Noticias del mercado

-

22:07

U.S. stocks rallied

U.S. stocks rallied in September's final session, with the Standard & Poor's 500 Index rising the most in three weeks, bringing traders some comfort as equities trimmed their worst quarterly decline since 2011.

Investors targeted their buying in some of the third quarter's most-battered companies. Energy, raw-material and health-care shares were among the leaders of the S&P 500's 10 main groups after falling the most since June. All 10 industries in the benchmark advanced Wednesday, while a gauge of volatility had its steepest decline in more than a week.

Investors should expect between $21 billion and $26 billion in buying of equities and some selling of bonds as pension-fund managers rebalance their portfolios at the end of the quarter, Boris Rjavinski, a strategist at UBS AG, wrote in a Sept. 25 report.

The S&P 500 Index climbed 1.9 percent to 1,919.50 at 4 p.m. in New York, the most in three weeks after snapping a five-day losing streak Tuesday. The measure ended September down 2.7 percent.

Mixed messages on Federal Reserve interest-rate policy combined with worries of a China slowdown have put the S&P 500 on track for consecutive monthly declines while creating the most turbulent period for stocks in years. The benchmark is down 10 percent from its record set in May, and came within five points Tuesday of its 2015 closing low reached in August. This quarter's retreat has wiped almost $11 trillion off the value of global shares.

As policy makers closely watch the strength of labor markets for potential cues on when to raise rates, a report today showed companies stepped up hiring in September, indicating the job market is standing firm in the face of weaker global demand.

The September jobs report issued by the Labor Department Friday may show private businesses added about 200,000 employees after a 140,000 increase in August, according to the median forecast of economists surveyed by Bloomberg. The unemployment rate probably held at 5.1 percent, the lowest since April 2008.

-

21:00

DJIA 16241.78 192.65 1.20%, NASDAQ 4604.86 87.54 1.94%, S&P 500 1913.11 29.02 1.54%

-

18:42

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Wednesday, helped by gains in technology stocks, but the three major indexes were set for their worst quarter since 2011. The third quarter was rocked by highly volatile trading due to fears of slowing growth in China. Adding to the uncertainty, the U.S. Federal Reserve held off on raising rates at its September meeting. Investors will be keen to put the bruising quarter behind them and look ahead to the third-quarter earnings season, which begins next week.

Most of all of Dow stocks in positive area (25 of 30). Top looser - 3M Company (MMM, -0.60%). Top gainer - Chevron Corporation (CVX, +2.93%).

All of S&P index sectors in positive area. Top gainer - Basic Materials (+1,5%).

At the moment:

