Noticias del mercado

-

21:00

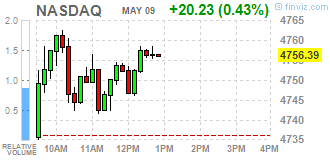

Dow -0.02% 17,737.96 -2.67 Nasdaq +0.74% 4,771.24 +35.08 S&P +0.33% 2,063.98 +6.84

-

18:52

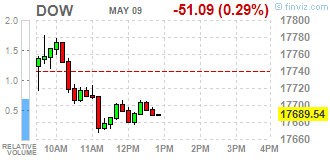

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed on Monday as a bounce in healthcare shares struggled to offset declines in energy and materials stocks. Oil prices reversed course to drop more than 2% after traders took in their stride the impact of wildfires on Canada's oil output and after another inventory build at the U.S. hub for crude futures. A bigger-than-expected drop in China's imports and exports in April pointed to weak demand in the world's second-biggest economy and weighed on materials stocks.

Dow stocks mixed (15 vs 15). Top looser - Caterpillar Inc. (CAT, -3,59). Top gainer - Merck & Co. Inc. (MRK, +1,24%).

S&P sectors mixed. Top looser - Basic Materials (-2,7%). Top gainer - Healthcare (+1,5%).

At the moment:

Dow 17623.00 -48.00 -0.27%

S&P 500 2052.75 0.00 0.00%

Nasdaq 100 4342.75 +14.50 +0.34%

Oil 43.46 -1.20 -2.69%

Gold 1267.10 -26.90 -2.08%

U.S. 10yr 1.76 -0.02

-

18:00

European stocks closed: FTSE 100 6,114.81 -10.89 -0.18% CAC 40 4,322.81 +21.57 +0.50% DAX 9,980.49 +110.54 +1.12%

-

18:00

European stocks close: stocks traded mixed as oil prices dropped

Stock indices traded mixed as oil prices turned negative in the second half of the day. Earlier, oil prices increased as the output in Canada dropped due to the wildfire.

Market participants also eyed the economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 6.2 in May from 5.7 in April.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Economic expectations for the Eurozone remain resilient as investors perception about the future development of Japan continues to deteriorate," Sentix said in its statement.

"Moreover, in May investors get wary about the situation of the US economy. Emerging markets proceed their recovery," Sentix added.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders jumped 1.9% in March, exceeding expectations for a 0.7% increase, after a 0.8% fall in February. February's figure was revised up from a 1.2% drop.

The rise was driven by an increase in foreign orders. Foreign orders increased by 4.3% in March, while domestic orders declined by 1.2%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,114.81 -10.89 -0.18 %

DAX 9,980.49 +110.54 +1.12 %

CAC 40 4,322.81 +21.57 +0.50 %

-

17:52

Bank of Japan’s March monetary policy meeting minutes: some Board members expressed concerns about the negative effect of negative interest rates

The Bank of Japan (BoJ) released its March monetary policy meeting minutes on late Monday evening. According to minutes, some Board members were concerned over the negative effect of negative interest rates. They said that there was "anxiety among financial institutions and depositors had arisen, the Bank's policy conduct had become difficult to understand, market turbulence had become exacerbated; and excessive expectations for further monetary easing had been created".

The central bank said the employment and income situation continued to improve steadily, while private consumption was resilient.

Board members shared the recognition that the Japanese economy continued to expand moderately, but exports and production were affected by the slowdown in emerging economies.

Board members noted that consumer price inflation was about 0% and it was likely to remain at this level for the time being due a decline in energy prices.

The BoJ kept its interest rate unchanged at -0.1% at its March monetary policy meeting.

