Noticias del mercado

-

21:00

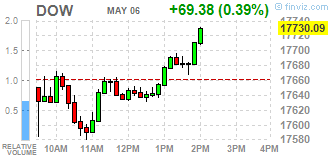

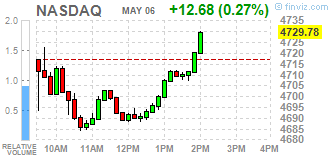

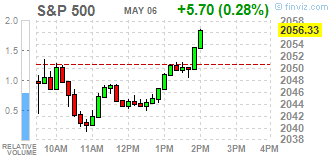

Dow +0.39% 17,730.44 +69.73 Nasdaq +0.28% 4,730.44 +13.35 S&P +0.29% 2,056.56 +5.93

-

20:11

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes slightly rose on Friday after April payrolls data showed employment gains hit a seven-month low, casting doubts about the health of the economy and the likelihood of an interest rate hike by the end of the year. Nonfarm payrolls increased by 160,000 last month, far below the 202,000 that economists polled by Reuters had forecast on average. The number was lower than the first-quarter average monthly job growth of 200,000.

Most of Dow stocks in positive area (20 of 30). Top looser - Merck & Co. Inc. (MRK, -1,55%). Top gainer - The Procter & Gamble Company (PG, +0,84%).

S&P sectors mixed. Top looser - Conglomerates (-2,1%). Top gainer - Industrial goods (+0,9%).

At the moment:

Dow 17621.00 +47.00 +0.27%

S&P 500 2045.50 +1.50 +0.07%

Nasdaq 100 4305.00 +4.75 +0.11%

Oil 44.64 +0.32 +0.72%

Gold 1293.30 +21.00 +1.65%

U.S. 10yr 1.78 +0.03

-

18:01

European stocks closed: FTSE 100 6,125.7 +8.45 +0.14% CAC 40 4,301.24 -18.22 -0.42% DAX 9,869.95 +18.09 +0.18%

-

18:01

European stocks close: stocks traded mixed on the U.S. labour market data

Stock indices traded mixed after the release of the U.S. labour market data. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 160,000 jobs in April, missing expectations for a rise of 202,000 jobs, after a gain of 208,000 jobs in March. March's figure was revised down from a rise of 215,000 jobs.

The increase was driven by rises in professional and business services, health care, and financial activities.

The U.S. unemployment rate remained unchanged at 5.0% in April, in line with expectations.

Average hourly earnings increased 0.3% in April, in line with forecasts, after a 0.2% rise in March. March's figure was revised down from a 0.3% increase.

No major economic reports were released in the Eurozone today.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,125.7 +8.45 +0.14 %

