Noticias del mercado

-

21:00

U.S.: Consumer Credit , December 14.8 (forecast 15.1)

-

17:34

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the mixed U.S. labour market data

The U.S. dollar traded higher against the most major currencies after the mixed U.S. labour market data. The U.S. economy added 257,000 jobs in January, exceeding expectations for a rise of 231,000 jobs, after a gain of 329,000 jobs in December. December's figure was revised up from a rise of 252,000 jobs.

The U.S. unemployment rate rose to 5.7% in January from 5.6% in December as the number of job seekers grew. Analysts had expected the unemployment rate to remain unchanged at 5.6%.

Average hourly earnings increased 0.5% in January, beating forecasts of a 0.2% gain, after a 0.2% drop in December.

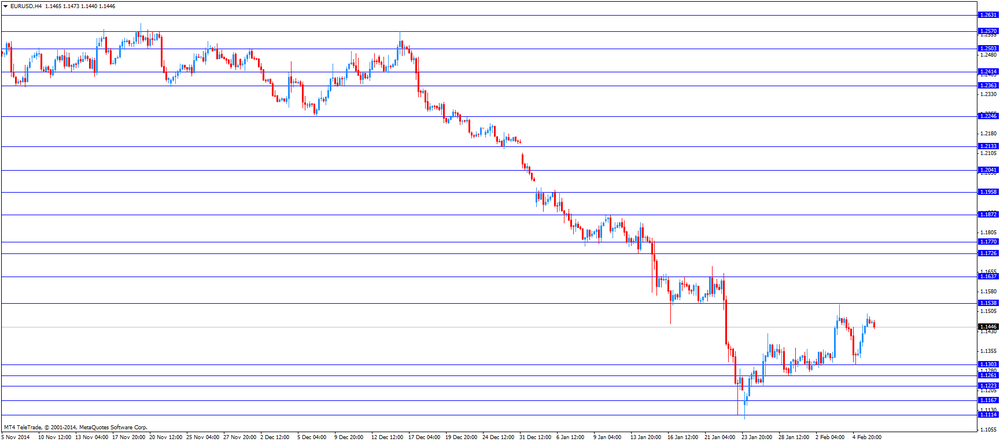

The euro fell against the U.S. dollar. Concerns over Greece's further bailout policy still weighed on the euro.

German industrial production increased 0.1% in December, missing forecasts of a 0.4% rise, after a 0.1% gain in November. November's figure was revised up from a 0.1% decrease.

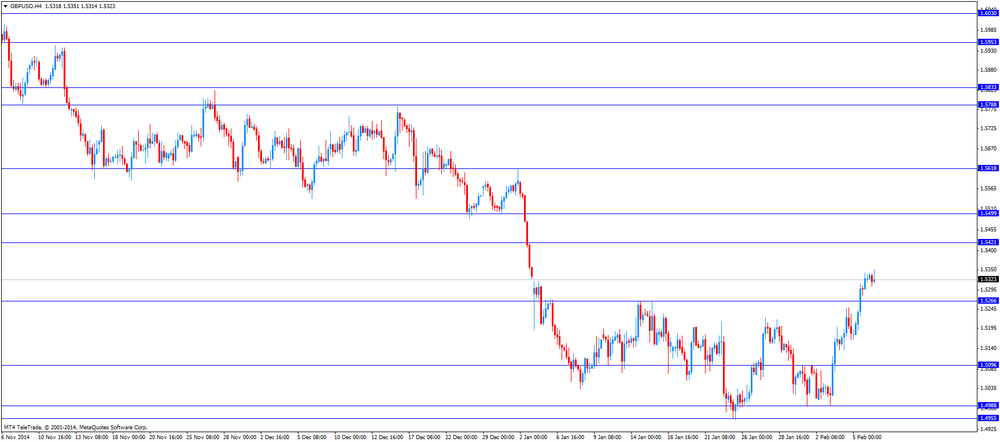

The British pound declined against the U.S. dollar. The U.K. trade deficit increased to £10.2 billion in December from £9.3 billion in November, missing expectations for a deficit of £9.0 billion. November's figure was revised down from a deficit of £8.85 billion.

The Canadian dollar decreased against the U.S. dollar despite the better-than-expected Canadian labour market data. Canada's unemployment rate decreased to 6.6% in January from 6.7% in December. December's figure was revised down from 6.6%. Analysts had expected the unemployment rate to remain unchanged.

