Noticias del mercado

-

23:59

Schedule for today, Wednesday, Jul 13’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence July -1.0%

02:00 China Trade Balance, bln June 49.98 46.64

04:30 Japan Industrial Production (MoM) (Finally) May 0.5% -2.3%

04:30 Japan Industrial Production (YoY) (Finally) May -3.3% -0.1%

09:00 Eurozone Industrial production, (MoM) May 1.1% -0.8%

09:00 Eurozone Industrial Production (YoY) May 2% 1.4%

12:30 U.S. Import Price Index June 1.4% 0.5%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories July -2.223

15:15 Canada BOC Press Conference

18:00 U.S. Federal budget June -53

18:00 U.S. Fed's Beige Book

22:30 New Zealand Business NZ PMI June 57.1

-

22:08

U.S. stocks closed

The Dow Jones Industrial Average joined the S&P 500 Index at a fresh record close, with U.S. equities climbing a third day as crude rallied and Alcoa Inc.'s results bolstered optimism on corporate health amid the start of the earnings season.

Alcoa jumped to a two-month high after the aluminum producer posted a profit that beat analysts' estimates, kicking off the quarterly reporting period. BlackRock Inc., JPMorgan Chase & Co. and Citigroup Inc. are among firms releasing results this week.

Commodity producers and and transportation stocks posted some of the biggest gains today, with American Airlines Inc. rallying 11 percent for its best day since at least December 2013. Oil and gas companies climbed to the highest since November as crude had its biggest gain in three months. Miner Freeport-McMoRan Inc. increased 11 percent.

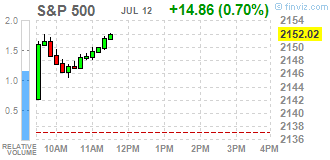

The S&P 500 added 0.7 percent to 2,152.06 at 4 p.m. in New York, extending its all-time high after surpassing yesterday the previous record reached in May 2015 on bets of a brighter economic outlook after Friday's jobs report.

Stocks have climbed since Friday, erasing the losses triggered by the U.K.'s vote to leave the European Union, as a stronger-than-forecast payrolls report helped allay investor concerns. At the same time, traders are pricing in little chance of an interest-rate hike from the Federal Reserve anytime soon, with September 2017 being the first month that has even odds of a raise, implying a so-called "Goldilocks" scenario for equities in which the economy expands but at a lukewarm pace to hold off further monetary tightening.

Meanwhile, investors have also sought the safety of Treasuries in the aftermath of the Brexit vote, sending bond yields to record lows last week. Fresh peaks for stocks coupled with all-time lows for bonds is unusual given that they are generally seen as risk-on/risk-off complements. Demand for U.S. bonds has also ramped up amid sub-zero yields in Europe and Japan.

-

21:00

DJIA 18350.79 123.86 0.68%, NASDAQ 5025.90 37.26 0.75%, S&P 500 2153.52 16.36 0.77%

-

18:00

European stocks closed: FTSE 6680.69 -2.17 -0.03%, DAX 9964.07 130.66 1.33%, CAC 4331.38 66.85 1.57%

-

17:45

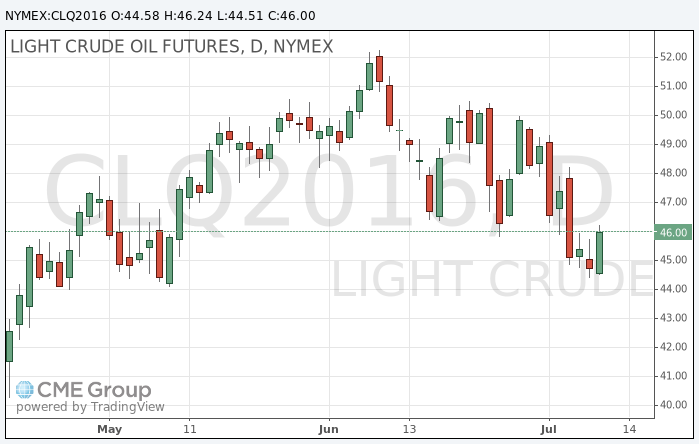

Oil quotes increased today

In today's trading, oil quotes demonstrate significant growth amid falling dollar and news of supply disruptions from the Middle East and Africa.

The US dollar is getting cheaper against almost all major world currencies on the news that the future British Prime Minister Theresa May will assume his duties on Wednesday. Earlier, there were fears that the struggle for leadership of the Conservative Party may be delayed.

Earlier, the British-Dutch company Royal Dutch Shell has confirmed the closure of the pipeline Trans Niger Pipeline (TNP), one of the most important in Nigeria following a leak. TNP, the capacity of which is about 180 thousand barrels per day, delivers crude oil to the Bonny Light export terminal and the local refinery.

Also reported disruptions to shipping in Iraqi oil port of Basra due to leakage from the pipeline.

In addition, market participants are waiting for the weekly data about the level of US oil reserves. It is expected that the official data of the Ministry of Energy, which will be published on Wednesday, show the reduction of stocks more than 3 million barrels.

OPEC expects that the excess supply of oil will leave the market in the next year due to the reduction of production outside the cartel.

Oil production outside OPEC in 2017 may decrease by 100 thousand b / d -. to 55.9 million b / d. Oil production growth is expected in Brazil and Canada, while Mexico, the US and Norway can demonstrate a decline in production.

Demand for oil next year could rise by 1.1 million b/d - up to 33 million b/d.

Oil production in Saudi Arabia increased in June by 280 thousand b/d -. to 10.55 million b/d, which is close to the record level recorded a year ago.

The cost of the August futures for US light crude oil WTI rose to 46.24 dollars per barrel.

September futures price for Brent crude rose to 47.97 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:38

