Noticias del mercado

-

22:15

Major US stock indices are markedly increased

Major stock indexes in Wall Street rose on Friday, recovering all of its losses due Brexit after data showed the largest increase in the number of jobs in the US in eight months in June.

As it became known today, the number of jobs in the US rose in June, as employment in manufacturing has increased, giving more evidence that the economy will recover growth after a lull of the first quarter, but a slow wage growth is likely to force the Fed policy makers remain cautious in matters increases in interest rates. The number of people employed in non-agricultural sectors of the economy increased by 287,000 jobs last month, the biggest increase since October last year, reported the Ministry of Labour. The data for May were revised down to a mere 11 000 versus 38 000 previously reported. At the same time, the slow growth of wages has become a negative factor on a positive note the report. The average hourly wage increased by only two cents, or 0.1% in June. annualized growth in revenue increased to 2.6% after rising 2.5% in May.

Oil futures rose slightly. In focus were the statements of the International Monetary Fund. The IMF estimated that if OPEC has received only a small market share, the price of oil in 2020 could rise to $ 58-75 per barrel. "OPEC holds 42% of the market, compared to 35% if it is to adapt to new market realities. Lesser of two evils for OPEC in the future would be the desire to achieve market equilibrium ", - stated in the working documents of the Fund.

All components of the index DOW closed mostly (30 of 30). Most remaining shares rose Caterpillar Inc. (CAT, + 3,16%).

All Sector S & P Index showed an increase. The leader turned conglomerates sector (+ 2.4%).

-

21:00

U.S.: Consumer Credit , May 18.56 (forecast 16)

-

16:51

IMF cuts Euro Zone GDP forecasts

- GDP decelerating to 1.4% from 1.6% this year.

- further slowdown in global growth could derail Eurozone's domestic-led recovery.

- downside risks include further Brexit spillover

- Medium-term growth prospects 'mediocre' with annual growth in 5 years at 1.5%.

- Brexit impact on Eurozone will be worse if risk aversion continues for long period.

-

16:20

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800,1.0900, 1.0917 (1.02bn), 1.0925, 1.0950, 1.0970/75/80 (1.24bn),1.0990,1.1000, 1.1020/25, 1.1050/55/60 (901m), 1.1095, 1.1095,1.1100, 1.1125/30 (730m), 1.1145, 1.1181,1.1200,(1.44bn), 1.1290,1.1300 (620m), 1.1325, 1.1350

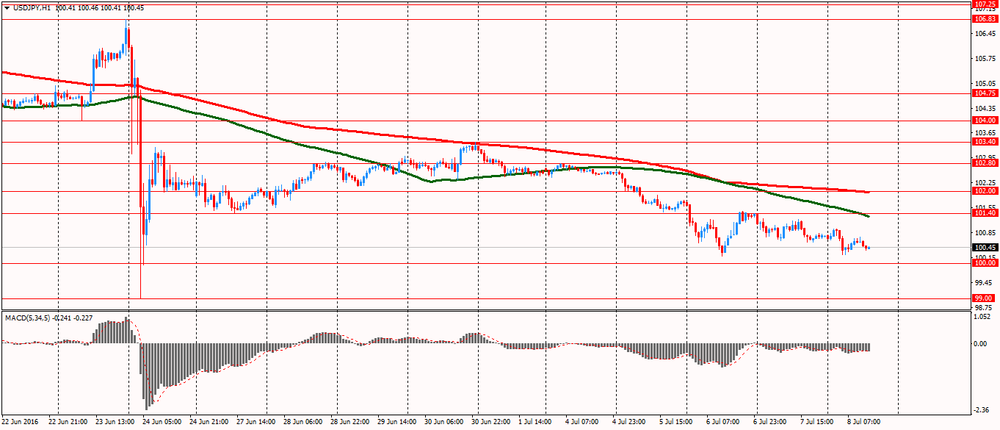

USD/JPY 100.00 (660m),101.25,102.45/50/55/60,103.00, 103.10, 103.30,104.40 (625m), 104.50, 104.95,105.00

GBP/USD 1.2910, 1.2945/50, 1.2990,1.3000, 1.3050,1.3190,1.3200,1.3440/50

AUD/USD 0.7390, 0.7400 (577m), 0.7420, 0.7445, 0.7470,0.7500, 0.7530

NZD/USD 0.7120

AUD/NZD 1.0480

USD/CAD 1.2740,1.2800, 1.2820,1.2900 (620m), 1.2935, 1.2950, 1.2965/70,1.2980/85/90,1.3000/05, 1.3020, 1.3035/40, 1.3085,1.3100, 1.3150,1.3250,1.3400 (871m)

EUR/GBP 0.8700,0.8900

-

14:54

Canadian employment mostly unchanged in June

Employment was unchanged in June (0.0%). The unemployment rate declined 0.1 percentage points to 6.8%, as the number of people searching for work edged down. In the second quarter of 2016, employment was little changed (+11,000 or +0.1%). This was the smallest quarterly change in employment in two years. In the 12 months to June, the number of people employed rose by 108,000 (+0.6%), with most of the gains in part time (+77,000 or +2.3%). Over the same period, the total number of hours worked fell slightly (-0.1%).

