Noticias del mercado

-

17:34

The World Trade Organization downgrades its world trade forecasts for this and next year

The World Trade Organization (WTO) said on Wednesday that the world trade expected to climb 2.8% in 2015, down its April's estimate of a 3.3% growth. The WTO pointed out that there are risks to the growth outlook.

"These include a sharper-than-expected slowdown in emerging and developing economies, the possibility of destabilizing financial flows from an eventual interest rate rise by the US Federal Reserve, and unanticipated costs associated with the migration crisis in Europe," the WTO said.

The world trade in 2016 is expected to rise by 3.9%, down its April's estimate of a 4.0% increase.

-

17:21

Private sector credit in Australia rises 0.6% in August

The Reserve Bank of Australia (RBA) released its private sector credit data on Wednesday. The total value of private sector credit in Australia rose 0.6% in August, exceeding expectations for a 0.5% gain, after a 0.6% increase in July.

Housing credit increased 0.6% in August, personal credit was up 0.1%, while business credit rose 0.5%.

On a yearly basis, the private sector credit in Australia jumped 6.3% in August, after a 6.1% in July.

-

17:05

European Central Bank (ECB) Governing Council member Ardo Hansson: it is too early to discuss the expansion of the asset-buying programme

European Central Bank (ECB) Governing Council member Ardo Hansson said on Wednesday that it is too early to discuss the expansion of the asset-buying programme.

"We are still in the initial phase of the program," he said.

Hansson added that the asset-buying programme could be changed, depending "on developments in inflation".

-

16:48

ANZ: New Zealand’s business confidence index declines 18.9% in September

The Australia and New Zealand Banking Group (ANZ) released its business confidence index for New Zealand on Wednesday. New Zealand's business confidence index declined 18.9% in September, after a 29.1 drop in August.

"The economy found a bungy cord attached, with the fall in business confidence being arrested," ANZ senior economist Philip Borkin said.

-

16:30

U.S.: Crude Oil Inventories, September 3.955

-

16:25

Building permits in Australia slide 6.9% in August

The Australian Bureau of Statistics released its building permits data on Wednesday. Building permits in Australia dropped 6.9% in August, missing expectations for a 2.0% gain, after a 7.9% rise in July. July's figure was revised up from a 4.2% increase.

On a yearly basis, building permits climbed 5.1% in August, after a revised 17.9% increase in July.

Building permits for private sector houses jumped 4.9% in August, while building permits for private sector dwellings excluding houses slid 11.4%.

The seasonally adjusted estimate of the value of total building approved was down 5.6% in August, after a 9.2% increase in the previous month.

-

16:10

Chicago purchasing managers' index falls to 48.7 in September

The Institute for Supply Management released its Chicago purchasing managers' index on Wednesday. The Chicago purchasing managers' index declined to 48.7 in September from 54.4 in August, missing expectations for a decrease to 53.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decline was driven by drops in production and in new orders. The production index plunged to 43.6 in September from 59.0 in August, the lowest level since July 2009, while the new orders index was down to 49.5 from 56.7.

The employment index rose to 52.3 in September from 49.1 in August.

"While activity between Q2 and Q3 actually picked up, the scale of the downturn in September following the recent global financial fallout is concerning. Disinflationary pressures intensified and output was down very sharply. We await the October data to better judge whether this was a knee jerk reaction and there is a bounceback, or whether it represents a more fundamental slowdown," Chief Economist of MNI Indicators Philip Uglow said.

-

15:59

Producer prices in Italy decrease 0.7% in August

The Italian statistical office Istat released its producer price inflation data for Italy on Wednesday. Italian producer prices decreased 0.7% in August, after a 0.5% decline in July.

Producer price declined by 0.7% on domestic market and by 0.4% on non-domestic market in August.

On a yearly basis, Italian PPI fell 2.9% in August, after a 2.3% drop in July.

Producer price slid 3.6% on domestic market and by 0.8% on non-domestic market in August.

-

15:45

U.S.: Chicago Purchasing Managers' Index , September 48.7 (forecast 53)

-

15:41

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 670m) 121.00 (885m)

EUR/USD 1.1100 (EUR 989m) 1.1200-10 (1.6bln) 1.1230 (320m)

GBP/USD 1.5050 (GBP (306m) 1.5250 (301m)

USD/CHF 0.9700 (USD 761m)

AUD/USD 0.6900 (AUD 4.2bln) 0.7100 (3.8bln)

NZD/USD 0.6425 (NZD 214m)

EUR/GBP 0.7300 (EUR 1.6bln)

-

15:15

Preliminary consumer prices in Italy decrease 0.3% in September

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Wednesday. Preliminary consumer prices in Italy fell 0.3% in September, after a 0.2% rise August.

The decline was mainly driven by a drop in services prices related to transport, which decreased 4.0% in September.

On a yearly basis, consumer prices climbed 0.3% in September, after a 0.2% increase in August.

The increase was driven by a rise in unprocessed food, which climbed 3.4% year-on-year in September.

