Noticias del mercado

-

22:05

U.S. stocks climbed

U.S. stocks climbed, pushing the benchmark S&P 500 Index to an all-time high, extending a rally from Friday when a better-than-forecast jobs report brightened the economic outlook without fueling expectations that the Federal Reserve will raise interest rates sooner.

The June payrolls data calmed concern brought about by the previous month's report that showed hiring had slowed to the weakest pace since 2010. The latest figures may convince investors that the economy will continue to expand in the face of weaker profits and Britain's vote to leave the European Union. Further reassuring investors, the Bank of England and the European Central Bank have said they'll act to arrest any fallout of Brexit, and a victory for the ruling party in Japan cleared the way for stimulus.

The S&P 500 advanced 1.5 percent on Friday, rising more than 1 percent for the fourth time in two weeks. The gains restored $1.4 trillion of market value that was erased after the U.K. voted to leave the EU on June 23. Before the payrolls figures, a report Wednesday showed service providers expanded in June at the fastest pace in seven months and Fed minutes indicated less urgency in the need to raise interest rates.

Traders price in little chance of an increase in borrowing costs this month and see less than even odds of a hike until at least the end of 2017. Probabilities for a move were as much as 55 percent at the beginning of June.

Even as the latest bout of global anxiety eased, the CBOE Volatility Index edged higher by 1.8 percent to 13.44. The measure of market turbulence known as the VIX sank 11 percent on Friday, capping the first back-to-back weekly declines since April.

Investors will also turn their attention to earnings with Alcoa Inc.'s report after the markets close on Monday. Analysts predict profit for S&P 500 companies will drop 5.7 percent, which would make it the fifth straight quarterly decline, the longest streak since 2009.

-

21:03

DJIA 18251.87 105.13 0.58%, NASDAQ 4995.60 38.85 0.78%, S&P 500 2140.31 10.41 0.49%

-

18:56

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday, spurred by increased investor confidence in the U.S. economy following a stellar jobs report last week. Utilities and telecom service stocks, considered defensive investments, were lower. Much of how the indexes perform over the next few weeks will depend of the quality of second-quarter corporate earnings, which kick off with Alcoa (AA) reporting results after markets close on Monday.

Most of Dow stocks in positive area (28 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -0,29%). Top gainer - The Boeing Company (BA, +1,68%).

Most of all S&P sectors in positive area. Top looser - Conglomerates (-0,2%). Top gainer - Financial (+0,9%).

At the moment:

Dow 18193.00 +155.00 +0.86%

S&P 500 2136.00 +15.50 +0.73%

Nasdaq 100 4560.75 +43.50 +0.96%

Oil 44.92 -0.49 -1.08%

Gold 1358.90 +0.50 +0.04%

U.S. 10yr 1.42 +0.06

-

18:01

European stocks closed: FTSE 6682.86 92.22 1.40%, DAX 9833.41 203.75 2.12%, CAC 4264.53 73.85 1.76%

