Noticias del mercado

-

23:59

Schedule for today, Wednesday, Jul 13’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence July -1.0%

02:00 China Trade Balance, bln June 49.98 46.64

04:30 Japan Industrial Production (MoM) (Finally) May 0.5% -2.3%

04:30 Japan Industrial Production (YoY) (Finally) May -3.3% -0.1%

09:00 Eurozone Industrial production, (MoM) May 1.1% -0.8%

09:00 Eurozone Industrial Production (YoY) May 2% 1.4%

12:30 U.S. Import Price Index June 1.4% 0.5%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories July -2.223

15:15 Canada BOC Press Conference

18:00 U.S. Federal budget June -53

18:00 U.S. Fed's Beige Book

22:30 New Zealand Business NZ PMI June 57.1

-

16:52

US inventories of wholesale trade increased slightly in May

The Commerce Department reported that wholesale inventories rose at the end of May, but slightly smaller than expected. Overall, the latest update indicates that investment in inventories probably will not support economic growth in the second quarter.

According to the report, seasonally adjusted inventories in the warehouses of wholesale trade increased by 0.1% in May, reaching $ 586.2 billion. Analysts expected an increase of 0.2%. Meanwhile, the index for April was revised up to + 0.7% from + 0.6%. Compared to May 2015 stocks increased by 0.5%.

Inventories of computers and computer peripheral equipment and software rose by 1.9% compared to the previous month, while stockpiles of motor vehicles and automotive parts decreased by 1.9%. Stocks of non-durable goods rose by 0.2% over the month and by 5.1% y/y.

Inventories are a key component of gross domestic product changes. Component of wholesale inventories, which goes into the calculation of GDP - excluding cars - increased by 0.4% in May.

Wholesale sales of $ 435.5 billion., An increase of 0.5% compared to April. However, sales fell by 2.5% in annual terms.

Also, the Ministry of Commerce said that the ratio of stocks to sales ratio was 1.35 months in May as compared to 1.36 months in April. The ratio was at 1.31 months in May 2015.

-

16:19

Fed, Bullard: only one hike is needed for the foreseeable future

-

Despite strong jobs data, the economy is stuck in a low growth, low inflation and low unemployment regime, with the path of interest rates essentially flat.

-

no reason to forecast a US recesion.

-

-

16:04

US job openings lower than forecasts

The number of job openings decreased to 5.5 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Hires and separations were both little changed at 5.0 million. Within separations, the quits rate was 2.0 percent and the layoffs and discharges rate was 1.2 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. Job Openings Job Openings decreased in May by 345,000 to 5.5 million. The prior 3-month average change in job openings was +80,000.

-

16:00

U.S.: JOLTs Job Openings, May 5.5 (forecast 5.7)

-

16:00

U.S.: Wholesale Inventories, May 0.1% (forecast 0.2%)

-

15:44

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0950 (EUR 718m) 1.1000 (941m) 1.1050 (1.2bln) 1.1075 (372m)

USDJPY 102.00 (USD 855m)

GBPUSD 1.3300 (GBP 554m)

USDCAD 1.3100 (USD 320m)

NZDUSD 0.7090 (NZD 200m) 0.7275 (200m)

-

15:04

BlackRock: Bank of England will cut interest rates to zero this week

"Britain's economy may be in recession over the next year. In addition, the GDP growth in each of the next five years will be at least 0.5 percentage points below and the main reason is the unexpected decision of the British to leave the European Union.

"Our baseline scenario assumes that the UK economy will shrink and also, we expect a significant decline in investment in the country, taking into account the strengthening of political and economic uncertainty after Brexit." - Said Richard Turnill, chief investment strategist at BlackRock.

Turnill and his colleagues expect that this week the Bank of England will cut interest rates to zero from the current record low of 0.5 percent, and in August will expand its quantitative easing program. "The market is not fully pricing in such developments, - said Scott Tief, Head of BlackRock Global bonds -. This means that the pound will fall further, though not to parity against the dollar."

