Noticias del mercado

-

21:00

Dow +1.48% 18,160.17 +264.29 Nasdaq +1.66% 4,957.75 +80.94 S&P +1.58% 2,130.96 +33.06

-

18:01

European stocks closed: FTSE 100 6,590.64 +56.85 +0.87% CAC 40 4,190.68 +72.83 +1.77% DAX 9,629.66 +210.88 +2.24%

-

17:38

WSE: Session Results

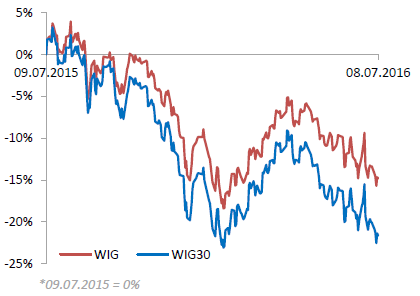

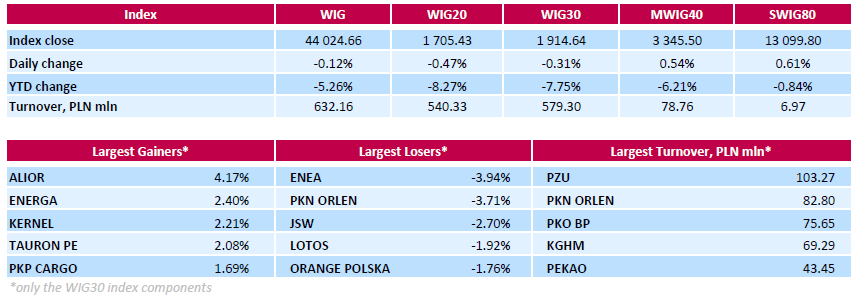

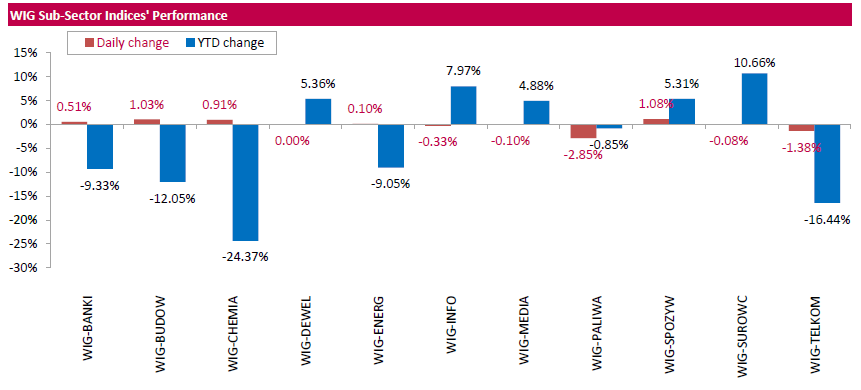

Polish equity market closed lower on Friday. The broad market measure, the WIG Index, slumped by 0.12%. Sector performance within the WIG Index was mixed. Oil and gas stocks (-2.85%) tumbled the most, while food names (+1.08%) fared the best.

The large-cap stocks fell by 0.31%, as measured by the WIG30 Index. In the index basket, genco ENEA (WSE: ENA) and oil refiner PKN ORLEN (WSE: PKN) led the decliners, tumbling by 3.94% and 3.71% respectively. They were followed by coking coal miner JSW (WSE: JSW), oil refiner LOTOS (WSE: LTS), telecommunication services provider ORANGE POLSKA (WSE: OPL) and gas producer PGNIG (WSE: PGN), which lost between 1.65% and 2.70%. On the other side of the ledger, bank ALIOR (WSE: ALR) was the session's best performer, advancing 4.17%. Other major gainers were agricultural producer KERNEL (WSE: KER) and two gencos ENERGA (WSE: ENG) and TAURON PE (WSE: TRE), which advanced between 2.08% and 2.40%.

-

15:35

U.S. Stocks open: Dow +0.67%, Nasdaq +0.57%, S&P +0.68%

-

15:32

Tesla Motors (TSLA): there are still some problems with the production of Model X

Analysts at RBC Capital Mkts lowered TSLA target share price to $ 210 from $ 220. The company notes that Tesla Motors produced 18,345 vehicles in the second quarter (+ 20% compared to the first quarter), and by the end of the quarter reached the production level of less than 2 000 vehicles per week. Based on what they saw during their recent visit to the plant of the company, analysts believe that the company still has problems with the production of Model X.