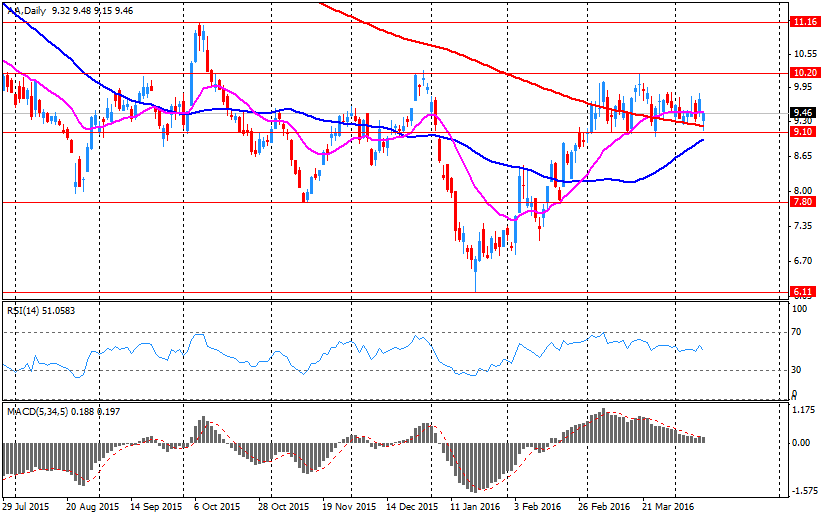

WSE: Session Results

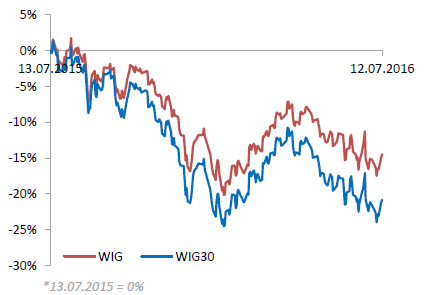

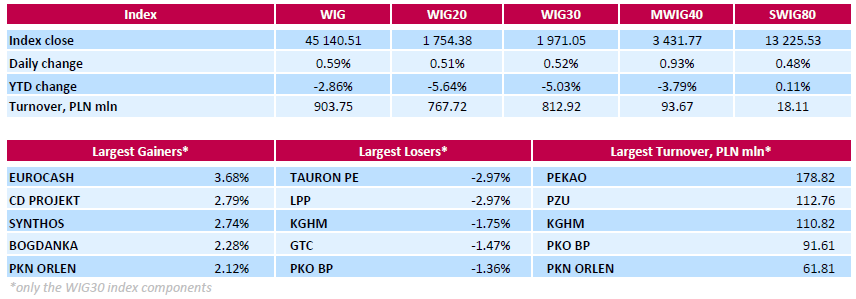

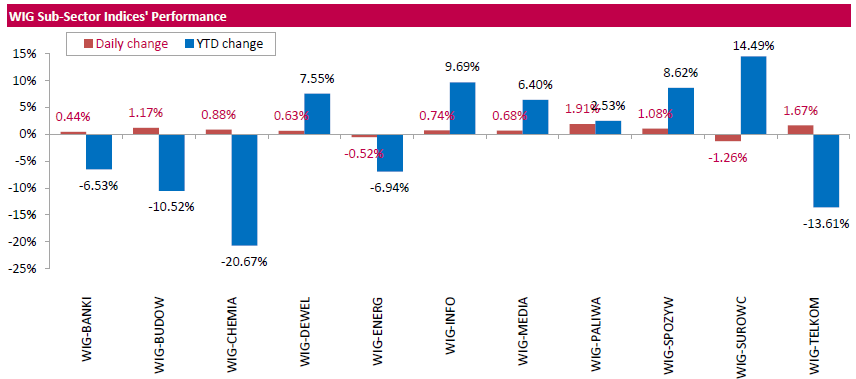

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.59%. Except for materials (-1.26%) and utilities (-0.52%), every sector in the WIG Index advanced, with oil and gas (+1.91%) outperforming.

Large-cap stocks measure, the WIG30 Index, recorded a 0.52% surge. In the index basket, FMCG-wholesaler EUROCASH (WSE: EUR) was the biggest gainer with a 3.68% advance, followed by videogame developer CD PROJEKT (WSE: CDR), chemical producer SYNTHOS (WSE: SNS) and thermal coal miner BOGDANKA (WSE: LWB), which added 2.79%, 2.74% and 2.28% respectively. On the other side of the ledger, genco TAURON PE (WSE: TPE) and clothing retailer LPP (WSE: LPP) were the sharpest decliners, each tumbling by 2.97%. Other biggest laggards were copper producer KGHM (WSE: KGH), property developer GTC (WSE: GTC), bank PKO BP (WSE: PKO) and chemical producer GRUPA AZOTY (WSE: ATT), losing between 1.35% and 1.75%.

-

17:36

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday, the S&P 500 and the Dow hit record intraday highs, while the Nasdaq wiped out its losses for the year, buoyed by increasing prospects of global economic health and with Alcoa getting the U.S. earnings season off to a promising start. Alcoa (AA) reported a smaller-than-expected drop in quarterly profit, sending the aluminum producer's shares up 5% and helping boost optimism about the earnings season.

Most of Dow stocks in positive area (19 of 30). Top looser - The Boeing Company (BA, -1,15%). Top gainer - E. I. du Pont de Nemours and Company (DD, +2,98%).

Most of all S&P sectors in positive area. Top looser - Utilities (-0,6%). Top gainer - Basic Materials (+2,2%).

At the moment:

Dow 18235.00 +88.00 +0.48%

S&P 500 2143.50 +13.25 +0.62%

Nasdaq 100 4572.25 +22.75 +0.50%

Oil 46.16 +1.40 +3.13%

Gold 1341.40 -15.20 -1.12%

U.S. 10yr 1.49 +0.06

-

17:27

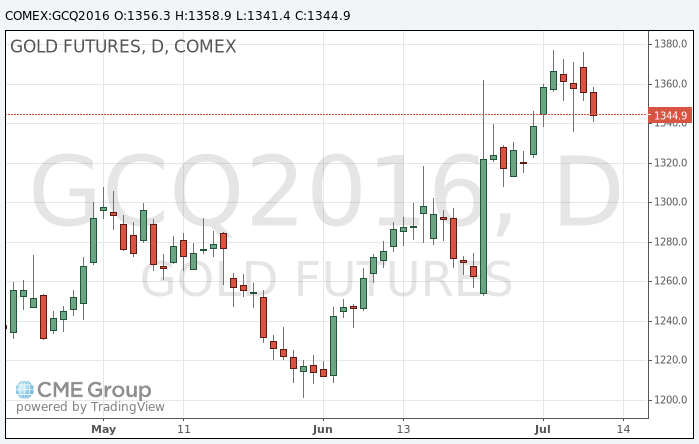

Gold price continue to decline

The price of gold fell during today's trading. The tendency of traders to take risks has increased, and investors took profits after the gold's price increase.

Gold prices rose strongly since the end of last month after British citizens decided to leave the EU. The market volatility that followed this decision, soon stopped, and investors in the gold market took profits in anticipation of other important economic data, said Ira Epstein of the Linn Group.

The positive employment report in the US, which was released on Friday, has also helped to reduce concerns about the US economy. On Tuesday, US stocks continued to rise after reaching highs Monday.

"Investors are suddenly switched their attention to the stock market and started to sell some other assets, including gold," - said Epstein.

Strong data from the US labor market forced some investors to believe that the US Federal Reserve this year could raise interest rates. Higher interest rates usually put pressure on gold, which become less attractive compared to other assets that generate income.

Many analysts remain optimistic about forecasts for gold on the background of negative interest rates around the world. However, the price of gold may be reduced because of the greater risk appetite.

"We should not be surprised to profit taking on gold as investors in other markets will be more inclined to take risks," - said William Adams of Fastmarkets.

The cost of the August gold futures on the COMEX fell to $ 1341.4 per ounce.

-

16:52

US inventories of wholesale trade increased slightly in May

The Commerce Department reported that wholesale inventories rose at the end of May, but slightly smaller than expected. Overall, the latest update indicates that investment in inventories probably will not support economic growth in the second quarter.

According to the report, seasonally adjusted inventories in the warehouses of wholesale trade increased by 0.1% in May, reaching $ 586.2 billion. Analysts expected an increase of 0.2%. Meanwhile, the index for April was revised up to + 0.7% from + 0.6%. Compared to May 2015 stocks increased by 0.5%.

