Noticias del mercado

-

23:45

New Zealand: Building Permits, m/m, August -4.9%

-

17:02

Federal Reserve Bank of Cleveland Loretta Mester: the U.S. economy can handle a small increase in interest rates this year

Federal Reserve Bank of Cleveland Loretta Mester said in an interview with The Nikkei on Tuesday that the U.S. economy can handle a small increase in interest rates this year.

"We can handle a small increase in interest rates, because policy will still remain very accommodative," she said.

Mester noted that she thinks that volatility in financial markets has no impact on the U.S. economy.

"In my view, the trajectory of my outlook didn't change much from those risks, but I did mark them down as downside risks to the forecast," she said.

-

16:34

U.S. consumer confidence index rises to 103.0 in September

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 103.0 in September from 101.3 in August, beating expectations for a rise to 96.1. August's figure was revised down from 101.5.

The increase was mainly driven by the better outlook for current conditions. The present conditions index climbed to 121.1 in September from 115.8 in August. It was the highest level since September 2007.

The Conference Board's consumer expectations index for the next six months decreased to 91.0 in September from 91.6 in August.

"Consumers' more positive assessment of current conditions fuelled this month's increase. Thus, while consumers view current economic conditions more favourably, they do not foresee growth accelerating in the months ahead," the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was up to 25.1% in September from 22.1% in August.

-

16:00

U.S.: Consumer confidence , September 103 (forecast 96.1)

-

15:55

Retail sales in Spain rise at a seasonally adjusted rate of 0.1% in August

The Spanish statistical office INE released its retail sales data on Tuesday. Retail sales in Spain rose at a seasonally adjusted rate of 0.1% in August, after a 1.2% gain in July.

Food sales were down 0.1% in August, while non-food sales climbed by 0.2%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 3.1% in August, after a 4.0% rise in June.

Sales of non-food products jumped 4.3% in August from a year ago, while food sales declined 0.7%.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.16BLN), $1.1100(E400M), $1.1140(E241M)

USD/JPY: Y119.00-10($1.06bn), Y120.50($280mn), Y120.70($380M)

-

15:44

Preliminary consumer price inflation in Spain declines 0.3% in September

The Spanish statistical office INE released its preliminary consumer price inflation data on Tuesday. Consumer price inflation in Spain was down 0.3% in September, after a 0.3% drop in August.

On a yearly basis, consumer prices fell by 0.9% in September from a year ago, after a 0.4% decrease in August.

The decline was mainly driven by the decline in the prices of fuels (gas and diesel oil) and electricity.

-

15:36

S&P/Case-Shiller home price index rises 5.0% in July

The S&P/Case-Shiller home price index increased 5.0% in July, missing expectations for a 5.2% rise, after a 4.9% gain in June. June's figure was revised down from a 5.0% increase.

San Francisco, Denver and Dallas were the largest contributors to the rise, where prices climbed by 10.4%, 10.3% and 8.7%, respectively.

"Prices of existing homes and housing overall are seeing strong growth and contributing to recent solid growth for the economy," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index fell by a seasonally adjusted 0.2% rate in July.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:00

CBI retail sales balance rises to +49% in September

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance jumped to +49% in September from +24% in August.

The increase was partly driven by a rise in sales in grocery and clothing stores.

Sales expectations for next month were up to +51%.

"Low inflation and the recovery in wage growth are helping to stimulate consumer demand, but the slowdown in the global economy and tight margins mean retailers won't get ahead of themselves as we head into autumn," CBI Director of Economics, Rain Newton-Smith, said.

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, July 5.0% (forecast 5.2%)

-

14:52

German import prices decline 1.5% in August

Destatis released its import prices data for Germany on Tuesday. German import prices declined by 3.1% in August from last year, after a 1.7% fall in July.

The decline was driven by a drop in energy prices, which plunged 29.8%.

Import prices decline since January 2013.

On a monthly base, import prices decreased 1.5% in August, after a 0.7% fall in July.

On a yearly base, import prices excluding crude oil and mineral oil products climbed by 1.6% in August.

Export prices decreased 0.8% year-on-year in August, after a 1.2% increase in July.

On a monthly base, export prices were down 0.5% in August, after a 0.1% rise in July.

