Noticias del mercado

-

17:37

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies ahead after the better-than-expected U.S. labour market data

The U.S. dollar traded higher against the most major currencies ahead after the better-than-expected U.S. labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. January's figure was revised down from a rise of 257,000 jobs.

The strongest job gains showed food services and drinking places, professional and business services, construction, healthcare, and transportation and warehousing.

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

The decline was driven by people leaving the labour force.

Average hourly earnings increased 0.1% in February, missing forecasts of a 0.2% gain, after a 0.2% drop in January. January's figure was revised up from a 0.1% increase.

These figures are signs that the labour market in the U.S. is strengthening. But the Fed might delay to hike its interest rate due to the weak wage growth figures and low inflation.

The U.S. trade deficit narrowed to $41.8 billion in January from a deficit of $45.6 billion in December. That was the lowest level since November 2012.

December's figure was revised up from a deficit of $46.6 billion.

Analysts had expected a trade deficit of $41.6 billion.

The decline of a deficit was driven by cheaper U.S. energy prices and lower demand for foreign oil.

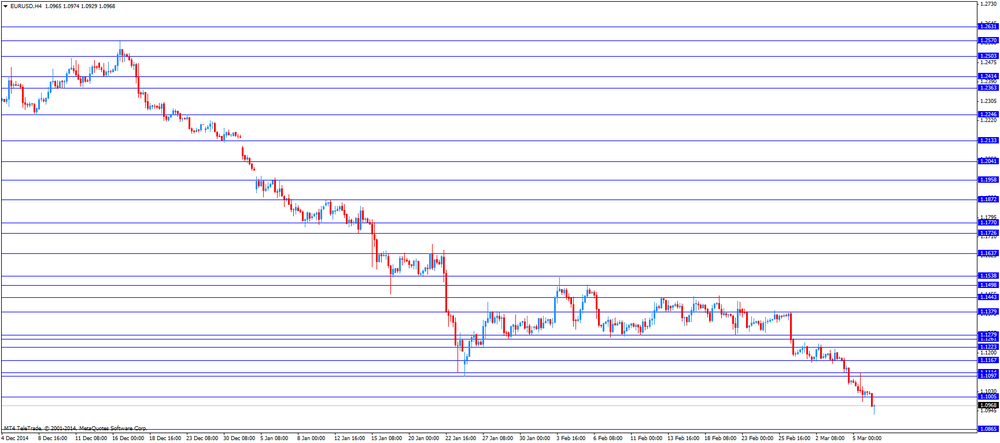

The euro fell against the U.S. dollar. The euro remained under pressure after yesterday's comments by the ECB President Mario Draghi. The European Central Bank (ECB) President Mario Draghi said at the press conference on Thursday that the central bank will start its 60 billion euro-a-month bond purchases on March, 9. He noted that the ECB will buy euro-dominated public sector securities in the secondary market, and it will also continue to purchase asset-backed securities and covered bonds.

Eurozone's revised gross domestic product (GDP) rose 0.32% in fourth quarter, in line with expectations and matching an initial estimate.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 0.9% in fourth quarter, in line with expectations, up from an initial estimate of 0.8%.

German industrial production increased 0.6% in January, in line with expectations, after a 1.0% gain in December. December's figure was revised up from a 0.1% increase.