-

17:43

WSE: Session Results

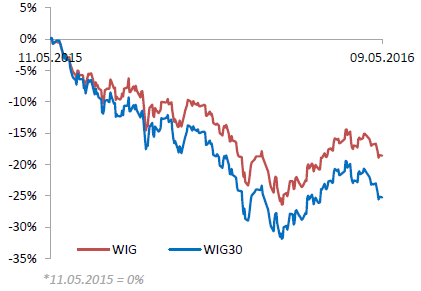

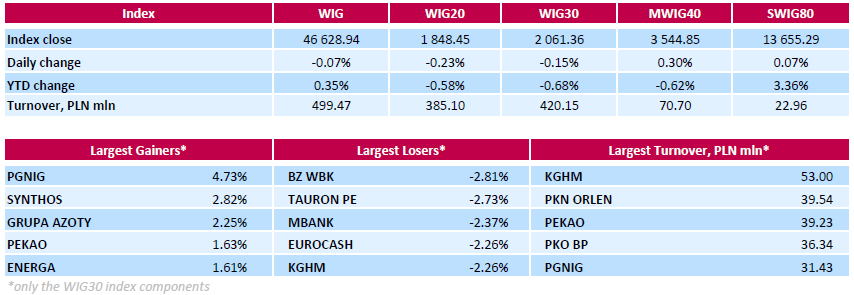

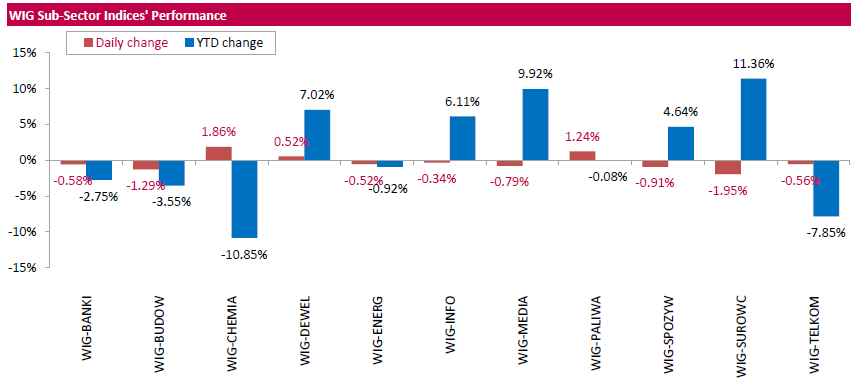

Polish equity market closed slightly lower on Monday. The broad market measure, the WIG Index, inched down 0.07%. From a sector perspective, materials (-1.95%) fared the worst, while chemicals (+1.86%) was the best-performing group.

The large-cap stocks' benchmark, the WIG30 Index, declined by 0.15%. In the index basket, bank BZ WBK (WSE: BZW) and genco TAURON PE (WSE: TPE) recorded the biggest drops, down 2.81% and 2.73% respectively. Other major underperformers were bank MBANK (WSE: MBK), copper producer KGHM (WSE: KGH) and FMCG-wholesaler EUROCASH (WSE: EUR), falling by 2.37%, 2.26% and 2.26% respectively. Elsewhere, bank PKO BP (WSE: PKO) lost 1.62% on the back of posted 1% y/y decline in its Q1 net profit to PLN 638.6 mln ($164.44 mln), broadly in line with forecasts. On the other side of the ledger, oil and gas producer PGNIG (WSE: PGN) topped the list of outperformers, jumping by 4.73% after the company reported a 12% y/y rise in its Q1 net profit to PLN 1.39 bln ($358 mln), beating analysts' consensus estimate of PLN 0.96 bln. Other noticeable gainers were chemical producers SYNTHOS (WSE: SNS) and GRUPA AZOTY (WSE: ATT), advancing 2.82% and 2.25% respectively.

-

16:51

Chicago Fed President Charles Evans: the Fed’s cautious approach in raising interest rates is appropriate

Chicago Fed President Charles Evans said in a speech on Monday that the Fed's cautious approach in raising interest rates was appropriate. He also said that he expected the U.S. economy to expand around 2.5% this year.

