Noticias del mercado

-

20:23

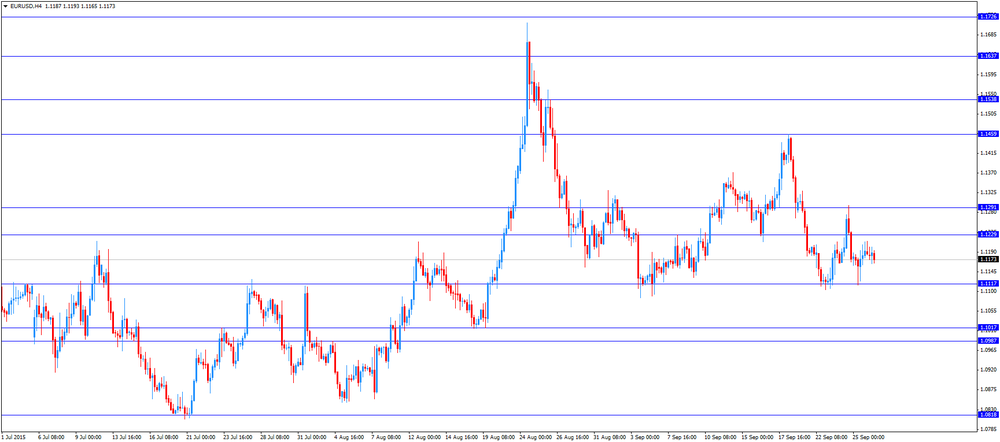

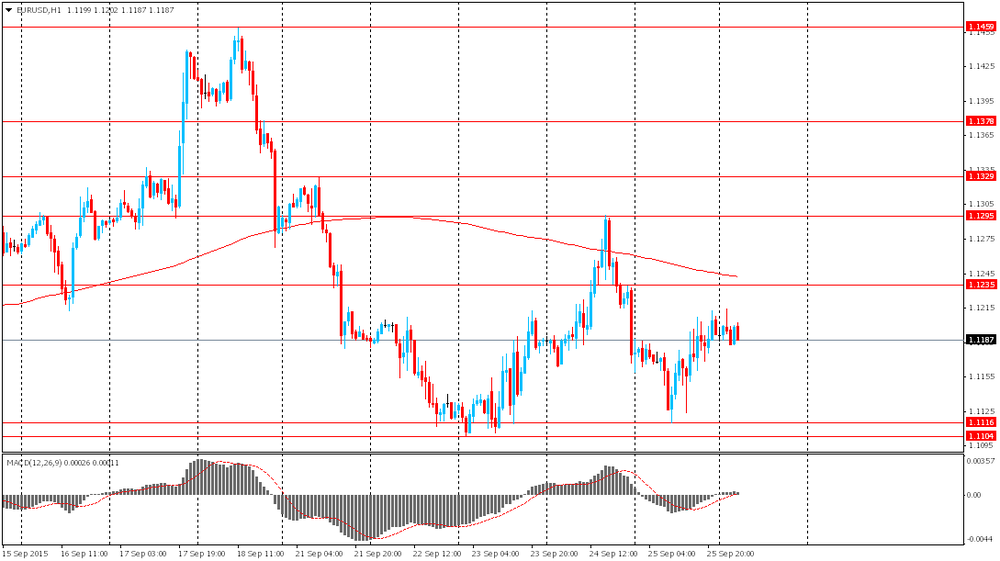

American focus: the euro rose

European currencies strengthened against the US dollar on a background of mixed US data and speeches of a number of Fed officials. The US Commerce Department reported that the volume of household spending rose again in August, topping with the assessment of experts. Last Change suggests that consumers continue to support the economy, despite the turbulence in financial markets and slowing growth abroad.

According to the data, personal spending increased in August by 0.4% compared with the previous month. Recall that in June, July and expenses increased by 0.4% and 0.3%, respectively. Meanwhile, the amount of personal income rose by 0.3% in August. Economists had forecast a 0.3 percent rise in spending and 0.4 percent increase in revenue.

