Noticias del mercado

-

17:01

Fed Tarullo: the world financial system "is pretty well prepared" for the Brexit shock

- US Response to Brexit generally in line with our expectations.

- wait to see what will be the macroeconomic consequences of Brexit.

- relevant interest rate depends on the factors affecting the economy.

- the overheating of the US economy is not a danger.

- the Fed probably does not provide much stimulus as many believe.

- Fed has the tools for an adequate response in the event of a sharp acceleration in economic growth.

- for Fed is better to wait for new evidence of rising inflation.

- low interest rates may give rise to financial instability, but this may not be sufficient to justify rate hikes.

- currently there are no worries about financial instability, "bubbles" in asset classes.

-

16:39

US business activity index for the services sector rose slightly in June

Data for June from Markit showed a steady growth of business activity in the US service sector, which has helped the most rapid expansion of new orders since the beginning of 2016, however, growth remains weak in comparison with the post-crisis trend, helped by a slowdown in job creation for third consecutive month in June. Business expectations for the year ahead have also continued to soften, while service providers showed the lowest degree of optimism ever since the survey began in October 2009.

The seasonally adjusted index of business activity in the US services sector by Markit rose slightly to 51.4 in June from 51.3 in May, and signaled a further slight expansion of service sector activity.

On average, in the second quarter of 2016 the index rose slightly compared with the previous quarter (to 51.8 in Q2 from 51.4 in Q1).

Respondents noted the overall improvement in customer spending, but there were also reports that restrained business confidence and growing economic uncertainty acted as a brake on growth in June.

-

16:13

US ISM non-manufacturing well above forecasts

The report was issued today by the Institute for Supply Management and registered 56.5 percent in June, 3.6 percentage points higher than the May reading of 52.9 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 59.5 percent, 4.4 percentage points higher than the May reading of 55.1 percent, reflecting growth for the 83rd consecutive month, at a faster rate in June. The New Orders Index registered 59.9 percent, 5.7 percentage points higher than the reading of 54.2 percent in May. The Employment Index grew 3 percentage points in June after one month of contraction to 52.7 percent from the May reading of 49.7 percent. The Prices Index decreased 0.1 percentage point from the May reading of 55.6 percent to 55.5 percent, indicating prices increased in June for the third consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in June. Respondents' comments are mostly positive about business conditions and the economy. Overall, the report reflects a strong rebound from the 'cooling-off' of the previous month for the non-manufacturing sector.

The 15 non-manufacturing industries reporting growth in June - listed in order - are: Mining; Arts, Entertainment & Recreation; Management of Companies & Support Services; Retail Trade; Health Care & Social Assistance; Utilities; Real Estate, Rental & Leasing; Accommodation & Food Services; Transportation & Warehousing; Wholesale Trade; Information; Public Administration; Agriculture, Forestry, Fishing & Hunting; Construction; and Finance & Insurance. The three industries reporting contraction in June are: Educational Services; Professional, Scientific & Technical Services; and Other Services.

-

16:00

U.S.: ISM Non-Manufacturing, June 56.5 (forecast 53.3)

-

15:45

U.S.: Services PMI, June 51.4 (forecast 51.5)

-

15:31

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0970, 1.1000/05, 1.1050,1.1100, 1.1160, 1.1185 (551m),1.1240

USD/JPY 99.85,101.00,102.35,103.00,104.00, 104.50,105.00 (757m)

GBP/USD 1.3000, 1.3075,1.3200

AUD/USD 0.7365,0.7470/75,0.7500 (500m), 0.7520

NZD/USD 0.6900,0.7050

USD/CAD 1.2845/50,1.2910/15, 1.2935, 1.2980,1.3100, 1.3125/30/35 (800m)

