Noticias del mercado

-

22:13

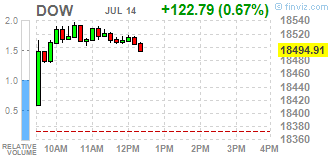

U.S. stocks rose

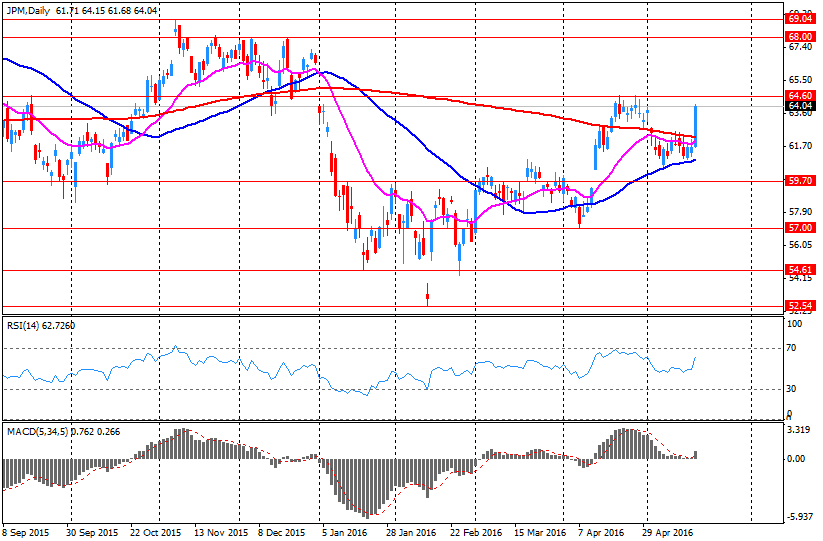

U.S. stocks rose to extend all-time highs, with the S&P 500 Index marking its longest winning streak in four months, as speculation grew for looser global monetary policies while a better-than-forecast profit from JPMorgan Chase & Co. boosted optimism for bank earnings.

JPMorgan climbed 1.5 percent to pace gains in banks, adding fresh momentum to a post-Brexit-vote rally that vaulted equities to records for the first time in more than 13 months. Citigroup Inc. increased 2.6 percent. Yum! Brands Inc. advanced 2.9 percent after its earnings beat estimates and the restaurant-chain operator raised its outlook. Industrial companies extended their longest stretch of gains since 2014.

Global equities climbed Thursday as speculation grew that Japan's Prime Minister Shinzo Abe is contemplating so-called helicopter money, which involves the central bank directly funding government spending. The Bank of England left its key rate at a record low and signaled it's readying stimulus for August as the economy reels from Britain's vote to leave the European Union.

U.S. share prices have added almost $2 trillion since June 27, an amount that ranks among the biggest increases in equity value, as easing concern about economic growth and optimism over earnings combines with speculation the Federal Reserve will hold off raising rates. The S&P 500 has climbed in 10 of the last 12 days, rising 8.2 percent to erase a 5.3 percent plunge following the Brexit referendum.

Injecting a cautionary note into the run-up today, the chief executive of the world's largest asset manager said the current rally may not be justified and won't last unless earnings pick up. "If we don't see better-than-anticipated corporate earnings I think the rally will be short lived," BlackRock Inc.'s Laurence D. Fink said in an interview.

-

21:01

DJIA 18506.45 134.33 0.73%, NASDAQ 5033.63 27.90 0.56%, S&P 500 2163.44 11.01 0.51%

-

18:28

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes scaled new highs on Thursday as JPMorgan's strong results set an upbeat mood for earnings and spurred a rally in financial stocks. While the Bank of England unexpectedly left interest rates unchanged, investors saw hope after the central bank signaled there would be a stimulus program in August, once the impact of Britain's vote to leave the European Union had been assessed.

Most of Dow stocks in positive area (27 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -0,14%). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,49%).

Almost of all S&P sectors in positive area. Top looser - Utilities (-0,6%). Top gainer - Financial (+1,1%).

At the moment:

Dow 18429.00 +141.00 +0.77%

S&P 500 2158.25 +12.25 +0.57%

Nasdaq 100 4587.75 +26.50 +0.58%

Oil 45.62 +0.87 +1.94%

Gold 1329.90 -13.70 -1.02%

U.S. 10yr 1.53 +0.07

-

18:03

European stocks closed: FTSE 6654.47 -15.93 -0.24%, DAX 10068.30 137.59 1.39%, CAC 4385.52 50.26 1.16%

