Noticias del mercado

-

21:01

S&P 500 2,063.42 +0.90 +0.04%, NASDAQ 4,763.94 -1.16 -0.02%, Dow 17,873.5 -11.38 -0.06%

-

18:00

European stocks close: stocks closed lower as concerns over Greece's further bailout policy weighed on markets

Stock indices traded lower as concerns over Greece's further bailout policy weighed on markets. The new Greece government plans to renegotiate the terms of its bailout.

German industrial production increased 0.1% in December, missing forecasts of a 0.4% rise, after a 0.1% gain in November. November's figure was revised up from a 0.1% decrease.

The U.K. trade deficit increased to £10.2 billion in December from £9.3 billion in November, missing expectations for a deficit of £9.0 billion. November's figure was revised down from a deficit of £8.85 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,853.44 -12.49 -0.18%

DAX 10,846.39 -59.02 -0.54%

CAC 40 4,691.03 -12.27 -0.26%

-

18:00

European stocks closed: FTSE 100 6,853.44 -12.49 -0.18 %, CAC 40 4,691.03 -12.27 -0.26 %, DAX 10,846.39 -59.02 -0.54 %

-

15:34

U.S. Stocks open: Dow +0.05%, Nasdaq -0.05%, S&P +0.03%

-

15:27

Before the bell: S&P futures +0.39%, Nasdaq futures +0.30%

U.S. stock-index futures rose after data showed employers added more jobs than forecast in January.

Global markets:

Nikkei 17,648.5 +143.88 +0.82%

Hang Seng 24,679.39 -86.10 -0.35%

Shanghai Composite 3,076.64 -59.89 -1.91%

FTSE 6,867.95 +2.02 +0.03%

CAC 4,695.21 -8.09 -0.17%

DAX 10,846.93 -58.48 -0.54%

Crude oil $51.97 (+2.99%)

Gold $1244.60 (-1.11%)

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Caterpillar Inc

CAT

83.60

+0.04%

4.2K

Amazon.com Inc., NASDAQ

AMZN

374.29

+0.11%

1.9K

Apple Inc.

AAPL

120.10

+0.13%

200.6K

Nike

NKE

93.49

+0.16%

2.0K

Johnson & Johnson

JNJ

102.62

+0.16%

0.9K

Walt Disney Co

DIS

102.80

+0.16%

6.7K

International Paper Company

IP

55.06

+0.16%

0.1K

International Business Machines Co...

IBM

157.07

+0.17%

5.5K

AT&T Inc

T

34.62

+0.23%

14.9K

Pfizer Inc

PFE

33.08

+0.27%

1.8K

Yahoo! Inc., NASDAQ

YHOO

43.68

+0.31%

17.1K

American Express Co

AXP

85.00

+0.32%

0.1K

Procter & Gamble Co

PG

86.98

+0.32%

0.6K

Visa

V

272.73

+0.34%

0.5K

Tesla Motors, Inc., NASDAQ

TSLA

221.75

+0.34%

17.0K

Facebook, Inc.

FB

75.88

+0.35%

6.3K

Starbucks Corporation, NASDAQ

SBUX

89.96

+0.36%

2.2K

Ford Motor Co.

F

15.91

+0.38%

13.9K

The Coca-Cola Co

KO

41.96

+0.41%

1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.67

+0.41%

7.6K

General Motors Company, NYSE

GM

36.40

+0.41%

6.2K

Microsoft Corp

MSFT

42.63

+0.42%

10.0K

Intel Corp

INTC

34.10

+0.47%

0.8K

Google Inc.