Consumer price inflation excluding unprocessed food and energy prices increased to 0.8% year-on-year in September from 0.7% in August.

-

15:05

French producer prices decrease 0.9% in August

French statistical office INSEE released its producer price index (PPI) data on Wednesday. French producer prices decreased 0.9% in August, after a 0.1% decline in July.

The decline was driven a fall in prices for refined petroleum products, which were down 12.5% in August.

On a yearly basis, French PPI fell 2.1% in August, after a 1.6% drop in July.

Import prices plunged 1.5% in August, after a 1.1% fall in July.

-

14:53

Canada's GDP rises 0.3% in July

Statistics Canada released GDP (gross domestic product) growth data on Wednesday. Canada's GDP growth rose 0.3% in July, exceeding expectations for a 0.2% increase, after a 0.4% gain in June.

The increase was driven by rises in mining, quarrying, and oil and gas extraction, manufacturing, and the finance and insurance sector.

The mining, quarrying and oil and gas extraction sector rose 2.9% in July, manufacturing output increased 0.6%, while the finance and insurance sector climbed 0.8%.

-

14:42

ADP report: private sector adds 200,000 jobs in September

Private sector in the U.S. added 200,000 jobs in September, according the ADP report on Wednesday. August's figure was revised down to 186,000 jobs from a previous reading of 190,000 jobs.

Analysts expected the private sector to add 194,000 jobs.

Services sector added 188,000 jobs in September, while manufacturing sector lost 15,000.

"The U.S. job machine continues to produce jobs at a strong and consistent pace. Despite job losses in the energy and manufacturing industries, the economy is creating close to 200,000 jobs per month. At this pace full employment is fast approaching," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.1% in September. The U.S. economy is expected to add 202,000 jobs in September, after adding 173,000 jobs in August.

-

14:33

French consumer spending is flat in August

French statistical office INSEE released its consumer spending data on Wednesday. French consumer spending was flat in August, after a 0.3% gain in July.

Spending on food was down 0.2% in August, while spending on energy rose 0.4%.

On a yearly basis, consumer spending climbed 1.6% in August.

-

14:30

Canada: GDP (m/m) , July 0.3% (forecast 0.2%)

-

14:19

Nationwide: UK house prices rise 0.5% in September

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.5% in September, exceeding expectations for a 0.4% rise, after a 0.4% increase in August.

On a yearly basis, house prices rose to 3.8% in September from 3.2% in August, in line with expectations.

"The data in recent months provides some encouragement that the pace of house price increases may be stabilising close to the pace of earnings growth. However, the risk remains that construction activity will lag behind strengthening demand, putting upward pressure on house prices and eventually reducing affordability," Nationwide's chief economist, Robert Gardner, said.

-

14:15

U.S.: ADP Employment Report, September 200 (forecast 194)

-

14:12

Italy’s unemployment rate decreases to 11.9% in August, the lowest level since February 2013

The Italian statistical office Istat released its unemployment data on Wednesday. The seasonally adjusted unemployment rate decreased to 11.9% in August from 12.0 in July. It was the lowest level since February 2013.

The number of unemployed people was 3.061 million in August, down by 0.4% from the month before.

The youth unemployment rate climbed to 40.7% in August from 40.4% in July.

The employment rate increased to 56.5% in August from 56.3% in July.

-

14:06

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the mostly negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence September -29.1 -18.9

01:30 Australia Private Sector Credit, m/m August 0.6% 0.5% 0.6%

01:30 Australia Private Sector Credit, y/y August 6.1% 6.3%

01:30 Australia Building Permits, m/m August 7.9% Revised From 4.2% -2% -6.9%

05:00 Japan Construction Orders, y/y August -4.0% -15.6%

05:00 Japan Housing Starts, y/y August 7.4% 7.8% 8.8%

06:00 United Kingdom Nationwide house price index, y/y September 3.2% 3.8% 3.8%

06:00 United Kingdom Nationwide house price index September 0.3% 0.4% 0.5%

06:00 Germany Retail sales, real adjusted August 1.6% Revised From 1.4% 0.2% -0.4%

06:00 Germany Retail sales, real unadjusted, y/y August 3.8% Revised From 3.3% 3.1% 2.5%

06:00 Switzerland UBS Consumption Indicator August 1.59 Revised From 1.64 1.63

07:00 Switzerland KOF Leading Indicator September 101.2 Revised From 100.7 100.9 100.4

07:55 Germany Unemployment Change September -6 -5 2

07:55 Germany Unemployment Rate s.a. September 6.4% 6.4% 6.4%

08:30 United Kingdom Current account, bln Quarter II -24 Revised From -26.6 -22.25 -16.8

08:30 United Kingdom GDP, q/q (Finally) Quarter II 0.4% 0.7% 0.7%

08:30 United Kingdom GDP, y/y (Finally) Quarter II 2.7% Revised From 2.9% 2.6% 2.4%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) September 0.1% 0% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) September 0.9% 0.9% 0.9%

09:00 Eurozone Unemployment Rate August 11% Revised From 10.9% 10.9% 11%

11:00 U.S. MBA Mortgage Applications September 13.9% -6.7%

12:00 U.S. FOMC Member Dudley Speak

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. According to the ADP employment report, the U.S. economy is expected to add 194,000 jobs in September.