The number of employed people increased by 35,400 in January, exceeding expectations for a gain of 5,100, after a 11,300 decline in December. December's figure was revised down from a 4,300 fall.

The increase was driven by part-time jobs.

Building permits in Canada climbed 7.7% in December, exceeding expectations for a 4.5% gain, after a 13.6% drop in November. November's figure was revised up from a 13.8% decrease.

The Swiss franc traded lower against the U.S. dollar. Retail sales in Switzerland increased at an annual rate of 2.2% in December, exceeding expectations for a 0.4% rise, after a 0.6% decline in November. November's figure was revised up from a 1.2% drop.

The Swiss National Bank's foreign exchange reserves increased to 498.398 billion Swiss francs in January from 495.130 billion francs in December. That might be the result of the Swiss National Bank's (SNB) intervention in currency markets last month.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any major economic reports from New Zealand. Markets in New Zealand were closed for a public holiday.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after the Reserve Bank of Australia's (RBA) released its quarterly Statement of Monetary Policy. The RBA revised its forecast for GDP growth and inflation.

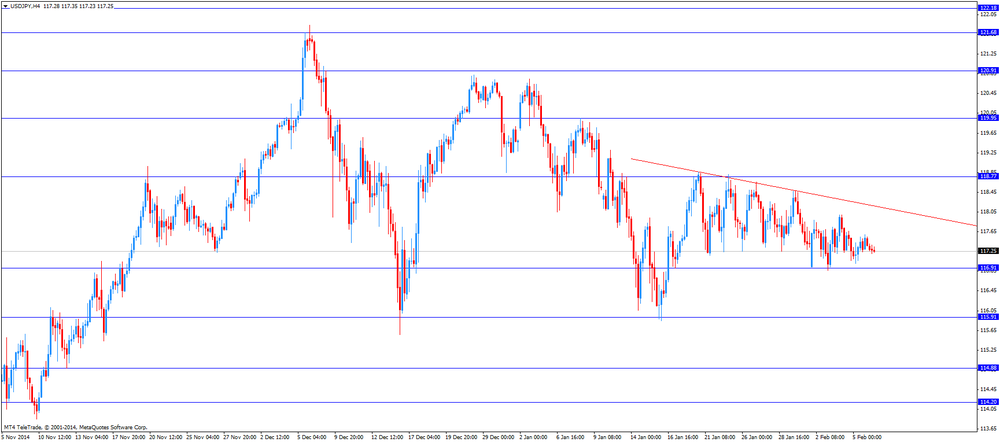

The Japanese yen dropped against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback. Japan's leading economic index increased to 105.2 in December from 103.9 in November, missing expectations for a rise to 105.5.

Japan's coincident index rose to 110.7 in December from 109.2 in November.

-

16:57

Reserve Bank of Australia cuts its growth forecasts

The Reserve Bank of Australia (RBA) released its quarterly Statement of Monetary Policy on Friday. The RBA revised its forecast for GDP growth for the year to June to 2.25%, compared with 2-3% in the RBA's previous estimate. The forecast for 2015 was lowered by 0.25% to 2.25% - 3.25 %.

GDP in 2015 was revised to 2.25% - 3.25%, down from 2.50% - 3.50%.

The growth at the end of the December 2016 was upgraded to between 3% - 4% from 2.75% - 4.25%.

The RBA downgraded its inflation forecast for the year to June to 1.25%, down from its previous estimate of 1.5% - 2.5%.

The RBA cut its interest rate to a new record low of 2.25% this week, down from 2.50%. The RBA said that the Aussie remains overvalued.

The central bank said today that the country's economy grew below trend in the second half of 2014.

-

16:05

Building permits in Canada rose 7.7% in December

Statistics Canada released housing market data on Friday. Building permits in Canada climbed 7.7% in December, exceeding expectations for a 4.5% gain, after a 13.6% drop in November. November's figure was revised up from a 13.8% decrease.

Building permits for non-residential construction climbed 22.9% in November, while permits in the residential sector remained unchanged.

-

15:54

Canada’s number of employed people rose by 35,400 in January, driven by part-time jobs

Statistics Canada released the labour market data on Friday. Canada's unemployment rate decreased to 6.6% in January from 6.7% in December. December's figure was revised down from 6.6%. Analysts had expected the unemployment rate to remain unchanged.

The number of employed people increased by 35,400 in January, exceeding expectations for a gain of 5,100, after a 11,300 decline in December. December's figure was revised down from a 4,300 fall.