-

15:26

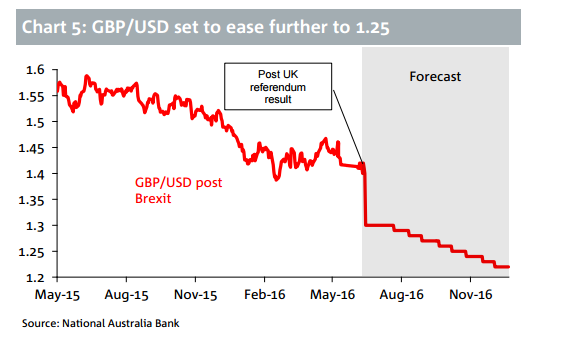

GBP: en-route towards 1.25 over coming weeks - NAB

"To the outside world the UK is a laughing stock. How could the world's 6th largest economy (depending on how you measure it) go against the advice of three-quarters of MPs, the IMF, BoE, business, not to mention the majority of private economists and tear up over 40-years of EU membership? The vote has seen the UK Prime Minister resign, enacted chaos in Her Majesty's official opposition, pushed Scotland and Northern Ireland to the brink of wanting their own referendum and has seen ratings agencies take the knife to the UK's coveted AAA sovereign rating. Worse. It is not only clear the UK has no leader and no functioning opposition, but apparently no plan; such is the shock and unpreparedness.

Capital outflows seem likely and the BoE appears to be doing its bit to try and ensure the exchange rate is where a large part of the adjustment is seen. Thus we expect to hear more BoE talking down of GBP and in that sense take some of the burden off the Bank in cutting rates.We place the probability of a 25bp rate cut in August at 35-40%. We expect GBP to drift to 1.25 over coming weeks and to as low as $1.20 in 2017. It will take EU political issues to set off EUR weakness and a reversal in the EUR/GBP uptrend".

-

14:49

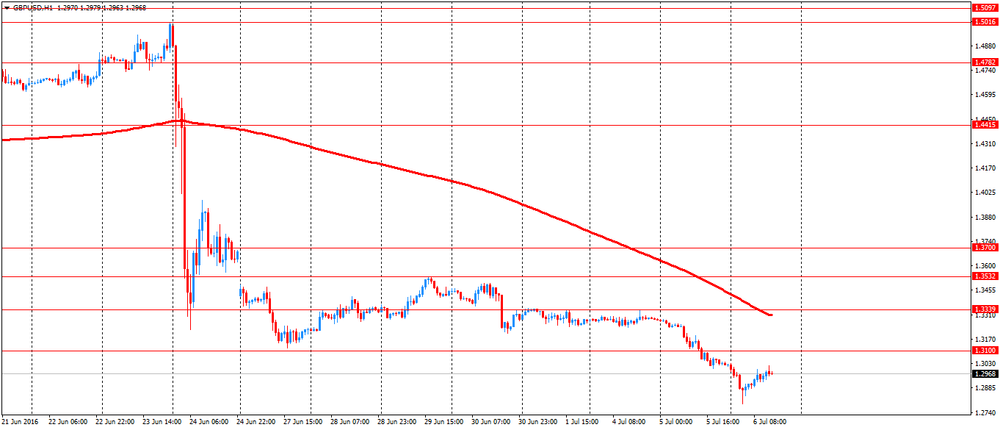

European session review: the pound recovered slightly from new multi-year lows

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Factory Orders m / m in May -2.0% 1% 0%

7:30 Speech Australia RBA assistant head G. Debellya

8:00 It Eurozone ECB President M. Draghi

Gbp/Usd dropped significantly before the start of the current session, dropping below the level which was considered a strong support - $ 1.30, and reached the lowest level in 31 years $ 1.2794.

The pair then rebounded to $ 1.3014, but analysts do not rule out a new round of selling. The pound fell after three British investment fund, engaged in real estate, suspended early repayment. This has called into question the health of the housing market and the economy in general and the increased concern about the outflow from UK.

"The basis for the UK economic growth remains weak, given the approaching 7% deficit of the current account of the balance of payments, as well as the fact that foreign investors believe the country is mired in uncertainty," - says Simon Smith.

"At the moment, the pound recovered after declining the previous day, but whatever its growth will be relatively short-lived," - said Keith Jax from Societe Generale.

"Looks more likely that GBP / USD will trade in $ 1.20-1.25 range", - he added.

The pound came under selling pressure after the Bank of England warned of "representing the complexity of the financial stability risks resulting after Brexit and reduced requirements for the volume of capital reserves for banks.

The head of the Bank of England Governor Mark Carney said that this move implies "substantial changes" to help the economy overcome the consequences of Britain leaving the EU.