-

14:28

European session review: Yen fell on expectations of new economic stimulus

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Consumer Price Index m / m (final data) June 0.3% 0.1% 0.1%

6:00 Germany CPI, y / y (final data) June 0.1% 0.3% 0.3%

9:30 UK Speech of the Bank of England Governor Mark Carney

The yen fell significantly against the dollar, updating the minimum of July, and the first time since June 24 approaching to the level of Y104.00. The reason for such dynamics is an indication about further stimulus in the Japanese economy. Yesterday, Prime Minister of Japan Shinzo Abe reiterated that his office will begin drawing up stimulus plan, with no specific data been specified.

It also became known that the Japanese government plans to lower the forecast for GDP growth in the fiscal year ending March 2017 to 0.9% from 1.7%. The new forecast will be published on Wednesday. Abe Administration is likely to present a forecast assuming GDP growth next year at 1.2%.

The pound has appreciated by more than 200 pips against the dollar, approaching to a maximum of 5 July, helped by confirmation that the next prime minister of Britain will be Theresa May. Earlier policies gained the support of more than half of the total number of representatives of the Conservative Party in the Parliament. Acting Prime Minister Cameron to resign on Wednesday. He stressed that the new prime minister is ready to provide full support.

Market participants are also waiting for tomorrow's meeting of the Bank of England. After the referendum, the head of the Central Bank Carney considering the possibility of easing monetary policy. It is likely that step will be taken at the upcoming meeting. It is expected that the Central Bank lowered interest rates for the first time since March 2009. Most likely, the Central Bank may consider a rate cut to 0.25%.

The dollar rose modestly against the euro before recovering most of the lost positions, and returning at the level of $ 1.1100. Experts point out, amid a lack of new catalysts that the euro is likely to follow the pound, which is the main topic of foreign exchange traders on the eve of the scheduled Bank of England meeting. Investors are also waiting for today's statements by Fed Tarullo and Bullard and US data to be released in the coming days.

Little impact on the price action had data from Germany. As it became known, the consumer price index rose 0.1% in June, in line with preliminary estimates and forecasts of experts. Recall that in May, the index increased by 0.3%. Annual inflation in Germany rose by 0.3% compared with an increase of 0.1% in May, but remained significantly below the ECB target level, which is located just below 2%. The harmonized index of consumer prices, calculated on the basis of statistical methodology, agreed between all EU countries increased by 0.1% compared to May and by 0.2% annually in June. These coincided with the preliminary estimates. Downward pressure on the inflation rate continued to be energy prices, which in June fell by 6.4% compared to June 2015. In May, energy prices fell by 7.9%. Food prices rose by 0.1% annually in June.

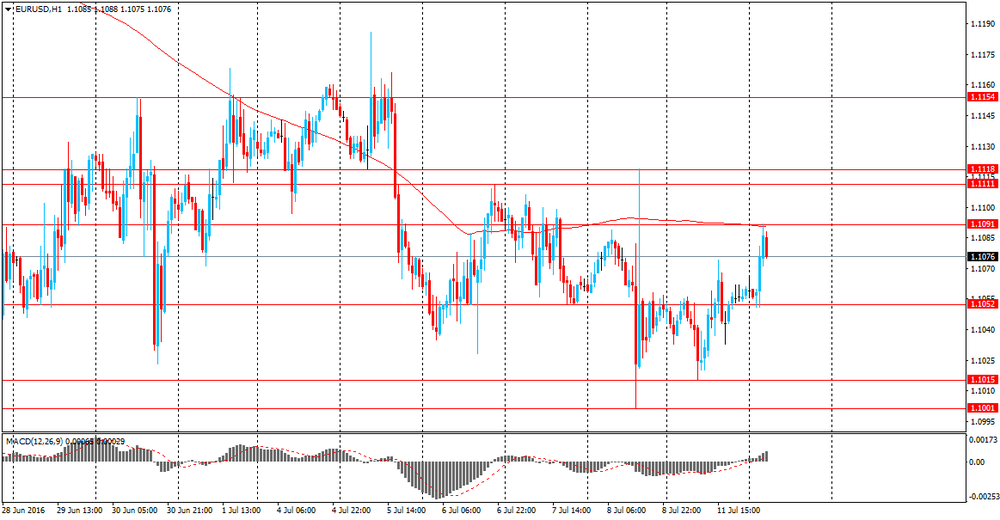

EUR / USD: during the European session, the pair has risen to $ 1.1125, but then went back to $ 1.1080.