DAX 9,869.95 +18.09 +0.18 %

CAC 40 4,301.24 -18.22 -0.42 %

-

17:40

WSE: Session Results

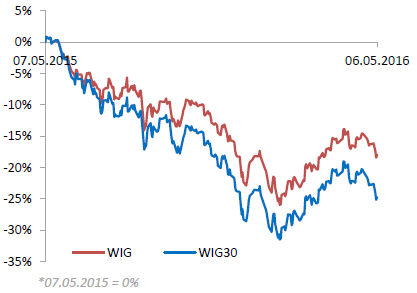

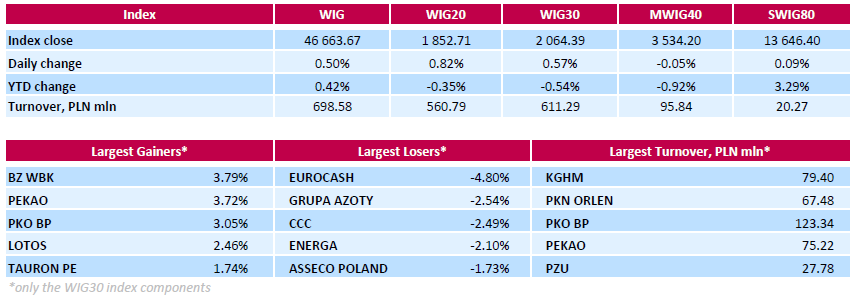

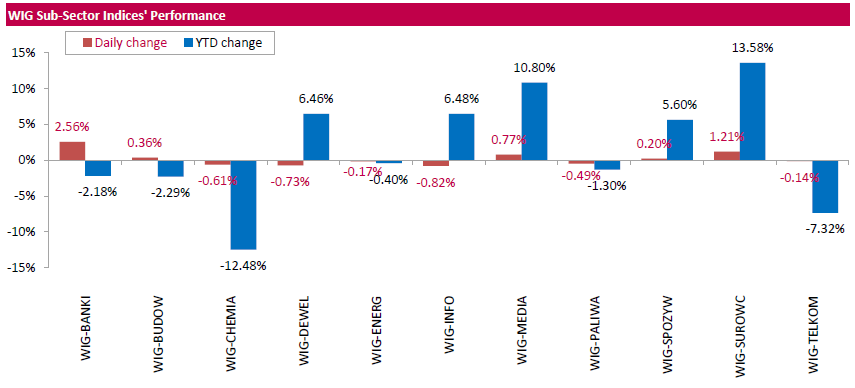

Polish equity market closed higher on Friday. The broad market measure, the WIG index, advanced 0.5%. Sector performance in the WIG Index was mixed. Banking stocks (+2.56%) recorded the biggest gain, as the chief of Polish bank guarantee fund stated that the banks' fee to the fund may stay flat or fall slightly next year given that the banking sector is stable and economic growth remains robust. At the same time, informational technology sector (-0.82%) fared the worst.

The large-cap stocks' measure, the WIG30 Index, surged by 0.57%. In the index basket, banking names BZ WBK (WSE: BZW), PEKAO (WSE: PEO) and PKO BP (WSE: PKO) generated the biggest advances, soaring by 3.79%, 3.72% and 3.05% respectively. Other major risers were oil refiner LOTOS (WSE: LTS), genco TAURON PE (WSE: TPE) and two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), growing by between 1.31% and 2.46%. On the other side of the ledger, FMCG-wholesaler EUROCASH (WSE: EUR) led the decliners with a 4.8% drop, followed by chemical producer GRUPA AZOTY (WSE: ATT) and footwear retailer CCC (WSE: CCC), sliding a respective 2.54% and 2.49%.

-

17:02

Ai Group/HIA Australian Performance of Construction Index is up to 50.8 in April

The Australian Industry Group (AiG) released its construction data for Australia on late Thursday evening. The Ai Group/HIA Australian Performance of Construction Index jumped to 50.8 in April from 45.2 in March.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The rise was mainly driven by an increase in engineering construction.

-

16:57

Atlanta Fed President Dennis Lockhart does not know how he will vote on the monetary policy meeting in June

Atlanta Fed President Dennis Lockhart said in an interview with CNBC on Thursday that he did not know how he would vote on the monetary policy meeting in June, adding that it would depend on the incoming economic data.

He noted that he expected the U.S. economy to expand stronger in the rest of the year than in the first quarter.

-

16:46

Dallas Federal Reserve President Robert Kaplan will support an interest rate hike June or July if the U.S. economy continues to improve

Dallas Federal Reserve President Robert Kaplan said in an interview with The Wall Street Journal on Thursday that he would support an interest rate hike June or July if the U.S. economy continued to improve.

"I will be advocating we take further action in June or July," he said.

Kaplan noted that Britain's referendum on the membership in the European Union would have impact on the Fed's interest rate decision in June.

-

16:40

Markit/Nikkei services purchasing managers' index for Japan decreases to 49.3 in April

The Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan decreased to 49.3 in April from 50.0 in March.

A reading below 50 indicates contraction of activity, while a reading above 50 indicates expansion.

The decrease was driven by a reduction in clients.

"Latest survey data indicated a slight deterioration in output at Japanese service providers. Activity decreased for the first time in over a year, while new orders were broadly stable during the month," economist at Markit, Amy Brownbill, said.

-

16:19

Reserve Bank of Australia Deputy Governor Philip Lowe will be next governor of the central bank

The Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe will be next governor of the central bank. He will replace Glenn Stevens. Steven's term ends in September.

Lowe is deputy governor since early 2012.