-

17:39

WSE: Session Results

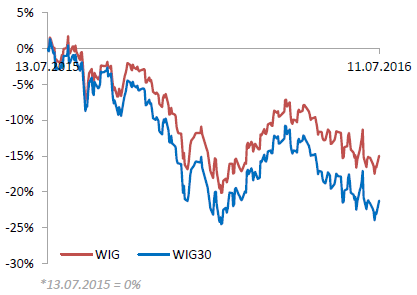

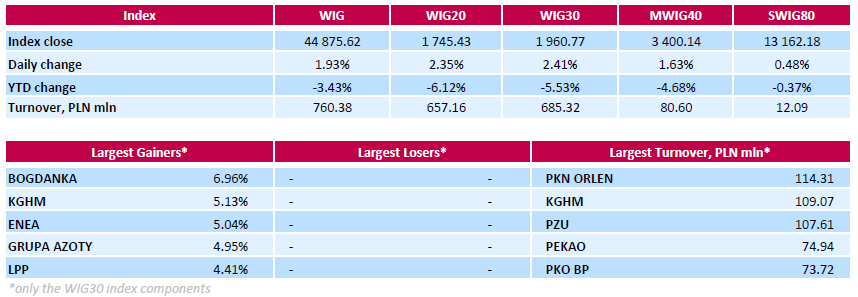

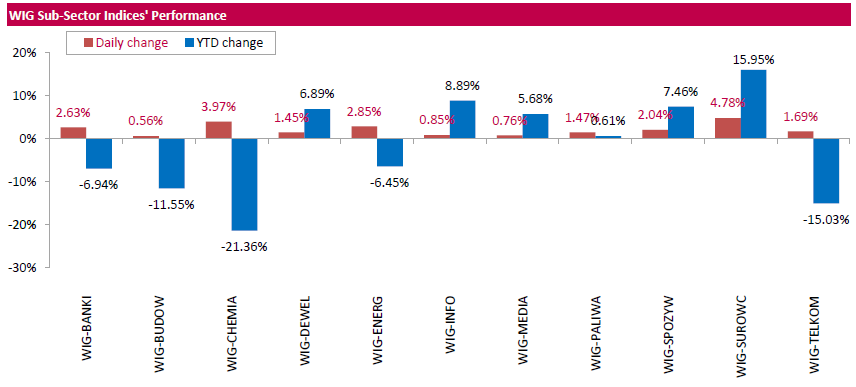

Polish equity market enjoyed a strong run on Monday amid global rally. The broad market measure, the WIG Index, surged by 1.93%. All sectors in the WIG generated positive returns, with materials (+4.78%) and chemicals (+3.97%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced by 2.41%. All index components posted gains. Thermal coal miner BOGDANKA (WSE: LWB) was the strongest performer, climbing by 6.96%. It was followed by copper producer KGHM (WSE: KGH), genco ENEA (WSE: ENA) and chemical producer GRUPA AZOTY (WSE: ATT), which rose by 5.13%, 5.04% and 4.95% respectively.

-

17:35

Nintendo earned $7.5 bln in two days after Pokemon Go was released

According to reuters the shares of Japan's Nintendo Co Ltd soared again on Monday, bringing market-value gains to $7.5 billion in just two days as investors cheered the runaway success of Pokemon GO - its first long-awaited venture in mobile gaming.

The game, which marries a classic 20-year old franchise with augmented reality, allows players to walk around real-life neighborhoods while seeking virtual Pokemon game characters on their smartphone screens - a scavenger hunt that has earned enthusiastic early reviews.

In the United States, by July 8 - two days after its release - it was installed on more than 5 percent of Android devices in the country, according to web analytics firm SimilarWeb.

It is now on more Android phones than dating app Tinder and its rate of daily active users was neck and neck with social network Twitter, the analytics firm said. The game is also being played an average of 43 minutes a day, more time spent than on WhatsApp or Instagram, it added.

-

15:50

WSE: After start on Wall Street

The market on Wall Street began trading in green, which in combination with the balance of the session on Friday, resulting in rise of the S&P500 above this year's highs. From today's morning the global sentiment is good, so this opening does not surprise anyone, and is in line with the observed trend. It is a very interesting moment, because we will see if at the new levels will appear a run out of enthusiasm to drive the market further, or perhaps end up of being since two years the lateral trend.

-

15:32

U.S. Stocks open: Dow +0.29%, Nasdaq +0.47%, S&P +0.27%

-

15:20

Before the bell: S&P futures +0.40%, NASDAQ futures +0.51%

U.S. stock-index futures climbed amid renewed optimism in the strength of the world's largest economy.

Global Stocks:

Nikkei 15,708.82 +601.84 +3.98%

Hang Seng 20,880.5 +316.33 +1.54%

Shanghai Composite 2,996.04 +7.95 +0.27%

FTSE 6,653.45 +62.81 +0.95%

CAC 4,255.45 +64.77 +1.55%

DAX 9,802.82 +173.16 +1.80%

Crude $45.24 (-0.37%)

Gold $1357.90 (-0.04%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.94

0.12(1.222%)

74497

Amazon.com Inc., NASDAQ

AMZN

750.04

4.23(0.5672%)

35087

American Express Co

AXP

61.66

0.17(0.2765%)

140

Apple Inc.

AAPL

97.17

0.49(0.5068%)

101668

AT&T Inc

T

42.53

-0.08(-0.1878%)

16062

Barrick Gold Corporation, NYSE

ABX

22.02

-0.30(-1.3441%)

49048

Boeing Co

BA

130.94

0.85(0.6534%)

1957

Caterpillar Inc

CAT

77.5

0.13(0.168%)

1025

Chevron Corp

CVX

104.9

0.13(0.1241%)

6620

Cisco Systems Inc

CSCO

29.35

0.09(0.3076%)

3390

Citigroup Inc., NYSE

C

42.3

0.32(0.7623%)

26034

E. I. du Pont de Nemours and Co

DD

64.1

0.41(0.6437%)

508

Exxon Mobil Corp

XOM

93.55

0.01(0.0107%)

1597

Facebook, Inc.

FB

117.62

0.38(0.3241%)

66340

Ford Motor Co.

F

13.17

0.08(0.6112%)

41659

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.47

0.27(2.4107%)

153534

General Electric Co

GE

32.31

0.11(0.3416%)

19885

General Motors Company, NYSE

GM

29.8

0.14(0.472%)

1904

Goldman Sachs

GS

151.38

1.00(0.665%)

4408

Google Inc.