The Chicago purchasing managers' index is expected to decline to 53.0 in September from 54.4 in August.

Fed Chairwoman Janet Yellen will speak at 19:00 GMT.

The euro traded lower against the U.S. dollar after the mostly negative economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone declined to an annual rate of -0.1% in September from 0.1% in August, missing expectations for a fall to 0.0%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in September.

Food, alcohol and tobacco prices were up 1.4% in September, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.3%, while energy prices dropped 8.9%.

Eurozone's unemployment rate remained unchanged at 11.0% in August. July's figure was revised up from 10.9%. Analysts had expected the unemployment rate to fall to 10.9%.

The Federal Labour Agency released its unemployment figures for Germany on Wednesday. The number of unemployed people in Germany climbed by 2,000 in September, missing expectations for a 5,000 decline, after a 6,000 decrease in August.

The number of unemployed people was 1.90 million in August, according to Destatis.

Destatis said that Germany's adjusted unemployment rate fell to 4.5% in August from 4.6% in July.

According to Destatis, German adjusted retail sales decreased 0.4% in August, missing forecasts of a 0.2% gain, after a 1.6% rise in July. July's figure was revised up from a 1.4% increase.

On a yearly basis, German retail sales jumped 2.5% in August, missing expectations for a 3.1% gain, after a 3.8% rise in July. July's figure was revised up from a 3.3% increase.

Sales of non-food products increased at an annual rate of 1.1% in August, while sales of food products climbed by 3.9%.

The British pound traded higher against the U.S. dollar after the mixed economic data from the U.K. The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Wednesday. The final U.K. GDP expanded at 0.7% in the second quarter, in line with August's estimate, after a 0.4% rise in the first quarter.

On a yearly basis, the revised U.K. GDP rose 2.4% in the second quarter, missing August's estimate of a 2.6% increase, after a 2.7% gain in the first quarter. The first quarter's figure was revised down from a 2.9% rise

The downward revision was partly driven by a slower pace of the services sector. The service sector climbed 0.2% in July, compared with a 0.6% rise in June.

The U.K. current account deficit narrowed to £16.8 billion in the second quarter from £24.0 billion in the first quarter. The first quarter's figure was revised up from a deficit of £26.6 billion.

Analysts had expected the current account deficit to decrease to £22.25 billion.

The second quarter's current account deficit amounted to 3.6% of GDP, the lowest share of GDP in two years.

Declines in the current account deficit were driven by a drop in the deficit on the trade account and a decline in the deficit on the primary income account.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of Canadian gross domestic product, which is expected to increase 0.2% in July, after a 0.5% rise in June.

The Swiss franc traded higher against the U.S. dollar after of the release of the mixed Swiss economic data. The Swiss Economic Institute KOF released its leading indicator for Switzerland on Wednesday. The KOF leading indicator declined to 100.4 in September from 101.2 in August, missing expectations for a decline to 100.9. July's figure was revised up from 100.7.

According to the institute, the outlook for the Swiss economy remained unchanged since August.

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.63 in August from 1.59 in July. July's figure was revised down from 1.64.

The increase was driven by a rise in employment in the second quarter.

Retailer sentiment was slightly less negative, while consumer sentiment rose.