Evans is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:36

The Conference Board’s Employment Trends Index (ETI) for the U.S. rises to 128.28 in April

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index increased to 128.28 in April from 126.42 in March. March's figure was revised down from 127.50.

All eight components increased in April.

"Despite the April bounce back in the Employment Trends Index, its growth has slowed in recent months, suggesting that job growth will also slow. Employers have become more cautious as economic growth remains moderate and profits decline. Looking ahead, we anticipate job growth will remain below 200,000 a month," Chief Economist, North America, at The Conference Board, Gad Levanon, said.

-

16:29

European Central Bank purchases €19.77 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €19.77 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.74 billion of covered bonds, and the value of asset-backed securities fell by €118 million.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion.

-

16:16

European Central Bank Vice President Vitor Constancio: the ECB’s stimulus measures needed more time to take effect

The European Central Bank (ECB) Vice President Vitor Constancio said in a speech on Monday that the central bank's stimulus measures needed more time to take effect.

"We have to allow some time for the package of measures adopted in March to produce its effects, while closely monitoring external developments," he said.

Constancio pointed out that the ECB was ready to add further stimulus measures to reach 2% inflation target.

"The ECB will continue to do what is necessary to achieve its goal of reaching a level of inflation close to 2% and enough policy tools can still be used," the ECB vice president said.

-

15:49

Labour cash earnings in Japan rise 1.4% year-on-year in March

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Monday. Labour cash earnings in Japan rose 1.4% year-on-year in March, after a 0.7% increase in February. February's figure was revised down from a 0.9% gain.

Contractual earnings rose 0.4% year-on-year in March, while special cash earnings gained 19.8%.

Total real wages climbed 1.4% in March, after a 0.3% rise in February.

-

15:48

WSE: After start on Wall Street

U.S. Stocks open: Dow -0.07%, Nasdaq -0.01%, S&P -0.01%

The market in the United States opened neutrally, but pretty soon the bulls took control leading to small increases. General trade picture is not so defensive, for which before the opening showed contracts. However the Warsaw Stock Exchange does not respond positively for these signals.

-

15:33

U.S. Stocks open: Dow -0.07%, Nasdaq -0.01%, S&P -0.01%

-

15:24

Before the bell: S&P futures +0.13%, NASDAQ futures +0.25%

U.S. stock-index futures edged up.

Nikkei 16,216.03 +109.31 +0.68%

Hang Seng 20,156.81 +46.94 +0.23%

Shanghai Composite 2,832.91 -80.34 -2.76%

FTSE 6,135.61 +9.91 +0.16%

CAC 4,344.53 +43.29 +1.01%

DAX 10,017.16 +147.21 +1.49%

Crude $44.46 (-0.45%)

Gold $1275.00 (-1.47%)

-

15:08

Japan’s consumer confidence index falls to 40.8 in April

Japan's Cabinet Office released its consumer confidence index on Monday. The consumer confidence index fell to 40.8 in April from 41.7 in March.

The decrease was driven by drops in 3 of 4 sub-indexes. The overall livelihood sub-index decreased to 39.6 in April from 40.5 in March, the income growth sub-index was up to 40.8 from 40.6, the employment sub-index fell to 42.8 from 43.9, while the willingness to buy durable goods sub-index slid to 39.8 from 41.7.

-

14:57

Australian ANZ job advertisements decline 0.8% in April

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements declined 0.8% in April, after a 0.1% rise in March. March's figure was revised down from a 0.2% increase.

The decrease was mainly driven by a drop in newspaper job advertisements, which plunged by 6.2% in April.

"The number of job ads has been broadly flat now for six months. This follows a period of substantial growth in employment, so some modest slowdown should probably not be surprising," the ANZ Head of Australian Economics Felicity Emmett noted.

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.91

-0.13(-1.2948%)

123512

ALTRIA GROUP INC.

MO

63.2

0.27(0.429%)

6141

Amazon.com Inc., NASDAQ

AMZN

675.85

1.90(0.2819%)

19451

Apple Inc.

