Noticias del mercado

-

20:20

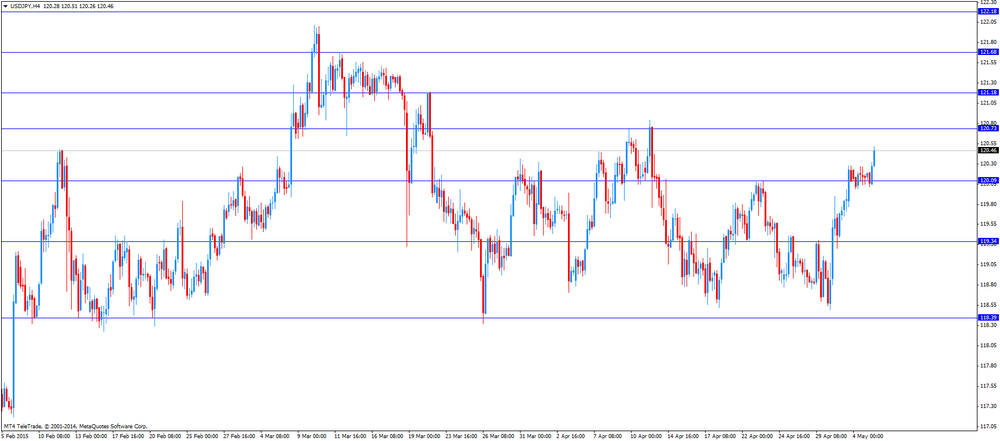

American focus: JPY increased significantly against the US dollar

The yen has risen significantly against the US dollar, entrenched below Y120. Experts note that the dollar came under pressure after a disappointing report on the March trade balance. As previously reported, the trade deficit grew by 43.1% to a seasonally adjusted amounted to $ 51.37 billion. In March. It was the largest monthly expansion of the trade deficit in December 1996 and the strongest largest deficit value since October 2008. Economists had forecast that the trade deficit will reach 40.3 billion. Dollars in March. The expansion of the trade deficit was caused by the largest increase in imports in the data series. This means that foreign goods are constantly coming into the United States in March after months of deceleration due to the labor dispute in the ports of the West Coast. Imports rose 7.7% to $ 239.21 billion. In March. Meanwhile, overseas demand for US goods and services remained modest. Exports increased by 0.9% from February to $ 187.84 billion. The trade deficit in February was revised to $ 35.89 billion. From originally reported $ 35.44 billion. The result of this month was the lowest since October 2009. The three-month moving average deficit of $ 43.31 billion. In March, a little wider than the $ 41.17 billion. Average deficit a year earlier. The trade deficit of petroleum products fell to $ 7.67 billion in March, the lowest level since June 2002. The average price of a barrel of crude oil imported in the United States was $ 46.47, compared with $ 93.91 a year earlier.

The euro strengthened against the US currency, thus offsetting yesterday's fall. Support currency had economic forecasts of the European Commission. Economists EU said that cheaper oil prices and measures to stimulate the CBA should help accelerate the economic growth of the eurozone in 2015. However, they doubt that the strong growth will continue in the long term. The European Commission expects the euro zone's GDP in 2015 will grow by 1.5%, not 1.3% as predicted in February. Of EU GDP, which consists of 28 countries in 2015 is likely to increase by 1.8%, not 1.7% as expected in February. The forecast of GDP growth in Germany in 2015 has been raised to 1.9% from 1.5%. The main engine of economic growth in Germany will be domestic demand, which will be supported by a strong labor market, immigration and low interest rates. Ireland's GDP in 2015 is expected to grow by 3.6%, which would be the highest in the eurozone. Spain's GDP will increase by 2.8%. At the same time, the European Commission lowered its forecast for GDP growth in Greece to 0.5% from 2.5%.

Further growth in the euro constrain US data from the Institute for Supply Management (ISM). According to the report, in April, the index of business activity in the US service sector improved, reaching 57.8 at the same level compared to the March reading at the level of 56.5. According to experts, the value of this indicator was to remain at the level of 56.5. In general, the sub-indices have proved as follows: the index of new orders in the non-manufacturing sector in April rose to 59.2 against 57.8 in March, the index of employment in the non-manufacturing sector rose to 56.7 from 56.6, the index of prices in the non-manufacturing sector It fell to 50.1 against 52.4 in March, while the index of business activity in the non-manufacturing sector improved to 61.6 vs. 57.5 in March.