-

14:41

NFP 287K but unemployment rate up 0.2%

Total nonfarm payroll employment increased by 287,000 in June, and the unemployment rate rose to 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Job growth occurred in leisure and hospitality, health care and social assistance, and financial activities. Employment also increased in information, mostly reflecting the return of workers from a strike.

The unemployment rate increased by 0.2 percentage point to 4.9 percent in June, and the number of unemployed persons increased by 347,000 to 7.8 million. These increases largely offset declines in May and brought both measures back in line with levels that had prevailed from August 2015 to April.

In June, average hourly earnings for all employees on private nonfarm payrolls edged up (+2 cents) to $25.61, following a 6-cent increase in May. Over the year, average hourly earnings have risen by 2.6 percent. Average hourly earnings of private-sector production and nonsupervisory employees increased by 4 cents to $21.51 in June.

-

14:38

-

14:30

Canada: Unemployment rate, June 6.8% (forecast 7%)

-

14:30

U.S.: Average hourly earnings , June 0.1% (forecast 0.2%)

-

14:30

U.S.: Nonfarm Payrolls, June 287 (forecast 175)

-

14:30

U.S.: Unemployment Rate, June 4.9% (forecast 4.8%)

-

14:30

U.S.: Average workweek, June 34.4 (forecast 34.4)

-

14:30

Canada: Employment , June -0.7 (forecast 5)

-

14:26

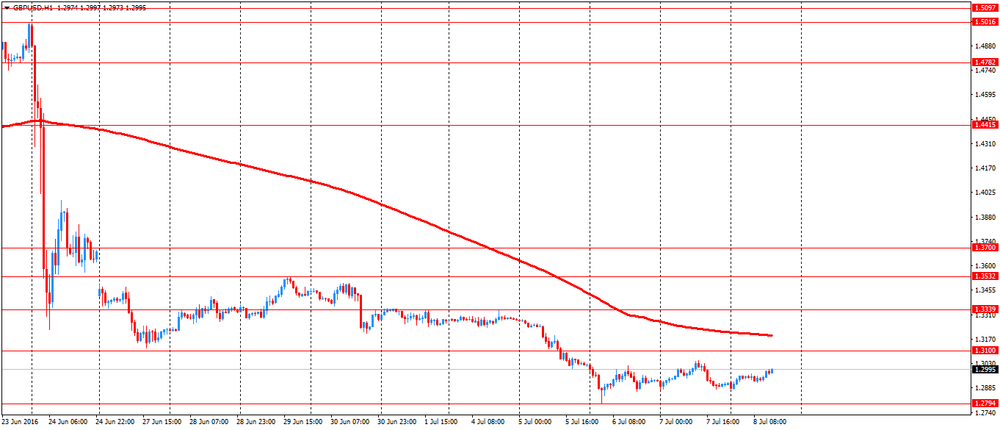

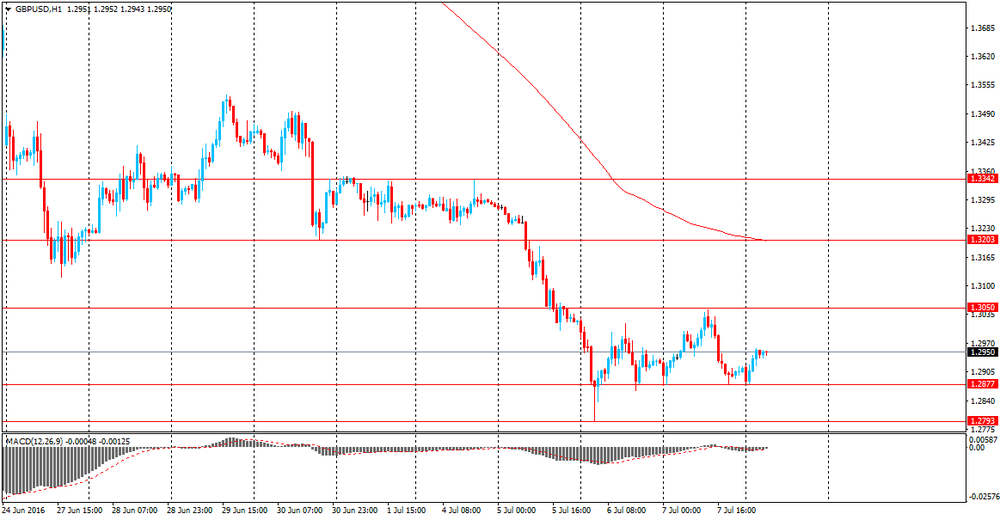

European session review: Gbp/Usd rose buy contained by the trading range

The following data was published:

(Time / country / index / period / previous value / forecast)

5:45 Switzerland's unemployment rate (not seasonally adjusted) in June 3.2% Revised from 3.3% 3.3% 3.1%

6:00 Germany Balance of payments, 28.4 billion in May from 28.8 17.5 Revised

6:00 Germany Trade balance (not seasonally adjusted), 25.7 billion in May from 25.6 Revision 21

6:45 France Industrial Production m / m in May 1.2% -0.5% -0.5%

8:30 UK Trade Balance Revised to May -1950 -3.294 -2.263

The US dollar fell against major currencies, as investors are waiting the release of the report on employment in non-farming sectors of the US later today.

Market participants have focused attention on the employment data in the US, after finding evidence of improvement in the US labor market after the publication of upbeat data on Thursday.