Tesla Motors plans to increase production to 2200 units / week in the third quarter and 2,400 units / week in the fourth quarter. This implies the production of about 50 thousand vehicles in the second half. Thus, if the company will be able to carry out the delivery of these vehicles, its sales will be able to reach the level of 80-90K cars by the end of 2016, which is the lower limit of the forecast range. The RBC Capital Mkts believe that the company will supply 75 thousand cars in 2016 (previous forecast ~ 79K.).

-

15:28

Before the bell: S&P futures +0.74%, NASDAQ futures +0.55%

U.S. stock-index futures rallied as payroll growth accelerated by the most since October.

Global Stocks:

Nikkei 15,106.98 -169.26 -1.11%

Hang Seng 20,564.17 -142.75 -0.69%

Shanghai Composite 2,989.25 -27.60 -0.91%

FTSE 6,579.47 +45.68 +0.70%

CAC 4,196.14 +78.29 +1.90%

DAX 9,629.71 +210.93 +2.24%

Crude $45.52 (+0.84%)

Gold $1344.80 (-1.27%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.49

0.15(1.606%)

37295

ALTRIA GROUP INC.

MO

69.48

0.18(0.2597%)

601

Amazon.com Inc., NASDAQ

AMZN

741

4.43(0.6014%)

28502

American Express Co

AXP

60.36

0.55(0.9196%)

400

AMERICAN INTERNATIONAL GROUP

AIG

52.54

0.72(1.3894%)

460

Apple Inc.

AAPL

96.34

0.40(0.4169%)

97992

AT&T Inc

T

42.21

-0.09(-0.2128%)

45748

Barrick Gold Corporation, NYSE

ABX

21.8

-0.55(-2.4609%)

247564

Boeing Co

BA

128.5

1.33(1.0458%)

835

Caterpillar Inc

CAT

75.6

0.55(0.7328%)

5604

Chevron Corp

CVX

103.56

0.51(0.4949%)

2607

Cisco Systems Inc

CSCO

28.94

0.20(0.6959%)

3868

Citigroup Inc., NYSE

C

42.08

0.79(1.9133%)

160002

Exxon Mobil Corp

XOM

93.45

0.49(0.5271%)

6417

Facebook, Inc.

FB

116.36

0.51(0.4402%)

122486

FedEx Corporation, NYSE

FDX

152.93

0.33(0.2162%)

103

Ford Motor Co.

F

12.88

0.13(1.0196%)

46164

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.9

0.23(2.1556%)

112327

General Electric Co

GE

31.98

0.16(0.5028%)

26311

General Motors Company, NYSE

GM

28.98

0.24(0.8351%)

14231

Goldman Sachs

GS

149.79

2.79(1.898%)

7124

Google Inc.

GOOG

699.46

4.10(0.5896%)

9517

Hewlett-Packard Co.

HPQ

12.95

0.10(0.7782%)

2150

Home Depot Inc

HD

132.5

1.34(1.0217%)

2965

HONEYWELL INTERNATIONAL INC.

HON

116.62

0.51(0.4392%)

200

Intel Corp

INTC

33.57

0.37(1.1145%)

73881

International Paper Company

IP

42.04

0.14(0.3341%)

200

JPMorgan Chase and Co

JPM

61.58

1.00(1.6507%)

84347

McDonald's Corp

MCD

121

0.08(0.0662%)

5075

Merck & Co Inc

MRK

59.02

0.24(0.4083%)

542

Microsoft Corp

MSFT

51.62

0.24(0.4671%)

27198

Nike

NKE

56.28

0.36(0.6438%)

5268

Pfizer Inc

PFE

35.9

0.13(0.3634%)

4367

Procter & Gamble Co

PG

84.96

0.13(0.1532%)

7964

Starbucks Corporation, NASDAQ

SBUX

57.07

0.16(0.2811%)

9451

Tesla Motors, Inc., NASDAQ

TSLA

219.02

3.08(1.4263%)

26776

The Coca-Cola Co

KO

45.23

0.14(0.3105%)

1025

Travelers Companies Inc

TRV

118.81

1.30(1.1063%)

550

Twitter, Inc., NYSE

TWTR

17.57

0.20(1.1514%)

105346

Verizon Communications Inc

VZ

55.25

-0.13(-0.2347%)