Dow 16077.00 +128.00 +0.80%

S&P 500 1893.25 +18.75 +1.00%

Nasdaq 100 4130.50 +55.75 +1.37%

10 Year yield 2,05% +0,00

Oil 45.33 +0.10 +0.22%

Gold 1115.30 -11.50 -1.02%

-

18:05

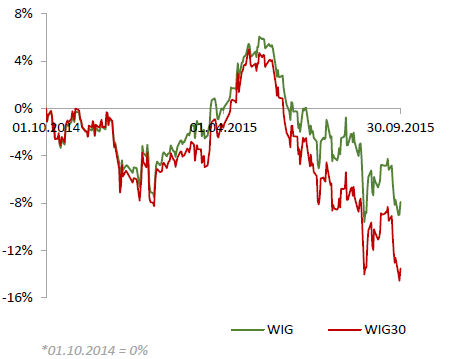

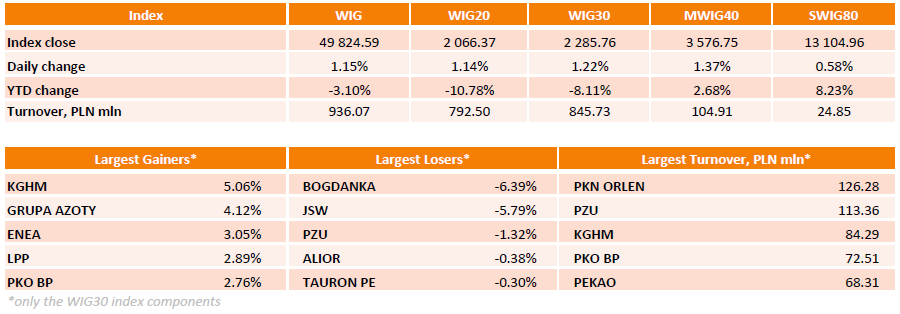

WSE: Session Results

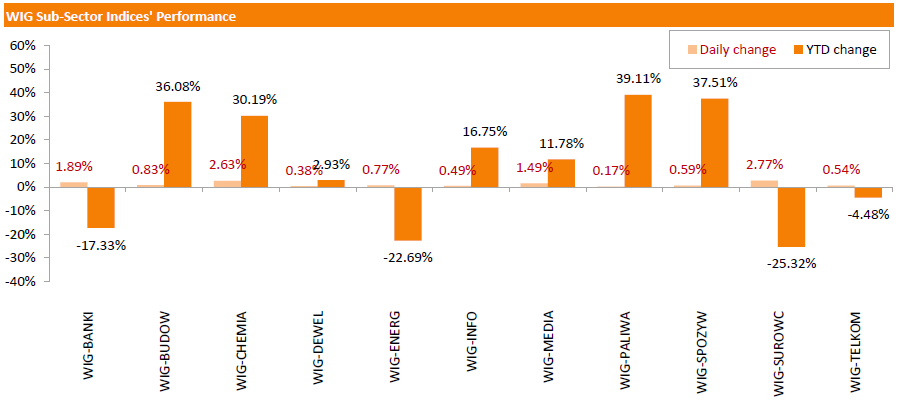

Polish equity market rebounded on Wednesday. The broad market measure, the WIG Index, added 1.15%. All sectors in the WIG gained, with materials (+2.77%) and chemicals (+2.63%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced by 1.22%. Within the indicator's components, KGHM (WSE: KGH) and GRUPA AZOTY (WSE: ATT) were the biggest advancers, gaining 5.06% and 4.12% respectively. Other major benefitors were ENEA (WSE: ENA), LPP (WSE: LPP), PKO BP (WSE: PKO) and EUROCASH (WSE: EUR), adding 2.71%-3.05%. On the other side of the ledger, BOGDANKA (WSE: LWB) was the worst-performing stock, correcting downwards by 6.39% after a significant surge, which was recorded earlier this month. It was followed by another coal miner JSW (WSE: JSW), which plunged by 5.79%.

-

18:00

European stocks closed: FTSE 6061.61 152.37 2.58%, DAX 9660.44 210.04 2.22%, CAC 40 4455.29 111.56 2.57%

-

17:59

European stocks close: stocks followed Asian markets and closed higher

Stock indices followed Asian markets and closed higher, ending the worst quarter in four years.

Meanwhile, the economic data from the Eurozone was mostly negative. Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone declined to an annual rate of -0.1% in September from 0.1% in August, missing expectations for a fall to 0.0%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in September.

Food, alcohol and tobacco prices were up 1.4% in September, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.3%, while energy prices dropped 8.9%.

Eurozone's unemployment rate remained unchanged at 11.0% in August. July's figure was revised up from 10.9%. Analysts had expected the unemployment rate to fall to 10.9%.

The Federal Labour Agency released its unemployment figures for Germany on Wednesday. The number of unemployed people in Germany climbed by 2,000 in September, missing expectations for a 5,000 decline, after a 6,000 decrease in August.

The number of unemployed people was 1.90 million in August, according to Destatis.

Destatis said that Germany's adjusted unemployment rate fell to 4.5% in August from 4.6% in July.

According to Destatis, German adjusted retail sales decreased 0.4% in August, missing forecasts of a 0.2% gain, after a 1.6% rise in July. July's figure was revised up from a 1.4% increase.

