Noticias del mercado

-

21:00

U.S.: Consumer Credit , March 29.67 (forecast 16)

-

20:20

American focus: The US dollar strengthened against the Canadian dollar

The dollar fell sharply against the euro after the release of US labor market data, but soon played all positions. Experts note that the dollar is supported by positive market sentiment and the recent statements by the Fed. With regard to today's statistics, US Department of Labor reported that the number of employed rose in April to 160 thousand. It was the weakest growth since September 2015. Economists had expected employment to increase by 202 thousand figures for February and March were revised down -.. In total 19 thousand Given the latest data, the average employment gains this year amounted to 192 thousand per month.. The unemployment rate remained at around 5.0%, confirming the forecasts. In addition, it was reported that the average hourly wages of private sector employees increased by 8 cents in April to $ 25.53. In annual terms, wages increased by 2.5%, accelerating compared with March. The average workweek for private sector workers increased by 0.1 hour to 34.5 hours, in line with expectations. The proportion of Americans involved in labor, dropped to 62.8% in April compared with 63.0% in March. The proportion of Americans with jobs was 59.7%, slightly down from March. A broad measure of unemployment, which includes Americans who are working part time or not searching for a job, fell in April to 9.7% from 9.8% in March.

The Canadian dollar fell considerably against the US dollar, breaking the mark of CAD1.2900, which was caused by the publication of the labor market in Canada and the United States report. Statistics Canada reported that the number of employed decreased by 2.1 thousand. People on the results of April as well as the reduction of jobs in energy sectors offsetting increase in employment in other sectors of the economy. Analysts had forecast that employment will increase by 1 thousand. Man, after rising by 40.6 thousand. People in March. The unemployment rate remained at around 7.1 percent, although experts expected an increase to 7.2 percent. The number of jobs in the manufacturing sector fell by 16.5 thousand., While a decrease of 7.8 thousand was recorded in the area of natural resources. On the other hand, employment in the retail and wholesale trade sector increased by 26.8 thousand. People . accommodation and catering sector reported an increase in the number of jobs by 21.9 thousand. Nationwide, the total employment decreased by 2.4 thousand. man in April and employment on a part-time increased by 400 people.

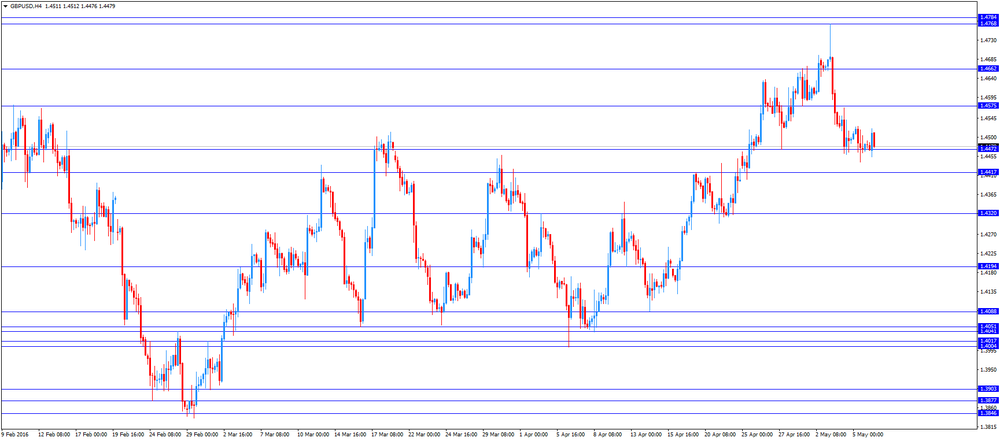

The British pound fell moderately against the dollar, updating yesterday's low. The main pressure on the pound had US employment data, which led investors to revise forecasts for tightening the monetary policy of the Fed. After the publication of the report the chances of further tightening of the Fed's monetary policy meeting in June decreased to 8% from 11% before the release of the data. However, experts point out that, given the faster growth of wages today's report does not rule out a rate hike in the US in June, but in order to inspire confidence in the leaders of the Central Bank will require additional improvement in consumption, consumer price inflation and employment.

