Noticias del mercado

-

17:47

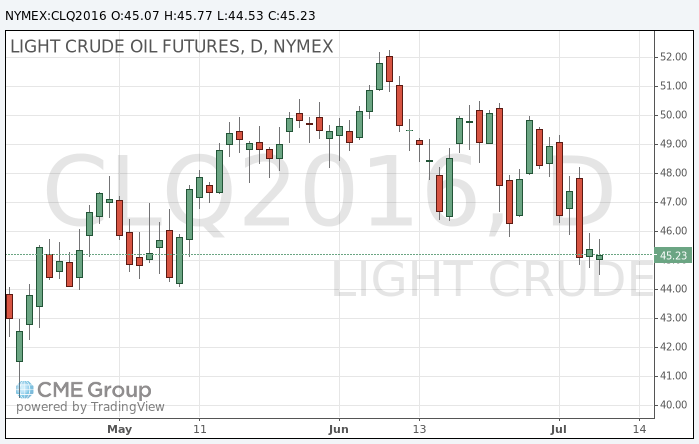

Oil little changed for the day

Earlier in the day, prices declined because market participants were worried about oversupply, which may worsen due to the end of oil supply disruptions from various regions of the world.

Last week the price of Brent crude oil lost 7.1%. Many observers believe that the elimination of supply disruptions is in the center of market attention.

As Bjarne Shildrop main raw analyst at SEB bank noticed, fast restoration of production in Canada and Nigeria after the interruption, as well as the prospects for the resumption of oil exports from Libya this week reinforce the bearish sentiment in the markets.

Although production in Nigeria is still low and the growth of production in Libya is something for the future, traders are showing caution, adds Shildrop.

On the demand side, Morgan Stanley pay attention to excess refinery production in the various regions of the world. If the market will form an excess supply of oil products, oil consumption this week can be reduced, which "will help restore balance in the oil market and oil prices."

Another factor influencing the price for this week may a increase in the number of drilling rigs in the United States. On Friday, Baker Hughes reported that the number of operating oil rigs in US last week increased by 10 units to 351 units.

The number of oil rigs in the United States is usually one of the indicators of activity in the oil industry. In October 2014 the number of drilling units peaked at 1609, but then it fell due to lower oil prices.

"Any data that the US oil producers are increasing production scare investors because global demand growth prospects are still unclear," - said Gao Jian of SCI International.

According to Gao, profit-taking in the oil market after Friday's rise in prices suggests that many investors are still not confident in the medium-term prospects for oil.

The cost of the August futures for US light crude oil WTI rose to 45.77 dollars per barrel.

September futures price for Brent crude rose to 47.10 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:31

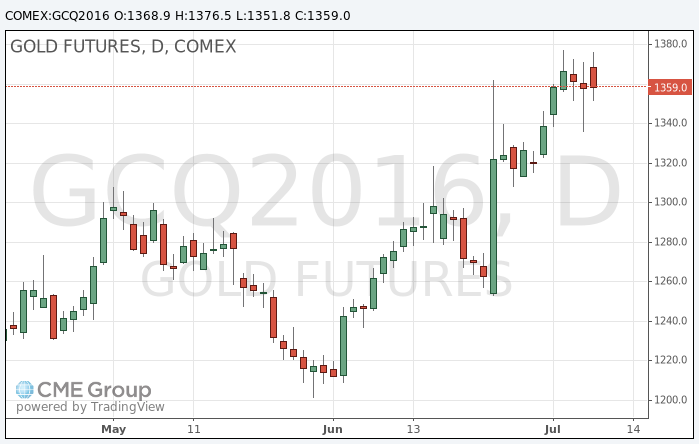

Gold price decrease today

Gold has fallen in price during today's trading as strong data on the US labor market and the prospects for monetary stimulus gain from some central banks have breathed life into the stock markets and the dollar rose against a basket of currencies.

But lingering concerns about the impact of Brexit supported gold, and its price is still far from the two-year high reached last week.

"Precious metal loses some luster as investors are more focused on the stock market, given the high chances of easing monetary policy of central banks," - said principal analyst Think Markets Naeem Aslam. "The strength of the dollar has also played a role. "

Stocks rose on Monday in Europe and Asia after the data on the number of jobs in the US, while the yen has fallen by more than 1 percent against the dollar after Japan's ruling coalition won the elections and promised a new stimulus package.

The dollar rose after strong data on US labor market on Friday, as the chances of an increase in the Fed's interest rate increased until the end of the year.

The probability of Fed raising rates in December is currently estimated at 24 percent, according to CME FedWatch, although the majority of market participants still believe that they will remain unchanged.

CFTC showed on Friday that hedge funds and money managers held a record net long positions in gold and silver contracts on COMEX.

Global mining companies have increased net hedging to 50 tons in the first quarter of 2016.

The cost of the August gold futures on the COMEX fell to $ 1351.8 per ounce.

-

00:33

Commodities. Daily history for Jul 08’2016:

(raw materials / closing price /% change)

Oil 45.12 -0.64%

Gold 1,367.40 +0.66%

-