-

14:45

Canadian industrial product and raw materials prices fall in August

Statistics Canada released its industrial product and raw materials price indexes on Tuesday. The Industrial Product Price Index (IPPI) fell 0.3% in August, beating forecasts for a 0.4% drop, after a 0.7% gain in July.

The decrease was driven by lower prices for energy and petroleum products, which slid 4.7% in August.

17 of the 21 commodity groups increased, 2 declined and 2 were unchanged.

The Raw Materials Price Index (RMPI) dropped 6.6% in August, after a 6.0% fall in July. It was the largest fall since January 2015.

The decline was driven by lower prices for crude energy products. Crude energy products plunged 14.8% in August.

2 of the 6 commodity groups rose and 4 decreased.

-

14:30

Canada: Industrial Product Price Index, y/y, August -0.4%

-

14:30

Canada: Industrial Product Price Index, m/m, August -0.3% (forecast -0.4%)

-

14:22

German consumer price inflation drop 0.2% in September

Destatis released its consumer price data for Germany on Tuesday. German preliminary consumer price index fell 0.2% in September, missing expectations for a 0.1% decline, after a flat reading in August.

On a yearly basis, German preliminary consumer price index decreased to 0.0% in September from 0.2% in August, missing expectations for a fall to 0.1%.

The decline was driven by a drop in goods prices, which decreased 1.3% year-on-year in September. Goods prices were driven by a decline in energy prices.

Services prices rose 1.1% year-on-year in September.

-

14:13

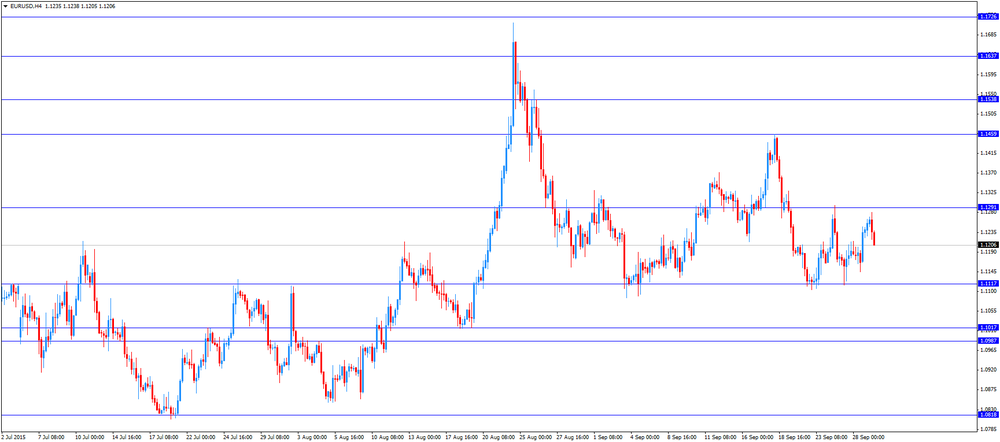

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:30 United Kingdom Consumer credit, mln August 1163 Revised From 1173 1200 860

08:30 United Kingdom Mortgage Approvals August 69.01 Revised From 68.76 70 71.03

08:30 United Kingdom Net Lending to Individuals, bln August 4.0 Revised From 3.9 4.1 4.3

09:00 Eurozone Economic sentiment index September 104.1 Revised From 104.2 104.1 105.6

09:00 Eurozone Consumer Confidence (Finally) September -6.9 -7.1 -7.1

09:00 Eurozone Business climate indicator September 0.2 Revised From 0.21 0.20 0.34

09:00 Eurozone Industrial confidence September -3.7 -3.8 -2.2

12:00 Germany CPI, m/m (Preliminary) September 0.0% -0.1% -0.2%

12:00 Germany CPI, y/y (Preliminary) September 0.2% 0.1% 0%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The S&P/Case-Shiller home price index is expected to rise by 5.2% in July, after a 5.0% gain in June.

The U.S. consumer confidence is expected to decline to 96.1 in September from 101.5 from August.

The euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone. German preliminary consumer price index fell 0.2% in September, missing expectations for a 0.1% decline, after a flat reading in August.

On a yearly basis, German preliminary consumer price index decreased to 0.0% in September from 0.2% in August, missing expectations for a fall to 0.1%.

The European Commission released its economic sentiment index for the Eurozone on Tuesday. The index increased to 105.6 in September from 104.1 in August. It was the highest level since April 2011.

August's figure was revised down from 104.2.