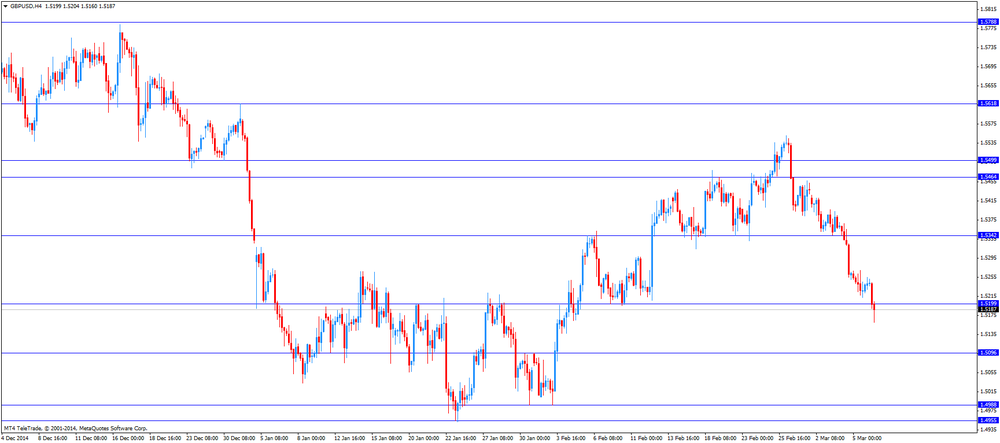

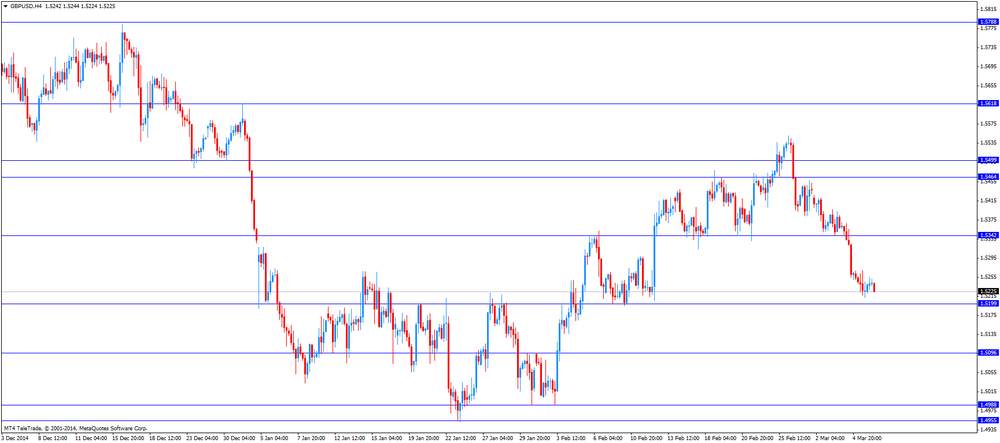

The British pound declined against the U.S. dollar. Consumer inflation expectations for the coming year in the UK declined to 1.9% in February from 2.5% in November. That was the lowest level since late 2001.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian economic data. Canada's trade deficit widened to C$2.45 billion in January from a deficit of C$1.22 billion in December. December's figure was revised down from a deficit of C$0.65 billion. Analysts had expected a trade surplus of C$0.3 billion.

The decline was driven by falling oil prices.

Building permits in Canada dropped 12.9% in January, missing expectations for a 5.5% gain, after a 6.1% rise in December. December's figure was revised down from a 7.7% increase.

That was the biggest drop since August 2014.

The labour productivity of Canadian businesses dropped by 0.1% in the fourth quarter, missing expectations for a 0.2% increase, after a 0.2% rise in the third quarter. The third quarter's figure was revised up from a 0.1% gain.

The Swiss franc traded lower against the U.S. dollar. Switzerland's consumer price index dropped 0.3% in February, missing expectations for a 0.1% rise, after a 0.4% decline in January.

The decline was driven by a decrease in petrol and diesel fuel, groceries, and package holidays.

On a yearly basis, Switzerland's consumer price index declined to -0.8% in February from -0.5% in January, missing expectations for a 0.6% drop. That was the since June 2012.

The Swiss National Bank's foreign exchange reserves increased to 509.250 billion Swiss francs in February from 498.463 billion francs in January. January's figure was revised up from 498.398 billion francs.

The increase was likely driven by a decline in the Swiss franc.

The SNB declined to comment if it may have intervened.

The New Zealand dollar declined against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar decreased against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after the AIG performance of construction index from Australia. The AIG performance of construction index declined to 43.9 in February from 45.9 in January.