In its report on Financial Stability, issued twice a year, the Bank of England said that the threats which he feared after the referendum began to materialize. The pound fell to its lowest level in 31 years, and the financial sector stocks have fallen by 20%.

Last week, Carney has signaled that more stimulus may be needed this summer, strengthening expectations of a possible rate cut by the end of August.

Euro stabilized against the dollar after a decline earlier in the day on the background data on factory orders in Germany. The volume of orders in Germany industry has not changed compared to the previous month, when the decline was 1.9% , data from the Ministry of Economy of Germany suggests. Forecasts indicated +1%.

Orders in May 2015 decreased by 0.2%, while experts predicted an increase of 0.9%.

The volume of orders received from Germany decreased by 1.9%. Export orders from outside the euro zone in the last month - 0.3%, while orders from other countries in the currency bloc jumped by 4%.

Demand for consumer goods decreased by 0.4%.

This year, business confidence and the German economy to suffer from the weak global economic growth and trade, restrained increase corporate profits and risks associated with Brexit. As stated by the head of the Bundesbank, Jens Weidmann last week, Brexit could further weaken the German economy.

In June, the Bundesbank cut its growth forecasts for the German economy in the years 2016 and 2017, to 1.7% and 1.4%, respectively, from 1.8% and 1.7%.

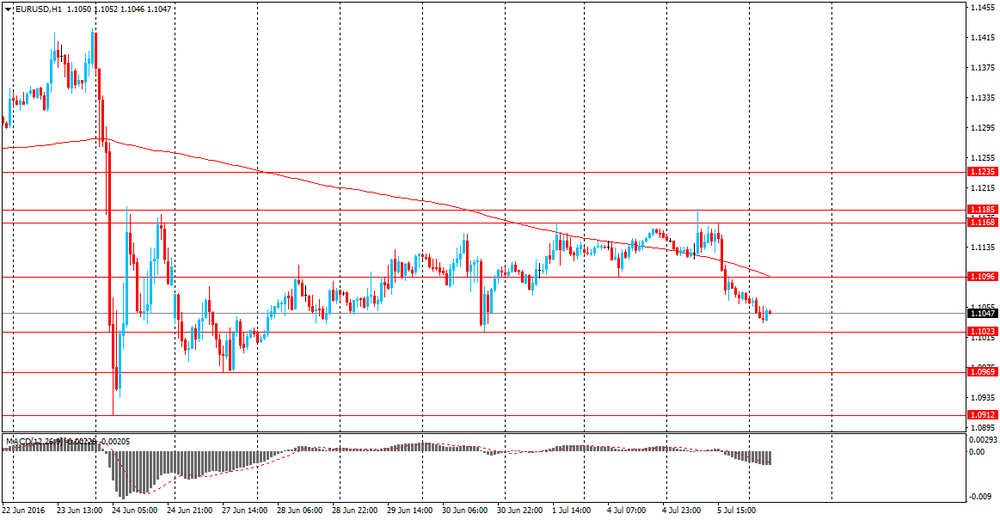

EUR / USD: during the European session, the pair has risen to $ 1.1078

GBP / USD: during the European session, the pair has risen to $ 1.3014

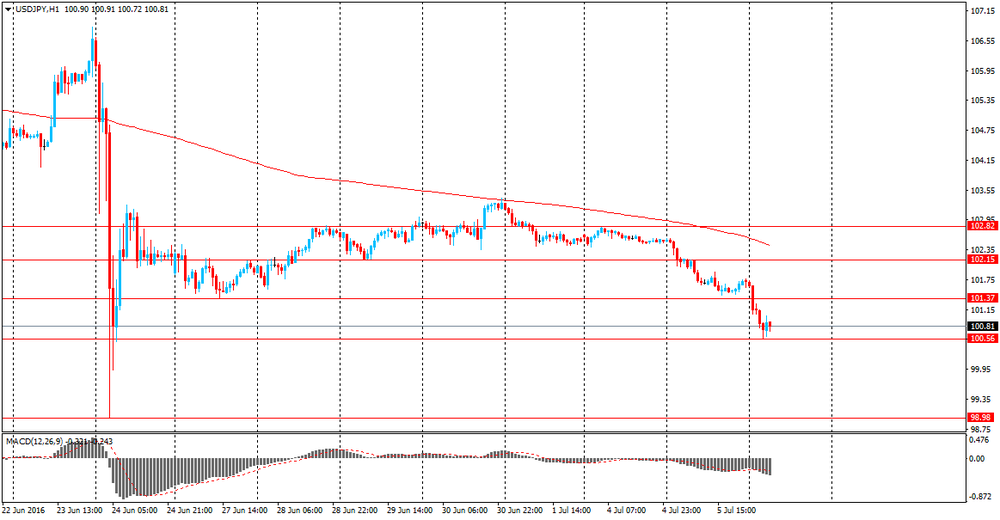

USD / JPY: during the European session, the pair fell to Y100.19

-

14:36

Growing US trade balance deficit

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, announced that the goods and services deficit was $41.1 billion in May, up $3.8

billion from $37.4 billion in April, revised. May exports were $182.4 billion, $0.3 billion ess than April exports. May imports were $223.5 billion, $3.4 billion more than April imports.

The May increase in the goods and services deficit reflected an increase in the goods deficit of $3.7 billion to $62.2 billion and a decrease in the services surplus of $0.1 billion to $21.1 billion.

Year-to-date, the goods and services deficit decreased $7.2 billion, or 3.5 percent, from the same period in 2015. Exports decreased $47.2 billion or 4.9 percent. Imports decreased $54.3 billion or 4.7 percent.

The average goods and services deficit decreased $1.0 billion to $38.0 billion for the three months ending in May.

