Noticias del mercado

-

22:09

US stocks closed

The S&P 500 Index eked out a third straight closing record, overcoming a drop in the price of crude that dragged energy shares lower as a let-up in the U.K.'s political turmoil kept demand for risk assets alive.

The S&P 500 Index added less than half a point after a 10-day surge restored almost $2 trillion to the value of shares. Energy producers led losses after crude sank below $45 a barrel amid an unexpected increase in fuel stockpiles. Treasuries advanced, halting the biggest two-day decline this year, as the U.S. auctioned 30-year bonds at the lowest yield on record. Copper rose along with precious metals.

While calm has returned to global markets amid higher confidence that the Brexit vote won't hamper growth, rallies in stocks lost momentum on Wednesday as investors looked for fresh signs that sluggish expansion isn't eroding corporate profits. America's largest lenders begin reporting Thursday. Risk assets had been in demand on speculation central banks will boost stimulus even as the American economy shows signs of accelerating..

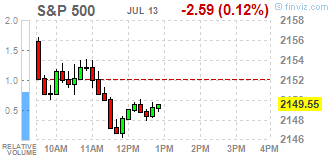

The S&P 500 added less than 0.1 percent at 4 p.m. in New York, edging higher to a third-straight record close. So-called defensive groups that pay higher dividends climbed the most, with telephone, consumer-staples and utility companies rising at least 0.5 percent. Energy shares led declines out of 10 groups, while retailers and banks also retreated.

-

21:01

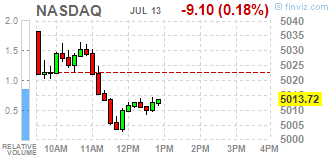

DJIA 18372.70 25.03 0.14%, NASDAQ 5013.43 -9.39 -0.19%, S&P 500 2152.70 0.56 0.03%

-

19:00

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed after a three-day record-setting rally, U.S. stocks took a breather on Wednesday, with investor focus now on corporate reports to see if the higher valuations are justifiable. A strong U.S. jobs report on Friday, easing political tension in Japan and Britain and increased prospects of central banks providing stimulus post Britain's vote to leave the European Union, calmed nerves and boosted faith in equities.

Most of Dow stocks in positive area (17 of 30). Top looser - The Home Depot, Inc. (HD, -1,03%). Top gainer - UnitedHealth Group Incorporated (UNH, +0,97%).

Almost of all S&P sectors in negative area. Top looser - Basic Materials (-1,1%). Top gainer - Utilities (+0,3%).

At the moment:

Dow 18260.00 -4.00 -0.02%

S&P 500 2143.00 -2.75 -0.13%

Nasdaq 100 4567.75 -2.00 -0.04%

Oil 44.93 -1.87 -4.00%

Gold 1343.70 +8.40 +0.63%

U.S. 10yr 1.47 -0.04

-

18:00

European stocks closed: FTSE 6670.40 -10.29 -0.15%, DAX 9930.71 -33.36 -0.33%, CAC 4335.26 3.88 0.09%