Consumers are the backbone of the US economy. Personal expenses are more than two-thirds of gross domestic product. Recall during the winter slowed down the growth of household spending, but in spring the situation has changed for the better, which helped secure the expansion of GDP of 3.9% in the second quarter. Economists believe that in the current quarter, economic growth will slow to around 2%.

The report also showed that the price index for personal consumption expenditures - the preferred inflation gauge of the central bank - has remained unchanged from July and rose by only 0.3% per annum. The basic price index, which excludes food and energy, rose by 0.1% in monthly terms and 1.3% per annum.

The Ministry of Commerce said that in August, consumers increased spending on durable goods. In addition, it was reported that the personal savings rate fell to 4.6% in August from 4.7% in July.

In addition, the National Association of Realtors (NAR) reported that in August, the number of pending home sales declined significantly in August, despite forecasts for a moderate increase.

According to data seasonally adjusted index of pending home sales - the gauge of expected sales - fell in August by 1.4 percent to 109.4 points. Economists had expected the index to rise 0.5 percent after a similar change in June. In annual terms, it had risen to 6.1 percent, recording the 12th consecutive monthly increase, fueled by steady job growth and low mortgage rates.

It should be emphasized, other recent data pointed to strong demand in the housing market this summer. Sales of new single-family home, which accounted for about 10% of the market, rose by 5.7% last month. Meanwhile, the pace of home sales in the secondary market have returned to their pre-crisis levels. However, despite the significant increase in sales, the establishment of new single-family homes increased by only 8.7% in August. Meanwhile, builders sentiment index rose to a high of nearly 10 years.

The momentum of the US economy is growing, but the US Federal Reserve should continue to closely monitor the risks. On Monday the Fed spokesman Daniel Tarullo.

Discussing financial regulation at a conference in Paris, Tarullo warned that the regulation should not be limited to certain standards, as the global financial crisis of 2008 are still being felt. There were too many lost jobs, and economic growth slowed down considerably.

"In the US there is a fairly strong growth momentum at the moment, although we continue to monitor the risks to which it is linked," - said Tarullo.

There are signs, the austerity measures taken by European countries, have been effective, but many other countries are in need of stimulation of aggregate demand to support the loans, he added.

President of the Federal Reserve Bank of New York, William Dudley said Monday that the central bank will be able to start tightening monetary policy until the end of 2015.

"I expect that we will probably raise rates later this year", and it is possible at any meeting of the Fed before the end of the year, he said. The Fed, however, will be dictated by the dynamics of the US economy and financial conditions and events abroad.