Inventories of computers and computer peripheral equipment and software rose by 1.9% compared to the previous month, while stockpiles of motor vehicles and automotive parts decreased by 1.9%. Stocks of non-durable goods rose by 0.2% over the month and by 5.1% y/y.

Inventories are a key component of gross domestic product changes. Component of wholesale inventories, which goes into the calculation of GDP - excluding cars - increased by 0.4% in May.

Wholesale sales of $ 435.5 billion., An increase of 0.5% compared to April. However, sales fell by 2.5% in annual terms.

Also, the Ministry of Commerce said that the ratio of stocks to sales ratio was 1.35 months in May as compared to 1.36 months in April. The ratio was at 1.31 months in May 2015.

-

16:19

Fed, Bullard: only one hike is needed for the foreseeable future

-

Despite strong jobs data, the economy is stuck in a low growth, low inflation and low unemployment regime, with the path of interest rates essentially flat.

-

no reason to forecast a US recesion.

-

-

16:04

US job openings lower than forecasts

The number of job openings decreased to 5.5 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Hires and separations were both little changed at 5.0 million. Within separations, the quits rate was 2.0 percent and the layoffs and discharges rate was 1.2 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. Job Openings Job Openings decreased in May by 345,000 to 5.5 million. The prior 3-month average change in job openings was +80,000.

-

16:00

U.S.: Wholesale Inventories, May 0.1% (forecast 0.2%)

-

16:00

U.S.: JOLTs Job Openings, May 5.5 (forecast 5.7)

-

15:51

WSE: After start on Wall Street

Start of the cash market on Wall Street brought new records and the S&P500 reached the psychological level of 2,150 points. So far, the trend is clear, and the dominance of demand persists. In Warsaw, a new peak in the US do not make much of impression and the WIG20 index still can not significantly break away from the vicinity of the level of 1,750 points. Optimistic behavior show today's mid-companies and the mWIG40 index behaves similarly to European indices. Besides, for a long time medium companies better reflect the trend of global than national blue chips involved in local issues.

-

15:44

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0950 (EUR 718m) 1.1000 (941m) 1.1050 (1.2bln) 1.1075 (372m)

USDJPY 102.00 (USD 855m)

GBPUSD 1.3300 (GBP 554m)

USDCAD 1.3100 (USD 320m)

NZDUSD 0.7090 (NZD 200m) 0.7275 (200m)

-

15:35

The Saudi Energy Minister: I hope that the slow growth of the world economy will not reduce the demand for oil

Saudi Arabia hopes that the global economic slowdown will not cause the fall of the current steady demand for oil. This was announced by Energy Minister Khalid al-Falih in an interview with a German newspaper, adding that oil prices near $ 50 is too low.

"Ultimately, market fundamentals, or supply and demand, are the main factor determining the price of oil, and at the moment we see a healthy demand for oil, - the Minister said -. However, there are economic headwinds in some important markets and we hope that it will not cause a slowdown in global demand. " Khalid al-Falih said that oil prices should be somewhere between $ 50 and $ 100 per barrel so the industry continue to increase investment.

"We're seeing supply reduction by about a million barrels of crude oil per day, - he said, referring to the situation in the US and Canada -. At the same time, demand has recovered, which means that supply and demand are now again more balanced, but it is even surplus stock in the market. It will take a long time to reduce these stocks. "

-

15:32

U.S. Stocks open: Dow +0.42%, Nasdaq +0.63%, S&P +0.53%

-

15:27

Before the bell: S&P futures +0.49%, NASDAQ futures +0.58%

U.S. stock-index futures climbed as investors weighed prospects for corporate health amid the start of the earnings season.

Global Stocks:

Nikkei 16,095.65 +386.83 +2.46%

Hang Seng 21,224.74 +344.24 +1.65%

Shanghai Composite 3,049.68 +54.76 +1.83%

FTSE 6,693.11 +10.25 +0.15%

CAC 4,331.66 +67.13 +1.57%

DAX 9,975.09 +141.68 +1.44%

Crude $45.84 (+2.41%)

Gold $1348.00 (-0.63%)

-

15:04

BlackRock: Bank of England will cut interest rates to zero this week

"Britain's economy may be in recession over the next year. In addition, the GDP growth in each of the next five years will be at least 0.5 percentage points below and the main reason is the unexpected decision of the British to leave the European Union.

"Our baseline scenario assumes that the UK economy will shrink and also, we expect a significant decline in investment in the country, taking into account the strengthening of political and economic uncertainty after Brexit." - Said Richard Turnill, chief investment strategist at BlackRock.

Turnill and his colleagues expect that this week the Bank of England will cut interest rates to zero from the current record low of 0.5 percent, and in August will expand its quantitative easing program. "The market is not fully pricing in such developments, - said Scott Tief, Head of BlackRock Global bonds -. This means that the pound will fall further, though not to parity against the dollar."

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.62

0.48(4.7337%)

532918

ALTRIA GROUP INC.

MO

69.87

0.00(0.00%)

1979

Amazon.com Inc., NASDAQ

AMZN

759

5.22(0.6925%)

28821

American Express Co

AXP

62.49

0.33(0.5309%)

200

AMERICAN INTERNATIONAL GROUP

AIG

53.75

0.46(0.8632%)

600

Apple Inc.

AAPL

97.38

0.40(0.4125%)

88846

AT&T Inc

T

42.35

-0.16(-0.3764%)

6950

Barrick Gold Corporation, NYSE

ABX

21.81

-0.23(-1.0436%)

96664

Boeing Co

BA

132.5

0.46(0.3484%)

4234

Caterpillar Inc

CAT

78.6

0.80(1.0283%)

6014

Chevron Corp

CVX

106.2

0.81(0.7686%)

11870

Cisco Systems Inc

CSCO

29.72

0.29(0.9854%)

7184

Citigroup Inc., NYSE

C

42.78

0.49(1.1587%)

39362

Exxon Mobil Corp

XOM

94.57

0.68(0.7243%)

7234

Facebook, Inc.

FB

118.5

0.63(0.5345%)

114624

Ford Motor Co.

F

13.37

0.10(0.7536%)

39105

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.08

0.43(3.691%)

467215

General Electric Co

GE

32.34

0.13(0.4036%)

35239

General Motors Company, NYSE

GM

30.35

0.22(0.7302%)

18297

Goldman Sachs

GS

153.8

1.61(1.0579%)

4534

Google Inc.

GOOG

719.49

4.40(0.6153%)

2653

Hewlett-Packard Co.

HPQ

13.41

0.25(1.8997%)

11000

Home Depot Inc

HD

136.28

1.13(0.8361%)

366

Intel Corp

INTC

34.62

0.24(0.6981%)

29330

International Business Machines Co...