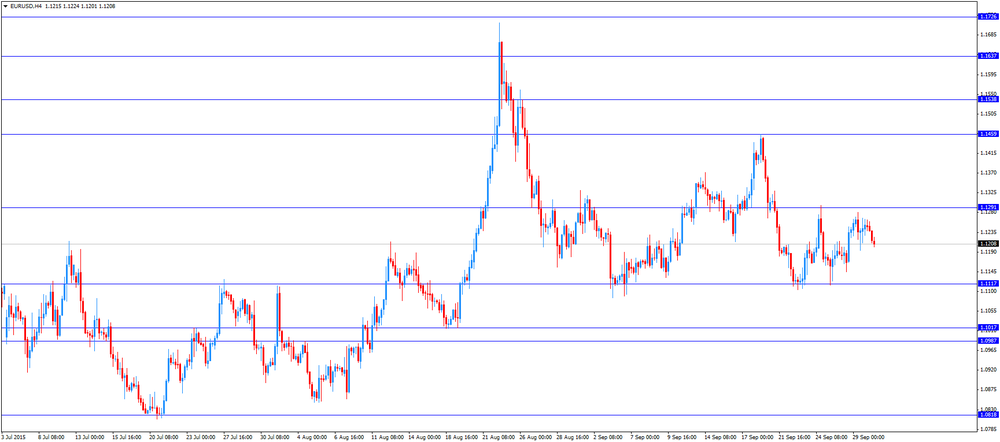

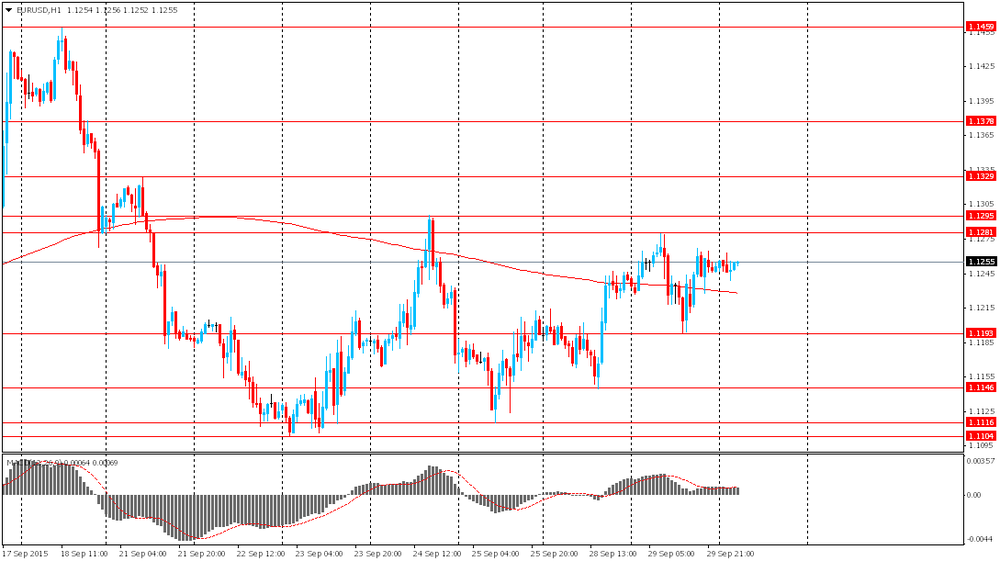

EUR/USD: the currency pair declined to $1.1201

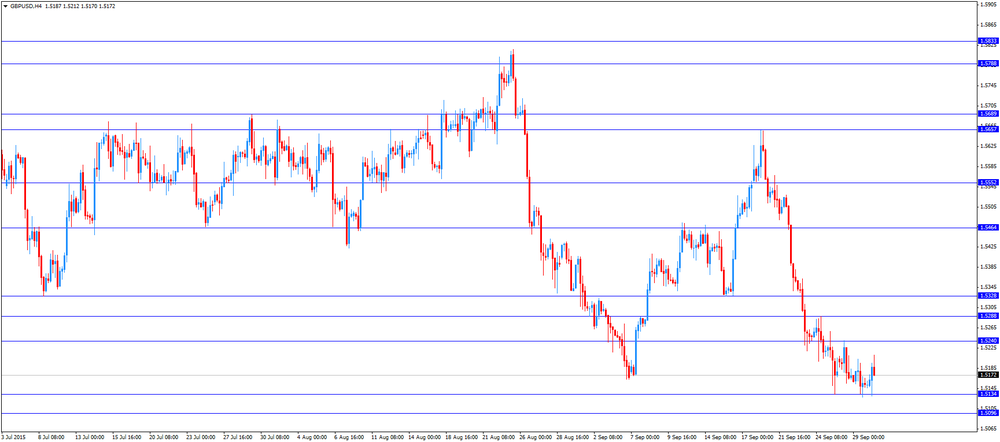

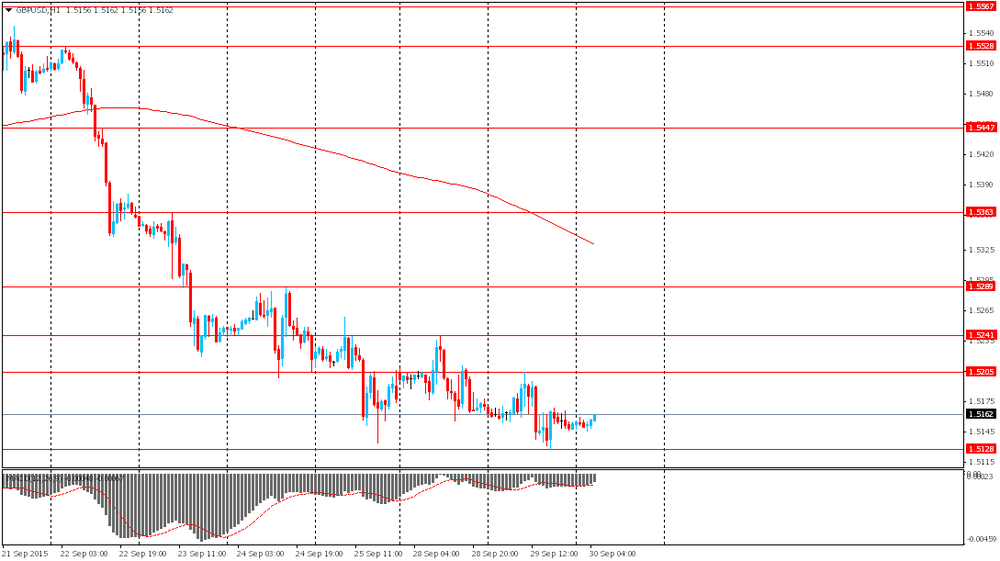

GBP/USD: the currency pair increased to $1.5212

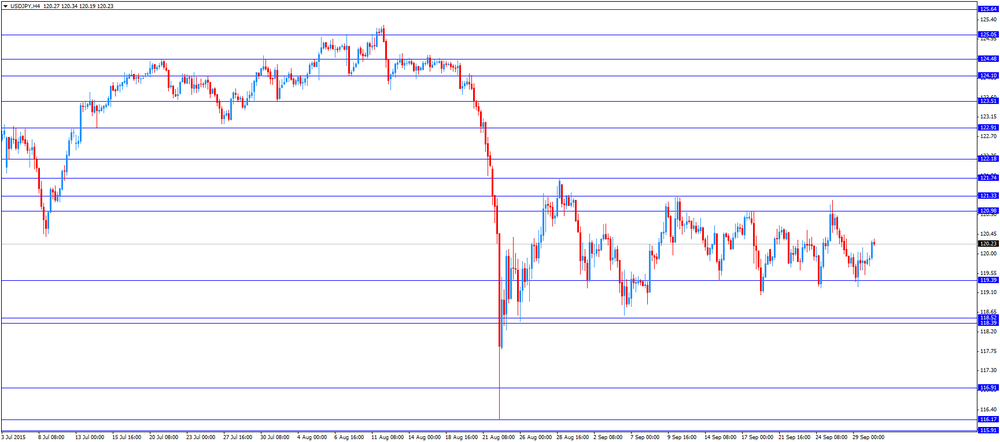

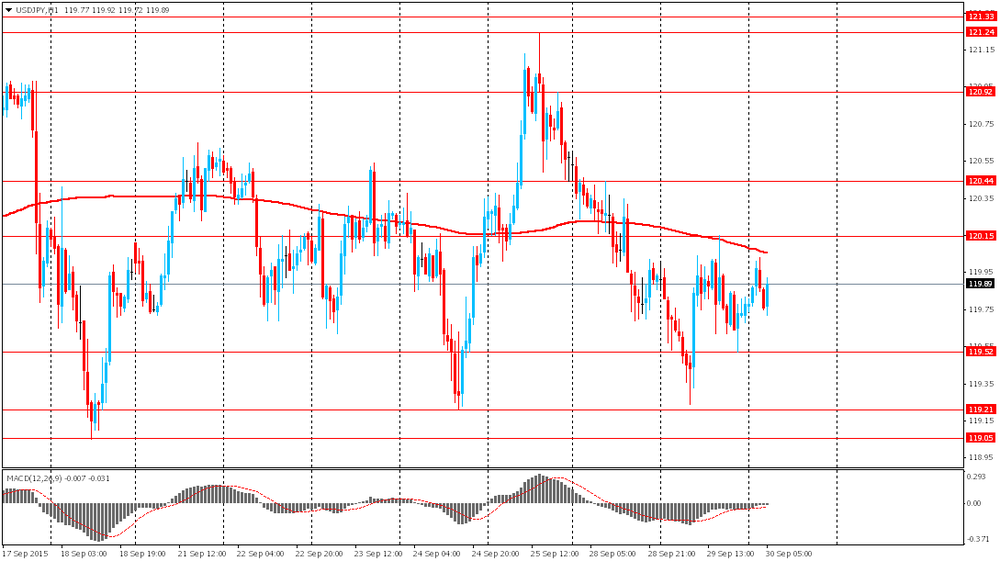

USD/JPY: the currency pair rose to Y120.34

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report September 190 194

12:30 Canada GDP (m/m) July 0.5% 0.2%

13:45 U.S. Chicago Purchasing Managers' Index September 54.4 53

19:00 U.S. Fed Chairman Janet Yellen Speaks

23:50 Japan BoJ Tankan. Manufacturing Index Quarter III 15 13

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter III 23 20

-

13:45

Orders

EUR/USD

Offers 1.1245 1.1260 1.1280 1.1300 1.1325-30 1.1350 1.1380-85 1.1400

Bids 1.1200 1.1180 1.1150 1.1135 1.1120 -25 1.1100 1.1085 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.5165-70 1.5185 1.5200 1.5220 1.5235 1.5250 1.5265 1.5285 1.5300

Bids 1.5125-30 1.5100 1.5085 1.5060 1.5030 1.5000 1.4985 1.4965 1.4950

EUR/GBP

Offers 0.7425 0.7435 0.7450 0.7465 0.7480 0.7500

Bids 0.7400 0.7385 0.7370 0.7350 0.7330-35 0.7300

EUR/JPY

Offers 135.00 135.25 135.50 135.80 136.00 136.30 136.50

Bids 134.50 134.20 134.00 133.80 133.50 133.30 133.00

USD/JPY

Offers 120.20 120.35 120.50 120.65 120.85 121.00 121.30 121.50

Bids 119.80 119.65 119.40 119.25 119.10 119.00 118.85 118.65 118.50

AUD/USD

Offers 0.7020 0.7035 0.7050 0.7065 0.7080 0.7100 0.7120 0.7150

Bids 0.6980 0.6965 0.6950 0.6925-30 0.6900 0.6885 0.6865 0.6850

-

13:00

U.S.: MBA Mortgage Applications, September -6.7%

-

11:57

KOF leading indicator for Switzerland declines to 100.4 in September

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Wednesday. The KOF leading indicator declined to 100.4 in September from 101.2 in August, missing expectations for a decline to 100.9. July's figure was revised up from 100.7.