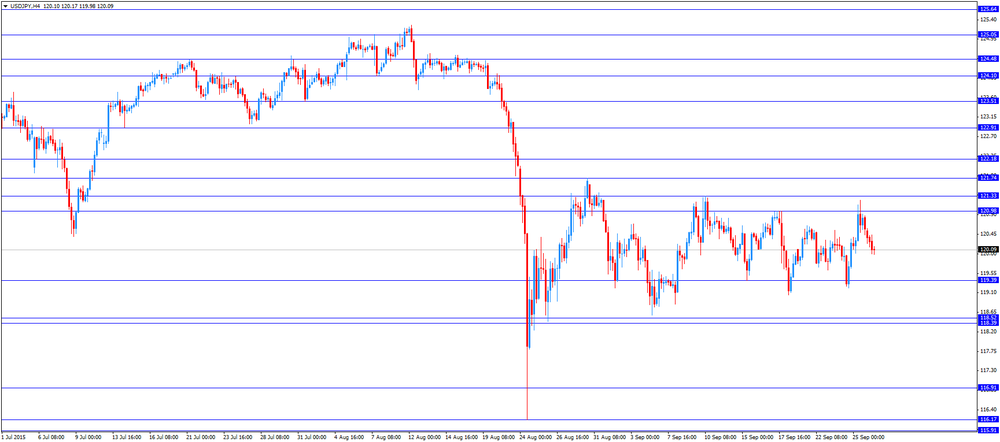

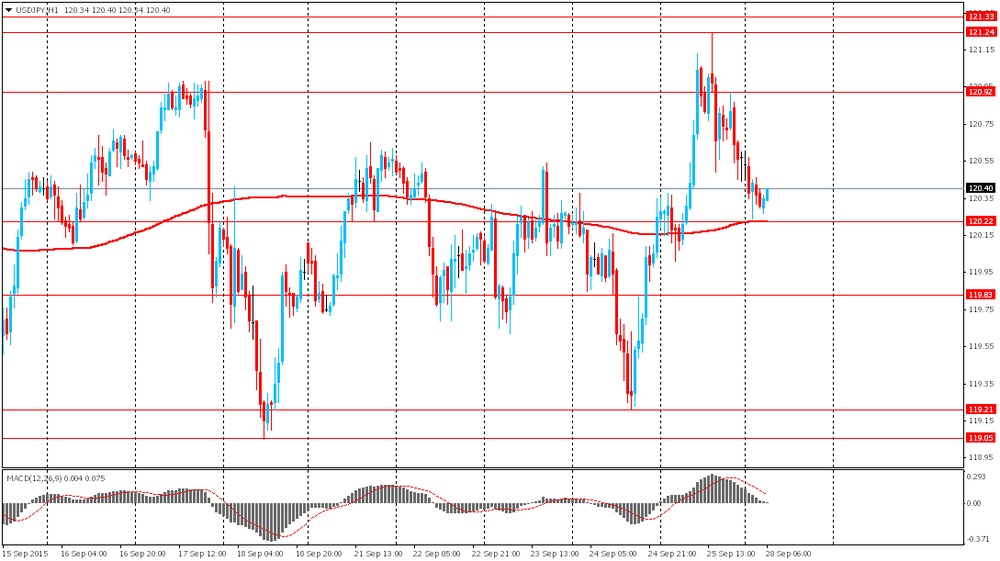

The yen rose significantly against the dollar, reaching Y120.00. On the dynamics of trade have affected the statements of the Bank of Japan Kuroda, who reiterated that the Central Bank will continue to implement accommodative policy until you reach the inflation target of 2%. "We will not hesitate to correct the policy, if it is required to achieve a target price level of the Central Bank", - said Kuroda, adding that in order to achieve the objective of 2% is necessary to further enhance the positive economic cycle in the country. According to the head of the Central Bank, consumer price inflation may reach 2% in the 1st half of fiscal 2016. Kuroda also said that time is needed to overcome the deflationary mindset of companies and households. "Japan's macroeconomic fundamentals remain strong, the economy will continue a moderate recovery. For a while exports may remain in the flat, but then resume a gradual increase in tandem with developing economies", - added the head of the Central Bank.

-

17:29

International Monetary Fund (IMF) Managing Director Christine Lagarde: the IMF is likely to cut its global growth forecasts due to a slowdown in emerging economies

International Monetary Fund (IMF) Managing Director Christine Lagarde in an interview with Les Echos that the IMF is likely to cut its global growth forecasts due to a slowdown in emerging economies.

"We are in a recovery process whose pace is decelerating. There is a shift between emerging countries and developed countries," she said.

Lagarde pointed out that forecasts of 3.3% growth this year and 3.8% next year are no longer realistic. She expect the global economic growth to be above the 3% threshold.

-

17:16

Italian consumer confidence index climbs to 112.7 in September

The Italian statistical office ISTAT released its consumer confidence index for Italy on Monday. The Italian consumer confidence index climbed to 112.7 in September from 109.3 in August. August's figure was revised up from 109.0.

The increase was driven by rises in economic expectations subindex.

The business confidence index climbed to 104.2 in September from 102.7 in August. August's figure was revised up from 102.5.

-

16:33

European Central Bank purchases €11.16 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €11.16 billion of government and agency bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.99 billion of covered bonds, and €759 million of asset-backed securities.

-

16:22

U.S. pending home sales plunge 1.4% in August

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. slid 1.4% in August, missing expectations for a 0.5% gain, after a 0.5% rise in July.

The decline was partly lead by a drop in the Northeast.

