Noticias del mercado

-

21:01

DJIA 16315.70 43.69 0.27%, NASDAQ 4654.87 27.79 0.60%, S&P 500 1930.47 6.65 0.35%

-

18:12

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fells on Friday after jobs data for September fell far short of expectations, raising doubts that the economy is robust enough to absorb an interest rate hike. Nonfarm payrolls rose by 142,000, below the 203,000 that economists had expected, and August figures were revised sharply lower. The jobless rate held steady at 5.1% but average hourly wages fell by a cent from August.

Most of Dow stocks in negative area (23 of 30). Top looser - JPMorgan Chase & Co. (JPM, -3.52%). Top gainer - Pfizer Inc. (PFE, +1.95%).

S&P index sectors mixed. Top looser - Financial (-1.4%). Top gainer - Basic Materials (+1,1%).

At the moment:

Dow 16099.00 -91.00 -0.56%

S&P 500 1904.75 -12.00 -0.63%

Nasdaq 100 4172.25 -15.25 -0.36%

10 Year yield 1,95% -0,09

Oil 44.18 -0.56 -1.25%

Gold 1138.50 +24.80 +2.23%

-

18:00

European stocks close: stocks closed higher despite the weak U.S. labour market and Eurozone’s producer price inflation data

Stock indices closed higher despite the weak U.S. labour market and Eurozone's producer price inflation data. According to the U.S. Labor Department, the U.S. economy added 142,000 jobs in September, missing expectations for a rise of 203,000 jobs, after a gain of 136,000 jobs in August. August's figure was revised down from a rise of 173,000 jobs.

The U.S. unemployment rate remained unchanged at 5.1% in September, in line with expectations. It was the lowest level since April 2008.

Average hourly earnings were flat in September, missing forecasts of a 0.2% gain, after a 0.4% increase in August. August's figure was revised up from a 0.3% rise.

These figures indicate that the interest rate by the Fed this month is unlikely despite comments by some Fed officials.

The European Central Bank President Marion Draghi said in New York on Thursday that the growth in the Eurozone is picking up.

"The progress achieved over the past three years to stabilize and strengthen the euro area is real. Growth is returning. The way forward is well identified. And we will not rest until our monetary union is complete," he noted.

Meanwhile, the economic data from the Eurozone was negative. Eurostat released its producer price index for the Eurozone on Friday. Eurozone's producer price index declined 0.8% in August, missing expectations for a 0.6% drop, after a 0.2% decrease in July. July's figure was revised down from a 0.1% decline.

Intermediate goods prices fell 0.5% in August, capital goods prices were flat and both durable and non-durable consumer goods prices climbed 0.1%, while energy prices decreased 2.6%.

On a yearly basis, Eurozone's producer price index dropped 2.6% in August, missing expectations for a 2.4% decrease, after a 2.1% fall in July.

Eurozone's producer prices excluding energy fell 0.5% year-on-year in August. Energy prices dropped at an annual rate of 8.2%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 59.9 in September from 57.3 in August, exceeding expectations for a rise to 57.5.

A reading above 50 indicates expansion in the construction sector.

The increase was partly driven by a strong rise in in residential building.

"Construction firms enjoyed a strong finish to the third quarter of 2015, as a sustained rebound in new development projects continued to have an impact on the ground. Moreover, September data suggests that the UK construction sector is still experiencing its most intense cycle of job hiring for at least 15 years, and consequently skill shortages remain a dominant concern across the industry," Senior Economist at Markit, Tim Moore, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,129.98 +57.51 +0.95 %

DAX 9,553.07 +43.82 +0.46 %

CAC 40 4,458.88 +32.34 +0.73 %

-

18:00

European stocks closed: FTSE 6129.98 57.51 0.95%, DAX 9553.07 43.82 0.46%, CAC 40 4458.88 32.34 0.73%