According to the institute, the outlook for the Swiss economy remained unchanged since August.

"Overall, slightly positive tendencies in the international environment are counterbalanced by slightly negative developments primarily in the manufacturing as well as construction sectors. With the indicators capturing tendencies in domestic consumption and banking sector stabilising at their previous readings, the overall result is a minor decrease in the Barometer," the KOF said.

-

11:53

UBS consumption index rises to 1.63 in August

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.63 in August from 1.59 in July. July's figure was revised down from 1.64.

The increase was driven by a rise in employment in the second quarter.

Retailer sentiment was slightly less negative, while consumer sentiment rose.

-

11:45

U.K. current account deficit narrows to £16.8 billion in the second quarter

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Wednesday. The U.K. current account deficit narrowed to £16.8 billion in the second quarter from £24.0 billion in the first quarter. The first quarter's figure was revised up from a deficit of £26.6 billion.

Analysts had expected the current account deficit to decrease to £22.25 billion.

The second quarter's current account deficit amounted to 3.6% of GDP, the lowest share of GDP in two years.

Declines in the current account deficit were driven by a drop in the deficit on the trade account and a decline in the deficit on the primary income account.

-

11:36

German adjusted retail sales are down 0.4% in August

Destatis released its retail sales for Germany on Wednesday. German adjusted retail sales decreased 0.4% in August, missing forecasts of a 0.2% gain, after a 1.6% rise in July. July's figure was revised up from a 1.4% increase.

On a yearly basis, German retail sales jumped 2.5% in August, missing expectations for a 3.1% gain, after a 3.8% rise in July. July's figure was revised up from a 3.3% increase.

Sales of non-food products increased at an annual rate of 1.1% in August, while sales of food products climbed by 3.9%.

-

11:30

Eurozone's unemployment rate remains unchanged at 11.0% in August

Eurostat released its unemployment data for the Eurozone on Wednesday. Eurozone's unemployment rate remained unchanged at 11.0% in August. July's figure was revised up from 10.9%.

Analysts had expected the unemployment rate to fall to 10.9%.

There were 17.603 million unemployed in the Eurozone in August, down from 17.604 million in July.

The lowest unemployment rate in the Eurozone in August was recorded in Germany (4.5%), and the highest in Greece (25.2% in June 2015) and Spain (22.2%).

The youth unemployment rate was 22.3% in the Eurozone in August, compared to 23.6% in August a year ago.

-

11:18

Preliminary consumer price inflation in the Eurozone declines to -0.1% in September

Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone declined to an annual rate of -0.1% in September from 0.1% in August, missing expectations for a fall to 0.0%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in September.

Food, alcohol and tobacco prices were up 1.4% in September, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.3%, while energy prices dropped 8.9%.

-

11:17

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 670m) 121.00 (885m)

EUR/USD 1.1100 (EUR 989m) 1.1200-10 (1.6bln) 1.1230 (320m)

GBP/USD 1.5050 (GBP (306m) 1.5250 (301m)

USD/CHF 0.9700 (USD 761m)

AUD/USD 0.6900 (AUD 4.2bln) 0.7100 (3.8bln)

NZD/USD 0.6425 (NZD 214m)

EUR/GBP 0.7300 (EUR 1.6bln)

-

11:11

Final U.K. GDP grows at 0.7% in the second quarter

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Wednesday. The final U.K. GDP expanded at 0.7% in the second quarter, in line with August's estimate, after a 0.4% rise in the first quarter.

On a yearly basis, the revised U.K. GDP rose 2.4% in the second quarter, missing August's estimate of a 2.6% increase, after a 2.7% gain in the first quarter. The first quarter's figure was revised down from a 2.9% rise

The downward revision was partly driven by a slower pace of the services sector. The service sector climbed 0.2% in July, compared with a 0.6% rise in June.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, September 0.9% (forecast 0.9%)

-

11:01

Eurozone: Unemployment Rate , August 11% (forecast 10.9%)

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, September 0.9% (forecast 0.9%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, September -0.1% (forecast 0%)

-

10:56

Number of unemployed people in Germany climbs by 2,000 in September

The Federal Labour Agency released its unemployment figures for Germany on Wednesday. The number of unemployed people in Germany climbed by 2,000 in September, missing expectations for a 5,000 decline, after a 6,000 decrease in August.

