Noticias del mercado

-

22:30

U.S. stocks closed

U.S. stocks tumbled toward the worst levels of last month's selloff as global equities slid amid a rout in commodity and biotechnology shares.

The Standard & Poor's 500 Index fell 2.6 percent to 1,881.85 at 4 p.m. in New York, down for a fifth consecutive session to a one-month low. The Russell 2000 Index slumped 2.9 percent to an 11-month low.

"We are in a chaotic market, lots of volatility but not making much progress in either direction," said James Gaul, a portfolio manager at Boston Advisors LLC, which oversees $2.8 billion. "Earnings are going to be really important this quarter considering the macro backdrop and general global fears as well as the concerns about the Fed potentially raising interest rates as early as next month."

The S&P 500 is down 8.8 percent in the third quarter, poised for its worst fall since 2011. The benchmark is almost 12 percent below its all-time high set in May. The Chicago Board Options Exchange Volatility Index has closed above 20 for the past 26 sessions, the longest streak since January 2012.

Equity markets have been turbulent in recent weeks amid confusion over the Federal Reserve's tightening policy and concern over a slowdown in Asia. Data today showed profits of Chinese industrial companies fell the most since the country's government began compiling data in 2011. Biotechnology shares tumbled on Friday, offsetting gains fueled by Fed Chair Janet Yellen's reassurances that turbulence in emerging markets won't harm U.S. growth.

Federal Reserve Bank of New York President William C. Dudley said today the central bank will "probably" raise interest rates later this year despite uncertainties over global growth. "I think that the economy is doing pretty well," Dudley said at an event in New York. He said he expected growth in the second half will be "a little bit weaker" than in the first half.

A report today showed household spending climbed more than forecast in August and incomes also rose as the biggest part of the U.S. economy continued to power past a global slowdown. Separate data showed contract signings to purchase previously owned U.S. homes unexpectedly declined in August for just the second time this year, signaling residential real estate might have difficulty building on recent momentum.

The Nasdaq Biotech Index slid into a bear market on Friday amid its worst weekly decline in four years. The rout was sparked by a tweet last Monday from Democratic presidential hopeful Hillary Clinton suggesting there may be "price gouging" in the market for prescription drugs. The group had rallied 56 percent from an October low to an all-time high on July 20, and has since plunged 27 percent.

Stocks fell after the Fed's decision to hold off raising rates on Sept. 17 raised questions about the impact of a global growth slowdown on the U.S. Despite Yellen signaling last week that the economy is sturdy enough to handle higher raise rates in 2015, traders are pricing in a 41 percent probability of the event in December and a 48 percent chance in January.

-

21:00

DJIA 16010.15 -304.52 -1.87%, NASDAQ 4545.06 -141.43 -3.02%, S&P 500 1883.09 -48.25 -2.50%

-

18:00

European stocks close: stocks closed lower on concerns over a slowdown in the global economy

Stock indices closed lower on concerns over a slowdown in the global economy. China's economic data added to concerns over the situation around the Chinese economy. China's National Bureau of Statistics (NBS) said on Monday that profits of industrial companies in China declined 8.8% in August from a year earlier. It was the biggest drop October 2011.

Profits in the coal mining sector dropped 64.9%, while oil and gas profits slid 67.3%.

For the first eight months of 2015, industrial profits fell 1.9% from a year earlier.

International Monetary Fund (IMF) Managing Director Christine Lagarde in an interview with Les Echos that the IMF is likely to cut its global growth forecasts due to a slowdown in emerging economies.

According to official results, the secessionist party "Junts pel Si" (Together for Yes) won 62 of 135 seats in Catalonia's parliament in an election on Sunday, while the leftist pro-independence Popular Unity Candidacy (CUP) party won 10 seats.

Pro-independence parties have an absolute majority in the parliament.

