Noticias del mercado

-

23:59

Schedule for today, Thursday, May 7’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Changing the number of employed April 37.7 5.0

01:30 Australia Unemployment rate April 6.1% 6.2%

05:45 Switzerland SECO Consumer Climate Quarter I -6

06:00 United Kingdom Parliamentary Elections

06:00 Germany Factory Orders s.a. (MoM) March -0.9% 1.5%

06:00 Germany Factory Orders n.s.a. (YoY) March -1.3%

06:45 France Industrial Production, m/m March 0.0% 0.0%

06:45 France Industrial Production, y/y March 0.3%

06:45 France Trade Balance, bln March -3.44 -3.6

07:00 United Kingdom Halifax house price index 3m Y/Y April 8.1% 7.8%

07:00 United Kingdom Halifax house price index April 0.4% 0.4%

07:00 Switzerland Foreign Currency Reserves April 522.3

12:30 Canada Building Permits (MoM) March -0.9% 2.5%

12:30 U.S. Initial Jobless Claims May 262 280

12:30 U.S. Continuing Jobless Claims April 2253 2280

19:00 U.S. Consumer Credit March 15.52 16

23:50 Japan Monetary Policy Meeting Minutes

-

20:20

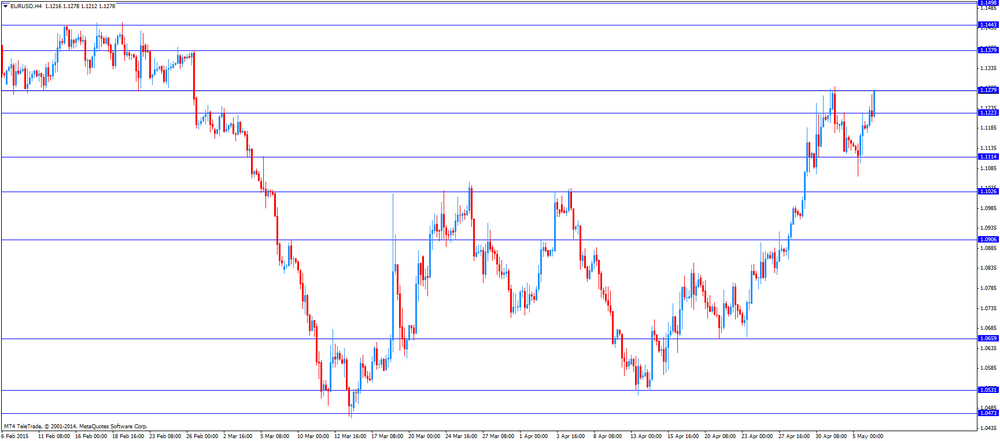

American focus: the euro has grown considerably against the US dollar, breaking the mark of $ 1.1300

The euro rose against the dollar significantly, updating the maximum in May, due to the publication of weak data on the US labor market and news on Greece. As previously reported, during a telephone conversation the head of the EU Jean-Claude Juncker, Prime Minister of Greece, Tsipras made progress in talks on Greek debt on Wednesday. During the talks, the leaders of Greece and the European Commission discussed the need for a fair, financially sustainable and effective reform of the pension system in Greece, as well as touched upon the problems of the labor market and the reform of the wage system. In a joint statement, and Tsipras Juncker also said that the "constructive talks" should be continued.

As for US data, Automatic Data Processing reported that private sector employment grew weaker in April than in March, while the growth was less than expected. According to a report last month, the number of employees increased by 169 thousand. People from a revised downward indicator for March at 175 thousand. (Originally reported growth of 189 thousand.). According to forecasts of the value of this indicator it was to reach 200 thousand.

Investors also await the publication of Friday's report on employment in the US non-farm payrolls in April. The recent series of disappointing US data undermined optimism about the economic recovery, prompting investors to reconsider the initial expectations rise in interest rates by the Federal Reserve at the end of the year instead of the middle.