A slight influence also provided data for the UK. Society of Motor Manufacturers and Traders (SMMT) reported that the volume of new car registrations in Britain rose by the end of April, recording the highest value for the month since 2003. According to reports, new car registrations increased in April by 2 percent year on year to 189.505 units. The last reading was the highest since April 2003 (when the number of registrations was at the level of 194 312 units). The volume of registrations of new cars and fleet business sector increased by 6.1 percent and 2.8 percent respectively, while the number of registrations individuals decreased by 2.5 percent. In annual terms, the number of new car registrations increased by the end of April by 4.4 percent, reaching 920,366 units.

-

18:24

WEEKLY REVIEW: Mixed picture of the U.S. economy

The U.S. labour market data was in focus this week. The pace of the job creation slowed in April, while wages rose slightly. Other U.S. economic data remained mixed.

Some Fed officials said this week that they could support an interest rate hike in June if the U.S. economy continued to improve. But there is a problem. The Fed's next monetary policy meeting is scheduled to be on June 14-15. But there is a referendum on Britain's membership in the European Union (EU) on June 23. As Britain's exit from the EU would have a negative impact on the U.S. economy, it is unlikely that the Fed will raise its interest rate in June.

If the U.S. economy does not improve significantly in May, it is unlikely that the Fed will hike its interest rate as it said that the interest rate decision will depend on the incoming economic data.

The Organization of the Petroleum Exporting Countries' (OPEC) meeting in June could also have an impact on the Fed's interest rate decision. If OPEC does not agree any measures to stabilise the oil market, oil price will likely decline, easing inflation pressures in the U.S. The rise in inflation is one of the Fed's conditions for an interest rate hike.

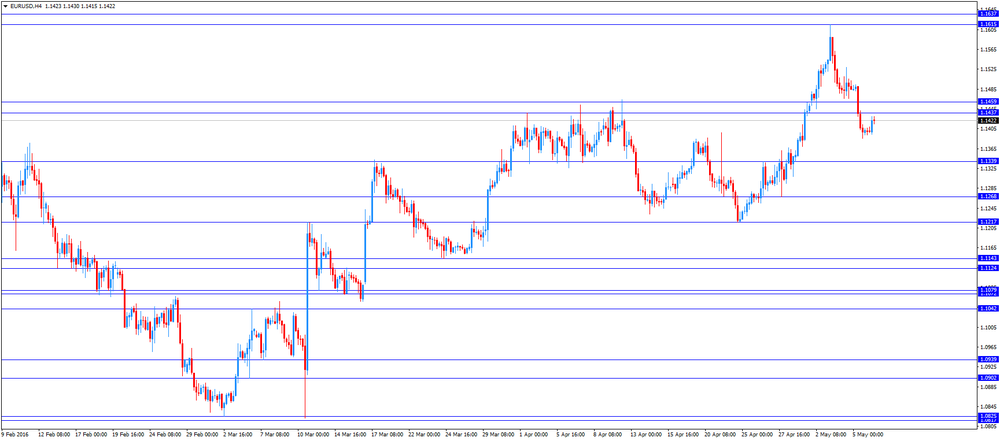

The euro declined slightly against the U.S. dollar this week compared to the last week, but remained fairly strong. If the euro rises against the U.S. dollar further, it will have negative impact on the economic recovery in the Eurozone as manufactured products in the Eurozone will be more expensive abroad and will weigh on the exporters. The European Central Bank will be forced to act.

It is likely that the currency pair EURUSD will rise toward the high of May 03 at $1.1615, if there are negative news from the U.S. and there are no negative economic data from the Eurozone.

If the U.S. economic data is better than expected and in case of the negative economic data from the Eurozone, the currency pair EURUSD may test the support level at $1.1300 or $1.1200.

-

17:02

Ai Group/HIA Australian Performance of Construction Index is up to 50.8 in April

The Australian Industry Group (AiG) released its construction data for Australia on late Thursday evening. The Ai Group/HIA Australian Performance of Construction Index jumped to 50.8 in April from 45.2 in March.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The rise was mainly driven by an increase in engineering construction.

