Noticias del mercado

-

20:21

American focus: the US dollar weakened

The US dollar fell against most major currencies against the background of the data on applications for unemployment benefits and business activity in the US manufacturing sector. US Department of Labor said the number of Americans who first applied for unemployment benefits, increased moderately in the last week, but remained near the level, indicating an improvement in the labor market.

According to the report, in the week ended Sept. 26, the number of initial applications for unemployment benefits rose by 10,000 (seasonally adjusted) and reached 277 000. Economists had expected 270,000 new claims. The figure for the previous week has not been revised. It is worth emphasizing the number of calls remained below the psychological threshold of 300,000 already the 30th week in a row, which is the longest series in more than 40 years. Also, the Labor Department said that there were no special factors influencing the latest weekly data.

Meanwhile, it became known that the moving average for 4 weeks, which smooths the volatile weekly data, fell by 1000 - up to 270 750. Meanwhile, the number of people who continue to receive unemployment benefits fell by 53,000 to 2.191 million . for the week ended September 19. Recall data on re-treatment come with a week delay.

In addition, the report published by the Institute for Supply Management (ISM), showed that in September, activity in the US manufacturing sector deteriorated sharply, with the average exceeded the forecasts of experts.

The PMI index for the US manufacturing in September was 50.2 points versus 51.1 points in August. The latter value was the lowest since July 2013. It was expected that this figure will drop to 50.6 points. Recall index is the result of a survey of about 400 companies from 60 sectors across the United States, including agriculture, mining, construction, transport sector, communications, wholesale and retail companies. The value of the index ISM, greater than 50, is generally regarded as an indicator of the growth of industrial activity, and less than 50, respectively, of falling.

The report also reported that the rate of new orders fell in September to 50.1 from 51.7 previously, while the sub-index of production - to 51.8 from 53.6. Unfilled orders fell to 41.5 from 46.5 in July. The employment index fell from 51.2 to 50.5, while export orders component remained at 46.5. Meanwhile, the index of inventories amounted to 48.5, as and August, and the price index dropped to 38.0 from 39.0.

The pound rose against the dollar, supported by data on business activity. As it became known, the British manufacturing sector showed another decline in activity in September, albeit slight. Meanwhile, manufacturers unexpectedly reduced its staff, which was recorded for the first time in more than two years. Experts point out that recent data support calls for the Bank of England to raise interest rates until production improves. According to Markit, the September index of manufacturing activity fell to 51.5 PMI compared with 51.6 in August. Despite the fact that the index remained above 50, it is close to the minimum of two years, which had been recorded in June. Economists had expected the index to fall to 51.3 points. It also became known that the prices paid by producers of raw materials and energy, fell in September at the fastest pace in more than 16 years, suggesting that producer prices are unlikely to rise in the near future. New export orders rose, albeit slightly, for the first time in six months, while production growth reached its highest level since March. Meanwhile, the employment index fell below 50 for the first time since April of 2013. "UK manufacturing sector remained weak in the third quarter, stunned the triple combination of a sharp slowdown in consumer spending, weak business investment and the stagnation of the inflow of export orders," - said the expert Markit Rob Dobson. - Reduction of jobs sends a signal that manufacturers are becoming more careful about future situations that may lead to further expand the scale of decline in production in some companies in the coming months. "

Investors also await the release of the report on non-farm employment in the United States on Friday. The Fed's closely watching these data when making decisions regarding the timing of raising short-term interest rates. The Fed's decision to leave interest rates unchanged at the end of September meeting fueled concerns about slowing global economic growth. Economists predict that the number of jobs in September grew by 203,000 and the unemployment rate remained at 5.1%. Regarding this indicator there is a rule of thumb: increase of 200 000 per month is equivalent to the GDP growth by 3.0%.

-

17:47

Federal Reserve Bank of Richmond President Jeffrey Lacker: the Fed could start raising its interest rates this month

Federal Reserve Bank of Richmond President Jeffrey Lacker said in an interview with The Wall Street Journal on Wednesday that the Fed could start raising its interest rates this month. He noted that the Fed will get enough information to make a decision.

-

16:57

Australian Industry Group’ Performance of Manufacturing Index rises to 52.1 in September

The Australian Industry Group (AiG) released its Performance of Manufacturing Index on Thursday. The index rose to 52.1 in September from 51.7 in August. It was the highest level since May.