Analysts had expected the index to remain unchanged at 104.1.

The increase was driven by improvements in the industry, services and retail trade sectors.

The industrial confidence index increased to -2.2 in September from -3.7 in August, beating expectations for a decline to -3.8.

The final consumer confidence index was down to -7.1 in September from -6.9 in August, in line with expectations.

The business climate index climbed to 0.34 in September from 0.2 in August. Analysts had expected the index to remain unchanged at 0.2.

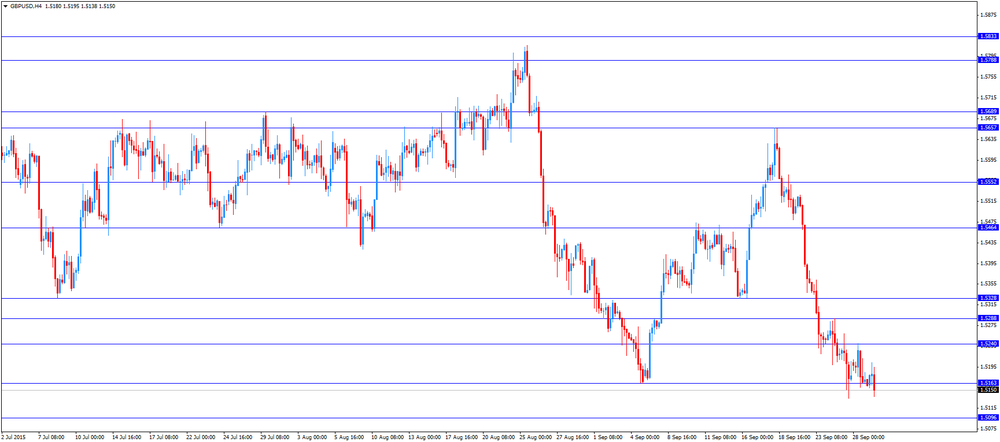

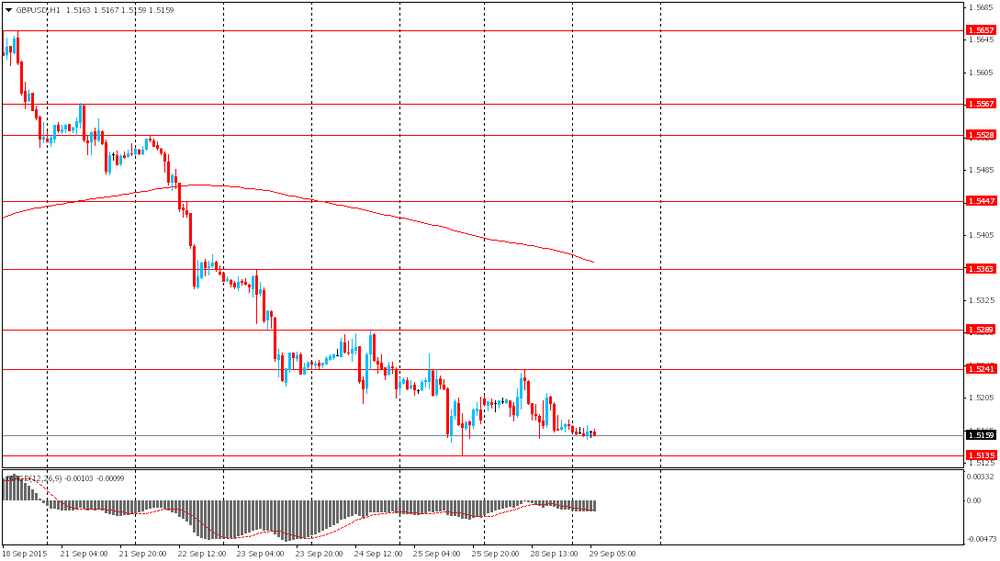

The British pound traded lower against the U.S. dollar after the release of the economic data from the U.K. The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. was up to 71,030 in August from 69,010 in July, exceeding expectations for an increase to 70,000. It was the highest reading since May 2008.

Consumer credit in the U.K. rose by £860 million in August, after a rise by £1.163 billion in July.

Net lending to individuals in the U.K. increased by £4.3 billion in August, exceeding expectations for a £4.1 billion, after a £4.0 billion gain in July. July's figure was revised up from a £3.9 billion increase.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of Canadian Industrial Product Price Index, which is expected to decline 0.4% in August, after a 0.7% rise in July.