IBM

156.72

1.39(0.8949%)

2041

Johnson & Johnson

JNJ

122.55

-0.38(-0.3091%)

1596

JPMorgan Chase and Co

JPM

62.97

0.70(1.1241%)

20736

Microsoft Corp

MSFT

53

0.41(0.7796%)

33740

Nike

NKE

57.24

0.41(0.7215%)

375

Pfizer Inc

PFE

36.24

0.09(0.249%)

1279

Procter & Gamble Co

PG

85.59

-0.16(-0.1866%)

4422

Starbucks Corporation, NASDAQ

SBUX

56.65

0.33(0.5859%)

3949

Tesla Motors, Inc., NASDAQ

TSLA

224.61

-0.17(-0.0756%)

31196

The Coca-Cola Co

KO

45.67

0.10(0.2194%)

24582

Twitter, Inc., NYSE

TWTR

17.98

0.27(1.5246%)

94512

United Technologies Corp

UTX

104

0.04(0.0385%)

1300

Verizon Communications Inc

VZ

55.65

-0.28(-0.5006%)

5902

Visa

V

77.25

0.73(0.954%)

2122

Wal-Mart Stores Inc

WMT

73.66

-0.40(-0.5401%)

6374

Walt Disney Co

DIS

100.4

0.42(0.4201%)

2044

Yahoo! Inc., NASDAQ

YHOO

38.19

0.23(0.6059%)

13163

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:Alcoa (AA) reiterated with a Market Perform at Cowen; target $10

Alcoa (AA) target raised to $13 from $12 at Stifel

-

14:28

European session review: Yen fell on expectations of new economic stimulus

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Consumer Price Index m / m (final data) June 0.3% 0.1% 0.1%

6:00 Germany CPI, y / y (final data) June 0.1% 0.3% 0.3%

9:30 UK Speech of the Bank of England Governor Mark Carney

The yen fell significantly against the dollar, updating the minimum of July, and the first time since June 24 approaching to the level of Y104.00. The reason for such dynamics is an indication about further stimulus in the Japanese economy. Yesterday, Prime Minister of Japan Shinzo Abe reiterated that his office will begin drawing up stimulus plan, with no specific data been specified.

It also became known that the Japanese government plans to lower the forecast for GDP growth in the fiscal year ending March 2017 to 0.9% from 1.7%. The new forecast will be published on Wednesday. Abe Administration is likely to present a forecast assuming GDP growth next year at 1.2%.

The pound has appreciated by more than 200 pips against the dollar, approaching to a maximum of 5 July, helped by confirmation that the next prime minister of Britain will be Theresa May. Earlier policies gained the support of more than half of the total number of representatives of the Conservative Party in the Parliament. Acting Prime Minister Cameron to resign on Wednesday. He stressed that the new prime minister is ready to provide full support.

Market participants are also waiting for tomorrow's meeting of the Bank of England. After the referendum, the head of the Central Bank Carney considering the possibility of easing monetary policy. It is likely that step will be taken at the upcoming meeting. It is expected that the Central Bank lowered interest rates for the first time since March 2009. Most likely, the Central Bank may consider a rate cut to 0.25%.

The dollar rose modestly against the euro before recovering most of the lost positions, and returning at the level of $ 1.1100. Experts point out, amid a lack of new catalysts that the euro is likely to follow the pound, which is the main topic of foreign exchange traders on the eve of the scheduled Bank of England meeting. Investors are also waiting for today's statements by Fed Tarullo and Bullard and US data to be released in the coming days.

Little impact on the price action had data from Germany. As it became known, the consumer price index rose 0.1% in June, in line with preliminary estimates and forecasts of experts. Recall that in May, the index increased by 0.3%. Annual inflation in Germany rose by 0.3% compared with an increase of 0.1% in May, but remained significantly below the ECB target level, which is located just below 2%. The harmonized index of consumer prices, calculated on the basis of statistical methodology, agreed between all EU countries increased by 0.1% compared to May and by 0.2% annually in June. These coincided with the preliminary estimates. Downward pressure on the inflation rate continued to be energy prices, which in June fell by 6.4% compared to June 2015. In May, energy prices fell by 7.9%. Food prices rose by 0.1% annually in June.

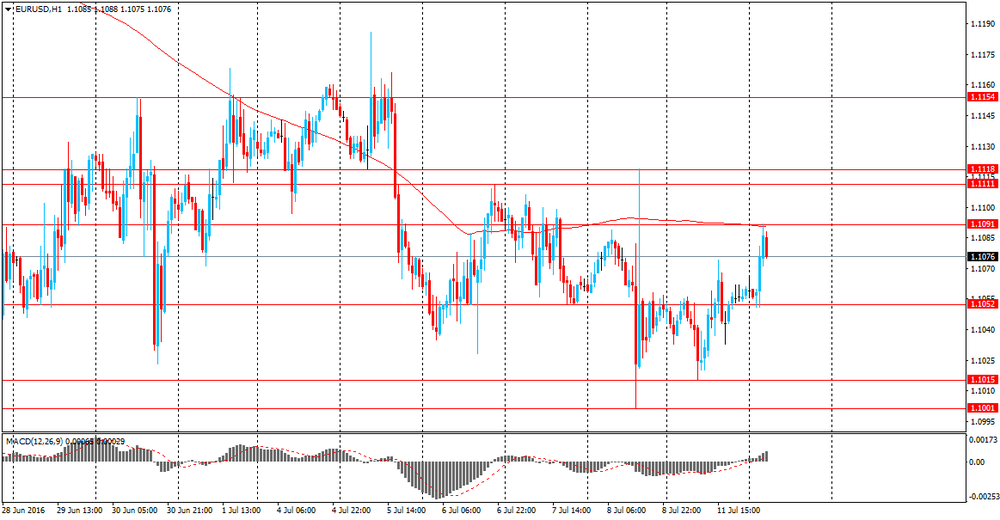

EUR / USD: during the European session, the pair has risen to $ 1.1125, but then went back to $ 1.1080.

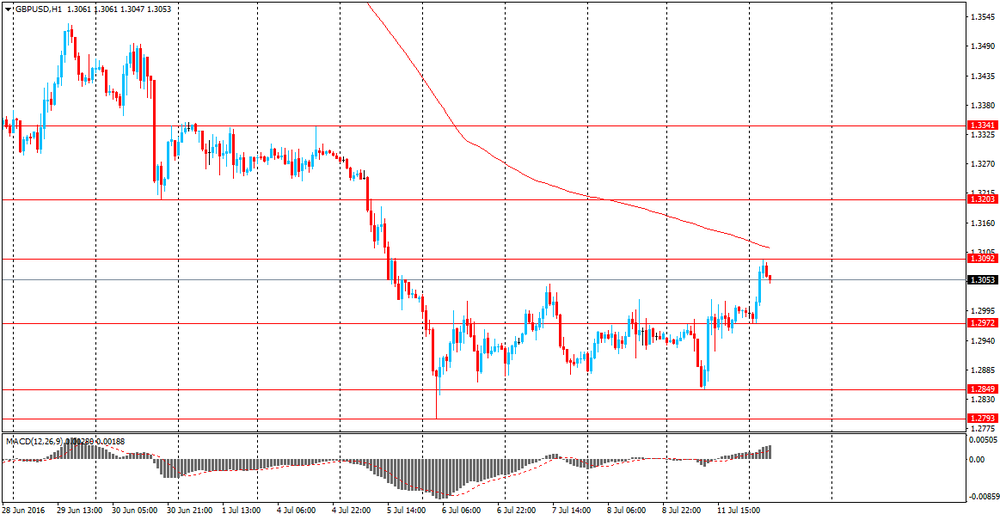

GBP / USD: during the European session, the pair rose to $ 1.3186.