The Canadian dollar has appreciated significantly against the US dollar, the most refreshing April 29, but then lost most of the earnings position. The Canadian currency was supported by rising oil prices and positive national statistics, but the anticipation of the publication of data on the US labor market and Canadian market participants are forced to be cautious. Recall the results of research presented by the Association of Purchasing Managers Canada and the Richard Ivey School of Business, have shown that the results of April PMI managers has grown significantly and moved above the neutral point. According to the report, the April business activity index rose to 58.2 compared with 47.9 in March. In addition, more detailed information is shown: the employment sub-index in April rose to 50.3 from 45.1, inventories sub-index fell to 53.3 from 57.9, a sub-price index fell to 57.8 from 59, 5, and the sub-index rose to 46.2 deliveries from 45.0. Meanwhile, it became known that the unadjusted index of business activity of purchasing managers in April amounted to 55.7 points against 56.0 points in March.

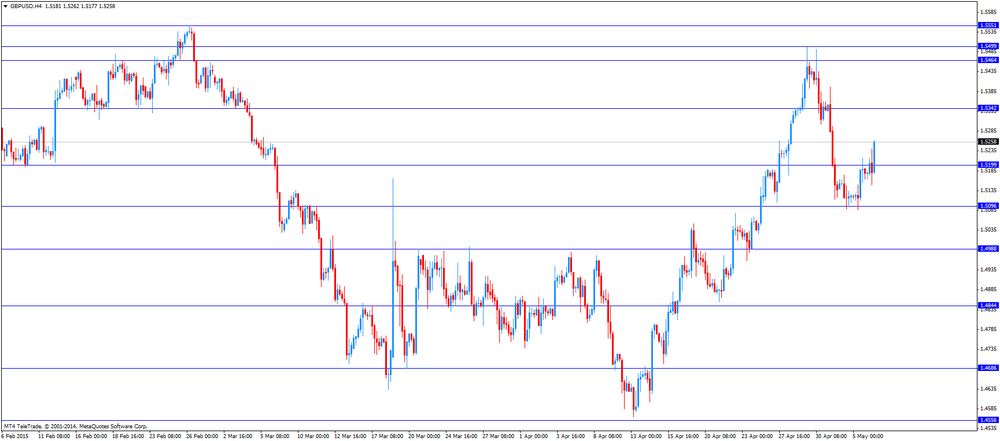

The British pound rose moderately against the US dollar, due to the publication of data on activity in the services sector, as well as the expectations of national elections in the UK. It is learned that the British service sector rose the most in eight months in April, led by a marked growth in new business, which prompted the company to continue a steady pace of jobs creation. The seasonally adjusted index of the British purchasing managers in the services sector from Markit / CIPS rose to 59.5 from 58.9 in March. Economists had expected a result of 58.5. PMI reading above 50 indicates expansion in the sector. The last reading was the highest since August last year, the UK service sector has now expanded 28 months in a row, which is the longest sequence of growth in seven years. "Fears of recession against the background of the election were scattered, because the rise in the activities of the services sector helped offset the sharp slowdown in manufacturing and construction. Research PMI suggest that the economy is showing robust growth rates in the second quarter will begin expanding at a rate of 0 , 8%, "- said Chris Williamson, chief economist at Markit ,.

Meanwhile, traders were silenced in the run-up to elections in Britain. Elections will be held tomorrow, and as recent social polls, the election race has become one of the most severe since the 1970's. According to the latest opinion polls, neither the Conservatives, led by Prime Minister David Cameron nor the opposition Labour Party failed to take a leading position. Therefore, the "small" parties can become key players vote, in which the British will choose the members of its parliament for the next five years. As expected, the Scottish nationalists take a good position in this election, so the vote can not only determine the future of Scotland, but the future of Great Britain in the European Union.

-

17:01

Fed Chair Janet Yellen: valuations in the stock market are high

The Federal Reserve Chair Janet Yellen said on Wednesday that valuations in the stock market are high and there is a potential risk there. She noted that the central bank needs to monitor closely the non-bank lending sector.