"Pending sales have levelled off since mid-summer, with buyers being bounded by rising prices and few available and affordable properties within their budget. Even with existing-housing supply barely budging all summer and no relief coming from new construction, contract activity is still higher than earlier this year and a year ago," the NAR's chief economist Lawrence Yun said.

-

16:12

New York Federal Reserve Bank President William Dudley: the Fed could still start raising its interest rates this year

New York Federal Reserve Bank President William Dudley said in an interview with The Wall Street Journal on Monday that the Fed could still start raising its interest rates this year. He added that the interest rate hike in October is also possible.

Dudley pointed out that the timing when to start raising interest rates depends on the incoming economic data.

New York Federal Reserve Bank president expect that the inflation in the U.S. would move back toward the target over time as weak global economy and the strong U.S. dollar would not permanently weigh on the inflation.

-

16:00

U.S.: Pending Home Sales (MoM) , August -1.4% (forecast 0.5%)

-

15:44

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0985/00(E2.5bn), $1.1080(E600mn), $1.1200($1.2bn), $1.1270($421mn)

USD/JPY: Y119.00($1.0bn),Y120.00($650mn)

USD/CAD: Cad1.3250($800mn), Cad1.3400($475mn)

USD/CHF: Chf0.9800(253mn)

EUR/JPY: Y135.50(E391mn)

-

15:21

Moody's confirms Greece's government bond rating at Caa3

Moody's Investors Service has confirmed Greece's government bond rating at Caa3 from Caa2 on Friday. The agency upgraded Greece's outlook to stable.

Moody's said that it confirmed the rating due "to the approval of the third bailout programme, and the emergence of a political configuration that is slightly more supportive".

The agency noted that the outlook was upgraded because the risks to creditors are now broadly balanced.

-

15:09

Member of the Executive Board of the European Central Bank (ECB) Sabine Lautenschläger: it is too early to discuss the expansion of the asset-buying programme

Member of the Executive Board of the European Central Bank (ECB), Sabine Lautenschläger, said on Monday that it is too early to discuss the expansion of the asset-buying programme. She added that the central bank's economic forecasts did not change.

-

14:53

U.S. personal spending climbs 0.4% in August

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending rose 0.4% in August, exceeding expectations for a 0.3% gain, after a 0.4% increase in July. July's figure was revised up from a 0.3% increase.

Consumer spending makes more than two-thirds of U.S. economic activity. This data showed that the U.S. economy continues to strengthen despite a slowdown abroad.

Personal spending was partly driven by higher demand for automobiles. Spending on auto mobiles rose 0.9% in August.

The saving rate declined to 4.6% in August from 4.7% in July.

Personal income increased 0.3% in August, missing expectations for a 0.4% rise, after a 0.5% gain in July. July's figure was revised up from a 0.4% increase.

Wages and salaries climbed 0.5% in August, after a 0.6% rise in July.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in August, in line with forecasts, after a 0.1% gain in July.

On a yearly basis, the PCE price index excluding food and index increased to 1.3% in August from 1.2% in July.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:32

Fed Governor Daniel Tarullo: the U.S economy has got “a fair amount of momentum right now”

Fed Governor Daniel Tarullo said in Paris on Monday that the U.S economy has got "a fair amount of momentum right now", but the Fed closely monitors risks to the momentum. He noted that the European economy was retrenching effectively.

Tarullo also said that costs of financial crisis are still being felt today.

-

14:30

U.S.: PCE price index ex food, energy, m/m, August 0.1% (forecast 0.1%)

-

14:30

U.S.: Personal spending , August 0.4% (forecast 0.3%)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, August 1.3%

-

14:30

U.S.: Personal Income, m/m, August 0.3% (forecast 0.4%)

-

14:09

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Coincident Index (Finally) July 113.3 Revised From 112.3 112.2 113.1

05:00 Japan Leading Economic Index (Finally) July 106.7 Revised From 106.5 104.9 105

09:15 U.S. FOMC Member Tarullo Speaks

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.1% in August, after a 0.1 rise in July.

Personal income in the U.S. is expected to rise 0.4% in August, after a 0.4% gain in July.

