Noticias del mercado

-

22:16

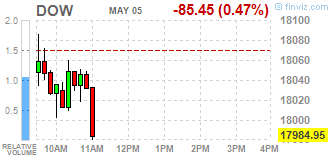

Major US stock indexes finished trading down

Major US stock indexes fell slightly on Tuesday after two sessions of gains after data showed that the US trade deficit rose in March, suggesting that economic growth fell in the first quarter. Thus, the trade deficit grew by 43.1% to a seasonally adjusted amounted to $ 51.37 billion. In March, said on Tuesday the Ministry of Commerce. It was the largest monthly expansion of the trade deficit in December 1996 and the strongest largest deficit value since October 2008. Economists had forecast that the trade deficit will reach 40.3 billion. Dollars in March.

In addition, it became known that the index of business activity in April in the US service sector, calculated by the Institute for Supply Management (ISM), improved, reaching 57.8 at the same level compared to the March reading at the level of 56.5. According to experts, the value of this indicator was to remain at the level of 56.5. Recall index is the result of a survey of about 400 companies from 60 sectors across the United States, including agriculture, mining, construction, transport sector, communications, wholesale and retail companies.

However, in April, the index of business activity in the US service sector, calculated by the Institute for Supply Management (ISM), improved, reaching 57.8 at the same level compared to the March reading at the level of 56.5. According to experts, the value of this indicator was to remain at the level of 56.5.

Almost all components of the index DOW closed in the red (29 of 30). Outsider shares were Intel Corporation (INTC, -2.30%). Shares rose only Visa Inc. (V, + 0.67%).

All sectors of the index S & P closed in the negative zone. Outsiders were utilities sector (-2.0%). The smallest decline recorded conglomerates sector (-0.4%).

At the close:

Dow -0.79% 17,928.20 -142.20

Nasdaq -1.55% 4,939.33 -77.60

S & P -1.18% 2,089.46 -25.03

-

21:00

Dow -0.82% 17,922.19 -148.21 Nasdaq -1.49% 4,942.03 -74.90 S&P -1.14% 2,090.48 -24.01

-

18:05

European stocks close: stocks closed higher on manufacturing PMIs from the Eurozone

Stock indices closed lower on concerns over the Greek debt crisis. Greece could run out of cash. It have to repay IMF loans next week.

The European Central Bank (ECB) Vice President Vitor Constancio said on Monday that he believes that the Greek exit from the Eurozone will be avoided.

The European Commission released it economic growth forecast for the Eurozone. Eurozone's economic growth for 2015 was upgraded to 1.5%, up from a previous estimate of 1.3%. Eurozone's economic growth for 2016 remained unchanged at 1.9%.

The European Central Bank's quantitative easing supports the economic growth in the Eurozone, the European Commission noted. It added that lower oil prices, the weak euro and steady global growth also are supporting the European economy.

German economic growth for 2015 was raised to 1.9%, up from a previous estimate of 1.5%. Germany's economic growth for 2016 remained unchanged at 2.0%.

The European Commission downgraded the Greek GDP growth for 2015 to 0.5% from a previous estimate of 2.5% due to the debt crisis. Greece's economic growth for 2016 was lowered at 2.9% from a previous estimate of 3.6%.

French economic growth for 2015 was raised to 1.1%, up from a previous estimate of 1.0%. France's economic growth for 2016 was cut to 1.7% from a previous estimate of 1.8%.

The European Commission upgraded the Italian GDP growth for 2016 to 1.4% from a previous estimate of 1.3% due to the debt crisis. Italy's economic growth for 2015 remained unchanged at 0.6%.

Spanish economic growth for 2015 was raised to 2.8%, up from a previous estimate of 2.3%. Spain's economic growth for 2016 was upgraded to 2.6% from a previous estimate of 2.5%.