39269

Visa

V

75.1

0.59(0.7918%)

16110

Wal-Mart Stores Inc

WMT

73.84

0.31(0.4216%)

900

Walt Disney Co

DIS

98.83

0.42(0.4268%)

5229

Yahoo! Inc., NASDAQ

YHOO

37.7

0.18(0.4797%)

13125

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded to Market Perform at Bernstein

Downgrades:Citigroup (C) downgraded to Market Perform from Outperform at Wells Fargo

Other:Tesla Motors (TSLA) target lowered to $210 from $220 at RBC Capital Mkts

Intel (INTC) target raised to $34 from $33 at RBC Capital Mkts -

13:19

Major stock indexes in Europe show a positive trend

European stock markets mostly rose in the course of today's session, as the strengthening of the shares of the mining sector due to growth in metal prices supported the market, but some of the major stock indexes may show the worst week for about five months.

Attention will be on the US labor market raport in June, which will be released by the US Department of Labor at 12:30 GMT.

The composite index Stoxx Europe 600 of the largest enterprises in the region increased in the course of trading by 0,5% - to 323.69 points, while on the week lost more than 3% and can show the largest weekly percentage drop since mid-February.

The UK trade deficit widened in May, against the background of weak exports, showed on Friday the data of the Office of National Statistics.

The merchandise trade deficit increased to 9.9 billion pounds from 9.4 billion pounds in April. The expected deficit was 10.7 billion pounds.

This extension reflects a greater reduction in exports by 2.1 billion pounds, than the fall of 1.6 billion pounds of imports.

The deficit with EU countries increased to 7.3 billion euros from 6.9 billion pounds, while with non-member states in the EU rose to 2.6 billion pounds from 2.5 billion pounds.

Meanwhile, the services surplus increased to 7.6 billion pounds from 7.5 billion pounds.

As a result, the overall trade deficit, including goods and services, increased to 2.3 billion pounds from 2 billion pounds. Exports fell by 2.0 billion pounds, while imports decreased by 1.7 billion pounds.

Shares of mining companies rising on Friday, bank stocks also rise in price.

The cost of securities of Rio Tinto rose by 1,8%, Anglo American - by 2.3%. Shares of Royal Bank of Scotland rose in price by 0,5%, Standard Chartered - +0,7%, Lloyds Banking Group - by 2%, HSBC - by 0.4%.

Shares of Air France-KLM fell 1.4%. The airline announced the resignation of its chief Pierre-François Riolachchi CFO, who will take the post of CFO at Danish company ISS A/S.

Air France-KLM also reported an increase in passenger traffic in June by 1% - to 8.3 million people. The number of passengers on long-haul destinations decreased by 3.9% compared with the same period a year earlier.

Shares of TDC Denmark telecom company increased by 5.9%.

At the moment

FTSE 6531.15 -2.64 -0.04%

DAX 9506.07 87.29 0.93%

CAC 4147.06 29.21 0.71%

-

13:12

WSE: Mid session comment

The first half of trading on the Warsaw market was marked by expectations of what will happen in the afternoon after the release of data from the US. Low liquidity, with which we are dealing today in Warsaw favors the unexpected movement, especially when everyone expects no changes. After two attempts to raise the index, the supply side tried its power which ended up with a downward move to the cosmetic cons. While our market is going down session lows, in Frankfurt investors showed a bit more optimism, which results in the increase of the DAX up to 1.1 percent. Unfortunately, the previously observed strength of the Warsaw Stock Exchange today is no longer present, and despite the very comfortable conditions for the development of yesterday's gains we do not see it.

In the mid-session, the WIG20 index reached the level of 1,714 points (+0.06%) with the turnover of PLN 154 mln.

-

09:48

Major stock exchanges trading mixed: DAX 9,425.41 + 6.63 + 0.07%, FTSE 100 6,540.46 + 76.87 + 1.19%, CAC 40 4,117.45-0.40-0.01%

-

09:13

WSE: After opening

The WIG20 futures lost 0.2 percent at the opening. The impact on such a situation comes purely from external factors in the form of slightly weaker than expected the US session, a further decline in Tokyo after a series of weaker economic data, and similar to our bottom line quotations of futures on the main Euroland parquets after weak data from Germany - the growth of exports and imports were below expectations.