The increase was driven by part-time jobs. Full-time employment in January fell by 11,800 jobs, while part-time work surged by 47,200.

Self-employment grew by 41,100.

In 2014 as whole, the pace of job growth in Canada was the slowest since 2009.

The labour participation rate fell to 65.7% in January, the lowest since 2000.

-

15:22

U.S. unemployment rate rose to 5.7% in January, 257,000 jobs were added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 257,000 jobs in January, exceeding expectations for a rise of 231,000 jobs, after a gain of 329,000 jobs in December. December's figure was revised up from a rise of 252,000 jobs.

The strongest job gains showed retail trade, construction and health care.

The U.S. unemployment rate rose to 5.7% in January from 5.6% in December as the number of job seekers grew. Analysts had expected the unemployment rate to remain unchanged at 5.6%.

Average hourly earnings increased 0.5% in January, beating forecasts of a 0.2% gain, after a 0.2% drop in December.

The labour-force participation rate rose to 62.9% in January.

These figures are signs that the labour market in the U.S. is strengthening. But the Fed might delay to hike its interest rate due to the weak wage growth figures and low inflation.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E455mn), $1.1380(E275mn), $1.1400(E1.03bn), $1.1450(E752mn), $1.1500(E1.63bn), $1.1600(E1.25n)

USD/JPY: Y115.50($3.0bn), Y117.00($1.53bn), Y118.00($475mn), Y118.25($300mn), Y118.50($310mn), Y119.50($650mn)

GBP/USD: $1.5175-95(Gbp250mn), $1.5300(Gbp200mn)

EUR/NOK: Nok7.58(E414mn)

NZD/USD: $0.7630(NZ$600mn)

USD/CAD: C$1.2470($260mn), C$1.2500($230mn

-

14:31

Canada: Employment , January +35.4 (forecast +5.1)

-

14:31

Canada: Unemployment rate, January 6.6% (forecast 6.7%)

-

14:31

U.S.: Average hourly earnings , January +0.5% (forecast +0.3%)

-

14:30

U.S.: Nonfarm Payrolls, January 257 (forecast 231)

-

14:30

U.S.: Unemployment Rate, January 5.7% (forecast 5.6%)

-

14:30

Canada: Building Permits (MoM) , December +7.7% (forecast +4.5%)

-

14:12

U.K. trade deficit rose to £10.2 billion in December

The U.K. Office for National Statistics (ONS) released trade data on Friday. The U.K. trade deficit increased to £10.2 billion in December from £9.3 billion in November, missing expectations for a deficit of £9.0 billion. November's figure was revised down from a deficit of £8.85 billion.

The increase was driven by higher oil imports. Imports rose 2.7% in December as oil imports climbed 37.0%.

Exports were up 0.1% in December.

The deficit on trade in goods with EU nations declined in the previous month, while that with non-EU nations rose. A stronger pound and the sanctions on Russia weighed on exports.

In 2014, the overall trade deficit widened to £34.8 billion, the largest deficit since 2010.

-

14:01

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the weaker-than-expected U.K. trade data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand Bank holiday

00:30 Australia RBA Monetary Policy Statement

05:00 Japan Leading Economic Index December 103.9 105.5 105.2

05:00 Japan Coincident Index December 109.2 110.7

07:00 Germany Industrial Production s.a. (MoM) December +0.1% +0.4% +0.1%

07:00 Germany Industrial Production (YoY) December -0.5% -0.7%

08:00 Switzerland Foreign Currency Reserves January 495.1 498.4

08:15 Switzerland Retail Sales Y/Y December -0.6% +0.4% +2.2%

09:30 United Kingdom Trade in goods December -9.2 Revised From -8.8 -9.0 -10.2

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to remain unchanged at 5.6% in January.

The U.S. economy is expected to add 231,000 jobs in January.

The euro traded mixed against the U.S. dollar as concerns over Greece's further bailout policy still weighed on the euro.

German industrial production increased 0.1% in December, missing forecasts of a 0.4% rise, after a 0.1% gain in November. November's figure was revised up from a 0.1% decrease.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected U.K. trade data. The U.K. trade deficit increased to £10.2 billion in December from £9.3 billion in November, missing expectations for a deficit of £9.0 billion. November's figure was revised down from a deficit of £8.85 billion.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian labour market data. The unemployment rate in Canada is expected to rise to 6.7% in January from 6.6% in December.