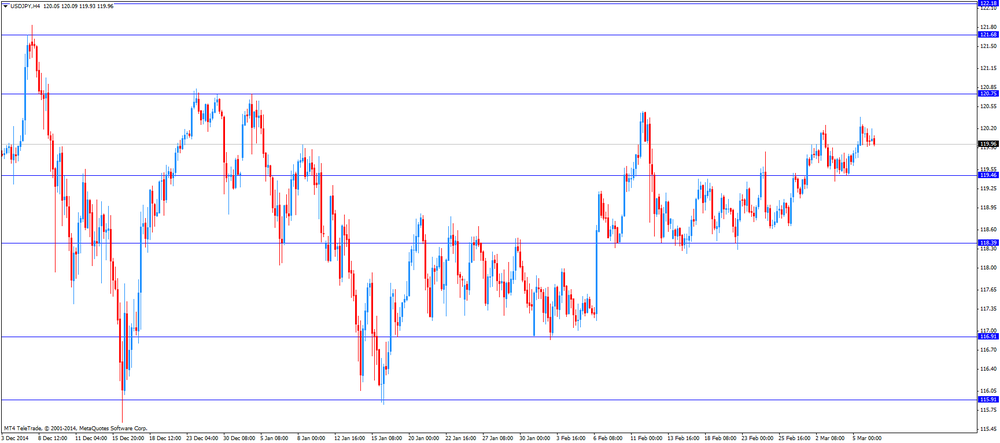

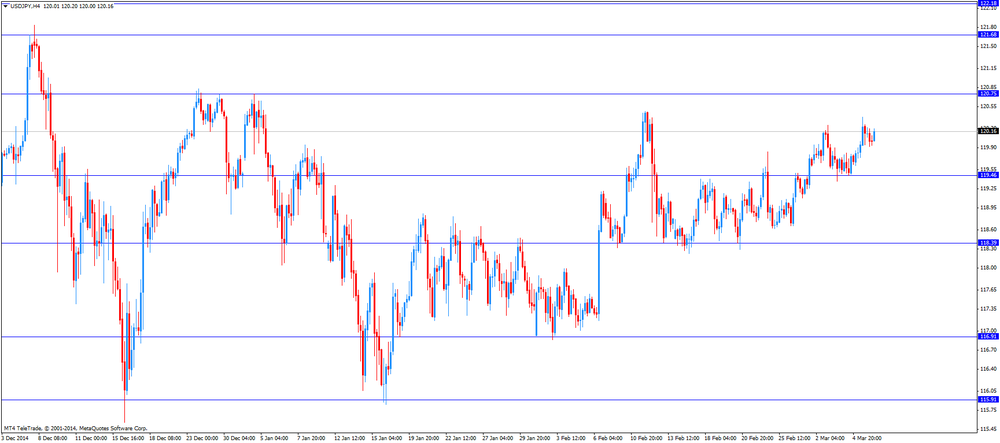

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback Japan's leading economic index decreased to 105.1 in January from 105.3 in December, missing expectations for a rise to 105.9. December's figure was revised down from 105.6.

Japan's coincident index rose to 113.0 in January from 110.6 in December. December's figure was revised down from 110.7.

-

16:43

Building permits in Canada plunges 12.9% in January

Statistics Canada released housing market data on Friday. Building permits in Canada dropped 12.9% in January, missing expectations for a 5.5% gain, after a 6.1% rise in December. December's figure was revised down from a 7.7% increase.

That was the biggest drop since August 2014.

Building permits for non-residential construction plunged 22.8% in January, while permits in the residential sector fell 7.0%.

Lower non-residential permits were driven by weaker demand in the major provinces of Alberta, British Columbia and Ontario.

-

16:28

Canada's trade deficit widened to C$2.45 billion in January

Statistics Canada released the trade data on Friday. Canada's trade deficit widened to C$2.45 billion in January from a deficit of C$1.22 billion in December. December's figure was revised down from a deficit of C$0.65 billion. Analysts had expected a trade surplus of C$0.3 billion.

The decline was driven by falling oil prices.

Exports declined 2.8% in January. Exports of energy products declined 14.7%.

Imports were flat in January.

-

16:12

U.S. trade deficit narrowed to $41.8 billion in January

The U.S. Commerce Department released the trade data on Friday. The U.S. trade deficit narrowed to $41.8 billion in January from a deficit of $45.6 billion in December. That was the lowest level since November 2012.

December's figure was revised up from a deficit of $46.6 billion.

Analysts had expected a trade deficit of $41.6 billion.

The decline of a deficit was driven by cheaper U.S. energy prices and lower demand for foreign oil.

Imports fell by 3.9% in January, while exports declined by 2.9%.

-

15:42

U.S. unemployment rate declines to 5.5% in January, 295,000 jobs were added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. January's figure was revised down from a rise of 257,000 jobs.

The strongest job gains showed food services and drinking places, professional and business services, construction, healthcare, and transportation and warehousing.