"Catalans have voted yes to independence," the Catalan President Artur Mas said.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,958.86 -150.15 -2.46 %

DAX 9,483.55 -204.98 -2.12 %

CAC 40 4,357.05 -123.61 -2.76 %

-

18:00

European stocks closed: FTSE 5958.86 -150.15 -2.46%, DAX 9483.55 -204.98 -2.12%, CAC 40 4357.05 -123.61 -2.76%

-

17:59

WSE: Session Results

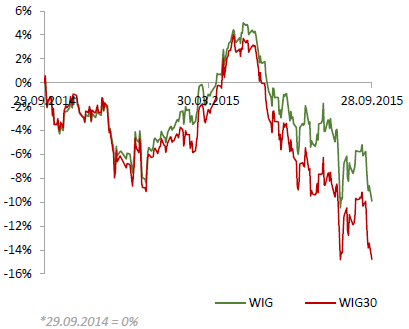

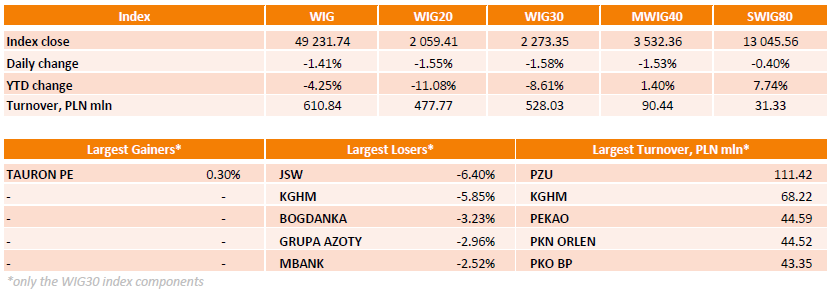

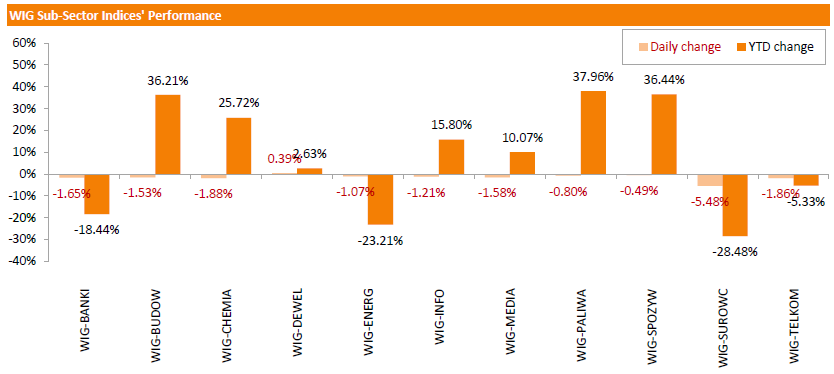

Polish equity market closed lower on Monday. The broad market measure, the WIG Index, fell by 1.41%. All sectors, but for constructions (+0.39%) posted negative daily returns. Materials sector (-5.48%) was the worst performer amid sliding commodity prices.

The large-cap stocks lost 1.58%, as measured by the WIG30 Index. TAURON PE (WSE: TPE) was the sole advancer among the index's components. The stock inched up 0.3%. At the same time, JSW (WSE: JSW) and KGHM (WSE: KGH) were hit the hardest, losing 6.40% and 5.85% respectively. They were followed by BOGDANKA (WSE: LWB), GRUPA AZOTY (WSE: ATT), MBANK (WSE: MBK) and ORANGE POLSKA (WSE: OPL), which slumped by 2.47%-3.23%.

-

17:29

International Monetary Fund (IMF) Managing Director Christine Lagarde: the IMF is likely to cut its global growth forecasts due to a slowdown in emerging economies

International Monetary Fund (IMF) Managing Director Christine Lagarde in an interview with Les Echos that the IMF is likely to cut its global growth forecasts due to a slowdown in emerging economies.

"We are in a recovery process whose pace is decelerating. There is a shift between emerging countries and developed countries," she said.

Lagarde pointed out that forecasts of 3.3% growth this year and 3.8% next year are no longer realistic. She expect the global economic growth to be above the 3% threshold.

-

17:16

Italian consumer confidence index climbs to 112.7 in September

The Italian statistical office ISTAT released its consumer confidence index for Italy on Monday. The Italian consumer confidence index climbed to 112.7 in September from 109.3 in August. August's figure was revised up from 109.0.

The increase was driven by rises in economic expectations subindex.

The business confidence index climbed to 104.2 in September from 102.7 in August. August's figure was revised up from 102.5.

-

16:43

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Monday after data showed a better-than-expected increase in consumer spending in August, adding to the case for an interest rate increase this year. New York Federal Reserve President William Dudley added to the expectations of an early rate increase, suggesting the central bank could pull the trigger as soon as in October. Federal Reserve Chair Janet Yellen has said she expects rates to be raised this year.