A reading above 50 indicates expansion, below indicates contraction.

Exports and sales sub-indices showed the biggest increases.

-

16:30

ISM manufacturing purchasing managers’ index falls to 50.2 in September, the lowest level since May of 2013

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Thursday. The index declined to 50.2 in September from 51.1 in August, missing expectations for a fall to 50.6. It was the lowest level since May of 2013.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in production. The production index declined to 51.8 in September from 53.6 in August.

The new orders index dropped to 50.1 in September from 51.7 in August.

The employment index was down to 50.5 in September from 51.2 in August.

The price index declined to 38.0 in September from 39.0 in August.

-

16:22

Construction spending in the U.S. is up 0.7% in August

The U.S. Commerce Department released construction spending data on Thursday. Construction spending in the U.S. rose 0.7% in August, exceeding expectations for a 0.5% gain, after a 0.4% increase in July. July's figure was revised down from a 0.7% rise.

The increase was mainly driven by a rise in private residential construction. Spending on private residential construction climbed 1.3% in August.

Spending on private non-residential construction projects increased 0.2% in August, while public construction spending increased 0.5%.

-

16:02

Greece’s final manufacturing PMI climbs to 43.3 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Tuesday. Greece's manufacturing purchasing managers' index (PMI) climbed to 43.3 in September from 31.1 in August.

The decline in production eased in September, while employment declined for six consecutive months.

"September data indicated that Greek manufacturers experienced the harsh effects of the ongoing capital controls implemented by the government. Latest survey data signalled a further contraction in output, as incoming new orders suffered from the strict austerity measures in place across the country," Markit economist Samuel Agass said.

-

16:00

U.S.: ISM Manufacturing, September 50.2 (forecast 50.6)

-

16:00

U.S.: Construction Spending, m/m, August 0.7% (forecast 0.5%)

-

15:55

U.S. final manufacturing purchasing managers' index (PMI) increases to 53.1 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Thursday. The U.S. final manufacturing purchasing managers' index (PMI) increased to 53.1 in September from 53.0 in August, up from the previous estimate of 53.0.

A reading above 50 indicates expansion in economic activity.

Both output and new business volumes rose at slower rates in September, while job creation eased.

"The US manufacturing sector has seen a distinct loss of growth momentum in recent months, endured the worst performance for two years during the third quarter. Headwinds include the rising dollar, weak demand in global markets, a downturn in business investment and financial market jitters," Markit's Chief Economist Chris Williamson said.

-

15:45

U.S.: Manufacturing PMI, September 53.1 (forecast 53)

-

15:40

Option expiries for today's 10:00 ET NY cut

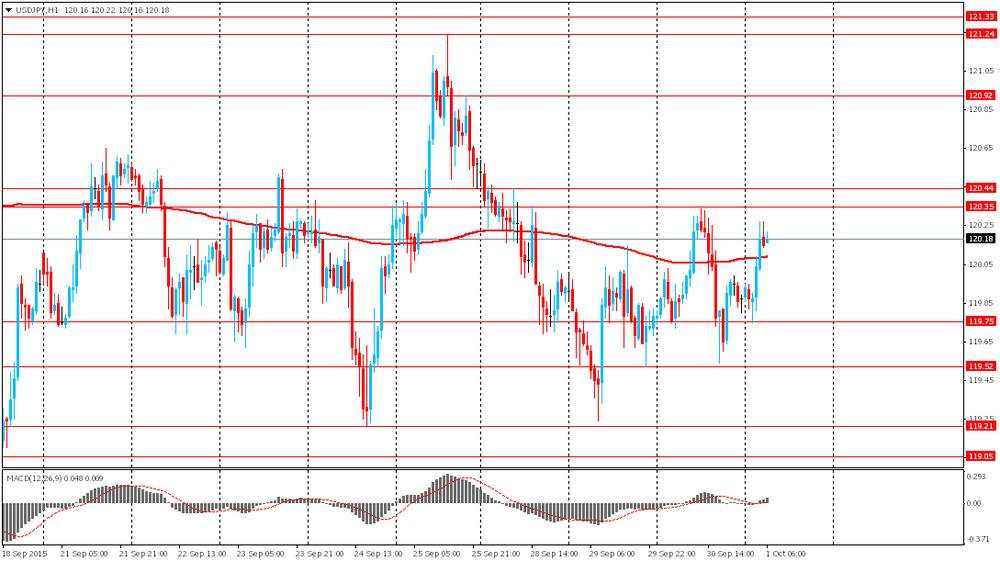

USD/JPY 119.70 (USD 628m) 120.00 (1.5bln)