-

17:36

WSE: Session Results

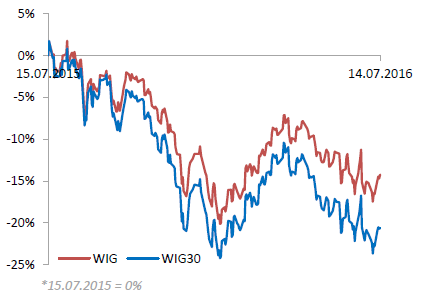

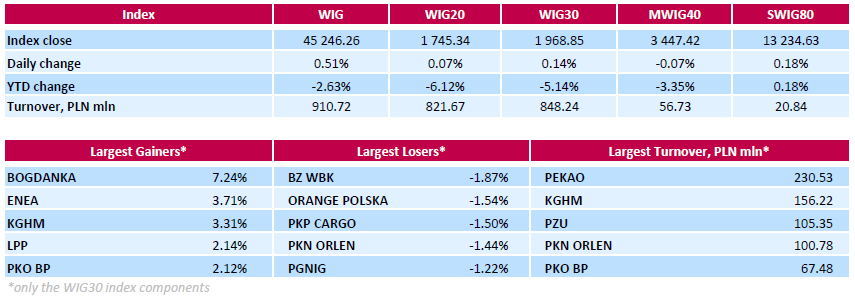

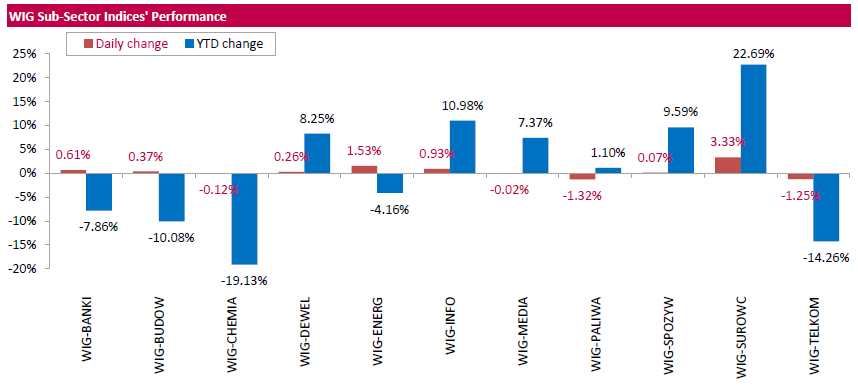

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, added 0.51%. Sector-wise, materials (+3.33%) fared the best, while oil and gas sector (-1.32%) posted the worst result.

The large-cap stocks' measure, the WIG30 Index, advanced 0.14%. Thermal coal miner BOGDANKA (WSE: LWB) kept its position as a growth leader among the large-cap stocks, gaining a further 7.24%. Overall, LWB added more than 25% after four consecutive days of growth. Other major advancers were genco ENEA (WSE: ENA), copper producer KGHM (WSE: KGH), clothing retailer LPP (WSE: LPP) and bank PKO BP (WSE: PKO), surging by 2.12%-3.71%. On the other side of the ledger, the session's biggest laggards were bank BZ WBK (WSE: BZW), telecommunication services provider ORANGE POLSKA (WSE: OPL) and railway freight transport operator PKP CARGO (WSE: PKP), dropping by 1.87%, 1.54% and 1.5% respectively.

-

15:40

WSE: After start on Wall Street

Behind us, a solid beginning of the session on Wall Street. The freedom with which the Americans acquire a new records of seemingly endless bull market is impressive. After Friday's improving of record from May of the last year, this week brings a further strengthening of the market. Similarly today.

On the wave of this optimism indexes in Europe returned to their morning highs (from before the BoE surprise decision about the lack of easing in the UK).

Today, on the horizon there are no events that could disrupt this optimism, so the final phase of the session in Europe may be strong.

-

15:33

U.S. Stocks open: Dow +0.71%, Nasdaq +0.68%, S&P +0.63%

-

15:27

Before the bell: S&P futures +0.75%, NASDAQ futures +0.66%

U.S. stock-index futures rose as speculation grew for looser global monetary policies while a better-than-forecast profit from JPMorgan Chase & Co. boosted optimism for bank earnings.

Global Stocks:

Nikkei 16,385.89 +154.46 +0.95%

Hang Seng 21,561.06 +238.69 +1.12%

Shanghai Composite 3,053.92 -6.77 -0.22%

FTSE 6,701.66 +31.26 +0.47%

CAC 4,395.78 +60.52 +1.40%

DAX 10,085.63 +154.92 +1.56%

Crude $45.66 (+2.03%)

Gold $1,323.60 (-1.49%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

69.07

-0.01(-0.0145%)

4992

3M Co

MMM

180.2

0.99(0.5524%)

687

ALCOA INC.