WIG20 index opened at 1714.84 points (+0.08%)*

WIG 44151.71 0.17

WIG30 1924.18 0.18

mWIG40 3331.16 0.10

*/ - change to previous close

The cash market opens with a small increase of 0.08% to 1,714 points. The German DAX opened with decrease of 0.3%, but quickly works it out, which slightly improves the climate. For improvement may help the words of ECB (Vítor Constancio, Member of the Executive Board) talking about "little" help for the banks. The opening can be considered as neutral, and the attitude of the environment as slightly edifying.

-

08:54

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,8%, FTSE 100 -1,0%, CAC 40 -0.5%

-

08:26

WSE: Before opening

Yesterday's a bit bearish ending of the US session was slightly disappointing. Downward move was not large, approx. of 0.1%, and resulted from the sell-off in the oil market by more than 5%. However Asia in the morning is dominated by the red color and the contracts in the US also go down about 0.10%. This means that a weak Europe may have trouble to generate growth, which hinders the activity of demand on the WSE. Nevertheless, follow the principle, before the hour 14:30 (Warsaw time) markets should be relatively calm.

At this hour will be published the report from the US labor market. Its outcome affects the expected FOMC policy. After a negative surprise in May, now is expected to return to the area of 200 thousand new workplaces. The reading of less than 100 thousand will be considered for the next negative surprise, and over 200 thousand as positive and beginning discussions about a possible rate hike in the US, as soon as echo of Brexit will temper.

-

07:14

Global Stocks

European stocks climbed Thursday as a surge in shares of France's Danone SA and financial stocks helped the benchmark index to break a three-session losing streak.

The Stoxx Europe 600 SXXP, +1.05% rose 1.1% to close at 322.12, with all sectors gaining ground. The benchmark on Wednesday fell 1.7%, rocked lower as bank and asset manager stocks fell in the wake of the Brexit vote.

U.S. stocks closed mostly lower Thursday, tracking sinking oil prices, but the market pared losses late in the session as investors sought bargains ahead of the closely watched jobs report.

Stocks had opened higher but was under pressure most of the session as oil futures tanked 5% after a report from the U.S. Energy Information Administration showed a smaller-than-expected weekly decline in domestic crude supplies of 2.2 million barrels.

The S&P 500 index SPX, -0.09% slid 1.83 points, or less than 0.1%, to close at 2,097.90. Sharp declines in so-called defensive groups, telecommunications and utilities, weighed on the large-cap benchmark.

The Dow Jones Industrial Average DJIA, -0.13% came off intraday low to fall 22.74 points, or 0.1%, to 17,895.88. Chevron Corp. CVX, -1.46% and Verizon Communications Inc. VZ, -1.56% were the worst performers among blue-chips.

Meanwhile, the Nasdaq Composite Index COMP, +0.36% gained 17.65 points, or 0.4%, to end at 4,876.81 and buck the losing trend for the main stock-market indexes.

Asian stocks looked set to post their biggest weekly loss in three weeks on Friday and government bond yields plunged to fresh record lows as investors awaited U.S. jobs data to get a clearer picture of the health of the world's biggest economy.

Hurt by a steady drip-feed of negative news this week from rising Brexit uncertainty to risks spreading among Italian banks, investment managers sought shelter in the U.S. dollar and gold, signaling a rocky start to the second half of the year.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.4 percent. For the week, it is set to fall 1 percent, its biggest weekly drop since June. 19. Hong Kong stocks .HSI led losers with a fall of 0.9 percent.

Japan's Nikkei .N225 fell 0.4 percent.

-

04:05

Nikkei 225 15,301.38 +25.14 +0.16 %, Hang Seng 20,615.71 -91.21 -0.44 %, Shanghai Composite 3,000.29 -16.56 -0.55 %

-

00:36

Stocks. Daily history for Jun Jul 07’2016:

(index / closing price / change items /% change)

Nikkei 225 15,276.24 -102.75 -0.67 %

Hang Seng 20,706.92 +211.63 +1.03 %

S&P/ASX 200 5,227.92 +30.37 +0.58 %

Shanghai Composite 3,016.93 -0.36 -0.01 %

FTSE 100 6,533.79 +70.20 +1.09 %

CAC 40 4,117.85 +32.55 +0.80 %

Xetra DAX 9,418.78 +45.52 +0.49 %

S&P 500 2,097.9 -1.83 -0.09 %

NASDAQ Composite 4,876.81 +17.65 +0.36 %

Dow Jones 17,895.88 -22.74 -0.13 %

-