Noticias del mercado

-

22:26

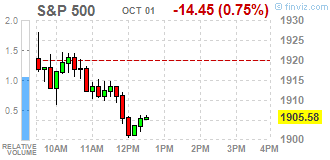

U.S. stocks closed

U.S. stocks erased a steep drop in afternoon trading, while Treasuries and crude ended little changed as investors remained cautious before a report on the American labor market.

The Standard & Poor's 500 Index rallied back from a drop of more than 1 percent to post a third day of gains. The advance added to an end-of-quarter rally that trimmed its worst performance in four years. Crude surged more than 4 percent only to settle near where it began. Treasury 10-year rates touched a five-week low before reversing in the final hour of the session.

Investors remained cautious before Friday's U.S. jobs report, expected to show the economy added 200,000 jobs last month, as the reading will factor into the Fed's next rate decision, due Oct. 28. The central bank is also weighing whether recent financial-market turmoil, which it cited as a reason for standing pat, has abated enough to warrant tightening. The selloff last quarter affected risk assets from emerging markets to oil and metals, while havens from Treasuries to the yen strengthened.

Global equities are trying to rebound from the steepest quarterly slide since September 2011, sparked by concern that the slowdown in China would hamper global growth at the same time the Fed moved toward its first interest-rate increase since 2006. Commodities got an early boost from Chinese data showing a stabilization in manufacturing, before a reading on American output raised concern about the strength of economic growth.

The S&P 500 added 0.2 percent at 4 p.m. in New York after rallying 1.9 percent yesterday. That advance began Tuesday after the index slid withing five points of its Aug. 25 low. The three days of gains are the most since Aug. 28.

The advance Thursday doesn't necessarily signal all-clear. Almost 35 percent of the gauge's members have slipped back below their price from that nadir. The heavyweights are doing all the lifting: Apple Inc., Microsoft Corp. and Exxon Mobil Corp. -- the three largest companies by market cap -- account for nearly one-fifth of the gains since the market bottomed.

-

21:00

DJIA 16243.82 -40.88 -0.25%, NASDAQ 4610.46 -9.70 -0.21%, S&P 500 1919.87 -0.16 -0.01%

-

18:36

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes started the last quarter of the year in the red on Thursday as Apple fell and investors parsed mixed U.S. data. Apple was down 2% on a report that chip suppliers were concerned the iPhone maker would cut chip orders for the fourth quarter. The stock was the biggest drag on the three major indexes. The Institute for Supply Management's (ISM) index of national factory activity fell to 50.2 in September, its lowest since May 2013. New jobless claims rose modestly last week but remained near 15-year lows. Also, a gauge of the trend in claims fell. Mixed signals from the data could complicate the Federal Reserve's plans to raise interest rates this year.

Almost all of Dow stocks in negative area (29 of 30). Top looser - Cisco Systems, Inc. (CSCO, -2.53%). Top gainer - Pfizer Inc. (PFE, +0.45%).

All of S&P index sectors in negative area. Top looser - Industrial Goods (-1.2%).

At the moment:

Dow 16001.00 -171.00 -1.06%

S&P 500 1894.00 -14.75 -0.77%

Nasdaq 100 4127.50 -35.50 -0.85%

10 Year yield 2,03% -0,03

Oil 44.99 -0.10 -0.22%

Gold 1114.20 -1.00 -0.09%

-

18:14

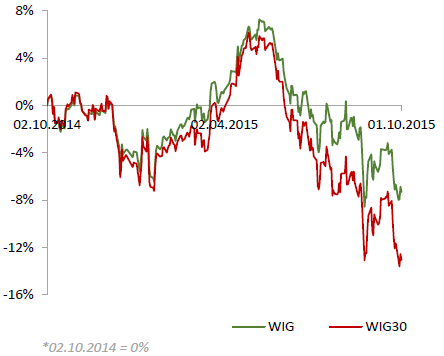

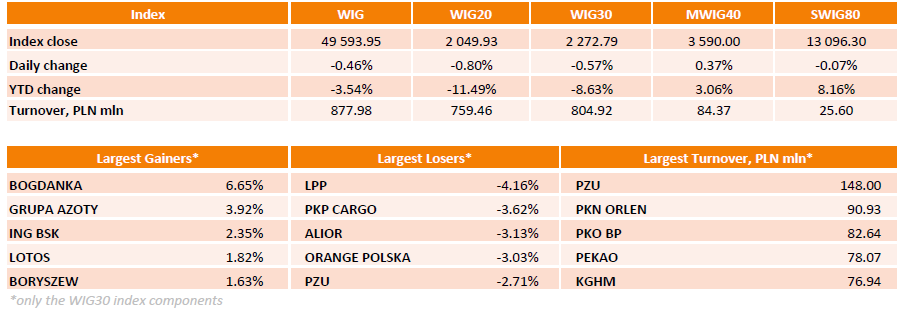

WSE: Session Results

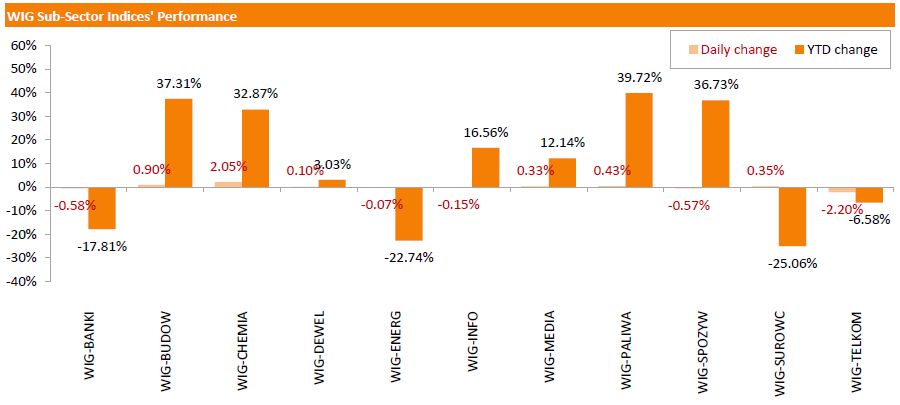

The Polish equity market finished lower Thursday. The broad-market measure, the WIG Index, fell by 0.46%. Sector performance in the WIG Index was mixed. Telecommunications names (-2.20%) fared the worst, while chemicals stocks (+2.05%) recorded the biggest gains.

The large-cap stocks' measure, the WIG30 Index, lost 0.57%. In the index basket, clothing retailer LPP (WSE: LPP) declined the most, down 4.16%, depressed by weak sales results for September. It was followed by PKP CARGO (WSE: PKP), ALIOR (WSE: ALR) and ORANGE POLSKA (WSE: OPL), losing 3.62%, 3.13% and 3.03% respectively. On the other side of the ledger, BOGDANKA (WSE: LWB) generated the biggest advance (+6.65%), following yesterday's drop. GRUPA AZOTY (WSE: ATT) continued to extend gains, adding 3.92%. Other major outperformers were ING BSK (WSE: ING), LOTOS (WSE: LTS), BORYSZEW (WSE: BRS) and ENERGA (WSE: ENG), surging by 1.42%-2.35%.

-

18:00

European stocks close: stocks closed mixed due to the weak manufacturing PMI from the Eurozone and a decline in telecom shares

Stock indices closed mixed due to the weak manufacturing PMI from the Eurozone and a decline in telecom shares. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in September from 52.3 in August, in line with a preliminary reading.

"Despite unprecedented central bank stimulus and substantial currency depreciation, the Eurozone manufacturing sector is failing to achieve significant growth momentum and even risks stalling again," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in September from 53.3 in August, down from a preliminary reading of 52.5.

The decline was driven by a fall in input prices.

France's final manufacturing purchasing managers' index (PMI) climbed to 50.6 in September from 48.3 in August, up from the preliminary reading of 50.4.

The increase was mainly driven by a rise in output, which climbed at the fastest pace since March 2014.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Thursday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in September from 51.6 in August, beating expectations for a fall to 51.3. August's figure was revised up from 51.5.