On Thursday, the US Labor Department said the number of initial applications for unemployment benefits for the week ending 2 July fell by 16,000 to 254,000 from 270,000 the previous week. Analysts had expected the number tol increase by 2,000 to 270,000 last week.

In addition, the ADP data showed that the number of people employed in the private sector rose by 172,000 last month, higher than the projected increase of 159,000.

The pound rose despite disappointing report of the Office of National Statistics, which showed that UK's trade deficit widened in May, against the background of weak exports.

The merchandise trade deficit increased to 9.9 billion pounds from 9.4 billion pounds in April. The expected deficit was 10.7 billion pounds.

This extension reflects a greater reduction in exports by 2.1 billion pounds, than the fall of 1.6 billion pounds of imports.

The deficit with EU countries increased to 7.3 billion euros from 6.9 billion pounds, while trade with non EU member states rose to 2.6 billion pounds from 2.5 billion pounds.

Meanwhile, the services surplus increased to 7.6 billion pounds from 7.5 billion pounds.

As a result, the overall trade deficit, including goods and services, increased to 2.3 billion pounds from 2 billion pounds. Exports fell by 2.0 billion pounds, while imports decreased by 1.7 billion pounds.

Meanwhile, the pound rallies might be sold hard, as Brexit reinforces the uncertainty regarding the country's economic prospects.

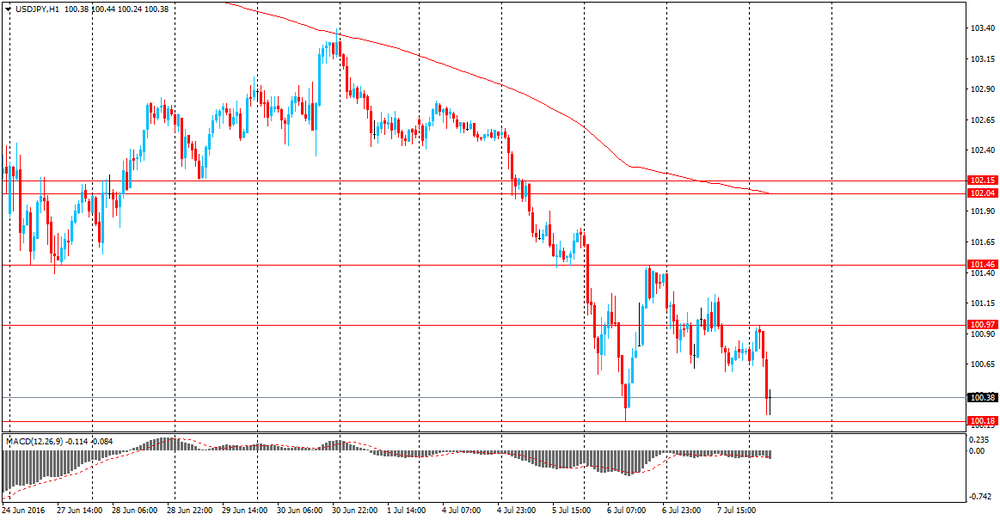

Intraday USD / JPY is approaching a break below the 100 level, and at the same time increases the probability of easing of monetary policy by the Bank of Japan at the meeting scheduled for the end of July. If the central bank will increase the asset purchase program or lower the rate even further deep into negative territory, it can shake the Japanese stock market.

"It is clear that the strengthening of the yen is negative for exporters, so if you can weaken the currency, their share will grow", - says Sunil Garg from J.P. Morgan.

However, lower interest rates may have a negative impact on the shares of financial companies, banks and insurance agencies. "Perhaps the weaker yen would help exporters, but the shares of companies whose rates depend on economic cycles, as well as financial institutions remain under pressure" - says Garg.