On a yearly basis, German retail sales jumped 2.5% in August, missing expectations for a 3.1% gain, after a 3.8% rise in July. July's figure was revised up from a 3.3% increase.

Sales of non-food products increased at an annual rate of 1.1% in August, while sales of food products climbed by 3.9%.

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Wednesday. The final U.K. GDP expanded at 0.7% in the second quarter, in line with August's estimate, after a 0.4% rise in the first quarter.

On a yearly basis, the revised U.K. GDP rose 2.4% in the second quarter, missing August's estimate of a 2.6% increase, after a 2.7% gain in the first quarter. The first quarter's figure was revised down from a 2.9% rise

The downward revision was partly driven by a slower pace of the services sector. The service sector climbed 0.2% in July, compared with a 0.6% rise in June.

The U.K. current account deficit narrowed to £16.8 billion in the second quarter from £24.0 billion in the first quarter. The first quarter's figure was revised up from a deficit of £26.6 billion.

Analysts had expected the current account deficit to decrease to £22.25 billion.

The second quarter's current account deficit amounted to 3.6% of GDP, the lowest share of GDP in two years.

Declines in the current account deficit were driven by a drop in the deficit on the trade account and a decline in the deficit on the primary income account.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,061.61 +152.37 +2.58 %

DAX 9,660.44 +210.04 +2.22 %

CAC 40 4,455.29 +111.56 +2.57 %

-

17:34

The World Trade Organization downgrades its world trade forecasts for this and next year

The World Trade Organization (WTO) said on Wednesday that the world trade expected to climb 2.8% in 2015, down its April's estimate of a 3.3% growth. The WTO pointed out that there are risks to the growth outlook.

"These include a sharper-than-expected slowdown in emerging and developing economies, the possibility of destabilizing financial flows from an eventual interest rate rise by the US Federal Reserve, and unanticipated costs associated with the migration crisis in Europe," the WTO said.

The world trade in 2016 is expected to rise by 3.9%, down its April's estimate of a 4.0% increase.

-

17:21

Private sector credit in Australia rises 0.6% in August

The Reserve Bank of Australia (RBA) released its private sector credit data on Wednesday. The total value of private sector credit in Australia rose 0.6% in August, exceeding expectations for a 0.5% gain, after a 0.6% increase in July.

Housing credit increased 0.6% in August, personal credit was up 0.1%, while business credit rose 0.5%.

On a yearly basis, the private sector credit in Australia jumped 6.3% in August, after a 6.1% in July.

-

17:05

European Central Bank (ECB) Governing Council member Ardo Hansson: it is too early to discuss the expansion of the asset-buying programme

European Central Bank (ECB) Governing Council member Ardo Hansson said on Wednesday that it is too early to discuss the expansion of the asset-buying programme.

"We are still in the initial phase of the program," he said.

Hansson added that the asset-buying programme could be changed, depending "on developments in inflation".

-

16:48

ANZ: New Zealand’s business confidence index declines 18.9% in September

The Australia and New Zealand Banking Group (ANZ) released its business confidence index for New Zealand on Wednesday. New Zealand's business confidence index declined 18.9% in September, after a 29.1 drop in August.

"The economy found a bungy cord attached, with the fall in business confidence being arrested," ANZ senior economist Philip Borkin said.

-

16:25

Building permits in Australia slide 6.9% in August

The Australian Bureau of Statistics released its building permits data on Wednesday. Building permits in Australia dropped 6.9% in August, missing expectations for a 2.0% gain, after a 7.9% rise in July. July's figure was revised up from a 4.2% increase.

On a yearly basis, building permits climbed 5.1% in August, after a revised 17.9% increase in July.

Building permits for private sector houses jumped 4.9% in August, while building permits for private sector dwellings excluding houses slid 11.4%.

The seasonally adjusted estimate of the value of total building approved was down 5.6% in August, after a 9.2% increase in the previous month.