Almost all of Dow stocks in negative area (26 of 30). Top looser - The Goldman Sachs Group, Inc. (GS, -2.58%). Top gainer - Intel Corporation (INTC, +1.28%).

All of S&P index sectors also in negative area. Top looser - Basic Materials (-2.8%).

At the moment:

Dow 16049.00 -154.00 -0.95%

S&P 500 1897.50 -21.75 -1.13%

Nasdaq 100 4155.50 -58.00 -1.38%

10 Year yield 2,12% -0,05

Oil 45.25 -0.45 -0.98%

Gold 1133.60 -12.00 -1.05%

-

16:33

European Central Bank purchases €11.16 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €11.16 billion of government and agency bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.99 billion of covered bonds, and €759 million of asset-backed securities.

-

16:22

U.S. pending home sales plunge 1.4% in August

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. slid 1.4% in August, missing expectations for a 0.5% gain, after a 0.5% rise in July.

The decline was partly lead by a drop in the Northeast.

"Pending sales have levelled off since mid-summer, with buyers being bounded by rising prices and few available and affordable properties within their budget. Even with existing-housing supply barely budging all summer and no relief coming from new construction, contract activity is still higher than earlier this year and a year ago," the NAR's chief economist Lawrence Yun said.

-

16:12

New York Federal Reserve Bank President William Dudley: the Fed could still start raising its interest rates this year

New York Federal Reserve Bank President William Dudley said in an interview with The Wall Street Journal on Monday that the Fed could still start raising its interest rates this year. He added that the interest rate hike in October is also possible.

Dudley pointed out that the timing when to start raising interest rates depends on the incoming economic data.

New York Federal Reserve Bank president expect that the inflation in the U.S. would move back toward the target over time as weak global economy and the strong U.S. dollar would not permanently weigh on the inflation.

-

15:35

U.S. Stocks open: Dow +0.07%, Nasdaq +0.01%, S&P +0.02%Dow -0.69%, Nasdaq -0.77%, S&P -0.71%

-

15:29

Before the bell: S&P futures -0.48%, NASDAQ futures -0.53%

U.S. index futures fall with raw-materials poised for retreat.

Nikkei 17,645.11 -235.40 -1.32%

Shanghai Composite 3,100.99 +8.65 +0.28%

FTSE 6,009.51 -99.50 -1.63%

CAC 4,388.28 -92.38 -2.06%

DAX 9,559.88 -128.65 -1.33%

Crude oil $44.82 (-1.93%)

Gold $1127.90 (-1.53%)

-

15:21

Moody's confirms Greece's government bond rating at Caa3

Moody's Investors Service has confirmed Greece's government bond rating at Caa3 from Caa2 on Friday. The agency upgraded Greece's outlook to stable.

Moody's said that it confirmed the rating due "to the approval of the third bailout programme, and the emergence of a political configuration that is slightly more supportive".

The agency noted that the outlook was upgraded because the risks to creditors are now broadly balanced.

-

15:09

Member of the Executive Board of the European Central Bank (ECB) Sabine Lautenschläger: it is too early to discuss the expansion of the asset-buying programme

Member of the Executive Board of the European Central Bank (ECB), Sabine Lautenschläger, said on Monday that it is too early to discuss the expansion of the asset-buying programme. She added that the central bank's economic forecasts did not change.

-

15:02

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALCOA INC.

AA

9.58

5.62%

888.8K

Yahoo! Inc., NASDAQ

YHOO

29.35

0.76%

22.1K

Merck & Co Inc

MRK

49.70

0.20%

1.9K

Apple Inc.

AAPL

114.90

0.17%

875.2K

Citigroup Inc., NYSE

C

50.62

0.14%

35.6K

Hewlett-Packard Co.

HPQ

24.95

-0.24%

0.8K

Tesla Motors, Inc., NASDAQ

TSLA

256.13

-0.30%

13.2K

HONEYWELL INTERNATIONAL INC.

HON

93.21

-0.33%

343.1K

Procter & Gamble Co

PG

72.38

-0.40%

1.1K

Visa

V

70.40

-0.41%

0.3K

Travelers Companies Inc

TRV

99.50

-0.41%

0.1K

Wal-Mart Stores Inc

WMT

63.52

-0.41%

0.4K

AT&T Inc

T

32.19

-0.43%

10.3K

Pfizer Inc

PFE

31.75

-0.44%

10.8K

Cisco Systems Inc

CSCO

25.90

-0.48%

6.8K

Facebook, Inc.

