Noticias del mercado

-

20:19

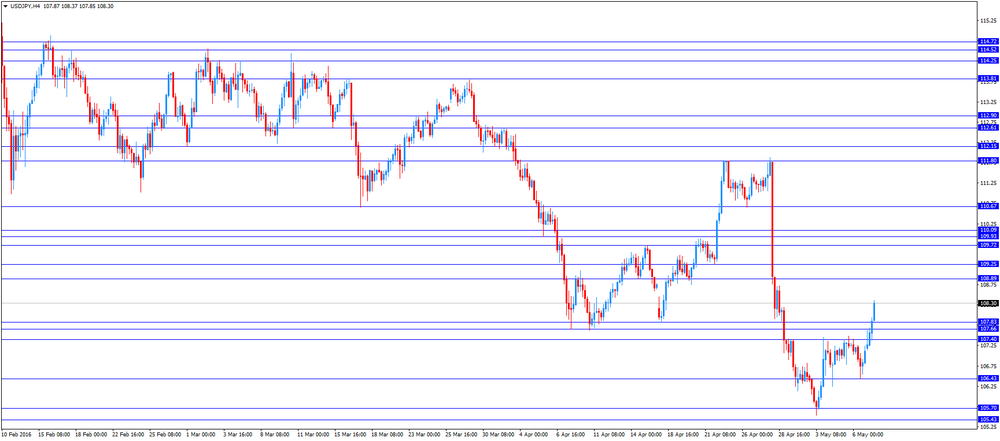

American focus: the US dollar strengthened significantly against the yen

The Japanese yen fell more than 1% against the US dollar, entrenched above $ Y108.00. The main pressure on the currency had a statement of the Minister of Finance of Japan Taro Aso. He noted that the Central Bank is ready to intervene in case of a sharp increase in the volatility of the national currency. Previously it was thought that Tokyo would not dare to intervene, given the US position, but Aso's words made market participants doubt it. Comments Aso became another sign of tension between the United States and Japan on the issue of exchange rates. "Certainly, we are ready to intervene if the yen continues to rise sharply," - said Aso. According to Aso, the change rate of USD / JPY for two days at 5 yen can be called "somewhat excessive". Recall that in recent months, other officials of Japan have already made warning of the possibility of intervention designed to put an end to the strengthening of the yen. This strengthening leads to the fact that Japan is more difficult to achieve the acceleration of inflation and stimulate economic growth.

The US dollar consolidated against the euro while remaining near the level of $ 1.1400. Experts point out that the reason for this was the lack of economic data and significant catalysts. Little influenced by the statements of representatives of the ECB and the Fed. ECB Vice President Constancio said that the data point to continued moderate, albeit fragile recovery. He also said that the ECB has the tools to accelerate inflation. Meanwhile, Constancio added that it takes time to see the effects of the March Central Bank measures. Thus, he signaled that the Central Bank is unlikely to change the policy in the near future.

Meanwhile, the head of the Chicago Fed Evans said the fundamentals of the US economy are "solid" and growth this year should accelerate to around 2.5%. He added that although the US economy looks healthy, he still would like to see more tangible evidence that inflationary pressures are strong enough to reach the target level.

The pound fell against the dollar, returning to the minimum session. Pressure on the pound has uncertainty associated with the upcoming referendum on Britain's membership of the EU. According to a study conducted by the agency Ipsos-MORI, 48% of respondents in eight major countries of the European Union believe that if Britain leaves the European Union, other countries may go to the same measures. In this case not less than 49% of respondents believe that UK residents will perform for an exit from the European Union, which in the opinion of 51% of the respondents will damage the EU economy, and in the opinion of 36% - the British economy. During the holding of the referendum, planned like in the UK, 45% of respondents were in favor of Belgium, France, Germany, Hungary, Italy, Poland, Spain and Sweden.

In addition, the attention of market participants gradually switched to meeting Bank of England. Economists will be closely watching those to preserve the unity of opinion among the leadership of the Bank of England after increasing downside risks to GDP growth. Over the weekend edition of the Guardian reported that at least one member of the Committee of Central Bank may act for the interest rate cut to stimulate the economy.