EUR/USD 1.1160 (EUR 613m) 1.1265-70 (1.5bln) 1.1295-1.1300 (1.1bln)

USD/CAD 1.3300 (USD 380m) 1.3400 (560m)

AUD/USD 0.6990 (AUD 317m) 0.7000 (569m) 0.7200 (617m)

NZD/USD 0.6450 (NZD 302m)

EUR/JPY 134.00 (EUR 380m)

-

15:38

Spain’s final manufacturing PMI falls to 51.7 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Spain on Thursday. Spain's manufacturing purchasing managers' index (PMI) declined to 51.7 in September from 53.2 in August. It was the lowest level since December 2013.

The decline was driven by a slower increase in new orders, the weakest pace of new orders since December 2013, and by a decline in input prices. Input prices fell due to lower fuel prices.

"The outlook for the remainder of the year is looking uncertain, but with macroeconomic risks skewed to the downside there is the possibility of outright declines in output and new orders being recorded," a senior economist at Markit Andrew Harker said.

-

14:57

Italy’s final manufacturing PMI falls to 52.7 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Italy on Thursday. Italy's manufacturing purchasing managers' index (PMI) declined to 52.7 in September from 53.8 in August.

The decline was partly driven by a fall in output costs.

"Output, buying levels and employment all rose as goods producers faced an increase in new orders, albeit one that was the slowest since February. Also noteworthy was an accelerated drop in manufacturers' costs, the fastest since April last year, amid falling global commodity prices," Markit economist Phil Smith said.

-

14:41

Initial jobless claims increase by 10,000 to 277,000 in the week ending September 26

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending September 26 in the U.S. rose by 10,000 to 277,000 from 267,000 in the previous week. Analysts had expected the initial jobless claims to increase to 270,000.

Jobless claims remained below 300,000 the 30th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 53,000 to 2,191,000 in the week ended September 19. It was the lowest level since November 2000.

-

14:30

U.S.: Initial Jobless Claims, September 277 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, September 2191 (forecast 2236)

-

14:28

European Central Bank Governing Council member Bostjan Jazbec: there is no need to change the central bank’s asset-buying programme

European Central Bank (ECB) Governing Council member Bostjan Jazbec said on Thursday that there is no need to change the central bank's asset-buying programme.

"At this moment, there is no need to change anything," he said.

Jazbec pointed out that the monetary policy always works with a lag.

-

14:22

Final Markit/Nikkei manufacturing purchasing managers' index for Japan decreases to 51.0 in September

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan decreased to 51.0 in September from 51.7 in August, up from the preliminary reading of 50.9.

A reading below 50 indicates contraction of activity.

The index was driven by declines in exports and purchasing activity.

"Growth in production at Japanese manufacturers eased further in September to the weakest rate in the current five-month sequence of expansion," economist at Markit, Amy Brownbill, said.

She added that the decline in exports was driven by lower trade volume with China.

-

14:09

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the mostly negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

00:00 U.S. FOMC Member Brainard Speaks

01:00 China Non-Manufacturing PMI September 53.4 53.4

01:00 China Manufacturing PMI September 49.7 49.6 49.8

01:35 Japan Manufacturing PMI (Finally) September 51.7 50.9 51

01:45 China Markit/Caixin Manufacturing PMI (Finally) September 47.3 47.0 47.2

01:45 China Markit/Caixin Services PMI September 51.5 51.2 50.5

07:15 Switzerland Retail Sales (MoM) August -0.6% 0.5%

07:15 Switzerland Retail Sales Y/Y August 0.1% Revised From -0.1% -0.3%

07:30 Switzerland Manufacturing PMI September 52.2 51.8 49.5

07:50 France Manufacturing PMI (Finally) September 48.3 50.4 50.6

07:55 Germany Manufacturing PMI (Finally) September 53.3 52.5 52.3

08:00 Eurozone Manufacturing PMI (Finally) September 52.3 52 52

08:30 United Kingdom Purchasing Manager Index Manufacturing September 51.6 Revised From 51.5 51.3 51.5

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to increase by 3,000 to 270,000 last week.

The final manufacturing purchasing managers' index is expected to remain unchanged at 53.0 in September.