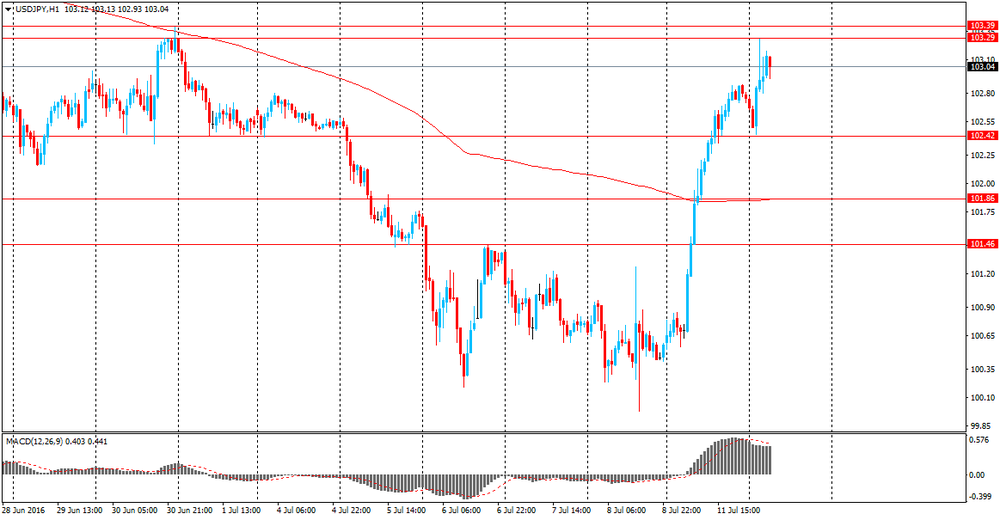

USD / JPY: during the European session, the pair rose to Y104.00.

-

14:00

Orders

EUR/USD

Offers 1.1150 1.1170 1.1185 1.1200 1.1220 1.1250

Bids 1.1100 1.1080 1.1055-60 1.1030 1.1000 1.0975-80 1.0950

GBP/USD

Offers 1.3180 1.3200-05 1.3230 1.3250 1.3275-80 1.3300

Bids 1.3100 1.3080 1.3050 1.3030-35 1.3000 1.2975 1.2950 1.2900

EUR/GBP

Offers 0.8485 0.8500 0.8520 0.8550 0.8585 0.8600

Bids 0.8450 0.8430 0.8400 0.8385 0.8350

EUR/JPY

Offers 114.60 114.80 115.00 115.25 115.50 115.75-80 116.00

Bids 114.20 114.00 113.80-85 113.50 113.00 112.80 112.50 112.00 111.85 111.50

USD/JPY

Offers 103.50-60 103.85 104.00 104.30 104.50

Bids 102.80 102.40-50 102.20 102.00 101.75 101.20 101.00

AUD/USD

Offers 0.7600 0.7650 0.7670 0.7700 0.7720 0.7750-55

Bids 0.7555-60 0.7540 0.7520 0.7500 0.7480 0.7450-55 0.7425 0.7400

-

13:45

Company News: Alcoa (AA) Q2 results beat analysts’ expectations

Alcoa reported Q2 FY 2016 earnings of $0.15 per share (versus $0.19 in Q2 FY 2015), beating analysts' consensus of $0.10.

The company's quarterly revenues amounted to $5.295 bln (-10.2% y/y), beating consensus estimate of $5.224 bln.

Alcoa also forecasted an improvement in the H2 2016 results as new platforms ramp up, and a strong 2017. The company expects FY 2016 deliveries to be flat to up 3%, followed by strong double-digit growth in 2017.

AA rose to $10.53 (+3.85%) in pre-market trading.

-

13:25

OPEC reduced forecasts for 2016 global economic growth

- global growth: 3% (3.1% previous estimate).

- Brexit is a cause of uncertainty.

- oil demand to rise by 1.15m bpd in 2017.

- 2016 world oil demand growth forecast unchanged at 1.19m bpd.

- expects demand for crude oil to average 32.98m bpd in 2017 (31.86m bpd in 2016).

- non-OPEC supply is expected to fall by 110k bpd in 2017.

- oil market conditions will help to remove excess oil stocks in 2017.

-

13:07

WSE: Mid session comment

The situation in Europe is very good and the main indices such as the DAX stick close to the maximum levels of the session (+ 1.6%) but on the Warsaw Stock Exchange we faced an unexpected deterioration. Definitely due to internal factors demand in the short time lost what was reached before the noon.

Negative attitude to the market remains in force and the latest comments on the part of foreign investors regarding Poland remain cautious, which means that demand is not aggressive.

At the halfway point of the session the WIG20 index reached the level of 1,752 points (+ 0.38%) at the turnover of approximately PLN 300 mln.

-

12:57

Major stock indices in Europe show a positive trend

European stocks rose for the fourth consecutive session, helped by easing political tensions in Britain, as well as expectations of the launch of additional measures to stimulate the economy by the Bank of England and Bank of Japan. In addition, investors' attention is focused on the US corporate reporting season.

On Monday, State Minister of Energy Andrea Leedsom withdrew his candidacy from the PM race. Thus, the only candidate for the post of British prime minister remained Theresa May. Earlier policies gained the support of more than half of the total number of representatives of the Conservative Party in the Parliament. Acting Prime Minister Cameron announced that he would resign on Wednesday, July 13th. He also stressed that the new prime minister is ready to provide full support. Overall, recent developments have provided some relief to investors, who were shocked by the decision of the british to leave the EU.

Meanwhile, market participants are waiting for the meeting of the Bank of England. After the referendum, the head of the Central Bank, Carney considering the possibility of easing monetary policy. It is likely that steps will be taken at the upcoming meeting. It is expected that the Central Bank lowered interest rates for the first time since March 2009. Most likely, the Central Bank may consider a rate cut to 0.25%.

Investors are also looking to mitigate the Bank of Japan's policy to revitalize the local economy. Yesterday, Abe reiterated that will begin drawing up stimulus plan, with no specific data been specified.

A slight impact on the course of trading also provided from Germany. As it became known, the consumer price index remained unchanged at 0.1% in June, in line with analysts' forecasts. Annual inflation in Germany rose by 0.3% compared to May, but remained significantly below the ECB target level, which is located just below 2%. The harmonized index of consumer prices, calculated on the basis of statistical methodology, agreed between all EU countries increased by 0.1% compared to May and by 0.2% annually in June. These coincided with the preliminary estimates. Downward pressure on the inflation rate continued to be energy prices, which in June fell by 6.4% compared to June 2015. In May, energy prices fell by 7.9%. Food prices rose by 0.1% annually in June.

The composite index of the largest companies in the region Stoxx Europe 600 increased by 0.9%.

All 19 industry groups of the index, with the exception of the health sector and utilities, show an increase.

