales data for the Eurozone on Monday. Retail sales in the Eurozone were flat in August, beating expectations for a 0.1% decline, after a 0.6% increase in June. July's figure was revised up from a 0.4% rise.

The increase was driven by higher gasoline sales, which rose 1.8% in August.

Food, drinks and tobacco sales were up 0.8% in August, while non-food sales decreased 0.3%.

On a yearly basis, retail sales in the Eurozone climbed 2.3% in August, exceeding forecasts of a 1.8% gain, after a 3.0% increase in July. July's figure was revised up from a 2.7% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 2.0% in August, gasoline sales increased 3.6%, while food, drinks and tobacco sales rose 2.5%.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final services purchasing managers' index (PMI) decreased to 53.7 in September from 54.4 in August, up from the preliminary reading of 54.0.

New orders rose at slower pace in September.

Eurozone's final composite output index declined to 53.6 in September from 54.3 in August, down from the preliminary reading of 53.9.

"The weakening of the pace of expansion in September raises the risk of growth fading further in the fourth quarter, which would in turn boost the likelihood of the ECB opening the QE taps further," Chief Economist at Markit Chris Williamson said.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index dropped to 11.7 in October from 13.6 in September. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

Markit Economics released final services purchasing managers' index (PMI) for Germany on Monday. Germany's final services purchasing managers' index (PMI) decreased 54.1 in September from 54.9 in August, down from the preliminary reading of 54.3.

Markit Economics released final services purchasing managers' index (PMI) for France on Monday. France's final services purchasing managers' index (PMI) increased to 51.9 in September from 50.6 in August, up from the preliminary reading of 51.2.

The increase was partly driven by a stronger rise in new business.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 53.3 in September from 55.6 in August, missing expectations for a rise to 56.0. It was the lowest level since April 2013.

The decline was partly driven by a slower growth in new business.

"Weakness is spreading from the struggling manufacturing sector, hitting transport and other industrial-related services in particular. There are also signs that consumers have become more cautious and are pulling back on their leisure spending, such as on restaurants and hotels," the Chief Economist at Markit Chris Williamson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,287.73 +157.75 +2.57 %

DAX 9,814.79 +261.72 +2.74 %

CAC 40 4,616.9 +158.02 +3.54 %

-

18:00

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Monday, after disappointing U.S. jobs data on Friday hardened views that the Federal Reserve will not raise interest rates this year.

Most of Dow stocks in positive area (26 of 30). Top looser - Apple Inc. (AAPL, -0.63%). Top gainer - General Electric Company (GE, +4.12%).

Almost all of S&P index sectors in positive area. Top looser - Healthcare (-0.5%). Top gainer - Basic Materials (+1,5%).

At the moment:

Dow 16545.00 +168.00 +1.03%

S&P 500 1964.00 +21.00 +1.08%

Nasdaq 100 4291.25 +30.00 +0.70%

10 Year yield 2,02% +0,03

Oil 46.69 +1.15 +2.53%

Gold 1135.10 -1.50 -0.13%

-

17:54

Final U.S. services PMI declines to 55.1 in September

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Monday. Final U.S. services purchasing managers' index (PMI) declined to 55.1 in September from 56.1 in August, down from the preliminary reading of 55.6.

The decline was partly driven by a weaker rise in output and new business.

"The US economic growth slowed in the third quarter according the PMI surveys, down to around 2.2%. But this largely represents a payback after growth rebounded in the second quarter, suggesting that the economy is settling down to a moderate rate of growth in line with its long term average," Chief Economist at Markit Chris Williamson said.