Personal spending in the U.S. is expected to gain 0.3% in August, after a 0.3% rise in July.

Pending home sales in the U.S. expected to climbs 0.5% in August, after a 0.5% increase in July.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone.

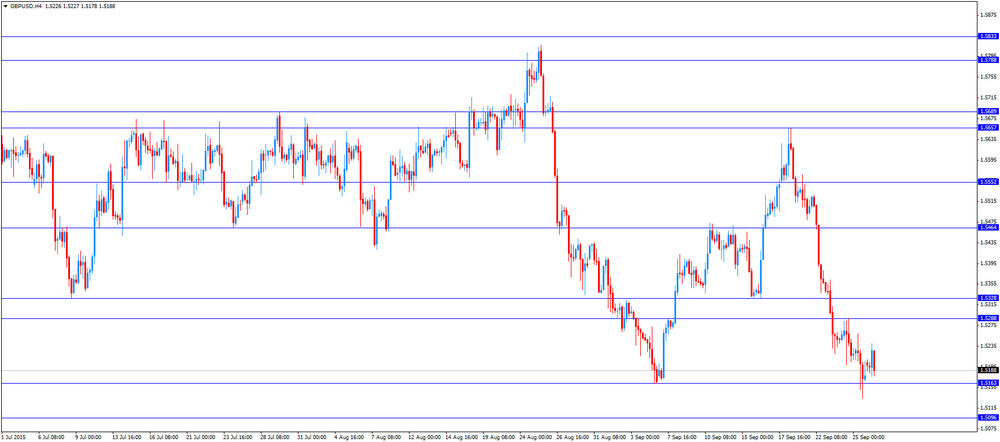

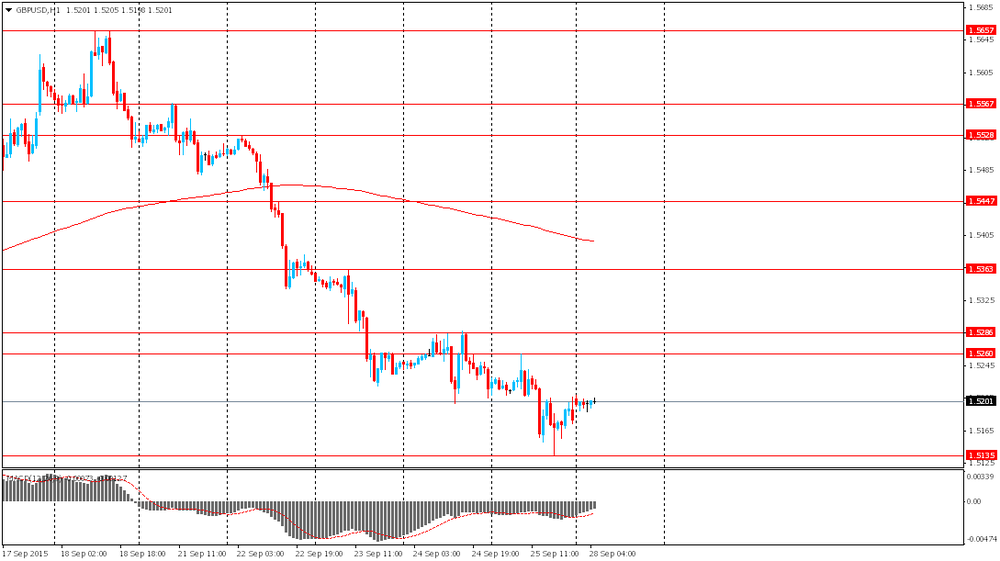

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair fell to Y119.98

The most important news that are expected (GMT0):