Yellen also said that she does not see any bubbles in financial markets.

-

16:33

Canada’s Ivey purchasing managers’ index climbs to 58.2 in April

Canada's seasonally adjusted Ivey purchasing managers' index rose to 58.2 in April from 47.9 in March. Analysts had expected the index to increase to 49.2.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was 46.2 in April, while employment index was 50.3.

Inventories index was 53.2.

-

16:31

U.S.: Crude Oil Inventories, May -3.882 (forecast 1.5)

-

16:20

Ifo economic climate index for the Eurozone climbs to 129.2 points in the second quarter

The Ifo research institute released its economic climate data for the Eurozone on Wednesday. The Ifo Index for the economic climate climbed to 129.2 points in the second quarter of 2015 from 112.7 points the previous quarter.

It was the highest level since 2007.

Eurozone's economy was improving. The main contributor was Germany. But here were also improvements in France, Italy and Spain.

An average inflation rate in the Eurozone is expected to be 0.6% in 2015.

"The experts surveyed expressed growing optimism about the six-month economic outlook in most countries. Positive expectations only clouded over slightly in Finland, Italy and Spain. Scepticism on the part of experts in Greece reached levels last seen three years ago,", the president of the Ifo Institute Hans-Werner Sinn said.

-

16:03

Head of the Eurogroup Jeroen Dijsselbloem: there will be no agreement between Greece and its creditors on Monday

The head of the Eurogroup Jeroen Dijsselbloem said in Paris on Wednesday that there will be no agreement between Greece and its creditors on Monday. He noted that some progress has been made but many issues have to be solved.

Dijsselbloem pointed out that the outlook to sign an agreement is more positive now than some weeks ago.

-

16:00

Canada: Ivey Purchasing Managers Index, April 58.2 (forecast 49.2)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E546mn), $1.1020-30(E892mn), $1.1100(E283mn), $1.1150-60(E800mn), $1.1225(E206mn), $1.1300(E798mn)

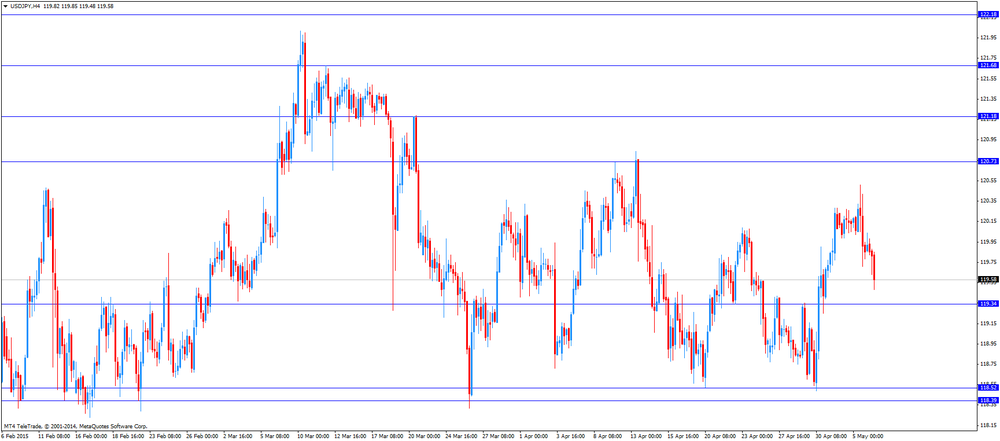

USD/JPY: Y120.50($654mn), Y121.00($756mn)

GBP/USD: $1.5000(Gbp216mn), $1.5100(Gbp209mn), $1.5170(Gbp254mn)

AUD/USD: $0.7900(A$410mn), $0.7800(A$200mn)

-

15:41

Greek unemployment rate declines to 25.4% in February, the lowest level since July 2012

The Hellenic Statistical Authority released its unemployment data on Wednesday. The seasonally adjusted unemployment rate in Greece declined to 25.4% in February from 25.6% in January.