-

16:10

Chicago purchasing managers' index falls to 48.7 in September

The Institute for Supply Management released its Chicago purchasing managers' index on Wednesday. The Chicago purchasing managers' index declined to 48.7 in September from 54.4 in August, missing expectations for a decrease to 53.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decline was driven by drops in production and in new orders. The production index plunged to 43.6 in September from 59.0 in August, the lowest level since July 2009, while the new orders index was down to 49.5 from 56.7.

The employment index rose to 52.3 in September from 49.1 in August.

"While activity between Q2 and Q3 actually picked up, the scale of the downturn in September following the recent global financial fallout is concerning. Disinflationary pressures intensified and output was down very sharply. We await the October data to better judge whether this was a knee jerk reaction and there is a bounceback, or whether it represents a more fundamental slowdown," Chief Economist of MNI Indicators Philip Uglow said.

-

15:59

Producer prices in Italy decrease 0.7% in August

The Italian statistical office Istat released its producer price inflation data for Italy on Wednesday. Italian producer prices decreased 0.7% in August, after a 0.5% decline in July.

Producer price declined by 0.7% on domestic market and by 0.4% on non-domestic market in August.

On a yearly basis, Italian PPI fell 2.9% in August, after a 2.3% drop in July.

Producer price slid 3.6% on domestic market and by 0.8% on non-domestic market in August.

-

15:34

U.S. Stocks open: Dow +1.06%, Nasdaq +1.48%, S&P +1.14%

-

15:26

Before the bell: S&P futures +1.19%, NASDAQ futures +1.25%

U.S. stock-index futures jumped, mirroring a rebound in equities around the world.

Nikkei 17,388.15 +457.31 +2.70%

Hang Seng 20,846.3 +289.70 +1.41%

Shanghai Composite 3,053.32 +15.19 +0.50%

FTSE 6,030.18 +120.94 +2.05%

CAC 4,456.91 +113.18 +2.61%

DAX 9,674.02 +223.62 +2.37%

Crude oil $44.98 (-0.53%)

Gold $1117.90 (-0.83%)

-

15:15

Preliminary consumer prices in Italy decrease 0.3% in September

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Wednesday. Preliminary consumer prices in Italy fell 0.3% in September, after a 0.2% rise August.

The decline was mainly driven by a drop in services prices related to transport, which decreased 4.0% in September.

On a yearly basis, consumer prices climbed 0.3% in September, after a 0.2% increase in August.

The increase was driven by a rise in unprocessed food, which climbed 3.4% year-on-year in September.

Consumer price inflation excluding unprocessed food and energy prices increased to 0.8% year-on-year in September from 0.7% in August.

-

15:05

French producer prices decrease 0.9% in August

French statistical office INSEE released its producer price index (PPI) data on Wednesday. French producer prices decreased 0.9% in August, after a 0.1% decline in July.

The decline was driven a fall in prices for refined petroleum products, which were down 12.5% in August.

On a yearly basis, French PPI fell 2.1% in August, after a 1.6% drop in July.

Import prices plunged 1.5% in August, after a 1.1% fall in July.

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

3M Co

MMM

143.02

1.04%

0.2K

Goldman Sachs

GS

174.00

1.25%

1.9K

American Express Co

AXP

74.02

1.26%

1.7K

AT&T Inc

T

32.37

0.94%

134.7K

Visa

V

69.40

1.27%

1.3K

Boeing Co

BA

130.23

1.15%

0.4K

Caterpillar Inc

CAT

65.10

1.23%

1.5K

Chevron Corp

CVX

76.81

0.73%

3.7K

Cisco Systems Inc

CSCO

25.93

1.13%

10.0K

E. I. du Pont de Nemours and Co

DD

48.00

1.05%

3.9K

Exxon Mobil Corp

XOM

73.55

0.79%

8.8K

General Electric Co

GE

24.80

0.94%

34.0K

Nike

NKE

120.85

0.99%

2.3K

Home Depot Inc

HD

114.36

1.28%

2.0K

Intel Corp

INTC

29.50

0.89%

9.6K

International Business Machines Co...

