Noticias del mercado

-

22:07

Major US stock indexes finished trading without any dynamics

Major stock indexes in Wall Street closed mixed on the eve of the publication of data on the number of jobs in non-farm payrolls on Friday.

In addition, as shown by data provided by Automatic Data Processing (ADP), employment growth in the US private sector accelerated in June, and were higher than forecasts of experts. According to the report, in June the number of employees increased by 172 thousand. People in comparison to the revised downward index for May at the level of 168 thousand. (Originally reported growth of 173 thousand.). Analysts had expected the number of people employed will increase by 159 thousand.

At the same time, the number of Americans who applied for unemployment benefits fell last week, offering yet another confirmation that the labor market remains on a sound basis, despite weak jobs growth in May. unemployment initial claims for benefits decreased by 16,000 and reached a seasonally adjusted 254,000 for the week ending July 2nd. The drop rate closer to 43-year low of 248,000 reached in mid-April.

DOW index components ended the session mixed (16 black, 14 red). Outsider were shares of Verizon Communications Inc. (VZ, -1,62%). Most remaining shares rose Intel Corporation (INTC, + 0,88%).

Sector of the S & P closed without any dynamics. Most utilities sector fell (-1.7%). The leader turned out to be the service sector (+ 0.4%).

At the close:

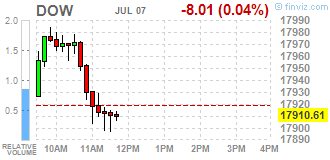

Dow -0.14% 17,894.19 -24.43

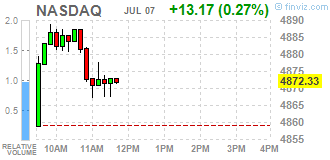

Nasdaq + 0.36% 4,876.81 +17.65

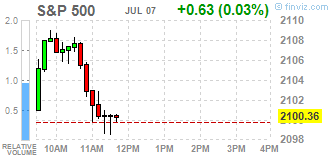

S & P -0.09% 2,097.83 -1.90

-

21:00

Dow -0.46% 17,836.10 -82.52 Nasdaq +0.02% 4,860.34 +1.18 S&P -0.41% 2,091.20 -8.53

-

18:00

European stocks closed: FTSE 100 6,533.79 +70.20 +1.09% CAC 40 4,117.85 +32.55 +0.80% DAX 9,418.78 +45.52 +0.49%

-

17:46

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday as strong private sector employment data and a drop in jobless claims pointed to a steadying labor market ahead of the monthly payrolls report on Friday. The ADP national employment report showed that 172,000 jobs were added in the private sector in June, compared to economists' expectation of 159,000. The number of Americans filing for unemployment benefits also fell unexpectedly last week, confirming that the labor market remains on solid footing despite tepid job gains in May. Claims fell to 254,000 in the week ended July 2, compared with expectations of 270,000

Dow stocks mixed (14 in positive area, 16 in negative). Top looser - Verizon Communications Inc. (VZ, -1,09%). Top gainer - Visa Inc. (V, +1,13%).

Most of S&P sectors in positive area. Top looser - Utilities (-1,5%). Top gainer - Conglomerates (+0,5%).

At the moment:

Dow 17822.00 -12.00 -0.07%

S&P 500 2093.00 -1.00 -0.05%

Nasdaq 100 4443.75 +4.25 +0.10%

Oil 46.52 -0.91 -1.92%

Gold 1356.20 -10.90 -0.80%

U.S. 10yr 1.40 +0.01

-

17:44

WSE: Session Results

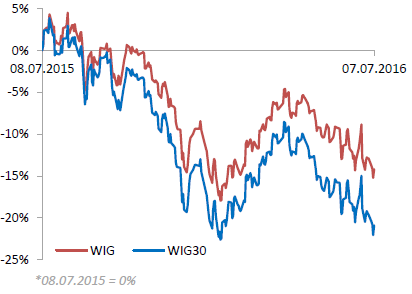

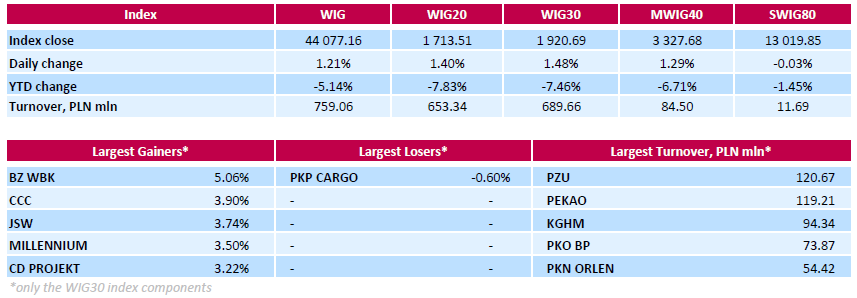

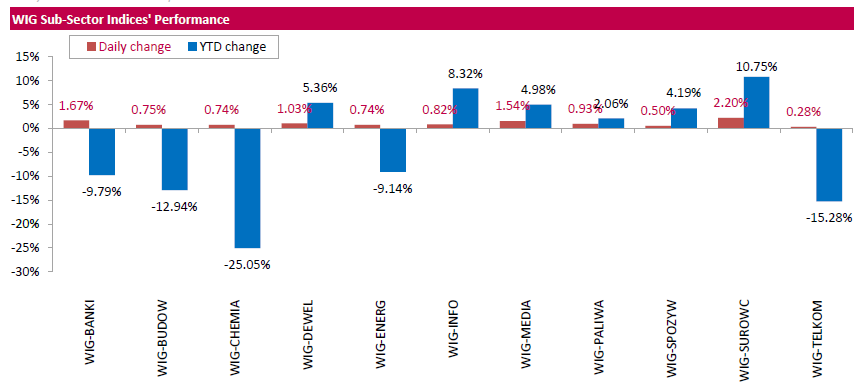

Polish equity market surged on Thursday. The broad market measure, the WIG index, rose by 1.21%. All sectors in the WIG gained, with materials (+2.2%) outperforming.

The large-cap stocks' measure, the WIG30 Index, grew by 1.48%. Railway freight transport operator PKP CARGO (WSE: PKP) was the sole decliner among the index constituents. It lost 0.6%. At the same time, bank BZ WBK (WSE: BZW) was the biggest advancer, climbing by 5.06%. Other noticeable gainers were footwear retailer CCC (WSE: CCC), coking coal miner JSW (WSE: JSW), bank MILLENNIUM (WSE: MIL), videogame developer CD PROJEKT (WSE: CDR) and FMCG-wholesaler EUROCASH (WSE: EUR), which added between 3.14% and 3.9%.

-

16:03

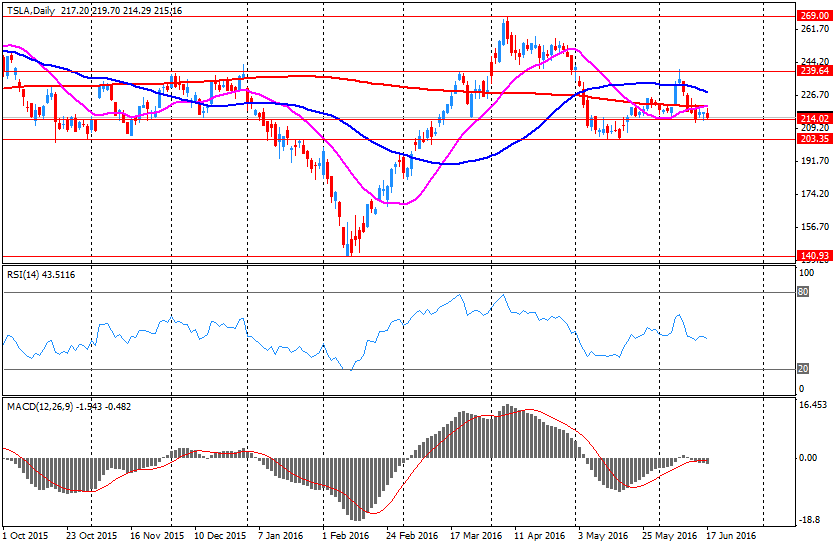

Company News: Tesla Motors (TSLA) may soon introduce Autopilot 2.0

As TechNoBuffalo reports, citing a source close to Tesla Motors, Autopilot 2.0 will be available in the near future. According to the source, the new autopilot will use two cameras that will recognize and react to brake lights and traffic lights without driver intervention. Currently Tesla autopilot automatically slows or stops only when the car ahead does the same.