It was the lowest level since July 2012.

The number of unemployed fell by 97,512 from last year, while employment climbed by 55,454 in February.

The youth unemployment rate was 50.1% in February.

-

15:24

Productivity in the U.S. non-farm businesses declines 1.9% in the first quarter

The U.S. Labor Department released non-farm productivity figures on Wednesday. Productivity in the U.S. non-farm businesses fell at a 1.9% annual rate in the first quarter, missing expectations for a 1.8% decrease, after a 2.2% drop in the fourth quarter. The fourth quarter's figure was revised down from a 1.8% fall.

The decline was driven by lower output, which fell 0.2% in April. Hours worked climbed by 1.7%.

Unit labour costs increased 5.0% in the first quarter, exceeding expectations for a 4.3% rise, after a 4.2 gain in the fourth quarter. The fourth quarter's figure was revised up from a 4.1% increase.

These figures indicate that the U.S. economy slowed down in the final months of 2014.

-

15:02

ADP report: private sector adds 169,000 jobs in April

Private sector in the U.S. added 169,000 jobs in April, according the ADP report on Wednesday.

March's figure was revised down to 175,000 jobs from a previous reading of 189,000 jobs.

Analysts expected the private sector to add 200,000 jobs.

"Fallout from the collapse of oil prices and the surging value of the dollar are weighing on job creation," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to decline to 5.4% in April from 5.5% in March. The U.S. economy is expected to add 224,000 jobs in April, after adding 126,000 jobs in March.

-

14:43

Chinese HSBC services PMI increases to 52.9 in April

The Chinese HSBC services PMI increased to 52.9 in April from 52.3 in March.

A reading below 50.0 indicates contraction.

The increase was driven by higher new orders and employment in the service sector.

"The latest set of PMI data indicated that Chinese service-sector companies had a strong start to the second quarter, with activity and new orders both rising solidly in April," the HSBC's chief economist for China Qu Hongbin said.

-

14:30

U.S.: Nonfarm Productivity, q/q, Quarter I -1.9% (forecast -1.8%)

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter I 5.0% (forecast 4.3%)

-

14:24

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies after the weaker-than-expected ADP report

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:00 Australia HIA New Home Sales, m/m March 1.1% 4.4%

01:30 Australia Retail Sales, M/M March 0.7% 0.4% 0.3%

01:30 Australia Retail Sales Y/Y March 4.3% 4.5%

01:45 China HSBC Services PMI April 52.3 52.9

07:50 France Services PMI (Finally) April 52.4 50.8 51.4

07:55 Germany Services PMI (Finally) April 55.4 54.4 54.0

08:00 Eurozone Services PMI (Finally) April 54.2 53.7 54.1

08:30 United Kingdom Purchasing Manager Index Services April 58.9 58.5 59.5

09:00 Eurozone Retail Sales (MoM) March 0.1% Revised From -0.2% -0.7% -0.8%

09:00 Eurozone Retail Sales (YoY) March 2.8% Revised From 3.0% 2.4% 1.6%

11:00 U.S. MBA Mortgage Applications May -2.3% -4.6%

12:15 U.S. ADP Employment Report April 175 200 169

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected ADP report. According the ADP report on Wednesday, private sector in the U.S. added 169,000 jobs in April, missing expectations for a rise of 200,000 jobs, after a gain of 175,000 jobs in March. March's figure was revised down from 189,000 jobs.

A speech by the Fed Chair Janet Yellen is scheduled to be at 13:15 GMT.

The euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone. Retail sales in the Eurozone fell 0.8% in March, missing expectations for a 0.7% decrease, after a 0.1% gain in February. February's figure was revised up from a 0.2% drop.

It was the first negative monthly reading since September 2014.

The decline was driven by lower gasoline sales, which dropped 2.8% in March.