The ISM manufacturing purchasing managers' index is expected to fall to 50.6 in September from 51.1 in August.

The euro traded higher against the U.S. dollar despite the mostly negative economic data from the Eurozone. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in September from 52.3 in August, in line with a preliminary reading.

"Despite unprecedented central bank stimulus and substantial currency depreciation, the Eurozone manufacturing sector is failing to achieve significant growth momentum and even risks stalling again," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in September from 53.3 in August, down from a preliminary reading of 52.5.

The decline was driven by a fall in input prices.

France's final manufacturing purchasing managers' index (PMI) climbed to 50.6 in September from 48.3 in August, up from the preliminary reading of 50.4.

The increase was mainly driven by a rise in output, which climbed at the fastest pace since March 2014.

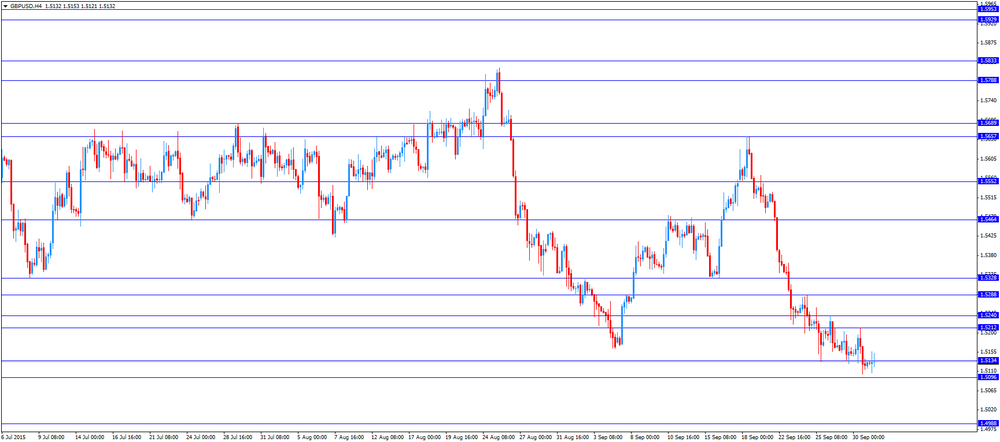

The British pound traded mixed against the U.S. dollar after the better-than-expected manufacturing PMI data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Thursday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in September from 51.6 in August, beating expectations for a fall to 51.3. August's figure was revised up from 51.5.

The decline was driven by a drop in input prices.

Employment also declined in September.

"The UK manufacturing sector remained sluggish at the end of the third quarter, stunned by a triple combination of a sharp slowdown in consumer spending, weak business investment and stagnating export order inflows. The survey is still broadly consistent with stagnation, or even a mild downturn, when compared to official data," Markit's Senior Economist Rob Dobson said.

The Swiss franc traded lower against the U.S. dollar after of the release of the mostly negative Swiss economic data. The Federal Statistical Office released its retail sales data for Switzerland on Thursday. Retail sales in Switzerland declined at an annual rate of 0.3% in August, after a 0.1% rise in July. July's figure was revised up from a 0.1% fall.

Sales of food, beverages and tobacco fell at an annual rate of 0.1% in August, while non-food sales rose 1.1%.

On a monthly basis, retail sales increased by 0.5% in August.

Sales of food, beverages and tobacco were down 0.3% in August, while non-food sales climbed 1.3%.

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Thursday. The manufacturing purchasing managers' index in Switzerland declined to 49.5 in September from 52.2 in August, missing expectations for a decrease to 51.8.

A reading above 50 indicates contraction.

The decrease was largely driven by a drop in production. The production was down to 49.1 in September from 62.4.