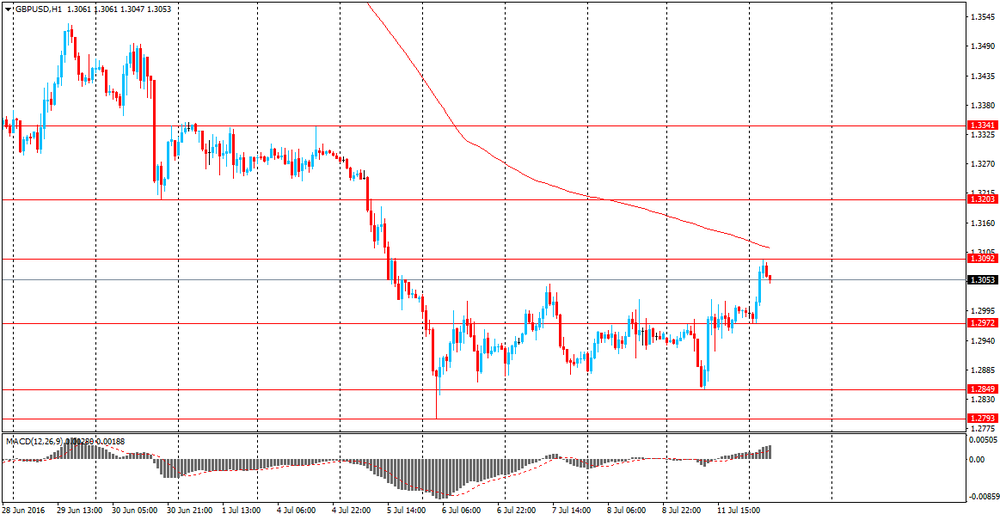

GBP / USD: during the European session, the pair rose to $ 1.3186.

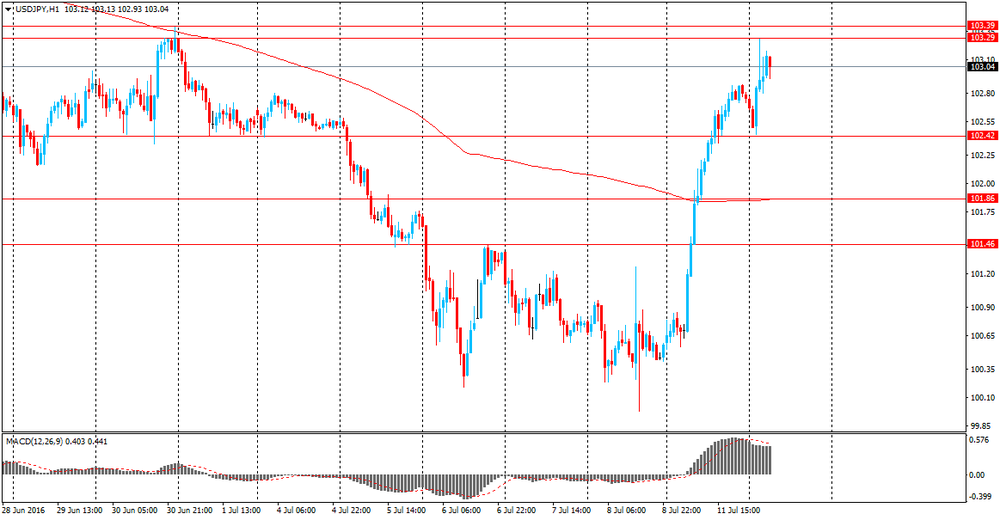

USD / JPY: during the European session, the pair rose to Y104.00.