* Average exports of goods and services increased $0.1 billion to $181.7 billion in May.

* Average imports of goods and services decreased $0.9 billion to $219.8 billion in May.

-

14:33

Canadian trade balance showing a deficit in May

Canada's exports of energy products increased 7.1% to $5.3 billion in May. For the section as a whole, prices were up 9.7%, while volumes were down 2.3%. Exports of crude oil and crude bitumen were the principal contributor to the gain, up 10.5% to $3.8 billion, mostly on higher prices (+9.9%). Volumes also rose (+0.6%) despite the wildfires in northeastern Alberta. Preliminary evidence indicates that Canadian refinery activity declined in May, freeing up crude oil supply for export, while the remaining shortfall was largely met by a drawdown of Alberta inventories of crude oil. Finally, although crude oil and crude bitumen export volumes for May increased, export volumes for April and May were below recent levels.

Imports of energy products increased 18.2% to $2.1 billion in May, the third consecutive monthly gain. Volumes were up 12.1% and prices rose 5.5%. Widespread increases throughout the section were led by refined petroleum energy products, up 63.8% to $694 million.

In real (or volume) terms, exports decreased 2.3% in May, led by energy products; farm, fishing and intermediate food products; and motor vehicles and parts. Import volumes were down 0.9%, as lower imports of aircraft and other transportation equipment and parts, and metal and non-metallic mineral products were partially offset by higher imports of energy products. Consequently, Canada's trade balance in real terms went from a $213 million surplus in April to a $317 million deficit in May.

-

14:30

U.S.: International Trade, bln, May -41.14 (forecast -40)

-

14:30

Canada: Trade balance, billions, May -3.28 (forecast -2.7)

-

13:51

Orders

EUR/USD

Offers : 1.1150 1.1140 1.1120 1.1090/95 1.1080 1.1060

Bids: 1.1040 1.1020/25 1.1000/10 1.0975/80 1.0950 1.0920/25 1.0900

GBP/USD

Offers : 1.3120 1.3100 1.3090 1.3080 1.3050 1.3030 1.3000

Bids: 1.2900/10 1.2880 1.2850 1.2800 1.2700 1.2600 1.2500

EUR/GBP

Offers : 0.8650 0.8625/30 0.8600 0.8580 0.8560

Bids: 0.85000 0.8475 0.8450 0.8400/10

EUR/JPY

Offers : 113.50 113.30 113.00 112.80 112.50 112.00

Bids: 111.00/10 110.75 110.50 110.00

USD/JPY

Offers : 102.25 102.00 101.75/80 101.50 101.40 101.20/25 101.00

Bids: 100.50 100.30 100.00 99.80/85 99.50

AUD/USD

Offers : 0.7550 0.7520/25 0.7500 0.7470/75

Bids: 0.7430 0.7420 0.7400/10 0.7380 0.7350

-

13:36

Lionel Messi has been sentenced to 21 months in prison over a tax fraud case

According to Sky news, Barcelona football star Lionel Messi has been sentenced to 21 months in prison over a tax fraud case in Spain.

