Noticias del mercado

-

22:08

U.S. stocks closed

The Dow Jones Industrial Average joined the S&P 500 Index at a fresh record close, with U.S. equities climbing a third day as crude rallied and Alcoa Inc.'s results bolstered optimism on corporate health amid the start of the earnings season.

Alcoa jumped to a two-month high after the aluminum producer posted a profit that beat analysts' estimates, kicking off the quarterly reporting period. BlackRock Inc., JPMorgan Chase & Co. and Citigroup Inc. are among firms releasing results this week.

Commodity producers and and transportation stocks posted some of the biggest gains today, with American Airlines Inc. rallying 11 percent for its best day since at least December 2013. Oil and gas companies climbed to the highest since November as crude had its biggest gain in three months. Miner Freeport-McMoRan Inc. increased 11 percent.

The S&P 500 added 0.7 percent to 2,152.06 at 4 p.m. in New York, extending its all-time high after surpassing yesterday the previous record reached in May 2015 on bets of a brighter economic outlook after Friday's jobs report.

Stocks have climbed since Friday, erasing the losses triggered by the U.K.'s vote to leave the European Union, as a stronger-than-forecast payrolls report helped allay investor concerns. At the same time, traders are pricing in little chance of an interest-rate hike from the Federal Reserve anytime soon, with September 2017 being the first month that has even odds of a raise, implying a so-called "Goldilocks" scenario for equities in which the economy expands but at a lukewarm pace to hold off further monetary tightening.

Meanwhile, investors have also sought the safety of Treasuries in the aftermath of the Brexit vote, sending bond yields to record lows last week. Fresh peaks for stocks coupled with all-time lows for bonds is unusual given that they are generally seen as risk-on/risk-off complements. Demand for U.S. bonds has also ramped up amid sub-zero yields in Europe and Japan.

-

21:00

DJIA 18350.79 123.86 0.68%, NASDAQ 5025.90 37.26 0.75%, S&P 500 2153.52 16.36 0.77%

-

18:00

European stocks closed: FTSE 6680.69 -2.17 -0.03%, DAX 9964.07 130.66 1.33%, CAC 4331.38 66.85 1.57%

-

17:38

WSE: Session Results

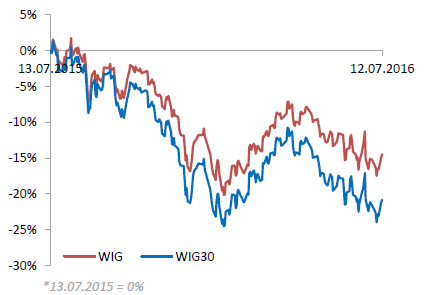

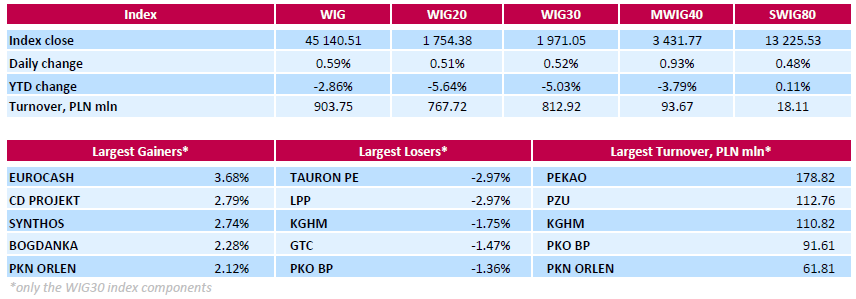

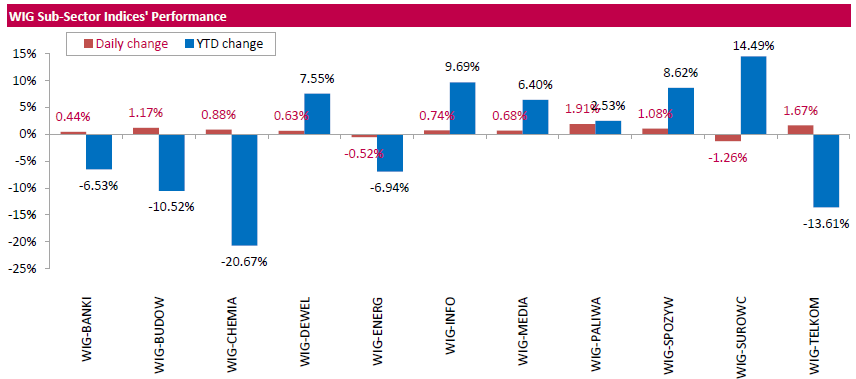

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.59%. Except for materials (-1.26%) and utilities (-0.52%), every sector in the WIG Index advanced, with oil and gas (+1.91%) outperforming.