-

16:57

Atlanta Fed President Dennis Lockhart does not know how he will vote on the monetary policy meeting in June

Atlanta Fed President Dennis Lockhart said in an interview with CNBC on Thursday that he did not know how he would vote on the monetary policy meeting in June, adding that it would depend on the incoming economic data.

He noted that he expected the U.S. economy to expand stronger in the rest of the year than in the first quarter.

-

16:46

Dallas Federal Reserve President Robert Kaplan will support an interest rate hike June or July if the U.S. economy continues to improve

Dallas Federal Reserve President Robert Kaplan said in an interview with The Wall Street Journal on Thursday that he would support an interest rate hike June or July if the U.S. economy continued to improve.

"I will be advocating we take further action in June or July," he said.

Kaplan noted that Britain's referendum on the membership in the European Union would have impact on the Fed's interest rate decision in June.

-

16:40

Markit/Nikkei services purchasing managers' index for Japan decreases to 49.3 in April

The Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan decreased to 49.3 in April from 50.0 in March.

A reading below 50 indicates contraction of activity, while a reading above 50 indicates expansion.

The decrease was driven by a reduction in clients.

"Latest survey data indicated a slight deterioration in output at Japanese service providers. Activity decreased for the first time in over a year, while new orders were broadly stable during the month," economist at Markit, Amy Brownbill, said.

-

16:19

Reserve Bank of Australia Deputy Governor Philip Lowe will be next governor of the central bank

The Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe will be next governor of the central bank. He will replace Glenn Stevens. Steven's term ends in September.

Lowe is deputy governor since early 2012.

"It is a superb appointment. There could be no one better qualified than Phil Lowe to lead the Bank through the next seven years. The Bank will be in the very best of hands," Stevens said.

-

16:08

Canada’s Ivey purchasing managers’ index climbs to 53.1 in April

Canada's seasonally adjusted Ivey purchasing managers' index climbed to 53.1 in April from 50.1 in March. Analysts had expected the index to rise to 52.5.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was down to 46.8 in April from 48.5 in March, while employment index declined to 49.9 from 50.7.

The prices index was dropped to 53.9 in April from 58.5 in March, while inventories jumped to 52.3 from 48.6.

-

16:00

Canada: Ivey Purchasing Managers Index, April 53.1 (forecast 52.5)

-

15:44

Option expiries for today's 10:00 ET NY cut

USDJPY 105.00 (USD 334m) 106.30 (395m) 107.50 (490m) 108.00 (361m) 108.50 (305m) 108.75 (600m)

EURUSD: 1.1350 (EUR 302m) 1.1390 (498m) 1.1400 (645m) 1.1425 (391m) 1.1475-80 (500m) 1.1500 (1.3bln) 1.1550 (726m) 1.1600 (392m)

GBPUSD 1.4400 (GBP 305m) 1.4500 (363m) 1.4600 (209m)

AUDUSD 0.7275 (AUD 302m) 0.7650 (1.69bln) 0.7750 (307m) 0.7800 (429m)

USDCAD 1.2950 (USD 220m) 1.3000 (410m)

NZDUSD 0.6753 (NZD 248m)

-

15:02

U.S. unemployment rate remains unchanged at 5.0% in April, 160,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 160,000 jobs in April, missing expectations for a rise of 202,000 jobs, after a gain of 208,000 jobs in March. March's figure was revised down from a rise of 215,000 jobs.

The increase was driven by rises in professional and business services, health care, and financial activities.

The Professional and business services added 65,000 jobs in April, financial activities added 20,000 jobs, while the manufacturing sector added 4,000 jobs.

Health care added 44,000 in April, while mining sector shed 7,100 jobs.

The U.S. unemployment rate remained unchanged at 5.0% in April, in line with expectations.

Average hourly earnings increased 0.3% in April, in line with forecasts, after a 0.2% rise in March. March's figure was revised down from a 0.3% increase.

The labour-force participation rate decreased to 62.8% in April from 63.0% in March.

As the U.S. labour market continues to strengthen, the Fed could raise its interest rate gradually this year.

-

14:41

Canada’s unemployment rate remains unchanged at 7.1% in April

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 7.1% in April. Analysts had expected the unemployment rate to rise to 7.2%.

The labour participation rate declined to 65.8% in April from 65.9% in March.