EUR/USD: the currency pair declined to $1.1205

GBP/USD: the currency pair fell to $1.5138

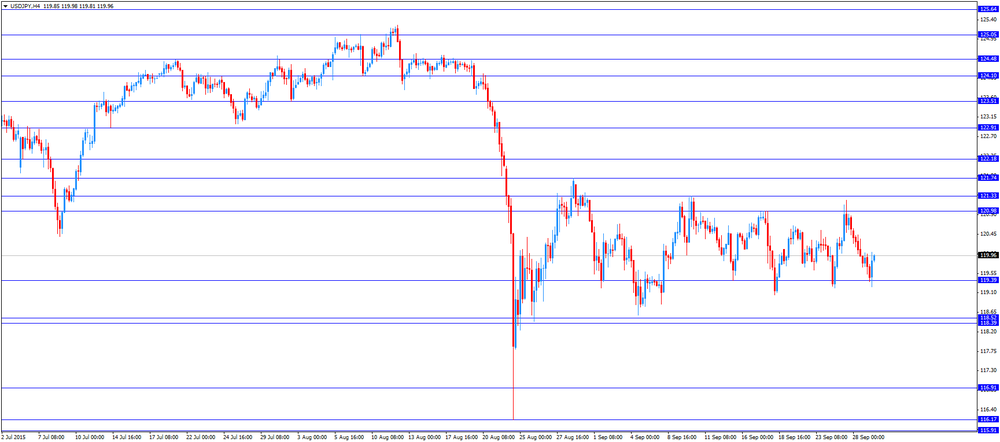

USD/JPY: the currency pair rose to Y120.04

The most important news that are expected (GMT0):

12:30 Canada Industrial Product Price Index, m/m August 0.7% -0.4%

12:30 Canada Industrial Product Price Index, y/y August 0.1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y July 5.0% 5.2%

14:00 U.S. Consumer confidence September 101.5 96.1

19:40 United Kingdom BOE Gov Mark Carney Speaks

21:45 New Zealand Building Permits, m/m August 20.4%

23:50 Japan Industrial Production (MoM) (Preliminary) August -0.8% 1%

23:50 Japan Industrial Production (YoY) (Preliminary) August 0.0%

23:50 Japan Retail sales, y/y August 1.6% 1.1%

-

14:00

Germany: CPI, y/y , September 0% (forecast 0.1%)

-

14:00

Germany: CPI, m/m, September -0.2% (forecast -0.1%)

-

13:44

Orders

EUR/USD

Offers 1.1280 1.1300 1.1325-30 1.1350 1.1380-85 1.1400 1.1420 1.1450

Bids 1.1220-25 1.2200 1.1180 1.1150 1.1135 1.1120 -25 1.1100 1.1085 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.5200 1.5220 1.5235 1.5250 1.5265 1.5285 1.5300 1.5320 1.5335 1.5360

Bids 1.5165 1.5150 1.5130 1.5100 1.5085 1.5060 1.5030 1.5000

EUR/GBP

Offers 0.7425 0.7435 0.7450 0.7465 0.7480 0.7500

Bids 0.7400 0.7385 0.7370 0.7350 0.7330-35 0.7300

EUR/JPY

Offers 135.00 135.25 135.50 135.80 136.00 136.30 136.50

Bids 134.50 134.20 134.00 133.80 133.50 133.30 133.00

USD/JPY

Offers 119.80 120.00 120.50 120.65 120.85 121.00 121.30 121.50

Bids 119.40 119.25 119.10 119.00 118.85 118.65 118.50 118.30 118.00

AUD/USD

Offers 0.7000 0.7020 0.7035 0.7050 0.7065 0.7080 0.7100 0.7120 0.7150

Bids 0.6965 0.6950 0.6925-30 0.6900 0.6885 0.6865 0.6850

-

12:29

Eurozone’s economic sentiment index is up to 104.2 in August, the highest level since April 2011

The European Commission released its economic sentiment index for the Eurozone on Tuesday. The index increased to 105.6 in September from 104.1 in August. It was the highest level since April 2011.

August's figure was revised down from 104.2.

Analysts had expected the index to remain unchanged at 104.1.

The increase was driven by improvements in the industry, services and retail trade sectors.

The industrial confidence index increased to -2.2 in September from -3.7 in August, beating expectations for a decline to -3.8.