"It is a superb appointment. There could be no one better qualified than Phil Lowe to lead the Bank through the next seven years. The Bank will be in the very best of hands," Stevens said.

-

16:08

Canada’s Ivey purchasing managers’ index climbs to 53.1 in April

Canada's seasonally adjusted Ivey purchasing managers' index climbed to 53.1 in April from 50.1 in March. Analysts had expected the index to rise to 52.5.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was down to 46.8 in April from 48.5 in March, while employment index declined to 49.9 from 50.7.

The prices index was dropped to 53.9 in April from 58.5 in March, while inventories jumped to 52.3 from 48.6.

-

15:38

WSE: After start on Wall Street

The US data regarding the number of new jobs outside agriculture did not make it into the forecast, but were similar to Wednesday's ADP reading. Interpretation of the latter is that the likelihood of interest rate hikes in the United States at the June FOMC meeting is further decreased. This suggests a weaker dollar, which will alleviate pressure for the WSE and the Polish zloty.

After about one hour after the publication, trading mostly returned to the levels preceding the data release. The impact of data was noticeable, but for now doesn't seem to be permanent. Minor exception is gold, which retained the attained highs.

U.S. Stocks open: Dow -0.33%, Nasdaq -0.38%, S&P -0.34%

-

15:33

U.S. Stocks open: Dow -0.33%, Nasdaq -0.38%, S&P -0.34%

-

15:17

Before the bell: S&P futures -0.50%, NASDAQ futures -0.45%

U.S. stock-index futures fell.

Nikkei 16,106.72 -40.66 -0.25%

Hang Seng 20,109.87 -339.95 -1.66%

Shanghai Composite 2,913.41 -84.43 -2.82%

FTSE 6,057.42 -59.83 -0.98%

CAC 4,248.4 -71.06 -1.65%

DAX 9,748.9 -102.96 -1.05%

Crude $43.81 (-1.15%)

Gold $1292.80 (+1.61%)

-

15:02

U.S. unemployment rate remains unchanged at 5.0% in April, 160,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 160,000 jobs in April, missing expectations for a rise of 202,000 jobs, after a gain of 208,000 jobs in March. March's figure was revised down from a rise of 215,000 jobs.

The increase was driven by rises in professional and business services, health care, and financial activities.

The Professional and business services added 65,000 jobs in April, financial activities added 20,000 jobs, while the manufacturing sector added 4,000 jobs.

Health care added 44,000 in April, while mining sector shed 7,100 jobs.

The U.S. unemployment rate remained unchanged at 5.0% in April, in line with expectations.

Average hourly earnings increased 0.3% in April, in line with forecasts, after a 0.2% rise in March. March's figure was revised down from a 0.3% increase.

The labour-force participation rate decreased to 62.8% in April from 63.0% in March.

As the U.S. labour market continues to strengthen, the Fed could raise its interest rate gradually this year.

-

14:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

166.5

-1.27(-0.757%)

251

ALCOA INC.

AA

9.97

-0.05(-0.499%)

21139

Amazon.com Inc., NASDAQ

AMZN

655.25

-3.84(-0.5826%)

14390

American Express Co

AXP

63.51

-0.41(-0.6414%)

312

AMERICAN INTERNATIONAL GROUP

AIG

54.51

-0.30(-0.5473%)

1704

Apple Inc.

AAPL

93.24

-0.00(-0.00%)

124639

AT&T Inc

T

38.76

0.02(0.0516%)

1325

Barrick Gold Corporation, NYSE

ABX

18.3

0.43(2.4063%)

256518

Caterpillar Inc

CAT

72.36

-0.43(-0.5907%)

2085

Chevron Corp

CVX

101.28

-0.14(-0.138%)

221

Cisco Systems Inc

CSCO

26.02

-0.19(-0.7249%)

7327

Citigroup Inc., NYSE

C

43.6

-0.63(-1.4244%)

67990

Exxon Mobil Corp

XOM

87.48

-0.56(-0.6361%)

3500

Facebook, Inc.

FB

117.3

-0.51(-0.4329%)

64179

Ford Motor Co.