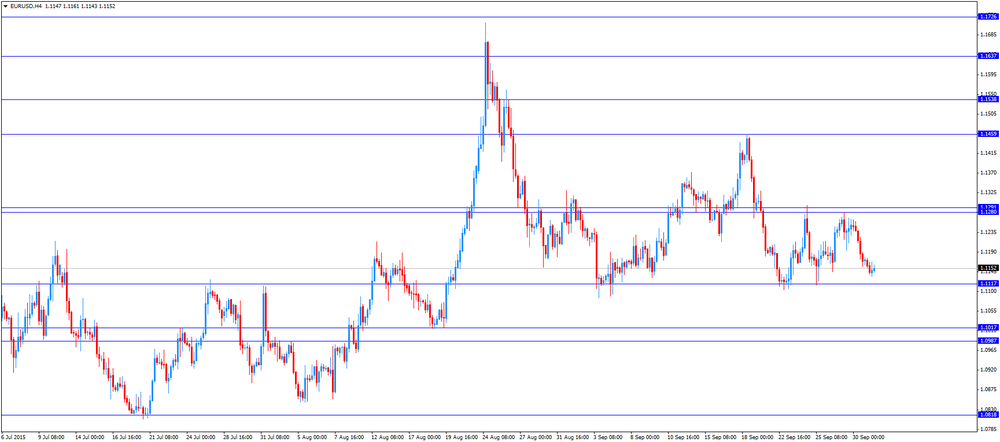

EUR/USD: the currency pair climbed to $1.1167

GBP/USD: the currency pair traded mixed

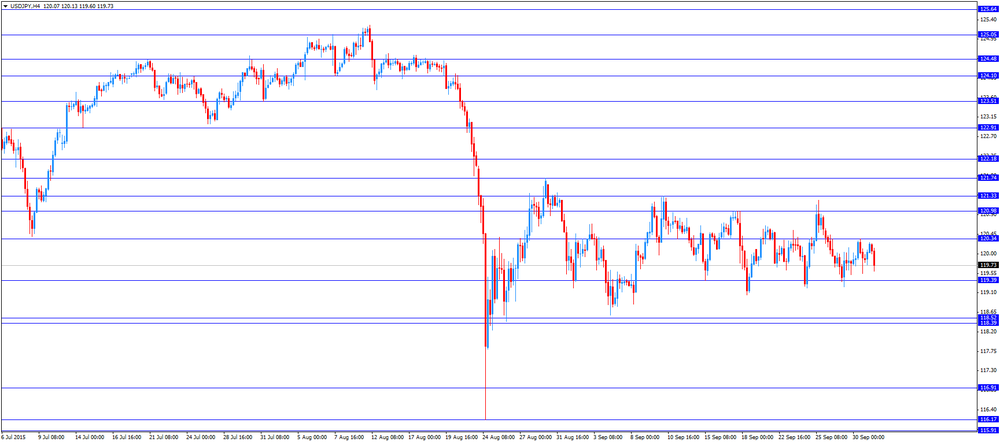

USD/JPY: the currency pair fell to Y119.60

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims September 267 270

13:45 U.S. Manufacturing PMI (Finally) September 53 53

14:00 U.S. ISM Manufacturing September 51.1 50.6

18:30 U.S. FOMC Member Williams Speaks

23:30 Japan Unemployment Rate August 3.3% 3.3%

-

14:00

Orders

EUR/USD

Offers 1.1170 1.1185 1.1200 1.1220 1.1245 1.1260 1.1280 1.1300

Bids 1.1135 1.1120 -25 1.1100 1.1085 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.5150 1.5170 1.5185 1.5200 1.5220 1.5235 1.5250

Bids 1.5100 1.5080-85 1.5060 1.5030 1.5000 1.4985 1.4965 1.4950

EUR/GBP

Offers 0.7385 0.7400 0.7425 0.7435 0.7450

Bids 0.7360 0.7350 0.7330-35 0.7300 0.7285 0.7250

EUR/JPY

Offers 134.25 134.50 134.80 135.00 135.25 135.50 135.80 136.00

Bids 133.75 133.50 133.30 133.00 132.80 132.50

USD/JPY

Offers 120.30-35 120.50 120.65 120.85 121.00 121.30 121.50

Bids 120.00 119.80 119.65 119.40 119.25 119.10 119.00

AUD/USD

Offers 0.7080-85 0.7100 0.7120 0.7150 0.7185 0.7200

Bids 0.7050 0.7025-30 0.7000 0.6980 0.6965 0.6950 0.6925-30 0.6900

-

11:47

Swiss retail sales fall 0.3% year-on-year in August

The Federal Statistical Office released its retail sales data for Switzerland on Thursday. Retail sales in Switzerland declined at an annual rate of 0.3% in August, after a 0.1% rise in July. July's figure was revised up from a 0.1% fall.

Sales of food, beverages and tobacco fell at an annual rate of 0.1% in August, while non-food sales rose 1.1%.

On a monthly basis, retail sales increased by 0.5% in August.