-

17:54

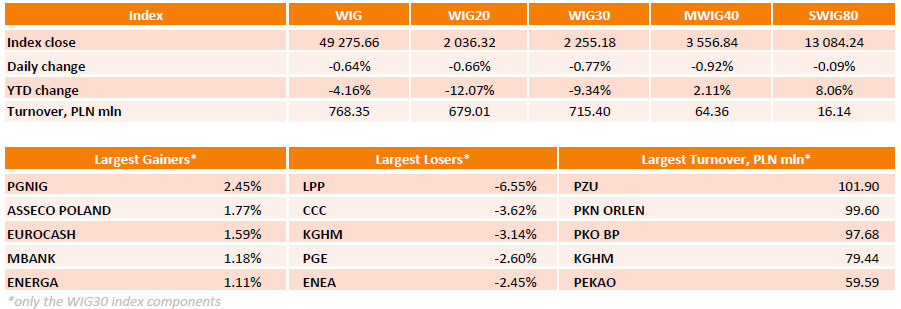

WSE: Session Results

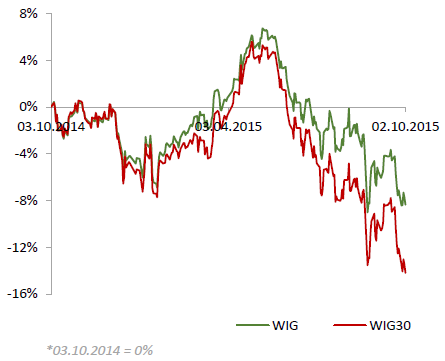

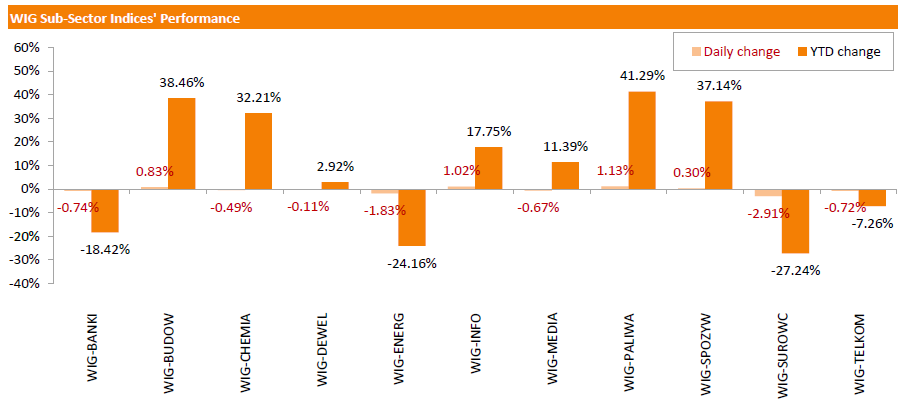

Polish equity market declined on Friday. The broad market measure, the WIG Index, slumped by 0.64%. Sector-wise, materials stocks (-2.91%) lagged behind, while oil and gas names (+1.13%) were the strongest group.

The large-cap stocks fell by 0.77%, as measured by the WIG30 Index. In the index basket, retailers LPP (WSE: LPP) and CCC (WSE: CCC) led the decliners, tumbling by 6.55% and 3.62% respectively on concerns about sales performance. Other major laggards were KGHM (WSE: KGH), PGE (WSE: PGE) and ENEA (WSE: ENA), plummeting by 2.45%-3.14%. On the other side of the ledger, PGNIG (WSE: PGN) became the biggest gainer with a 2.45% advance, followed ASSECO POLAND (WSE: ACP) and EUROCASH (WSE: EUR), which quotations went up by 1.77% and 1.59% respectively.

-

16:54

Number of registered unemployed people in Spain increases by 22,087 in September

Spain's labour ministry release its labour market figures on Friday. The number of registered unemployed people rose 22,087 in September.

The services sector lost the most jobs.

-

16:30

U.S. factory orders drop 1.7% in August

The U.S. Commerce Department released factory orders data on Friday. Factory orders in the U.S. slid 1.7% in August, missing expectations for a 1.2% decline, after a 0.2% increase in July. July's figure was revised down from a 0.4% rise.

The decline was driven by a drop in durable goods orders. Durable goods orders decreased by 2.3% in August, while orders for nondurable goods declined 1.1%.

Factory orders excluding transportation fell 0.8% in August, after a 0.7% in July.

Orders for transportation equipment plunged 6.2% in August.

-

16:18

Minneapolis Federal Reserve Bank President Narayana Kocherlakota: the Fed should adjust its monetary policy so that it can reach its 2% inflation target within two years

Minneapolis Federal Reserve Bank President Narayana Kocherlakota said on Friday that the Fed should adjust its monetary policy so that it can reach its 2% inflation target within two years. He also said that the Fed should not raise its interest rate as the inflation is low and as the interest rate hike will have a negative effect on job creation.