F

13.28

-0.04(-0.3003%)

16261

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.23

-0.06(-0.5314%)

237174

General Electric Co

GE

29.75

-0.14(-0.4684%)

14114

General Motors Company, NYSE

GM

30.57

0.03(0.0982%)

21998

Goldman Sachs

GS

157

-2.53(-1.5859%)

4467

Google Inc.

GOOG

697.7

-3.73(-0.5318%)

1273

Home Depot Inc

HD

133.5

-1.17(-0.8688%)

254

Intel Corp

INTC

29.8

-0.10(-0.3345%)

1044

International Business Machines Co...

IBM

145.22

0.15(0.1034%)

3467

Johnson & Johnson

JNJ

112.5

-0.38(-0.3366%)

210

JPMorgan Chase and Co

JPM

60.41

-0.83(-1.3553%)

16476

McDonald's Corp

MCD

128.88

-0.40(-0.3094%)

2544

Microsoft Corp

MSFT

49.7

-0.24(-0.4806%)

16728

Nike

NKE

58.05

-0.14(-0.2406%)

4755

Pfizer Inc

PFE

33.35

-0.22(-0.6554%)

720

Procter & Gamble Co

PG

81.3

0.00(0.00%)

190

Starbucks Corporation, NASDAQ

SBUX

55.95

-0.30(-0.5333%)

883

Tesla Motors, Inc., NASDAQ

TSLA

211

-0.53(-0.2506%)

24910

The Coca-Cola Co

KO

44.9

-0.16(-0.3551%)

2400

Twitter, Inc., NYSE

TWTR

14.15

0.03(0.2125%)

66582

Walt Disney Co

DIS

104.7

-0.23(-0.2192%)

7989

Yahoo! Inc., NASDAQ

YHOO

36.62

-0.32(-0.8663%)

612

Yandex N.V., NASDAQ

YNDX

19.5

-0.47(-2.3535%)

9450

-

14:42

Upgrades and downgrades before the market open

Upgrades:

General Motors (GM) upgraded to Equal-Weight from Underweight at Morgan Stanley; target raised to $29 from $28

Downgrades:

Other:

-

14:41

Canada’s unemployment rate remains unchanged at 7.1% in April

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 7.1% in April. Analysts had expected the unemployment rate to rise to 7.2%.

The labour participation rate declined to 65.8% in April from 65.9% in March.

The Bank of Canada monitors closely the labour participation rate.

The number of employed people declined by 2,100 jobs in April, missing expectations for a rise of 1,000 jobs, after a 40,600 increase in March.

The decrease was mainly driven by a fall in full-time work. Full-time employment declined by 2,400 in April, while part-time employment increased by 400 jobs.

Employment declined in manufacturing, business, building, and other support services, 'other services' natural resources, and agriculture.

-

13:11

WSE: Mid session comment

In the mid-session the WIG20 index reached the level of 1,834 pts. with turnover a bit over PLN 300 mln.

The morning impulse associated with a positive recovery of banking sector is now a history. Morning booster was built on the comments of politicians regarding plans related to foreign currency loans. Here was the visible impact of yesterday's Reuters information about the possible emergence of changes in the conversion of CHF loans, which responded to the domestic currency appreciation.

Today's speech of the Polish Finance Minister, which cooled the expectations vs. the new solutions, resulted in return to the initial situation.

Supply, which is responsible for bringing the index close to 1,830 points has the answer on demand side. Therefore we may say that the proximity of 1,800 points begins to activate buyers who are counting on saving support. At the moment - except "market sell out" signaled by oscillators - there is no "buy" signals.

-

12:05

European stock markets mid session: stocks traded lower ahead of the U.S. labour market data

Stock indices traded lower ahead of the release of the U.S. labour market data later in the day. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in April. The U.S. economy is expected to add 200,000 jobs in April, after adding 215,000 jobs in March.

No major economic reports were released in the Eurozone today.