-

14:00

Orders

EUR/USD

Offers 1.1150 1.1170 1.1185 1.1200 1.1220 1.1250

Bids 1.1100 1.1080 1.1055-60 1.1030 1.1000 1.0975-80 1.0950

GBP/USD

Offers 1.3180 1.3200-05 1.3230 1.3250 1.3275-80 1.3300

Bids 1.3100 1.3080 1.3050 1.3030-35 1.3000 1.2975 1.2950 1.2900

EUR/GBP

Offers 0.8485 0.8500 0.8520 0.8550 0.8585 0.8600

Bids 0.8450 0.8430 0.8400 0.8385 0.8350

EUR/JPY

Offers 114.60 114.80 115.00 115.25 115.50 115.75-80 116.00

Bids 114.20 114.00 113.80-85 113.50 113.00 112.80 112.50 112.00 111.85 111.50

USD/JPY

Offers 103.50-60 103.85 104.00 104.30 104.50

Bids 102.80 102.40-50 102.20 102.00 101.75 101.20 101.00

AUD/USD

Offers 0.7600 0.7650 0.7670 0.7700 0.7720 0.7750-55

Bids 0.7555-60 0.7540 0.7520 0.7500 0.7480 0.7450-55 0.7425 0.7400

-

13:25

OPEC reduced forecasts for 2016 global economic growth

- global growth: 3% (3.1% previous estimate).

- Brexit is a cause of uncertainty.

- oil demand to rise by 1.15m bpd in 2017.

- 2016 world oil demand growth forecast unchanged at 1.19m bpd.

- expects demand for crude oil to average 32.98m bpd in 2017 (31.86m bpd in 2016).

- non-OPEC supply is expected to fall by 110k bpd in 2017.

- oil market conditions will help to remove excess oil stocks in 2017.

-

12:57

Major stock indices in Europe show a positive trend

European stocks rose for the fourth consecutive session, helped by easing political tensions in Britain, as well as expectations of the launch of additional measures to stimulate the economy by the Bank of England and Bank of Japan. In addition, investors' attention is focused on the US corporate reporting season.

On Monday, State Minister of Energy Andrea Leedsom withdrew his candidacy from the PM race. Thus, the only candidate for the post of British prime minister remained Theresa May. Earlier policies gained the support of more than half of the total number of representatives of the Conservative Party in the Parliament. Acting Prime Minister Cameron announced that he would resign on Wednesday, July 13th. He also stressed that the new prime minister is ready to provide full support. Overall, recent developments have provided some relief to investors, who were shocked by the decision of the british to leave the EU.

Meanwhile, market participants are waiting for the meeting of the Bank of England. After the referendum, the head of the Central Bank, Carney considering the possibility of easing monetary policy. It is likely that steps will be taken at the upcoming meeting. It is expected that the Central Bank lowered interest rates for the first time since March 2009. Most likely, the Central Bank may consider a rate cut to 0.25%.

Investors are also looking to mitigate the Bank of Japan's policy to revitalize the local economy. Yesterday, Abe reiterated that will begin drawing up stimulus plan, with no specific data been specified.

A slight impact on the course of trading also provided from Germany. As it became known, the consumer price index remained unchanged at 0.1% in June, in line with analysts' forecasts. Annual inflation in Germany rose by 0.3% compared to May, but remained significantly below the ECB target level, which is located just below 2%. The harmonized index of consumer prices, calculated on the basis of statistical methodology, agreed between all EU countries increased by 0.1% compared to May and by 0.2% annually in June. These coincided with the preliminary estimates. Downward pressure on the inflation rate continued to be energy prices, which in June fell by 6.4% compared to June 2015. In May, energy prices fell by 7.9%. Food prices rose by 0.1% annually in June.

The composite index of the largest companies in the region Stoxx Europe 600 increased by 0.9%.

All 19 industry groups of the index, with the exception of the health sector and utilities, show an increase.

Daimler capitalization rose 3.8 percent after the German automaker posted encouraging financial results and confirmed its full-year outlook, dispelled some fears about the impact of Brexit.

Shares of ASOS Plc - online retailer of clothing - rose by 3.2 percent against the backdrop of higher than expected sales in the last four months.