Eurozone's producer price index climbed 0.2% in March, missing expectations for a 0.3% increase, after a 0.6% rise in February. February's figure was revised up from 0.5% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,927.58 -58.37 -0.8 %

DAX 11,327.68 -292.17 -2.5 %

CAC 40 4,974.07 -107.90 -2.1 %

-

18:00

European stocks closed: FTSE 100 6,927.58 -58.37 -0.84% CAC 40 4,974.07 -107.90 -2.12% DAX 11,327.68 -292.17 -2.51%

-

17:12

Wall Street. Major U.S. stock-indexes lower

Major U.S. stock-indexes lower on Tuesday after two sessions of gains after data showed that U.S. trade deficit rose in March, suggesting that economic growth contracted in the first quarter. Deficit surged to its highest in nearly 6,5 years and the $51.4 billion gap was larger than the $45.2 billion deficit the government assumed in its snapshot of first-quarter gross domestic product last week.

Most of the Dow stocks are trading in negative area (20 of 30). Top loosetr - Intel Corporation (INTC, -1.81%). Top gainer - Chevron Corporation (CVX, +1.42%).

Almost all S&P index sectors in positive area. Top gainer - Basic Materials (+0,5%). Top looser -Utilities (-1.1%).

At the moment:

Dow 17960.00 -35.00 -0.19%

S&P 500 2100.25 -9.00 -0.43%

Nasdaq 100 4432.50 -44.00 -0.98%

10-year yield 2.19% +0.05

Oil 61.05 +2.12 +3.60%

Gold 1196.80 +10.00 +0.84%

-

16:39

ISM non-manufacturing purchasing managers’ index rises to 57.8 in April

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Tuesday. The index climbed to 57.8 in April from 56.5 in March. Analysts had expected the index to remain unchanged at 56.5.

A reading above 50 indicates a growth in the service sector.

The increase was partly driven by a rise in the non-manufacturing business activity index, which climbed to 61.6 in April from 57.5 in March.

The ISM's new orders index increased to 59.2 in April from 57.8 in March.

The ISM's business activity/production index was up to 61.6 in April from 57.5 in March.

The ISM's employment index climbed to 56.7 in April from 56.6 in March.

The ISM's price index fell to 50.1 in April from 52.4 in March.

-

16:01

European Central Bank (ECB) Governing Council Member and France’s central bank governor Christian Noyer: diverging Eurozone and U.S. monetary policies could entail a risk of instability for financial markets

The European Central Bank (ECB) Governing Council Member and France's central bank governor Christian Noyer said on Tuesday that diverging Eurozone and U.S. monetary policies could entail a risk of instability for financial markets.

He also said that the Britain's exit from the European Union would be "bad news" for both.

Noyer noted that the French economy is improving due to a weaker euro, accommodating monetary policy and low interest rates.

-

15:40

Canada's trade deficit widens to C$3.02 billion in March, the largest deficit since July 2012

Statistics Canada released the trade data on Tuesday. Canada's trade deficit widened to C$3.02 billion in March from a deficit of C$2.2 billion in February. It was the largest deficit since July 2012.

February's figure was revised down from a deficit of C$0.98 billion.

Analysts had expected a trade deficit of C$0.8 billion.

The larger deficit was driven by higher imports and lower oil prices.

Exports were up 0.4% in March. Exports of energy products dropped by 8.9%.

Imports rose 2.2% in March. Imports of motor vehicles and parts climbed by 3.7%, while imports of consumer goods rose 7.9%.

-

15:35

U.S. Stocks open: Dow -0.03%, Nasdaq -0.24%, S&P -0.06%

-

15:26

Before the bell: S&P futures -0.34%, NASDAQ futures -0.52%

U.S. stock-index futures fell after trade data. Walt Disney Co. better-than-estimated results are in focus of market participant. Traders await data on services industries.

Global markets:

Hang Seng 27,755.54 -368.28 -1.31%

Shanghai Composite 4,298.37 -182.10 -4.06%

FTSE 6,993.26 +7.31 +0.10%

CAC 5,033.26 -48.71 -0.96%

DAX 11,468.09 -151.76 -1.31%

Crude oil $60.38 (+2.48%)

Gold $1196.70 (+0.83%)

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Citigroup Inc., NYSE

C

54.18

+0.02%

2.5K

AT&T Inc

T

34.55

+0.06%

1.5K

Procter & Gamble Co

PG

80.40

+0.06%

0.3K

Verizon Communications Inc

VZ

50.55

+0.06%

1.9K

The Coca-Cola Co

KO

41.00

+0.10%

0.2K

ALTRIA GROUP INC.