The decline was driven by a drop in input prices.

Employment also declined in September.

"The UK manufacturing sector remained sluggish at the end of the third quarter, stunned by a triple combination of a sharp slowdown in consumer spending, weak business investment and stagnating export order inflows. The survey is still broadly consistent with stagnation, or even a mild downturn, when compared to official data," Markit's Senior Economist Rob Dobson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,072.47 +10.86 +0.18 %

DAX 9,509.25 -151.19 -1.57 %

CAC 40 4,426.54 -28.75 -0.65 %

-

18:00

European stocks closed: FTSE 6072.47 10.86 0.18%, DAX 9509.25 -151.19 -1.57%, CAC 40 4426.54 -28.75 -0.65%

-

17:47

Federal Reserve Bank of Richmond President Jeffrey Lacker: the Fed could start raising its interest rates this month

Federal Reserve Bank of Richmond President Jeffrey Lacker said in an interview with The Wall Street Journal on Wednesday that the Fed could start raising its interest rates this month. He noted that the Fed will get enough information to make a decision.

-

16:57

Australian Industry Group’ Performance of Manufacturing Index rises to 52.1 in September

The Australian Industry Group (AiG) released its Performance of Manufacturing Index on Thursday. The index rose to 52.1 in September from 51.7 in August. It was the highest level since May.

A reading above 50 indicates expansion, below indicates contraction.

Exports and sales sub-indices showed the biggest increases.

-

16:30

ISM manufacturing purchasing managers’ index falls to 50.2 in September, the lowest level since May of 2013

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Thursday. The index declined to 50.2 in September from 51.1 in August, missing expectations for a fall to 50.6. It was the lowest level since May of 2013.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in production. The production index declined to 51.8 in September from 53.6 in August.

The new orders index dropped to 50.1 in September from 51.7 in August.

The employment index was down to 50.5 in September from 51.2 in August.

The price index declined to 38.0 in September from 39.0 in August.

-

16:22

Construction spending in the U.S. is up 0.7% in August

The U.S. Commerce Department released construction spending data on Thursday. Construction spending in the U.S. rose 0.7% in August, exceeding expectations for a 0.5% gain, after a 0.4% increase in July. July's figure was revised down from a 0.7% rise.

The increase was mainly driven by a rise in private residential construction. Spending on private residential construction climbed 1.3% in August.

Spending on private non-residential construction projects increased 0.2% in August, while public construction spending increased 0.5%.

-

16:02

Greece’s final manufacturing PMI climbs to 43.3 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Tuesday. Greece's manufacturing purchasing managers' index (PMI) climbed to 43.3 in September from 31.1 in August.

The decline in production eased in September, while employment declined for six consecutive months.

"September data indicated that Greek manufacturers experienced the harsh effects of the ongoing capital controls implemented by the government. Latest survey data signalled a further contraction in output, as incoming new orders suffered from the strict austerity measures in place across the country," Markit economist Samuel Agass said.

-

15:55

U.S. final manufacturing purchasing managers' index (PMI) increases to 53.1 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Thursday. The U.S. final manufacturing purchasing managers' index (PMI) increased to 53.1 in September from 53.0 in August, up from the previous estimate of 53.0.

A reading above 50 indicates expansion in economic activity.

Both output and new business volumes rose at slower rates in September, while job creation eased.

"The US manufacturing sector has seen a distinct loss of growth momentum in recent months, endured the worst performance for two years during the third quarter. Headwinds include the rising dollar, weak demand in global markets, a downturn in business investment and financial market jitters," Markit's Chief Economist Chris Williamson said.

-

15:38

Spain’s final manufacturing PMI falls to 51.7 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Spain on Thursday. Spain's manufacturing purchasing managers' index (PMI) declined to 51.7 in September from 53.2 in August. It was the lowest level since December 2013.

The decline was driven by a slower increase in new orders, the weakest pace of new orders since December 2013, and by a decline in input prices. Input prices fell due to lower fuel prices.