-

17:52

Bank of Japan’s March monetary policy meeting minutes: some Board members expressed concerns about the negative effect of negative interest rates

The Bank of Japan (BoJ) released its March monetary policy meeting minutes on late Monday evening. According to minutes, some Board members were concerned over the negative effect of negative interest rates. They said that there was "anxiety among financial institutions and depositors had arisen, the Bank's policy conduct had become difficult to understand, market turbulence had become exacerbated; and excessive expectations for further monetary easing had been created".

The central bank said the employment and income situation continued to improve steadily, while private consumption was resilient.

Board members shared the recognition that the Japanese economy continued to expand moderately, but exports and production were affected by the slowdown in emerging economies.

Board members noted that consumer price inflation was about 0% and it was likely to remain at this level for the time being due a decline in energy prices.

The BoJ kept its interest rate unchanged at -0.1% at its March monetary policy meeting.

-

16:51

Chicago Fed President Charles Evans: the Fed’s cautious approach in raising interest rates is appropriate

Chicago Fed President Charles Evans said in a speech on Monday that the Fed's cautious approach in raising interest rates was appropriate. He also said that he expected the U.S. economy to expand around 2.5% this year.

Evans is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:36

The Conference Board’s Employment Trends Index (ETI) for the U.S. rises to 128.28 in April

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index increased to 128.28 in April from 126.42 in March. March's figure was revised down from 127.50.

All eight components increased in April.

"Despite the April bounce back in the Employment Trends Index, its growth has slowed in recent months, suggesting that job growth will also slow. Employers have become more cautious as economic growth remains moderate and profits decline. Looking ahead, we anticipate job growth will remain below 200,000 a month," Chief Economist, North America, at The Conference Board, Gad Levanon, said.

-

16:29

European Central Bank purchases €19.77 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €19.77 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.74 billion of covered bonds, and the value of asset-backed securities fell by €118 million.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion.

-

16:16

European Central Bank Vice President Vitor Constancio: the ECB’s stimulus measures needed more time to take effect

The European Central Bank (ECB) Vice President Vitor Constancio said in a speech on Monday that the central bank's stimulus measures needed more time to take effect.

"We have to allow some time for the package of measures adopted in March to produce its effects, while closely monitoring external developments," he said.

Constancio pointed out that the ECB was ready to add further stimulus measures to reach 2% inflation target.

"The ECB will continue to do what is necessary to achieve its goal of reaching a level of inflation close to 2% and enough policy tools can still be used," the ECB vice president said.

-

16:01

U.S.: Labor Market Conditions Index, April -0.9

-

15:49

Labour cash earnings in Japan rise 1.4% year-on-year in March

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Monday. Labour cash earnings in Japan rose 1.4% year-on-year in March, after a 0.7% increase in February. February's figure was revised down from a 0.9% gain.

Contractual earnings rose 0.4% year-on-year in March, while special cash earnings gained 19.8%.

Total real wages climbed 1.4% in March, after a 0.3% rise in February.

-

15:41

Option expiries for today's 10:00 ET NY cut

USDJPY 106.00 (USD 208m) 107.85 (350m) 108.00 (275m) 108.91 (250m)

EURUSD: 1.1300 (EUR 2.99bln) 1.1325 (388m) 1.1340 (509m) 1.1385-90 (482m) 1.1400 (303m) 1.1500 (795m) 1.1600 (646m)

GBPUSD 1.4220 (GBP 225m) 1.4240-50 (758m)

AUDUSD 0.7400 (AUD 1.27bln) 0.7500 (355m) 0.7545 (652m)

EURJPY 124.65 (396m)

-

15:08

Japan’s consumer confidence index falls to 40.8 in April

Japan's Cabinet Office released its consumer confidence index on Monday. The consumer confidence index fell to 40.8 in April from 41.7 in March.

The decrease was driven by drops in 3 of 4 sub-indexes. The overall livelihood sub-index decreased to 39.6 in April from 40.5 in March, the income growth sub-index was up to 40.8 from 40.6, the employment sub-index fell to 42.8 from 43.9, while the willingness to buy durable goods sub-index slid to 39.8 from 41.7.