IBM

143.63

0.81%

0.9K

Johnson & Johnson

JNJ

93.94

0.97%

0.1K

JPMorgan Chase and Co

JPM

60.50

1.10%

0.9K

McDonald's Corp

MCD

98.00

0.53%

0.6K

Merck & Co Inc

MRK

49.34

1.42%

0.5K

Microsoft Corp

MSFT

43.85

0.94%

53.6K

Pfizer Inc

PFE

31.30

0.90%

9.1K

Procter & Gamble Co

PG

73.00

1.00%

2.7K

The Coca-Cola Co

KO

39.93

0.68%

1.9K

United Technologies Corp

UTX

88.75

0.88%

2.6K

Verizon Communications Inc

VZ

43.78

0.57%

14.2K

Wal-Mart Stores Inc

WMT

64.44

1.03%

1.9K

Walt Disney Co

DIS

100.90

1.49%

14.5K

ALCOA INC.

AA

9.59

1.48%

23.5K

Apple Inc.

AAPL

110.22

1.06%

440.4K

Barrick Gold Corporation, NYSE

ABX

6.13

-1.29%

14.0K

AMERICAN INTERNATIONAL GROUP

AIG

56.10

0.68%

0.2K

Amazon.com Inc., NASDAQ

AMZN

504.00

1.60%

20.5K

Citigroup Inc., NYSE

C

49.61

1.24%

22.3K

Deere & Company, NYSE

DE

74.50

1.20%

0.1K

Ford Motor Co.

F

13.35

1.52%

82.8K

Facebook, Inc.

FB

88.33

1.92%

72.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.37

2.85%

102.9K

General Motors Company, NYSE

GM

29.81

2.26%

42.4K

Google Inc.

GOOG

603.89

1.50%

5.4K

Hewlett-Packard Co.

HPQ

24.95

1.22%

8.4K

International Paper Company

IP

38.00

1.63%

0.1K

ALTRIA GROUP INC.

MO

54.66

0.79%

3.2K

Starbucks Corporation, NASDAQ

SBUX

56.40

1.22%

4.1K

Tesla Motors, Inc., NASDAQ

TSLA

252.98

2.57%

18.6K

Twitter, Inc., NYSE

TWTR

25.92

1.29%

23.3K

Yahoo! Inc., NASDAQ

YHOO

28.81

1.95%

7.5K

Yandex N.V., NASDAQ

YNDX

11.05

2.60%

2.6K

-

15:00

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Verizon (VZ) target lowered to $48 from $51 at RBC Capital Mkts

-

14:53

Canada's GDP rises 0.3% in July

Statistics Canada released GDP (gross domestic product) growth data on Wednesday. Canada's GDP growth rose 0.3% in July, exceeding expectations for a 0.2% increase, after a 0.4% gain in June.

The increase was driven by rises in mining, quarrying, and oil and gas extraction, manufacturing, and the finance and insurance sector.

The mining, quarrying and oil and gas extraction sector rose 2.9% in July, manufacturing output increased 0.6%, while the finance and insurance sector climbed 0.8%.

-

14:42

ADP report: private sector adds 200,000 jobs in September

Private sector in the U.S. added 200,000 jobs in September, according the ADP report on Wednesday. August's figure was revised down to 186,000 jobs from a previous reading of 190,000 jobs.

Analysts expected the private sector to add 194,000 jobs.

Services sector added 188,000 jobs in September, while manufacturing sector lost 15,000.

"The U.S. job machine continues to produce jobs at a strong and consistent pace. Despite job losses in the energy and manufacturing industries, the economy is creating close to 200,000 jobs per month. At this pace full employment is fast approaching," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.1% in September. The U.S. economy is expected to add 202,000 jobs in September, after adding 173,000 jobs in August.

-

14:33

French consumer spending is flat in August

French statistical office INSEE released its consumer spending data on Wednesday. French consumer spending was flat in August, after a 0.3% gain in July.

Spending on food was down 0.2% in August, while spending on energy rose 0.4%.