"The outlook for the remainder of the year is looking uncertain, but with macroeconomic risks skewed to the downside there is the possibility of outright declines in output and new orders being recorded," a senior economist at Markit Andrew Harker said.

-

15:34

U.S. Stocks open: Dow +0.31%, Nasdaq +0.03%, S&P +0.29%

-

15:28

Before the bell: S&P futures +0.14%, NASDAQ futures +0.22%

U.S. stock-index futures fluctuated.

Nikkei 17,722.42 +334.27 +1.92%

Hang Seng 20,846.3 +289.70 +1.41%

FTSE 6,108.5 +46.89 +0.77%

CAC 4,470.59 +15.30 +0.34%

DAX 9,605.98 -54.46 -0.56%

Crude oil $45.88 (+1.75%)

Gold $1114.00 (-0.11%)

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Apple Inc.

AAPL

108.60

-1.54%

700.8K

Twitter, Inc., NYSE

TWTR

26.82

-0.45%

60.7K

Tesla Motors, Inc., NASDAQ

TSLA

247.50

-0.36%

6.9K

Barrick Gold Corporation, NYSE

ABX

6.34

-0.31%

1.5K

Amazon.com Inc., NASDAQ

AMZN

510.35

-0.30%

13.0K

3M Co

MMM

141.50

-0.19%

0.2K

American Express Co

AXP

74.01

-0.16%

1.1K

Google Inc.

GOOG

607.88

-0.09%

7.3K

Visa

V

69.66

0.00%

0.5K

Johnson & Johnson

JNJ

93.35

0.00%

0.2K

Facebook, Inc.

FB

89.90

0.00%

135.2K

Starbucks Corporation, NASDAQ

SBUX

56.84

0.00%

2.7K

Boeing Co

BA

131.00

0.04%

2.1K

Procter & Gamble Co

PG

72.01

0.10%

0.3K

ALCOA INC.

AA

9.67

0.10%

4.6K

Nike

NKE

123.10

0.11%

2.8K

AT&T Inc

T

32.62

0.12%

2.7K

Walt Disney Co

DIS

102.32

0.12%

4.5K

General Motors Company, NYSE

GM

30.06

0.13%

70.1K

Goldman Sachs

GS

174.00

0.14%

1.9K

International Business Machines Co...

IBM

145.19

0.15%

0.8K

McDonald's Corp

MCD

98.68

0.15%

0.2K

The Coca-Cola Co

KO

40.18

0.15%

19.1K

General Electric Co

GE

25.26

0.16%

2.5K

Citigroup Inc., NYSE

C

49.69

0.16%

18.2K

Home Depot Inc

HD

115.70

0.18%

1.2K

Yandex N.V., NASDAQ

YNDX

10.75

0.19%

3.1K

Caterpillar Inc

CAT

65.50

0.21%

1.7K

Verizon Communications Inc

VZ

43.60

0.21%

4.2K

Ford Motor Co.

F

13.60

0.22%

5.8K

Cisco Systems Inc

CSCO

26.10

0.23%

2.0K

AMERICAN INTERNATIONAL GROUP

AIG

56.95

0.23%

2.6K

JPMorgan Chase and Co

JPM

61.12

0.25%

10.8K

Pfizer Inc

PFE

31.50

0.29%

1.5K

Yahoo! Inc., NASDAQ

YHOO

29.00

0.31%

0.1K

Exxon Mobil Corp

XOM

74.70

0.47%

28.0K

Intel Corp

INTC

30.29

0.50%

35.5K

Merck & Co Inc

MRK

49.69

0.61%

0.5K

Chevron Corp

CVX

79.55

0.85%

11.1K

Microsoft Corp

MSFT

44.65

0.88%

63.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.78

0.93%

29.5K

-

14:57

Italy’s final manufacturing PMI falls to 52.7 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Italy on Thursday. Italy's manufacturing purchasing managers' index (PMI) declined to 52.7 in September from 53.8 in August.

The decline was partly driven by a fall in output costs.