12:30 U.S. Personal spending August 0.3% 0.3%

12:30 U.S. Personal Income, m/m August 0.4% 0.4%

12:30 U.S. PCE price index ex food, energy, Y/Y August 1.2%

12:30 U.S. PCE price index ex food, energy, m/m August 0.1% 0.1%

12:30 U.S. FOMC Member Dudley Speak

14:00 U.S. Pending Home Sales (MoM) August 0.5% 0.5%

17:30 U.S. FOMC Member Charles Evans Speaks

21:00 U.S. FOMC Member Williams Speaks

-

14:00

Orders

EUR/USD

Offers 1.1185 1.1180 1.1200 1.1220-25 1.1245 1.1275 1.1300

Bids 1.1150 1.1135 1.1120 -25 1.1100 1.1085 1.1065 1.1050 1.1030 1.10

GBP/USD

Offers 1.5220 1.5235 1.5250 1.5265 1.5285 1.5300 1.5320 1.5335 1.5360

Bids 1.5180 1.5165 1.5150 1.5130 1.5100 1.5085 1.5060

EUR/GBP

Offers 0.7370 0.7385 0.7400 0.7420 0.7535 0.7450

Bids 0.7330-35 0.7300 0.7285 0.7265 0.7250 0.7225-30 0.7200

EUR/JPY

Offers 134.80 135.00 135.50 135.80 136.00

Bids 134.20 134.00 133.80133.50 133.30 133.00

USD/JPY

Offers 120.50 120.65 120.85 121.00 121.30 121.50 121.75 122.00

Bids 120.20 120.00 119.80-85 119.65 119.50 119.30 119.10 119.00

AUD/USD

Offers 0.7050 0.7065 0.7080 0.7100 0.7120 0.7150

Bids 0.7000 0.6985 0.6965 0.6950 0.6925-30 0.6900

-

11:25

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0985/00(E2.5bn), $1.1080(E600mn), $1.1200($1.2bn), $1.1270($421mn)

USD/JPY: Y119.00($1.0bn),Y120.00($650mn)

USD/CAD: Cad1.3250($800mn), Cad1.3400($475mn)

USD/CHF: Chf0.9800(253mn)

EUR/JPY: Y135.50(E391mn)

-

11:24

Japan’s leading index falls 105.0 in July

Japan's Cabinet Office released its final leading economic index on Monday. The leading index in Japan plunged 105.0 in July from 106.7 in June, up from the preliminary estimate of 104.9.

The coincident index was down to 113.1 from 113.3, up from the preliminary estimate of 112.2.

-

11:03

Profits of industrial companies in China drop 8.8% in August

China's National Bureau of Statistics (NBS) said on Monday that profits of industrial companies in China declined 8.8% in August from a year earlier. It was the biggest drop October 2011.

Profits in the coal mining sector dropped 64.9%, while oil and gas profits slid 67.3%.

For the first eight months of 2015, industrial profits fell 1.9% from a year earlier.

-

10:50

Bank of Japan (BoJ) Governor Haruhiko Kuroda: the central bank will adjust its asset-buying programme if needed

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in Osaka on Monday that the central bank will adjust its asset-buying programme if needed.

"If risks materialize and lead to changes in trend inflation, the BOJ won't hesitate to adjust policy as needed to achieve its price target at the earliest possible time," he said.

Kuroda also pointed out that the interest rate hike by the Fed will not have a negative impact on the global economy.

"Fears that U.S. rate normalization would trigger a massive, sharp outflow of funds from emerging economies and disrupt the global economy appear to be receding somewhat," the BoJ governor said.

Kuroda noted that a weaker yen hurts smaller companies and households by higher import costs.

-

10:33

Pro-independence parties win an absolute majority in Catalonia's parliament

According to official results, the secessionist party "Junts pel Si" (Together for Yes) won 62 of 135 seats in Catalonia's parliament in an election on Sunday, while the leftist pro-independence Popular Unity Candidacy (CUP) party won 10 seats.

Pro-independence parties have an absolute majority in the parliament.

"Catalans have voted yes to independence," the Catalan President Artur Mas said.

-

08:26

Foreign exchange market. Asian session: the dollar climbed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan Coincident Index (Finally) July 112.3 112.2 113.1

05:00 Japan Leading Economic Index (Finally) July 106.5 104.9 105

The U.S. dollar advanced slightly against the euro after strong revised U.S. GDP data intensified expectations for higher rates this year. U.S. gross domestic product rose by 3.9% y/y in the second quarter compared to a 3.7% growth pace in the first quarter.