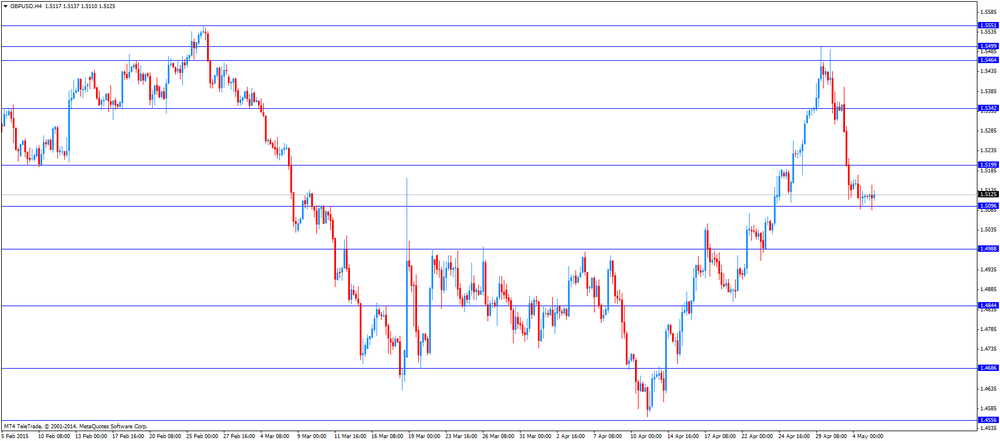

The British pound rose moderately against the dollar, approaching to the level of $ 1.5200 after the release of mixed US data. Recall, the US trade deficit widened to a maximum of 1996 in March, and the ISM service sector rose to 57.8 in April from 56.5 in March. However, the pair held in a range as traders were silenced in the run-up to elections in Britain. Recall elections will be held on May 7, and as shown by the latest social polls, the election race has become one of the most severe since the 1970's. According to the latest opinion polls, neither the Conservatives, led by Prime Minister David Cameron nor the opposition Labour Party failed to take a leading position. Therefore, the "small" parties can become key players vote, in which the British will choose the members of its parliament for the next five years. As expected, the Scottish nationalists take a good position in this election, so the vote can not only determine the future of Scotland, but the future of Great Britain in the European Union. Cameron has promised to hold a referendum on membership in the alliance.

-

16:39

ISM non-manufacturing purchasing managers’ index rises to 57.8 in April

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Tuesday. The index climbed to 57.8 in April from 56.5 in March. Analysts had expected the index to remain unchanged at 56.5.

A reading above 50 indicates a growth in the service sector.

The increase was partly driven by a rise in the non-manufacturing business activity index, which climbed to 61.6 in April from 57.5 in March.

The ISM's new orders index increased to 59.2 in April from 57.8 in March.

The ISM's business activity/production index was up to 61.6 in April from 57.5 in March.

The ISM's employment index climbed to 56.7 in April from 56.6 in March.

The ISM's price index fell to 50.1 in April from 52.4 in March.

-

16:01

European Central Bank (ECB) Governing Council Member and France’s central bank governor Christian Noyer: diverging Eurozone and U.S. monetary policies could entail a risk of instability for financial markets

The European Central Bank (ECB) Governing Council Member and France's central bank governor Christian Noyer said on Tuesday that diverging Eurozone and U.S. monetary policies could entail a risk of instability for financial markets.

He also said that the Britain's exit from the European Union would be "bad news" for both.

Noyer noted that the French economy is improving due to a weaker euro, accommodating monetary policy and low interest rates.

-

16:00

U.S.: ISM Non-Manufacturing, April 57.8 (forecast 56.5)

-

15:45

U.S.: Services PMI, April 57.4 (forecast 57.8)

-

15:40

Canada's trade deficit widens to C$3.02 billion in March, the largest deficit since July 2012

Statistics Canada released the trade data on Tuesday. Canada's trade deficit widened to C$3.02 billion in March from a deficit of C$2.2 billion in February. It was the largest deficit since July 2012.