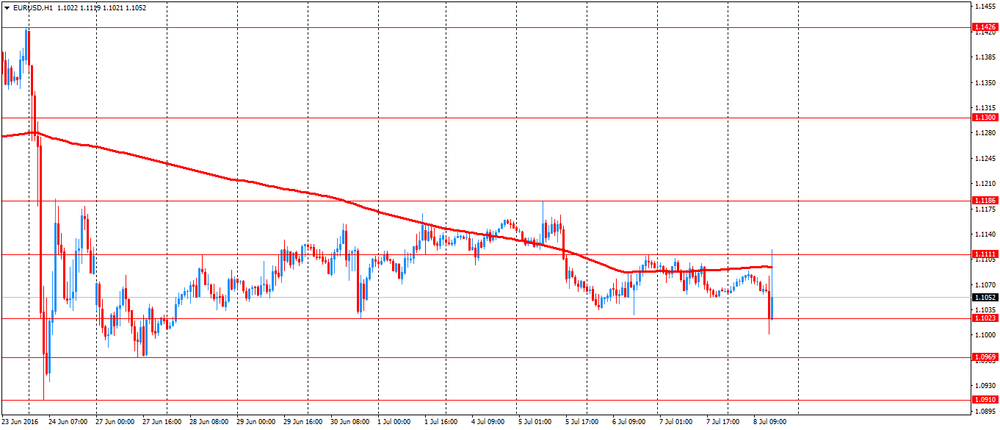

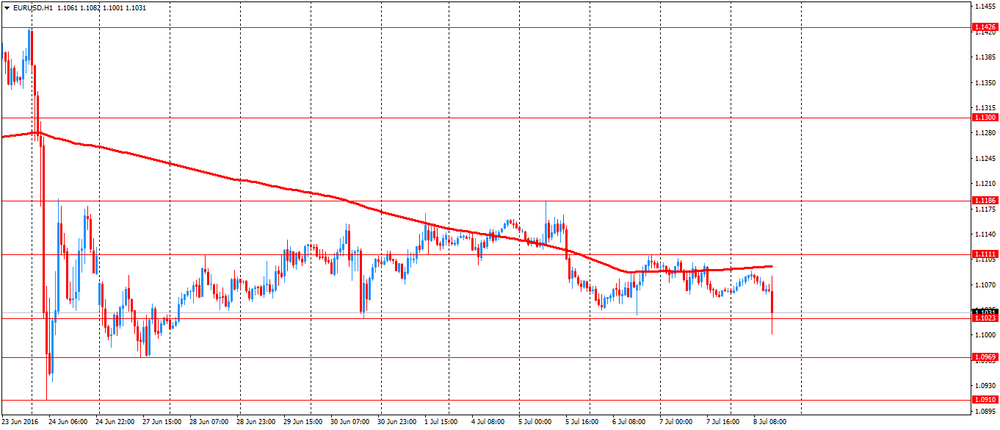

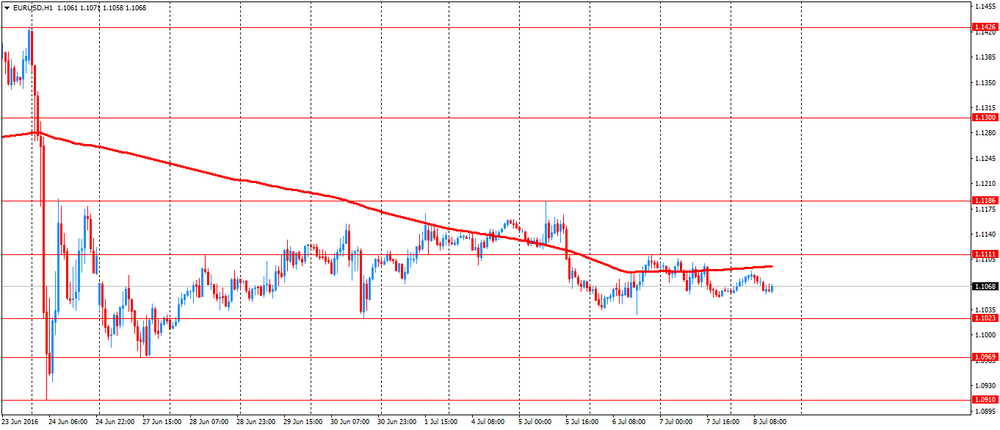

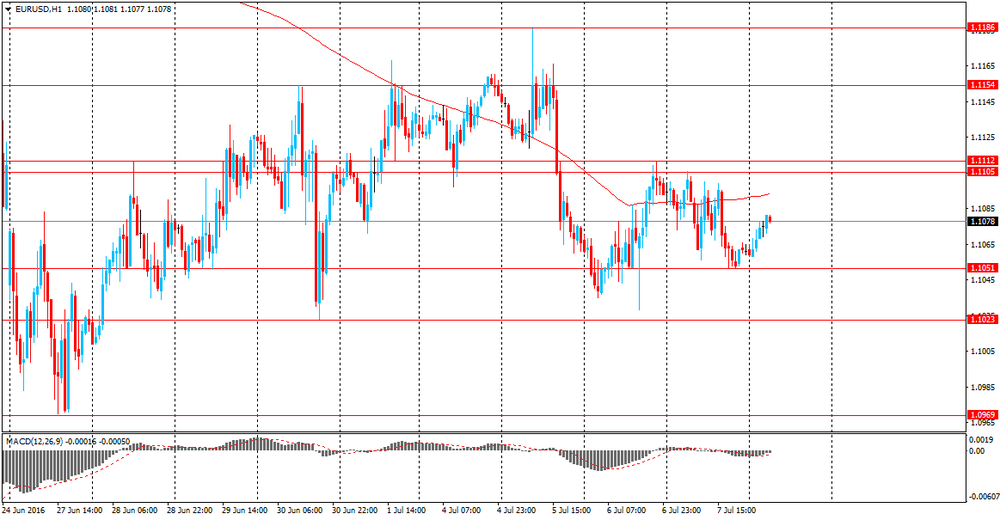

EUR / USD: during the European session, the pair fell to $ 1.1056

GBP / USD: during the European session, the pair has risen to $ 1.2997

USD / JPY: during the European session, the pair fell to Y100.24 and then rose to Y100.74