-

17:43

WSE: Session Results

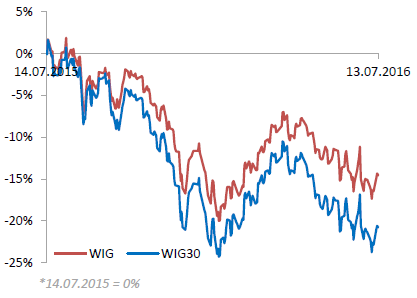

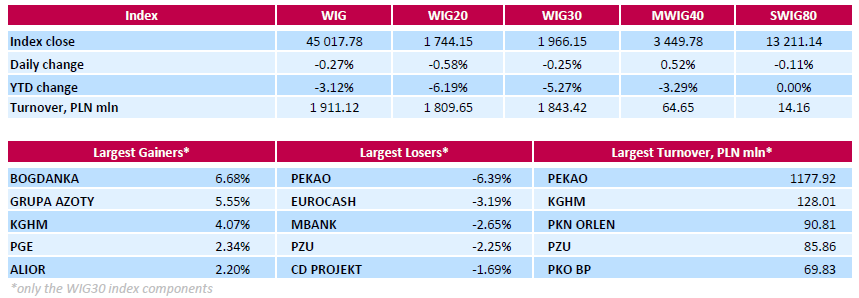

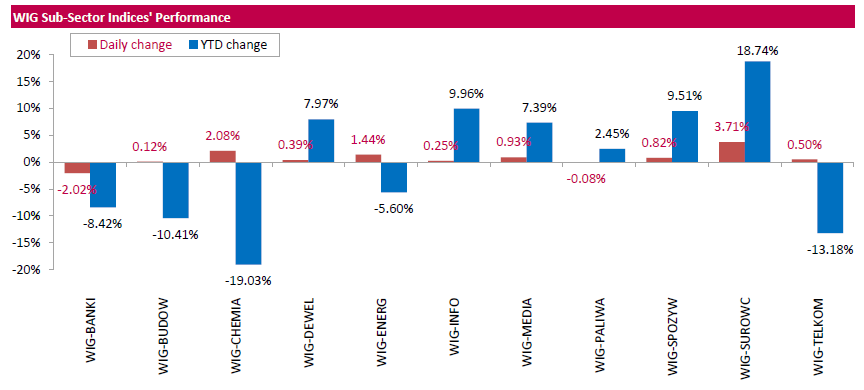

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, lost 0.27%. Except for banking sector (-2.02%) and oil and gas (-0.08%) every sector in the WIG Index rose, with materials (+3.71%) outperforming.

The large-cap stocks' measure, the WIG30 Index, fell by 0.25%. Within the WIG30 Index components, bank PEKAO (WSE: PEO) was hit the hardest, tumbling by 6.39% on the announcement that Italy's biggest bank by assets UniCredit raised €749 mln by placing a 10 percent stake in its Polish subsidiary at a 6 percent discount to the previous session's closing price. Sources familiar with the matter said that most of the stake was sold to foreign investors. After the sale of the stake, UniCredit still holds about 40 percent of PEKAO. Other major losers were FMCG-wholesaler EUROCASH (WSE: EUR), bank MBANK (WSE: MBK) and insurer PZU (WSE: PZU), declining by 3.19%, 2.65% and 2.25% respectively. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB), chemical producer GRUPA AZOTY (WSE: ATT) and copper producer KGHM (WSE: KGH) recorded the strongest daily results, climbing by 6.68%, 5.55% and 4.07% respectively.

-

15:50

WSE: After start on Wall Street

The Wall Street began today's session from the area of yesterday's close, however the DJIA and the S&P500 indices reached new records of all time. The lack of major shifts at the opening was encouraged by neutrally performing exchanges of Euroland. It is worth to remember that the S&P500 is at new levels after amplification of the last days, where in addition to the completion of opportunities over a 2-year consolidation are also some risks. The Wall Street now operates during the season of quarterly results, which always bring with them a dose of hype and technical credibility of the charts decreases. It does not change the fact that the market broke out with several months of consolidation and there is a question about the range increases.

On the Warsaw market, we still have to deal with the weakness of Pekao (WSE: PEO). The company has already lost 6.5 percent, and the lack of any reflection from the bottom of the session weakens index of the largest companies.

-

15:32

U.S. Stocks open: Dow +0.21, Nasdaq +0.21%, S&P +0.19%

-

15:05

Before the bell: S&P futures +0.17%, NASDAQ futures +0.25%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,231.43 +135.78 +0.84%

Hang Seng 21,322.37 +97.63 +0.46%

Shanghai Composite 3,060.21 +10.83 +0.36%

FTSE 6,691.75 +11.06 +0.17%

CAC 4,356.06 +24.68 +0.57%

DAX 9,986.76 +22.69 +0.23%

Crude $46.40 (-0.85%)

Gold $1342.50 (+0.54%)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.76

0.07(0.6548%)

120350

ALTRIA GROUP INC.

MO

69.05

0.18(0.2614%)

782

Amazon.com Inc., NASDAQ

AMZN

747.14

-1.07(-0.143%)

10090

Apple Inc.