-

14:57

Australian ANZ job advertisements decline 0.8% in April

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements declined 0.8% in April, after a 0.1% rise in March. March's figure was revised down from a 0.2% increase.

The decrease was mainly driven by a drop in newspaper job advertisements, which plunged by 6.2% in April.

"The number of job ads has been broadly flat now for six months. This follows a period of substantial growth in employment, so some modest slowdown should probably not be surprising," the ANZ Head of Australian Economics Felicity Emmett noted.

-

14:36

Housing starts in Canada fall to a seasonally adjusted annualized rate of 191,512 units in April

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Friday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 191,512 units in April from 202,375 units in March. March's figure was revised down from 204,251 units.

Housing starts were driven by a drop in the single and multi-unit segment.

"While the trend for Canada remained stable in April, there were off-setting differences at the local level, notably in Vancouver and Montreal. Condo construction is slowing down in Montreal as builders are managing inventories by channelling demand to units that have been completed but remain unsold," the CMHC's Chief Economist Bob Dugan said.

-

14:15

Canada: Housing Starts, April 191.5 (forecast 191.5)

-

14:02

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Labor Cash Earnings, YoY March 0.7% Revised From 0.9% 1.4%

05:00 Japan Consumer Confidence April 41.7 40.8

06:00 Germany Factory Orders s.a. (MoM) March -0.8% Revised From -1.2% 0.7% 1.9%

07:15 Switzerland Consumer Price Index (MoM) April 0.3% 0.1% 0.3%

07:15 Switzerland Consumer Price Index (YoY) April -0.9% -0.6% -0.4%

07:30 United Kingdom Halifax house price index 3m Y/Y April 10.1% 9.6% 9.2%

07:30 United Kingdom Halifax house price index April 2.2% Revised From 2.6% 0.1% -0.8%

08:30 Eurozone Sentix Investor Confidence May 5.7 6.2

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major economic reports.

Market participants continued to eye the U.S. labour market data. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 160,000 jobs in April, missing expectations for a rise of 202,000 jobs, after a gain of 208,000 jobs in March. March's figure was revised down from a rise of 215,000 jobs. The increase was driven by rises in professional and business services, health care, and financial activities.

The U.S. unemployment rate remained unchanged at 5.0% in April, in line with expectations.

Average hourly earnings increased 0.3% in April, in line with forecasts, after a 0.2% rise in March. March's figure was revised down from a 0.3% increase.

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 6.2 in May from 5.7 in April.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Economic expectations for the Eurozone remain resilient as investors perception about the future development of Japan continues to deteriorate," Sentix said in its statement.

"Moreover, in May investors get wary about the situation of the US economy. Emerging markets proceed their recovery," Sentix added.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders jumped 1.9% in March, exceeding expectations for a 0.7% increase, after a 0.8% fall in February. February's figure was revised up from a 1.2% drop.

The rise was driven by an increase in foreign orders. Foreign orders increased by 4.3% in March, while domestic orders declined by 1.2%.

The British pound traded mixed against the U.S. dollar. Halifax released its house prices data for the U.K. on Monday. House prices in the U.K. fell 0.8% in April, missing expectations for a 0.1% rise, after a 2.2% increase in March. March's figure was revised down from a 2.6% rise.

On a yearly basis, house prices jumped 9.2% in the three months to April, missing forecasts of a 9.6% gain, after a 10.1% increase in the three months to March.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Candian housing market data. Housing starts in Canada are expected to decline to 191,500 in April from 204,300 in March.

The Swiss franc traded mixed against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Monday. Switzerland's consumer price index rose 0.3% in April, exceeding expectations for a 0.1% gain, after a 0.3% increase in March.

The increase was mainly driven by higher prices for petroleum products, and clothing and footwear.

On a yearly basis, Switzerland's consumer price index increased to -0.4% in April from -0.9% in March, beating forecasts of a rise to -0.6%.