AA

10.79

0.08(0.747%)

119174

Amazon.com Inc., NASDAQ

AMZN

747.9

5.27(0.7096%)

19367

American Express Co

AXP

63.55

0.45(0.7132%)

24194

AMERICAN INTERNATIONAL GROUP

AIG

54.45

0.64(1.1894%)

7109

Apple Inc.

AAPL

97.4

0.53(0.5471%)

102204

AT&T Inc

T

42.51

-0.08(-0.1878%)

21688

Barrick Gold Corporation, NYSE

ABX

20.4

-0.68(-3.2258%)

199415

Boeing Co

BA

131.05

0.94(0.7225%)

3630

Caterpillar Inc

CAT

80.44

0.75(0.9412%)

3820

Chevron Corp

CVX

107.01

0.36(0.3376%)

2765

Cisco Systems Inc

CSCO

29.91

0.16(0.5378%)

7016

Citigroup Inc., NYSE

C

44.5

1.17(2.7002%)

201571

Deere & Company, NYSE

DE

82.46

-0.50(-0.6027%)

650

Exxon Mobil Corp

XOM

95.09

0.21(0.2213%)

22241

Facebook, Inc.

FB

117.35

0.57(0.4881%)

102863

Ford Motor Co.

F

13.55

0.07(0.5193%)

113990

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.13

0.17(1.3117%)

307018

General Electric Co

GE

32.48

0.12(0.3708%)

44892

General Motors Company, NYSE

GM

30.75

0.12(0.3918%)

8493

Goldman Sachs

GS

160.99

3.07(1.944%)

16271

Google Inc.

GOOG

720.75

3.77(0.5258%)

4863

Home Depot Inc

HD

134.5

0.94(0.7038%)

1900

HONEYWELL INTERNATIONAL INC.

HON

119.5

0.45(0.378%)

100

Intel Corp

INTC

35.38

0.37(1.0568%)

11481

International Business Machines Co...

IBM

157.5

-0.52(-0.3291%)

795

Johnson & Johnson

JNJ

123.25

0.25(0.2033%)

464

JPMorgan Chase and Co

JPM

64.9

1.74(2.7549%)

629613

McDonald's Corp

MCD

123.99

1.17(0.9526%)

1978

Merck & Co Inc

MRK

60.01

0.46(0.7725%)

246

Microsoft Corp

MSFT

54

0.49(0.9157%)

23540

Pfizer Inc

PFE

36.45

0.14(0.3856%)

8166

Procter & Gamble Co

PG

86.7

0.81(0.9431%)

58278

Starbucks Corporation, NASDAQ

SBUX

56.96

0.48(0.8499%)

5447

Tesla Motors, Inc., NASDAQ

TSLA

224.17

1.64(0.737%)

26895

The Coca-Cola Co

KO

45.8

0.06(0.1312%)

6870

Travelers Companies Inc

TRV

118.59

0.59(0.50%)

100

Twitter, Inc., NYSE

TWTR

18

0.26(1.4656%)

155948

UnitedHealth Group Inc

UNH

142.08

0.60(0.4241%)

623

Verizon Communications Inc

VZ

55.8

-0.20(-0.3571%)

5316

Visa

V

78.03

0.57(0.7359%)

3732

Wal-Mart Stores Inc

WMT

73.92

0.30(0.4075%)

810

Walt Disney Co

DIS

100.51

0.63(0.6308%)

987

Yahoo! Inc., NASDAQ

YHOO

37.85

0.21(0.5579%)

8385

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Procter & Gamble (PG) upgraded to Buy from Neutral at UBS; target raised to $96 from $85

Downgrades:

Other: -

13:42

-

13:29

Major stock indexes in Europe show a positive trend

European stocks traded with a moderate increase. Positive impact on the dynamics of trade had statements by the new British Chancellor Philip Hammond. He said he would do whatever is necessary to stabilize the economy and give confidence to the financial markets after the British voted for withdrawal from the European Union structure. In addition, Hammond said that the country does not need an emergency budget, adding that the government will monitor the economic situation during the summer before the announcement of the fiscal plans in the autumn statement.

At the same time, investors are gradually shifting their focus from political risk to the prospects for corporate reporting. Alcoa Inc. in the US and European companies, including Daimler AG and Burberry Group Plc reported better than expected financial results, signaled the start of a strong earnings season.

Today's oil prices rebound after yesterday's fall of more than 4 percent as improved market sentiment, pushing at the European energy companies to the highest level since November 4 last year.

The composite index of the largest companies in the region Stoxx Europe 600 rose 1 percent, cutting the losses suffered after the British announcement of the referendum results, to 2.1 percent.

All 19 industry groups of Stoxx Europe 600 index show an increase. automakers and mining companies are at the head of growth.

The cost of recruiting company Hays Plc jumped 10 percent after the statements that the amount of profit in 2016 may exceed the expert evaluation.

