Noticias del mercado

-

22:05

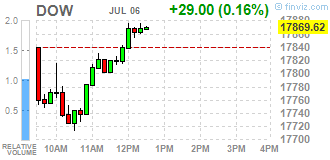

Major US stock indexes finished trading with a moderate increase

Major stock indexes on Wall Street have returned the lost positions in the morning on the background of robust economic data and the recovery of oil prices, which helped to mitigate investors' concerns about the global economic downturn.

Data for June from Markit showed a steady growth of business activity in the US service sector, which has helped the most rapid expansion of new orders since the beginning of 2016, however, growth remains weak in comparison with the post-crisis trend, helped by a slowdown in job creation the third consecutive month in June. Business expectations for the year ahead have also continued to soften, while service providers showed the lowest level of optimism since October 2009. The seasonally adjusted PMI index in the services sector rose to 51.4 from 51.3 in May, and signaled a further modest expansion of activity.

In addition, the index of business activity in the US service sector, which is calculated by the Institute of Supply Management (ISM), has improved markedly in June, reaching 56.5 compared with 52.9 in the previous month. According to the forecast, the index value would grow to 53.3. The ISM said that the expansion of activity in the service sector has recorded the 77th consecutive month.

In focus were also reports of the last Fed meeting, which showed that the views of policy makers about economic prospects and interest rates are divided. However, despite the differences, Fed officials agreed that it was justified to wait for additional data before making a decision on further action. For a considerable period of time this year the authorities were preparing for another rate increase, but now investors see almost no chance that the Fed will raise rates in July, after having been released weak data on employment and the UK voted in favor of withdrawal from the EU.

Most of the DOW index components ended the session in positive territory (21 of 30). Outsider were shares of E. I. du Pont de Nemours and Company (DD, -1,88%). Most remaining shares rose Merck & Co. Inc. (MRK, + 2,13%).

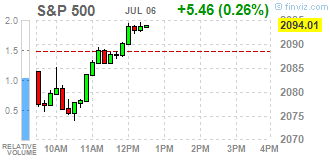

Almost all sectors of the S & P showed an increase. conglomerates (-0.7%) sectors fell most. The leader turned out to be the health sector (+ 1.0%).

At the close:

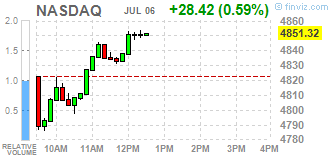

Dow + 0.44% 17,918.35 +77.73

Nasdaq + 0.75% 4,859.16 +36.26

S & P + 0.53% 2,099.72 +11.17

-

21:00

Dow +0.42% 17,916.22 +75.60 Nasdaq +0.73% 4,858.33 +35.43 S&P +0.49% 2,098.73 +10.18

-

18:33

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes pared losses in late morning trade on Wednesday as robust economic data and recovering oil prices helped alleviate investor concerns about a global economic slowdown.

Most of all Dow stocks in positive area (20 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -1,46%). Top gainer - Merck & Co. Inc. (MRK, +1,45%).

S&P sectors mixed. Top looser - Conglomerates (-1,2%). Top gainer - Healthcare (+0,8%).

At the moment:

Dow 17772.00 +10.00 +0.06%

S&P 500 2085.75 +3.00 +0.14%

Nasdaq 100 4431.50 +27.50 +0.62%

Oil 47.02 +0.42 +0.90%

Gold 1366.90 +8.20 +0.60%

U.S. 10yr 1.39 +0.02

-

18:00

European stocks closed: FTSE 100 6,463.59 -81.78 -1.25% CAC 40 4,085.3 -78.12 -1.88% DAX 9,373.26 -159.35 -1.67%