Shares of the Italian bank Unicredit rose nearly 7 percent after the bank accepted to increase the amount of capital measures by selling online share broker.

Quotes DNB ASA fell 7.6 percent, as the representatives of the bank said that the amount of write downs in connection with the 2016 depreciation of the assets may exceed the previous estimate

At the moment:

FTSE 6,689.6 +6.74 + 0.10%

CAC 40 4,336.51 +71.98 + 1.69%

DAX 9,992.21 +158.80 + 1.61%

-

12:38

European Commissioner Moscovici: uncertainty about Brexit reduce GDP growth

Commissioner for Economic Affairs, Pierre Moscovici said that the uncertainty associated with the withdrawal of the UK from the European Union's structure, leading to slower economic growth in the eurozone and the UK. He also warned that the longer the period of uncertainty, the higher the price to pay in the region.

"According to earlier estimates, Brexit reduce Britain's GDP growth rate with 1-2.5 percent by the year 2017 and the euro area economy is likely to lose 0.2-0.5 percent of GDP by 2017." In May, the European Commission predicted the eurozone GDP growth of 1.6 percent in 2016 and 1.8 percent for next year.

The International Monetary Fund last week lowered its forecasts for growth in the euro zone economy, citing the uncertainty created by the unexpected outcome of the British referendum. Now the lender is expected to expand by 1.6 percent this year and 1.4 percent in 2017.

-

12:21

Small business optimism increased in US

The Index of Small Business Optimism increased 0.7 points to 94.5, still well below the 40 year average of 98, but the third monthly gain in a row, although the gains are very small. Four of the 10 Index components posted a gain, three declined and three were unchanged. The outlook for business conditions six months out continued to improve, although more owners still expect conditions to be worse than expect improvement. First quarter GDP growth was revised up again, to a sluggish 1.1 percent. Second quarter growth will likely be better, in the low 2 percent range.

-

11:49

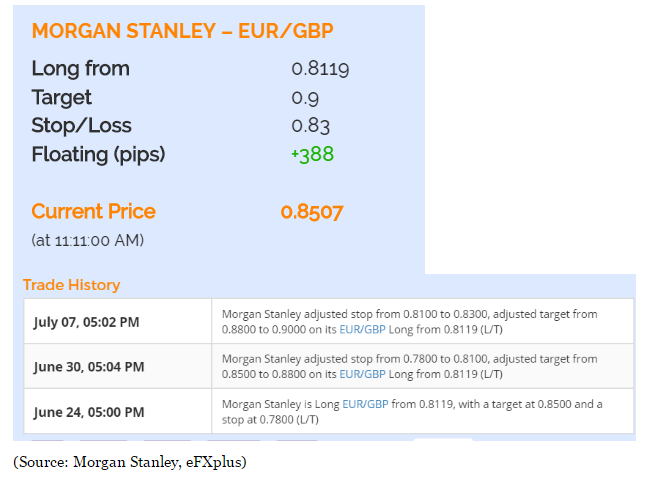

Morgan Stalney staying long Eur/Gbp for the Bank of England meeting

"Remaining long EURGBP: We expect the BoE to cut rates by 25bp on Thursday, which should keep GBP offered and risk bid.

Otherwise, markets will focus on EMU's industrial production on Wednesday and inflation data on Friday. An indication of EMU authorities providing equity support to Italian banks without triggering the bail-in mechanism should allow EUR to rebound sharply.

EURGBP near 0.8425 offers an opportunity to add to longs, looking for 0.94.

Morgan Stanley maintains a long EUR/GBP from June 24".

-

11:37

Bank of England Governor, Carney:

-

some criticism of BOE has been extraordinary in all sense of the word.

-

had a wide range of discussions with fin min Osborne understandably.

-

did not pre-determine stance taken by BOE's FPC or MPC on Brexit risks.

-

Minutes available from official discussions but none from private.

It seems that limited informations will be made public today about the Bank of England's meeting on Thursday when the rate is expected to be reduced to 0.25%.

-

-

11:10

FPC minutes: Brexit seriously increases risk outlook

-

Brexit seriously increases risk outlook

-

Reduced the UK countercyclical capital buffer rate from 0.5% to 0% of banks' UK exposures with immediate effect.