"Output, buying levels and employment all rose as goods producers faced an increase in new orders, albeit one that was the slowest since February. Also noteworthy was an accelerated drop in manufacturers' costs, the fastest since April last year, amid falling global commodity prices," Markit economist Phil Smith said.

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Microsoft (MSFT) upgraded to Neutral from Underperform at BofA/Merrill; target raised to $46 from $39

Downgrades:

Other:

Visa (V) initiated with an Outperform at Cowen

-

14:41

Initial jobless claims increase by 10,000 to 277,000 in the week ending September 26

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending September 26 in the U.S. rose by 10,000 to 277,000 from 267,000 in the previous week. Analysts had expected the initial jobless claims to increase to 270,000.

Jobless claims remained below 300,000 the 30th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 53,000 to 2,191,000 in the week ended September 19. It was the lowest level since November 2000.

-

14:28

European Central Bank Governing Council member Bostjan Jazbec: there is no need to change the central bank’s asset-buying programme

European Central Bank (ECB) Governing Council member Bostjan Jazbec said on Thursday that there is no need to change the central bank's asset-buying programme.

"At this moment, there is no need to change anything," he said.

Jazbec pointed out that the monetary policy always works with a lag.

-

14:22

Final Markit/Nikkei manufacturing purchasing managers' index for Japan decreases to 51.0 in September

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan decreased to 51.0 in September from 51.7 in August, up from the preliminary reading of 50.9.

A reading below 50 indicates contraction of activity.

The index was driven by declines in exports and purchasing activity.

"Growth in production at Japanese manufacturers eased further in September to the weakest rate in the current five-month sequence of expansion," economist at Markit, Amy Brownbill, said.

She added that the decline in exports was driven by lower trade volume with China.

-

12:00

European stock markets mid session: stocks traded higher on the positive Chinese economic data

Stock indices traded higher on the positive Chinese economic data. The Chinese manufacturing PMI rose to 49.8 in September from 49.7 in August, beating expectations for a decline to 49.6, according to the Chinese government. A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.2 in September from 47.3 in August, beating the preliminary reading of a fall to 47.0. It was the lowest level since March 2009.

"The industry has reached a crucial stage in its structural transformation. Tepid demand is a main factor behind the oversupply of manufacturing and why it has not recovered," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

Meanwhile, the economic data from the Eurozone was mostly negative. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in September from 52.3 in August, in line with a preliminary reading.

"Despite unprecedented central bank stimulus and substantial currency depreciation, the Eurozone manufacturing sector is failing to achieve significant growth momentum and even risks stalling again," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in September from 53.3 in August, down from a preliminary reading of 52.5.

The decline was driven by a fall in input prices.

France's final manufacturing purchasing managers' index (PMI) climbed to 50.6 in September from 48.3 in August, up from the preliminary reading of 50.4.

The increase was mainly driven by a rise in output, which climbed at the fastest pace since March 2014.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Thursday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in September from 51.6 in August, beating expectations for a fall to 51.3. August's figure was revised up from 51.5.

The decline was driven by a drop in input prices.

Employment also declined in September.

"The UK manufacturing sector remained sluggish at the end of the third quarter, stunned by a triple combination of a sharp slowdown in consumer spending, weak business investment and stagnating export order inflows. The survey is still broadly consistent with stagnation, or even a mild downturn, when compared to official data," Markit's Senior Economist Rob Dobson said.

Current figures:

Name Price Change Change %

FTSE 100 6,149.1 +87.49 +1.44 %

DAX 9,677.48 +17.04 +0.18 %

CAC 40 4,502.51 +47.22 +1.06 %

-

11:47

Swiss retail sales fall 0.3% year-on-year in August

The Federal Statistical Office released its retail sales data for Switzerland on Thursday. Retail sales in Switzerland declined at an annual rate of 0.3% in August, after a 0.1% rise in July. July's figure was revised up from a 0.1% fall.

Sales of food, beverages and tobacco fell at an annual rate of 0.1% in August, while non-food sales rose 1.1%.

On a monthly basis, retail sales increased by 0.5% in August.