-

17:37

WSE: Session Results

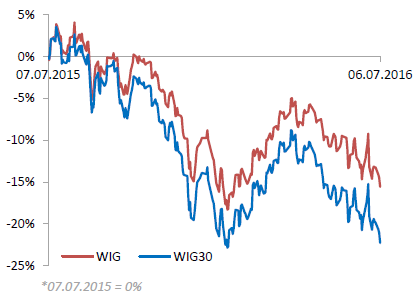

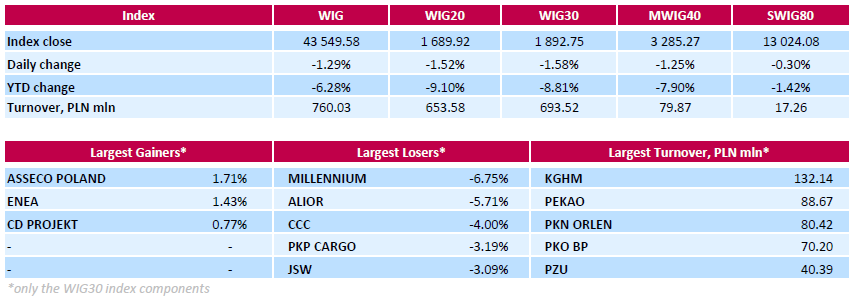

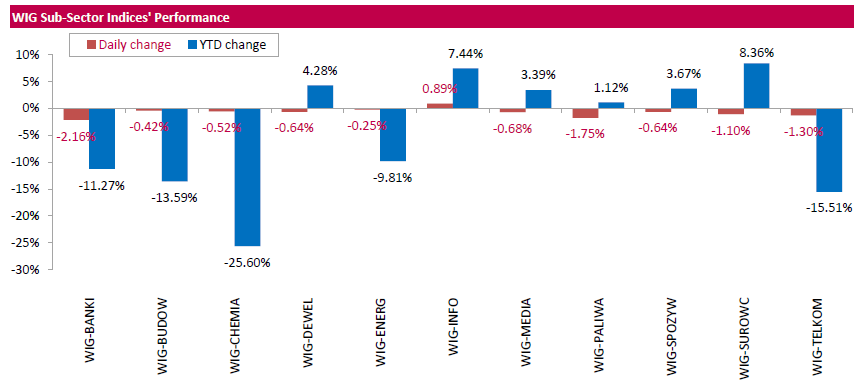

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, fell by 1.29%. The WIG sub-sector indices were mainly lower with banking sector stocks' gauge (-2.16%) underperforming.

The large-cap stocks' measure, the WIG30 Index lost 1.58%. A majority of the index components recorded declines with bank MILLENNIUM (WSE: MIL) posting the biggest drop of 6.75%. Other noticeable losers were bank ALIOR (WSE: ALR), footwear retailer CCC (WSE: CCC) and railway freight transport operator PKP CARGO (WSE: PKP), which tumbled by 5.71%, 4% and 3.19% respectively. On the other side of the ledger, IT-company ASSECO POLAND (WSE: ACP) led a handful of gainers with a 1.71% advance, followed by genco ENEA (WSE: ENA) and videogame developer CD PROJEKT (WSE: CDR), which added 1.43% and 0.77% respectively.

-

16:49

Company news: Tesla shares fall further and this is the reason

Tesla Motors (TSLA) shares - US car company in Silicon Valley focused on the production of electric vehicles fall on Wednesday, as the company talked to regulators about the fatal accidents involving a Tesla car who was riding on "autopilot". The event took place nine days earlier.

Tesla found out about the Model S sedan crash in Florida after the accident on 7 May. On May 16th the company reported the accident to the government, according to Reuters.

On June 30 The National Authority for Road Safety (NHTSA) has announced an investigation.

The technology is one of the most advanced and promoted by Tesla, but is still in test mode.

However, according to Elon Musk, Tesla autopilot is safer than human control, since the first deadly incident occurred after Tesla autopilot 200 million km, while the world average for a lethal accident is 100 million km.

TheStreet Ratings has assigned the rating to "sell."

"You can see the weaknesses of the company in many areas, such as deterioration of its net income, generally high risk debt, disappointing return on equity, weak operating cash flow and generally disappointing historical performance shares themselves", - noted the TheStreet.

Currently, shares traded at $ 209.51 (-2.09%).