-

14:00

Orders

EUR/USD

Offers : 1.1100-05 1.1120-25 1.1150 1.1170 1.1185 1.1200 1.1230-40 1.1280 1.1300

Bids: 1 .1070 1.1050-55 1.1025-30 1.1000 1.0975-80 1.0950 1.0930 1.0900

GBP/USD

Offers : 1.2980-85 1.3000 1.3020 1.3035-40 1.3060 1.3075 1.3100 1.3130 1.3150

Bids: 1.2920 1.2900 1.2875-80 1.2855 1.2835 1.2800 1.2750 1.2700

EUR/GBP

Offers : 0.8585 0.8600 0.8620-25 0.8650 0.8700-05 0.8760

Bids: 0.8545-50 0.8520 0.8500 0.8485 0.8470 0.8450 0.8400

EUR/JPY

Offers : 111.85 112.00 112.30 112.50 112.80 113.00

Bids: 111.20 111.00 110.80 110.50 110.00 109.50 109.30 109.00

USD/JPY

Offers : 100.85 101.00 101.15-20 101.40 101.75-80 102.00 102.20 102.50 102.80-85 103.00

Bids: 100.25-30 100.00 99.85 99.50 99.00-05 98.70 98.50

AUD/USD

Offers : 0.7520 0.7550 0.7600 0.7650

Bids: 0.7480 0.7450-55 0.7430 0.7400 0.7375 0.7360 0.7325-30 0.7300

-

13:54

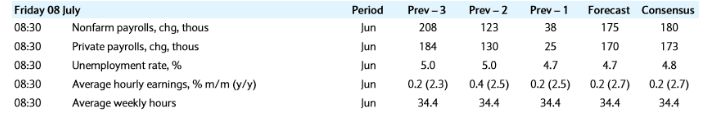

Today at 12:30 GMT US NFP will be published

May non-farm employment data disappointed market participants. Employment grew only by 38 000 people, while the figures for the previous two months were revised downward. Employment in the telecommunications industry fell by 37,200 people, partly due to the Verizon strike. But the figures were weak even without the one-time impact of Verizon strike. The data showed that employment in the sector of production of goods decreased in the past month, while the private sector recorded the smallest increase in nearly four years. The unemployment rate fell to a cyclical low and amounted to 4.7 percent, caused by a sharp decline in labor force participation. In light of the unexpectedly weak report for May, the June data will be very important to assess the situation on the labor market.

According to the average forecast in June, employment increased by 180K.

-

12:12

ECB members generally ready to wait until Dec before discussing the future of QE - sources

- ECB want to focus on the implementation of recent measures.

- Some thinking that the current measures will have a greater impact than the staff projections imply.

-

11:55

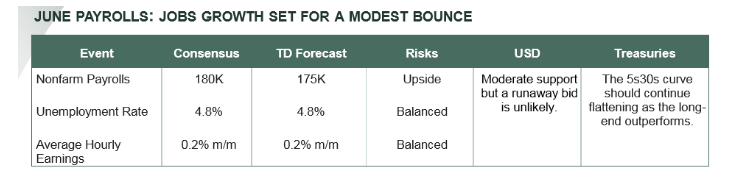

NFP preview Goldman, TD, Barclays

Barclays: For the June US employment report, we expect nonfarm payrolls to rise by 175k, private payrolls to increase by 170k, and government payrolls to rise by 5k. A number in line with our expectation would represent a modest rebound in hiring relative to the May employment report after adjusting for the effects of the Verizon strike. Telecommunications employment fell 37k in May, about in line with the estimate of the strike-related effects as estimated by the BLS, and we look for this employment to return in June given the conclusion of the strike prior to the survey week. Elsewhere in the report, we expect the unemployment rate to remain unchanged at 4.7%. Finally, we expect average hourly earnings to rise 0.2% m/m (2.7% y/y) and average weekly hours to hold steady at 34.4.

(Source: Barclays, eFXplus)

TD: We expect the sharp downdraft in employment to partially reverse in June, with a forecasted increase of 175k jobs. This print will be supported by the return of 34k Verizon workers who were on strike in May. In addition to the rebound in the telecom sector, a bounce back in the wholesale, manufacturing and construction sectors should also bolster the headline print. The unemployment rate is forecast to increase to 4.8% from the cycle-low of 4.7% on account of an expected rebound in the labor force (following the outsized 820K decline over the prior two months), which should more than offset the gains in household employment. On the wage growth front, average hourly earnings are expected to rise modestly, posting a 0.2% m/m gain, resulting in the pace of wage growth accelerating from 2.5% to 2.7% y/y due in large part to favorable base effects.

(Source: TD, eFXplus)

Goldman: We forecast that nonfarm payroll growth rebounded to +210k in June from just +38k in May. In part the pickup reflects the conclusion of a strike at Verizon Communications-this alone accounts for 70k of the month-over-month swing. However, we also see scope for improvement beyond Verizon, as other labor market data have generally looked encouraging. We expect a small increase in the unemployment rate to 4.8% after its three month decline in May. Data from the household survey have been volatile in recent months, but the broad trends-participation stabilizing and job growth remaining strong enough to reduce slack over time-still look intact. We see a low month-over-month gain in average hourly earnings due to calendar quirks, but the year-over-year rate should edge higher.

-

11:10

Moody's cuts UK and Eurozone growth forecasts

UK GDP

2016 1.5% vs 1.8% prior

2017 1.2% vs 2.1% prior

Eurozone GDP

2016 1.5% vs 1.7% prior

2017 1.3% vs 1.6% prior

- Brexit vote is likely to result in a shock to confidence that will curb UK economic growth.

- Eurozone cut reflects country specific developments combined with limited spillovers from Brexit.

- political contagion across EU is the greatest Brexit risk, forexlive said.