Daimler capitalization rose 3.8 percent after the German automaker posted encouraging financial results and confirmed its full-year outlook, dispelled some fears about the impact of Brexit.

Shares of ASOS Plc - online retailer of clothing - rose by 3.2 percent against the backdrop of higher than expected sales in the last four months.

Shares of the Italian bank Unicredit rose nearly 7 percent after the bank accepted to increase the amount of capital measures by selling online share broker.

Quotes DNB ASA fell 7.6 percent, as the representatives of the bank said that the amount of write downs in connection with the 2016 depreciation of the assets may exceed the previous estimate

At the moment:

FTSE 6,689.6 +6.74 + 0.10%

CAC 40 4,336.51 +71.98 + 1.69%

DAX 9,992.21 +158.80 + 1.61%

-

12:38

European Commissioner Moscovici: uncertainty about Brexit reduce GDP growth

Commissioner for Economic Affairs, Pierre Moscovici said that the uncertainty associated with the withdrawal of the UK from the European Union's structure, leading to slower economic growth in the eurozone and the UK. He also warned that the longer the period of uncertainty, the higher the price to pay in the region.

"According to earlier estimates, Brexit reduce Britain's GDP growth rate with 1-2.5 percent by the year 2017 and the euro area economy is likely to lose 0.2-0.5 percent of GDP by 2017." In May, the European Commission predicted the eurozone GDP growth of 1.6 percent in 2016 and 1.8 percent for next year.

The International Monetary Fund last week lowered its forecasts for growth in the euro zone economy, citing the uncertainty created by the unexpected outcome of the British referendum. Now the lender is expected to expand by 1.6 percent this year and 1.4 percent in 2017.

-

12:21

Small business optimism increased in US

The Index of Small Business Optimism increased 0.7 points to 94.5, still well below the 40 year average of 98, but the third monthly gain in a row, although the gains are very small. Four of the 10 Index components posted a gain, three declined and three were unchanged. The outlook for business conditions six months out continued to improve, although more owners still expect conditions to be worse than expect improvement. First quarter GDP growth was revised up again, to a sluggish 1.1 percent. Second quarter growth will likely be better, in the low 2 percent range.

-

11:49

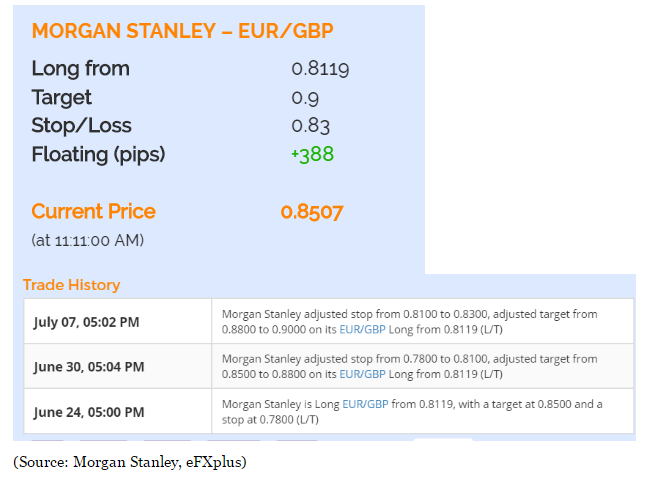

Morgan Stalney staying long Eur/Gbp for the Bank of England meeting

"Remaining long EURGBP: We expect the BoE to cut rates by 25bp on Thursday, which should keep GBP offered and risk bid.

Otherwise, markets will focus on EMU's industrial production on Wednesday and inflation data on Friday. An indication of EMU authorities providing equity support to Italian banks without triggering the bail-in mechanism should allow EUR to rebound sharply.

EURGBP near 0.8425 offers an opportunity to add to longs, looking for 0.94.

Morgan Stanley maintains a long EUR/GBP from June 24".

-

11:37

Bank of England Governor, Carney:

-

some criticism of BOE has been extraordinary in all sense of the word.

-

had a wide range of discussions with fin min Osborne understandably.

-

did not pre-determine stance taken by BOE's FPC or MPC on Brexit risks.

-

Minutes available from official discussions but none from private.

It seems that limited informations will be made public today about the Bank of England's meeting on Thursday when the rate is expected to be reduced to 0.25%.

-

-

11:10

FPC minutes: Brexit seriously increases risk outlook

-

Brexit seriously increases risk outlook

-

Reduced the UK countercyclical capital buffer rate from 0.5% to 0% of banks' UK exposures with immediate effect.

-

Welcomed the Bank of England's announcement that it will continue to offer indexed long-term repo operations on a weekly basis until end-September 2016. This is a precautionary step to provide additional flexibility in the Bank's provision of liquidity insurance, further reinforcing the ability of firms to draw on their own liquidity buffers.

-

Supported the position of the PRA to allow insurance companies to use flexibility in Solvency II regulations to recalculate transitional measures. These measures smooth the impact of those new regulations.

*via forexlive

-

-

10:53

Pound awaits Bank of England testify in a supply area. Big moves could come in just a few minutes. Push through resistance or back down to Brexit lows?

-

10:51

Oil is gaining in early trading

This morning, New York crude oil futures WTI rose by 0.45% to $ 44.96 per barrel. At the same time, crude oil futures for Brent increased by + 0.56% to $ 46.50 per barrel. Thus, the black gold increases amid interruptions in shipment of oil from the main Iraqi port of Basra, as well as the expectations of the weekly publication of data on levels in the US fuel stocks. Interruptions in Basra occurred due to leakage of oil from the pipeline. In general, the market keeps the negative mood, prices remain near two-month lows. Investors are concerned about the increase in drilling volumes in the US, the growth of exports of raw materials from Iran.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0950 (EUR 718m) 1.1000 (941m) 1.1050 (1.2bln) 1.1075 (372m)

USD/JPY 102.00 (USD 855m)

GBP/USD 1.3300 (GBP 554m)

USD/CAD 1.3100 (USD 320m)

NZD/USD 0.7090 (NZD 200m) 0.7275 (200m)

-

10:08

Prime Minister of Japan advisor, Hamada: Bernanke urged Abe to continue a policy of planned economic development

- at its meeting, Bernanke and Abe did not discuss any specific issues of monetary policy and did not talk about the upcoming meeting of the Bank of Japan.

- Abe said that Japan needs to increase budget spending.

- Bernanke noted that the the US economy is doing well.

- participants at the meeting stated that the Bank of Japan acts successfully in the implementation of monetary policy.

-

09:42

Positive start for major stock exchanges: DAX 9,848.26 + 14.85 + 0.15%, FTSE 100 6,692.38 + 9.52 + 0.14%, CAC 40 4,276.8 + 12.27 + 0.29%

-

09:25

Today’s events:

At 09:00 GMT, a special hearing of the Treasury Committee, Bank of England Governor Mark Carney will deliver a speech, and the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

At 11:00 GMT the Bank of England Quarterly Bulletin (2Q)

At 13:15 GMT FOMC Member Daniel Tarullo deliver a speech

At 13:35 GMT FOMC member James Bullard will give a speech

At 17:01 GMT the United States will hold an auction of 10-year bonds

At 21:30 GMT FOMC members Neil Kashkari will deliver a speech

-

09:15

WSE: After opening

WIG20 index opened at 1747.85 points (+0.14%)*

WIG 44985.30 0.24%

WIG30 1965.17 0.22%

mWIG40 3409.44 0.27%

*/ - change to previous close

The cash market opens with an increase of 0.14% to 1,747 points., which leads to meeting the index with the psychological level of 1,750 points and at the same time exponential average of 21 sessions. The market also returned to the range of consolidation prior information about the changes planned in the operation of pension funds (OFE). So it seems that we should have a chance to extend yesterday's bullish trading atmosphere.