The number of unemployed people was 1.90 million in August, according to Destatis.

Destatis said that Germany's adjusted unemployment rate fell to 4.5% in August from 4.6% in July.

-

10:47

Preliminary industrial production in Japan declines 0.5% in August

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Tuesday evening. Preliminary industrial production in Japan declined 0.5% in August, missing expectations for a 1.0% increase, after a 0.8% drop in July.

The decline was driven by general-purpose, production and business oriented machinery, electrical machinery and transport equipment.

On a yearly basis, Japan's industrial production was up 0.2% in August, after a flat reading in July.

-

10:43

Retail sales in Japan climb 0.8% in August

According to the Ministry of Economy, Trade and Industry, retail sales in Japan climbed at an annual rate of 0.8% in August, missing expectations for a 1.1% rise, after a 1.8% gain in July. July's was revised up from a 1.6% rise.

Sales at large-scale retailers increased 1.8% year-on-year in August.

Domestic consumption remained sluggish.

-

10:30

United Kingdom: GDP, q/q, Quarter II 0.7% (forecast 0.7%)

-

10:30

United Kingdom: GDP, y/y, Quarter II 2.4% (forecast 2.6%)

-

10:30

United Kingdom: Current account, bln , Quarter II -16.8 (forecast -22.25)

-

10:23

European Central Bank Governing Council member Jens Weidmann: concerns over the deflation in the Eurozone dissipated

The European Central Bank Governing Council member Jens Weidmann said on Tuesday that concerns over the deflation in the Eurozone dissipated.

"Worries about deflation, which were then exaggerated, have further dissipated," he said.

Weidmann pointed out that an accommodative monetary policy is needed in the Eurozone.

"Therefore a normalization of monetary policy in the Eurozone is currently not on the agenda," he noted.

-

10:10

European Central Bank Governing Council member Ewald Nowotny: the Eurozone needs a monetary union

The European Central Bank Governing Council member Ewald Nowotny said on Tuesday that the Eurozone needs a monetary union and not a currency union. He added that the Eurozone needs a governance reform.

-

09:55

Germany: Unemployment Rate s.a. , September 6.4% (forecast 6.4%)

-

09:55

Germany: Unemployment Change, September 2 (forecast -5)

-

09:00

Switzerland: KOF Leading Indicator, September 100.4 (forecast 100.9)

-

08:19

Options levels on wednesday, September 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1370 (2467)

$1.1325 (1802)

$1.1289 (557)

Price at time of writing this review: $1.1229

Support levels (open interest**, contracts):

$1.1177 (2554)

$1.1147 (5424)

$1.1113 (2308)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 54679 contracts, with the maximum number of contracts with strike price $1,1400 (5072);

- Overall open interest on the PUT options with the expiration date October, 9 is 70533 contracts, with the maximum number of contracts with strike price $1,1000 (6581);

- The ratio of PUT/CALL was 1.29 versus 1.29 from the previous trading day according to data from September, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.5401 (1087)

$1.5303 (606)

$1.5206 (1115)

Price at time of writing this review: $1.5162

Support levels (open interest**, contracts):

$1.5094 (1691)

$1.4997 (1983)

$1.4899 (1077)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 23587 contracts, with the maximum number of contracts with strike price $1,5500 (1691);

- Overall open interest on the PUT options with the expiration date October, 9 is 22900 contracts, with the maximum number of contracts with strike price $1,5200 (2733);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from September, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:13

Foreign exchange market. Asian session: the yen little changed despite weak domestic data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence September -29.1 -18.9

01:30 Australia Private Sector Credit, m/m August 0.6% 0.5% 0.6%

01:30 Australia Private Sector Credit, y/y August 6.1% 6.3%

01:30 Australia Building Permits, m/m August 7.9% Revised From 4.2% -2% -6.9%

05:00 Japan Construction Orders, y/y August -4.0% -15.6%

05:00 Japan Housing Starts, y/y August 7.4% 7.8% 8.8%

06:00 United Kingdom Nationwide house price index, y/y September 3.2% 3.8% 3.8%

06:00 United Kingdom Nationwide house price index September 0.3% 0.4% 0.5%

06:00 Germany Retail sales, real adjusted August 1.4% 0.2% -0.4%

06:00 Germany Retail sales, real unadjusted, y/y August 3.3% 3.1% 2.5%

06:00 Switzerland UBS Consumption Indicator August 1.64 1.63

The yen traded with modest changes amid disappointing domestic statistics. The country's industrial production fell by 0.5% m/m in August as companies tried to handle consequences of uneven recovery around the globe. The decline was led by weaker output of construction machines, air conditioners and automobiles. Economists expected the index to grow by 1.0%. On an annualized basis industrial production rose by 0.2%. The index reflects the change of output in manufacturing, mining industry and utility services. Meanwhile Japanese retail sales fell by 0.8% y/y in August vs expectations for a 1.1% increase.

The Australian dollar advanced amid growth in Chinese stocks and positive data on private sector credit in Australia (+0.6% in August vs +0.5% expected).