The pound was steady ahead of UK GDP data scheduled for this week. The report is likely to show that the country's gross domestic product rose moderately in the second quarter, but the current account deficit remained significant.

The New Zealand dollar rose amid gains in Australian stock markets. The kiwi is also supported by optimism about dairy products. Unlike the Federal Reserve, the Reserve Bank of Australia is likely to cut its benchmark rate by 50 basis points next year. The central bank of New Zealend is also ready to cut rates further.

EUR/USD: the pair fluctuated within $1.1175-15 in Asian trade

USD/JPY: the pair fell to Y120.20

GBP/USD: the pair traded within $1.5185-10

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:15 U.S. FOMC Member Tarullo Speaks

12:30 U.S. Personal spending August 0.3% 0.3%

12:30 U.S. Personal Income, m/m August 0.4% 0.4%

12:30 U.S. PCE price index ex food, energy, Y/Y August 1.2%

12:30 U.S. PCE price index ex food, energy, m/m August 0.1% 0.1%

12:30 U.S. FOMC Member Dudley Speak

14:00 U.S. Pending Home Sales (MoM) August 0.5% 0.5%

17:30 U.S. FOMC Member Charles Evans Speaks

21:00 U.S. FOMC Member Williams Speaks

-

08:11

Options levels on monday, September 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1322 (1916)

$1.1273 (1201)

$1.1240 (557)

Price at time of writing this review: $1.1178

Support levels (open interest**, contracts):

$1.1149 (1395)

$1.1108 (5368)

$1.1048 (4020)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 54766 contracts, with the maximum number of contracts with strike price $1,1500 (4933);

- Overall open interest on the PUT options with the expiration date October, 9 is 70678 contracts, with the maximum number of contracts with strike price $1,1000 (6995);

- The ratio of PUT/CALL was 1.29 versus 1.29 from the previous trading day according to data from September, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.5501 (1676)

$1.5403 (1085)

$1.5305 (586)

Price at time of writing this review: $1.5192

Support levels (open interest**, contracts):

$1.5094 (1692)

$1.4997 (1987)

$1.4898 (1092)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 23549 contracts, with the maximum number of contracts with strike price $1,5500 (1676);

- Overall open interest on the PUT options with the expiration date October, 9 is 22933 contracts, with the maximum number of contracts with strike price $1,5200 (2749);

- The ratio of PUT/CALL was 0.97 versus 1.00 from the previous trading day according to data from September, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:02

Japan: Coincident Index, July 113.1 (forecast 112.2)

-

07:01

Japan: Leading Economic Index , July 105 (forecast 104.9)

-

07:01

Japan: Leading Economic Index , July 105 (forecast 104.9)

-

00:49

Currencies. Daily history for Sep 25’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1192 +0,16%

GBP/USD $1,5178 -0,26%

USD/CHF Chf0,979 +0,09%

USD/JPY Y120,57 +0,27%

EUR/JPY Y134,93 +0,42%

GBP/JPY Y183 +0,02%

AUD/USD $0,7026 +0,64%

NZD/USD $0,6382 +0,99%

USD/CAD C$1,3332 -0,03%

-

00:00

Schedule for today, Monday, Sep 28’2015:

(time / country / index / period / previous value / forecast)

05:00 Japan Coincident Index (Finally) July 112.3 112.2

05:00 Japan Leading Economic Index (Finally) July 106.5 104.9

09:15 U.S. FOMC Member Tarullo Speaks

11:45 U.S. FOMC Member Dudley Speak

12:30 U.S. Personal spending August 0.3% 0.3%

12:30 U.S. Personal Income, m/m August 0.4% 0.4%

12:30 U.S. PCE price index ex food, energy, Y/Y August 1.2%

12:30 U.S. PCE price index ex food, energy, m/m August 0.1% 0.1%

12:30 U.S. FOMC Member Dudley Speak

14:00 U.S. Pending Home Sales (MoM) August 0.5% 0.5%

17:30 U.S. FOMC Member Charles Evans Speaks

21:00 U.S. FOMC Member Williams Speaks

-