Noticias del mercado

-

17:45

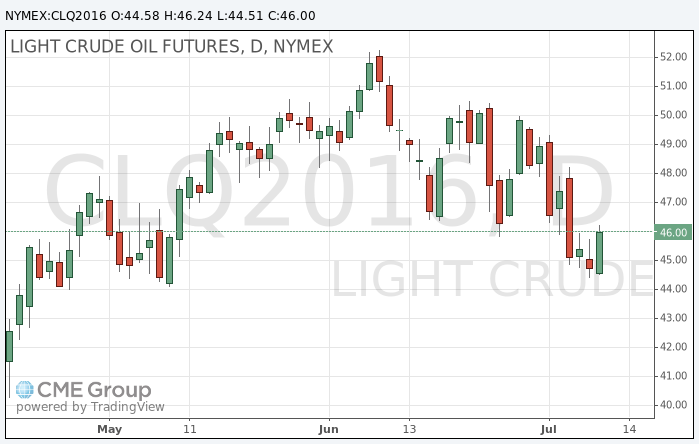

Oil quotes increased today

In today's trading, oil quotes demonstrate significant growth amid falling dollar and news of supply disruptions from the Middle East and Africa.

The US dollar is getting cheaper against almost all major world currencies on the news that the future British Prime Minister Theresa May will assume his duties on Wednesday. Earlier, there were fears that the struggle for leadership of the Conservative Party may be delayed.

Earlier, the British-Dutch company Royal Dutch Shell has confirmed the closure of the pipeline Trans Niger Pipeline (TNP), one of the most important in Nigeria following a leak. TNP, the capacity of which is about 180 thousand barrels per day, delivers crude oil to the Bonny Light export terminal and the local refinery.

Also reported disruptions to shipping in Iraqi oil port of Basra due to leakage from the pipeline.

In addition, market participants are waiting for the weekly data about the level of US oil reserves. It is expected that the official data of the Ministry of Energy, which will be published on Wednesday, show the reduction of stocks more than 3 million barrels.

OPEC expects that the excess supply of oil will leave the market in the next year due to the reduction of production outside the cartel.

Oil production outside OPEC in 2017 may decrease by 100 thousand b / d -. to 55.9 million b / d. Oil production growth is expected in Brazil and Canada, while Mexico, the US and Norway can demonstrate a decline in production.

Demand for oil next year could rise by 1.1 million b/d - up to 33 million b/d.

Oil production in Saudi Arabia increased in June by 280 thousand b/d -. to 10.55 million b/d, which is close to the record level recorded a year ago.

The cost of the August futures for US light crude oil WTI rose to 46.24 dollars per barrel.

September futures price for Brent crude rose to 47.97 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:27

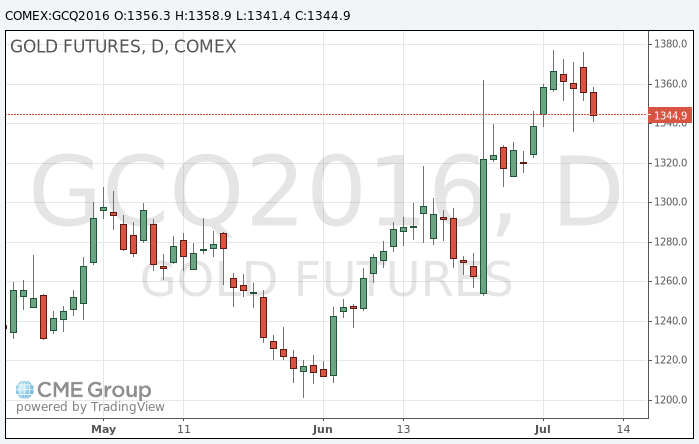

Gold price continue to decline

The price of gold fell during today's trading. The tendency of traders to take risks has increased, and investors took profits after the gold's price increase.

Gold prices rose strongly since the end of last month after British citizens decided to leave the EU. The market volatility that followed this decision, soon stopped, and investors in the gold market took profits in anticipation of other important economic data, said Ira Epstein of the Linn Group.

The positive employment report in the US, which was released on Friday, has also helped to reduce concerns about the US economy. On Tuesday, US stocks continued to rise after reaching highs Monday.

"Investors are suddenly switched their attention to the stock market and started to sell some other assets, including gold," - said Epstein.

Strong data from the US labor market forced some investors to believe that the US Federal Reserve this year could raise interest rates. Higher interest rates usually put pressure on gold, which become less attractive compared to other assets that generate income.

Many analysts remain optimistic about forecasts for gold on the background of negative interest rates around the world. However, the price of gold may be reduced because of the greater risk appetite.

"We should not be surprised to profit taking on gold as investors in other markets will be more inclined to take risks," - said William Adams of Fastmarkets.

The cost of the August gold futures on the COMEX fell to $ 1341.4 per ounce.

-

15:35

The Saudi Energy Minister: I hope that the slow growth of the world economy will not reduce the demand for oil

Saudi Arabia hopes that the global economic slowdown will not cause the fall of the current steady demand for oil. This was announced by Energy Minister Khalid al-Falih in an interview with a German newspaper, adding that oil prices near $ 50 is too low.

"Ultimately, market fundamentals, or supply and demand, are the main factor determining the price of oil, and at the moment we see a healthy demand for oil, - the Minister said -. However, there are economic headwinds in some important markets and we hope that it will not cause a slowdown in global demand. " Khalid al-Falih said that oil prices should be somewhere between $ 50 and $ 100 per barrel so the industry continue to increase investment.

"We're seeing supply reduction by about a million barrels of crude oil per day, - he said, referring to the situation in the US and Canada -. At the same time, demand has recovered, which means that supply and demand are now again more balanced, but it is even surplus stock in the market. It will take a long time to reduce these stocks. "

-

00:33

Commodities. Daily history for Jul 11’2016:

(raw materials / closing price /% change)

Oil 44.55 -0.47%

Gold 1,356.10 -0.04%

-