AAPL

93.05

0.33(0.3559%)

157594

AT&T Inc

T

39.04

0.05(0.1282%)

2290

Barrick Gold Corporation, NYSE

ABX

18.01

-0.46(-2.4905%)

68708

Boeing Co

BA

133.26

-0.00(-0.00%)

3600

Caterpillar Inc

CAT

72.76

-0.60(-0.8179%)

4993

Chevron Corp

CVX

102.19

0.33(0.324%)

5252

Cisco Systems Inc

CSCO

26.58

0.05(0.1885%)

4059

Citigroup Inc., NYSE

C

44.45

0.04(0.0901%)

5775

Deere & Company, NYSE

DE

81.49

0.04(0.0491%)

316

Exxon Mobil Corp

XOM

88.7

0.19(0.2147%)

11924

Facebook, Inc.

FB

119.34

-0.15(-0.1255%)

133504

Ford Motor Co.

F

13.49

0.05(0.372%)

17188

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.45

-0.34(-2.8838%)

733270

General Electric Co

GE

30.17

0.05(0.166%)

780

General Motors Company, NYSE

GM

31.07

0.11(0.3553%)

926

Goldman Sachs

GS

159

0.15(0.0944%)

930

Google Inc.

GOOG

712.88

1.76(0.2475%)

2012

International Business Machines Co...

IBM

147.3

0.01(0.0068%)

535

JPMorgan Chase and Co

JPM

61.4

-0.20(-0.3247%)

3518

McDonald's Corp

MCD

130.35

-0.23(-0.1761%)

242

Merck & Co Inc

MRK

53.6

-0.00(-0.00%)

1400

Microsoft Corp

MSFT

50.6

0.21(0.4167%)

27531

Starbucks Corporation, NASDAQ

SBUX

56.55

0.24(0.4262%)

3927

Tesla Motors, Inc., NASDAQ

TSLA

216.75

1.82(0.8468%)

31974

The Coca-Cola Co

KO

45.29

-0.03(-0.0662%)

175

Twitter, Inc., NYSE

TWTR

14.38

-0.02(-0.1389%)

24272

Visa

V

77.9

0.18(0.2316%)

3062

Wal-Mart Stores Inc

WMT

68.31

0.06(0.0879%)

284

Walt Disney Co

DIS

106.4

0.86(0.8149%)

42830

Yahoo! Inc., NASDAQ

YHOO

37.36

0.13(0.3492%)

313

Yandex N.V., NASDAQ

YNDX

19.92

0.04(0.2012%)

1400

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) resumed with a Buy at Dougherty & Company; target $500

Barrick Gold (ABX) target raised to $18 from $16 at RBC Capital Mkts

-

14:36

Housing starts in Canada fall to a seasonally adjusted annualized rate of 191,512 units in April

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Friday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 191,512 units in April from 202,375 units in March. March's figure was revised down from 204,251 units.

Housing starts were driven by a drop in the single and multi-unit segment.

"While the trend for Canada remained stable in April, there were off-setting differences at the local level, notably in Vancouver and Montreal. Condo construction is slowing down in Montreal as builders are managing inventories by channelling demand to units that have been completed but remain unsold," the CMHC's Chief Economist Bob Dugan said.

-

13:12

WSE: Mid session comment

When the German DAX-having increased by 1.8% our the WIG20 index grows by 0.4% and returns to the level of its opening. Turnover in the segment of blue chips are moving slowly to PLN 200 mln, which after nearly four hours means low average less than PLN 50 mln per hour. We see quiet trading Monday with a positive distinction on the side of the resulting PGNiG (WSE: PGN). The main index remains well above the level of 1,850 points, which means that positive pulse from Friday is hold, though is not really developed yet, which may, however, come later.

-

11:59

European stock markets mid session: stocks rise on higher oil prices

Stock indices traded higher on a rise in oil prices. Oil prices increased as the output in Canada dropped due to the wildfire.