Current figures:

Name Price Change Change %

FTSE 100 6,081.22 -36.03 -0.59 %

DAX 9,807.62 -44.24 -0.45 %

CAC 40 4,282.69 -36.77 -0.85 %

-

12:01

Swiss National Bank's foreign exchange reserves increase to 587.566 billion Swiss francs in April

The Swiss National Bank's (SNB) foreign exchange reserves increased to 587.566 billion Swiss francs in April from 576.479 billion francs in March. The data could mean that the central bank the central bank may have intervened in the foreign exchange market.

The SNB declined to comment.

-

11:54

Industrial production in Spain rises 1.2% in March

Spanish statistical office INE released its industrial production figures for Spain on Friday. Industrial production in Spain rose 1.2% in March, the biggest rise since April 2014.

On a yearly basis, industrial production in Spain climbed at adjusted 2.8% in March, after a 2.1% increase in February. February's figure was revised down from a 2.2% gain.

Output of capital goods jumped at seasonally adjusted 9.2% year-on-year in March, output of intermediate goods climbed 3.1%, energy production was down 2.5%, while consumer goods output rose 0.3%.

-

11:43

Germany's construction PMI decreases to 53.4 in April

Markit Economics released construction purchasing managers' index (PMI) for Germany on Friday. Germany's construction PMI decreased to 53.4 in April from 55.8 in March.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by a softer growth in in the commercial and civil engineering sub-sectors.

"Latest survey results signalled that the upturn in Germany's construction sector is down but not out at the start of the second quarter. The headline PMI fell to a five-month low, but remained in territory that is consistent with ongoing growth of construction output," an economist at Markit, Oliver Kolodseike, said.

-

11:37

Eurozone's retail PMI declines to 47.9 in April

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Friday. Eurozone's construction purchasing managers' index (PMI) declined to 47.9 in April from 49.2 in March.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in France and Italy declined in April, while sales growth in Germany was softer.

"It was a disappointing start to the second quarter for retailers across the big-three Eurozone economies," an economist at Markit, Phil Smith, said.

-

11:30

Germany's retail PMI drops to 51.0 in April

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Friday. Germany's retail PMI dropped to 51.0 in April from 54.1 in March.

The driven was driven by a softer growth in buying activity, sales and employment.

"Today's PMI numbers signal a note of caution for German retailers, as growth in sales slowed sharply during the month," an economist at Markit, Oliver Kolodseike, said.

-

11:08

Reserve Bank of Australia’s Statement on Monetary Policy: the central bank lowers its inflation forecasts

The Reserve Bank of Australia (RBA) release its Statement on Monetary Policy on Friday. The central bank cut its inflation forecasts. Consumer price inflation is expected to be 1%-2% by the end of 2016, down from its previous estimate of 2%-3%, and 1.5%-2.5% by mid-2018, down from its previous estimate of 2%-3%. The Australian economy is expected to expand 2.5%-3.5% by the end of 2016, and 3%-4% by mid-2018, both forecasts remained unchanged.

The RBA said that uncertainty weighed on consumer price inflation in Australia, adding that it will adjust its monetary policy to boost consumption and inflation.

-

10:54

San Francisco Fed President John Williams: the Fed could raise its interest rate twice or three time this year

San Francisco Fed President John Williams said in an interview with CNBC on Thursday that the Fed could raise its interest rate twice or three time this year, noting that it would be "appropriate". He added that further interest rate hikes would depend on the incoming economic data.

San Francisco Fed president also said that concerns over the slowdown in the global economy dissipated.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:43

St. Louis Fed President James Bullard: global headwinds seem to dissipate in the first half of the year

St. Louis Fed President James Bullard said on Thursday that he did not decide how to vote on the monetary policy yet. He noted that global headwinds, which weighed on the Fed's monetary policy, seemed to dissipate in the first half of the year.

"Those factors appear to be waning during the first half of 2016," St. Louis Fed president said.

He also said that the effects of a stronger U.S. dollar seemed also to dissipate.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:25

Japanese Prime Minister Shinzo Abe: recent fluctuations in the yen are “undesirable”

Japanese Prime Minister Shinzo Abe said on Thursday that recent fluctuations in the yen were "undesirable". He noted that the government was ready to act to prevent a speculative rise in the yen.

"We will watch currency moves carefully and take action as needed," Abe said.