Sales of food, beverages and tobacco were down 0.3% in August, while non-food sales climbed 1.3%.

-

11:40

Swiss manufacturing PMI drops to 49.5 in September

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Thursday. The manufacturing purchasing managers' index in Switzerland declined to 49.5 in September from 52.2 in August, missing expectations for a decrease to 51.8.

A reading above 50 indicates contraction.

The decrease was largely driven by a drop in production. The production was down to 49.1 in September from 62.4.

Purchase prices decreased to 35.1 in September from 36.1 in August, while the backlog of orders sub-index fell to 51.5 from 52.4.

-

11:33

France’s final manufacturing PMI climbs to 50.6 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Thursday. France's final manufacturing purchasing managers' index (PMI) climbed to 50.6 in September from 48.3 in August, up from the preliminary reading of 50.4.

The increase was mainly driven by a rise in output, which climbed at the fastest pace since March 2014.

"The French manufacturing sector moved onto a firmer footing in September, with business conditions improving slightly on the month. Output rose for the first time in three months, while new orders and employment broadly stabilised following recent periods of decline," Markit Senior Economist Jack Kennedy said.

-

11:25

Germany’s final manufacturing PMI falls to 52.3 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Thursday. Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in September from 53.3 in August, down from a preliminary reading of 52.5.

The decline was driven by a fall in input prices.

"Germany's manufacturing sector lost some of its growth momentum in September, with the headline PMI down slightly since August. Nevertheless, the average for the third quarter as a whole was the best in over a year, suggesting that the goods-producing sector should have a positive contribution to overall GDP in Q3," Markit economist Oliver Kolodseike said.

-

11:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 119.70 (USD 628m) 120.00 (1.5bln)

EUR/USD 1.1160 (EUR 613m) 1.1265-70 (1.5bln) 1.1295-1.1300 (1.1bln)

USD/CAD 1.3300 (USD 380m) 1.3400 (560m)

AUD/USD 0.6990 (AUD 317m) 0.7000 (569m) 0.7200 (617m)

NZD/USD 0.6450 (NZD 302m)

EUR/JPY 134.00 (EUR 380m)

-

11:18

Eurozone’s final manufacturing PMI falls to 52.0 in September

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in September from 52.3 in August, in line with a preliminary reading.

"Despite unprecedented central bank stimulus and substantial currency depreciation, the Eurozone manufacturing sector is failing to achieve significant growth momentum and even risks stalling again," Chris Williamson, Chief Economist at Markit said.

-

11:15

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declines to 51.5 in September

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Thursday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.5 in September from 51.6 in August, beating expectations for a fall to 51.3. August's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The decline was driven by a drop in input prices.

Employment also declined in September.

"The UK manufacturing sector remained sluggish at the end of the third quarter, stunned by a triple combination of a sharp slowdown in consumer spending, weak business investment and stagnating export order inflows. The survey is still broadly consistent with stagnation, or even a mild downturn, when compared to official data," Markit's Senior Economist Rob Dobson said.

-

10:59

Final Chinese Markit/Caixin manufacturing PMI falls to 47.2 in September

The final Chinese Markit/Caixin manufacturing PMI declined to 47.2 in September from 47.3 in August, beating the preliminary reading of a fall to 47.0. It was the lowest level since March 2009.

"The industry has reached a crucial stage in its structural transformation. Tepid demand is a main factor behind the oversupply of manufacturing and why it has not recovered," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China dropped to 50.5 in September from 51.5 in August, missing expectations for a decrease to 51.2.

"The employment category improved markedly, pointing to the continued strength of the service sector in creating jobs," Dr. He Fan said.

-

10:55

Official data: Chinese manufacturing PMI rises to 49.8 in September

The Chinese manufacturing PMI rose to 49.8 in September from 49.7 in August, beating expectations for a decline to 49.6, according to the Chinese government.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The increase was driven by rises in production and new orders.

The services PMI remained unchanged at 53.4 in September.

-

10:48

Tankan Survey: the large manufacturers’ index declines to +12 in the third quarter

The Bank of Japan released its quarterly Tankan business survey on Thursday. The large manufacturers' index declined to +12 in the third quarter from +15 in the second quarter, missing expectations for a fall to +13. Confidence worsened despite record-high profits of companies.

The outlook fell to +10 in the third quarter from +16 in the second quarter.