-

10:43

Review of financial and economic press: with the reduction of the share of OPEC oil could rise to $ 75 per barrel in 2020

D / W

Two candidates for the post of British prime minister

Among the candidates for the next British prime minister there were only women. The Conservative Party decided on the two candidates for the post of leader of the Tories. They were the current Interior Minister Theresa May and Energy State Minister Andrea Leeds.

newspaper. ru

With the reduction of the share of OPEC the market could rise to $ 75 per barrel

The International Monetary Fund (IMF) believes that if OPEC has received only a small market share, the price of oil in 2020 could rise to $ 58-75 per barrel.

Survey: Consumer confidence index in the UK lowest from 1994

According to the survey research firm GfK, the consumer confidence index in the UK fell to the lowest in 22 years, reports Reuters.

Fitch has set the record for credit rating cuts

Fitch international rating agency since the beginning of 2016 lowered the sovereign credit ratings of a record number of countries, according to Reuters. According to the agency, the indicators related to the negative effects of lower oil prices.

-

10:38

UK trade balance deficit declined

The UK's deficit on trade in goods and services was estimated to have been £2.3 billion in May 2016, a widening of £0.3 billion from April 2016. Exports decreased by £2.0 billion and imports decreased by £1.7 billion.

The deficit on trade in goods was £9.9 billion in May 2016; widening by £0.5 billion from April 2016. This widening reflected a larger decrease in exports (down £2.1 billion to £23.7 billion) than the decrease in imports (down £1.6 billion to £33.5 billion).

Between the 3 months to February 2016 and the 3 months to May 2016, the total trade deficit for goods and services narrowed by £2.5 billion to £8.2 billion.

The deficit on trade in goods narrowed by £2.7 billion to a deficit of £30.6 billion between the 3 months to February 2016 and the 3 months to May 2016. Exports increased by £4.5 billion (6.5%) and imports increased by £1.7 billion (1.7%).

-

10:30

United Kingdom: Total Trade Balance, May -2.263

-

10:01

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800,1.0900, 1.0917 (1.02bn), 1.0925, 1.0950, 1.0970/75/80 (1.24bn),1.0990,1.1000, 1.1020/25, 1.1050/55/60 (901m), 1.1095, 1.1095,1.1100, 1.1125/30 (730m), 1.1145, 1.1181,1.1200,(1.44bn), 1.1290,1.1300 (620m), 1.1325, 1.1350

USD/JPY 100.00 (660m),101.25,102.45/50/55/60,103.00, 103.10, 103.30,104.40 (625m), 104.50, 104.95,105.00

GBP/USD 1.2910, 1.2945/50, 1.2990,1.3000, 1.3050,1.3190,1.3200,1.3440/50

AUD/USD 0.7390, 0.7400 (577m), 0.7420, 0.7445, 0.7470,0.7500, 0.7530

NZD/USD 0.7120

AUD/NZD 1.0480

USD/CAD 1.2740,1.2800, 1.2820,1.2900 (620m), 1.2935, 1.2950, 1.2965/70,1.2980/85/90,1.3000/05, 1.3020, 1.3035/40, 1.3085,1.3100, 1.3150,1.3250,1.3400 (871m)

EUR/GBP 0.8700,0.8900

-

09:11

France: manufacturing production stable in May

Over the past three months, output diminished in the manufacturing industry (-0.9% q-o-q), and to a lesser extent in the overall industry (-0.3%).

Output decreased in "other manufacturing" (-1.3%), in the manufacture of food products and beverages (-1.5%), in the manufacture of machinery and equipment goods (-1.3%). It tumbled in the manufacture of coke and refined petroleum products (-5.0%). Conversely, output rose sharply in mining and quarrying; energy; water supply (+3.7%) and in the manufacture of transport equipment (+2.9%).

Over the year, manufacturing output increased by +0.3%

Manufacturing output of the past three months of 2016 increased slightly compared to the same months of 2015 (+0.3%, y-o-y); so did overall industrial output (+0.5% y-o-y).

Over the year, manufacturing output soared in the manufacture of transport equipment (+7.4%), and rose more moderately in mining and quarrying; energy; water supply (+1.6%). Conversely, it shrank in the manufacture of food products and beverages (-1.9%) and in the manufacture of machinery and equipment goods (-1.4%), and plummeted in the manufacture of coke and refined petroleum products (-10.8%). Finally, it was stable in "other manufacturing".

-

08:46

France: Industrial Production, m/m, May -0.5% (forecast -0.5%)

-

08:42

Asian session review: US dollar lost some ground

The yen began to rise again against the dollar, returning to support levels. US dollar fell to Y100,25, reaching the low of July 6 and then recovered to 100.36, on the news of the violent protests against the cruelty of the law enforcement agencies in Dallas.

On Thursday night in Dallas ten police officers had been shot - three of them are dead, seven wounded, it caused chaos in the city.

The balance of payments of Japan without regard to seasonal fluctuations amounted to ¥ 1 809.1 billion in May, higher than analysts' expectations of ¥ 1 750.0 billion. In April, the balance surplus amounted to ¥ 878.5 billion.

The balance of the current account - a figure published by the Ministry of Finance and reflect the balance of the current export and import of goods and services, with the addition of net investment income and current transfers. The current account surplus indicates that the flow of capital into Japan exceeds its outflow. The high value of the index is a positive factor for the Japanese currency.