-

08:43

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,2%, FTSE 100 -0,1%, CAC 40 -0.1%

-

08:38

Asian session review: yen continues to decline

During the Asian session, the yen continues to fall after yesterday's press conference were Japanese Prime Minister Shinzo Abe said the Japanese government is preparing to take measures to stimulate the economy. Abe said that today intends to instruct the Minister of economic recovery of Japan Nobuteru Ishihara to prepare comprehensive economic measures to remedy the situation.

USD / JPY, gained momentum after the news about the meeting and Bernanke Abe, who said that one The Government of Japan will lower GDP forecast. Prime Minister Shinzo Abe plans to lower GDP growth forecast for the fiscal year ending March 2017 to 0.9% from 1.7%. The new forecast will be published on Wednesday and will be adjusted for inflation. The previous forecast was published in January. Abe Administration is likely to present a forecast assuming GDP growth next year at 1.2%.

Ministry of Economy, Trade and Industry said today that the index of activity in Japan of services decreased by 0.7% in May, in line with analysts' forecasts. The previous value was revised downward from 1.4% to 0.7%. This indicator reflects the state of Japan's domestic service sector, including information and communications, electricity, gas heating and water supply, services, transport, wholesale and retail trade, finance and insurance, and social security. According to the Japanese economy on exports, this figure may account for the lower volatility of the yen. The decline also negatively impact on the Japanese currency.

The euro rose against the US dollar, following the strengthening of the pound, which was supported by evidence that Theresa May will be the next Prime Minister of Great Britain. The euro is likely to follow the pound, which is the main topic of discussion of traders before the meeting of the Bank of England, devoted to monetary policy, which will take place on Thursday. The probability of lowering interest rates by the Bank of England to a new record low and a possible political stability are the two opposing market forces for the pound and the euro.

After the referendum, the head of the Bank of England Carney said that to support the economy will probably require an easing of monetary policy during the summer. Thus, Carney signaled that the Central Bank may lower interest rates. He added that the Bank of England has a number of other tools to protect the economy and banking system, which may indicate a resumption of the bond purchase program.

After the unexpected results of the referendum, analysts expect a prolonged period of uncertainty and volatility. However, many predict a recession, increasing inflation. Most likely, the Central Bank may consider a rate cut to 0.25% an adequate measure.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1050-85 range.

GBP / USD: during the Asian session, the pair is trading in the $ 1.2970-1.3080 range

USD / JPY: during the Asian session, the pair was trading in range Y102.45-103.30.

-

08:35

Options levels on tuesday, July 12, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1291 (2234)

$1.1224 (1616)

$1.1173 (1649)

Price at time of writing this review: $1.1085

Support levels (open interest**, contracts):

$1.0989 (2926)

$1.0931 (2903)

$1.0860 (6937)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 29841 contracts, with the maximum number of contracts with strike price $1,1400 (2910);

- Overall open interest on the PUT options with the expiration date August, 5 is 45563 contracts, with the maximum number of contracts with strike price $1,0900 (6937);

- The ratio of PUT/CALL was 1.53 versus 1.43 from the previous trading day according to data from July, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.3405 (1227)

$1.3308 (416)

$1.3211 (418)

Price at time of writing this review: $1.3078

Support levels (open interest**, contracts):

$1.2982 (615)

$1.2886 (558)

$1.2789 (1396)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 17944 contracts, with the maximum number of contracts with strike price $1,3400 (1227);

- Overall open interest on the PUT options with the expiration date August, 5 is 17504 contracts, with the maximum number of contracts with strike price $1,2950 (2435);

- The ratio of PUT/CALL was 0.98 versus 0.92 from the previous trading day according to data from July, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

Loretta Mester, Fed: rate hike timing will depend on how the situation will develop in the economy

- the Fed does not take a decision on the interest rate in advance.

- financial stability is best maintained by regulation and supervision.

- often, the task of maintaining stability and objectives of monetary policy are complementary.

- macroprudential tools by and large have not yet tested completely.

- the situation on the US labor market is quite positive, because we have almost reached full employment.

- it is advisable to gradually increase rates.

-

08:22

Consumer spending in UK grew at its slowest rate since the depths of the 2008-09 recession

According to theguardian, consumer spending grew at its slowest rate since the depths of the 2008-09 recession in the three months leading to the EU referendum, but retailers have blamed bad weather for the tough trading conditions.

The monthly survey of high street and online sales from the British Retail Consortium and KPMG found that sales in the second quarter of 2016 were up 0.5% on the first quarter and 1.2% up on an annual basis. The BRC said this was the weakest performance since May 2009, when the economy was contracting during its longest and deepest postwar recessions.

In June alone, total sales were 0.2% higher than in the same month last year, but were 0.5% lower on a like-for-like basis, which takes account of increased retail capacity over the past 12 months.

David McCorquodale of KPMG said: "As consumer attention shifted indoors to escape autumnal downpours, furniture and home accessories bounced back in the month, with bigger-ticket items proving relatively resilient in the days immediately following the EU referendum.

Spending growth slows as shoppers delay big purchases

"With May sunshine a distant memory, however, summer wardrobes remained bare as sales of women's fashion and footwear plummeted following one of the wettest and dullest starts to a UK summer since records began."

-

08:19

Moody's: Brexit to have negligible credit impact on GCC sovereigns

Moody's Investors Service says that the United Kingdom's (UK, Aa1 negative) vote to leave the European Union (EU, Aaa stable) will not have a significant credit impact on GCC sovereigns because their trade exposure to the UK is limited and the size of their sovereign wealth funds offers resilience against potential fluctuations in the value of some assets.

Moody's report, entitled "Sovereigns -- Brexit and the Gulf Cooperation Council: Negligible credit impact given large investment buffers and limited trade," is available on www.moodys.com. Moody's subscribers can access this report via the link provided at the end of this press release. The rating agency's report is an update to the markets and does not constitute a rating action.

It is unlikely that a loss in value of some existing GCC investment in the UK will materially weaken GCC governments' net asset position, according to Moody's. GCC sovereign wealth fund portfolios are generally large and well diversified. This will allow it to absorb the impact of asset price and exchange rate movements associated with Brexit.

While the combination of Brexit and low oil prices could affect GCC investment inflows into the UK, Moody's notes that overall GCC government investments are generally sticky because of the sovereign wealth funds' relatively long investment horizon.

UK investment in the GCC is unlikely to slow. Most of the UK's FDI in the GCC is in the hydrocarbon sector, which is unlikely to be materially affected by Brexit.