Canada's economy is expected to add 5,100 jobs in January.

The Swiss franc traded higher against the U.S. dollar. Retail sales in Switzerland increased at an annual rate of 2.2% in December, exceeding expectations for a 0.4% rise, after a 0.6% decline in November. November's figure was revised up from a 1.2% drop.

The Swiss National Bank's foreign exchange reserves increased to 498.398 billion Swiss francs in January from 495.130 billion francs in December. That might be the result of the Swiss National Bank's (SNB) intervention in currency markets last month.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Building Permits (MoM) December -13.8% +4.5%

13:30 Canada Employment January -4.3 +5.1

13:30 Canada Unemployment rate January 6.6% 6.7%

13:30 U.S. Average hourly earnings January -0.2% +0.3%

13:30 U.S. Nonfarm Payrolls January 252 231

13:30 U.S. Unemployment Rate January 5.6% 5.6%

-

14:00

Orders

EUR/USD

Offers $1.1700, $1.1670/80, $1.1600, $1.1540/35

Bids $1.1300, $1.1260, $1.1220, $1.1200

GBP/USD

Offers $1.5500, $1.5400

Bids $1.5250, $1.5140, $1.5100, $1.5080, $1.4990/00

AUD/USD

Offers $0.8025, $0.8000, $0.7900, $0.7860

Bids $0.7700, $0.7625, $0.7600, $0.7500

EUR/JPY

Offers Y137.70, Y137.30, Y136.00, Y135.75, Y135.35

Bids Y133.70, Y132.35, Y132.00, Y130.15

USD/JPY

Offers Y119.00, Y118.50, Y118.00

Bids Y116.90, Y116.50, Y115.85

EUR/GBP

Offers stg0.7715, stg0.7700, stg0.7590, stg0.7510

Bids stg0.7440, stg0.7400

-

13:34

Swiss National Bank's foreign exchange reserves rose to 498.398 billion Swiss francs in January

The Swiss National Bank's foreign exchange reserves increased to 498.398 billion Swiss francs in January from 495.130 billion francs in December. December's figure was revised up from 495.104 billion francs.

Data indicates that the central bank may have intervened after discontinuing the 1.20 per euro exchange rate floor on January 15th.

The SNB declined to comment.

-

11:06

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1300(E455mn), $1.1380(E275mn), $1.1400(E1.03bn), $1.1450(E752mn), $1.1500(E1.63bn), $1.1600(E1.25n)

USD/JPY: Y115.50($3.0bn), Y117.00($1.53bn), Y118.00($475mn), Y118.25($300mn), Y118.50($310mn), Y119.50($650mn)

GBP/USD: $1.5175-95(Gbp250mn), $1.5300(Gbp200mn)

EUR/NOK: Nok7.58(E414mn)

NZD/USD: $0.7630(NZ$600mn)

USD/CAD: C$1.2470($260mn), C$1.2500($230mn

-

10:30

United Kingdom: Trade in goods , December -10.2 (forecast -9.0)

-

10:30

German Industrial Production growing below estimates

Data on German Industrial Production came in below estimates but rose for a fourth consecutive month, adding to expectations that Germany's economy is strengthening. Industrial Production in the Eurozone's biggest economy rose less-than expected last month to a seasonally adjusted annual rate of +0.1%, short of expectations of +0.4%. The preceding month figure was revised up from -0.1%. Year on year it declined by -0.7%, compared to a reading of -0.5% in the previous period.

-

10:20

Press Review: In oil price war, Gulf producers grab market share in Asia

BLOOMBERG

Deflation Risk in U.S. Seen Rivaling Euro Area: Chart of the Day

(Bloomberg) -- Deflation would be as much of an issue for the U.S. as it is for the euro region if consumer prices were tracked the same way, according to Albert Edwards, a global strategist at Societe Generale SA.

The CHART OF THE DAY helps illustrate how Edwards drew his conclusion, presented in a report yesterday. He tracked changes in the core U.S. consumer-price index, which excludes food and energy, and the CPI for shelter.

Core inflation in December was 1.6 percent, according to the Labor Department. That's 0.9 percentage point more than the euro region's comparable figure, as compiled by Eurostat. This gap disappears after bringing the U.S. figure into line with Eurostat's definition of housing, Edwards wrote.

"The deflationary fault line on which the U.S. sits is every bit as precarious as that of the euro zone, but is being disguised," the London-based strategist wrote. "The scales will soon lift from the market's eyes."