On a yearly basis, consumer spending climbed 1.6% in August.

-

14:19

Nationwide: UK house prices rise 0.5% in September

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.5% in September, exceeding expectations for a 0.4% rise, after a 0.4% increase in August.

On a yearly basis, house prices rose to 3.8% in September from 3.2% in August, in line with expectations.

"The data in recent months provides some encouragement that the pace of house price increases may be stabilising close to the pace of earnings growth. However, the risk remains that construction activity will lag behind strengthening demand, putting upward pressure on house prices and eventually reducing affordability," Nationwide's chief economist, Robert Gardner, said.

-

14:12

Italy’s unemployment rate decreases to 11.9% in August, the lowest level since February 2013

The Italian statistical office Istat released its unemployment data on Wednesday. The seasonally adjusted unemployment rate decreased to 11.9% in August from 12.0 in July. It was the lowest level since February 2013.

The number of unemployed people was 3.061 million in August, down by 0.4% from the month before.

The youth unemployment rate climbed to 40.7% in August from 40.4% in July.

The employment rate increased to 56.5% in August from 56.3% in July.

-

12:04

European stock markets mid session: stocks traded higher, recovering yesterday’s losses despite the mostly negative economic data from the Eurozone

Stock indices traded higher, recovering yesterday's losses despite the mostly negative economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone declined to an annual rate of -0.1% in September from 0.1% in August, missing expectations for a fall to 0.0%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in September.

Food, alcohol and tobacco prices were up 1.4% in September, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.3%, while energy prices dropped 8.9%.

Eurozone's unemployment rate remained unchanged at 11.0% in August. July's figure was revised up from 10.9%. Analysts had expected the unemployment rate to fall to 10.9%.

The Federal Labour Agency released its unemployment figures for Germany on Wednesday. The number of unemployed people in Germany climbed by 2,000 in September, missing expectations for a 5,000 decline, after a 6,000 decrease in August.

The number of unemployed people was 1.90 million in August, according to Destatis.

Destatis said that Germany's adjusted unemployment rate fell to 4.5% in August from 4.6% in July.

According to Destatis, German adjusted retail sales decreased 0.4% in August, missing forecasts of a 0.2% gain, after a 1.6% rise in July. July's figure was revised up from a 1.4% increase.

On a yearly basis, German retail sales jumped 2.5% in August, missing expectations for a 3.1% gain, after a 3.8% rise in July. July's figure was revised up from a 3.3% increase.

Sales of non-food products increased at an annual rate of 1.1% in August, while sales of food products climbed by 3.9%.

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Wednesday. The final U.K. GDP expanded at 0.7% in the second quarter, in line with August's estimate, after a 0.4% rise in the first quarter.

On a yearly basis, the revised U.K. GDP rose 2.4% in the second quarter, missing August's estimate of a 2.6% increase, after a 2.7% gain in the first quarter. The first quarter's figure was revised down from a 2.9% rise

The downward revision was partly driven by a slower pace of the services sector. The service sector climbed 0.2% in July, compared with a 0.6% rise in June.

The U.K. current account deficit narrowed to £16.8 billion in the second quarter from £24.0 billion in the first quarter. The first quarter's figure was revised up from a deficit of £26.6 billion.

Analysts had expected the current account deficit to decrease to £22.25 billion.

The second quarter's current account deficit amounted to 3.6% of GDP, the lowest share of GDP in two years.

Declines in the current account deficit were driven by a drop in the deficit on the trade account and a decline in the deficit on the primary income account.

Current figures:

Name Price Change Change %

FTSE 100 6,033.81 +124.57 +2.11 %

DAX 9,676.65 +226.25 +2.39 %

CAC 40 4,454.63 +110.90 +2.55 %

-

11:57

KOF leading indicator for Switzerland declines to 100.4 in September

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Wednesday. The KOF leading indicator declined to 100.4 in September from 101.2 in August, missing expectations for a decline to 100.9. July's figure was revised up from 100.7.