TSLA shares fell in premarket trading to $ 212.98 (-0.68%).

-

15:50

WSE: After start on Wall Street

Behind us good data from the US labor market. In the afternoon we met the ADP report, which shows that tomorrow's monthly important indication should return to the area of 200 k newly created jobs.

The beginning of the US session is slightly upward, and the first trades stand under the sign of enlargement gains of the demand side, which leads to new highs on the futures market in the US. Thus there is no trace after a short correction on Wall Street, but there is a well-known problem of proximity to the historical maximum.

-

15:35

U.S. Stocks open: Dow +0.17%, Nasdaq +0.33%, S&P +0.21%

-

15:29

Before the bell: S&P futures -0.07%, NASDAQ futures +0.01%

U.S. stock-index futures were little changed as traders turned their focus to the upcoming monthly jobs report.

Global Stocks:

Nikkei 15,276.24 -102.75 -0.67%

Hang Seng 20,706.92 +211.63 +1.03%

Shanghai Composite 3,016.93 -0.36 -0.01%

FTSE 6,543.73 +80.14 +1.24%

CAC 4,124.91 +39.61 +0.97%

DAX 9,411.12 +37.86 +0.40%

Crude $48.00 (+1.20%)

Gold $1364.10 (-0.22%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

175.5

0.34(0.1941%)

200

ALCOA INC.

AA

9.22

0.03(0.3264%)

51420

ALTRIA GROUP INC.

MO

69.85

0.13(0.1865%)

1780

Amazon.com Inc., NASDAQ

AMZN

738.8

1.19(0.1613%)

19941

Apple Inc.

AAPL

95.65

0.12(0.1256%)

32897

AT&T Inc

T

42.7

-0.40(-0.9281%)

82611

Barrick Gold Corporation, NYSE

ABX

23

-0.16(-0.6908%)

127509

Boeing Co

BA

126.95

-0.01(-0.0079%)

200

Cisco Systems Inc

CSCO

28.66

-0.06(-0.2089%)

9055

Citigroup Inc., NYSE

C

41.18

0.12(0.2923%)

19843

Exxon Mobil Corp

XOM

94.25

0.16(0.17%)

725

Facebook, Inc.

FB

116.84

0.14(0.12%)

93033

Ford Motor Co.

F

12.56

-0.01(-0.0796%)

5003

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.02

0.13(1.1938%)

146826

General Electric Co

GE

31.8

0.06(0.189%)

5835

General Motors Company, NYSE

GM

28.38

-0.02(-0.0704%)

352

Goldman Sachs

GS

146.4

0.82(0.5633%)

510

Google Inc.

GOOG

699.25

1.48(0.2121%)

1469

Intel Corp

INTC

32.96

-0.01(-0.0303%)

2420

JPMorgan Chase and Co

JPM

60.2

0.01(0.0166%)

6079

McDonald's Corp

MCD

121.03

0.40(0.3316%)

314

Merck & Co Inc

MRK

59.02

-0.14(-0.2366%)

888

Microsoft Corp

MSFT

51.41

0.03(0.0584%)

13396

Pfizer Inc

PFE

35.69

-0.17(-0.4741%)

744

Procter & Gamble Co

PG

85.02

-0.01(-0.0118%)

450

Tesla Motors, Inc., NASDAQ

TSLA

212.98

-1.46(-0.6808%)

19933

The Coca-Cola Co

KO

45.5

0.23(0.5081%)

5500

Twitter, Inc., NYSE

TWTR

17.25

0.05(0.2907%)

6961

UnitedHealth Group Inc

UNH

143.05

0.67(0.4706%)