REUTERS

In oil price war, Gulf producers grab market share in Asia(Reuters) - Saudi Arabia's move to slash the price it charges in Asia for its oil this week to the lowest in more than a decade is the latest aggressive action by Gulf states to defend market share in the world's top oil consuming region.

A price war between producers has raged since Saudi Arabia and its Gulf OPEC allies last November chose to keep their taps open in a bid for market share over price, sending oil prices down more than a third to under $50 a barrel in just two months.

Since then, Gulf producers - including Saudi Arabia and the United Arab Emirates - have steadily increased shipments to Asia, helped by low production costs that allow aggressive discounts, at the expense of West African and Latin American supplies.

Source: http://www.reuters.com/article/2015/02/06/us-asia-gulf-crude-idUSKBN0LA0J720150206

REUTERS

With currency war threatening, speculators focus on Swedish crownFeb 5 (Reuters) - Speculators are turning their attention to the Swedish crown, expecting it to weaken as Sweden reacts to the threat of a widening currency war in Europe.

Sweden's Riksbank might open fire as early as next week by cutting interest rates to less than zero and setting the stage for quantitative easing. But if those efforts fall short, analysts say, the central bank may need to intervene directly to weaken the crown.

The European Central Bank's 1.1 trillion-euro quantitative easing programme, announced last month, pushed the euro lower against a host of European currencies. In response, the Swiss National Bank abandoned its cap on the value of the franc and Denmark's central bank intervened in record amounts.

Source: http://www.reuters.com/article/2015/02/05/markets-forex-swedish-crown-idUSL6N0VD2TG20150205

-

09:33

RBA Monetary Policy Statement: lowered growth and inflation forecasts for 2015

The RBA lowered growth and inflation forecasts for 2015 in today's Monetary Policy Statement and stated that unemployment is going to rise. Economic growth is going to expand between 1.75% and 2.75% compared to the previous forecast of 2% to 3% in November. Inflation is projected to be around 1.25%, the previous forecast of the RBA was from 1.5% to 2.5%. Three days ago RBA's Governor Glenn Stevens's cut benchmark interest rates unexpectedly to a record low to 2.25% by 25 basis points as a consequence of slumping iron ore prices. Iron ore accounts for 20% of Australia's exports. A strong Australian dollar weighs on the country's export industry.

-

09:15

Switzerland: Retail Sales Y/Y, December +2.2% (forecast +0.4%)

-

09:01

Switzerland: Foreign Currency Reserves, January 498.

-

08:30

Foreign exchange market. Asian session: U.S. dollar lower against the most major currencies, small gains versus the euro, almost flat against sterling

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual00:00 New Zealand Bank holiday

00:30 Australia RBA Monetary Policy Statement

05:00 Japan Leading Economic Index December 103.9 105.5 105.2

05:00 Japan Coincident Index December 109.2 110.7

07:00 Germany Industrial Production s.a. (MoM) December -0.1% +0.4% +0.1%

07:00 Germany Industrial Production (YoY) December -0.5% -0.7%

The U.S. dollar traded lower against the most major currencies except for the euro that pauses after yesterday's gains and trading almost flat against the British pound. U.S. data from yesterday was mainly weaker-than-expected. The number of initial jobless claims in the week ending January 31 in the U.S. increased by 11,000 to 278,000. The U.S. trade deficit widened to $46.56 billion in December from a deficit of $39.75 billion in November, driven by falling oil prices, a stronger greenback and a strengthening U.S. economy. Productivity in the U.S. non-farm businesses fell at a 1.8% annual rate in the fourth quarter. Unit labour costs increased 2.7% in the fourth quarter, exceeding expectations for a 1.1% rise.

Today U.S. data on Average Hourly Earnings, Nonfarm Payrolls and the Unemployment rate followed by FOMC member Dennis Lockhart's speech will be in the focus.

The Australian dollar further recovered from a six-year low against the U.S. dollar hit on Monday. The RBA lowered growth and inflation forecasts for 2015 in its Monetary Policy Statement and stated that unemployment is going to rise. Economic growth is going to expand between 1.75% and 2.75% compared to the previous forecast of 2% to 3% in November. Inflation is projected to be around 1.25%, the previous forecast of the RBA was from 1.5% to 2.5%. Three days ago RBA's Governor Glenn Stevens's lowered rates as a consequence of slumping iron ore prices. Iron ore accounts to 20% of Australia's exports. A strong Australian dollar is threatening the export industry.