The large non-manufacturers' index rose +25 in the third quarter from 23 in the previous quarter. It was the highest level since 1991. The outlook decreased to +19 from +21.

-

10:36

International Monetary Fund (IMF) Managing Director Christine Lagarde: the global economy will grow slower due to a slowdown in emerging economies

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Wednesday that the global economy will grow slower due to a slowdown in emerging economies.

"Global growth will likely be weaker this year than last, with only a modest acceleration expected in 2016," she said.

"The prospect of rising interest rates in the United States and China's slowdown are contributing to uncertainty and higher market volatility. There has been a sharp deceleration in the growth of global trade. And the rapid drop in commodity prices is posing problems for resource-based economies," Lagarde added.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , September 51.5 (forecast 51.3)

-

10:21

U.S. Congress passes a U.S. government spending bill

The U.S. Congress passed a U.S. government spending bill before a shutdown deadline on Wednesday. The House of Representatives voted 277-151 for the bill. The Senate passed the bill by a 78-20 vote. U.S. President Barack Obama welcomed the news.

-

10:11

Fitch Ratings cuts its global economic outlook for 2015

Fitch Ratings cut its global economic outlook for 2015. The global growth is expected to be 2.3% in 2015, down from June estimate of a 2.4% increase, and 2.7% in 2016, down from June estimate of a 2.9% rise. The growth in 2015 would be the weakest growth since the global financial crisis in 2009.

The downward revision was driven by a slowdown in emerging economies.

Fitch expects the U.S. economy to expand 2.5% in 2015 and 2016, and 2.3% in 2017. The agency noted that it expect the Fed to start raising its interest rates by the end of the year.

Eurozone's economy is expected to grow at 1.6% over the 2015 to 2017 period.

-

10:00

Eurozone: Manufacturing PMI, September 52 (forecast 52)

-

09:55

Germany: Manufacturing PMI, September 52.3 (forecast 52.5)

-

09:50

France: Manufacturing PMI, September 50.6 (forecast 50.4)

-

09:31

Switzerland: Retail Sales (MoM), August 0.5%

-

09:30

Switzerland: Manufacturing PMI, September 49.5 (forecast 51.8)

-

09:15

Switzerland: Retail Sales Y/Y, August -0.3%

-

08:29

Foreign exchange market. Asian session: the Australian dollar climbed on macroeconomic data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 U.S. FOMC Member Brainard Speaks

01:00 China Non-Manufacturing PMI September 53.4 53.4

01:00 China Manufacturing PMI September 49.7 49.6 49.8

01:35 Japan Manufacturing PMI (Finally) September 51.7 50.9 51

01:45 China Markit/Caixin Manufacturing PMI (Finally) September 47.3 47.0 47.2

01:45 China Markit/Caixin Services PMI September 51.5 51.2 50.5

The euro declined amid weak data from Germany and the euro zone on the whole. German unemployment level unexpectedly rose in September suggesting that the German economy is not secured from risks arising from slowing growth in emerging markets. The seasonally adjusted number of unemployed rose by 2,000 to 2.795 million. Economists expected a decline of 5,000. Meanwhile the unemployment rate remained at 6.4%.

The Australian dollar advanced amid recent data. On one hand the currency was supported by Australian AiG Manufacturing index, which rose to 52.1 in September compared to 51.7 in August. On the other hand China's official Manufacturing PMI rose to 49.8 in September from 49.7 in August vs forecast of a 49.7.

The yen declined against the greenback after release of BOJ Tankan report. The report has shown that the index of confidence of large manufacturers declined to 12 from 15 in the third quarter despite record profits. Japanese manufacturers became more cautious in the third quarter, which highlights difficulties exporters face due to slower growth in China.

EUR/USD: the pair fell to $1.1145 in Asian trade

USD/JPY: the pair traded rose to Y120.25

GBP/USD: the pair traded within $1.5115-35

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Retail Sales (MoM) August -0.6%