MO

50.75

+0.14%

0.4K

Starbucks Corporation, NASDAQ

SBUX

50.38

+0.19%

11.7K

Cisco Systems Inc

CSCO

29.24

+0.24%

8.9K

Boeing Co

BA

144.45

+0.30%

1.0K

Twitter, Inc., NYSE

TWTR

38.00

+0.32%

20.6K

3M Co

MMM

159.75

+0.46%

1.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

23.50

+0.47%

1.7K

E. I. du Pont de Nemours and Co

DD

74.45

+0.57%

1.0K

Chevron Corp

CVX

109.03

+0.66%

4.2K

Exxon Mobil Corp

XOM

89.70

+0.66%

15.9K

Barrick Gold Corporation, NYSE

ABX

13.36

+1.44%

3.6K

Yandex N.V., NASDAQ

YNDX

19.51

+1.67%

2.5K

Walt Disney Co

DIS

113.35

+2.09%

261.0K

Tesla Motors, Inc., NASDAQ

TSLA

237.72

+3.13%

124.9K

ALCOA INC.

AA

14.01

0.00%

14.0K

General Motors Company, NYSE

GM

35.40

0.00%

2.2K

Amazon.com Inc., NASDAQ

AMZN

423.03

-0.00%

1.7K

UnitedHealth Group Inc

UNH

114.52

-0.03%

2.2K

Caterpillar Inc

CAT

87.26

-0.05%

0.2K

Home Depot Inc

HD

110.00

-0.05%

1.5K

Facebook, Inc.

FB

78.77

-0.05%

18.5K

Pfizer Inc

PFE

34.30

-0.06%

1.2K

General Electric Co

GE

27.24

-0.11%

2.0K

McDonald's Corp

MCD

96.02

-0.11%

4.3K

International Business Machines Co...

IBM

173.75

-0.13%

2.1K

Johnson & Johnson

JNJ

100.21

-0.14%

2.2K

American Express Co

AXP

78.14

-0.18%

0.8K

Intel Corp

INTC

33.13

-0.18%

12.8K

Apple Inc.

AAPL

128.32

-0.30%

239.0K

Goldman Sachs

GS

198.68

-0.31%

0.3K

AMERICAN INTERNATIONAL GROUP

AIG

58.02

-0.31%

0.1K

Ford Motor Co.

F

15.73

-0.32%

4.4K

JPMorgan Chase and Co

JPM

64.50

-0.34%

0.3K

Merck & Co Inc

MRK

60.40

-0.40%

2.4K

Yahoo! Inc., NASDAQ

YHOO

41.83

-0.50%

2.4K

Microsoft Corp

MSFT

47.97

-0.56%

8.2K

-

15:07

U.S. trade deficit widens to $51.37 billion in March, the largest deficit since October 2008

The U.S. Commerce Department released the trade data on Tuesday. The U.S. trade deficit widened to $51.37 billion in March from a deficit of $35.9 billion in February. It was the largest deficit since October 2008.

February's figure was revised down from a deficit of $35.44 billion.

Analysts had expected a trade deficit of $40.3 billion.

The rise of a deficit was driven by higher imports. Imports soared by 7.7% in March, while exports increased by 0.9%.

Imports of consumer goods, capital goods, and automotive vehicles, parts, and engines increased in March.

Exports to Canada and Mexico were up in March, exports to China rose 13.6%, while exports to the European Union climbed 8.6%.

Imports from China jumped 31.6%.

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) initiated at Buy at Jefferies, target $350

Cisco Systems (CSCO) reiterated at Outperform at Oppenheimer, target raised from $30 to $32

-

14:38

Federal Reserve Bank of San Francisco President John Williams: “we're finally coming into the light at the end of the proverbial tunnel”

The Federal Reserve Bank of San Francisco President John Williams said on Monday that the policymaker should focus to support small-business owners.