GOOG

707.85

2.22(0.3146%)

3077

Hewlett-Packard Co.

HPQ

13.12

0.04(0.3058%)

100

Home Depot Inc

HD

134.74

0.40(0.2978%)

1979

Intel Corp

INTC

34.3

0.30(0.8824%)

25474

Johnson & Johnson

JNJ

122.95

0.10(0.0814%)

1583

JPMorgan Chase and Co

JPM

62.2

0.37(0.5984%)

10600

Merck & Co Inc

MRK

59.34

-0.01(-0.0168%)

700

Microsoft Corp

MSFT

52.49

0.19(0.3633%)

9930

Pfizer Inc

PFE

36.11

-0.01(-0.0277%)

5979

Starbucks Corporation, NASDAQ

SBUX

56.61

0.10(0.177%)

4207

Tesla Motors, Inc., NASDAQ

TSLA

219.99

3.21(1.4808%)

43417

The Coca-Cola Co

KO

45.4

0.02(0.0441%)

1518

Twitter, Inc., NYSE

TWTR

17.71

-0.37(-2.0465%)

471291

United Technologies Corp

UTX

103.84

0.18(0.1736%)

1420

Verizon Communications Inc

VZ

56

0.10(0.1789%)

2420

Visa

V

76.68

0.26(0.3402%)

3841

Wal-Mart Stores Inc

WMT

74

0.16(0.2167%)

1002

Walt Disney Co

DIS

99.96

0.34(0.3413%)

1391

Yahoo! Inc., NASDAQ

YHOO

37.43

-0.31(-0.8214%)

34251

Yandex N.V., NASDAQ

YNDX

22.2

0.12(0.5435%)

3000

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:Twitter (TWTR) downgraded to Neutral from Buy at Monness Crespi & Hardt

Twitter (TWTR) downgraded to Neutral from Buy at SunTrust

Yahoo! (YHOO) downgraded to Neutral from Buy at SunTrust

Other:Intel (INTC) target raised to $36 from $32 at Cowen

Apple (AAPL) reiterated with a Buy at Mizuho; target $120

Amazon (AMZN) target raised to $853 from $811 at Axiom Capital

-

13:16

WSE: Mid session comment

The morning optimism continues. It seems that the expectations on the possibility of entering of the parquet in New York into a new trend increased, which support sentiment.

In the first hour of trading we were able to shut a downward gap from the last week, but the WIG20 index slightly fell from highs set in the vicinity of 1,740 points. Thus the WIG20 is only cosmetically above the resistance line. The turnover, however, is substantial and exceeded PLN 300 mln in the segment of blue chips. Participation in the growth is quite wide, but the biggest positive contribution have energy companies and KGHM. The market at that moment looks properly and does not present such a weakness like on Friday.

-

12:53

Major stock indexes in Europe on the rise

European stocks rise moderately aided by increasing optimism about global growth prospects, as well as reports about the imminent launch of additional stimulus measures in Japan.

Today, Japanese Prime Minister Shinzo Abe said the government is preparing to take measures to stimulate the economy. Abe said that on July 12, he intends to instruct the Minister to prepare a comprehensive economic revival of measures to remedy the situation. The need for measures to stimulate the Japanese economy has been discussed for a long time, but all were waiting for the results of upper house elections, which took place this Sunday. Shinzo Abe was leading the ruling coalition who received two thirds of the seats, and the same number they already have in the lower house.

The composite index of the largest companies in the region Stoxx Europe 600 increased 0.7%.

Shares of mining companies led the growth among the 19 industry groups, aided by the increase in Glencore Plc quotes and ArcelorMittal up 4.5% and 5.8% respectively.

Shares of LafargeHolcim Ltd increased by 2.5% after agreeing the sale of Indian business for the production of building materials Nirma Ltd. for about $ 1.4 billion.

Airbus Group SE has risen 3% after people familiar with the matter said that the company is ready to win an order for 100 aircraft from AirAsia Bhd.

Cerillion Plc shares jumped 7.4%. The software provider announced the signing of a contract in amount of 2.1 million pounds.