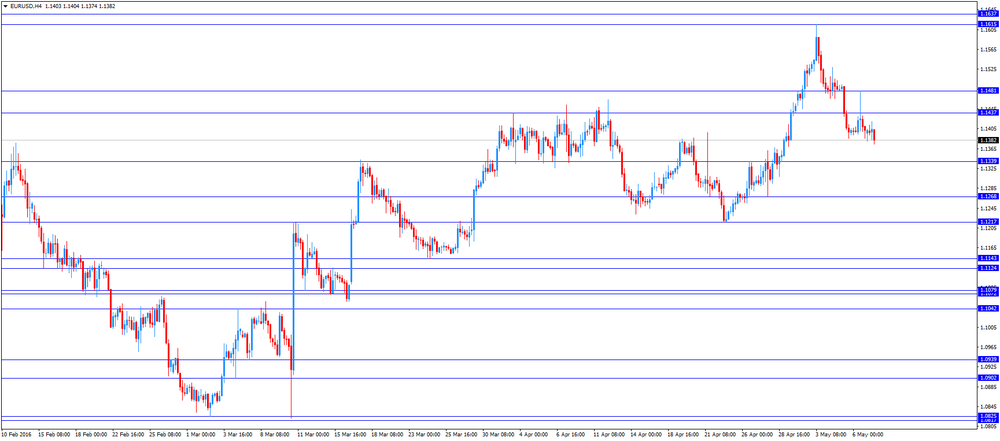

EUR/USD: the currency pair fell to $1.1374

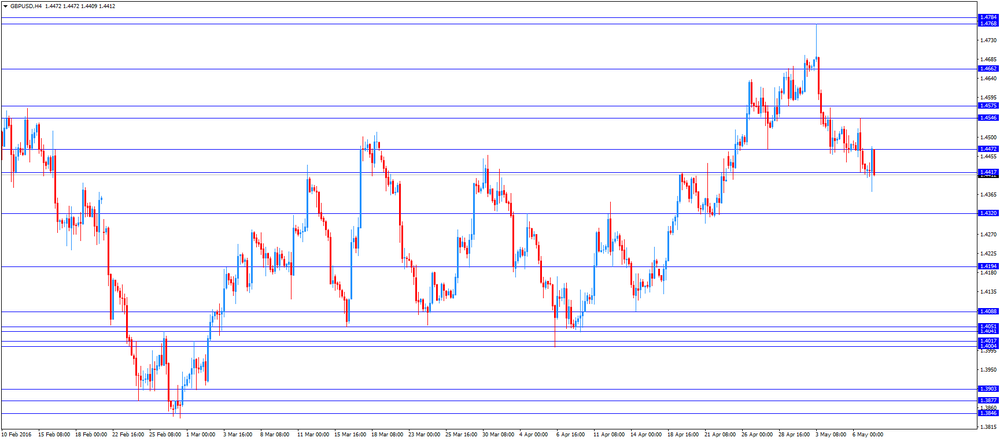

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y108.37

The most important news that are expected (GMT0):

12:15 Canada Housing Starts April 204.3 191.5

14:00 U.S. Labor Market Conditions Index April -2.1

-

11:44

Halifax: House prices in the U.K. fall 0.8% in April

Halifax released its house prices data for the U.K. on Monday. House prices in the U.K. fell 0.8% in April, missing expectations for a 0.1% rise, after a 2.2% increase in March. March's figure was revised down from a 2.6% rise.

On a yearly basis, house prices jumped 9.2% in the three months to April, missing forecasts of a 9.6% gain, after a 10.1% increase in the three months to March.

"Current market conditions remain very tight as the severe imbalance between supply and demand persists. This situation, combined with low interest rates and rising employment and real earnings, should continue to push house prices up over the coming months," Halifax's housing economist Martin Ellis said.

-

11:38

Switzerland’s consumer price inflation rises 0.3% in April

The Swiss Federal Statistics Office released its consumer inflation data on Monday. Switzerland's consumer price index rose 0.3% in April, exceeding expectations for a 0.1% gain, after a 0.3% increase in March.