With regard to the U.S. economy, he said: "We're finally coming into the light at the end of the proverbial tunnel."

-

14:28

Company News: Walt Disney (DIS) reported better than expected result

Company reported Q2 earnings of $1.23 per share versus $1.11 consensus. Revenues rose 7.0% year/year to $12.46 bln versus $12.25 bln consensus.

Operating income by segments:

Media networks: -2% with rev +13% to $5.8 bln.

Parks and Resorts: +24% with rev +6% to $3.76 bln.

Studio: -10% with rev -6% to $1.7 bln.

Consumer Products: +32% with rev +10% to $971 mln.

DIS rose to $113.20 (+1.95%) on the premarket.

-

12:08

European stock markets mid session: stocks traded higher despite concerns over the Greek debt crisis

Stock indices traded higher despite concerns over the Greek debt crisis. Greece could run out of cash. It have to repay IMF loans next week.

The European Central Bank (ECB) Vice President Vitor Constancio said on Monday that he believes that the Greek exit from the Eurozone will be avoided.

The European Commission released it economic growth forecast for the Eurozone. Eurozone's economic growth for 2015 was upgraded to 1.5%, up from a previous estimate of 1.3%. Eurozone's economic growth for 2016 remained unchanged at 1.9%.

The European Central Bank's quantitative easing supports the economic growth in the Eurozone, the European Commission noted. It added that lower oil prices, the weak euro and steady global growth also are supporting the European economy.

German economic growth for 2015 was raised to 1.9%, up from a previous estimate of 1.5%. Germany's economic growth for 2016 remained unchanged at 2.0%.

The European Commission downgraded the Greek GDP growth for 2015 to 0.5% from a previous estimate of 2.5% due to the debt crisis. Greece's economic growth for 2016 was lowered at 2.9% from a previous estimate of 3.6%.

French economic growth for 2015 was raised to 1.1%, up from a previous estimate of 1.0%. France's economic growth for 2016 was cut to 1.7% from a previous estimate of 1.8%.

The European Commission upgraded the Italian GDP growth for 2016 to 1.4% from a previous estimate of 1.3% due to the debt crisis. Italy's economic growth for 2015 remained unchanged at 0.6%.

Spanish economic growth for 2015 was raised to 2.8%, up from a previous estimate of 2.3%. Spain's economic growth for 2016 was upgraded to 2.6% from a previous estimate of 2.5%.

Eurozone's producer price index climbed 0.2% in March, missing expectations for a 0.3% increase, after a 0.6% rise in February. February's figure was revised up from 0.5% gain.

Current figures:

Name Price Change Change %

FTSE 100 7,021.68 +35.73 +0.51 %

DAX 11,681.27 +61.42 +0.53 %

CAC 40 5,103.28 +21.31 +0.42 %

-

11:43

European Commission upgrades its GDP growth forecast for the Eurozone

The European Commission released it economic growth forecast for the Eurozone. Eurozone's economic growth for 2015 was upgraded to 1.5%, up from a previous estimate of 1.3%. Eurozone's economic growth for 2016 remained unchanged at 1.9%.

The European Central Bank's quantitative easing supports the economic growth in the Eurozone, the European Commission noted. It added that lower oil prices, the weak euro and steady global growth also are supporting the European economy.

German economic growth for 2015 was raised to 1.9%, up from a previous estimate of 1.5%. Germany's economic growth for 2016 remained unchanged at 2.0%.

The European Commission downgraded the Greek GDP growth for 2015 to 0.5% from a previous estimate of 2.5% due to the debt crisis. Greece's economic growth for 2016 was lowered at 2.9% from a previous estimate of 3.6%.

French economic growth for 2015 was raised to 1.1%, up from a previous estimate of 1.0%. France's economic growth for 2016 was cut to 1.7% from a previous estimate of 1.8%.