07:15 Switzerland Retail Sales Y/Y August -0.1%

07:30 Switzerland Manufacturing PMI September 52.2 51.8

07:50 France Manufacturing PMI (Finally) September 48.3 50.4

07:55 Germany Manufacturing PMI (Finally) September 53.3 52.5

08:00 Eurozone Manufacturing PMI (Finally) September 52.3 52

08:30 United Kingdom Purchasing Manager Index Manufacturing September 51.5 51.3

12:30 U.S. Continuing Jobless Claims September 2242 2236

12:30 U.S. Initial Jobless Claims September 267 270

13:45 U.S. Manufacturing PMI (Finally) September 53 53

14:00 U.S. Construction Spending, m/m August 0.7% 0.5%

14:00 U.S. ISM Manufacturing September 51.1 50.6

18:30 U.S. FOMC Member Williams Speaks

19:40 U.S. Total Vehicle Sales, mln September 17.81 17.6

23:30 Japan Household spending Y/Y August -0.2% 0.4%

23:30 Japan Unemployment Rate August 3.3% 3.3%

-

08:26

Options levels on thursday, October 1, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1297 (2239)

$1.1242 (1272)

$1.1198 (551)

Price at time of writing this review: $1.1146

Support levels (open interest**, contracts):

$1.1112 (5428)

$1.1057 (3784)

$1.0981 (6405)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 55067 contracts, with the maximum number of contracts with strike price $1,1400 (5128);

- Overall open interest on the PUT options with the expiration date October, 9 is 69537 contracts, with the maximum number of contracts with strike price $1,1000 (6405);

- The ratio of PUT/CALL was 1.26 versus 1.29 from the previous trading day according to data from September, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.5401 (1042)

$1.5302 (662)

$1.5204 (1115)

Price at time of writing this review: $1.5125

Support levels (open interest**, contracts):

$1.5093 (1613)

$1.4996 (1988)

$1.4898 (1046)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 23636 contracts, with the maximum number of contracts with strike price $1,5500 (1680);

- Overall open interest on the PUT options with the expiration date October, 9 is 22910 contracts, with the maximum number of contracts with strike price $1,5200 (2691);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from September, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:55

China: Markit/Caixin Manufacturing PMI, September 47.2 (forecast 47.0)

-

03:55

China: Markit/Caixin Services PMI, September 50.5 (forecast 51.2)

-

03:36

Japan: Manufacturing PMI, September 51 (forecast 50.9)

-

02:57

China: Non-Manufacturing PMI, September 53.4

-

02:56

China: Manufacturing PMI , September 49.8 (forecast 49.6)

-

01:54

Japan: BoJ Tankan. Manufacturing Index, Quarter III 12 (forecast 13)

-

01:32

Australia: AIG Manufacturing Index, September 52.1

-

00:30

Currencies. Daily history for Sep 30’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1172 -0,71%

GBP/USD $1,5124 -0,19%

USD/CHF Chf0,9739 +0,31%

USD/JPY Y119,78 0,00%

EUR/JPY Y133,93 -0,62%

GBP/JPY Y181,27 -0,13%

AUD/USD $0,7017 +0,37%

NZD/USD $0,6399 +0,80%

USD/CAD C$1,3326 -0,74%

-

00:01

Schedule for today, Thursday, Oct 1’2015:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

00:00 U.S. FOMC Member Brainard Speaks

01:00 China Non-Manufacturing PMI September 53.4

01:00 China Manufacturing PMI September 49.7 49.6

01:35 Japan Manufacturing PMI (Finally) September 51.7 50.9

01:45 China Markit/Caixin Manufacturing PMI (Finally) September 47.3 47.0

01:45 China Markit/Caixin Services PMI September 51.5 51.2

07:15 Switzerland Retail Sales (MoM) August -0.6%

07:15 Switzerland Retail Sales Y/Y August -0.1%

07:30 Switzerland Manufacturing PMI September 52.2 51.8

07:50 France Manufacturing PMI (Finally) September 48.3 50.4

07:55 Germany Manufacturing PMI (Finally) September 53.3 52.5

08:00 Eurozone Manufacturing PMI (Finally) September 52.3 52

08:30 United Kingdom Purchasing Manager Index Manufacturing September 51.5 51.3

12:30 U.S. Continuing Jobless Claims September 2242 2236

12:30 U.S. Initial Jobless Claims September 267 270

13:45 U.S. Manufacturing PMI (Finally) September 53 53

14:00 U.S. Construction Spending, m/m August 0.7% 0.5%

14:00 U.S. ISM Manufacturing September 51.1 50.7

18:30 U.S. FOMC Member Williams Speaks

19:40 U.S. Total Vehicle Sales, mln September 17.81 17.6

23:30 Japan Household spending Y/Y August -0.2% 0.4%

23:30 Japan Unemployment Rate August 3.3% 3.3%

-