SEB AB quotes climbed 1.3 percent after the lender said second-quarter profit beating analysts' forecasts.

Shares of insurance company Storebrand ASA rose 5.8 percent, as the company reported an increase in premiums and net profit in the 2nd quarter.

At the moment:

FTSE 6,741.34 +70.94 + 1.06%

CAC 4,387.54 +52.28 + 1.21%

DAX 10,081.53 +150.82 + 1.52%

-

13:09

WSE: Mid session comment

The first half of today's trading did not brought any major changes with respect to the opening. The bulls side tried to light approach, but still the behavior of the WSE remaining in the shadow of that observed in the environment, which today surprises very positively. Contracts in the US gain about 0.9% and the German DAX is rising by almost 1.5%.

The Warsaw market for some time is not too strong, and this week waiting for Friday's decision by the Fitch agency is an additional negative factor. Other agencies have already changed the rating level (S& P) or attitude (Moody's), so the last Fitch will certainly be under pressure to also make some changes. Regardless of this, the attitude of foreign investors remain very cautious and it inhibits demand, the consequences of which may be seen on the market every day.

KGHM shares recovered quite well of the dividend cut today. Worse in this respect cope PKN Orlen, which, not counting the "after-Braxit" slump, for a while may have the lowest since March quotations.

At the halfway point of the session, the WIG20 index was at the level of 1,735 points (-0,49%) and with turnover in the amount of PLN 365 mln.

-

09:43

Major stock exchanges gaining in early trading: DAX 10,091.5 + 160.79 + 1.62%, FTSE 100 6,737.45 + 56.76 + 0.85%, CAC 40 4,388.91 + 53.65 + 1.24%

-

09:25

WSE: After opening

WIG20 index opened at 1740.03 points (-0.24%)*

WIG 45197.13 0.40%

WIG30 1964.89 -0.06%

mWIG40 3452.18 0.07%

*/ - change to previous close

The cash market opened with decrease of -0.24% to 1,740 points, what with the increasing of the WIG index and contracts clearly demonstrates the impact of severed dividends from PKN Orlen (WSE: PKN, PLN 2,00)and KGHM (PLN 1,50). The German DAX rises by almost 1.5%, while the US futures gain of 0.5%. The mood is very good, and in this context, the Warsaw Stock Exchange once again stands out from the pack, where the WIG20 could not break out of the level of 1,750 points, at which, from Monday's growth, we still are.

-

08:49

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0,1%, FTSE 100 + 0,1%, CAC 40 + 0.2%

-

07:16

Global Stocks

European stocks scored a fourth consecutive win Tuesday, with investors hanging onto brighter prospects for further global stimulus efforts as the markets headed into a new earnings season.

The Stoxx Europe 600 SXXP, -0.13% rose 1.1% to close at 336.26, ending at the highest level since June 23rd, the day of the U.K.'s Brexit vote.

Investors are looking at the potential for an interest-rate cut by the Bank of England when it meets on Thursday. Mark Carney, Bank of England chief, was testifying at a Treasury committee to discuss the central bank's financial stability report.

U.S. stocks ticked up on Wednesday, just enough for the S&P 500 and Dow industrials to set record highs, with investors expecting upbeat earnings to keep the rally going.

Wall Street shares have quickly recovered the losses triggered by Britain's vote on June 23 to leave the European Union, driven by solid U.S. economic data.

Asian shares remained near an eight-month high on Thursday as investors bet the Bank of England will cut rates to ward off recession following Britain's vote to leave the European Union.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent, hovering near the highest level since November it reached on Wednesday. Japan's Nikkei .N225 added 0.8 percent.

Chinese stocks, however, were lower, with the CSI 300 index .CSI300 slipping 0.3 percent and the Shanghai Composite .SSEC down 0.4 percent. Hong Kong's Hang Seng .HSI was little changed.

-

04:04

Nikkei 225 16,282.67 +51.24 +0.32 %, Hang Seng 21,263.59 -58.78 -0.28 %, Shanghai Composite 3,054.53 -6.16 -0.20 %

-

01:03

Stocks. Daily history for Jun Jul 13’2016:

(index / closing price / change items /% change)

Nikkei 225 16,231.43+135.78+0.84%

Hang Seng 21,322.37+97.63+0.46%

S&P/ASX 200 5,388.54+35.32+0.66%

Shanghai Composite 3,060.21+10.83+0.36%

FTSE 100 6,670.4 -10.29 -0.15 %

CAC 40 4,335.26 +3.88 +0.09 %

Xetra DAX 9,930.71 -33.36 -0.33 %

S&P 500 2,152.43 +0.29 +0.01 %

NASDAQ Composite 5,005.73 -17.09 -0.34 %

Dow Jones 18,372.12 +24.45 +0.13 %

-