The balance of foreign trade, published by the Customs Department of Japan, in May amounted to ¥ 39.9 billion lower than the previous value of ¥ 697.1 Bln. This indicator measures the balance between imports and exports. A positive value represents a trade surplus while a negative - trade deficit. Due to the high dependence on exports of Japan, the country's economy is highly dependent on the trade surplus. Confident demand for Japanese exports leads to a positive growth of the trade balance.

Also today, the Bank of Japan released a report on bank lending, which estimates the amount of all outstanding loans in the banking sector. As it became on an annualized basis in June bank lending increased by 2.0%, after rising 2.2% in May.

Also today, the Ministry of Health, Labour and Welfare of Japan, said that the level of wages in May fell by 0.2% after rising by 0.3%. Analysts had expected an increase of 0.5%.

Real cash incomes increased by 0.2% after rising 0.4% in May, in April. The April value was revised downward to 0.6%

Wage growth is one of the key tasks of the administration's policies of Prime Minister Shinzo Abe. Nominal wage growth in Japan fell in May for the first time since June 2015.

The US dollar fell against most major currencies in Asian trade, while traders waiting took profits before the NFP report. The June data on the number of workers is likely to recover after a disappointing May report. According to forecasts, the number of employees increased by 178 thousand., After rising a meager 38 thousand. Analysts say that the Fed has little reason to raise interest rates this year. Until recently, it had been widely expected that the Fed will raise interest rates at some point this summer. Nevertheless, given Brexit and the May employment data in the US, investors are skeptical that the Fed will raise rates this year.

The New Zealand dollar continued to rise against the background of the widespread weakening of the dollar, after Reserve Bank of New Zealand once again expressed concern about the state of the housing market.

Yesterday, deputy governor of the RBNZ Grant Spencer, speaking about the report on macro-prudential policy and the housing market, said that the bank is considering the possibility of expanding restrictions on lending to cool the housing market. He did not announce any new measures, but said that they could be adopted by the end of the year.

The Swiss franc rose against the background of increasing demand for safe-haven assets. According to the report of the State Secretariat for Economic Affairs (SECO) unemployment rate declined to 3.3% from the previous value of 3.5%. Analysts had expected the index at the same level.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1060-85 range.

GBP / USD: during the Asian session, the pair is trading in the $ 1.1.2880-1.2945 range.

USD / JPY: during the Asian session, the pair was trading in Y100.25-100.40 range.

At 08:30 GMT the UK will release the total trade balance for May. At 12:30 GMT the United States and Canada will publish the employment reports for June.

-

08:29

Options levels on friday, July 8, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1254 (3178)

$1.1207 (3775)

$1.1166 (1759)

Price at time of writing this review: $1.1081

Support levels (open interest**, contracts):

$1.0987 (8777)

$1.0944 (5368)

$1.0897 (14238)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 45299 contracts, with the maximum number of contracts with strike price $1,1500 (5312);

- Overall open interest on the PUT options with the expiration date July, 8 is 85224 contracts, with the maximum number of contracts with strike price $1,0900 (14238);

- The ratio of PUT/CALL was 1.88 versus 1.94 from the previous trading day according to data from July, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.3200 (1833)

$1.3101 (198)

$1.3002 (2746)

Price at time of writing this review: $1.2940

Support levels (open interest**, contracts):

$1.2798 (522)

$1.2699 (269)

$1.2600 (196)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 37642 contracts, with the maximum number of contracts with strike price $1,5000 (4009);

- Overall open interest on the PUT options with the expiration date July, 8 is 43958 contracts, with the maximum number of contracts with strike price $1,3500 (4724);

- The ratio of PUT/CALL was 1.17 versus 1.18 from the previous trading day according to data from July, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

60% of UK’s consumers expect the situation to worsen - GFK

In a one-off special GfK Consumer Confidence Barometer (CCB) to measure post-referendum sentiment, the core Index has fallen 8 points to -9. All of the key measures used to calculate the Index have fallen. This long-running survey dates back to 1974, and there has not been a sharper drop than this for 21 years (December 1994).

Splitting the core Index result by how people said they voted in the referendum, Remainers were at -13, versus Leavers who were more optimistic at -5. The survey was run from 30 June to 5 July to capture the mood of consumers immediately after the Brexit decision on 24 June.

Joe Staton, Head of Market Dynamics at GfK, says: "In these extraordinary times this one-off CCB Brexit Special gauges the temperature of consumer confidence right now. During this period of uncertainty, we've seen a very significant drop in confidence, as is clear from the fact that every one of our key measures has fallen, with the biggest decrease occurring in the outlook for the general economic situation in the next 12 months."

The results reveal consumer concerns about the economic outlook. Six in 10 (60 percent) expect the general economic situation to worsen in the next 12 months, up from 46 percent in June. Only 20 percent of consumers expect it to improve, down from 27 percent in June. The proportion of people who believe prices will increase rapidly in the next 12 months has jumped 20 percentage points from 13 percent to 33 percent.Regional, age and income analysis from the Brexit special.