-

Welcomed the Bank of England's announcement that it will continue to offer indexed long-term repo operations on a weekly basis until end-September 2016. This is a precautionary step to provide additional flexibility in the Bank's provision of liquidity insurance, further reinforcing the ability of firms to draw on their own liquidity buffers.

-

Supported the position of the PRA to allow insurance companies to use flexibility in Solvency II regulations to recalculate transitional measures. These measures smooth the impact of those new regulations.

*via forexlive

-

-

10:53

Pound awaits Bank of England testify in a supply area. Big moves could come in just a few minutes. Push through resistance or back down to Brexit lows?

-

10:51

Oil is gaining in early trading

This morning, New York crude oil futures WTI rose by 0.45% to $ 44.96 per barrel. At the same time, crude oil futures for Brent increased by + 0.56% to $ 46.50 per barrel. Thus, the black gold increases amid interruptions in shipment of oil from the main Iraqi port of Basra, as well as the expectations of the weekly publication of data on levels in the US fuel stocks. Interruptions in Basra occurred due to leakage of oil from the pipeline. In general, the market keeps the negative mood, prices remain near two-month lows. Investors are concerned about the increase in drilling volumes in the US, the growth of exports of raw materials from Iran.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0950 (EUR 718m) 1.1000 (941m) 1.1050 (1.2bln) 1.1075 (372m)

USD/JPY 102.00 (USD 855m)

GBP/USD 1.3300 (GBP 554m)

USD/CAD 1.3100 (USD 320m)

NZD/USD 0.7090 (NZD 200m) 0.7275 (200m)

-

10:08

Prime Minister of Japan advisor, Hamada: Bernanke urged Abe to continue a policy of planned economic development

- at its meeting, Bernanke and Abe did not discuss any specific issues of monetary policy and did not talk about the upcoming meeting of the Bank of Japan.

- Abe said that Japan needs to increase budget spending.

- Bernanke noted that the the US economy is doing well.

- participants at the meeting stated that the Bank of Japan acts successfully in the implementation of monetary policy.

-

09:25

Today’s events:

At 09:00 GMT, a special hearing of the Treasury Committee, Bank of England Governor Mark Carney will deliver a speech, and the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

At 11:00 GMT the Bank of England Quarterly Bulletin (2Q)

At 13:15 GMT FOMC Member Daniel Tarullo deliver a speech

At 13:35 GMT FOMC member James Bullard will give a speech

At 17:01 GMT the United States will hold an auction of 10-year bonds

At 21:30 GMT FOMC members Neil Kashkari will deliver a speech

-

08:38

Asian session review: yen continues to decline

During the Asian session, the yen continues to fall after yesterday's press conference were Japanese Prime Minister Shinzo Abe said the Japanese government is preparing to take measures to stimulate the economy. Abe said that today intends to instruct the Minister of economic recovery of Japan Nobuteru Ishihara to prepare comprehensive economic measures to remedy the situation.

USD / JPY, gained momentum after the news about the meeting and Bernanke Abe, who said that one The Government of Japan will lower GDP forecast. Prime Minister Shinzo Abe plans to lower GDP growth forecast for the fiscal year ending March 2017 to 0.9% from 1.7%. The new forecast will be published on Wednesday and will be adjusted for inflation. The previous forecast was published in January. Abe Administration is likely to present a forecast assuming GDP growth next year at 1.2%.

Ministry of Economy, Trade and Industry said today that the index of activity in Japan of services decreased by 0.7% in May, in line with analysts' forecasts. The previous value was revised downward from 1.4% to 0.7%. This indicator reflects the state of Japan's domestic service sector, including information and communications, electricity, gas heating and water supply, services, transport, wholesale and retail trade, finance and insurance, and social security. According to the Japanese economy on exports, this figure may account for the lower volatility of the yen. The decline also negatively impact on the Japanese currency.