February's figure was revised down from a deficit of C$0.98 billion.

Analysts had expected a trade deficit of C$0.8 billion.

The larger deficit was driven by higher imports and lower oil prices.

Exports were up 0.4% in March. Exports of energy products dropped by 8.9%.

Imports rose 2.2% in March. Imports of motor vehicles and parts climbed by 3.7%, while imports of consumer goods rose 7.9%.

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1020(E239mn), $1.1100-10(E630mn), $1.1200(E216mn)

USD/JPY: Y120.50($940mn), Y120.95-1.2100($470mn)

GBP/USD: $1.4900(Gbp744mn), $1.4950(Gbp450mn), $1.5000(Gbp1.17bn), $1.5120(Gbp1.36bn)

AUD/USD: $0.7850(A$241mn), $0.7700(A$516mn)

NZD/USD: $0.7485(NZ$283mn)

USD/CAD: C$1.1980($200mn), C$1.2000($200mn)

-

15:07

U.S. trade deficit widens to $51.37 billion in March, the largest deficit since October 2008

The U.S. Commerce Department released the trade data on Tuesday. The U.S. trade deficit widened to $51.37 billion in March from a deficit of $35.9 billion in February. It was the largest deficit since October 2008.

February's figure was revised down from a deficit of $35.44 billion.

Analysts had expected a trade deficit of $40.3 billion.

The rise of a deficit was driven by higher imports. Imports soared by 7.7% in March, while exports increased by 0.9%.

Imports of consumer goods, capital goods, and automotive vehicles, parts, and engines increased in March.

Exports to Canada and Mexico were up in March, exports to China rose 13.6%, while exports to the European Union climbed 8.6%.

Imports from China jumped 31.6%.

-

14:38

Federal Reserve Bank of San Francisco President John Williams: “we're finally coming into the light at the end of the proverbial tunnel”

The Federal Reserve Bank of San Francisco President John Williams said on Monday that the policymaker should focus to support small-business owners.

With regard to the U.S. economy, he said: "We're finally coming into the light at the end of the proverbial tunnel."

-

14:30

U.S.: International Trade, bln, March -51.37 (forecast -40.3)

-

14:30

Canada: Trade balance, billions, March -3.02 (forecast -0.8)

-

14:22

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the weaker-than-expected construction PMI from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:30 Australia Trade Balance March -1.61 Revised From -1.26 -1.0 -1.32

04:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2% 2.0%

04:30 Australia RBA Rate Statement

08:30 United Kingdom PMI Construction April 57.8 57.5 54.2

09:00 Eurozone Producer Price Index (YoY) March -2.8% -2.3% -2.3%

09:00 Eurozone Producer Price Index, MoM March 0.6% Revised From 0.5% 0.3% 0.2%

09:00 Eurozone European Commission Economic Growth Forecasts

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. trade deficit is expected to widen to $40.3 billion in March from $35.44 billion in February.

The ISM non-manufacturing purchasing managers' index is expected to remain unchanged at 56.5 in March.

The euro traded mixed against the U.S. dollar after the European Commission released it economic growth forecast for the Eurozone. Eurozone's economic growth for 2015 was upgraded to 1.5%, up from a previous estimate of 1.3%. Eurozone's economic growth for 2016 remained unchanged at 1.9%.

The European Central Bank's quantitative easing supports the economic growth in the Eurozone, the European Commission noted. It added that lower oil prices, the weak euro and steady global growth also are supporting the European economy.

German economic growth for 2015 was raised to 1.9%, up from a previous estimate of 1.5%. Germany's economic growth for 2016 remained unchanged at 2.0%.

The European Commission downgraded the Greek GDP growth for 2015 to 0.5% from a previous estimate of 2.5% due to the debt crisis. Greece's economic growth for 2016 was lowered at 2.9% from a previous estimate of 3.6%.

French economic growth for 2015 was raised to 1.1%, up from a previous estimate of 1.0%. France's economic growth for 2016 was cut to 1.7% from a previous estimate of 1.8%.

The European Commission upgraded the Italian GDP growth for 2016 to 1.4% from a previous estimate of 1.3% due to the debt crisis. Italy's economic growth for 2015 remained unchanged at 0.6%.