The final consumer confidence index was down to -7.1 in September from -6.9 in August, in line with expectations.

The business climate index climbed to 0.34 in September from 0.2 in August. Analysts had expected the index to remain unchanged at 0.2.

-

11:24

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.16BLN), $1.1100(E400M), $1.1140(E241M)

USD/JPY: Y119.00-10($1.06bn), Y120.50($280mn), Y120.70($380M)

-

11:01

Eurozone: Industrial confidence, September -2.2 (forecast -3.8)

-

11:01

Eurozone: Consumer Confidence, September -7.1 (forecast -7.1)

-

11:00

Eurozone: Economic sentiment index , September 105.6 (forecast 104.1)

-

11:00

Eurozone: Business climate indicator , September 0.34 (forecast 0.20)

-

10:58

Number of mortgages approvals in the U.K. rise to 71,030 in August, the highest reading since May 2008

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. was up to 71,030 in August from 69,010 in July, exceeding expectations for an increase to 70,000. It was the highest reading since May 2008.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. rose by £860 million in August, after a rise by £1.163 billion in July.

Net lending to individuals in the U.K. increased by £4.3 billion in August, exceeding expectations for a £4.1 billion, after a £4.0 billion gain in July. July's figure was revised up from a £3.9 billion increase.

-

10:46

International Monetary Fund: energy exporting countries could lose about 2.25% of their economic growth through from 2015 to 2017

The International Monetary Fund (IMF) released its new World Economic Outlook study on Monday. The IMF said that energy exporting countries could lose about 2.25% of their economic growth through from 2015 to 2017, compared to 2012 to 2014, due to falling oil prices.

Earlier, International Monetary Fund (IMF) Managing Director Christine Lagarde in an interview with Les Echos that the IMF is likely to cut its global growth forecasts due to a slowdown in emerging economies.

Lagarde pointed out that forecasts of 3.3% growth this year and 3.8% next year are no longer realistic. She expect the global economic growth to be above the 3% threshold.

-

10:38

San Francisco Federal Reserve Bank President John Williams expects the Fed to raise its interest rates "sometime later this year"

San Francisco Federal Reserve Bank President John Williams said on Monday that he expects the Fed to raise its interest rates "sometime later this year".

"Given the progress we've made and continue to make on our goals, I view the next appropriate step as gradually raising interest rates, most likely starting sometime later this year," he said.

He pointed out that he sees the signs of overheating of the U.S. housing market.

"I am starting to see signs of imbalances emerge in the form of high asset prices, especially in real estate, and that trips the alert system," Williams said.

-

10:30

United Kingdom: Mortgage Approvals, August 71.03 (forecast 70)

-

10:30

United Kingdom: Consumer credit, mln, August 860 (forecast 1200)

-

10:30

United Kingdom: Net Lending to Individuals, bln, August 3.4 (forecast 4.1)

-

10:23

Chicago Fed President Charles Evans said on Monday would not back the interest rate hike until mid-2016

Chicago Fed President Charles Evans said on Monday that he would not back the interest rate hike until mid-2016.

"Before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. I believe that it could well be the middle of next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation. After lift-off, I think it would be appropriate to raise the target interest rate very gradually," he said.

Evans noted that he does not expect the inflation to rise to the Fed's 2% target until the end of 2018.

-

10:13

The Japan Center for Economic Research: the Chinese economy expanded 4.8% to 6.5% in the second quarter

The Japan Center for Economic Research released its so-called Li Keqiang index on Tuesday. The index is based on three economic indicators: railway freight, electric power generation and growth in bank lending. The Li Keqiang index showed that the Chinese economy expanded 4.8% to 6.5% in the second quarter, below the official 7% growth.

The Japan Center for Economic Research's data began to differ around summer 2013 and the gap widened.