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

The decline was driven by people leaving the labour force.

Average hourly earnings increased 0.1% in February, missing forecasts of a 0.2% gain, after a 0.2% drop in January. January's figure was revised up from a 0.1% increase.

The labour-force participation rate declined to 62.8% in February.

These figures are signs that the labour market in the U.S. is strengthening. But the Fed might delay to hike its interest rate due to the weak wage growth figures and low inflation.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E2.4bn), $1.1065-75(E1.9bn), $1.1090-1.1100(E3.0bn), $1.1150(E1.5bn)

USD/JPY: Y119.50($545mn), Y120.00($2.2bn), Y120.50($1.5bn), Y121.00($2.5bn)

EUR/JPY: Y131.00(E450mn), Y134.00(E360mn)

USD/CHF: Chf0.9450($440mn), Chf0.9600-20($300mn)

AUD/USD: $0.7825(A$250mn)

AUD/JPY: Y93.00(A$277mn), Y94.00(A$640mn)

-

14:32

U.S.: Average hourly earnings , February +0.1% (forecast +0.2%)

-

14:31

U.S.: International Trade, bln, January -41.8 (forecast -41.6)

-

14:31

U.S.: Nonfarm Payrolls, February 295 (forecast 241)

-

14:31

U.S.: Unemployment Rate, February 5.5% (forecast 5.6%)

-

14:31

Canada: Trade balance, billions, January -2.5 (forecast 0.3)

-

14:30

Canada: Building Permits (MoM) , January -12.9% (forecast +5.5%)

-

14:30

Canada: Labor Productivity, Quarter IV -0.1% (forecast +0.2%)

-

14:00

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after consumer inflation expectations from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index January 105.3 Revised From 105.6 105.9 105.1

05:00 Japan Coincident Index January 110.6 Revised From 110.7 113

07:00 Germany Industrial Production s.a. (MoM) January +1.0% Revised From +0.1% +0.6% +0.6%

07:00 Germany Industrial Production (YoY) January +0.5% Revised From -0.7% +0.9%

07:45 France Trade Balance, bln January -3.4 -3.7

08:00 Switzerland Foreign Currency Reserves February 498.4 509.3

08:15 Switzerland Consumer Price Index (MoM) February -0.4% +0.1% -0.3%

08:15 Switzerland Consumer Price Index (YoY) February -0.5% -0.6% -0.8%

09:30 United Kingdom Consumer Inflation Expectations Quarter I +2.5% +1.9%

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV +0.3% +0.3% +0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV +0.8% +0.9% +0.9%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to decline to 5.6% in February from 5.7% in January. The U.S. economy is expected to add 241,000 jobs in February.

The U.S. trade deficit is expected to narrow to $41.6 billion in January from $46.6 billion in December.

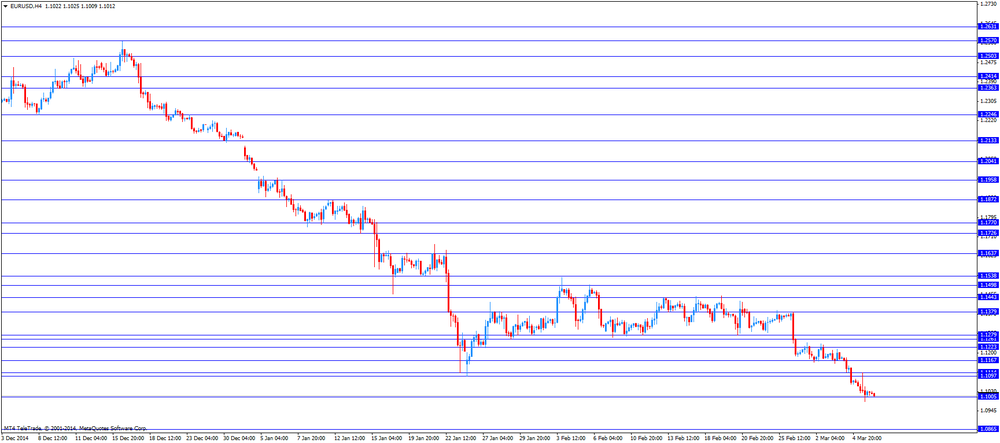

The euro fell against the U.S. dollar. The euro remained under pressure after yesterday's comments by the ECB President Mario Draghi. The European Central Bank (ECB) President Mario Draghi said at the press conference on Thursday that the central bank will start its 60 billion euro-a-month bond purchases on March, 9. He noted that the ECB will buy euro-dominated public sector securities in the secondary market, and it will also continue to purchase asset-backed securities and covered bonds.