The euro rose against the US dollar, following the strengthening of the pound, which was supported by evidence that Theresa May will be the next Prime Minister of Great Britain. The euro is likely to follow the pound, which is the main topic of discussion of traders before the meeting of the Bank of England, devoted to monetary policy, which will take place on Thursday. The probability of lowering interest rates by the Bank of England to a new record low and a possible political stability are the two opposing market forces for the pound and the euro.

After the referendum, the head of the Bank of England Carney said that to support the economy will probably require an easing of monetary policy during the summer. Thus, Carney signaled that the Central Bank may lower interest rates. He added that the Bank of England has a number of other tools to protect the economy and banking system, which may indicate a resumption of the bond purchase program.

After the unexpected results of the referendum, analysts expect a prolonged period of uncertainty and volatility. However, many predict a recession, increasing inflation. Most likely, the Central Bank may consider a rate cut to 0.25% an adequate measure.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1050-85 range.

GBP / USD: during the Asian session, the pair is trading in the $ 1.2970-1.3080 range

USD / JPY: during the Asian session, the pair was trading in range Y102.45-103.30.

-

08:35

Options levels on tuesday, July 12, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1291 (2234)

$1.1224 (1616)

$1.1173 (1649)

Price at time of writing this review: $1.1085

Support levels (open interest**, contracts):

$1.0989 (2926)

$1.0931 (2903)

$1.0860 (6937)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 29841 contracts, with the maximum number of contracts with strike price $1,1400 (2910);

- Overall open interest on the PUT options with the expiration date August, 5 is 45563 contracts, with the maximum number of contracts with strike price $1,0900 (6937);

- The ratio of PUT/CALL was 1.53 versus 1.43 from the previous trading day according to data from July, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.3405 (1227)

$1.3308 (416)

$1.3211 (418)

Price at time of writing this review: $1.3078

Support levels (open interest**, contracts):

$1.2982 (615)

$1.2886 (558)

$1.2789 (1396)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 17944 contracts, with the maximum number of contracts with strike price $1,3400 (1227);

- Overall open interest on the PUT options with the expiration date August, 5 is 17504 contracts, with the maximum number of contracts with strike price $1,2950 (2435);

- The ratio of PUT/CALL was 0.98 versus 0.92 from the previous trading day according to data from July, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

Loretta Mester, Fed: rate hike timing will depend on how the situation will develop in the economy

- the Fed does not take a decision on the interest rate in advance.

- financial stability is best maintained by regulation and supervision.

- often, the task of maintaining stability and objectives of monetary policy are complementary.

- macroprudential tools by and large have not yet tested completely.

- the situation on the US labor market is quite positive, because we have almost reached full employment.

- it is advisable to gradually increase rates.

-

08:22

Consumer spending in UK grew at its slowest rate since the depths of the 2008-09 recession

According to theguardian, consumer spending grew at its slowest rate since the depths of the 2008-09 recession in the three months leading to the EU referendum, but retailers have blamed bad weather for the tough trading conditions.

The monthly survey of high street and online sales from the British Retail Consortium and KPMG found that sales in the second quarter of 2016 were up 0.5% on the first quarter and 1.2% up on an annual basis. The BRC said this was the weakest performance since May 2009, when the economy was contracting during its longest and deepest postwar recessions.

In June alone, total sales were 0.2% higher than in the same month last year, but were 0.5% lower on a like-for-like basis, which takes account of increased retail capacity over the past 12 months.

David McCorquodale of KPMG said: "As consumer attention shifted indoors to escape autumnal downpours, furniture and home accessories bounced back in the month, with bigger-ticket items proving relatively resilient in the days immediately following the EU referendum.

Spending growth slows as shoppers delay big purchases

"With May sunshine a distant memory, however, summer wardrobes remained bare as sales of women's fashion and footwear plummeted following one of the wettest and dullest starts to a UK summer since records began."

-

08:19

Moody's: Brexit to have negligible credit impact on GCC sovereigns

Moody's Investors Service says that the United Kingdom's (UK, Aa1 negative) vote to leave the European Union (EU, Aaa stable) will not have a significant credit impact on GCC sovereigns because their trade exposure to the UK is limited and the size of their sovereign wealth funds offers resilience against potential fluctuations in the value of some assets.