-

10:12

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 42.0 in in the week ended May 01

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 42.0 in in the week ended May 01 from 43.4 the prior week.

The decrease was driven by drops in all sub-indexes. The measure of views of the economy was down to 32.6 from 33.5, the buying climate index decreased to 38.2 from 40.0, while the personal finances index slid to 55.3 from 56.8.

-

09:25

WSE: After opening

WIG20 index opened at 1838.83 points (+0.06%)*

WIG 46487.60 0.12%

WIG30 2055.49 0.14%

mWIG40 3543.30 0.20%

*/ - change to previous close

The WIG20 index started the day with a modest changes. However the decline in core markets - the DAX lost 0.5 percent and the CAC 0.7 per cent - do not allow involve serious hope of the relative strength of the WIG20. In fact, the market is trying to wake up after the stabilization of USDPLN pair, which yesterday strengthening lay a long shadow on the Warsaw Stock Exchange. Turnover exceeds PLN 10 mln, of which nearly half was PKO. As always at the game is also KGHM. Shares of the bank and the copper company are traded with optimism - each of them growing significantly more than the market.

-

08:25

WSE: Before opening

Thursday's session on Wall Street ended with modest changes in the major indexes. The DJIA and the S&P500 recorded a shift discernible only under a magnifying glass and the Nasdaq Composite moved 0.18 percent. From the perspective of European markets, it is worth to note the weaker second half of the day, in which a shadow has been cast on the market by the withdrawal of oil. The current valuation of the contract for the S&P500 is different from the valuation before the twelve hours of barely 0.1 per cent, then the trading in the US can be treated in terms of waiting before today's Labor Department report (14:30 Warsaw time).

The first half of the session in close proximity to the Warsaw Stock Exchange should just be waiting for the data from 14:30. The foreign exchange market already seems to wait for the US data stabilizing the EURUSD and USDJPY pairs. Part of emotion probably will be also focused on the oil market, which recently does not help bulls.

The WSE recently is strongly influenced by the condition of the PLN and trading is correlated with the weakness of the Polish currency to the dollar.

Investors have reasons to expect to decline of the index WIG20 to 1,800 points, where demand should become more aggressive. In the context of the condition of the zloty, it is worth to remember that today we will know a new candidate for President of the NBP (the Polish Central Bank).

-

07:23

Global Stocks

European stock markets rose for the first time in five sessions on Thursday, with optimism over a rally in oil prices outweighing concerns over a slowdown in growth in China's services sector. Trading volumes were lower than usual because of Ascension Day, which kept several markets closed, including Switzerland, Austria and the Scandinavian bourses.

The Dow industrials and S&P 500 finished little changed on Thursday, and the Nasdaq Composite booked its 10th loss in 11 sessions ahead of a key report on employment due Friday. Weak economic data, disappointing earnings and skittishness ahead of the closely watched employment report combined to weigh on investor sentiment.

Shares in Asia edged lower on Friday, amid caution before a key U.S. jobs report and shaky oil prices. Trading was largely muted as investors waited for U.S. jobs data due late Friday in Asia. The report offers a glimpse of the health of the U.S. economy and is a key factor in swaying expectations for future interest-rate increases by the Federal Reserve. Economists estimate roughly 205,000 jobs were added in April.

Based on MarketWatch materials

-

04:22

Nikkei 225 16,011.39 -135.99 -0.84 %, Hang Seng 20,241.08 -208.74 -1.02 %, Shanghai Composite 3,000.87 +3.03 +0.10 %

-

00:34

Stocks. Daily history for Sep Apr May 5’2016:

(index / closing price / change items /% change)

Hang Seng 20,449.82 -76.01 -0.37 %

S&P/ASX 200 5,279.06 +7.92 +0.15 %

Shanghai Composite 2,998.14 +6.87 +0.23 %

FTSE 100 6,117.25 +5.23 +0.09 %

CAC 40 4,319.46 -4.77 -0.11 %

Xetra DAX 9,851.86 +23.61 +0.24 %

S&P 500 2,050.63 -0.49 -0.02 %

NASDAQ Composite 4,717.09 -8.55 -0.18 %

Dow Jones 17,660.71 +9.45 +0.05 %

-