Kocherlakota isn't a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:05

Boston Fed President Eric Rosengren: the interest rate hike is still possible

Boston Fed President Eric Rosengren said on Friday that the interest rate hike is still possible. He noted that the Fed could start raising its interest rates this year if the U.S. economic data will stay strong.

Rosengren pointed out that the strengthening U.S. labour market is key to reach the 2% inflation target.

Boston Fed president also said that commodity and oil prices have a temporary effect on inflation.

-

15:34

U.S. Stocks open: Dow -1.24%, Nasdaq -1.33%, S&P -1.26%

-

15:26

Before the bell: S&P futures -1.13%, NASDAQ futures -1.10%

U.S. stock-index futures fell after weaker-than-forecast jobs data suggested that the economy is feeling the impact of slowing global growth.

Nikkei 17,725.13 +2.71 +0.02%

Hang Seng 21,506.09 +659.79 +3.17%

FTSE 6,095.9 +23.43 +0.39%

CAC 4,420.34 -6.20 -0.14%

DAX 9,476 -33.25 -0.35%

Crude oil $44.96 (+0.49%)

Gold $1128.30 (+1.31%)

-

15:10

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Visa

V

70.01

+0.03%

0.2K

Nike

NKE

123.90

+0.06%

6.7K

Pfizer Inc

PFE

32.05

+0.66%

9.8K

Barrick Gold Corporation, NYSE

ABX

6.45

+4.20%

4.8K

The Coca-Cola Co

KO

39.80

0.00%

14.9K

Hewlett-Packard Co.

HPQ

25.26

-0.36%

4.1K

Caterpillar Inc

CAT

64.15

-0.37%

0.6K

United Technologies Corp

UTX

88.00

-0.41%

0.8K

Deere & Company, NYSE

DE

72.58

-0.43%

17.7K

Exxon Mobil Corp

XOM

73.70

-0.49%

13.9K

UnitedHealth Group Inc

UNH

116.00

-0.52%

1.3K

Home Depot Inc

HD

116.40

-0.54%

3.2K

AT&T Inc

T

32.35

-0.55%

41.8K

Travelers Companies Inc

TRV

97.80

-0.55%

0.7K

Chevron Corp

CVX

77.90

-0.56%

4.3K

Procter & Gamble Co

PG

71.49

-0.64%

1.7K

ALCOA INC.

AA

9.20

-0.65%

10.4K

McDonald's Corp

MCD

98.07

-0.72%

0.7K

Wal-Mart Stores Inc

WMT

63.80

-0.73%

0.1K

Johnson & Johnson

JNJ

92.47

-0.75%

0.89K

International Business Machines Co...

IBM

142.50

-0.76%

0.23K

Intel Corp

INTC

29.75

-0.83%

1.9K

Merck & Co Inc

MRK

48.96

-0.83%

5.9K

Starbucks Corporation, NASDAQ

SBUX

57.00

-0.84%

2.4K

Google Inc.

GOOG

606.10

-0.85%

9.3K

Verizon Communications Inc

VZ

42.59

-0.86%

2.8K

ALTRIA GROUP INC.

MO

53.75

-0.87%

13.3K

Ford Motor Co.

F

13.55

-0.88%

3.5K

Cisco Systems Inc

CSCO

25.50

-0.89%

6.8K

Microsoft Corp

MSFT

44.20

-0.92%

23.1K

HONEYWELL INTERNATIONAL INC.

HON

93.80

-0.96%

0.5K

Twitter, Inc., NYSE

TWTR

24.44

-0.97%

92.0K

Yandex N.V., NASDAQ

YNDX

10.62

-1.03%

3.0K

Yahoo! Inc., NASDAQ

YHOO

28.61

-1.04%

1K

American Express Co

AXP

73.10

-1.07%

1.8K

General Electric Co

GE

24.92

-1.07%

3.4K

Walt Disney Co

DIS

101.50

-1.14%

3.5K

Apple Inc.

AAPL

108.20

-1.26%

153.1K

Amazon.com Inc., NASDAQ

AMZN

513.92

-1.31%

5.8K

General Motors Company, NYSE

GM

30.26

-1.34%

59.1K

Boeing Co

BA

128.71

-1.45%

2.5K

Tesla Motors, Inc., NASDAQ

TSLA

236.00

-1.62%

13.3K

E. I. du Pont de Nemours and Co

DD

47.56

-1.63%

1.5K

Facebook, Inc.