-

17:50

WSE: Session Results

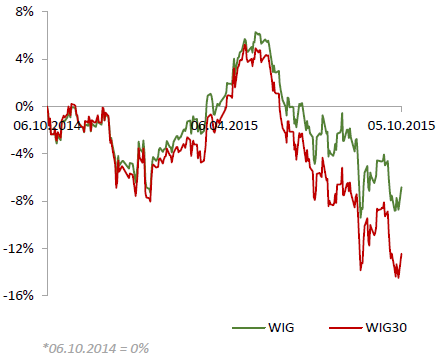

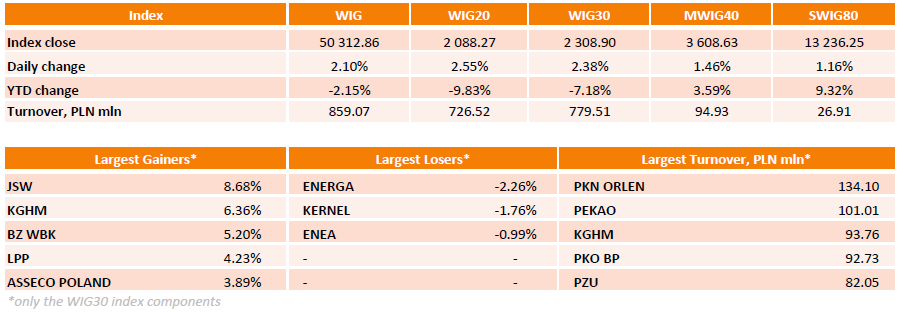

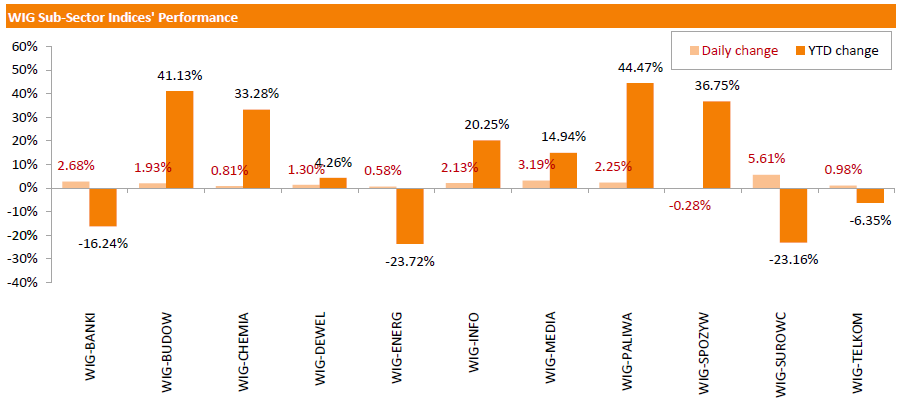

Polish equity market advanced on Monday. The broad market measure, the WIG index, surged by 2.10%. Food sector (-0.28%) was the sole laggard among the WIG's 11 industry groups. At the same time, the materials (+5.61%) and media sector (+3.19%) posed the best results.

The large-cap stocks' gauge, the WIG30 Index, rose by 2.38%. Almost all components of the index advanced, with shares of JSW (WSE: JSW; +8.68%), KGHM (WSE: KGH; +6.36%) and BZ WBK (WSE: BZW; +5.20%) leading gains. The handful losers included ENERGA (WSE: ENG; -2.26%), KERNEL (WSE: KER; -1.76%) and ENEA (WSE: ENA; -0.99%).

-

16:30

Standard & Poor’s upgrades Spain’s credit rating to BBB+

Standard & Poor's (S&P) upgraded Spain's credit rating to BBB+ to BBB on Friday. The outlook is stable.

The agency noted that Spain' economy benefited from labour market reforms.

"The upgrade reflects our view of Spain's strong, balanced economic performance over the past four years, which is gradually benefiting public finances," S&P said.

-

15:35

U.S. Stocks open: Dow +0.73%, Nasdaq +0.77%, S&P +0.83%

-

15:29

Before the bell: S&P futures +0.71%, NASDAQ futures +0.58%

U.S. stock-index futures advanced as disappointing employment data Friday pushed out expectations for an interest-rate increase.

Nikkei 18,005.49 +280.36 +1.58%

Hang Seng 21,854.5 +348.41 +1.62%

FTSE 6,262.18 +132.20 +2.16%

CAC 4,612.13 +153.25 +3.44%

DAX 9,800.54 +247.47 +2.59%

Crude oil $46.04 (+1.14%)

Gold $1135.90 (-0.06%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

General Electric Co

GE

26.30

3.26%

4.1M

ALCOA INC.

AA

9.67

1.58%

27.6K

HONEYWELL INTERNATIONAL INC.

HON

98.00

1.51%

0.3K

Yandex N.V., NASDAQ

YNDX

11.50

1.41%

1K

United Technologies Corp

UTX

90.90

1.26%

0.3K

International Paper Company

IP

39.39

1.21%

0.3K

Merck & Co Inc

MRK

50.68

1.08%

1.9K

Starbucks Corporation, NASDAQ

SBUX

58.65

0.98%

1.2K

Nike

NKE

126.37

0.93%

0.1K

Cisco Systems Inc

CSCO

25.99

0.89%

2.8K

Pfizer Inc

PFE

33.37

0.88%

1.8K

Chevron Corp

CVX

82.25

0.86%

13.7K

Ford Motor Co.

