Noticias del mercado

-

17:47

Oil prices decline on the on the weak U.S. labour market data

Oil prices increased on the on the weak U.S. labour market data. According to the U.S. Labor Department, the U.S. economy added 142,000 jobs in September, missing expectations for a rise of 203,000 jobs, after a gain of 136,000 jobs in August. August's figure was revised down from a rise of 173,000 jobs.

These figures indicate that the interest rate by the Fed this month is unlikely despite comments by some Fed officials.

Concerns over the global oil oversupply also weighed on oil prices. According to the government data released on Friday, oil production in Russia rose to 10.74 million barrels per day (bpd) in September from 10.68 million bpd in August, adding to the global oil oversupply.

Russian Finance Minister Anton Siluanov said on Friday that oil prices will not recover as fast as after the financial crisis in 2008-2009. He pointed that the ministry expect the oil price to be at $50 per barrel in 2016 and $52 per barrel in 2017.

Earlier, oil prices were supported by concerns over the escalation of the conflict in Syria as Russia started air strikes against Islamic State targets in Syria on Wednesday.

Market participants are awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported last Friday that the number of active U.S. rigs declined by 4 rigs to 640 last week. It was the fourth consecutive decrease.

WTI crude oil for November delivery declined to $43.97 a barrel on the New York Mercantile Exchange.

Brent crude oil for November climbed to $47.27 a barrel on ICE Futures Europe.

-

17:15

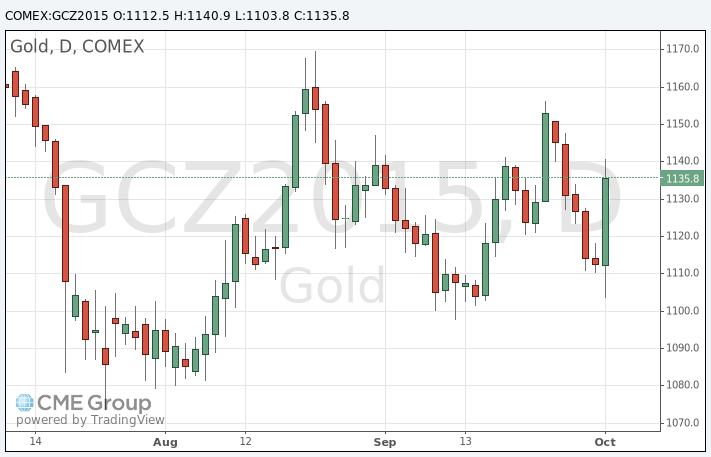

Gold price climbs on the weak U.S. labour market data

Gold price rose on the weak U.S. labour market data. According to the U.S. Labor Department, the U.S. economy added 142,000 jobs in September, missing expectations for a rise of 203,000 jobs, after a gain of 136,000 jobs in August. August's figure was revised down from a rise of 173,000 jobs.

The increase was partly driven by a rise in health care employment. Health care sector added 34,000 jobs in September, while the manufacturing sector lost 9,000 jobs.

Professional and business services sector added 31,000 jobs in September, while mining sector shed 10,300 jobs.

The U.S. unemployment rate remained unchanged at 5.1% in September, in line with expectations. It was the lowest level since April 2008.

Average hourly earnings were flat in September, missing forecasts of a 0.2% gain, after a 0.4% increase in August. August's figure was revised up from a 0.3% rise.

The labour-force participation rate declined to 62.4% in September from 62.6% in August. It was the lowest level since October 1977.

These figures indicate that the interest rate by the Fed this month is unlikely despite comments by some Fed officials.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

December futures for gold on the COMEX today increased to 1140.90 dollars per ounce.

-

16:49

Oil production in Russia rises to 10.74 million barrels per day in September

According to the government data released on Friday, oil production in Russia rose to 10.74 million barrels per day (bpd) in September from 10.68 million bpd in August, adding to the global oil oversupply.

Russian Finance Minister Anton Siluanov said on Friday that oil prices will not recover as fast as after the financial crisis in 2008-2009. He pointed that the ministry expect the oil price to be at $50 per barrel in 2016 and $52 per barrel in 2017.

-

15:05

U.S. unemployment rate remains unchanged at 5.1% in September, 142,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 142,000 jobs in September, missing expectations for a rise of 203,000 jobs, after a gain of 136,000 jobs in August. August's figure was revised down from a rise of 173,000 jobs.

The increase was partly driven by a rise in health care employment. Health care sector added 34,000 jobs in September, while the manufacturing sector lost 9,000 jobs.

Professional and business services sector added 31,000 jobs in September, while mining sector shed 10,300 jobs.

The U.S. unemployment rate remained unchanged at 5.1% in September, in line with expectations. It was the lowest level since April 2008.

Average hourly earnings were flat in September, missing forecasts of a 0.2% gain, after a 0.4% increase in August. August's figure was revised up from a 0.3% rise.

The labour-force participation rate declined to 62.4% in September from 62.6% in August. It was the lowest level since October 1977.

These figures indicate that the interest rate by the Fed this month is unlikely despite comments by some Fed officials.

-

14:35

-

10:10

U.S. Senate Committee on Banking, Housing and Urban Affairs votes to lift off the ban on U.S. crude oil exports

The U.S. Senate Committee on Banking, Housing and Urban Affairs voted on Thursday to lift off the ban on U.S. crude oil exports. The committee voted 13 to 9. The ban was introduced in 1975 due to fears about fuel shortages.

-

08:45

Oil prices rose

West Texas Intermediate futures for November delivery rose to $45.34 (+1.34%), while Brent crude advanced to $48.09 (+0.84%) ahead of U.S. employment and rig count data, which will be released later today.

Market participants are getting ready for the non-farm payrolls report, which could suggest that the U.S. economy is ready for higher rates. Any substantial fluctuations of currencies would affect oil, because it is denominated in dollars. However many analysts say that any gains in oil prices due to today's data are likely to be short-lived considering high levels of oil output and inventories around the globe.

-

08:42

Gold steady ahead of U.S. jobs data

Gold is currently at $1,111.30 (-0.22%) near a two-week low ahead of a closely-watched U.S. payrolls report. A strong report could put additional pressure on bullion as it would mean that the U.S. economy is improving and it can handle higher rates. Several Federal Reserve's officials said in their speeches that the Federal Open Market Committee can raise rates at any meeting before the end of the year.

Higher interest rates would decrease demand for this non-interest-bearing precious metal.

-

00:34

Commodities. Daily history for Sep Oct 1 ’2015:

(raw materials / closing price /% change)

Oil 45.02 +0.63%

Gold 1,112.70 -0.09%

-