-

15:56

WSE: After start on Wall Street

Like yesterday, today also the beginning of the US session is in about 0.5% of declines in major indices. However, unlike yesterday, today's session is the latest in a row of declining, and that means a greater chance of taking by market participants attempt to fight for a growth reflection.

-

15:32

U.S. Stocks open: Dow -0.30%, Nasdaq -0.45%, S&P -0.34%

-

15:14

Before the bell: S&P futures -0.55%, NASDAQ futures -0.64%

U.S. stock-index futures fell as investors fretted over prospects for global growth in the wake of the U.K.'s decision to leave the European Union.

Global Stocks:

Nikkei 15,378.99 -290.34 -1.85%

Hang Seng 20,495.29 -255.43 -1.23%

Shanghai Composite 3,017.1 +10.71 +0.36%

FTSE 6,438.16 -107.21 -1.64%

CAC 4,079.93 -83.49 -2.01%

DAX 9,347.23 -185.38 -1.94%

Crude $46.05 (-1.18%)

Gold $1371.50 (+0.94%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.15

-0.11(-1.1879%)

32068

ALTRIA GROUP INC.

MO

69.6

-0.01(-0.0144%)

1425

Amazon.com Inc., NASDAQ

AMZN

725.05

-3.05(-0.4189%)

18944

AMERICAN INTERNATIONAL GROUP

AIG

51

-0.21(-0.4101%)

2511

Apple Inc.

AAPL

94.52

-0.47(-0.4948%)

115976

AT&T Inc

T

42.77

-0.10(-0.2333%)

28578

Barrick Gold Corporation, NYSE

ABX

22.8

0.40(1.7857%)

111098

Boeing Co

BA

126.17

-0.80(-0.6301%)

1856

Caterpillar Inc

CAT

73.61

-0.77(-1.0352%)

2508

Chevron Corp

CVX

102.86

-0.71(-0.6855%)

397

Cisco Systems Inc

CSCO

28.19

-0.14(-0.4942%)

6428

Citigroup Inc., NYSE

C

40.07

-0.71(-1.7411%)

53833

Exxon Mobil Corp

XOM

92.41

-0.61(-0.6558%)

5371

Facebook, Inc.

FB

113.31

-0.69(-0.6053%)

34625

Ford Motor Co.

F

12.32

-0.08(-0.6452%)

41581

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.29

-0.21(-2.00%)

240030

General Electric Co

GE

31.27

-0.18(-0.5723%)

31641

General Motors Company, NYSE

GM

27.95

-0.22(-0.781%)

15095

Goldman Sachs

GS

142.55

-1.90(-1.3153%)

4998

Intel Corp

INTC

32.52

-0.16(-0.4896%)

3959

Johnson & Johnson

JNJ

122.16

-0.11(-0.09%)

1357

JPMorgan Chase and Co

JPM

58.75

-0.80(-1.3434%)

11272

McDonald's Corp

MCD

119

-1.76(-1.4574%)

20949

Merck & Co Inc

MRK

57.85

-0.15(-0.2586%)

550

Microsoft Corp

MSFT

50.86

-0.31(-0.6058%)

3244

Nike

NKE

54.75

-0.45(-0.8152%)

3241

Pfizer Inc

PFE

35.73

-0.08(-0.2234%)

1331

Procter & Gamble Co

PG

85.16

-0.28(-0.3277%)

650

Starbucks Corporation, NASDAQ

SBUX

56.51

-0.26(-0.458%)

1105

Tesla Motors, Inc., NASDAQ

TSLA

210.25

-3.73(-1.7432%)

47304

The Coca-Cola Co

KO

45.38

-0.05(-0.1101%)

630

Twitter, Inc., NYSE

TWTR

17.02

-0.12(-0.7001%)

31273

United Technologies Corp

UTX

100.33

-0.29(-0.2882%)

711

UnitedHealth Group Inc

UNH

141

-0.56(-0.3956%)

561

Verizon Communications Inc

VZ

55.85

-0.115(-0.2055%)

6480

Visa

V

74.28

-0.39(-0.5223%)

1200

Wal-Mart Stores Inc

WMT

73.02

-0.12(-0.1641%)