Eurozone's revised gross domestic product (GDP) rose 0.32% in fourth quarter, in line with expectations and matching an initial estimate.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 0.9% in fourth quarter, in line with expectations, up from an initial estimate of 0.8%.

German industrial production increased 0.6% in January, in line with expectations, after a 1.0% gain in December. December's figure was revised up from a 0.1% increase.

The British pound traded lower against the U.S. dollar after consumer inflation expectations from the U.K. Consumer inflation expectations for the coming year in the UK declined to 1.9% in February from 2.5% in November. That was the lowest level since late 2001.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian economic data. Building permits in Canada are expected to climb 5.5% in January, after a 7.7% rise in December.

The Canadian trade deficit is expected to narrow to a surplus of C$0.3 billion in January from a deficit of C$0.65 billion in December.

Canadian labour productivity is expected to rise 0.2% in the fourth quarter, after a 0.1% increase in the third quarter.

The Swiss franc traded lower against the U.S. dollar after the weak consumer price inflation from Switzerland. Switzerland's consumer price index dropped 0.3% in February, missing expectations for a 0.1% rise, after a 0.4% decline in January.

The decline was driven by a decrease in petrol and diesel fuel, groceries, and package holidays.

On a yearly basis, Switzerland's consumer price index declined to -0.8% in February from -0.5% in January, missing expectations for a 0.6% drop. That was the since June 2012.

The Swiss National Bank's foreign exchange reserves increased to 509.250 billion Swiss francs in February from 498.463 billion francs in January. January's figure was revised up from 498.398 billion francs.

The increase was likely driven by a decline in the Swiss franc.

The SNB declined to comment if it may have intervened.

EUR/USD: the currency pair fell to $1.0929

GBP/USD: the currency pair declined to $1.5160

USD/JPY: the currency pair decreased to Y119.93

The most important news that are expected (GMT0):

13:30 Canada Building Permits (MoM) January +7.7% +5.5%

13:30 Canada Trade balance, billions January -0.6 0.3

13:30 Canada Labor Productivity Quarter IV +0.1% +0.2%

13:30 U.S. International Trade, bln January -46.6 -41.6

13:30 U.S. Average hourly earnings February +0.5% +0.2%

13:30 U.S. Nonfarm Payrolls February 257 241

13:30 U.S. Unemployment Rate February 5.7% 5.6%

-

14:00

Orders

EUR/USD

Offers 1.1035-30 1.1110-00 1.1150 1.1220 1.1250-45 1.1300

Bids 1.0930 1.0900 1.0800

GBP/USD

Offers 1.5270 1.5315 1.5400-95 1.5420 1.5455 1.5475-80 1.5500 1.5530

Bids 1.5140 1.5100 1.5000-90 1.4950

EUR/JPY

Offers 132.50-40 133.00 133.60 134.00 134.60 134.80 135.00 135.50

Bids 131.50 131.00 130.85 130.10-00

USD/JPY

Offers 120.40 120.50 120.85 121.00

Bids 119.50 119.00-10 118.85 118.60 118.40 118.20 118.00 117.85

EUR/GBP

Offers 0.7245 0.7285 0.7300 0.7320-25 0.7345-50 0.7385 0.7400

Bids 0.7200 0.7180-85 0.7160

AUD/USD

Offers 0.7840 0.7860 0.7880 0.7900-10 0.7930

Bids 0.7750-40 0.7720 0.7700 0.7640

-

13:38

Switzerland’s consumer price inflation dropped 0.3% in February

The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index dropped 0.3% in February, missing expectations for a 0.1% rise, after a 0.4% decline in January.

The decline was driven by a decrease in petrol and diesel fuel, groceries, and package holidays.

On a yearly basis, Switzerland's consumer price index declined to -0.8% in February from -0.5% in January, missing expectations for a 0.6% drop. That was the since June 2012.

These figures have added to concerns over deflation in Switzerland.