The Bank of Canada monitors closely the labour participation rate.

The number of employed people declined by 2,100 jobs in April, missing expectations for a rise of 1,000 jobs, after a 40,600 increase in March.

The decrease was mainly driven by a fall in full-time work. Full-time employment declined by 2,400 in April, while part-time employment increased by 400 jobs.

Employment declined in manufacturing, business, building, and other support services, 'other services' natural resources, and agriculture.

-

14:31

U.S.: Average workweek, April 34.5 (forecast 34.5)

-

14:31

U.S.: Average hourly earnings , April 0.3% (forecast 0.3%)

-

14:30

U.S.: Unemployment Rate, April 5% (forecast 5%)

-

14:30

Canada: Unemployment rate, April 7.1% (forecast 7.2%)

-

14:30

Canada: Employment , April -2.1 (forecast 1)

-

14:30

U.S.: Nonfarm Payrolls, April 160 (forecast 202)

-

14:11

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Monetary Policy Statement

07:00 Switzerland Foreign Currency Reserves April 576 587

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in April. The U.S. economy is expected to add 200,000 jobs in April, after adding 215,000 jobs in March.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian labour market data. The unemployment rate in Canada is expected to rise to 7.2% in April from 7.1% in March.

Canada's economy is expected to add 1,000 jobs in April.

Canada's seasonally adjusted Ivey purchasing managers' index is expected to rise to 52.5 in April from 50.1 in March.

The Swiss franc traded lower against the U.S. dollar. The Swiss National Bank's (SNB) foreign exchange reserves increased to 587.566 billion Swiss francs in April from 576.479 billion francs in March. The data could mean that the central bank the central bank may have intervened in the foreign exchange market. The SNB declined to comment.

EUR/USD: the currency pair rose to $1.1430

GBP/USD: the currency pair traded mixed

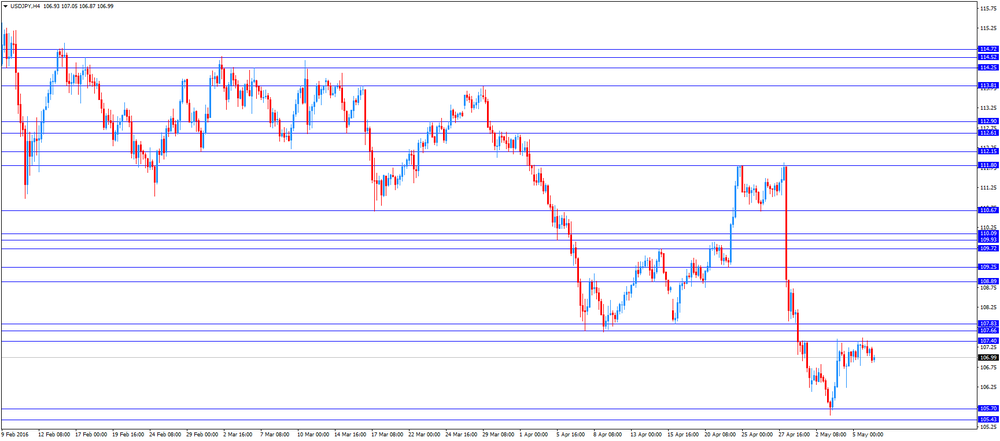

USD/JPY: the currency pair declined to Y106.86

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate April 7.1% 7.2%

12:30 Canada Employment April 40.6 1

12:30 U.S. Average hourly earnings April 0.3% 0.3%

12:30 U.S. Nonfarm Payrolls April 215 202

12:30 U.S. Unemployment Rate April 5% 5%

14:00 Canada Ivey Purchasing Managers Index April 50.1 52.5

-

12:01

Swiss National Bank's foreign exchange reserves increase to 587.566 billion Swiss francs in April

The Swiss National Bank's (SNB) foreign exchange reserves increased to 587.566 billion Swiss francs in April from 576.479 billion francs in March. The data could mean that the central bank the central bank may have intervened in the foreign exchange market.

The SNB declined to comment.

-

11:54

Industrial production in Spain rises 1.2% in March

Spanish statistical office INE released its industrial production figures for Spain on Friday. Industrial production in Spain rose 1.2% in March, the biggest rise since April 2014.