Market participants also eyed the economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 6.2 in May from 5.7 in April.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Economic expectations for the Eurozone remain resilient as investors perception about the future development of Japan continues to deteriorate," Sentix said in its statement.

"Moreover, in May investors get wary about the situation of the US economy. Emerging markets proceed their recovery," Sentix added.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders jumped 1.9% in March, exceeding expectations for a 0.7% increase, after a 0.8% fall in February. February's figure was revised up from a 1.2% drop.

The rise was driven by an increase in foreign orders. Foreign orders increased by 4.3% in March, while domestic orders declined by 1.2%.

Current figures:

Name Price Change Change %

FTSE 100 6,171.82 +46.12 +0.75 %

DAX 10,061.88 +191.93 +1.94 %

CAC 40 4,359.02 +57.78 +1.34 %

-

11:44

Halifax: House prices in the U.K. fall 0.8% in April

Halifax released its house prices data for the U.K. on Monday. House prices in the U.K. fell 0.8% in April, missing expectations for a 0.1% rise, after a 2.2% increase in March. March's figure was revised down from a 2.6% rise.

On a yearly basis, house prices jumped 9.2% in the three months to April, missing forecasts of a 9.6% gain, after a 10.1% increase in the three months to March.

"Current market conditions remain very tight as the severe imbalance between supply and demand persists. This situation, combined with low interest rates and rising employment and real earnings, should continue to push house prices up over the coming months," Halifax's housing economist Martin Ellis said.

-

11:38

Switzerland’s consumer price inflation rises 0.3% in April

The Swiss Federal Statistics Office released its consumer inflation data on Monday. Switzerland's consumer price index rose 0.3% in April, exceeding expectations for a 0.1% gain, after a 0.3% increase in March.

The increase was mainly driven by higher prices for petroleum products, and clothing and footwear.

On a yearly basis, Switzerland's consumer price index increased to -0.4% in April from -0.9% in March, beating forecasts of a rise to -0.6%.

-

11:27

Sentix investor confidence index for the Eurozone rises to 6.2 in May

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 6.2 in May from 5.7 in April.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Economic expectations for the Eurozone remain resilient as investors perception about the future development of Japan continues to deteriorate," Sentix said in its statement.

"Moreover, in May investors get wary about the situation of the US economy. Emerging markets proceed their recovery," Sentix added.

The current conditions index was up to 7.0 in May from 6.0 in April.

The expectations index remained unchanged at 5.5 in May.

German investor confidence index rose to 18.3 in May from 17.6 in April.

-

11:20

German seasonal adjusted factory orders jump 1.9% in March

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders jumped 1.9% in March, exceeding expectations for a 0.7% increase, after a 0.8% fall in February. February's figure was revised up from a 1.2% drop.

The rise was driven by an increase in foreign orders. Foreign orders increased by 4.3% in March, while domestic orders declined by 1.2%.

New orders from the Eurozone rose 1.1% in March, while orders from other countries climbed 6.2%.

Orders of the intermediate goods decreased by 1.2% in March, capital goods orders were up 4.0%, while consumer goods orders rose 1.6%.

-

11:00

New York Fed President William C. Dudley: it would be appropriate to raise the interest rate twice this year

New York Fed President William C. Dudley said in an interview on Friday that it would be appropriate to raise the interest rate twice this year.

"I think we're still on track," he said.

Dudley expects the U.S. economy to continue to strengthen despite the weak growth in the first quarter.

-

10:23

Japanese Finance Minister Taro Aso: the government is ready to intervene in the foreign exchange market

Japanese Finance Minister Taro Aso said before the parliament on Monday that the government was ready to intervene in the foreign exchange market if the yen would raise further, adding that the yen's volatility was undesirable.

"For Japan, excessive volatility in yen moves that affect Japan's trade, economic and fiscal policies - be it yen rises or yen falls - is undesirable," Aso said.