However, the striker - generally considered the best in the world currently - is unlikely to face any time in jail as a term of under two years in duration, for a non-violent offence, usually results in a period of probation under Spanish law.

The court in Barcelona found the Argentina player and his father, who handles his financial affairs, guilty of three offences.

Jorge Messi was also handed a 21-month prison term and fine of €1.7m (£1.4m).

His son, who is understood to earn £26m in annual salary under his current club contract alone and is said to be worth at least £240m, was told to pay €2m (£1.7m).

-

11:52

Eurozone retail sales below forecasts

June saw contrasting trends in retail sector performance across the single currency area, according to the latest Markit Eurozone Retail PMI . While there were slight increases in sales across both Germany and France, the overall picture was darkened by a sharp and accelerated reduction in sales in Italy.

The headline Markit Eurozone Retail PMI - which tracks month-on-month changes in like-for-like retail sales in the bloc's biggest three economies combined - registered 48.5 in June, down from May's 50.6. It was the index's third sub-50 reading - signalling a drop in sales - in the past four months. Sales were also down compared with the same month one year before, albeit only slightly.

Phil Smith, economist at Markit which compiles the Eurozone Retail PMI survey, said: "The biggest talking point will be Italy's sharp drop in sales, which contrasted with upturns across both France and Germany. Clearly consumer spending is on the wane in the eurozone's third-largest economy after recent tentative signs of recovery. But it was a brighter picture for retailers in France, where back-to-back increases in sales were recorded for the first time in two years and employment edged higher. Germany remained the best performer overall, although sales growth there eased from the solid pace seen in May."

-

11:47

UK: shop prices fell in June - BRC

In the UK the prices in shops have fallen at a faster pace in June, said on Wednesday the British Retail Consortium (BRC).

Prices in shops decreased by 2 percent in June compared with a year ago, there were more than 1.8 percent decline in May.

Food prices fell by 0.8 per centper y/y, noting the largest decline in more than a year.

The survey was conducted in the period from 6 to 10 June, before the British voted for withdrawal from the EU.

-

11:43

The MICEX fell by 0.3% to 1890.5 points

The Moscow Stock Exchange fell by 0.3% to 1890.5 points at the opening.

-

10:23

Review of financial and economic press: The Bank of England lowerd requirements for UK banks

D/W

Austrian presidential re-election scheduled for 2 October

The Constitutional Court in Vienna declared invalid the presidential elections, held on May 22 because of procedural violations during the vote count. There were no indications of fraud or manipulation in the elections.

newspaper. ru

The Bank of England lowerd requirements for UK banks

The Bank of England lowered its requirement for banks to 0.5 percent a countercyclical capital buffer, as shown in a published report on financial stability.

FT: US oil and gas companies are experiencing problems with financing

US oil and gas companies are facing serious difficulties in raising finance, writes Financial Times. It is noted that the bond sales fell to the lowest value in more than a decade. Thus, according to Dealogic, in the second quarter US companies involved in the exploration and production sold US bonds for only $ 280 million, which is the lowest value since the time of financial crisis of 2008-2009.

RBC

Oil companies have announced major investments in production after the collapse of prices

Chevron and its partners officially announced plans to invest $ 36.8 billion to increase oil production at the Tengiz field in Kazakhstan. This project will be the largest since the beginning of the period of low oil prices

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0970, 1.1000/05, 1.1050,1.1100, 1.1160, 1.1185 (551m),1.1240

USD/JPY 99.85,101.00,102.35,103.00,104.00, 104.50,105.00 (757m)

GBP/USD 1.3000, 1.3075,1.3200

AUD/USD 0.7365,0.7470/75,0.7500 (500m), 0.7520

NZD/USD 0.6900,0.7050

USD/CAD 1.2845/50,1.2910/15, 1.2935, 1.2980,1.3100, 1.3125/30/35 (800m)

-

09:52

ECB representative Villeroy: The Bank of France is waiting for 1.4% GDP growth in 2016

- There is no reason for pessimism regarding Brexit.