EUR/USD: the pair fluctuated within $1.1235-65 in Asian trade

USD/JPY: the pair traded within Y119.70-00

GBP/USD: the pair traded within $1.5145-60

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator September 100.7 100.9

07:55 Germany Unemployment Change September -6 -5

07:55 Germany Unemployment Rate s.a. September 6.4% 6.4%

08:30 United Kingdom Current account, bln Quarter II -26.6 -22.25

08:30 United Kingdom GDP, q/q (Finally) Quarter II 0.4% 0.7%

08:30 United Kingdom GDP, y/y (Finally) Quarter II 2.9% 2.6%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) September 0.1% 0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) September 0.9% 0.9%

09:00 Eurozone Unemployment Rate August 10.9% 10.9%

11:00 U.S. MBA Mortgage Applications September 13.9%

12:00 U.S. FOMC Member Dudley Speak

12:15 U.S. ADP Employment Report September 190 194

12:30 Canada GDP (m/m) July 0.5% 0.2%

13:45 U.S. Chicago Purchasing Managers' Index September 54.4 53

14:30 U.S. Crude Oil Inventories September -1.925 0

19:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Australia AIG Manufacturing Index September 51.7

23:50 Japan BoJ Tankan. Manufacturing Index Quarter III 15 13

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter III 23 20

-

08:01

Switzerland: UBS Consumption Indicator, August 1.63

-

08:01

Germany: Retail sales, real unadjusted, y/y, August 2.5% (forecast 3.1%)

-

08:00

United Kingdom: Nationwide house price index , September 0.5% (forecast 0.4%)

-

08:00

Germany: Retail sales, real adjusted , August -0.4% (forecast 0.2%)

-

07:59

United Kingdom: Nationwide house price index, y/y, September 3.8% (forecast 3.8%)

-

07:16

Japan: Construction Orders, y/y, August -15.6%

-

07:02

Japan: Housing Starts, y/y, August 8.8% (forecast 7.8%)

-

03:31

Australia: Private Sector Credit, y/y, August 6.3%

-

03:31

Australia: Building Permits, m/m, August -6.9% (forecast -2%)

-

03:30

Australia: Private Sector Credit, m/m, August 0.6% (forecast 0.5%)

-

02:00

New Zealand: ANZ Business Confidence, September -18.9

-

01:52

Japan: Industrial Production (YoY), August 0.2%

-

01:52

Japan: Industrial Production (MoM) , August -0.5% (forecast 1%)

-

01:51

Japan: Retail sales, y/y, August 0.8% (forecast 1.1%)

-

00:28

Currencies. Daily history for Sep 29’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1251 +0,10%

GBP/USD $1,5153 -0,12%

USD/CHF Chf0,9709 -0,26%

USD/JPY Y119,78 -0,13%

EUR/JPY Y134,76 -0,03%

GBP/JPY Y181,5 -0,24%

AUD/USD $0,6991 +0,16%

NZD/USD $0,6348 +0,44%

USD/CAD C$1,3424 +0,24%

-

00:01

Schedule for today, Wednesday, Sep 30’2015:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence September -29.1

01:30 Australia Private Sector Credit, m/m August 0.6% 0.5%

01:30 Australia Private Sector Credit, y/y August 6.1%

01:30 Australia Building Permits, m/m August 4.2% -2%

05:00 Japan Construction Orders, y/y August -4.0%

05:00 Japan Housing Starts, y/y August 7.4% 7.8%

06:00 United Kingdom Nationwide house price index, y/y September 3.2% 3.8%

06:00 United Kingdom Nationwide house price index September 0.3% 0.4%

06:00 Germany Retail sales, real adjusted August 1.4% 0.2%

06:00 Germany Retail sales, real unadjusted, y/y August 3.3% 3.1%

06:00 Switzerland UBS Consumption Indicator August 1.64

07:00 Switzerland KOF Leading Indicator September 100.7 100.9

07:55 Germany Unemployment Change September -6 -5

07:55 Germany Unemployment Rate s.a. September 6.4% 6.4%

08:30 United Kingdom Current account, bln Quarter II -26.6 -22.6

08:30 United Kingdom GDP, q/q (Finally) Quarter II 0.4% 0.7%

08:30 United Kingdom GDP, y/y (Finally) Quarter II 2.9% 2.6%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) September 0.1% 0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) September 0.9% 0.9%

09:00 Eurozone Unemployment Rate August 10.9% 10.9%

11:00 U.S. MBA Mortgage Applications September 13.9%

12:00 U.S. FOMC Member Dudley Speak

12:15 U.S. ADP Employment Report September 190 195

12:30 Canada GDP (m/m) July 0.5% 0.2%

13:45 U.S. Chicago Purchasing Managers' Index September 54.4 53

14:30 U.S. Crude Oil Inventories September -1.925

19:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Australia AIG Manufacturing Index September 51.7

23:50 Japan BoJ Tankan. Manufacturing Index Quarter III 15 13

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter III 23 20

-