-

13:27

Swiss National Bank's foreign exchange reserves rose to 509.250 billion Swiss francs in February

The Swiss National Bank's foreign exchange reserves increased to 509.250 billion Swiss francs in February from 498.463 billion francs in January. January's figure was revised up from 498.398 billion francs.

The increase was likely driven by a decline in the Swiss franc.

The SNB declined to comment if it may have intervened.

-

12:18

Press review: The Price of Oil Is Down, So Why Is Production Still Going Up?

Bloomberg

The Price of Oil Is Down, So Why Is Production Still Going Up?

Too much oil, too fast.

That turns out to be the downside of the U.S. oil boom-at least if you're an investor. Prices crashed, and America is pumping so much crude its running out of places to store it. One promising sign you may have heard about: The plunge in U.S. oil rigs.

MarketWatch

European stocks extend multiyear highs ahead of QE launch

LONDON (MarketWatch) - European stocks rose Friday, extending their reach into multiyear highs ahead of the start of a massive asset-purchase program aimed at bolstering inflation levels and growth in the eurozone.

RTTNews

Asian Stocks Rise After ECB Boost

The Asian stock markets rose broadly on Friday after the European Central Bank upped economic growth forecasts for the euro zone and laid out its plans for bond purchases to combat deflation. ECB President Mario Draghi on Thursday said the ECB would purchase 60 billion euros of public and private sector assets each and every month until September 2016, or beyond if necessary to put the eurozone back on track for sustained growth. The bond-buying stimulus program would begin on March 9.

Source: http://www.rttnews.com/2466958/asian-stocks-rise-after-ecb-boost.aspx

-

11:17

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E2.4bn), $1.1065-75(E1.9bn), $1.1090-1.1100(E3.0bn), $1.1150(E1.5bn)

USD/JPY: Y119.50($545mn), Y120.00($2.2bn), Y120.50($1.5bn), Y121.00($2.5bn)

EUR/JPY: Y131.00(E450mn), Y134.00(E360mn)

USD/CHF: Chf0.9450($440mn), Chf0.9600-20($300mn)

AUD/USD: $0.7825(A$250mn)

AUD/JPY: Y93.00(A$277mn), Y94.00(A$640mn)

-

11:00

Eurozone: GDP (QoQ), Quarter IV +0.3% (forecast +0.3%)

-

11:00

Eurozone: GDP (YoY), Quarter IV +0.9% (forecast +0.9%)

-

10:40

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the AIG performance of construction index from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index January 105.3 Revised From 105.6 105.9 105.1

05:00 Japan Coincident Index January 110.6 Revised From 110.7 113

07:00 Germany Industrial Production s.a. (MoM) January +1.0% Revised From +0.1% +0.6% +0.6%

07:00 Germany Industrial Production (YoY) January +0.5% Revised From -0.7% +0.9%

07:45 France Trade Balance, bln January -3.4 -3.7

08:00 Switzerland Foreign Currency Reserves February 498.4 509.3

08:15 Switzerland Consumer Price Index (MoM) February -0.4% +0.1% -0.3%

08:15 Switzerland Consumer Price Index (YoY) February -0.5% -0.6% -0.8%

09:30 United Kingdom Consumer Inflation Expectations Quarter I +2.5% +1.9%

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported despite yesterday's weaker-than-expected U.S. economic data. Factory orders in the U.S. declined 0.2% in January, missing expectations for a 0.1% increase, after a 3.5% drop in December. That was the sixth straight decline.

December's figure was revised down from a 3.4% fall.

The decline was driven by lower orders for non-durable goods.

The number of initial jobless claims in the week ending February 281 in the U.S. climbed by 7,000 to 320,000 from 313,000 in the previous week, missing expectations for a rise by 6,000.

Final non-farm business sector labour productivity fell by 2.2% in the fourth quarter, missing expectations for a 0.4% rise, down from a preliminary estimate of a 1.8% decline.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar after the AIG performance of construction index from Australia. The AIG performance of construction index declined to 43.9 in February from 45.9 in January.

The Japanese yen traded higher against the U.S. dollar. Japan's leading economic index decreased to 105.1 in January from 105.3 in December, missing expectations for a rise to 105.9. December's figure was revised down from 105.6.

Japan's coincident index rose to 113.0 in January from 110.6 in December. December's figure was revised down from 110.7.