According to the institute, the outlook for the Swiss economy remained unchanged since August.

"Overall, slightly positive tendencies in the international environment are counterbalanced by slightly negative developments primarily in the manufacturing as well as construction sectors. With the indicators capturing tendencies in domestic consumption and banking sector stabilising at their previous readings, the overall result is a minor decrease in the Barometer," the KOF said.

-

11:53

UBS consumption index rises to 1.63 in August

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.63 in August from 1.59 in July. July's figure was revised down from 1.64.

The increase was driven by a rise in employment in the second quarter.

Retailer sentiment was slightly less negative, while consumer sentiment rose.

-

11:45

U.K. current account deficit narrows to £16.8 billion in the second quarter

The U.K.'s National Statistics Office (ONS) released its current account data for the U.K. on Wednesday. The U.K. current account deficit narrowed to £16.8 billion in the second quarter from £24.0 billion in the first quarter. The first quarter's figure was revised up from a deficit of £26.6 billion.

Analysts had expected the current account deficit to decrease to £22.25 billion.

The second quarter's current account deficit amounted to 3.6% of GDP, the lowest share of GDP in two years.

Declines in the current account deficit were driven by a drop in the deficit on the trade account and a decline in the deficit on the primary income account.

-

11:36

German adjusted retail sales are down 0.4% in August

Destatis released its retail sales for Germany on Wednesday. German adjusted retail sales decreased 0.4% in August, missing forecasts of a 0.2% gain, after a 1.6% rise in July. July's figure was revised up from a 1.4% increase.

On a yearly basis, German retail sales jumped 2.5% in August, missing expectations for a 3.1% gain, after a 3.8% rise in July. July's figure was revised up from a 3.3% increase.

Sales of non-food products increased at an annual rate of 1.1% in August, while sales of food products climbed by 3.9%.

-

11:30

Eurozone's unemployment rate remains unchanged at 11.0% in August

Eurostat released its unemployment data for the Eurozone on Wednesday. Eurozone's unemployment rate remained unchanged at 11.0% in August. July's figure was revised up from 10.9%.

Analysts had expected the unemployment rate to fall to 10.9%.

There were 17.603 million unemployed in the Eurozone in August, down from 17.604 million in July.

The lowest unemployment rate in the Eurozone in August was recorded in Germany (4.5%), and the highest in Greece (25.2% in June 2015) and Spain (22.2%).

The youth unemployment rate was 22.3% in the Eurozone in August, compared to 23.6% in August a year ago.

-

11:18

Preliminary consumer price inflation in the Eurozone declines to -0.1% in September

Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone declined to an annual rate of -0.1% in September from 0.1% in August, missing expectations for a fall to 0.0%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in September.

Food, alcohol and tobacco prices were up 1.4% in September, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.3%, while energy prices dropped 8.9%.

-

11:11

Final U.K. GDP grows at 0.7% in the second quarter

The Office for National Statistics (ONS) released its final gross domestic product (GDP) data on Wednesday. The final U.K. GDP expanded at 0.7% in the second quarter, in line with August's estimate, after a 0.4% rise in the first quarter.

On a yearly basis, the revised U.K. GDP rose 2.4% in the second quarter, missing August's estimate of a 2.6% increase, after a 2.7% gain in the first quarter. The first quarter's figure was revised down from a 2.9% rise

The downward revision was partly driven by a slower pace of the services sector. The service sector climbed 0.2% in July, compared with a 0.6% rise in June.

-

10:56

Number of unemployed people in Germany climbs by 2,000 in September

The Federal Labour Agency released its unemployment figures for Germany on Wednesday. The number of unemployed people in Germany climbed by 2,000 in September, missing expectations for a 5,000 decline, after a 6,000 decrease in August.

The number of unemployed people was 1.90 million in August, according to Destatis.

Destatis said that Germany's adjusted unemployment rate fell to 4.5% in August from 4.6% in July.