1000

Verizon Communications Inc

VZ

56.17

-0.09(-0.16%)

5649

Visa

V

74.32

0.26(0.3511%)

226

Walt Disney Co

DIS

98.01

0.27(0.2762%)

948

Yahoo! Inc., NASDAQ

YHOO

37.61

0.10(0.2666%)

1927

Yandex N.V., NASDAQ

YNDX

21.68

0.12(0.5566%)

7500

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Bank of America (BAC) downgraded to Mkt Perform from Outperform at Raymond James

AT&T (T) downgraded to Neutral from Buy at Citigroup; target raised to $46 from $42

Other:

Disney (DIS) initiated with a Hold at Brean Capital

-

13:08

WSE: Mid session comment

The morning trading phase was marked by expansion of so successful achievements from the first hour of trading. The scale of increasing growth after the trauma of the three previous sessions may surprise even the bigger optimists. The WIG20 grows by 2 per cent, and with each fragment of the session bulls are doing more and more confident. It looks as the market has already cleaned after the Brexit and uncertainty associated with the future of Pension Funds (OFE). The Warsaw Stock Exchange stands out against the background of Europe. The growth of the German DAX exceeds a bit 1% and the French CAC40 1.2%. The WIG20 index managed to go over the level of 1,720 points, which means full make up for yesterday's losses and at the same time shows the first sign of a possible improvement in future sessions. However in the south part of the session we face with consolidation.

The improvement in sentiment on European markets, resulting in the best session since the beginning of the week on stock exchanges, is also reflected in currency trading. The zloty begins to strengthen, which is evident especially in the last hour of trading.

-

12:54

European stocks on the rise

In today's trading, European stocks are actively growing for the first time in four sessions after the UK market and Italian banks, investors are counting on a gradual stabilization of the situation in the region.

The composite index of Europe's largest enterprises Stoxx 600 rose by 1.6% - to 323.80 points, an increase is observed in all 19 industry groups indicator. Over the previous three sessions Stoxx 600 fell by 4.1%.

The value of the UK's FTSE 100 increased 1.5% after the decline of the pound after and improvedvprospects for companies profits.

Some support for market was given by the minutes of the last meeting of the Federal Open Market Committee (FOMC) that showed the majority of the Central Bank managers still prefer to refrain from raising interest rates.

Investors were also evaluating data on British industrial production. Industrial production fell less than expected in May, data showed on Thursday, the Office for National Statistics said.

The volume of industrial production decreased by 0.5 percent in May after the growth with 2.1 percent in April. It was the biggest drop in the past five months, but less than the expected decline of 1 per cent.

In addition, manufacturing output fell by 0.5 percent, in contrast to an increase of 2.4 percent a month ago.

In annual terms, industrial production growth slowed to 1.4 percent in May, compared with 2.2 percent. Economists had forecast an increase of 0.5 percent.

Shares of the largest Italian bank Unicredit rose 1,3%, Intesa Sanpaolo 2,6%, Banca Monte dei Paschi di Siena - by 1.4%.

Securities of Associated British Foods Plc jumped 5.7% due to better annual profit forecast due to the weakening pound.

The market value of the French Danone SA, the world's largest yogurt maker, climbed 4.3% after the purchase announcement of American WhiteWave Foods Co. for $ 12.5 billion including debt.

Shares of Rentokil Initial Plc rose 5.4%. The Company has agreed to acquire US distributor of means to combat pests Residex LLC for $ 30 million.

At the moment:

FTSE 6561.80 98.21 1.52%

DAX 9473.28 100.02 1.07%

CAC 4148.61 63.31 1.55%

-

09:45

Mixed start of trading on major stock exchanges: DAX 9,431.89 + 58.63 + 0.63%, FTSE 100 6,521.05-24.32-0.37%, CAC 40 4,115.07 + 29.77 + 0.73%

-

09:15

WSE: After opening

WIG20 index opened at 1697.51 points (+0.45%)*

WIG 43790.36 0.55%

WIG30 1905.33 0.66%

mWIG40 3297.89 0.38%

*/ - change to previous close

The futures market began today's from the growth of 0.41% to 1,694 points. This optimism of contracts was not accidental. At the beginning of the session, most of the values among blue chips glows green, mainly banks sector. Bulls quickly regain the level of 1,700 points on the WIG20 index, which gives hope to avoid a collision with a key support level that is January minimum index, affected by the results of the British referendum.