Greece repaid a 200-million-euro loan from the International Monetary Fund on Wednesday.

Eurozone's final services purchasing managers' index (PMI) fell to 54.1 in April from 54.2 in March, up from a preliminary reading of 53.7.

Spain was the top performers in April.

Germany's final services PMI decreased to 54.0 in April from 55.4 in March, down from a preliminary reading of 54.4.

France's final manufacturing PMI dropped to 51.4 in April from 52.4 in March, up a preliminary reading of 50.8.

The British pound traded mixed against the U.S. dollar after the better-than-expected services PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. increased to 59.5 in April from 58.9 in March, beating expectations for a fall to 58.5. It was the highest level since August 2014.

The rise was driven by an increase in new business, stronger economic confidence and warm weather.

The uncertainty ahead UK's parliamentary elections tomorrow weighed on the pound. The win of the Conservatives is expected to have a negative impact on the pound as the Conservatives want to carry out a referendum on Britain's membership in the European Union (EU). The Labour Party said that the Britain's exit from the EU will be a catastrophe for the U.K. The Labour Party has promised to reduce the budget deficit.

The United Kingdom Independence Party (UKIP), a Eurosceptic and right-wing populist political party in the U.K., may win seats in the parliament. It will not will contribute to political stability in the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian Ivey purchasing managers' index. The Ivey purchasing managers' index is expected to increase to 49.2 in April from 47.9 in March.

EUR/USD: the currency pair rose to $1.1278

GBP/USD: the currency pair increased to $1.5262

USD/JPY: the currency pair fell to Y119.48

The most important news that are expected (GMT0):

13:15 U.S. Fed Chairman Janet Yellen Speaks

14:00 Canada Ivey Purchasing Managers Index April 47.9 49.2

17:30 U.S. FOMC Member Dennis Lockhart Speaks

-

14:16

U.S.: ADP Employment Report, April 169 (forecast 200)

-

14:03

Retail sales in Australia rise 0.3% in March

The Australian Bureau of Statistics released its retail sales figures on Wednesday. Retail sales in Australia rose 0.3% in March, missing expectations for a 0.4% gain, after a 0.7% increase in February.

Department stores sales jumped 3.8% in March, clothing, footwear and personal accessory sales increased 2.2%, while food sales were up 0.4%.

Household goods dropped 1.0% in March, while cafes, restaurants and takeaway food services sales plunged 1.1%.

Retail sales increased by 0.7% in the first quarter, after a 1.2% gain in the fourth quarter.

On a yearly basis, retail sales were up to 4.5% in March from 4.3% in February.

Retail sales climbed 0.7% in the state of Queensland. Retail sales declined by 0.8% in the Northern Territory.

-

13:45

Orders

EUR/USD

Offers 1.1280 1.1300 1.1325-30 1.1360 1.1385 1.1400

Bids 1.1220 1.1200 1.1180 1.1160 1.1140 1.1120 1.1100 1.1080

GBP/USD

Offers 1.5230 1.5250 1.5280 1.5300 1.5325-30 1.5350

Bids 1.5200 1.5180 1.5160 1.5125 1.5100 1.5085 1.5065 1.5050

EUR/GBP

Offers 0.7420-25 0.7445-50 0.7465 0.7485 0.7500

Bids 0.7385 0.7365 0.7350 0.7330 0.7300-10 0.7280 0.7260 0.7240 0.7200

EUR/JPY

Offers 135.00 135.50 135.80 136.00

Bids 134.30 134.00 133.70 133.50 133.00

USD/JPY

Offers 120.00 120.25-30 120.50 120.80 121.00

Bids 119.60-65 119.40 119.20 119.00 118.85

AUD/USD

Offers 0.8000 0.8025 0.8050-60 0.8085 0.8100

Bids 0.7950 0.7920-25 0.7900 0.7880 0.7850-55 0.7820-25 0.7800

-

13:00

U.S.: MBA Mortgage Applications, May -4.6%

-

11:40

Eurozone’s retail sales decline 0.8% in March

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone fell 0.8% in March, missing expectations for a 0.7% decrease, after a 0.1% gain in February. February's figure was revised up from a 0.2% drop.