F

14.11

0.86%

45.3K

Caterpillar Inc

CAT

66.25

0.84%

2.4K

UnitedHealth Group Inc

UNH

119.80

0.82%

2.3K

General Motors Company, NYSE

GM

31.99

0.82%

12.2K

Procter & Gamble Co

PG

73.00

0.80%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

249.50

0.78%

26.2K

AT&T Inc

T

32.89

0.77%

22.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.70

0.75%

47.5K

Microsoft Corp

MSFT

45.90

0.72%

25.8K

Verizon Communications Inc

VZ

43.15

0.72%

8.5K

Home Depot Inc

HD

118.65

0.71%

6.6K

Google Inc.

GOOG

631.00

0.65%

2.4K

Citigroup Inc., NYSE

C

50.20

0.64%

15.1K

Exxon Mobil Corp

XOM

76.35

0.62%

6.8K

Intel Corp

INTC

30.70

0.62%

19.6K

Johnson & Johnson

JNJ

94.51

0.62%

2.8K

Yahoo! Inc., NASDAQ

YHOO

30.90

0.62%

6.9K

Barrick Gold Corporation, NYSE

ABX

6.61

0.61%

39.5K

Amazon.com Inc., NASDAQ

AMZN

535.70

0.59%

23.5K

Deere & Company, NYSE

DE

74.00

0.58%

0.3K

Visa

V

71.07

0.57%

4.2K

Goldman Sachs

GS

178.00

0.56%

1.7K

3M Co

MMM

143.97

0.54%

0.1K

JPMorgan Chase and Co

JPM

61.13

0.53%

23.7K

McDonald's Corp

MCD

100.32

0.53%

2.9K

Walt Disney Co

DIS

103.50

0.49%

4.0K

Facebook, Inc.

FB

92.50

0.47%

46.2K

ALTRIA GROUP INC.

MO

55.05

0.35%

0.5K

Travelers Companies Inc

TRV

100.35

0.32%

0.3K

Boeing Co

BA

132.91

0.26%

2.3K

International Business Machines Co...

IBM

144.94

0.25%

3.1K

Wal-Mart Stores Inc

WMT

65.14

0.25%

4.6K

Hewlett-Packard Co.

HPQ

26.11

0.15%

0.3K

Twitter, Inc., NYSE

TWTR

26.35

0.15%

127.4K

The Coca-Cola Co

KO

40.40

0.02%

2.8K

American Express Co

AXP

74.30

-0.15%

1K

Apple Inc.

AAPL

109.61

-0.70%

426.6K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Buy from Hold at Axiom Capital; target lowered to $37 from $40

Downgrades:

Other:

Yahoo! (YHOO) target raised to $41 from $39 at Axiom Capital

IBM (IBM) target lowered to $155 from $170 at RBC Capital Mkts

Johnson & Johnson (JNJ) resumed with a Neutral at Piper Jaffray; target $105

-

12:04

European stock markets mid session: stocks traded higher on speculation that the Fed will delay its interest rate hike after the release of the weak U.S. labour market data

Stock indices traded higher on speculation that the Fed will delay its interest rate hike after the release of the weak U.S. labour market data. According to the U.S. Labor Department, the U.S. economy added 142,000 jobs in September, missing expectations for a rise of 203,000 jobs, after a gain of 136,000 jobs in August. The U.S. unemployment rate remained unchanged at 5.1% in September, in line with expectations. It was the lowest level since April 2008.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its retail sales data for the Eurozone on Monday. Retail sales in the Eurozone were flat in August, beating expectations for a 0.1% decline, after a 0.6% increase in June. July's figure was revised up from a 0.4% rise.

The increase was driven by higher gasoline sales, which rose 1.8% in August.

Food, drinks and tobacco sales were up 0.8% in August, while non-food sales decreased 0.3%.

On a yearly basis, retail sales in the Eurozone climbed 2.3% in August, exceeding forecasts of a 1.8% gain, after a 3.0% increase in July. July's figure was revised up from a 2.7% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 2.0% in August, gasoline sales increased 3.6%, while food, drinks and tobacco sales rose 2.5%.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final services purchasing managers' index (PMI) decreased to 53.7 in September from 54.4 in August, up from the preliminary reading of 54.0.