- If the United Kingdom will get access to the single market, it would have to comply with all the rules.

- It is necessary to reduce the uncertainty caused by Brexit as soon as possible.

- Brexit hasn't changed the forecast for the French economy in 2016.

- Brexit had an impact on the euro area economy.

- ECB mobilized to combat the effects of Brexit.

- consequences will be most severe for the UK.

-

09:16

2.0% inflation cand be achieved with ¥20tn stimulus - Fujii

According to Bloomberg:

- Fuji suggests ¥20 trn stimulus this fiscal year.

- Abe can end deflation with ¥37tn fiscal stimulus over three years.

- Negative rates strongly push investment.

-

09:07

Today’s events:

At 07:00 GMT the ECB president Mario Draghi will deliver a speech

At 07:30 GMT ECB Board Member Peter Preat will make a speech

At 07:30 GMT RBA Assistant Governor Guy Debell deliver a speech.

At 09:30 GMT the ECB Vice-President Vitor Constancio will give a speech.

At 12:00 GMT the ECB member Yves Mersch will make a speech.

At 13:00 GMT FOMC Member Daniel Tarullo deliver a speech.

-

08:42

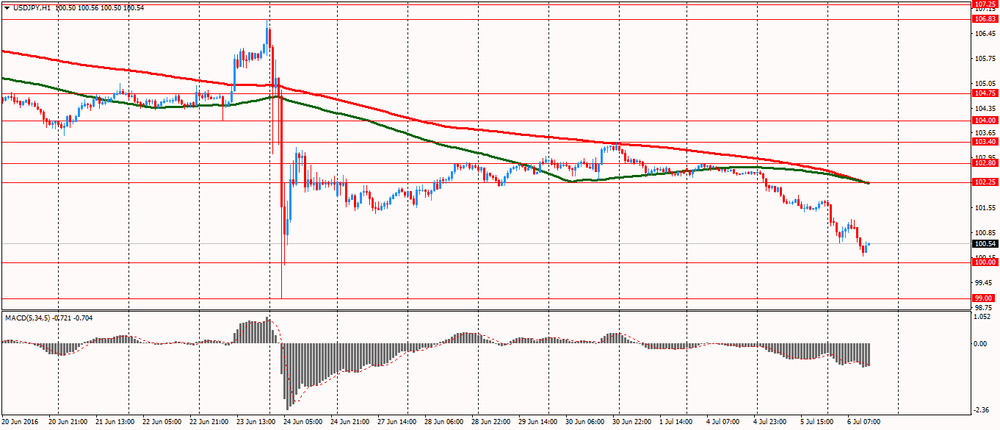

Asian session review: the pound hit hard in a “risk off” enviroment

The US dollar fell against the yen below Y101,00, to Y100,60, as the active sale of the British pound had an upward pressure on the Japanese currency. In addition, the yen is supported by closure of long positions in the currencies of emerging markets.

Brexit fears reignited and anxiety for the Italian banking system also contributes to the pesimistic mood of investors, so that the pound and the euro moving down and the yen, which is a safe haven, is in demand.

According to analysts, the Bank of Japan is unlikely to hold an intervention to limit the strengthening of the yen against the US dollar if Japanese Finance Minister will not make a statement. Probably, the central bank will take a wait and see attitude, and will coordinate with the Federal Reserve, before taking any measures.

GBP / JPY also fell by 1.4% compared to the closing level of the New York session on Tuesday.

"We are seeing a situation similar to that observed soon after Brexit pound selling, euros and yen demand - the most popular currency in terms of risk aversion," - notes ANZ

During the Asian session the British pound fell reaching a new historic low of $ 1.2794. Pound again began to fall, the first time since June 1985 touched the level of $ 1.30. The cause of this trend is the new wave of concerns about the consequences of Britain's exit from the European Union.

Yesterday, the Bank of England said it sees risks reducing capital inflows after the referendum and believes that a sustained reduction in capital inflows will put further downward pressure on the pound. Against this background, the Central Bank decided to reduce the capital requirements for banks in the country, which would allow British banks to issue more loans totaling $ 150 billion pounds and ensure adequate levels of lending. Reuters survey showed that 33 of 52 economists expect that in July, the Central Bank will left unchanged the monetary policy, 17 respondents forecast a rate cut by 0.25% and 2 economists - 0.5%. The average forecast reflects a 80% probability of a rate cut this year.