-

08:43

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,3%, FTSE 100 -0,8%, CAC 40 -0.1%

-

08:19

WSE: Before opening

After yesterday's session in the US where the S&P500 index gained 0.54% and closed at daily highs, it seems that today we may expect some growth on the markets.

Another day strengthened the Japanese yen and gold, on the other hand, since this morning we have a small correction in the dollar and the Swiss franc. Investors from the beginning of the session for the Asian markets are clearly hesitant as to the direction that they should take. On the one hand, yesterday's behavior of overseas parquets gave a little courage for buyers, but awareness of the dangers that arise on the horizon does not allow buyers to develop wings and causes that assets considered as "safe havens" such as gold and the yen are still more expensive.

In the morning in Asia is dominated by the green color, although with some exceptions, such as the Nikkei index, falling in response to the still strong yen. Europe, however, gets a chance to fight for reflection after a disastrous first part of the week, and the Warsaw Stock Exchange should take advantage of it. The scale of the possible reaction in Warsaw will be able to build up a new opinion about the condition of our market, which yesterday was not the best.

Additionally, today will flow to the market quite a lot of macro data, including industrial production in Germany, Norway and the UK as well as data from the US labor market, which can kick-start trade in Europe. We have to remember that there is a heavy atmosphere on the market and subsequent bad data will be intensified desire for selling off the shares.

-

07:16

Global Stocks

European stocks moved sharply lower again Tuesday, as concerns over the U.K.'s Brexit vote gripped the market after three London asset manages suspended trading in a property funds.

A more than 4% slide in oil prices further hurt the investment mood.

U.S. stocks shook off worries tied to the U.K.'s vote late last month to exit the European Union, dubbed Brexit, and closed higher Wednesday.

A stronger-than-expected report on nonmanufacturing activity helped nudge investors back into equities, while minutes from the Federal Reserve's June policy meeting showed the majority of policy makers were in favor of keeping rates on hold.

Some analysts attributed gains in the aftermath of Brexit to investors' strategy of buying stocks when the market dips, which tends to lead to up-and-down trading.

The S&P 500 index SPX, +0.54% rose 11.18 points, or 0.5%, to finish at 2,099.73. The health-care and consumer discretionary sectors led gains, while sectors considered defensive, such as telecoms and utilities, declined. The Dow Jones Industrial Average DJIA, +0.44% gained 78 points, or 0.4%, to finish at 17,918.62.

Asian share markets crept higher on Thursday after upbeat U.S. economic data took some of the sting out of the latest Brexit scare, while the Australian dollar slipped as the country's triple A credit rating came under threat.

The agency had warned it may act after inconclusive elections over the weekend suggested the next government would have a hard time getting reforms through to law.

Elsewhere in Asia, the mood was one of relief that Brexit fears had faded for the moment. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.8 percent.

Japanese shares were restrained by a strong yen and the Nikkei .N225 dipped 0.3 percent.

-

04:04

Nikkei 225 15,320.76 -58.23 -0.38 %, Hang Seng 20,698.29 +203.00 +0.99 %, Shanghai Composite 3,012.41 -4.88 -0.16 %

-

00:32

Stocks. Daily history for Jun Jul 06’2016:

(index / closing price / change items /% change)

Nikkei 225 15,378.99 -290.34 -1.85 %

Hang Seng 20,495.29 -255.43 -1.23 %

S&P/ASX 200 5,197.55 -30.45 -0.58 %

Shanghai Composite 3,017.1 +10.71 +0.36 %

FTSE 100 6,463.59 -81.78 -1.25 %

CAC 40 4,085.3 -78.12 -1.88 %

S&P 500 2,099.73 +11.18 +0.54 %

NASDAQ Composite 4,859.16 +36.26 +0.75 %

Dow Jones 17,918.62 +78.00 +0.44 %

-