Noticias del mercado

-

17:46

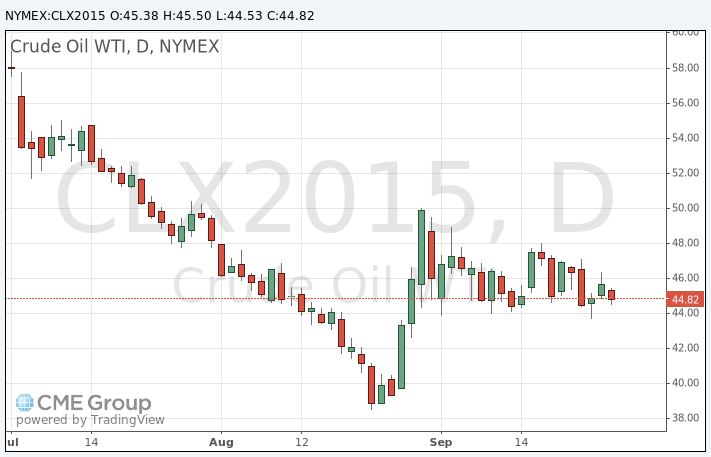

Oil prices fall on concerns over the global oil oversupply and over a slowdown in the global economy

Oil prices declined on concerns over the global oil oversupply and over a slowdown in the global economy. China's economic data added to concerns over the situation around the Chinese economy. China's National Bureau of Statistics (NBS) said on Monday that profits of industrial companies in China declined 8.8% in August from a year earlier. It was the biggest drop October 2011.

Profits in the coal mining sector dropped 64.9%, while oil and gas profits slid 67.3%.

For the first eight months of 2015, industrial profits fell 1.9% from a year earlier.

International Monetary Fund (IMF) Managing Director Christine Lagarde in an interview with Les Echos that the IMF is likely to cut its global growth forecasts due to a slowdown in emerging economies.

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 4 rigs to 640 last week. It was the fourth consecutive decrease.

Combined oil and gas rigs fell by 4 to 838.

WTI crude oil for November delivery decreased to $44.53 a barrel on the New York Mercantile Exchange.

Brent crude oil for October declined to $48.44 a barrel on ICE Futures Europe.

-

17:22

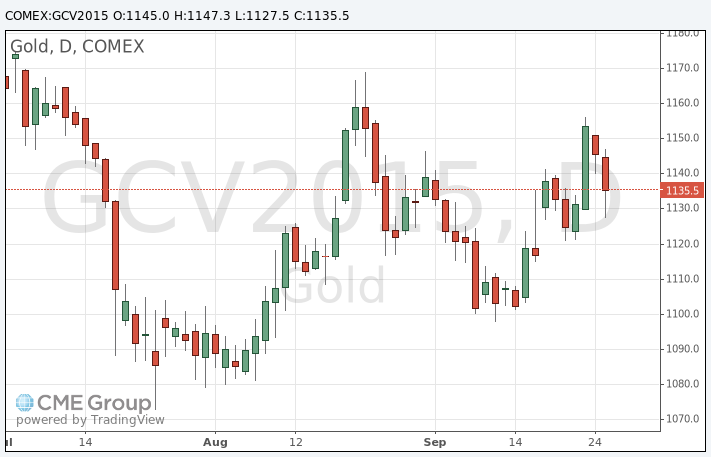

Gold price declines on the speculation on the interest rate hike by the Fed this year

Gold price drops on the speculation on the interest rate hike by the Fed this year. Fed Chairwoman Janet Yellen said in a speech at the University of Massachusetts on Thursday that she expects that the Fed will start raising its interest rates by the end of the year, followed by a gradual pace of interest rate hikes.

Today's U.S. economic data was mixed. The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending rose 0.4% in August, exceeding expectations for a 0.3% gain, after a 0.4% increase in July. July's figure was revised up from a 0.3% increase.

Consumer spending makes more than two-thirds of U.S. economic activity. This data showed that the U.S. economy continues to strengthen despite a slowdown abroad.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in August, in line with forecasts, after a 0.1% gain in July.

On a yearly basis, the PCE price index excluding food and index increased to 1.3% in August from 1.2% in July.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. slid 1.4% in August, missing expectations for a 0.5% gain, after a 0.5% rise in July.

October futures for gold on the COMEX today declined to 1127.50 dollars per ounce.

-

11:03

Profits of industrial companies in China drop 8.8% in August

China's National Bureau of Statistics (NBS) said on Monday that profits of industrial companies in China declined 8.8% in August from a year earlier. It was the biggest drop October 2011.

Profits in the coal mining sector dropped 64.9%, while oil and gas profits slid 67.3%.

For the first eight months of 2015, industrial profits fell 1.9% from a year earlier.

-

10:21

Standard & Poor's cuts its price forecasts for Brent and WTI crude oil

Standard & Poor's (S&P) lowered its price forecasts for Brent and WTI crude oil on Friday. The agency expects Brent crude oil to be $50 in 2015, down from the previous estimate of $55, and WTI crude oil to be $45 in 2015, down from the previous estimate of $50. Brent crude oil in 2016 is expected to be $55, while WTI crude oil in 2016 is expected to be $50.

It will take longer for prices to recover, the agency said.

-

10:11

The number of active U.S. rigs declines by 4 rigs to 640 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 4 rigs to 640 last week. It was the fourth consecutive decrease.

Combined oil and gas rigs fell by 4 to 838.

-

08:33

Oil prices declined

West Texas Intermediate futures for November delivery fell to $45.19 (-1.12%), while Brent crude fell to $48.09 (-1.05%) as investors focused on weak global growth outlook and ignored declines in the number of drilling rigs in the U.S.

IMF head Christine Lagarde said that growth forecasts might be revised down. "A forecast of 3.3% growth this year is no longer realistic. (Neither is) a forecast of 3.8% for next year. We will however remain above the 3% threshold," she told Les Echos newspaper in an interview.

The latest data from China intensified concerns over economy of the world's second-biggest oil consumer. Profits of China's industrial companies fell 8.8% in August from the same month last year, and January to August profits were down 1.9%.

Meanwhile the number of drilling rigs fell for the fourth consecutive week in the U.S.

-

08:31

Gold steady at the beginning of the week

Gold is currently at $1,144.90 (-0.06%) near Friday's close level. Fed monetary policy will remain in focus today as several officials from the central bank are scheduled to speak this week.

In her latest speech Fed Chair Janet Yellen said that the U.S. economy was improving and that a rate hike before the end of the year was still probable. Data released on Friday supported this opinion. U.S. gross domestic product rose by 3.9% y/y in the second quarter compared to a 3.7% growth pace in the first quarter.

Higher interest rates would decrease demand for non-yielding bullion.

-

00:53

Commodities. Daily history for Sep 25’2015:

(raw materials / closing price /% change)

Oil 45.34-0.79%

Gold 1,145.50-0.01%

-