The New Zealand dollar fell below $ 0.7100 in the absence of risk appetite. Commodity currencies such as the Nzd, Aud and Cad retain a tendency to decrease.

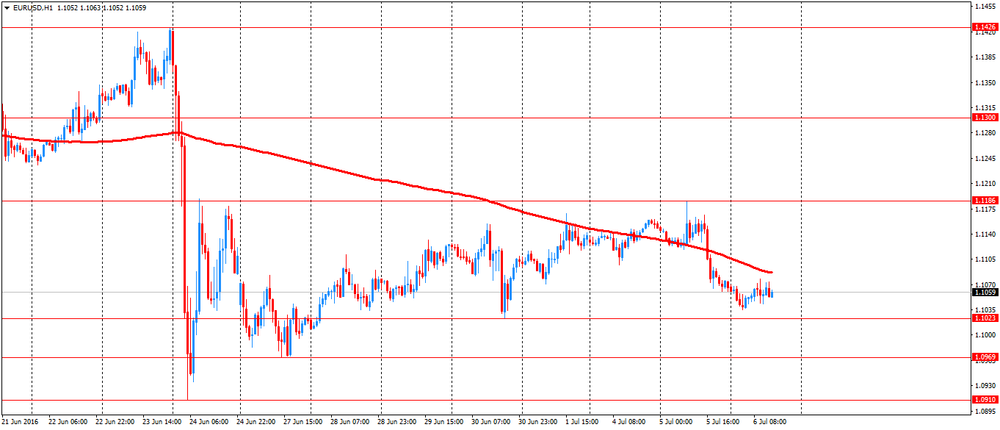

EUR / USD: during the Asian session, the pair was trading in the $ 1.1035-60 range.

GBP / USD: fell to 1.2794.

USD / JPY: fell to Y100.54

-

08:33

Options levels on wednesday, July 6, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1305 (2288)

$1.1217 (3512)

$1.1155 (1391)

Price at time of writing this review: $1.1058

Support levels (open interest**, contracts):

$1.0979 (8837)

$1.0938 (5384)

$1.0893 (15194)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 43565 contracts, with the maximum number of contracts with strike price $1,1500 (5314);

- Overall open interest on the PUT options with the expiration date July, 8 is 88854 contracts, with the maximum number of contracts with strike price $1,0900 (15194);

- The ratio of PUT/CALL was 2.04 versus 2.08 from the previous trading day according to data from July, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.3203 (2032)

$1.3106 (155)

$1.3012 (1506)

Price at time of writing this review: $1.2915

Support levels (open interest**, contracts):

$1.2798 (701)

$1.2699 (253)

$1.2599 (195)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 35734 contracts, with the maximum number of contracts with strike price $1,5000 (4014);

- Overall open interest on the PUT options with the expiration date July, 8 is 44251 contracts, with the maximum number of contracts with strike price $1,3500 (4738);

- The ratio of PUT/CALL was 1.24 versus 1.32 from the previous trading day according to data from July, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:30

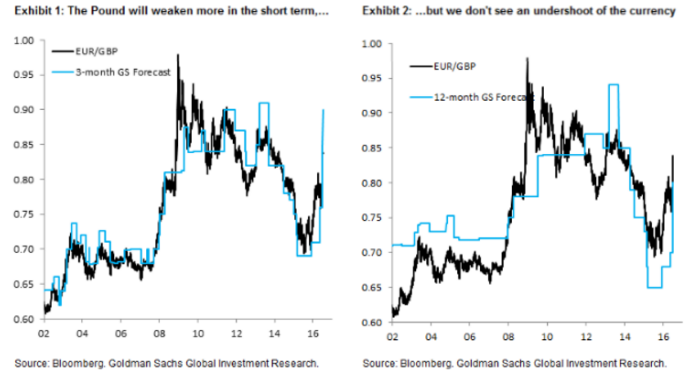

Goldman Sachs cuts Eur and Gbp forecasts

"Following the Brexit surprise, we revised our Sterling forecasts weaker, but - amid lots of doomsday scenarios for the Pound - resisted the temptation to forecast a free-fall. Now that markets have settled somewhat, we are switching to forecast a second leg of weakness for the Pound, as the Bank of England's policy response drives the currency weaker.