-

08:27

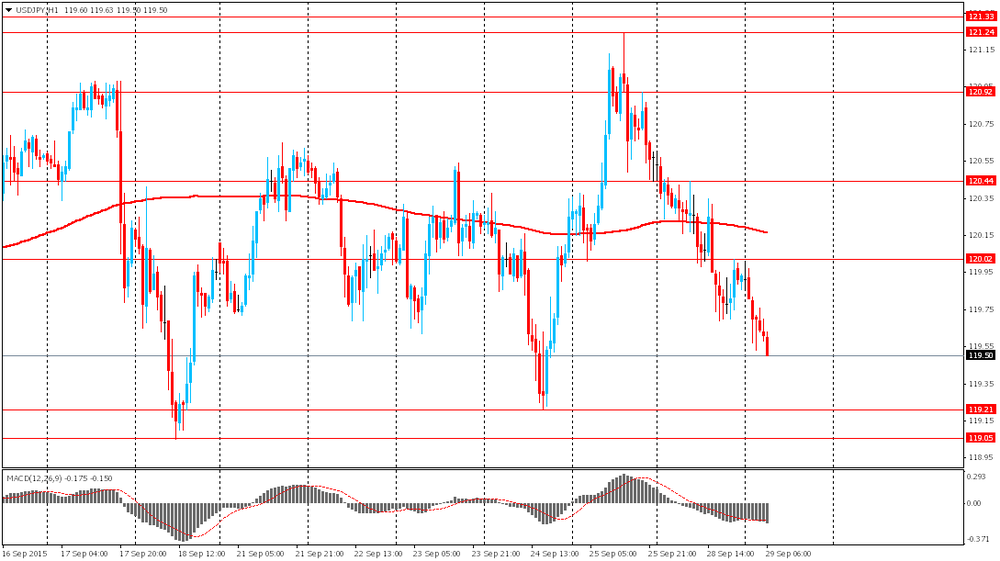

Foreign exchange market. Asian session: the yen climbed

The U.S. dollar declined against the euro amid mixed domestic data and speeches of several Fed officials. US Bureau of Economic analysis reported that personal spending rose by 0.4% in August compared to the previous month. Meanwhile personal income rose by 0.3% in August. Economists expected a 0.3% rise in spending and a 0.4% rise in income.

Meanwhile FOMC Member Dudley said on Monday that the central bank is likely to raise rates later this year.

The Australian dollar fell amid concerns over China's economy and declines in Chinese stocks. Investors' pessimism is related to signs of weaker activity in the country's manufacturing sector. Data have also shown that in the first eight month of the current year total revenues of large Chinese manufacturers fell by 1.9% to $592 billion compared to the same period last year. China is Australia's biggest trading partner and news on China affects the Australian dollar.

The yen rose against the U.S. dollar due to higher demand for safe-haven assets amid declines in stocks worldwide. Stocks in Tokyo have fallen below 17,000 for the first time since January 19.

EUR/USD: the pair rose to $1.1265 in Asian trade

USD/JPY: the pair fell to Y119.45

GBP/USD: the pair traded within $1.5155-70

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Consumer credit, mln August 1173 1200

08:30 United Kingdom Mortgage Approvals August 68.76 70

08:30 United Kingdom Net Lending to Individuals, bln August 3.9 4.1

09:00 Eurozone Economic sentiment index September 104.2 104.1

09:00 Eurozone Consumer Confidence (Finally) September -6.9 -7.1

09:00 Eurozone Business climate indicator September 0.21 0.20

09:00 Eurozone Industrial confidence September -3.7 -3.8

12:00 Germany CPI, m/m (Preliminary) September 0.0% -0.1%

12:00 Germany CPI, y/y (Preliminary) September 0.2% 0.1%

12:30 Canada Industrial Product Price Index, m/m August 0.7% -0.4%

12:30 Canada Industrial Product Price Index, y/y August 0.1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y July 5.0% 5.2%