On a yearly basis, industrial production in Spain climbed at adjusted 2.8% in March, after a 2.1% increase in February. February's figure was revised down from a 2.2% gain.

Output of capital goods jumped at seasonally adjusted 9.2% year-on-year in March, output of intermediate goods climbed 3.1%, energy production was down 2.5%, while consumer goods output rose 0.3%.

-

11:43

Germany's construction PMI decreases to 53.4 in April

Markit Economics released construction purchasing managers' index (PMI) for Germany on Friday. Germany's construction PMI decreased to 53.4 in April from 55.8 in March.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by a softer growth in in the commercial and civil engineering sub-sectors.

"Latest survey results signalled that the upturn in Germany's construction sector is down but not out at the start of the second quarter. The headline PMI fell to a five-month low, but remained in territory that is consistent with ongoing growth of construction output," an economist at Markit, Oliver Kolodseike, said.

-

11:37

Eurozone's retail PMI declines to 47.9 in April

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Friday. Eurozone's construction purchasing managers' index (PMI) declined to 47.9 in April from 49.2 in March.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in France and Italy declined in April, while sales growth in Germany was softer.

"It was a disappointing start to the second quarter for retailers across the big-three Eurozone economies," an economist at Markit, Phil Smith, said.

-

11:30

Germany's retail PMI drops to 51.0 in April

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Friday. Germany's retail PMI dropped to 51.0 in April from 54.1 in March.

The driven was driven by a softer growth in buying activity, sales and employment.

"Today's PMI numbers signal a note of caution for German retailers, as growth in sales slowed sharply during the month," an economist at Markit, Oliver Kolodseike, said.

-

11:08

Reserve Bank of Australia’s Statement on Monetary Policy: the central bank lowers its inflation forecasts

The Reserve Bank of Australia (RBA) release its Statement on Monetary Policy on Friday. The central bank cut its inflation forecasts. Consumer price inflation is expected to be 1%-2% by the end of 2016, down from its previous estimate of 2%-3%, and 1.5%-2.5% by mid-2018, down from its previous estimate of 2%-3%. The Australian economy is expected to expand 2.5%-3.5% by the end of 2016, and 3%-4% by mid-2018, both forecasts remained unchanged.

The RBA said that uncertainty weighed on consumer price inflation in Australia, adding that it will adjust its monetary policy to boost consumption and inflation.

-

10:54

San Francisco Fed President John Williams: the Fed could raise its interest rate twice or three time this year

San Francisco Fed President John Williams said in an interview with CNBC on Thursday that the Fed could raise its interest rate twice or three time this year, noting that it would be "appropriate". He added that further interest rate hikes would depend on the incoming economic data.

San Francisco Fed president also said that concerns over the slowdown in the global economy dissipated.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:43

St. Louis Fed President James Bullard: global headwinds seem to dissipate in the first half of the year

St. Louis Fed President James Bullard said on Thursday that he did not decide how to vote on the monetary policy yet. He noted that global headwinds, which weighed on the Fed's monetary policy, seemed to dissipate in the first half of the year.

"Those factors appear to be waning during the first half of 2016," St. Louis Fed president said.

He also said that the effects of a stronger U.S. dollar seemed also to dissipate.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:25

Japanese Prime Minister Shinzo Abe: recent fluctuations in the yen are “undesirable”

Japanese Prime Minister Shinzo Abe said on Thursday that recent fluctuations in the yen were "undesirable". He noted that the government was ready to act to prevent a speculative rise in the yen.

"We will watch currency moves carefully and take action as needed," Abe said.

-

10:12

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 42.0 in in the week ended May 01

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 42.0 in in the week ended May 01 from 43.4 the prior week.

The decrease was driven by drops in all sub-indexes. The measure of views of the economy was down to 32.6 from 33.5, the buying climate index decreased to 38.2 from 40.0, while the personal finances index slid to 55.3 from 56.8.