Large-cap stocks measure, the WIG30 Index, recorded a 0.52% surge. In the index basket, FMCG-wholesaler EUROCASH (WSE: EUR) was the biggest gainer with a 3.68% advance, followed by videogame developer CD PROJEKT (WSE: CDR), chemical producer SYNTHOS (WSE: SNS) and thermal coal miner BOGDANKA (WSE: LWB), which added 2.79%, 2.74% and 2.28% respectively. On the other side of the ledger, genco TAURON PE (WSE: TPE) and clothing retailer LPP (WSE: LPP) were the sharpest decliners, each tumbling by 2.97%. Other biggest laggards were copper producer KGHM (WSE: KGH), property developer GTC (WSE: GTC), bank PKO BP (WSE: PKO) and chemical producer GRUPA AZOTY (WSE: ATT), losing between 1.35% and 1.75%.

-

17:36

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday, the S&P 500 and the Dow hit record intraday highs, while the Nasdaq wiped out its losses for the year, buoyed by increasing prospects of global economic health and with Alcoa getting the U.S. earnings season off to a promising start. Alcoa (AA) reported a smaller-than-expected drop in quarterly profit, sending the aluminum producer's shares up 5% and helping boost optimism about the earnings season.

Most of Dow stocks in positive area (19 of 30). Top looser - The Boeing Company (BA, -1,15%). Top gainer - E. I. du Pont de Nemours and Company (DD, +2,98%).

Most of all S&P sectors in positive area. Top looser - Utilities (-0,6%). Top gainer - Basic Materials (+2,2%).

At the moment:

Dow 18235.00 +88.00 +0.48%

S&P 500 2143.50 +13.25 +0.62%

Nasdaq 100 4572.25 +22.75 +0.50%

Oil 46.16 +1.40 +3.13%

Gold 1341.40 -15.20 -1.12%

U.S. 10yr 1.49 +0.06

-

15:51

WSE: After start on Wall Street

Start of the cash market on Wall Street brought new records and the S&P500 reached the psychological level of 2,150 points. So far, the trend is clear, and the dominance of demand persists. In Warsaw, a new peak in the US do not make much of impression and the WIG20 index still can not significantly break away from the vicinity of the level of 1,750 points. Optimistic behavior show today's mid-companies and the mWIG40 index behaves similarly to European indices. Besides, for a long time medium companies better reflect the trend of global than national blue chips involved in local issues.

-

15:32

U.S. Stocks open: Dow +0.42%, Nasdaq +0.63%, S&P +0.53%

-

15:27

Before the bell: S&P futures +0.49%, NASDAQ futures +0.58%

U.S. stock-index futures climbed as investors weighed prospects for corporate health amid the start of the earnings season.

Global Stocks:

Nikkei 16,095.65 +386.83 +2.46%

Hang Seng 21,224.74 +344.24 +1.65%

Shanghai Composite 3,049.68 +54.76 +1.83%

FTSE 6,693.11 +10.25 +0.15%

CAC 4,331.66 +67.13 +1.57%

DAX 9,975.09 +141.68 +1.44%

Crude $45.84 (+2.41%)

Gold $1348.00 (-0.63%)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.62

0.48(4.7337%)

532918

ALTRIA GROUP INC.

MO

69.87

0.00(0.00%)

1979

Amazon.com Inc., NASDAQ

AMZN

759

5.22(0.6925%)

28821

American Express Co

AXP

62.49

0.33(0.5309%)

200

AMERICAN INTERNATIONAL GROUP

AIG

53.75

0.46(0.8632%)

600

Apple Inc.