Spanish economic growth for 2015 was raised to 2.8%, up from a previous estimate of 2.3%. Spain's economic growth for 2016 was upgraded to 2.6% from a previous estimate of 2.5%.

Eurozone's producer price index climbed 0.2% in March, missing expectations for a 0.3% increase, after a 0.6% rise in February. February's figure was revised up from 0.5% gain.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 54.2 in April from 57.8 in March, missing expectations for a decline to 57.5. It was second consecutive decline.

The decline was driven by slower rise of output and new orders.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian trade data. The Canadian trade deficit is expected to narrow to C$0.8 billion in March from C$0.98 billion in February.

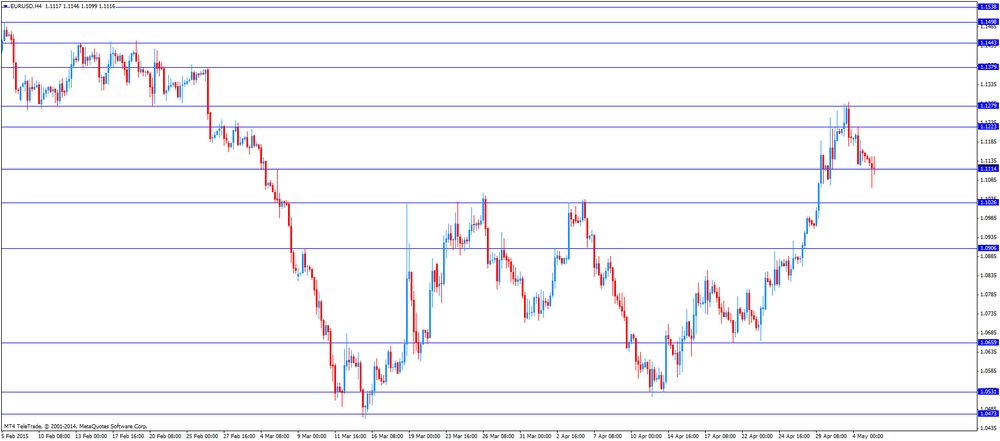

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y120.51

The most important news that are expected (GMT0):

12:30 Canada Trade balance, billions March -0.98 -0.8

12:30 U.S. International Trade, bln March -35.44 -40.3

14:00 U.S. ISM Non-Manufacturing April 56.5 56.5

16:45 Canada Gov Council Member Wilkins Speaks

22:45 New Zealand Employment Change, q/q Quarter I 1.2% 0.8%

22:45 New Zealand Unemployment Rate Quarter I 5.7% 5.5%

-

13:50

Orders

EUR/USD

Offers 1.1110 1.1125 1.1140 1.1165 1.1180 1.1200 1.1220 1.1235 1.1250

Bids 1.11080 1.1050-60 1.1030 1.1000 1.0980 1.0960

GBP/USD

Offers 1.5140 1.5160 1.5180 1.5200 1.5225 1.5250 1.5280 1.5300

Bids 1.5100 1.5085 1.5065 1.5050 1.5030 1.5000 1.4980 1.4960

EUR/GBP

Offers 0.7355-60 0.7380-85 0.7400 0.0.7420-25 0.7445-50

Bids 0.7300-10 0.7280 0.7260 0.7240 0.7200

EUR/JPY

Offers 134.30 134.60 134.80 135.00 135.50

Bids 133.70 133.50 133.00 132.80 132.50

USD/JPY

Offers 120.25-30 120.50 120.80 121.00

Bids 120.00 119.80-85 119.65 119.40 119.00

AUD/USD

Offers 0.7900 0.7920-25 0.7940 0.7960 0.7985 0.8000

Bids 0.7850-55 0.7820-25 0.7800 0.7780 0.7750-60 0.7720 0.7700

-

11:43

European Commission upgrades its GDP growth forecast for the Eurozone

The European Commission released it economic growth forecast for the Eurozone. Eurozone's economic growth for 2015 was upgraded to 1.5%, up from a previous estimate of 1.3%. Eurozone's economic growth for 2016 remained unchanged at 1.9%.