Moody's report, entitled "Sovereigns -- Brexit and the Gulf Cooperation Council: Negligible credit impact given large investment buffers and limited trade," is available on www.moodys.com. Moody's subscribers can access this report via the link provided at the end of this press release. The rating agency's report is an update to the markets and does not constitute a rating action.

It is unlikely that a loss in value of some existing GCC investment in the UK will materially weaken GCC governments' net asset position, according to Moody's. GCC sovereign wealth fund portfolios are generally large and well diversified. This will allow it to absorb the impact of asset price and exchange rate movements associated with Brexit.

While the combination of Brexit and low oil prices could affect GCC investment inflows into the UK, Moody's notes that overall GCC government investments are generally sticky because of the sovereign wealth funds' relatively long investment horizon.

UK investment in the GCC is unlikely to slow. Most of the UK's FDI in the GCC is in the hydrocarbon sector, which is unlikely to be materially affected by Brexit.

Banking sector retrenchment presents moderate risks, with the UAE (Aa2 negative) and Qatar (Aa2 negative) vulnerable in the event of a retrenchment of UK banks from the region. Nonetheless, the risk of a sudden scale-back in operations is limited and stocks have proved relatively stable through past shocks.

Finally, Moody's notes that trade between the GCC and the UK is modest. GCC export shares to both the UK and EU have declined over time, as energy demand from Asia has increased. In 2015, GCC trade with the UK accounted for 2.7% of the region's global trade.

-

08:15

Confidence in the business environment Australia rose in June - NAB

Business confidence in Australia rose in June to 6 from the previous value of 3. The National Australia Bank's business confidence report - a study of the current business conditions in Australia shows the dynamics of the Australian economy as a whole in the short term. Positive economic growth is bullish for the Australian currency. Conditions index in the Australian business community have also improved from 10 to 12.

The employment index rose to +4 (its average growth rate of about 1.2). Strengthening of the index shows a good long-term employment growth.

Planned capital expenditures to increase in June. The measure in the retail price survey declined by -0.2% during the 3 months to June, so that in the short-term the measure of inflation is still on the weak side

NAB survey was conducted in view of the increased uncertainty surrounding Brexit, and on the eve of the Australian federal election. Despite the risk nature of these events, the confidence of the business community in Australia continues to grow.

-

08:08

Japanese PM Abe said to be meeting former Fed chair Bernanke today - Bloomberg

-

08:05

German CPI unchanged from preliminary release

Consumer prices in Germany rose by 0.3% in June 2016 compared with June 2015. The inflation rate as measured by the consumer price index increased slightly for the second consecutive month. This year, a slightly higher rate than in June 2016 was measured only in January (+0.5%). Compared with the previous month, the consumer price index was up 0.1% in June 2016. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 29 June 2016.

The development of energy prices (-6.4%) had a downward effect on the overall rise in prices in June 2016, as had been the case in the preceding months. However, the year-on-year decrease in energy prices continued to slow; in May 2016 it had been -7.9%. Especially the prices of mineral oil products (-11.4%, of which heating oil: -19.0% and motor fuels: -9.4%) were down in June 2016 on a year earlier. The prices of other energy products, too, were below the level of the same month of the preceding year (for example, charges for central and district heating: -9.1%; gas: -2.8%). Only electricity prices rose on a year earlier (+0.9%). Excluding energy prices, the inflation rate in June 2016 would have been +1.1%.

-

08:00

Germany: CPI, y/y , June 0.3% (forecast 0.3%)

-

08:00

Germany: CPI, m/m, June 0.1% (forecast 0.1%)

-

00:31

Currencies. Daily history for Jul 11’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1060 +0,09%

GBP/USD $1,2992 +0,60%

USD/CHF Chf0,9826 -0,04%

USD/JPY Y102,76 +2,13%

EUR/JPY Y113,65 +2,27%

GBP/JPY Y133,49 +2,42%

AUD/USD $0,7531 -0,49%

NZD/USD $0,7218 -1,18%

USD/CAD C$1,3113 -2,26%

-