-

10:47

Preliminary industrial production in Japan declines 0.5% in August

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Tuesday evening. Preliminary industrial production in Japan declined 0.5% in August, missing expectations for a 1.0% increase, after a 0.8% drop in July.

The decline was driven by general-purpose, production and business oriented machinery, electrical machinery and transport equipment.

On a yearly basis, Japan's industrial production was up 0.2% in August, after a flat reading in July.

-

10:43

Retail sales in Japan climb 0.8% in August

According to the Ministry of Economy, Trade and Industry, retail sales in Japan climbed at an annual rate of 0.8% in August, missing expectations for a 1.1% rise, after a 1.8% gain in July. July's was revised up from a 1.6% rise.

Sales at large-scale retailers increased 1.8% year-on-year in August.

Domestic consumption remained sluggish.

-

10:23

European Central Bank Governing Council member Jens Weidmann: concerns over the deflation in the Eurozone dissipated

The European Central Bank Governing Council member Jens Weidmann said on Tuesday that concerns over the deflation in the Eurozone dissipated.

"Worries about deflation, which were then exaggerated, have further dissipated," he said.

Weidmann pointed out that an accommodative monetary policy is needed in the Eurozone.

"Therefore a normalization of monetary policy in the Eurozone is currently not on the agenda," he noted.

-

10:10

European Central Bank Governing Council member Ewald Nowotny: the Eurozone needs a monetary union

The European Central Bank Governing Council member Ewald Nowotny said on Tuesday that the Eurozone needs a monetary union and not a currency union. He added that the Eurozone needs a governance reform.

-

08:16

Global Stocks: U.S. indices mostly climbed on macroeconomic data

U.S. stock indices mostly closed higher on Tuesday as favorable consumer confidence data served as a sign that the U.S. economy got stronger.

The Dow Jones Industrial Average rose 47.24 points, or 0.3%, to 16,049.13. The S&P 500 climbed 2.32, or 0.1%, to 1,884.09. The Nasdaq Composite Index lost 26.65, or 0.6%, to 4,517.32.

A report by the Conference Board showed that the U.S. consumer confidence index rose to 103.0 in September from 101.5 in August (revised from 101.3), while economists had expected a reading of 96.1 points. 25.1% of respondents said that there were enough jobs (vs 22.1% in the previous month).

Nevertheless stocks of mining companies declined further worldwide amid concerns about China's economy. On Thursday Markit Economics will publish its September report on economic activity in China. It will help investor to assess the situation.

This morning in Asia Hong Kong Hang Seng rose 1.42%, or 291.84, to 20,848.44. China Shanghai Composite Index advanced 0.70%, or 21.23 points, to 3,059.36. The Nikkei jumped 2.75%, or 465.93, to 17,396.77.

Asian stocks climbed following improvements in U.S. markets. However many analysts say that Nikkei's growth is just a correction after yesterday's decline, because recent economic data suggest weakness of the Japanese economy.

Japanese Ministry of Economy, Trade and Industry reported that the country's industrial production fell by 0.5% m/m in August, while retail sales fell by 0.8% y/y in the same month.

-

04:08

Nikkei 225 17,276.34 +345.50 +2.04 %, Hang Seng 20,819.32 +262.72 +1.28 %, Shanghai Composite 3,057.81 +19.68 +0.65 %

-

00:29

Stocks. Daily history for Sep 29’2015:

(index / closing price / change items /% change)

Hang Seng 20,556.6 -629.72 -2.97 %

S&P/ASX 200 4,918.43 -195.07 -3.81 %

Shanghai Composite 3,036.77 -63.98 -2.06 %

Topix 1,375.5 2 -63.15 -4.39 %

FTSE 100 5,909.24 -49.62 -0.83 %

CAC 40 4,343.73 -13.32 -0.31 %

Xetra DAX 9,450.4 -33.15 -0.35 %

S&P 500 1,884.09 +2.32 +0.12 %

NASDAQ Composite 4,517.32 -26.65 -0.59 %

Dow Jones 16,049.13 +47.24 +0.30 %

-