New orders rose at slower pace in September.

Eurozone's final composite output index declined to 53.6 in September from 54.3 in August, down from the preliminary reading of 53.9.

"The weakening of the pace of expansion in September raises the risk of growth fading further in the fourth quarter, which would in turn boost the likelihood of the ECB opening the QE taps further," Chief Economist at Markit Chris Williamson said.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index dropped to 11.7 in October from 13.6 in September. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

Markit Economics released final services purchasing managers' index (PMI) for Germany on Monday. Germany's final services purchasing managers' index (PMI) decreased 54.1 in September from 54.9 in August, down from the preliminary reading of 54.3.

Markit Economics released final services purchasing managers' index (PMI) for France on Monday. France's final services purchasing managers' index (PMI) increased to 51.9 in September from 50.6 in August, up from the preliminary reading of 51.2.

The increase was partly driven by a stronger rise in new business.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 53.3 in September from 55.6 in August, missing expectations for a rise to 56.0. It was the lowest level since April 2013.

The decline was partly driven by a slower growth in new business.

"Weakness is spreading from the struggling manufacturing sector, hitting transport and other industrial-related services in particular. There are also signs that consumers have become more cautious and are pulling back on their leisure spending, such as on restaurants and hotels," the Chief Economist at Markit Chris Williamson said.

Current figures:

Name Price Change Change %

FTSE 100 6,249.88 +119.90 +1.96 %

DAX 9,755.11 +202.04 +2.11 %

CAC 40 4,586.98 +128.10 +2.87 %

-

11:57

Sentix investor confidence index for the Eurozone is down to 11.7 in October

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index dropped to 11.7 in October from 13.6 in September. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

The current conditions index fell to 13.0 in October from 15.0 in September.

The expectations index plunged to 10.5 in October from 12.3 in September, the lowest level since December 2014.

German investor confidence index declined to 17.8 from 20.5, the lowest level since December 2014.

-

11:49

France's final services PMI rises to 51.9 in September

Markit Economics released final services purchasing managers' index (PMI) for France on Monday. France's final services purchasing managers' index (PMI) increased to 51.9 in September from 50.6 in August, up from the preliminary reading of 51.2.

The increase was partly driven by a stronger rise in new business.

"The French service sector recorded slightly firmer activity growth in September, underpinned by a pick-up in new business inflows. Over the third quarter as a whole, Composite PMI data are consistent with a modest expansion of GDP, following stagnation in the second quarter," Senior Economist at Markit Jack Kennedy said.

-

11:45

Germany's final services PMI declines to 54.1 in September

Markit Economics released final services purchasing managers' index (PMI) for Germany on Monday. Germany's final services purchasing managers' index (PMI) decreased 54.1 in September from 54.9 in August, down from the preliminary reading of 54.3.

"Output continued to rise at a robust rate as service providers benefitted from increased demand. Some panellists also mentioned that the need to build shelters for refugees had led to higher activity," an economist at Markit, Oliver Kolodseike, said.

-

11:42

Eurozone's final services PMI falls to 53.7 in September

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final services purchasing managers' index (PMI) decreased to 53.7 in September from 54.4 in August, up from the preliminary reading of 54.0.

New orders rose at slower pace in September.

Eurozone's final composite output index declined to 53.6 in September from 54.3 in August, down from the preliminary reading of 53.9.

"The weakening of the pace of expansion in September raises the risk of growth fading further in the fourth quarter, which would in turn boost the likelihood of the ECB opening the QE taps further," Chief Economist at Markit Chris Williamson said.

-

11:34

UK’s services PMI falls to 53.3 in September, the lowest level since April 2013

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 53.3 in September from 55.6 in August, missing expectations for a rise to 56.0. It was the lowest level since April 2013.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in new business.

"Weakness is spreading from the struggling manufacturing sector, hitting transport and other industrial-related services in particular. There are also signs that consumers have become more cautious and are pulling back on their leisure spending, such as on restaurants and hotels," the Chief Economist at Markit Chris Williamson said.

-

11:28

Eurozone’s retail sales are flat in August

Eurostat released its retail sales data for the Eurozone on Monday. Retail sales in the Eurozone were flat in August, beating expectations for a 0.1% decline, after a 0.6% increase in June. July's figure was revised up from a 0.4% rise.

The increase was driven by higher gasoline sales, which rose 1.8% in August.