The European Central Bank's quantitative easing supports the economic growth in the Eurozone, the European Commission noted. It added that lower oil prices, the weak euro and steady global growth also are supporting the European economy.

German economic growth for 2015 was raised to 1.9%, up from a previous estimate of 1.5%. Germany's economic growth for 2016 remained unchanged at 2.0%.

The European Commission downgraded the Greek GDP growth for 2015 to 0.5% from a previous estimate of 2.5% due to the debt crisis. Greece's economic growth for 2016 was lowered at 2.9% from a previous estimate of 3.6%.

French economic growth for 2015 was raised to 1.1%, up from a previous estimate of 1.0%. France's economic growth for 2016 was cut to 1.7% from a previous estimate of 1.8%.

The European Commission upgraded the Italian GDP growth for 2016 to 1.4% from a previous estimate of 1.3% due to the debt crisis. Italy's economic growth for 2015 remained unchanged at 0.6%.

Spanish economic growth for 2015 was raised to 2.8%, up from a previous estimate of 2.3%. Spain's economic growth for 2016 was upgraded to 2.6% from a previous estimate of 2.5%.

-

11:28

UK construction PMI drops to 54.2 in April

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 54.2 in April from 57.8 in March, missing expectations for a decline to 57.5. It was second consecutive decline.

The decline was driven by slower rise of output and new orders. Output and new orders rose at the slowest pace since June 2013 due to the uncertainty ahead of the election this month.

Residential building activity slowed in April, commercial construction increased, while civil engineering work fell for the first time in four months.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1020(E239mn), $1.1100-10(E630mn), $1.1200(E216mn)

USD/JPY: Y120.50($940mn), Y120.95-1.2100($470mn)

GBP/USD: $1.4900(Gbp744mn), $1.4950(Gbp450mn), $1.5000(Gbp1.17bn), $1.5120(Gbp1.36bn)

AUD/USD: $0.7850(A$241mn), $0.7700(A$516mn)

NZD/USD: $0.7485(NZ$283mn)

USD/CAD: C$1.1980($200mn), C$1.2000($200mn) -

11:04

Reserve Bank of Australia lowers its interest rate to 2.00% from 2.25%

The Reserve Bank of Australia (RBA) cut its interest rate to 2.00% from 2.25% on Tuesday. This decision was expected by analysts. It was the second interest rate cut this year.

"At today's meeting, the Board judged that the inflation outlook provided the opportunity for monetary policy to be eased further, so as to reinforce recent encouraging trends in household demand," the RBA Governor Glenn Stevens said.

The central bank said that falling commodity prices, weak business investment and subdued government spending were dragging on the Australian economy. But the RBA added that there is an improved trend in household demand.

The RBA noted that the further interest rate cut is "both likely and necessary" despite the significant decline of the Australian dollar over the past year as the key commodity prices decreased.

-

11:00

Eurozone: Producer Price Index (YoY), March -2.3% (forecast -2.3%)

-

11:00

Eurozone: Producer Price Index, MoM , March 0.2% (forecast 0.3%)

-

10:57

Moody’s expects lower U.S. economic growth in a long-term period

Rating agency Moody's expects that the U.S. economic growth in a long-term period will be lower than the average prior to the financial crisis. The slower economic growth can support the US's Aaa rating with stable outlook, Moody's noted. But the rating agency added that the slower growth will make the rating more vulnerable to economic shocks and fiscal policy changes.

Moody's expects the U.S. economy to expand at about 2.8% in 2015 and 2016 due to productivity growth, consumer spending and non-residential fixed investment.

-

10:40

European Central Vice President Vitor Constancio: that there was no reason to stop the central bank’s asset buying programme

The European Central Bank (ECB) Vice President Vitor Constancio said on Monday that there was no reason to stop the central bank's asset buying programme as long as inflation was negative and inflation expectations were well away from the central bank's 2% target.

He noted that there is no "generalized asset overvaluations" in the Eurozone.

Constancio also said that he believes that the Greek exit from the Eurozone will be avoided.

-

10:30

United Kingdom: PMI Construction, April 54.2 (forecast 57.5)

-

10:23

Chicago Fed President Charles Evans: the Fed should not begin to hike interest rates until early next year

The Chicago Fed President Charles Evans said on Monday that the Fed may raise its interest rate at each monetary policy meeting.