-

08:18

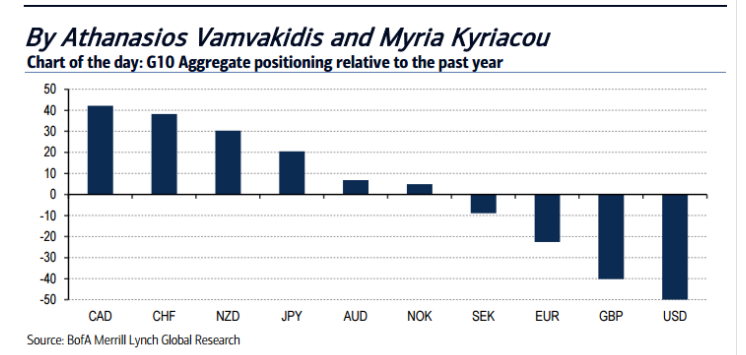

“Most important NFP of the year” - BofA Merrill

"In our view, Friday's US payrolls report will be watched even more keenly than usual as investors look for confirmation that the weak print last month was an outlier and not the start of a new, weaker trend.

Market expectations are for a significant bounce to 180k, matching our economists' estimates, but looking at historical data, we find some evidence of a tendency for consensus to over-estimate the size of the rebound following particularly disappointing payroll reports.

With Brexit spillovers keeping markets nervous, we believe the risks around Non-farm Payrolls (NFP) are asymmetric, especially following the broad risk rally we have seen up until Tuesday this week, with a miss in payrolls likely to see risk sentiment sharply affected. While a strong NFP report would moderate some negativity, we believe it would take a particularly strong print to meaningfully (and sustainably) move near-term Fed expectations forward, given post-Brexit global uncertainty.

Positioning for delight… or disappointment in FX - sell CAD

Positioning suggests disappointment from a weak NFP would be negative for CAD/JPY and NZD/JPY, while a strong number could support USD/CAD and USD/CHF.

On balance, being short CAD going into the NFP has the best risk-reward potential, in our view".

-

08:15

Balance of payments - Japan

Balance of payments of Japan without regard to seasonal fluctuations amounted to ¥ 1 809.1 billion in May, higher than analysts' expectations of ¥ 1 750.0 billion. In April, the balance surplus amounted to ¥ 878.5 billion.

The balance of the current account - a figure published by the Ministry of Finance and reflect the balance of the current export and import of goods and services, with the addition of net investment income and current transfers. The current account surplus indicates that the flow of capital into Japan exceeds its outflow. The high value of the index is a positive factor for the Japanese currency.

The balance of foreign trade, published by the Customs Department of Japan, in May amounted to ¥ 39.9 billion lower than the previous value of ¥ 697.1 Bln. This indicator measures the balance between imports and exports. A positive value represents a trade surplus while a negative - trade deficit. Due to the high dependence on exports of Japan, the country's economy is highly dependent on the trade surplus. Confident demand for Japanese exports leads to a positive growth of the trade balance.

Also today, the Bank of Japan released a report on bank lending, which estimates the amount of all outstanding loans in the banking sector. As it became on an annualized basis in June bank lending increased by 2.0%, after rising 2.2% in May.

-

08:09

German trade balance lower than forecasts

Germany exported goods to the value of 97.2 billion euros and imported goods to the value of 76.2 billion euros in May 2016. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 1.6% and imports decreased by 0.1% in May 2016 year on year. After calendar and seasonal adjustment, exports fell by 1.8% and imports rose by 0.1% compared with April 2016.

The foreign trade balance showed a surplus of 21.0 billion euros in May 2016. In May 2015, the surplus amounted to +19.4 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 22.2 billion euros in May 2016.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 17.5 billion euros in May 2016, which takes into account the balances of trade in goods including supplementary trade items (+23.3 billion euros), services (-1.8 billion euros), primary income (-3.4 billion euros) and secondary income (-0.6 billion euros). In May 2015, the German current account showed a surplus of 11.7 billion euros.

-

08:05

Germany: Current Account , May 17.5

-

08:01

Germany: Trade Balance (non s.a.), bln, May 21

-

08:00

Swiss unemployment rate fell 0.2% in June

Registered unemployment in June 2016 - According to surveys conducted by the State Secretariat for Economic Affairs (SECO) in late June 2016 were enrolled 139'127 unemployed at the regional employment centers, 5'651 less than in the previous month. The unemployment rate fell from 3.2% in May 2016, 3.1% in the reporting month. Compared to the previous month, unemployment increased by 5'871 persons (+ 4.4%).

-

07:46

Switzerland: Unemployment Rate (non s.a.), June 3.3% (forecast 3.3%)

-

07:02

Japan: Eco Watchers Survey: Current , June 41.2 (forecast 42.9)

-

07:02

Japan: Eco Watchers Survey: Outlook, June 41.5

-

03:33

Japan: Labor Cash Earnings, YoY, May -0.2%

-

01:52

Japan: Current Account, bln, May 189.1 (forecast 1750)

-

00:35

Currencies. Daily history for Jul 07’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1061 -0,29%

GBP/USD $1,2914 -0,08%

USD/CHF Chf0,979 +0,39%

USD/JPY Y100,76 -0,62%

EUR/JPY Y111,45 -0,92%

GBP/JPY Y130,11 -0,69%

AUD/USD $0,7480 -0,44%

NZD/USD $0,7218 +1,30%

USD/CAD C$1,3 +0,27%

-