Noticias del mercado

-

17:41

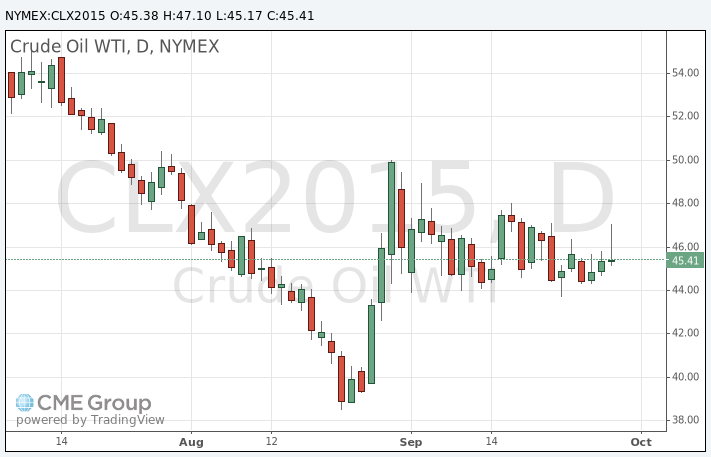

Oil prices rise on the better-than-expected Chinese economic data and on concerns over the escalation of the conflict in Syria

Oil prices increased on the better-than-expected Chinese economic data and on concerns over the escalation of the conflict in Syria as Russia started air strikes against Islamic State targets in Syria on Wednesday.

The Chinese manufacturing PMI rose to 49.8 in September from 49.7 in August, beating expectations for a decline to 49.6, according to the Chinese government. A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.2 in September from 47.3 in August, beating the preliminary reading of a fall to 47.0. It was the lowest level since March 2009.

"The industry has reached a crucial stage in its structural transformation. Tepid demand is a main factor behind the oversupply of manufacturing and why it has not recovered," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

WTI crude oil for November delivery rose to $47.10 a barrel on the New York Mercantile Exchange.

Brent crude oil for November climbed to $49.49 a barrel on ICE Futures Europe.

-

17:26

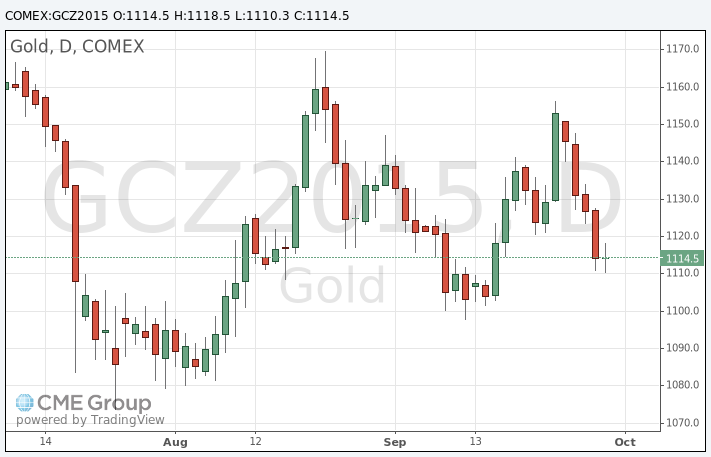

Gold price is up on a weaker U.S. dollar

Gold price rose on a weaker U.S. dollar. The U.S. dollar declines against other currencies due to the mostly weaker-than-expected U.S. economic data. The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending September 26 in the U.S. rose by 10,000 to 277,000 from 267,000 in the previous week. Analysts had expected the initial jobless claims to increase to 270,000.

Market participants are awaiting the release of the official U.S. labour market data tomorrow. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.1% in September. The U.S. economy is expected to add 202,000 jobs in September, after adding 173,000 jobs in August.

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Thursday. The index declined to 50.2 in September from 51.1 in August, missing expectations for a fall to 50.6. It was the lowest level since May of 2013.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

December futures for gold on the COMEX today increased to 1118.50 dollars per ounce.

-

10:55

Official data: Chinese manufacturing PMI rises to 49.8 in September

The Chinese manufacturing PMI rose to 49.8 in September from 49.7 in August, beating expectations for a decline to 49.6, according to the Chinese government.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was driven by rises in production and new orders.

The services PMI remained unchanged at 53.4 in September.

-

09:04

Oil prices rose despite rising crude inventories in the U.S.

West Texas Intermediate futures for November delivery rose to $45.69 (+1.33%), while Brent crude advanced to $48.83 (+0.95%) as Russian air forces in Syria worried market participants.

Prices grew despite signs of slowing demand. China's official Manufacturing PMI contracted for the second straight month in September, although its reading was slightly above forecasts (49.8 vs 49.6). Meanwhile Caixin/Markit PMI fell to a fresh six-and-a-half-year low of 47.2.

Data by the Energy Information Administration showed that U.S. crude stocks rose by 4 million barrels to 457.9 million barrels in the week ended September 25. Economists expected crude inventories to remain unchanged.

-

08:48

Gold declined further

Gold declined to $1,111.80 (-0.30%) after a stronger-than-expected 200,000 increase in the number of employed in the U.S. intensified expectations for a rate hike by the Federal Reserve this year. A more anticipated U.S. payrolls report is due tomorrow. A strong report could put additional pressure on bullion.

Higher interest rates would decrease demand for this non-interest-bearing precious metal.

-

00:35

Commodities. Daily history for Sep 30’2015:

(raw materials / closing price /% change)

Oil 45.36 +0.60%

Gold 1,114.50 -0.06%

-