New Zealand's dollar continued to add gains for a sixth straight day against the greenback in Asian trade. The RBNZ Governor Graeme Wheeler said on Wednesday that interest rates will remain on hold "for some time". Today is a bank holiday in New Zealand.

The Japanese yen traded higher against the greenback on Friday. Japan's Leading Economic Index declined to 105.2 from a reading of 103.9. It was expected to rise to 105.5. The Coincident Index for December rose to 110.7 points with a previous reading of 109.2.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar lost against the yen

GPB/USD: Sterling traded almost flat against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland Foreign Currency Reserves January 495.1

08:15 Switzerland Retail Sales Y/Y December -1.2% +0.4%

09:30 United Kingdom Trade in goods December -8.8 -9.0

13:30 Canada Building Permits (MoM) December -13.8% +4.5%

13:30 Canada Employment January -4.3 +5.1

13:30 Canada Unemployment rate January 6.6% 6.7%

13:30 U.S. Average hourly earnings January -0.2% +0.3%

13:30 U.S. Nonfarm Payrolls January 252 231

13:30 U.S. Unemployment Rate January 5.6% 5.6%

17:45 U.S. FOMC Member Dennis Lockhart Speaks

20:00 U.S. Consumer Credit December 14.1 15.1

-

08:01

Germany: Industrial Production (YoY), December -0.7%

-

08:00

Germany: Industrial Production s.a. (MoM), December +0.1% (forecast +0.4%)

-

07:29

Options levels on friday, February 6, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1654 (1890)

$1.1572 (2585)

$1.1515 (3782)

Price at time of writing this review: $1.1466

Support levels (open interest**, contracts):

$1.1381 (4372)

$1.1295 (3164)

$1.1198 (3769)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 90387 contracts, with the maximum number of contracts with strike price $1,2100 (6528);

- Overall open interest on the PUT options with the expiration date February, 6 is 79308 contracts, with the maximum number of contracts with strike price $1,1700 (6658);

- The ratio of PUT/CALL was 0.88 versus 0.87 from the previous trading day according to data from February, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5600 (1355)

$1.5500 (611)

$1.5401 (654)

Price at time of writing this review: $1.5332

Support levels (open interest**, contracts):

$1.5297 (404)

$1.5199 (639)

$1.5100 (1509)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 18391 contracts, with the maximum number of contracts with strike price $1,5600 (1355);

- Overall open interest on the PUT options with the expiration date February, 6 is 18228 contracts, with the maximum number of contracts with strike price $1,4900 (2035);

- The ratio of PUT/CALL was 0.99 versus 1.00 from the previous trading day according to data from February, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:30

Japan: Leading Economic Index , December 105.2 (forecast 105.5)

-

06:30

Japan: Coincident Index, December 110.7

-

00:30

Currencies. Daily history for Feb 5’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1477 +1,16%

GBP/USD $1,5327 +0,95%

USD/CHF Chf0,9260 0,00%

USD/JPY Y117,52 +0,21%

EUR/JPY Y134,86 +1,35%

GBP/JPY Y180,1 +1,15%

AUD/USD $0,7796 +0,47%

NZD/USD $0,7394 +0,42%

USD/CAD C$1,2433 -1,17%

-

00:00

Schedule for today, Friday, Feb 6’2015:

(time / country / index / period / previous value / forecast)

00:00 New Zealand Bank holiday

00:30 Australia RBA Monetary Policy Statement

05:00 Japan Leading Economic Index December 103.9 105.5

05:00 Japan Coincident Index December 109.2

07:00 Germany Industrial Production s.a. (MoM) December -0.1% +0.4%

07:00 Germany Industrial Production (YoY) December -0.5%

08:00 Switzerland Foreign Currency Reserves January 495.1

08:15 Switzerland Retail Sales Y/Y December -1.2% +0.4%

09:30 United Kingdom Trade in goods December -8.8 -9.0

13:30 Canada Building Permits (MoM) December -13.8% +4.5%

13:30 Canada Employment January -4.3 +5.1

13:30 Canada Unemployment rate January 6.6% 6.7%

13:30 U.S. Average hourly earnings January -0.2% +0.3%

13:30 U.S. Nonfarm Payrolls January 252 231

13:30 U.S. Unemployment Rate January 5.6% 5.6%

17:45 U.S. FOMC Member Dennis Lockhart Speaks

20:00 U.S. Consumer Credit December 14.1 15.1

-