EUR/USD: the currency pair fell to $1.1014

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y119.92

The most important news that are expected (GMT0):

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV +0.3% +0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV +0.8% +0.9%

13:30 Canada Building Permits (MoM) January +7.7% +5.5%

13:30 Canada Trade balance, billions January -0.6 0.3

13:30 Canada Labor Productivity Quarter IV +0.1% +0.2%

13:30 U.S. International Trade, bln January -46.6 -41.6

13:30 U.S. Average hourly earnings February +0.5% +0.2%

13:30 U.S. Nonfarm Payrolls February 257 241

13:30 U.S. Unemployment Rate February 5.7% 5.6%

-

10:31

United Kingdom: Consumer Inflation Expectations, Quarter I +1.9%

-

09:15

Switzerland: Consumer Price Index (MoM) , February -0.3% (forecast +0.1%)

-

09:15

Switzerland: Consumer Price Index (YoY), February -0.8% (forecast -0.6%)

-

09:00

Switzerland: Foreign Currency Reserves, February 509.3

-

08:45

France: Trade Balance, bln, January -3.7

-

08:08

Options levels on friday, March 6, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1155 (1289)

$1.1114 (2402)

$1.1056 (968)

Price at time of writing this review: $1.1016

Support levels (open interest**, contracts):

$1.0972 (6909)

$1.0937 (1766)

$1.0895 (5451)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 120209 contracts, with the maximum number of contracts with strike price $1,1500 (6200);

- Overall open interest on the PUT options with the expiration date March, 6 is 115093 contracts, with the maximum number of contracts with strike price $1,1100 (6909);

- The ratio of PUT/CALL was 0.96 versus 0.98 from the previous trading day according to data from March, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5500 (2822)

$1.5400 (2152)

$1.5301 (2347)

Price at time of writing this review: $1.5239

Support levels (open interest**, contracts):

$1.5198 (2538)

$1.5100 (1617)

$1.5000 (1904)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 31058 contracts, with the maximum number of contracts with strike price $1,5500 (2822);

- Overall open interest on the PUT options with the expiration date March, 6 is 35523 contracts, with the maximum number of contracts with strike price $1,5200 (2538);

- The ratio of PUT/CALL was 1.14 versus 1.17 from the previous trading day according to data from March, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Industrial Production (YoY), January +0.9%

-

08:00

Germany: Industrial Production s.a. (MoM), January +0.6% (forecast +0.6%)

-

06:07

Japan: Coincident Index, January 113

-

06:02

Japan: Leading Economic Index , January 105.1 (forecast 105.9)

-

01:01

Currencies. Daily history for Mar 5’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1030 -0,43%

GBP/USD $1,5237 -0,17%

USD/CHF Chf0,9739 +1,11%

USD/JPY Y120,13 +0,42%

EUR/JPY Y132,45 -0,08%

GBP/JPY Y183,04 +0,21%

AUD/USD $0,7780 -0,45%

NZD/USD $0,7484 -1,36%

USD/CAD C$1,2484 +0,47%

-

00:01

Schedule for today, Friday, Mar 6’2015:

(time / country / index / period / previous value / forecast)

05:00 Japan Leading Economic Index January 105.6 105.9

05:00 Japan Coincident Index January 110.7

07:00 Germany Industrial Production s.a. (MoM) January +0.1% +0.6%

07:00 Germany Industrial Production (YoY) January -0.7%

07:45 France Trade Balance, bln January -3.4

08:00 Switzerland Foreign Currency Reserves February 498.4

08:15 Switzerland Consumer Price Index (MoM) February -0.4% +0.1%

08:15 Switzerland Consumer Price Index (YoY) February -0.5% -0.6%

09:30 United Kingdom Consumer Inflation Expectations Quarter I +2.5%

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV +0.3% +0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV +0.8% +0.9%

13:30 Canada Building Permits (MoM) January +7.7% +5.5%

13:30 Canada Trade balance, billions January -0.6 0.3

13:30 Canada Labor Productivity Quarter IV +0.1% +0.2%

13:30 U.S. International Trade, bln January -46.6 -41.6

13:30 U.S. Average hourly earnings February +0.5% +0.2%

13:30 U.S. Nonfarm Payrolls February 257 241

13:30 U.S. Unemployment Rate February 5.7% 5.6%

20:00 U.S. Consumer Credit January 14.8 15.1

-