Sales of food, beverages and tobacco were down 0.3% in August, while non-food sales climbed 1.3%.

-

11:40

Swiss manufacturing PMI drops to 49.5 in September

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Thursday. The manufacturing purchasing managers' index in Switzerland declined to 49.5 in September from 52.2 in August, missing expectations for a decrease to 51.8.

A reading above 50 indicates contraction.

The decrease was largely driven by a drop in production. The production was down to 49.1 in September from 62.4.

Purchase prices decreased to 35.1 in September from 36.1 in August, while the backlog of orders sub-index fell to 51.5 from 52.4.

-

11:33

France’s final manufacturing PMI climbs to 50.6 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Thursday. France's final manufacturing purchasing managers' index (PMI) climbed to 50.6 in September from 48.3 in August, up from the preliminary reading of 50.4.

The increase was mainly driven by a rise in output, which climbed at the fastest pace since March 2014.

"The French manufacturing sector moved onto a firmer footing in September, with business conditions improving slightly on the month. Output rose for the first time in three months, while new orders and employment broadly stabilised following recent periods of decline," Markit Senior Economist Jack Kennedy said.

-

11:25

Germany’s final manufacturing PMI falls to 52.3 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Thursday. Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in September from 53.3 in August, down from a preliminary reading of 52.5.

The decline was driven by a fall in input prices.

"Germany's manufacturing sector lost some of its growth momentum in September, with the headline PMI down slightly since August. Nevertheless, the average for the third quarter as a whole was the best in over a year, suggesting that the goods-producing sector should have a positive contribution to overall GDP in Q3," Markit economist Oliver Kolodseike said.

-

11:18

Eurozone’s final manufacturing PMI falls to 52.0 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in September from 52.3 in August, in line with a preliminary reading.

"Despite unprecedented central bank stimulus and substantial currency depreciation, the Eurozone manufacturing sector is failing to achieve significant growth momentum and even risks stalling again," Chris Williamson, Chief Economist at Markit said.

-

11:15

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declines to 51.5 in September

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Thursday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in September from 51.6 in August, beating expectations for a fall to 51.3. August's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The decline was driven by a drop in input prices.

Employment also declined in September.

"The UK manufacturing sector remained sluggish at the end of the third quarter, stunned by a triple combination of a sharp slowdown in consumer spending, weak business investment and stagnating export order inflows. The survey is still broadly consistent with stagnation, or even a mild downturn, when compared to official data," Markit's Senior Economist Rob Dobson said.

-

10:59

Final Chinese Markit/Caixin manufacturing PMI falls to 47.2 in September

The final Chinese Markit/Caixin manufacturing PMI declined to 47.2 in September from 47.3 in August, beating the preliminary reading of a fall to 47.0. It was the lowest level since March 2009.

"The industry has reached a crucial stage in its structural transformation. Tepid demand is a main factor behind the oversupply of manufacturing and why it has not recovered," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 50.5 in September from 51.5 in August, missing expectations for a decrease to 51.2.

"The employment category improved markedly, pointing to the continued strength of the service sector in creating jobs," Dr. He Fan said.

-

10:55

Official data: Chinese manufacturing PMI rises to 49.8 in September

The Chinese manufacturing PMI rose to 49.8 in September from 49.7 in August, beating expectations for a decline to 49.6, according to the Chinese government.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was driven by rises in production and new orders.

The services PMI remained unchanged at 53.4 in September.

-

10:48

Tankan Survey: the large manufacturers’ index declines to +12 in the third quarter

The Bank of Japan released its quarterly Tankan business survey on Thursday. The large manufacturers' index declined to +12 in the third quarter from +15 in the second quarter, missing expectations for a fall to +13. Confidence worsened despite record-high profits of companies.

The outlook fell to +10 in the third quarter from +16 in the second quarter.

The large non-manufacturers' index rose +25 in the third quarter from 23 in the previous quarter. It was the highest level since 1991. The outlook decreased to +19 from +21.