GOOG

530.25

+0.51%

0.8K

Exxon Mobil Corp

XOM

92.18

+0.56%

20.3K

General Electric Co

GE

24.64

+0.57%

7.0K

Chevron Corp

CVX

110.01

+0.64%

2.9K

Cisco Systems Inc

CSCO

27.45

+0.70%

5.5K

Goldman Sachs

GS

182.47

+0.94%

3.4K

Verizon Communications Inc

VZ

48.38

+1.09%

11.8K

Citigroup Inc., NYSE

C

49.30

+1.57%

45.2K

JPMorgan Chase and Co

JPM

57.70

+1.64%

0.8K

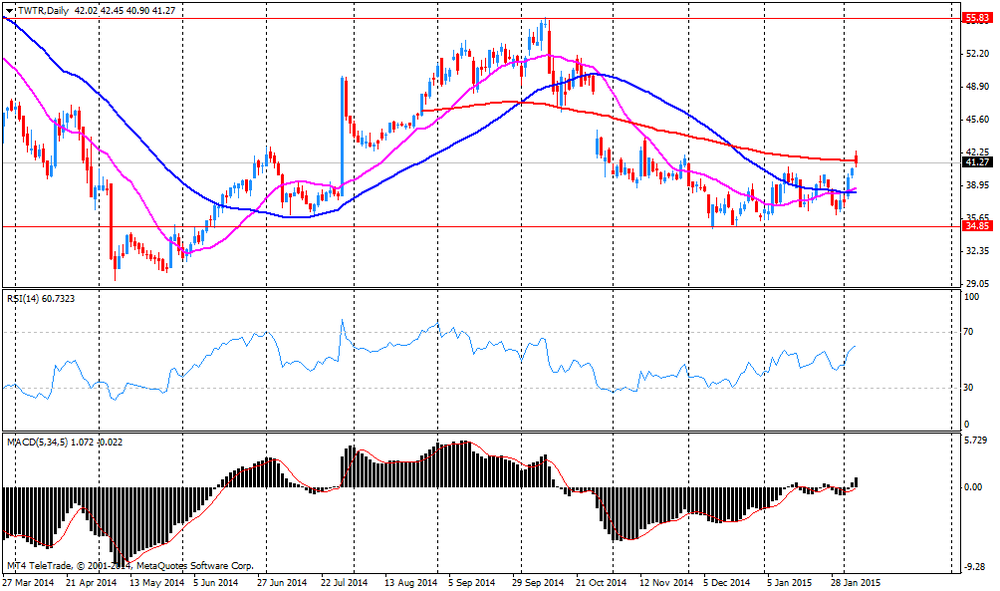

Twitter, Inc., NYSE

TWTR

46.11

+11.75%

1.6M

Yandex N.V., NASDAQ

YNDX

16.60

+2.22%

0.8K

Hewlett-Packard Co.

HPQ

37.95

0.00%

0.2K

ALTRIA GROUP INC.

MO

53.67

0.00%

2.8K

3M Co

MMM

166.50

-0.03%

0.1K

McDonald's Corp

MCD

94.30

-0.04%

0.1K

Boeing Co

BA

148.01

-0.40%

13.2K

ALCOA INC.

AA

16.98

-0.53%

36.2K

Barrick Gold Corporation, NYSE

ABX

12.80

-1.99%

4.0K

-

15:01

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Twitter (TWTR) target raised from $36 to $46 at Oppenheimer, from $47 to $55 at RBC Capital Mkts

-

14:51

Company News: Twitter (TWTR) reported better than expected fourth quarter profits

Twitter (TWTR) earned $0.12 per share in the fourth quarter, beating analysts' estimate of $0.06. Revenue in the fourth quarter increased 97.5% year-over-year to $479.1 million, exceeding analysts' estimate of $453.79 million.

The company released its forecasts for the first quarter 2015 and full year 2015. Revenue is expected to be $440-$450 million in the first quarter (analysts' estimate: $446.74 million). Revenue in 2015 is expected to be $2.3-$2.35 billion (analysts' estimate: $2.26 billion).

The company also announced that it had 288 million active users per month in the fourth quarter, missing analysts' estimate of 295 million users, but beating the third quarter figure of 284 million users.

Twitter (TWTR) shares increased to $46.10 (+11.73%) prior to the opening bell.

-

13:00

European stock markets mid-session: shares decline on German data

European indices are trading lower today as concerns over Greece continue to weigh after the ECB unexpectedly cancelled the acceptance of Greek bonds in return for funding forcing the Greek central bank to provide billions of emergency liquidity for banks in the weeks to come.

Data on German Industrial Production came in below estimates but rose for a fourth consecutive month, adding to expectations that Germany's economy is strengthening. Industrial Production in the Eurozone's biggest economy rose less-than expected last month to a seasonally adjusted annual rate of +0.1%, short of expectations of +0.4%. The preceding month figure was revised up from -0.1%. Year on year it declined by -0.7%, compared to a reading of -0.5% in the previous period.