FB

92.32

-0.49%

27.0K

Verizon Communications Inc

VZ

44.00

-0.50%

7.4K

Johnson & Johnson

JNJ

90.52

-0.53%

0.7K

ALTRIA GROUP INC.

MO

54.50

-0.53%

2.0K

General Motors Company, NYSE

GM

29.25

-0.54%

0.8K

General Electric Co

GE

24.78

-0.56%

15.8K

Nike

NKE

124.30

-0.56%

4.9K

Microsoft Corp

MSFT

43.69

-0.57%

2.3K

The Coca-Cola Co

KO

39.39

-0.58%

2.7K

Amazon.com Inc., NASDAQ

AMZN

521.07

-0.61%

7.8K

Intel Corp

INTC

28.63

-0.62%

5.8K

Walt Disney Co

DIS

99.67

-0.63%

8.1K

Google Inc.

GOOG

608.00

-0.65%

0.7K

International Business Machines Co...

IBM

144.40

-0.70%

0.5K

Goldman Sachs

GS

178.50

-0.74%

23.1K

Caterpillar Inc

CAT

64.50

-0.74%

0.8K

Ford Motor Co.

F

13.43

-0.74%

3.8K

JPMorgan Chase and Co

JPM

61.00

-0.76%

5.4K

Boeing Co

BA

130.00

-0.77%

0.3K

Starbucks Corporation, NASDAQ

SBUX

57.53

-0.79%

1.2K

Exxon Mobil Corp

XOM

72.60

-0.86%

6.0K

Yandex N.V., NASDAQ

YNDX

10.59

-0.94%

12.9K

UnitedHealth Group Inc

UNH

115.05

-1.13%

1K

Chevron Corp

CVX

76.75

-1.22%

0.2K

Twitter, Inc., NYSE

TWTR

24.97

-1.27%

17.3K

Home Depot Inc

HD

114.28

-2.11%

0.8K

Barrick Gold Corporation, NYSE

ABX

6.37

-3.04%

5.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.43

-3.78%

70.6K

-

14:56

Upgrades and downgrades before the market open

Upgrades:

Citigroup (C) upgraded to Buy from Hold at Jefferies

Citigroup (C) upgraded to Outperform from Neutral at Credit Suisse

Downgrades:

Other:

FedEx (FDX) removed from US 1 List at BofA/Merrill

-

14:53

U.S. personal spending climbs 0.4% in August

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending rose 0.4% in August, exceeding expectations for a 0.3% gain, after a 0.4% increase in July. July's figure was revised up from a 0.3% increase.

Consumer spending makes more than two-thirds of U.S. economic activity. This data showed that the U.S. economy continues to strengthen despite a slowdown abroad.

Personal spending was partly driven by higher demand for automobiles. Spending on auto mobiles rose 0.9% in August.

The saving rate declined to 4.6% in August from 4.7% in July.

Personal income increased 0.3% in August, missing expectations for a 0.4% rise, after a 0.5% gain in July. July's figure was revised up from a 0.4% increase.

Wages and salaries climbed 0.5% in August, after a 0.6% rise in July.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in August, in line with forecasts, after a 0.1% gain in July.

On a yearly basis, the PCE price index excluding food and index increased to 1.3% in August from 1.2% in July.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:32

Fed Governor Daniel Tarullo: the U.S economy has got “a fair amount of momentum right now”

Fed Governor Daniel Tarullo said in Paris on Monday that the U.S economy has got "a fair amount of momentum right now", but the Fed closely monitors risks to the momentum. He noted that the European economy was retrenching effectively.

Tarullo also said that costs of financial crisis are still being felt today.

-

12:00

European stock markets mid session: stocks traded lower on concerns over a slowdown in the Chinese economy

Stock indices traded lower on concerns over a slowdown in the Chinese economy. China's National Bureau of Statistics (NBS) said on Monday that profits of industrial companies in China declined 8.8% in August from a year earlier. It was the biggest drop October 2011.

Profits in the coal mining sector dropped 64.9%, while oil and gas profits slid 67.3%.

For the first eight months of 2015, industrial profits fell 1.9% from a year earlier.

According to official results, the secessionist party "Junts pel Si" (Together for Yes) won 62 of 135 seats in Catalonia's parliament in an election on Sunday, while the leftist pro-independence Popular Unity Candidacy (CUP) party won 10 seats.