-

10:36

International Monetary Fund (IMF) Managing Director Christine Lagarde: the global economy will grow slower due to a slowdown in emerging economies

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Wednesday that the global economy will grow slower due to a slowdown in emerging economies.

"Global growth will likely be weaker this year than last, with only a modest acceleration expected in 2016," she said.

"The prospect of rising interest rates in the United States and China's slowdown are contributing to uncertainty and higher market volatility. There has been a sharp deceleration in the growth of global trade. And the rapid drop in commodity prices is posing problems for resource-based economies," Lagarde added.

-

10:21

U.S. Congress passes a U.S. government spending bill

The U.S. Congress passed a U.S. government spending bill before a shutdown deadline on Wednesday. The House of Representatives voted 277-151 for the bill. The Senate passed the bill by a 78-20 vote. U.S. President Barack Obama welcomed the news.

-

10:11

Fitch Ratings cuts its global economic outlook for 2015

Fitch Ratings cut its global economic outlook for 2015. The global growth is expected to be 2.3% in 2015, down from June estimate of a 2.4% increase, and 2.7% in 2016, down from June estimate of a 2.9% rise. The growth in 2015 would be the weakest growth since the global financial crisis in 2009.

The downward revision was driven by a slowdown in emerging economies.

Fitch expects the U.S. economy to expand 2.5% in 2015 and 2016, and 2.3% in 2017. The agency noted that it expect the Fed to start raising its interest rates by the end of the year.

Eurozone's economy is expected to grow at 1.6% over the 2015 to 2017 period.

-

08:32

Global Stocks: U.S. indices climbed over the session, but fell over the quarter

U.S. stock indices rose on Wednesday, but posted their worst quarterly results since 2011.

In the third quarter investors were concerned about signs of slowing economic growth in China. At the same time the Federal Reserve postponed a rate hike adding uncertainty to the market.

The Dow Jones Industrial Average rose 235.57 points, or 1.5%, to 16,284.70 (-1.5% over the month and -7.6% over the quarter). The S&P 500 rose 35.94, or 1.9%, to 1,920.03 (-2.6% over the month and -6.9% over the quarter). The Nasdaq Composite Index gained 102.84, or 2.3%, to 4,620.16.

A report by the Automatic Data Processing showed that the pace of employment improved in September and exceeded expectations. The number of employed rose by 200,000 compared to +186,000 in August, while analysts had expected a 194,000 increase.

This morning in Asia the Nikkei rose 2.29%, or 397.82, to 17,785.97. Markets in China and Hong Kong are on holiday.

Japanese stocks advanced amid gains in U.S. equities and a weaker yen despite mixed data from the Bank of Japan. BOJ Tankan Manufacturing index declined to 12 in the third quarter vs 13 expected and 15 reported previously. Meanwhile the corresponding non-manufacturing index climbed to 25 in Q3 vs 20 expected and 23 prev.

The latest data also showed that China's official manufacturing purchasing managers' index (PMI) climbed to 49.8, beating expectations of 49.6 and compared with a result of 49.7 in August. However the final Caixin/Markit PMI fell to a fresh six-and-a-half-year low of 47.2 in September, vs a preliminary estimate of 47.

-

03:57

Nikkei 225 17,455.3 +67.15 +0.39 %, S&P/ASX 200 5,051.9 +30.27 +0.60 %, Topix 1,430.09 +18.93 +1.34 %

-

00:33

Stocks. Daily history for Sep 30’2015:

(index / closing price / change items /% change)

Nikkei 225 17,388.15 +457.31 +2.70 %

Hang Seng 20,846.3 +289.70 +1.41 %

S&P/ASX 200 5,021.63 +103.20 +2.10 %

Shanghai Composite 3,053.32 +15.19 +0.50 %

FTSE 100 6,061.61 +152.37 +2.58 %

CAC 40 4,455.29 +111.56 +2.57 %

Xetra DAX 9,660.44 +210.04 +2.22 %

S&P 500 1,920.03 +35.94 +1.91 %

NASDAQ Composite 4,620.17 +102.84 +2.28 %

Dow Jones 16,284.7 +235.57 +1.47 %

-