Food, drinks and tobacco sales were up 0.8% in August, while non-food sales decreased 0.3%.

On a yearly basis, retail sales in the Eurozone climbed 2.3% in August, exceeding forecasts of a 1.8% gain, after a 3.0% increase in July. July's figure was revised up from a 2.7% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 2.0% in August, gasoline sales increased 3.6%, while food, drinks and tobacco sales rose 2.5%.

-

11:20

Fed Vice Chairman Stanley Fischer said on Friday that there are no risks to short-term financial stability

Fed Vice Chairman Stanley Fischer said on Friday that there are no risks to short-term financial stability.

"Banks are well capitalized and have sizable liquidity buffers, the housing market is not overheated and borrowing by households and businesses has only begun to pick up after years of decline or very slow growth," he said.

Fischer directly said nothing about the Fed's monetary policy.

"The limited macroprudential toolkit in the United States leads me to conclude that there may be times when adjustments in monetary policy should be discussed as a means to curb risks to financial stability. A more restrictive monetary policy would, all else being equal, lead to deviations from price stability and full employment," he noted.

-

10:56

Portuguese Prime Minister Pedro Passos Coelho’s Social Democrat party wins the parliament election

Portuguese Prime Minister Pedro Passos Coelho's Social Democrat party won the parliament election on Sunday. The ruling coalition, Social Democrat and Christian Democrat, had around 38.5% of the vote. It is not enough for an absolute majority in the parliament. Coelho could form a minority government.

The final results will be available on late Monday evening.

-

10:46

ISM current business conditions index drops to 44.5 in September

The Institute for Supply Management (ISM) released its current business conditions index on Friday. The index dropped to 44.5 in September from 51.1 in August, reaching a six-year low.

The decline was mainly driven by a fall in the employment subindex, which plunged to 44.9 from 65.8.

-

10:10

Bloomberg Consumer Comfort Index: consumers' expectations for U.S. economy rose to 43.0 in in the week ended September 27

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 43.0 in in the week ended September 27 from 41.9 the prior week.

All indices were up as lower energy prices and a stronger U.S. labour market supported consumer spending.

The measure of views of the economy increased to 33.2 from 32.6.

The buying climate index climbed to 38.4 from 36.6.

The personal finances index was up to 57.4 from 56.4.

-

08:30

Global Stocks: U.S. indices rose despite weak jobs data

U.S. stock indices closed higher on Friday despite early loss as rising oil prices were taken for a sign of positive developments. Nowadays gains in crude prices are good for the market on the whole.

The Dow Jones Industrial Average rose 200.36 points, or 1.2%, to 16,472.37 (+1% over the week). The S&P 500 gained 27.54, or 1.4%, to 1,951.36 (+1% over the week). The Nasdaq Composite Index added 80.69, or 1.7%, to 4,707.78 (+0.5% over the week).

An anticipated report showed on Friday that the U.S. economy generated 142,000 jobs in September compared to the expected 200,000.The unemployment rate remained at 5.1%. However some analysts say that a weaker-than-expected jobs report does not mean that U.S. corporate profits will fall over the long-term period.

This morning in Asia Hong Kong Hang Seng rose 1.73%, or 371.80, to 21,877.89. The Nikkei rose 1.74%, or 308.81, to 18,033.94. Markets in China are on holiday until Wednesday.

Asian stocks gained as weak U.S. employment data eased concerns over a looming rate hike by the Federal Reserve. Meanwhile the same jobs report suggested that the U.S. economy felt the consequences of an economic slowdown in China. This intensified expectations of changes to monetary policy of the central bank of China.

-

03:03

Nikkei 225 17,968 +242.87 +1.37 %, S&P/ASX 200 5,146 +93.98 +1.86 %, Topix 1,458.55 +13.63 +0.94 %

-

00:29

Stocks. Daily history for Sep Oct 2 ’2015:

(index / closing price / change items /% change)

Nikkei 225 17,725.13 +2.71 +0.02%

S&P/ASX 200 5,052.02 -60.12 -1.18%

Topix 1,444.92 +2.18 +0.15%

FTSE 100 6,129.98 +57.51 +0.95%

CAC 40 4,458.88 +32.34 +0.73%

Xetra DAX 9,553.07 +43.82 +0.46%

S&P 500 1,951.36 +27.54 +1.43%

NASDAQ Composite 4,707.78 +80.69 +1.74%

Dow Jones 16,472.37 +200.36 +1.23%

-