FB

89.46

-1.64%

233.0K

JPMorgan Chase and Co

JPM

59.82

-1.90%

1.5K

Citigroup Inc., NYSE

C

48.89

-2.00%

16.4K

Goldman Sachs

GS

172.30

-2.11%

17.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.60

-2.24%

83.2K

AMERICAN INTERNATIONAL GROUP

AIG

55.50

-2.49%

12.0K

-

15:08

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume))

Barrick Gold Corporation, NYSE

ABX

6.45

4.20%

4.8K

Pfizer Inc

PFE

32.05

0.66%

9.8K

The Coca-Cola Co

KO

39.80

0.00%

14.9K

Hewlett-Packard Co.

HPQ

25.26

-0.36%

4.1K

United Technologies Corp

UTX

88.00

-0.41%

0.8K

Deere & Company, NYSE

DE

72.58

-0.43%

17.7K

Travelers Companies Inc

TRV

97.80

-0.55%

0.7K

Procter & Gamble Co

PG

71.49

-0.64%

1.7K

ALCOA INC.

AA

9.20

-0.65%

10.4K

McDonald's Corp

MCD

98.07

-0.72%

0.7K

Wal-Mart Stores Inc

WMT

63.80

-0.73%

0.1K

Merck & Co Inc

MRK

48.96

-0.83%

5.9K

Starbucks Corporation, NASDAQ

SBUX

57.00

-0.84%

2.4K

Google Inc.

GOOG

606.10

-0.85%

9.3K

Verizon Communications Inc

VZ

42.59

-0.86%

2.8K

ALTRIA GROUP INC.

MO

53.75

-0.87%

13.3K

Ford Motor Co.

F

13.55

-0.88%

3.5K

Microsoft Corp

MSFT

44.20

-0.92%

23.1K

HONEYWELL INTERNATIONAL INC.

HON

93.80

-0.96%

0.5K

Twitter, Inc., NYSE

TWTR

24.44

-0.97%

92.0K

Yandex N.V., NASDAQ

YNDX

10.62

-1.03%

3.0K

Yahoo! Inc., NASDAQ

YHOO

28.61

-1.04%

1K

Walt Disney Co

DIS

101.50

-1.14%

3.5K

Apple Inc.

AAPL

108.20

-1.26%

153.1K

Amazon.com Inc., NASDAQ

AMZN

513.92

-1.31%

5.8K

General Motors Company, NYSE

GM

30.26

-1.34%

59.1K

Tesla Motors, Inc., NASDAQ

TSLA

236.00

-1.62%

13.3K

Facebook, Inc.

FB

89.46

-1.64%

233.0K

Citigroup Inc., NYSE

C

48.89

-2.00%

16.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.60

-2.24%

83.2K

AMERICAN INTERNATIONAL GROUP

AIG

55.50

-2.49%

12.0K

-

15:05

U.S. unemployment rate remains unchanged at 5.1% in September, 142,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 142,000 jobs in September, missing expectations for a rise of 203,000 jobs, after a gain of 136,000 jobs in August. August's figure was revised down from a rise of 173,000 jobs.

The increase was partly driven by a rise in health care employment. Health care sector added 34,000 jobs in September, while the manufacturing sector lost 9,000 jobs.

Professional and business services sector added 31,000 jobs in September, while mining sector shed 10,300 jobs.

The U.S. unemployment rate remained unchanged at 5.1% in September, in line with expectations. It was the lowest level since April 2008.

Average hourly earnings were flat in September, missing forecasts of a 0.2% gain, after a 0.4% increase in August. August's figure was revised up from a 0.3% rise.

The labour-force participation rate declined to 62.4% in September from 62.6% in August. It was the lowest level since October 1977.

These figures indicate that the interest rate by the Fed this month is unlikely despite comments by some Fed officials.

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Google (GOOG) upgraded to Outperform from Perform at Oppenheimer; target $700

Pfizer (PFE) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $38 from $35

Downgrades:

Other:

Facebook (FB) resumed with a Outperform at Wedbush; target $115

Twitter (TWTR) resumed with a Neutral at Wedbush ; target $30

McDonald's (MCD) initiated with a Neutral at Nomura

Apple (AAPL) initiated with a Buy at Drexel Hamilton; target $200

UnitedHealth Group (UNH) initiated with a Buy at Citigroup

-

14:24

Household spending in Japan climbs 2.9% year-on-year in August

Japan's Ministry of Internal Affairs and Communications released its household spending data on late Thursday evening. The household spending in Japan increased 2.9% year-on-year in August, exceeding expectations for a 0.4% rise, after a 0.2% fall in July.