At the moment:

FTSE 6,627.36 +36.72 + 0.56%

CAC 4,220.43 +29.75 + 0.71%

DAX 9,736.58 +106.92 + 1.11%

-

11:33

Earnings Season in U.S.: Major Reports of the Week

July 11

After the Close:

Alcoa (AA). Consensus EPS $0.10, Consensus Revenue $5224.35 mln

July 14

Before the Open:

JPMorgan Chase (JPM). Consensus EPS $1.43, Consensus Revenue $23763.30 mln

July 15

Before the Open:

Citigroup (C). Consensus EPS $1.11, Consensus Revenue $17558.56 mln

Wells Fargo (WFC). Consensus EPS $1.01, Consensus Revenue $22164.68 mln

-

09:48

Major stock markets up in early trading: FTSE 100 6,635.32 +44.68 +0.68%, CAC 40 4,238.61 +47.93 +1.14%, Xetra DAX 9,766.91 +137.25 +1.43%

-

09:14

WSE: After opening

WIG20 index opened at 1719.81 points (+0.84%)*

WIG 44490.94 1.06%

WIG30 1941.66 1.41%

mWIG40 3359.92 0.43%

*/ - Change to Previous Close

The cash market started from the rise of 0.84% to 1,719 points. The first bars are growth and, consequently, the index attacks the last week gap, which is the closest resistance. What was failed to make on Friday, were forced to have today, but so strong beginning of the session raise concerns about the possibility of further development.

-

08:53

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0,8%, FTSE 100 + 0,4%, CAC 40 + 0.7%

-

08:20

WSE: Before opening

As the result of Friday's report from the US labor market the S&P500 index went to new highs this year gaining 1.5%. In addition, we are virtually at historical highs and another upward session will be regarded as striking signal over several months tiring lateral trend.

This morning, the mood remains good, which indicates the booster of contract on the S&P500 index by 0.4%, and Asian stock markets rise where the Japanese Nikkei rising as much as 4.0% after the party of Prime Minister Abe clearly won the elections to the upper house of parliament. From the point of view of the Warsaw Stock Exchange is more important, however, information about the increase in copper prices, despite the fact that oil remains significantly weaker after a Thursday's clear decline.

Warsaw Stock Exchange on Friday showed the weak side, especially in the case of blue chips, which ultimately did not respond to the global optimism. It does not look particularly optimistic for the near future, and the only justification of the whole situation may be that also Hungarian and Turkish exchanges behaved worse, which may mean that our region was not preferred.

-

07:06

Global Stocks

European stocks swung higher Friday with added lift from an upbeat U.S. jobs report that helped financial shares advance after their tough week.

In Frankfurt, the DAX 30 DAX, +2.24% pushed up 2.2% to 9,629.66 and France's CAC 40 PX1, +1.77% rose 1.8% to 4,190.68.

U.S. stocks soared on Friday, sending the S&P 500 above its all-time closing high set on May 21, 2015. The gains on Wall Street were fueled by a surprisingly strong jobs report, showing 287,000 jobs created in June. The S&P 500 SPX, +1.53% was up 32 points, or 1.6% at 2,131. The Dow Jones Industrial Average DJIA, +1.40% jumped 267 points, or 1.5%, to 18,163. The Nasdaq Composite COMP, +1.64% advanced 81 points, or 1.7% to 4.957.

Asian share markets enjoyed a relief rally on Monday as upbeat U.S. jobs data lessened immediate concerns about the health of the world's largest economy, while the long-run fallout from Brexit kept sovereign yields near record lows.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS jumped 1.9 percent to a one-month top. Australia added 1.8 percent and Shanghai .SSEC 1 percent.

Japan's Nikkei .N225 climbed 3.5 percent, its biggest daily gain in three months, following a clear win by the government in upper house elections.

Prime Minister Shinzo Abe's ruling coalition won a landslide victory giving it the power to potentially revise the nation's post-war pacifist constitution for the first time.

"Abe's victory boosted confidence in investor sentiment, and winning a two-thirds majority sends foreign investors a message that Abe's policies will see a progress," said Hikaru Sato, a senior technical analyst at Daiwa Securities.

-

04:06

Nikkei 225 15,625.34 +518.36 +3.43 %, Hang Seng 20,900.44 +336.27 +1.64 %, Shanghai Composite 2,992.68 +4.59 +0.15 %

-

00:32

Stocks. Daily history for Jun Jul 08’2016:

(index / closing price / change items /% change)

Nikkei 225 15,106.98 -169.26 -1.11 %

Hang Seng 20,564.17 -142.75 -0.69 %

S&P/ASX 200 5,230.54 +2.62 +0.05 %

Shanghai Composite 2,989.25 -27.60 -0.91 %

FTSE 100 6,590.64 +56.85 +0.87 %

CAC 40 4,190.68 +72.83 +1.77 %

Xetra DAX 9,629.66 +210.88 +2.24 %

S&P 500 2,129.9 +32.00 +1.53 %

NASDAQ Composite 4,956.76 +79.95 +1.64 %

Dow Jones 18,146.74 +250.86 +1.40 %

-