Pro-independence parties have an absolute majority in the parliament.

"Catalans have voted yes to independence," the Catalan President Artur Mas said.

Current figures:

Name Price Change Change %

FTSE 100 6,029.34 -79.67 -1.30 %

DAX 9,527.54 -160.99 -1.66 %

CAC 40 4,398.43 -82.23 -1.84 %

-

11:24

Japan’s leading index falls 105.0 in July

Japan's Cabinet Office released its final leading economic index on Monday. The leading index in Japan plunged 105.0 in July from 106.7 in June, up from the preliminary estimate of 104.9.

The coincident index was down to 113.1 from 113.3, up from the preliminary estimate of 112.2.

-

11:03

Profits of industrial companies in China drop 8.8% in August

China's National Bureau of Statistics (NBS) said on Monday that profits of industrial companies in China declined 8.8% in August from a year earlier. It was the biggest drop October 2011.

Profits in the coal mining sector dropped 64.9%, while oil and gas profits slid 67.3%.

For the first eight months of 2015, industrial profits fell 1.9% from a year earlier.

-

10:50

Bank of Japan (BoJ) Governor Haruhiko Kuroda: the central bank will adjust its asset-buying programme if needed

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in Osaka on Monday that the central bank will adjust its asset-buying programme if needed.

"If risks materialize and lead to changes in trend inflation, the BOJ won't hesitate to adjust policy as needed to achieve its price target at the earliest possible time," he said.

Kuroda also pointed out that the interest rate hike by the Fed will not have a negative impact on the global economy.

"Fears that U.S. rate normalization would trigger a massive, sharp outflow of funds from emerging economies and disrupt the global economy appear to be receding somewhat," the BoJ governor said.

Kuroda noted that a weaker yen hurts smaller companies and households by higher import costs.

-

10:33

Pro-independence parties win an absolute majority in Catalonia's parliament

According to official results, the secessionist party "Junts pel Si" (Together for Yes) won 62 of 135 seats in Catalonia's parliament in an election on Sunday, while the leftist pro-independence Popular Unity Candidacy (CUP) party won 10 seats.

Pro-independence parties have an absolute majority in the parliament.

"Catalans have voted yes to independence," the Catalan President Artur Mas said.

-

08:28

Global Stocks: U.S. indices declined

U.S. stock indices mostly closed down on Friday despite opening gains. Biotech and health-care stocks led declines. The Dow managed to end the session with a moderate gain due to an 8.9% increase in prices of Nike Inc. shares. Early Friday gains were generated by optimism after Fed Chair Janet Yellen said Thursday that the U.S. economy strengthened.

The Dow Jones Industrial Average rose 113.35 points, or 0.7%, to 16,314.67 (-0.4% over the week). The S&P 500 declined 0.90, or 005%, to 1,931.34 (-1.4% over the week). The Nasdaq Composite Index lost 47.98, or 1%, to 4,686.50 (-2.9% over the week).

This morning in Asia China Shanghai Composite Index fell 0.30%, or 9.31 point, to 3,083.04. The Nikkei lost 1.14%, or 203.43, to 17,677.08. Hong Kong markets are on holiday.

Japanese stocks declined amid profit taking.

Chinese stocks are weighed by economic data. Pessimism is driven by a survey from Caixin, which showed that China's Manufacturing PMI declined to 47 (the lowest level in 6.5 years) in September.

-

04:06

Nikkei 225 17,688.44 -192.07 -1.07 %, Hang Seng 21,186.32 +90.34 +0.43 %, Shanghai Composite 3,078.94 -13.41 -0.43 %

-

00:52

Stocks. Daily history for Sep 25’2015:

(index / closing price / change items /% change)

Nikkei 225 17,880.51 +308.68 +1.76 %

Hang Seng 21,186.32 +90.34 +0.43 %

S&P/ASX 200 5,042.11 -29.56 -0.58 %

Shanghai Composite 3,091.81 -50.88 -1.62 %

FTSE 100 6,109.01 +147.52 +2.47 %

CAC 40 4,480.66 +133.42 +3.07 %

Xetra DAX 9,688.53 +260.89 +2.77 %

S&P 500 1,931.34 -0.90 -0.05 %

NASDAQ Composite 4,686.5 -47.98 -1.01 %

Dow Jones Industrial Average 16,314.67 +113.35 +0.70 %

-