The increase was driven by higher car purchases.

-

14:15

Japan’s unemployment rate rises to 3.4% in August

Japan's Ministry of Internal Affairs and Communications released its unemployment data on late Thursday evening. The unemployment rate in Japan rose to 3.4% in August from 3.3% in July. Analysts had expected the unemployment rate to remain unchanged.

The number of unemployed people in Japan increased a seasonally adjusted 1.8% to 2.24 million in August from July.

The participation rate remained unchanged at 59.6% in August.

-

11:59

European stock markets mid session: stocks traded higher ahead of the release of the U.S. labour market data

Stock indices traded higher ahead of the release of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.1% in September. The U.S. economy is expected to add 202,000 jobs in September, after adding 173,000 jobs in August.

The European Central Bank President Marion Draghi said in New York on Thursday that the growth in the Eurozone is picking up.

"The progress achieved over the past three years to stabilize and strengthen the euro area is real. Growth is returning. The way forward is well identified. And we will not rest until our monetary union is complete," he noted.

Meanwhile, the economic data from the Eurozone was negative. Eurostat released its producer price index for the Eurozone on Friday. Eurozone's producer price index declined 0.8% in August, missing expectations for a 0.6% drop, after a 0.2% decrease in July. July's figure was revised down from a 0.1% decline.

Intermediate goods prices fell 0.5% in August, capital goods prices were flat and both durable and non-durable consumer goods prices climbed 0.1%, while energy prices decreased 2.6%.

On a yearly basis, Eurozone's producer price index dropped 2.6% in August, missing expectations for a 2.4% decrease, after a 2.1% fall in July.

Eurozone's producer prices excluding energy fell 0.5% year-on-year in August. Energy prices dropped at an annual rate of 8.2%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 59.9 in September from 57.3 in August, exceeding expectations for a rise to 57.5.

A reading above 50 indicates expansion in the construction sector.

The increase was partly driven by a strong rise in in residential building.

"Construction firms enjoyed a strong finish to the third quarter of 2015, as a sustained rebound in new development projects continued to have an impact on the ground. Moreover, September data suggests that the UK construction sector is still experiencing its most intense cycle of job hiring for at least 15 years, and consequently skill shortages remain a dominant concern across the industry," Senior Economist at Markit, Tim Moore, said.

Current figures:

Name Price Change Change %

FTSE 100 6,153.91 +81.44 +1.34 %

DAX 9,635.5 +126.25 +1.33 %

CAC 40 4,499.6 +73.06 +1.65 %

-

11:45

Retail sales in Australia climb 0.4% in August

The Australian Bureau of Statistics released its retail sales data on Friday. Retail sales in Australia rose 0.4% in August, in line with expectations, after a 0.1% decline in July.

The increase was mainly driven by higher sales at department stores and cafes, restaurants and takeaway food services sales. Both sales at department stores and cafes, restaurants and takeaway food services sales rose 0.4% in August.

On a yearly basis, retail sales climbed 4.5% in August.

-

11:35

European Central Bank President Marion Draghi: the growth in the Eurozone is picking up

The European Central Bank President Marion Draghi said in New York on Thursday that the growth in the Eurozone is picking up.

"The progress achieved over the past three years to stabilize and strengthen the euro area is real. Growth is returning. The way forward is well identified. And we will not rest until our monetary union is complete," he noted.

-

11:25

Eurozone's producer price index declines 0.8% in August

Eurostat released its producer price index for the Eurozone on Friday. Eurozone's producer price index declined 0.8% in August, missing expectations for a 0.6% drop, after a 0.2% decrease in July. July's figure was revised down from a 0.1% decline.

Intermediate goods prices fell 0.5% in August, capital goods prices were flat and both durable and non-durable consumer goods prices climbed 0.1%, while energy prices decreased 2.6%.

On a yearly basis, Eurozone's producer price index dropped 2.6% in August, missing expectations for a 2.4% decrease, after a 2.1% fall in July.