Banking sector retrenchment presents moderate risks, with the UAE (Aa2 negative) and Qatar (Aa2 negative) vulnerable in the event of a retrenchment of UK banks from the region. Nonetheless, the risk of a sudden scale-back in operations is limited and stocks have proved relatively stable through past shocks.

Finally, Moody's notes that trade between the GCC and the UK is modest. GCC export shares to both the UK and EU have declined over time, as energy demand from Asia has increased. In 2015, GCC trade with the UK accounted for 2.7% of the region's global trade.

-

08:18

WSE: Before opening

The beginning of the new week in the financial markets was extremely optimistic - the US S&P500 index set a record-high levels, indicating that investors pay more attention to incoming economic data rather than to the incumbent risks of Brexit. In the morning the main news, like yesterday, come from Japan. It is the announcement of a new stimulus package by the Prime Minister Abe. The size was not given, but is expected to reach nearly 100 billion dollars. As a result, the Nikkei index gaining more than 2% and compares favorably against Asian indices. Contracts in the US remain relatively stable.

Yesterday's trading was rewarded for emerging markets, including the WSE. Looking at the morning, rather balanced, moods, today it may be difficult to find a simple continuation of it and attention can shift to a desire of maintaining the gained achievements.

In the currency market investors seem to spend more and more attention to Friday's revision of the Polish rating by Fitch. This institution has not done so far movements similar to those of other agencies, hence the baseline scenario assumes reduction rating outlook to negative. In theory, this should already be priced in the market, but in the case of such a scenario, we may expect a slight decline in PLN.

-

08:15

Confidence in the business environment Australia rose in June - NAB

Business confidence in Australia rose in June to 6 from the previous value of 3. The National Australia Bank's business confidence report - a study of the current business conditions in Australia shows the dynamics of the Australian economy as a whole in the short term. Positive economic growth is bullish for the Australian currency. Conditions index in the Australian business community have also improved from 10 to 12.

The employment index rose to +4 (its average growth rate of about 1.2). Strengthening of the index shows a good long-term employment growth.

Planned capital expenditures to increase in June. The measure in the retail price survey declined by -0.2% during the 3 months to June, so that in the short-term the measure of inflation is still on the weak side

NAB survey was conducted in view of the increased uncertainty surrounding Brexit, and on the eve of the Australian federal election. Despite the risk nature of these events, the confidence of the business community in Australia continues to grow.

-

08:08

Japanese PM Abe said to be meeting former Fed chair Bernanke today - Bloomberg

-

08:05

German CPI unchanged from preliminary release

Consumer prices in Germany rose by 0.3% in June 2016 compared with June 2015. The inflation rate as measured by the consumer price index increased slightly for the second consecutive month. This year, a slightly higher rate than in June 2016 was measured only in January (+0.5%). Compared with the previous month, the consumer price index was up 0.1% in June 2016. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 29 June 2016.

The development of energy prices (-6.4%) had a downward effect on the overall rise in prices in June 2016, as had been the case in the preceding months. However, the year-on-year decrease in energy prices continued to slow; in May 2016 it had been -7.9%. Especially the prices of mineral oil products (-11.4%, of which heating oil: -19.0% and motor fuels: -9.4%) were down in June 2016 on a year earlier. The prices of other energy products, too, were below the level of the same month of the preceding year (for example, charges for central and district heating: -9.1%; gas: -2.8%). Only electricity prices rose on a year earlier (+0.9%). Excluding energy prices, the inflation rate in June 2016 would have been +1.1%.

-

08:00

Germany: CPI, y/y , June 0.3% (forecast 0.3%)

-

08:00

Germany: CPI, m/m, June 0.1% (forecast 0.1%)

-

07:17

Global Stocks

European stocks scored a third consecutive rise on Monday, extending gains after a stronger-than-expected U.S. jobs report and as investors assessed the possibility of more monetary easing by global central banks.

The Stoxx Europe 600 SXXP, +1.64% picked up 1.6% to end at 332.72, closing at the highest level since June 23, the day of the U.K.'s Brexit vote.

ThyssenKrupp's move helped propel Germany's DAX 30 index DAX, +2.12% up by 2.1% to 9,833.41.

The Stoxx 600 on Friday jumped 1.6%, leaping after the U.S. Labor Department said 287,000 new jobs were created in June, outstripping expectations of job growth of 170,000 forecast by economists polled by MarketWatch. The data soothed some concerns about growth in the U.S., the world's largest economy.

U.K. politics: Prime Minister David Cameron said he plans to formally turn in his previously announced resignation. That makes way for Home Secretary Theresa May to succeed him by Wednesday evening as the country's leader and head of the ruling Conservative Party after Andrea Leadsom dropped her bid to become the next prime minister.

The S&P 500 finished at a record high Monday as investors bought stocks amid a reinvigorated appetite for assets perceived as risky following a surprisingly strong jobs report last Friday.

The Dow Jones Industrial Average DJIA, +0.44% climbed 80.19 points, or 0.4%, to finish at 18,226.93, within a shouting distance of its record of 18,312.39 hit on May 19, 2015. The blue-chip gauge was led by a 1.5% rise in Boeing Co. BA, +1.50%

Meanwhile, the Nasdaq Composite Index COMP, +0.64% advanced 31.88 points, or 0.6%, to close at 4,988.64, after moving above the key 5,000 level during the day for the first time this year.

Asian stocks rose to a 2-1/2-month peak on Tuesday, a day after Wall Street shares hit a record high thanks to a combination of upbeat U.S. data and expectations of more stimulus from global policymakers.

Japan's Nikkei .N225 jumped 3.0 percent as investors bet the country's government may inject $100 billion in fiscal spending to boost the economy, possibly financed by the central bank's money-printing, a policy mix that is often dubbed "helicopter money".

-

00:33

Commodities. Daily history for Jul 11’2016:

(raw materials / closing price /% change)

Oil 44.55 -0.47%

Gold 1,356.10 -0.04%

-

00:32

Stocks. Daily history for Jun Jul 11’2016:

(index / closing price / change items /% change)

Nikkei 225 15,708.82 +601.84 +3.98 %

Hang Seng 20,880.5 +316.33 +1.54 %

S&P/ASX 200 5,337.1 +106.57 +2.04 %

Shanghai Composite 2,996.04 +7.95 +0.27 %

FTSE 100 6,682.86 +92.22 +1.40 %

CAC 40 4,264.53 +73.85 +1.76 %

Xetra DAX 9,833.41 +203.75 +2.12 %

S&P 500 2,137.16 +7.26 +0.34 %

NASDAQ Composite 4,988.64 +31.88 +0.64 %

Dow Jones 18,226.93 +80.19 +0.44 %

-

00:31

Currencies. Daily history for Jul 11’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1060 +0,09%

GBP/USD $1,2992 +0,60%

USD/CHF Chf0,9826 -0,04%

USD/JPY Y102,76 +2,13%

EUR/JPY Y113,65 +2,27%

GBP/JPY Y133,49 +2,42%

AUD/USD $0,7531 -0,49%

NZD/USD $0,7218 -1,18%

USD/CAD C$1,3113 -2,26%

-