It was the first negative monthly reading since September 2014.

The decline was driven by lower gasoline sales, which dropped 2.8% in March.

Non-food sales fell 0.8% in March, while sales of food, drinks and tobacco decreased 0.6%.

On a yearly basis, retail sales in the Eurozone rose 1.6% in March, missing forecast of a 2.4% gain, after a 2.8% increase in February. February's figure was revised down from a 3.0% rise.

Gasoline sales declined 0.7% in March, while non-food products rose 3%.

-

11:24

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E546mn), $1.1020-30(E892mn), $1.1100(E283mn), $1.1150-60(E800mn), $1.1225(E206mn), $1.1300(E798mn)

USD/JPY: Y120.50($654mn), Y121.00($756mn)

GBP/USD: $1.5000(Gbp216mn), $1.5100(Gbp209mn), $1.5170(Gbp254mn)

AUD/USD: $0.7900(A$410mn), $0.7800(A$200mn)

-

11:24

UK’s services PMI climbs to 59.5 in April

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. increased to 59.5 in April from 58.9 in March, beating expectations for a fall to 58.5. It was the highest level since August 2014.

The rise was driven by an increase in new business, stronger economic confidence and warm weather.

"Fears of the economy slumping amid election jitters are allayed as an upturn in service sector activity has helped offset sharp slowdowns in both manufacturing and construction," the Chief Economist at Markit Chris Williamson said.

-

11:04

NIESR cuts its GDP growth forecast for the U.K.

The National Institute of Economic and Social Research (NIESR) lowered its GDP growth forecast for the U.K. The U.K. GDP is expected to grow 2.5% in 2015, down from the previous estimate of 2.9%. The NIESR expects the U.K. economy to expand at 2.4% in 2016.

The NIESR said that the economic growth will be driven by consumer spending this year.

The unemployment rate is expected to decline to around 5.25% at the end of the year.

The productivity growth in the U.K. remains the largest uncertainty to the economy, according to NIESR.

The inflation is expected to decrease slightly this year.

-

11:00

Eurozone: Retail Sales (MoM), March -0.8% (forecast -0.7%)

-

11:00

Eurozone: Retail Sales (YoY), March 1.6% (forecast 2.4%)

-

10:38

IMF denied that it push for large-scale debt haircut in negotiations for emergency financing for Greece in Riga last month

The International Monetary Fund (IMF) said on Tuesday that IMF officials didn't push for large-scale debt haircut in negotiations for emergency financing for Greece in Riga last month.

"IMF European Department Director Poul Thomsen pointed to the trade-off that needs to be made in reaching agreement in the current discussions," the IMF said.

-

10:30

United Kingdom: Purchasing Manager Index Services, April 59.5 (forecast 58.5)

-

10:00

Eurozone: Services PMI, April 54.1 (forecast 53.7)

-

09:55

Germany: Services PMI, April 54.0 (forecast 54.4)

-

09:50

France: Services PMI, April 51.4 (forecast 50.8)

-

08:21

Options levels on Wednesday, May 6, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1374 (1773)

$1.1337 (3908)

$1.1278 (6867)

Price at time of writing this review: $1.1234

Support levels (open interest**, contracts):

$1.1164 (936)

$1.1123 (2862)

$1.1061 (4148)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 64673 contracts, with the maximum number of contracts with strike price $1,1200 (6867);

- Overall open interest on the PUT options with the expiration date May, 8 is 91740 contracts, with the maximum number of contracts with strike price $1,0000 (9280);

- The ratio of PUT/CALL was 1.42 versus 1.40 from the previous trading day according to data from May, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5502 (2843)

$1.5403 (1008)