Eurozone's producer prices excluding energy fell 0.5% year-on-year in August. Energy prices dropped at an annual rate of 8.2%.

-

11:09

UK construction PMI rises to 59.9 in September

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 59.9 in September from 57.3 in August, exceeding expectations for a rise to 57.5.

A reading above 50 indicates expansion in the construction sector.

The increase was partly driven by a strong rise in in residential building.

"Construction firms enjoyed a strong finish to the third quarter of 2015, as a sustained rebound in new development projects continued to have an impact on the ground. Moreover, September data suggests that the UK construction sector is still experiencing its most intense cycle of job hiring for at least 15 years, and consequently skill shortages remain a dominant concern across the industry," Senior Economist at Markit, Tim Moore, said.

-

10:55

OECD: consumer price inflation in the OECD area remains unchanged at 0.6% year-on-year in August

OECD released its consumer price inflation (CPI) data on Thursday. Consumer price inflation in the OECD area remained unchanged at 0.6% year-on-year in August.

Energy prices dropped at an annual rate of 10.3% in August, while food prices increased to 1.4% in August from 1.3% in July.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.7% in August.

August's CPI was 0.2% in Germany, Italy, Japan and the U.S, 1.3% in Canada, and 0.0% in the U.K. The consumer price inflation in Eurozone was 0.1% in August, while the inflation in China was 1.4%.

-

10:27

Swiss National Bank Vice Chairman Fritz Zurbruegg: negative interest rates were temporary

The Swiss National Bank (SNB) Vice Chairman Fritz Zurbruegg said on Thursday that negative interest rates were temporary.

"This can't be business as normal. This is a temporary situation," he said.

Zurbruegg noted that the Swiss franc is overvalued and the central bank will intervene in the foreign exchange market if needed.

-

10:23

San Francisco Fed President John Williams expects the Fed to start raising its interest rates this year, maybe in October

San Francisco Fed President John Williams said on Thursday that he expects the Fed to start raising its interest rates this year, maybe in October. He noted the U.S. economy is close to reach full employment.

Williams pointed out that the Fed continues to monitor developments abroad.

-

08:40

Global Stocks: U.S. indices posted mixed results

U.S. stock indices little changed on Thursday amid mixed domestic data and concerns over global economic growth.

The Dow Jones Industrial Average declined 12.69 points, or 0.8%, to 16,272.01. The S&P 500 gained 3.79, or 0.2%, to 1,923.82. The Nasdaq Composite Index climbed 6.92, or 0.2%, to 4,627.08.

A report from the Institute of Supply Management showed that activity in the U.S. manufacturing sector slowed in September. The Manufacturing PMI came in at 50.2 in September compared to 51.1 in August. The latest reading is the minimum since July 2013. The index was expected to slide to 50.6.

U.S. Department of Labor reported that the number of initial jobless claims rose moderately last week staying near a level, which suggests that conditions in the labor market are improving. In the week ended September 26 the number of initial jobless claims rose by 10,000 on a seasonally adjusted basis to 277,000.

This morning in Asia Hong Kong Hang Seng rose 0.48%, or 529.67, to 21,375.97. The Nikkei rose 2.29%, or 397.82, to 17,785.97. Markets in China are on holiday.

Japanese stocks declined at the beginning of the session amid disappointing data on U.S. manufacturing, but rebounded later.

Japan's household spending rose 2.9% y/y in August from a year earlier compared to expectations for a 0.4% rise. Meanwhile the unemployment rate climbed to 3.4% in August from 3.3% in July, where it was expected to stay.

-

04:34

Nikkei 225 17,629.77 -92.65 -0.52 %, S&P/ASX 200, 5,090.4 -21.74 -0.43, Topix 1,434.83 -7.91 -0.55 %

-

00:32

Stocks. Daily history for Sep Oct 1 ’2015:

(index / closing price / change items /% change)

Nikkei 225 17,722.42 +334.27 +1.92 %

S&P/ASX 200 5,112.14 +90.51 +1.80 %

FTSE 100 6,072.47 +10.86 +0.18 %

CAC 40 4,426.54 -28.75 -0.65 %

Xetra DAX 9,509.25 -151.19 -1.57 %

S&P 500 1,923.82 +3.79 +0.20 %

NASDAQ Composite 4,627.08 +6.92 +0.15 %

Dow Jones 16,272.01 -12.69 -0.08 %

-