AAPL

97.38

0.40(0.4125%)

88846

AT&T Inc

T

42.35

-0.16(-0.3764%)

6950

Barrick Gold Corporation, NYSE

ABX

21.81

-0.23(-1.0436%)

96664

Boeing Co

BA

132.5

0.46(0.3484%)

4234

Caterpillar Inc

CAT

78.6

0.80(1.0283%)

6014

Chevron Corp

CVX

106.2

0.81(0.7686%)

11870

Cisco Systems Inc

CSCO

29.72

0.29(0.9854%)

7184

Citigroup Inc., NYSE

C

42.78

0.49(1.1587%)

39362

Exxon Mobil Corp

XOM

94.57

0.68(0.7243%)

7234

Facebook, Inc.

FB

118.5

0.63(0.5345%)

114624

Ford Motor Co.

F

13.37

0.10(0.7536%)

39105

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.08

0.43(3.691%)

467215

General Electric Co

GE

32.34

0.13(0.4036%)

35239

General Motors Company, NYSE

GM

30.35

0.22(0.7302%)

18297

Goldman Sachs

GS

153.8

1.61(1.0579%)

4534

Google Inc.

GOOG

719.49

4.40(0.6153%)

2653

Hewlett-Packard Co.

HPQ

13.41

0.25(1.8997%)

11000

Home Depot Inc

HD

136.28

1.13(0.8361%)

366

Intel Corp

INTC

34.62

0.24(0.6981%)

29330

International Business Machines Co...

IBM

156.72

1.39(0.8949%)

2041

Johnson & Johnson

JNJ

122.55

-0.38(-0.3091%)

1596

JPMorgan Chase and Co

JPM

62.97

0.70(1.1241%)

20736

Microsoft Corp

MSFT

53

0.41(0.7796%)

33740

Nike

NKE

57.24

0.41(0.7215%)

375

Pfizer Inc

PFE

36.24

0.09(0.249%)

1279

Procter & Gamble Co

PG

85.59

-0.16(-0.1866%)

4422

Starbucks Corporation, NASDAQ

SBUX

56.65

0.33(0.5859%)

3949

Tesla Motors, Inc., NASDAQ

TSLA

224.61

-0.17(-0.0756%)

31196

The Coca-Cola Co

KO

45.67

0.10(0.2194%)

24582

Twitter, Inc., NYSE

TWTR

17.98

0.27(1.5246%)

94512

United Technologies Corp

UTX

104

0.04(0.0385%)

1300

Verizon Communications Inc

VZ

55.65

-0.28(-0.5006%)

5902

Visa

V

77.25

0.73(0.954%)

2122

Wal-Mart Stores Inc

WMT

73.66

-0.40(-0.5401%)

6374

Walt Disney Co

DIS

100.4

0.42(0.4201%)

2044

Yahoo! Inc., NASDAQ

YHOO

38.19

0.23(0.6059%)

13163

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:Alcoa (AA) reiterated with a Market Perform at Cowen; target $10

Alcoa (AA) target raised to $13 from $12 at Stifel

-

13:45

Company News: Alcoa (AA) Q2 results beat analysts’ expectations

Alcoa reported Q2 FY 2016 earnings of $0.15 per share (versus $0.19 in Q2 FY 2015), beating analysts' consensus of $0.10.

The company's quarterly revenues amounted to $5.295 bln (-10.2% y/y), beating consensus estimate of $5.224 bln.

Alcoa also forecasted an improvement in the H2 2016 results as new platforms ramp up, and a strong 2017. The company expects FY 2016 deliveries to be flat to up 3%, followed by strong double-digit growth in 2017.

AA rose to $10.53 (+3.85%) in pre-market trading.

-

13:07

WSE: Mid session comment

The situation in Europe is very good and the main indices such as the DAX stick close to the maximum levels of the session (+ 1.6%) but on the Warsaw Stock Exchange we faced an unexpected deterioration. Definitely due to internal factors demand in the short time lost what was reached before the noon.

Negative attitude to the market remains in force and the latest comments on the part of foreign investors regarding Poland remain cautious, which means that demand is not aggressive.

At the halfway point of the session the WIG20 index reached the level of 1,752 points (+ 0.38%) at the turnover of approximately PLN 300 mln.

-

09:42

Positive start for major stock exchanges: DAX 9,848.26 + 14.85 + 0.15%, FTSE 100 6,692.38 + 9.52 + 0.14%, CAC 40 4,276.8 + 12.27 + 0.29%

-

09:15

WSE: After opening

WIG20 index opened at 1747.85 points (+0.14%)*

WIG 44985.30 0.24%

WIG30 1965.17 0.22%

mWIG40 3409.44 0.27%

*/ - change to previous close

The cash market opens with an increase of 0.14% to 1,747 points., which leads to meeting the index with the psychological level of 1,750 points and at the same time exponential average of 21 sessions. The market also returned to the range of consolidation prior information about the changes planned in the operation of pension funds (OFE). So it seems that we should have a chance to extend yesterday's bullish trading atmosphere.