The increase was mainly driven by higher prices for petroleum products, and clothing and footwear.

On a yearly basis, Switzerland's consumer price index increased to -0.4% in April from -0.9% in March, beating forecasts of a rise to -0.6%.

-

11:27

Sentix investor confidence index for the Eurozone rises to 6.2 in May

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 6.2 in May from 5.7 in April.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Economic expectations for the Eurozone remain resilient as investors perception about the future development of Japan continues to deteriorate," Sentix said in its statement.

"Moreover, in May investors get wary about the situation of the US economy. Emerging markets proceed their recovery," Sentix added.

The current conditions index was up to 7.0 in May from 6.0 in April.

The expectations index remained unchanged at 5.5 in May.

German investor confidence index rose to 18.3 in May from 17.6 in April.

-

11:20

German seasonal adjusted factory orders jump 1.9% in March

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders jumped 1.9% in March, exceeding expectations for a 0.7% increase, after a 0.8% fall in February. February's figure was revised up from a 1.2% drop.

The rise was driven by an increase in foreign orders. Foreign orders increased by 4.3% in March, while domestic orders declined by 1.2%.

New orders from the Eurozone rose 1.1% in March, while orders from other countries climbed 6.2%.

Orders of the intermediate goods decreased by 1.2% in March, capital goods orders were up 4.0%, while consumer goods orders rose 1.6%.

-

11:00

New York Fed President William C. Dudley: it would be appropriate to raise the interest rate twice this year

New York Fed President William C. Dudley said in an interview on Friday that it would be appropriate to raise the interest rate twice this year.

"I think we're still on track," he said.

Dudley expects the U.S. economy to continue to strengthen despite the weak growth in the first quarter.

-

10:35

Bank of Canada Deputy Governor Lawrence Schembri: central banks could contribute to the financial stability

The Bank of Canada (BoC) Deputy Governor Lawrence Schembri said in a speech on Friday that central banks could contribute to the financial stability.

"So although central banks don't themselves have a broad set of instruments to mitigate financial vulnerabilities, they do have that system-wide view, which they can and do use to promote financial stability by making public their analyses of financial vulnerabilities and risks and making recommendations for preventive policy actions," he said.

"At the same time that central banks are enhancing their efforts to promote financial stability, they must maintain their focus on monetary policy to achieve price and macroeconomic stability. These are necessary conditions for financial stability," Schembri added.

The BoC deputy governor noted that the central bank would introduce a framework for stress tests that would incorporate different sectors of the financial system.

-

10:23

Japanese Finance Minister Taro Aso: the government is ready to intervene in the foreign exchange market

Japanese Finance Minister Taro Aso said before the parliament on Monday that the government was ready to intervene in the foreign exchange market if the yen would raise further, adding that the yen's volatility was undesirable.

"For Japan, excessive volatility in yen moves that affect Japan's trade, economic and fiscal policies - be it yen rises or yen falls - is undesirable," Aso said.

"If such moves occur, Japan is ready to intervene in the market," he added.

-

10:09

China's trade surplus widens $45.56 billion in April

The Chinese Customs Office released its trade data on Sunday. China's trade surplus climbed to $45.56 billion in April from $29.86 billion in March from $32.59 billion, exceeding expectations for a rise to a surplus of $40.00 billion.

Exports fell at an annual rate of 1.8% in April, while imports slid at an annual rate of 10.9%, the seventeenth consecutive decline.

-

10:02

Option expiries for today's 10:00 ET NY cut

USD/JPY 106.00 (USD 208m) 107.85 (350m) 108.00 (275m) 108.91 (250m)

EUR/USD: 1.1300 (EUR 2.99bln) 1.1325 (388m) 1.1340 (509m) 1.1385-90 (482m) 1.1400 (303m) 1.1500 (795m) 1.1600 (646m)

GBP/USD 1.4220 (GBP 225m) 1.4240-50 (758m)

AUD/USD 0.7400 (AUD 1.27bln) 0.7500 (355m) 0.7545 (652m)

EUR/JPY 124.65 (396m)