1280

Walt Disney Co

DIS

97.1

-0.56(-0.5734%)

1193

Yahoo! Inc., NASDAQ

YHOO

37.29

-0.21(-0.56%)

5494

Yandex N.V., NASDAQ

YNDX

21.25

-0.40(-1.8476%)

100

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) initiated with a Buy at Longbow; target $125

Tesla Motors (TSLA) target lowered to $190 from $212 at Pacific Crest

-

13:10

WSE: Mid session comment

Very poor attitude of the environment, with new lows on the afternoon phase, keeps the pressure on the Warsaw Stock Exchange, where the consequences are beginning to be seen quite widely, in all market segments. The WIG20 index fell in the middle of the session by 1.66% (1,687 points), the index of medium-sized companies mWIG40 lost 0.8% and like the sWIG80 (-0.4%) set new lows.

Decreases take place also in Western Europe - the German DAX lost more than 2 percent.

The turnover on the WSE (the WIG20) reach PLN 330 mln, and the highest volume of trade recorded KGHM with a fall of 1.1 percent. The second is Pekao (WSE: PEO) with a fall of 1.6 percent., the third Orlen (WSE: PKN), which lost 1.5 percent.

-

12:41

Major stock indices in Europe declined

Most European stock indices fall on the background of a new wave of concerns about the effects of Brexit for the global economy.

FTSE rose at the opening due to the weakening of the pound sterling, supporting shares of exporters, as well as the rise of securities of mining companies following an increase in the price of gold.

The composite index of the largest companies in the region, Stoxx Europe 600 fell during trading 1,1% - to 320.50 points.

Shares of Volkswagen AG lost 0.2%, shares of BMW AG fell 0.6%, while shares of Daimler AG retreated 0.4% on reports that Germany's antitrust regulators started an investigation.

Shares of British alcohol producer Diageo rose in price by 1,7%, British American Tobacco - by 0.4%.

Shares of Burberry Group, one of the world's leading manufacturers of "luxury" items rose1%. Experts at UBS improved the 12-month target price of shares for the company up to 17 pounds from 15 pounds and recommended investors to "buy" Burberry, noting that the weakening pound compensates for the weakness of retail demand.

Securities of gold mining companies Fresnillo and Randgold Resources jumped by 4.5% and 4.7%.

"The insurance sector also came under pressure after the Bank of England Governor Mark Carney said that fears surrounding the area, in tough economic conditions".

Shares of British Insurers Standard Life, Aviva and Prudential fell during trading on Wednesday by 1.7%, 2.5% and 1.4%. Earlier these companies have suspended trading securities of real estate funds, as investors began to withdraw investments due to Brexit.

Shares of construction companies Barratt Developments and Taylor Wimpey dropped by 4.3% and 3.5%.

The cost of airline EasyJet shares fell 2.1%. EasyJet reported an increase in the number of passengers carried in June by 5.8% - to 6.56 million people. The growth rate, however, was worse than the average for the 12 months (7.1%).

Shares of Spanish Caixabank fell 0.4% after the lender warned that the expected loss amount of 1.25 billion euros ($ 1.4 billion) related to mortgage loans.

At the moment:

FTSE 6522.46 -22.91 -0.35%

DAX 9373.93 -158.68 -1.66%

CAC 4092.51 -70.91 -1.70%

-

09:15

WSE: After opening

The futures market began from the decline of 0.29% to 1,707 points. At the same time, the contract for German DAX lost 0.6%. Thanks to it, the Warsaw market walked up to the start of trading quite calmly.

WIG20 index opened at 1716.30 points (+0.02%)

WIG 44074.59 -0.10%

WIG30 1919.45 -0.19%

mWIG40 3329.96 0.09%

*/ - change to previous close

The cash market opens with cosmetic rise of the 0.02% to 1,726 points., which is a very good result in relation to the environment, where the indices in France and Germany start sessions of declines of around 0.9%. Thus, the relative strength of the Warsaw Stock Exchange maintains and we must wait for the first signs of improving sentiment in the environment and scale of the reaction to it in Warsaw.