...The market is not discounting the easing effect of asset purchases, the persistence of easier monetary conditions in the UK, and the US-UK monetary policy divergence that we expect nearly as much as it should.

Next week, we expect the BoE to provide a further indication of the scope of the conventional and unconventional monetary policy measures we expect. This will be the catalyst for a further downward move in Sterling.

...Turning to the Euro, the negative growth spill-overs that our economists expect is a cumulative 0.5 percent over two years (compared with 2.75 percent for the UK). This slowdown implies downside risks to our already low inflation projections and puts additional pressure on the ECB to step up the pace of monetary accommodation.

Our economists expect an extension of the asset purchase programme through 2018 and a shift away from the ECB's capital key. The latter change could reduce market worries over Bund scarcity and, in our view, could lead to more EUR/$ weakness.

Our new EUR/GBP forecast is 0.90, 0.86 and 0.80 in 3-, 6- and 12-months (from 0.85, 0.82 and 0.78 previously), i.e. builds in more Sterling weakness in the near term. We also revise our EUR/$ forecast to 1.08, 1.04 and 1.00 in 3-, 6- and 12-months (from 1.12, 1.10 and 1.05 previously).

These changes imply a new path for GBP/$ of 1.20, 1.21 and 1.25 in 3-, 6- and 12-months, i.e. substantially more front-loaded downside than in our forecast in the immediate aftermath of the Brexit vote (1.32, 1.34 and 1.35)".

-

08:27

Bloomberg survey: EU is moving in the wrong direction

Bloomberg news agency has conducted a survey among the French, which resulted in the majority stating that the EU is moving in the wrong direction recently. Also many believe that the way out of the EU would have negative consequences.

-

08:24

-

08:20

Australia’s 10-yr govt bond yield falls to 1.849% - record low - as risk aversion prevails. Gold up

-

08:17

Japan's 20yr yield declines to a record low of 0.005%

-

08:17

German factory orders unchanged in May

As reported by the Federal Statistical Office (Destatis) on the basis of provisional data, the manufacturing sector saw new orders unchanged in real terms adjusted for seasonally fluctuations and working-day variations in May 2016 compared with April 2016. For April 2016, revision of the preliminary outcome resulted in a decrease of 1.9% compared with March 2016 (primary -2.0%). Price-adjusted new orders without major orders in manufacturing had increased in May 2016 a seasonally and working-day adjusted 0.5% on April 2016.

In May 2016, domestic orders decreased by 1.9%, while foreign orders increased by 1.4% on the previous month. New orders from the euro area were up 4.0% on the previous month, while new orders from other countries decreased by 0.3% compared to April 2016.

In May 2016 the manufacturers of intermediate goods fell 2.9%, while the manufacturers of capital goods showed an increase of 1.9% on the previous month. For consumer goods, a decrease in new orders of 0.4% was recorded.

-

08:11

Germany: Factory Orders s.a. (MoM), May 0% (forecast 1%)

-

02:31

Currencies. Daily history for Jul 05’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1066 -0,74%

GBP/USD $1,3020 -2,00%

USD/CHF Chf0,9771 +0,60%

USD/JPY Y101,71 -0,80%

EUR/JPY Y112,56 -1,55%

GBP/JPY Y132,43 -2,82%

AUD/USD $0,7457 -0,98%

NZD/USD $0,7149 -1,08%

USD/CAD C$1,2985 +1,06%

-

02:02

Schedule for today, Wednesday, Jul 06’2016:

(time / country / index / period / previous value / forecast)

6:00 Germany Factory Orders s.a. (MoM) May -2.0% 1%

12:30 Canada Trade balance, billions May -2.94 -2.7

12:30 U.S. International Trade, bln May -37.4 -40

13:45 U.S. Services PMI (Finally) June 51.3 51.5

14:00 U.S. ISM Non-Manufacturing June 52.9 53.3

23:30 Australia AiG Performance of Construction Index June 46.7

-