"If such moves occur, Japan is ready to intervene in the market," he added.

-

10:09

China's trade surplus widens $45.56 billion in April

The Chinese Customs Office released its trade data on Sunday. China's trade surplus climbed to $45.56 billion in April from $29.86 billion in March from $32.59 billion, exceeding expectations for a rise to a surplus of $40.00 billion.

Exports fell at an annual rate of 1.8% in April, while imports slid at an annual rate of 10.9%, the seventeenth consecutive decline.

-

09:18

WSE: After opening

WIG20 index opened at 1859.84 points (+0.38%)*

WIG 46790.70 0.27%

WIG30 2070.48 0.30%

mWIG40 3549.36 0.43%

*/ - change to previous close

The Cash market opens with the rise of 0.38% to 1,859 points on the WIG20 index with relatively low turnover. We may see a noticeable decrease in the valuation of KGHM (WSE: KGH) shares, which in terms of behavior of copper prices should not be surprising. Positively responds to the results of PGNiG (WSE: PGN) their stock price, and PKO BP (W SE: PKO) shares neutrally accept the publication of quarterly results. Surrounded the DAX gained more than 0.6%, but it lacks a clearer pulse to continue the approach, and that's made at the opening is big. On the WSE the banks do not continue Friday's growth, which leads to a balanced trade.

-

08:24

WSE: Before opening

We begin the second week of the month in which the macro calendar is very poor. Therefore investors should build their strategies on known on Friday data from the US labor market and the recent weekend data regarding Chinese trade. Reports from China were not so very beneficial. The dynamics of Chinese exports is back to negative values, however that was expected. In the case of import the data are more surprising, but the investors should become accustomed. It was shown by a larger reaction only in China and on the copper market. Behind them it is now more balanced.

Opening part of sessions in Europe should proceed neutral or slightly up, followed pretty good behavior of Wall Street on Friday. In Warsaw, copper prices may hurt KGHM, but banks on Friday showed a good side and it depends on them now, whether Friday's improvement will be more durable.

This week, there will also be the decision of Moody's regarding the Poland rating, which is expected on Friday. The end of last week showed, however, that the Warsaw Stock Exchange is slightly less worried about this decision, which the concerns were still visible on the currency market.

-

06:35

Global Stocks

European stock markets ended a choppy session mostly lower on Friday, with a downbeat reading on U.S. jobs growth outweighing a late-day rally in oil prices.

U.S. stocks finished higher Friday, rebounding after spending much of the session in the red, as investors grappled with the jobs report and its ramifications for Federal Reserve's monetary policy. The main indexes booked their second consecutive weekly losses, however, as poor economic reports have raised concerns about domestic growth.

Stock markets in China were broadly lower Monday, after the Communist Party's mouthpiece reported that the nation's economy is headed for an "L-shaped" recovery, stoking worries among investors that growth in the world's second-largest economy will moderate further.

Based on MarketWatch materials

-

04:19

Nikkei 225 16,159.74 +53.02 +0.33 %, Hang Seng 20,176.69 +66.82 +0.33 %, Shanghai Composite 2,865.21 -48.04 -1.65 %

-

02:49

Stocks. Daily history for Sep Apr May 6’2016:

(index / closing price / change items /% change)

S&P/ASX 200 5,292.05 +12.99 +0.25%

TOPIX 1,298.32 -1.64 -0.13%

SHANGHAI COMP 2,913.41 -84.43 -2.82%

HANG SENG 20,146.29 -303.53 -1.48%

FTSE 100 6,125.7 +8.45 +0.14 %

CAC 40 4,301.24 -18.22 -0.42 %

Xetra DAX 9,869.95 +18.09 +0.18 %

S&P 500 2,057.14 +6.51 +0.32 %

NASDAQ Composite 4,736.16 +19.06 +0.40 %

Dow Jones 17,740.63 +79.92 +0.45 %

-