-

09:31

United Kingdom: Halifax house price index 3m Y/Y, April 9.2% (forecast 9.6%)

-

09:31

United Kingdom: Halifax house price index, April -0.8% (forecast 0.1%)

-

09:15

Switzerland: Consumer Price Index (MoM) , April 0.3% (forecast 0.1%)

-

09:15

Switzerland: Consumer Price Index (YoY), April -0.4% (forecast -0.6%)

-

08:30

Asian session: The dollar got off to a calm start following a choppy end to last week

China April exports, imports decline more than expected China's exports and imports fell more than expected in April, underlining weak demand at home and abroad and cooling hopes of a recovery in the world's second-largest economy.

Australian PM calls July 2 poll amid economic slowdown, instability Prime Minister Malcolm Turnbull fired the starting gun on Sunday on one of the longest election campaigns in Australia's history, against the backdrop of a flagging economy and heated debate over sensitive political issues like asylum seekers.

The dollar got off to a calm start following a choppy end to last week, while disappointing trade figures out of China barely dented an already defensive Australian dollar.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1380-15

GBP / USD: during the Asian session, the pair was trading in the $ 1.4405-40

USD / JPY: during the Asian session, the pair was trading in range Y107.20-60

Based on Reuters materials

-

08:01

Germany: Factory Orders s.a. (MoM), March 1.9% (forecast 0.7%)

-

07:06

Options levels on monday, May 9, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1571 (4264)

$1.1514 (4277)

$1.1474 (2128)

Price at time of writing this review: $1.1411

Support levels (open interest**, contracts):

$1.1339 (1707)

$1.1296 (3634)

$1.1236 (4807)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 62576 contracts, with the maximum number of contracts with strike price $1,1600 (5191);

- Overall open interest on the PUT options with the expiration date June, 3 is 83365 contracts, with the maximum number of contracts with strike price $1,1200 (8416);

- The ratio of PUT/CALL was 1.33 versus 1.43 from the previous trading day according to data from May, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.4706 (1783)

$1.4608 (2083)

$1.4512 (1928)

Price at time of writing this review: $1.4438

Support levels (open interest**, contracts):

$1.4385 (1343)

$1.4289 (2172)

$1.4192 (2706)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 28641 contracts, with the maximum number of contracts with strike price $1,4600 (2083);

- Overall open interest on the PUT options with the expiration date June, 3 is 31484 contracts, with the maximum number of contracts with strike price $1,4200 (2706);

- The ratio of PUT/CALL was 1.10 versus 1.54 from the previous trading day according to data from May, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:01

Japan: Consumer Confidence, April 40.8

-

07:01

Japan: Consumer Confidence, April 40.8

-

02:45

Currencies. Daily history for May 6’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1402 0,00%

GBP/USD $1,4425 -0,41%

USD/CHF Chf0,9725 +0,48%

USD/JPY Y107,12 -0,13%

EUR/JPY Y122,20 -0,08%

GBP/JPY Y154,5 -0,56%

AUD/USD $0,7365 -1,33%

NZD/USD $0,6837 -0,64%

USD/CAD C$1,291 +0,36%

-

02:01

Schedule for today, Monday, May 9’2016:

(time / country / index / period / previous value / forecast)

00:00 Japan Labor Cash Earnings, YoY March 0.7% Revised From 0.9% 1.4%

05:00 Japan Consumer Confidence April 41.7

06:00 Germany Factory Orders s.a. (MoM) March -1.2% 0.7%

07:00 United Kingdom Halifax house price index 3m Y/Y April 10.1% 9.6%

07:00 United Kingdom Halifax house price index April 2.6% 0.1%

07:15 Switzerland Consumer Price Index (MoM) April 0.3% 0.1%

07:15 Switzerland Consumer Price Index (YoY) April -0.9% -0.6%

08:30 Eurozone Sentix Investor Confidence May 5.7

12:15 Canada Housing Starts April 204.3 191.5

14:00 U.S. Labor Market Conditions Index April -2.1

-

01:59

Japan: Labor Cash Earnings, YoY, March 0.6%

-