-

08:44

Mixed start of trading expected on the major stock exchanges in Europe: DAX + 0,2%, FTSE 100 -0,8%, CAC 40 + 0.1%

-

08:25

WSE: Before opening

The US market at yesterday's session lost 0.7%, while in the morning futures on the S&P500 are falling by almost 0.4%. Since the beginning of the week the mood in the world is deteriorating, and this trend is also visible today's morning. Asian parquets lose and the leader of declines is, falling by more than 2%, Nikkei, which negatively reacts to the strengthening of the yen. Strongly lose the pound, and gold in the morning went out on the new post-Brexit highs.

All this is due to concerns about the condition of the global economy, which yesterday led to declines in Europe and the USA. These concerns were translated into strong demand for the currency of "security". The yen is rising to its highest from three years level. The CHF index improves their annual highs, and the dollar index today was the highest in 15 years.

Such an environment is not favorable for the beginning of today's trading in Europe and on the Warsaw market. Therefore, today we may have to reckon with the possibility of further deepening of downward movement, mainly for the reason of external factors.

The macro calendar today does not contain the most important information. In the USA, because of Monday's holiday, will be published today the PMI and ISM reading for services sector, and in the evening the minutes of the last FOMC meeting.

-

07:09

Global Stocks

European stocks moved sharply lower again Tuesday, as concerns over the U.K.'s Brexit vote gripped the market after three London asset manages suspended trading in a property funds.

A more than 4% slide in oil prices further hurt the investment mood.

U.K. fund fears: The financial sector posted the biggest losses in Europe, after three U.K. asset managers froze funds exposed to U.K. property because of a rapid increase in redemptions following the June 23 EU referendum.

The Bank of England also noted in its Financial Stability Report out earlier on Tuesday "that some risks have begun to crystallize" in the aftermath of the vote. In an effort to soothe the economy through bank lending, the central bank cut the so-called countercyclical capital buffer for banks to zero from 0.5%.

U.S. stock investors quashed a four-session rally Tuesday as Brexit-related uncertainties resurfaced to spook the market, on a day marked by light-trading volume following Independence Day.

A sharp drop in crude-oil prices contributed to the overall sentiment, weighing on energy shares.

The S&P 500 index SPX, -0.68% lost 14.40 points, or 0.7%, to close at 2,088.55.

The Dow Jones Industrial Average DJIA, -0.61% fell 108.75 points, or 0.6%, to end at 17,840.62, bouncing back from its intraday low of 17,785. The Nasdaq Composite COMP, -0.82% lost 39.67 points, or 0.8%, to close at 4,822.90, after trading as low as 4,797.

Asian share markets turned tail on Wednesday as fears over instability in the European Union returned with a vengeance, sending the pound to three-decade lows and hammering risky assets of all stripes.

Spooked investors rushed into safe-haven sovereign debt and took markets deeper into unknown territory.

"Financial markets appear to have taken a more realistic view around the complexity and uncertainty characterizing the global political background and its impact on already lackluster economic growth," wrote analysts at ANZ in a note.

-

04:01

Nikkei 225 15,219.87 -449.46 -2.87%, Hang Seng 20,441.17 -309.55 -1.49%, Shanghai Composite 3,006.04 -0.35 -0.01%

-

02:32

Stocks. Daily history for Jun Jul 05’2016:

(index / closing price / change items /% change)

Nikkei 225 15,669.33-106.47-0.67%

Hang Seng 20,791.54-267.66-1.27%

S&P/ASX 200 5,228-53.77-1.02%

Shanghai Composite 3,007.11+18.51+0.62%

Topix 1,256.64-5.33-0.42%

FTSE 100 6,545.37 +23.11 +0.35 %

CAC 40 4,163.42 -71.44 -1.69 %

Xetra DAX 9,532.61 -176.48 -1.82 %

S&P 500 2,088.55 -14.40 -0.68 %

NASDAQ Composite 4,822.9 -39.67 -0.82 %

Dow Jones 17,840.62 -108.75 -0.61 %

-