AAPL

97.6

0.18(0.1848%)

46895

AT&T Inc

T

42.49

0.08(0.1886%)

9620

Barrick Gold Corporation, NYSE

ABX

21.24

0.62(3.0068%)

187076

Boeing Co

BA

130.81

-0.00(-0.00%)

704

Caterpillar Inc

CAT

79.87

0.07(0.0877%)

4570

Chevron Corp

CVX

106.85

0.07(0.0656%)

7720

Cisco Systems Inc

CSCO

29.56

-0.05(-0.1689%)

1665

Citigroup Inc., NYSE

C

43.3

-0.14(-0.3223%)

19966

E. I. du Pont de Nemours and Co

DD

65.94

0.00(0.00%)

1332

Exxon Mobil Corp

XOM

94.74

-0.21(-0.2212%)

770

Facebook, Inc.

FB

118.2

0.27(0.2289%)

39692

Ford Motor Co.

F

13.45

-0.00(-0.00%)

26361

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.83

-0.07(-0.5426%)

724154

General Electric Co

GE

32.27

0.01(0.031%)

19565

General Motors Company, NYSE

GM

30.61

0.01(0.0327%)

352

Goldman Sachs

GS

156.97

0.05(0.0319%)

1285

Google Inc.

GOOG

721.4

0.76(0.1055%)

2225

Home Depot Inc

HD

134.82

-0.02(-0.0148%)

180

Intel Corp

INTC

35.1

0.16(0.4579%)

22134

JPMorgan Chase and Co

JPM

63.06

-0.14(-0.2215%)

22703

McDonald's Corp

MCD

122.25

0.00(0.00%)

126

Merck & Co Inc

MRK

59.4

-0.20(-0.3356%)

460

Microsoft Corp

MSFT

53.42

0.21(0.3947%)

7399

Nike

NKE

58.04

-0.02(-0.0344%)

400

Pfizer Inc

PFE

36.44

0.20(0.5519%)

3663

Starbucks Corporation, NASDAQ

SBUX

56.55

-0.93(-1.618%)

43980

Tesla Motors, Inc., NASDAQ

TSLA

225.83

1.18(0.5253%)

12507

Twitter, Inc., NYSE

TWTR

18.25

0.15(0.8287%)

43292

UnitedHealth Group Inc

UNH

139.86

0.00(0.00%)

600

Verizon Communications Inc

VZ

55.57

0.10(0.1803%)

6368

Visa

V

77.55

0.07(0.0903%)

3759

Yahoo! Inc., NASDAQ

YHOO

37.88

-0.01(-0.0264%)

1805

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:Microsoft (MSFT) reiterated at Outperform at RBC Capital Mkts; target $61

JMorgan Chase (JPM) initiated with a Sell at Berenberg

Morgan Stanley (MS) initiated with a Hold at Berenberg

Goldman Sachs (GS) initiated with a Hold at Berenberg

Citigroup (C) initiated with a Buy at Berenberg

Bank of America (BAC) initiated with a Buy at Berenberg

Amazon (AMZN) target raised to $915 at The Benchmark Company

-

13:13

WSE: Mid session comment

The morning phase of the session came to the end. Today we have to deal with more than the average volume of trading, while almost PLN 700 million was made on the shares of Pekao (WSE: PEO) and on the other companies from the WIG20 index falls slightly above PLN 200 million. As far as turnover is now more than satisfactory, the variability is already at several points and the WIG20 index fluctuates around the level of 1,750 points.

-

09:47

Major stock exchanges trading mixed: DAX 9,946.77-17.30-0.17%, FTSE 100 6,662.92-19.94-0.30%, CAC 40 4,333.27 + 1.89 + 0.04%

-

09:15

WSE: After opening

The first transactions on future market and changes in the prices of futures on European indices stand under the sign of the lack of large deviations. The market reached peaks of reflection, which appeared after the British referendum and which is a technical resistance. Growing turnover on the approach of the last days may suggest that bigger capital plays under closing of the Brexit gap with which have long ago coped markets in Euroland and emerging markets too.

WIG20 index opened at 1747.31 points (-0.40%)*

WIG 45160.39 0.04%

WIG30 1970.86 -0.01%

mWIG40 3444.38 0.37%

*/ - change to previous close

UniCredit sold 26.2 million shares of Bank Pekao (WSE:PEO) in an accelerated book-building process at a price of PLN 126 per share, for a total amount of Euro 749 mln. Today in the morning values of Pekao are losing more than 4%. The turnover on the PEO is now PLN 55 mln, for the whole WIG20 index is PLN 62 mln.