$1.5306 (1210)

Price at time of writing this review: $1.5211

Support levels (open interest**, contracts):

$1.5091 (1178)

$1.4995 (2326)

$1.4897 (2035)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 27921 contracts, with the maximum number of contracts with strike price $1,5500 (2843);

- Overall open interest on the PUT options with the expiration date May, 8 is 36676 contracts, with the maximum number of contracts with strike price $1,4800 (2983);

- The ratio of PUT/CALL was 1.31 versus 1.36 from the previous trading day according to data from May, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:59

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:00 Australia HIA New Home Sales, m/m March 1.1% 4.4%

01:30 Australia Retail Sales, M/M March 0.7% 0.4% 0.3%

01:30 Australia Retail Sales Y/Y March 4.3% 0.3%

01:45 China HSBC Services PMI April 52.3 52.9

New Zealand's dollar slid as jobs data spurred interest-rate cut speculation. The kiwi lost as much as 1.3 percent to 74.59 U.S. cents after data showed New Zealand's jobless rate held at 5.8 percent last quarter. Economists had predicted a drop to 5.5 percent. The figures spurred ASB Bank Ltd. and Deutsche Bank AG to predict interest rate cuts this year.

A gauge of the dollar fell last month for the first time since June. A 2.95 percent decline was the most for a month since October 2011. Lower-than-forecast data, including first-quarter gross domestic product, fueled speculation the Federal Reserve will keep U.S. interest rates lower for longer. Friday's nonfarm payrolls is among the economic reports the data-dependent Fed uses to gauge the timing of a rate increase.

EUR / USD: during the Asian session the pair rose to $ 1.1240

GBP / USD: during the Asian session the pair rose to $ 1.5215

USD / JPY: during the Asian session the pair rose to Y120.05

-

03:45

China: HSBC Services PMI, April 52.9

-

03:30

Australia: Retail Sales, M/M, March 0.3% (forecast 0.4%)

-

03:00

Australia: HIA New Home Sales, m/m, March 4.4%

-

00:45

New Zealand: Unemployment Rate, Quarter I 5.8% (forecast 5.5%)

-

00:30

Currencies. Daily history for May 5’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1185 +0,33%

GBP/USD $1,5178 +0,37%

USD/CHF Chf0,9263 -0,78%

USD/JPY Y119,85 -0,23%

EUR/JPY Y134,06 +0,10%

GBP/JPY Y181,9 +0,13%

AUD/USD $0,7940 +1,35%

NZD/USD $0,7564 +0,40%

USD/CAD C$1,2069 -0,17%

-

00:00

Schedule for today, Wednesday, May 6’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

01:00 Australia HIA New Home Sales, m/m March 1.1%

01:30 Australia Retail Sales, M/M March 0.7% 0.4%

01:30 Australia Retail Sales Y/Y March 4.3%

01:45 China HSBC Services PMI April 52.3

07:50 France Services PMI (Finally) April 52.4 50.8

07:55 Germany Services PMI (Finally) April 55.4 54.4

08:00 Eurozone Services PMI (Preliminary) April 54.2 53.7

08:30 United Kingdom Purchasing Manager Index Services April 58.9 58.5

09:00 Eurozone Retail Sales (MoM) March -0.2% -0.3%

09:00 Eurozone Retail Sales (YoY) March 3.0%

11:00 U.S. MBA Mortgage Applications May -2.3%

12:15 U.S. ADP Employment Report April 189 198

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter I 4.1% 4.0%

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter I -1.8% -2.0%

13:15 U.S. Fed Chairman Janet Yellen Speaks

14:00 Canada Ivey Purchasing Managers Index April 47.9 50.1

14:30 U.S. Crude Oil Inventories May 1.910

17:30 U.S. FOMC Member Dennis Lockhart Speaks

23:30 Australia AiG Performance of Construction Index April 50.1

23:50 Japan Monetary Base, y/y April 35.2%

-