14:00 U.S. Consumer confidence September 101.5 96.1

19:40 United Kingdom BOE Gov Mark Carney Speaks

20:30 U.S. API Crude Oil Inventories September -3.7

21:45 New Zealand Building Permits, m/m August 20.4%

23:50 Japan Industrial Production (MoM) (Preliminary) August -0.8% 1%

23:50 Japan Industrial Production (YoY) (Preliminary) August 0.0%

23:50 Japan Retail sales, y/y August 1.6% 1.1%

-

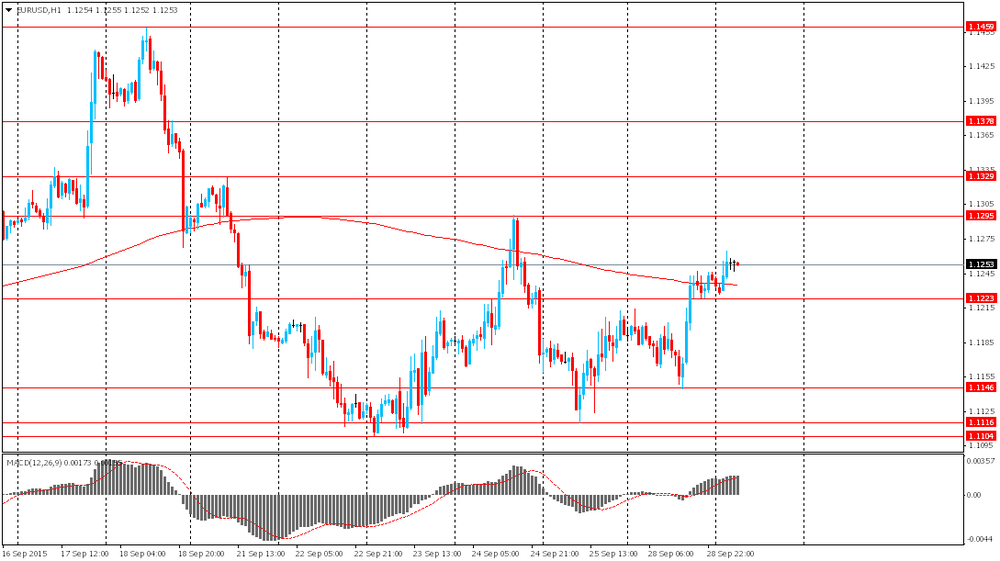

08:20

Options levels on tuesday, September 29, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1394 (3961)

$1.1362 (2471)

$1.1313 (1820)

Price at time of writing this review: $1.1268

Support levels (open interest**, contracts):

$1.1213 (1238)

$1.1182 (1391)

$1.1133 (5394)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 54962 contracts, with the maximum number of contracts with strike price $1,1400 (4974);

- Overall open interest on the PUT options with the expiration date October, 9 is 70912 contracts, with the maximum number of contracts with strike price $1,1000 (6969);

- The ratio of PUT/CALL was 1.29 versus 1.29 from the previous trading day according to data from September, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.5402 (1087)

$1.5304 (591)

$1.5208 (1153)

Price at time of writing this review: $1.5174

Support levels (open interest**, contracts):

$1.5094 (1693)

$1.4996 (1979)

$1.4898 (1077)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 23559 contracts, with the maximum number of contracts with strike price $1,5500 (1687);

- Overall open interest on the PUT options with the expiration date October, 9 is 22857 contracts, with the maximum number of contracts with strike price $1,5200 (2732);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from September, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:31

Currencies. Daily history for Sep 28’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1240 +0,43%

GBP/USD $1,5171 -0,05%

USD/CHF Chf0,934 -4,82%

USD/JPY Y119,93 -0,53%

EUR/JPY Y134,80 -0,10%

GBP/JPY Y181,93 -0,59%

AUD/USD $0,6980 -0,66%

NZD/USD $0,6320 -0,98%

USD/CAD C$1,3392 +0,45%

-

00:01

Schedule for today,Tuesday, Sep 29’2015:

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Consumer credit, mln August 1173 1200

08:30 United Kingdom Mortgage Approvals August 68.76 70

08:30 United Kingdom Net Lending to Individuals, bln August 3.9

09:00 Eurozone Economic sentiment index September 104.2 104.1

09:00 Eurozone Consumer Confidence (Finally) September -6.9 -7.1

09:00 Eurozone Business climate indicator September 0.21 0.20

09:00 Eurozone Industrial confidence September -3.7 -3.8

12:00 Germany CPI, m/m (Preliminary) September 0.0% -0.1%

12:00 Germany CPI, y/y (Preliminary) September 0.2% 0.1%

12:30 Canada Industrial Product Price Index, m/m August 0.7%

12:30 Canada Industrial Product Price Index, y/y August 0.1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y July 5.0% 5.1%

14:00 U.S. Consumer confidence September 101.5 96.1

19:40 United Kingdom BOE Gov Mark Carney Speaks

20:30 U.S. API Crude Oil Inventories September -3.7

21:45 New Zealand Building Permits, m/m August 20.4%

23:50 Japan Industrial Production (MoM) (Preliminary) August -0.8% 1%

23:50 Japan Industrial Production (YoY) (Preliminary) August 0.0%

23:50 Japan Retail sales, y/y August 1.6% 1.1%

-