-

08:33

WSE: Before opening

Tuesday's session on Wall Street ended with joint increases in the major indexes, it was a day of new records for the the DJIA and S&P500 indices. By sectors, best handle the fuel industry. The focus is earnings season in the US, which launched this week. Better-than-expected report was aluminum producer Alcoa, which the company published on Monday. Later in the week its quarterly reports publish among large US banks: JP Morgan on Thursday, on Friday Wells Fargo and Citigroup.

Positive market sentiment will help for price of crude oil. Brent price rose during the session by more than 2.5 percent and reached the level of $ 47.5. Earlier this week, oil prices fell to the lowest level in two months.

From the point of view of European markets closing of trading in the US will not be a surprise. No surprises sessions makes the US less inspiring, although new records of all time have a broader meaning, which may not be ignored and that raises questions about the medium-term consequences of increases of the first two sessions of the week.

Looking at the Warsaw market, the situation is somewhat more complicated. The environment of low interest rates in the US and around the world favors shares in emerging markets, but the ever-present question is, what are the consequences for the economies of Europe will Brexit have. There are also important factors in Poland about the form of changes in the pension system, which short-term effects are dangerous for the Warsaw Stock Exchange and the medium give hope to the output of the Warsaw market out of the shadows depending on the appetites of politicians for the funds accumulated in the pension funds.

-

08:32

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,4%, FTSE 100 -0,4%, CAC 40 -0.4%

-

07:13

Global Stocks

European stocks scored a fourth consecutive win Tuesday, with investors hanging onto brighter prospects for further global stimulus efforts as the markets headed into a new earnings season.

The Stoxx Europe 600 SXXP, +1.06% rose 1.1% to close at 336.26, ending at the highest level since June 23rd, the day of the U.K.'s Brexit vote.

Meanwhile, investors are looking at the potential for an interest-rate cut by the Bank of England when it meets on Thursday. Mark Carney, Bank of England chief, was testifying at a Treasury committee to discuss the central bank's financial stability report.

The Dow Jones Industrial Average finished at a record on Tuesday, joining the S&P 500 index at an all-time closing high as a rally in oil prices and stronger-than-expected earnings from Alcoa Inc. AA, +5.42% vaulted stocks to new heights. The record for the the blue-chip benchmark comes a day after the S&P 500 index SPX, +0.70% set an all-time closing high. The Dow DJIA, +0.66% added 120.74 points, or 0.7%, to 18,347.67, ending at a record for the first time in nearly 14 months. The blue-chip index set an intraday high at 18,371.95. The S&P 500 SPX, +0.70% climbed 14.98 points, or 0.7%, to 2,152.14, a few points off its all-time intraday high of 2,155.49. The Nasdaq Composite COMP, +0.69% advanced 34.18 points, or 0.7% to 5,022.82, erasing its losses in 2016.

Asian shares came within reach of testing their 2016 peak on Wednesday as prospects of solid U.S. growth and accommodative economic policy in major markets whet investors' risk appetite damaged by uncertainty from Brexit.

Japan's Nikkei .N225 gained 1 percent. Australian stocks added 0.3 percent and South Korea's Kospi .KS11 rose 0.6 percent. New Zealand shares .NZ50 were little changed, hovering near a record high struck Tuesday. Shanghai .SSEC advanced 0.3 percent.

-

04:06

Nikkei 225 16,316.52 +220.87 +1.37 %, Hang Seng 21,363 +138.26 +0.65 %, Shanghai Composite 3,059.85 +10.47 +0.34 %

-

00:31

Stocks. Daily history for Jun Jul 12’2016:

(index / closing price / change items /% change)

Nikkei 225 16,095.65 +386.83 +2.46 %

Hang Seng 21,224.74 +344.24 +1.65 %

S&P/ASX 200 5,353.22 +16.11 +0.30 %

Shanghai Composite 3,049.68 +54.76 +1.83 %

FTSE 100 6,680.69 -2.17 -0.03 %

CAC 40 4,331.38 +66.85 +1.57 %

Xetra DAX 9,964.07 +130.66 +1.33 %

S&P 500 2,152.14 +14.98 +0.70 %

NASDAQ Composite 5,022.82 +34.18 +0.69 %

Dow Jones 18,347.67 +120.74 +0.66 %

-