The European Commission upgraded the Italian GDP growth for 2016 to 1.4% from a previous estimate of 1.3% due to the debt crisis. Italy's economic growth for 2015 remained unchanged at 0.6%.

Spanish economic growth for 2015 was raised to 2.8%, up from a previous estimate of 2.3%. Spain's economic growth for 2016 was upgraded to 2.6% from a previous estimate of 2.5%.

-

11:28

UK construction PMI drops to 54.2 in April

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 54.2 in April from 57.8 in March, missing expectations for a decline to 57.5. It was second consecutive decline.

The decline was driven by slower rise of output and new orders. Output and new orders rose at the slowest pace since June 2013 due to the uncertainty ahead of the election this month.

Residential building activity slowed in April, commercial construction increased, while civil engineering work fell for the first time in four months.

-

11:04

Reserve Bank of Australia lowers its interest rate to 2.00% from 2.25%

The Reserve Bank of Australia (RBA) cut its interest rate to 2.00% from 2.25% on Tuesday. This decision was expected by analysts. It was the second interest rate cut this year.

"At today's meeting, the Board judged that the inflation outlook provided the opportunity for monetary policy to be eased further, so as to reinforce recent encouraging trends in household demand," the RBA Governor Glenn Stevens said.

The central bank said that falling commodity prices, weak business investment and subdued government spending were dragging on the Australian economy. But the RBA added that there is an improved trend in household demand.

The RBA noted that the further interest rate cut is "both likely and necessary" despite the significant decline of the Australian dollar over the past year as the key commodity prices decreased.

-

10:57

Moody’s expects lower U.S. economic growth in a long-term period

Rating agency Moody's expects that the U.S. economic growth in a long-term period will be lower than the average prior to the financial crisis. The slower economic growth can support the US's Aaa rating with stable outlook, Moody's noted. But the rating agency added that the slower growth will make the rating more vulnerable to economic shocks and fiscal policy changes.

Moody's expects the U.S. economy to expand at about 2.8% in 2015 and 2016 due to productivity growth, consumer spending and non-residential fixed investment.

-

10:44

Asia Pasific Stocks closed:

HANG SENG 27,687.59 -436.23 -1.55%

S&P/ASX 200 5,826.5 -1.00 -0.02%

TOPIX closed

SHANGHAI COMP 4,298.37 -182.10 -4.06%

-

10:40

European Central Vice President Vitor Constancio: that there was no reason to stop the central bank’s asset buying programme

The European Central Bank (ECB) Vice President Vitor Constancio said on Monday that there was no reason to stop the central bank's asset buying programme as long as inflation was negative and inflation expectations were well away from the central bank's 2% target.

He noted that there is no "generalized asset overvaluations" in the Eurozone.

Constancio also said that he believes that the Greek exit from the Eurozone will be avoided.

-

10:23

Chicago Fed President Charles Evans: the Fed should not begin to hike interest rates until early next year

The Chicago Fed President Charles Evans said on Monday that the Fed may raise its interest rate at each monetary policy meeting.

He added that the Fed should not begin to hike interest rates until early next year.

"My preference would be that we not raise rates until we're confident that we are going to see rates rise, and those rate increases be clearly in train," the Chicago Fed president said.

Evens is a voting member of the Federal Open Market Committee this year.

-

04:02

Hang Seng 28,195.61 +71.79 +0.26 %, Shanghai Composite 4,474.7 -5.76 -0.13 %

-

00:32

Stocks. Daily history for Apr May 4’2015:

(index / closing price / change items /% change)

Hang Seng 28,123.82 -9.18 -0.03 %

S&P/ASX 200 5,827.5 +13.14 +0.23 %

Shanghai Composite 4,481.59 +39.93 +0.90 %

FTSE 100 6,985.95 +25.32 +0.36 %

CAC 40 5,081.97 +35.48 +0.70 %

Xetra DAX 11,619.85 +165.47 +1.44 %

S&P 500 2,114.49 +6.20 +0.29 %

NASDAQ Composite 5,016.93 +11.54 +0.23 %

Dow Jones 18,070.4 +46.34 +0.26 %

-