-

08:43

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,2%, FTSE 100 -0,1%, CAC 40 -0.1%

-

08:18

WSE: Before opening

The beginning of the new week in the financial markets was extremely optimistic - the US S&P500 index set a record-high levels, indicating that investors pay more attention to incoming economic data rather than to the incumbent risks of Brexit. In the morning the main news, like yesterday, come from Japan. It is the announcement of a new stimulus package by the Prime Minister Abe. The size was not given, but is expected to reach nearly 100 billion dollars. As a result, the Nikkei index gaining more than 2% and compares favorably against Asian indices. Contracts in the US remain relatively stable.

Yesterday's trading was rewarded for emerging markets, including the WSE. Looking at the morning, rather balanced, moods, today it may be difficult to find a simple continuation of it and attention can shift to a desire of maintaining the gained achievements.

In the currency market investors seem to spend more and more attention to Friday's revision of the Polish rating by Fitch. This institution has not done so far movements similar to those of other agencies, hence the baseline scenario assumes reduction rating outlook to negative. In theory, this should already be priced in the market, but in the case of such a scenario, we may expect a slight decline in PLN.

-

07:17

Global Stocks

European stocks scored a third consecutive rise on Monday, extending gains after a stronger-than-expected U.S. jobs report and as investors assessed the possibility of more monetary easing by global central banks.

The Stoxx Europe 600 SXXP, +1.64% picked up 1.6% to end at 332.72, closing at the highest level since June 23, the day of the U.K.'s Brexit vote.

ThyssenKrupp's move helped propel Germany's DAX 30 index DAX, +2.12% up by 2.1% to 9,833.41.

The Stoxx 600 on Friday jumped 1.6%, leaping after the U.S. Labor Department said 287,000 new jobs were created in June, outstripping expectations of job growth of 170,000 forecast by economists polled by MarketWatch. The data soothed some concerns about growth in the U.S., the world's largest economy.

U.K. politics: Prime Minister David Cameron said he plans to formally turn in his previously announced resignation. That makes way for Home Secretary Theresa May to succeed him by Wednesday evening as the country's leader and head of the ruling Conservative Party after Andrea Leadsom dropped her bid to become the next prime minister.

The S&P 500 finished at a record high Monday as investors bought stocks amid a reinvigorated appetite for assets perceived as risky following a surprisingly strong jobs report last Friday.

The Dow Jones Industrial Average DJIA, +0.44% climbed 80.19 points, or 0.4%, to finish at 18,226.93, within a shouting distance of its record of 18,312.39 hit on May 19, 2015. The blue-chip gauge was led by a 1.5% rise in Boeing Co. BA, +1.50%

Meanwhile, the Nasdaq Composite Index COMP, +0.64% advanced 31.88 points, or 0.6%, to close at 4,988.64, after moving above the key 5,000 level during the day for the first time this year.

Asian stocks rose to a 2-1/2-month peak on Tuesday, a day after Wall Street shares hit a record high thanks to a combination of upbeat U.S. data and expectations of more stimulus from global policymakers.

Japan's Nikkei .N225 jumped 3.0 percent as investors bet the country's government may inject $100 billion in fiscal spending to boost the economy, possibly financed by the central bank's money-printing, a policy mix that is often dubbed "helicopter money".

-

00:32

Stocks. Daily history for Jun Jul 11’2016:

(index / closing price / change items /% change)

Nikkei 225 15,708.82 +601.84 +3.98 %

Hang Seng 20,880.5 +316.33 +1.54 %

S&P/ASX 200 5,337.1 +106.57 +2.04 %

Shanghai Composite 2,996.04 +7.95 +0.27 %

FTSE 100 6,682.86 +92.22 +1.40 %

CAC 40 4,264.53 +73.85 +1.76 %

Xetra DAX 9,833.41 +203.75 +2.12 %

S&P 500 2,137.16 +7.26 +0.34 %

NASDAQ Composite 4,988.64 +31.88 +0.64 %

Dow Jones 18,226.93 +80.19 +0.44 %

-