He added that the Fed should not begin to hike interest rates until early next year.

"My preference would be that we not raise rates until we're confident that we are going to see rates rise, and those rate increases be clearly in train," the Chicago Fed president said.

Evens is a voting member of the Federal Open Market Committee this year.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:30 Australia Trade Balance March -1.61 Revised From -1.26 -1.0 -1.32

04:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2% 2.0%

04:30 Australia RBA Rate Statement

The Australian dollar tumbled from 0.7850 to as low as 0.7795 against the greenback after the Reserve Bank of Australia cut its policy rate to 2.00% from 2.25% as many market participants had anticipated, and then quickly rebounded to as high as 0.7905.

Pair undermined by uncertainty over outcome of Thursday's U.K. general election; positive USD sentiment (ICE spot dollar index last 95.42 versus 95.25 early Monday); continued impact from Friday's weak U.K. April manufacturing PMI data. Data focus Tuesday on 0830 GMT U.K. April CIPS / Markit construction PMI (forecast 57.5 versus March's 57.8).

EUR / USD: during the Asian session, the pair was trading around $ 1.1140

GBP / USD: during the Asian session, the pair was trading around $ 1.5115

USD / JPY: during the Asian session, the pair was trading around Y120.15

-

08:15

Options levels on tuesday, May 5, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1264 (6723)

$1.1214 (2477)

$1.1153 (3240)

Price at time of writing this review: $1.1097

Support levels (open interest**, contracts):

$1.1031 (3874)

$1.0963 (2459)

$1.0882 (2542)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 64323 contracts, with the maximum number of contracts with strike price $1,1200 (6723);

- Overall open interest on the PUT options with the expiration date May, 8 is 90339 contracts, with the maximum number of contracts with strike price $1,0000 (9280);

- The ratio of PUT/CALL was 1.40 versus 1.39 from the previous trading day according to data from May, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5403 (1009)

$1.5305 (1243)

$1.5208 (1611)

Price at time of writing this review: $1.5115

Support levels (open interest**, contracts):

$1.5088 (1122)

$1.4992 (2315)

$1.4895 (1996)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 27953 contracts, with the maximum number of contracts with strike price $1,5500 (2872);

- Overall open interest on the PUT options with the expiration date May, 8 is 38006 contracts, with the maximum number of contracts with strike price $1,4800 (3039);

- The ratio of PUT/CALL was 1.36 versus 1.37 from the previous trading day according to data from May, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 2.0% (forecast 2%)

-

03:31

Australia: Trade Balance , March -1.32 (forecast -1.0)

-

01:32

Australia: AIG Services Index, April 49.7

-

00:31

Currencies. Daily history for May 4’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1148 -0,44%

GBP/USD $1,5122 -0,10%

USD/CHF Chf0,9335 +0,09%

USD/JPY Y120,13 +0,04%

EUR/JPY Y133,93 -0,47%

GBP/JPY Y181,66 -0,16%

AUD/USD $0,7833 -0,22%

NZD/USD $0,7534 -0,07%

USD/CAD C$1,2089 -0,56%

-

00:02

Schedule for today, Tuesday, May 5’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

01:30 Australia Trade Balance March -1.26 -1.0

04:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2%

04:30 Australia RBA Rate Statement

08:30 United Kingdom PMI Construction April 57.8 57.4

09:00 Eurozone Producer Price Index (YoY) March -2.8% -2.3%

09:00 Eurozone Producer Price Index, MoM March 0.5% 0.3%

09:00 Eurozone European Commission Economic Growth Forecasts

12:30 Canada Trade balance, billions March -0.98

12:30 U.S. International Trade, bln March -35.44 -39

13:45 U.S. Services PMI (Finally) April 59.2 57.8

14:00 U.S. ISM Non-Manufacturing April 56.5 56.5

16:45 Canada Gov Council Member Wilkins Speaks

20:30 U.S. API Crude Oil Inventories April 4.2

22:45 New Zealand Employment Change, q/q Quarter I 1.2% 0.8%

22:45 New Zealand Unemployment Rate Quarter I 5.7% 5.5%

-