U.K.'s trade balance deficit widened to a seasonally adjusted -10.2 billion, from -9.20 billion in the preceding month.

Later in the day Today U.S. data on Average Hourly Earnings, Nonfarm Payrolls and the Unemployment rate (13:30GMT) followed by FOMC member's Dennis Lockhart's speech (17:45GMT) will be in the focus.

The commodity heavy FTSE 100 index is currently trading -0.29% quoted at 6,845.87 points. Germany's DAX 30 lost -0.71% trading at 10,828.51. France's CAC 40 is currently trading at 4,686.00 points, -0.37%.

-

10:30

German Industrial Production growing below estimates

Data on German Industrial Production came in below estimates but rose for a fourth consecutive month, adding to expectations that Germany's economy is strengthening. Industrial Production in the Eurozone's biggest economy rose less-than expected last month to a seasonally adjusted annual rate of +0.1%, short of expectations of +0.4%. The preceding month figure was revised up from -0.1%. Year on year it declined by -0.7%, compared to a reading of -0.5% in the previous period.

-

10:00

European Stocks. First hour: Indices decline on German data and Greece Concerns

European stocks decline in early trading after data on German Industrial Production came in below estimates. Industrial Production in the Eurozone's biggest economy rose less-than expected last month to a seasonally adjusted annual rate of +0.1%, short of expectations of +0.4%. Year on year it declined by -0.7%, compared to a reading of -0.5% in the previous period.

Later in the day Today U.S. data on Average Hourly Earnings, Nonfarm Payrolls and the Unemployment rate (13:30GMT) followed by FOMC member's Dennis Lockhart's speech (17:45GMT) will be in the focus.

Concerns over Greece's future in the euro zone continued to weigh on markets after the European Central Bank said it would no longer accept Greek bonds as collateral for lending.

The commodity heavy FTSE 100 index is currently trading -0.21% quoted at 6,851.38 points.. Germany's DAX 30 declined by -0.67% trading at 10,832.13. France's CAC 40 lost -0.29%, currently trading at 4,689.47 points.

-

09:00

Global Stocks: Wall Street and Nikkei post gains, Chinese stocks decline

U.S. markets extended gains on Wednesday with rebounding oil prices. Further negotiations about Greece's debt eased concerns over the Eurozone. The number of initial jobless claims in the week ending January 31 in the U.S. increased by 11,000 to 278,000. The U.S. trade deficit widened to $46.56 billion in December from a deficit of $39.75 billion in November, driven by falling oil prices, a stronger greenback and a strengthening U.S. economy. Productivity in the U.S. non-farm businesses fell at a 1.8% annual rate in the fourth quarter. Unit labour costs increased 2.7% in the fourth quarter, exceeding expectations for a 1.1% rise.

Today U.S. data on Average Hourly Earnings, Nonfarm Payrolls and the Unemployment rate followed by FOMC member's Dennis Lockhart's speech will be in the focus.

The DOW JONES index added +1.20% closing at 17,884.88 points. The S&P 500 rose by +1.03% with a final quote of 2,062.51 points. The index is positive for the year again after volatile trading.

Chinese stocks declined on growing concerns over economic growth and in the wake of a set of IPOs. Hong Kong's Hang Seng is trading -0.27% at 24,698.58 points. China's Shanghai Composite closed at 3,076.64 points -1.91%.

Japan's Nikkei added gains on Friday after oil prices recovered, closing +0.82% with a final quote of 17,648.50.

-

03:04

Nikkei 225 17,652.67 +148.05 +0.85%, Hang Seng 24,703.65 -61.84 -0.25%, Shanghai Composite 3,121.27 -15.26 -0.49%

-

00:31

Stocks. Daily history for Feb 5’2015:

(index / closing price / change items /% change)

Nikkei 225 17,504.62 -174.12 -0.98%

Hang Seng 24,765.49 +85.73 +0.35%

Shanghai Composite 3,136.53 -37.59 -1.18%

FTSE 100 6,865.93 +5.91 +0.09%

CAC 40 4,703.3 +7.00 +0.15%

Xetra DAX 10,905.41 -5.91 -0.05%

S&P 500 2,062.52 +21.01 +1.03%

NASDAQ Composite 4,765.1 +48.39 +1.03%

Dow Jones 17,884.88 +211.86 +1.20%

-