-

10:01

Option expiries for today's 10:00 ET NY cut

USD/JPY 105.00 (USD 334m) 106.30 (395m) 107.50 (490m) 108.00 (361m) 108.50 (305m) 108.75 (600m)

EUR/USD: 1.1350 (EUR 302m) 1.1390 (498m) 1.1400 (645m) 1.1425 (391m) 1.1475-80 (500m) 1.1500 (1.3bln) 1.1550 (726m) 1.1600 (392m)

GBP/USD 1.4400 (GBP 305m) 1.4500 (363m) 1.4600 (209m)

AUD/USD 0.7275 (AUD 302m) 0.7650 (1.69bln) 0.7750 (307m) 0.7800 (429m)

USD/CAD 1.2950 (USD 220m) 1.3000 (410m)

NZD/USD 0.6753 (NZD 248m)

-

08:33

Options levels on friday, May 6, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1555 (3781)

$1.1510 (6619)

$1.1472 (3124)

Price at time of writing this review: $1.1412

Support levels (open interest**, contracts):

$1.1367 (3351)

$1.1335 (3594)

$1.1294 (3976)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 44464 contracts, with the maximum number of contracts with strike price $1,1500 (6619);

- Overall open interest on the PUT options with the expiration date May, 6 is 63580 contracts, with the maximum number of contracts with strike price $1,1000 (10024);

- The ratio of PUT/CALL was 1.43 versus 1.46 from the previous trading day according to data from May, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.4800 (1065)

$1.4700 (1093)

$1.4601 (1160)

Price at time of writing this review: $1.4481

Support levels (open interest**, contracts):

$1.4399 (1550)

$1.4300 (1284)

$1.4200 (1554)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 23698 contracts, with the maximum number of contracts with strike price $1,4400 (2063);

- Overall open interest on the PUT options with the expiration date May, 6 is 36520 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.54 versus 1.54 from the previous trading day according to data from May, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:22

Asian session: The yen slightly gained against the dollar

The yen slightly gained against the dollar and the euro in a rangebound Asia trade Friday, with investors sitting on their hands ahead of closely-watched U.S. jobs data.

Investors have found short-covering brought the dollar higher against the yen, but trading on Friday remained thin with many of Japanese corporate players still away on vacation. In addition, a wait-and-see mood persisted before the release of the U.S. jobs data for April to get more of an indication of what the Federal Reserve will do.

Economists predicted that nonfarm payrolls grew by 205,000 new jobs in April, while jobless rates likely stood at 5.0% and the hourly wage likely increased 0.3%.

Meanwhile, the Australian dollar tumbled after the Australia's central bank sharply revised down its forecasts for inflation over coming years. The Reserve Bank of Australia said in a quarterly statement on monetary policy that the outlook for inflation will remain "a key source of uncertainty" for some time, revising downward its consumer price inflation to between 1% and 2% on-year at the end of 2016, down from the bank's forecast in February of between 2% and 3%.

EUR/USD: during the Asian session the pair traded in the range of $1.1390-10

GBP/USD: during the Asian session the pair traded in the range of $1.4470-90

USD/JPY: during the Asian session the pair traded in the range of Y107.00-45

Based on Reuters materials

-

01:30

Australia: AiG Performance of Construction Index, April 50.8

-

00:31

Currencies. Daily history for May 5’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1402 -0,72%

GBP/USD $1,4484 -0,08%

USD/CHF Chf0,9678 +1,06%

USD/JPY Y107,26 +0,23%

EUR/JPY Y122,30 -0,49%

GBP/JPY Y155,36 +0,15%

AUD/USD $0,7463 +0,08%

NZD/USD $0,6881 +0,01%

USD/CAD C$1,2863 -0,02%

-

00:01

Schedule for today, Friday, May 6’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Monetary Policy Statement

07:00 Switzerland Foreign Currency Reserves April 576

12:30 Canada Unemployment rate April 7.1% 7.2%

12:30 Canada Employment April 40.6 1

12:30 U.S. Average workweek April 34.4 34.5

12:30 U.S. Average hourly earnings April 0.3% 0.3%

12:30 U.S. Nonfarm Payrolls April 215 202

12:30 U.S. Unemployment Rate April 5% 5%

14:00 Canada Ivey Purchasing Managers Index April 50.1 52.5

19:00 U.S. Consumer Credit March 17.22 16

-