Noticias del mercado

-

21:00

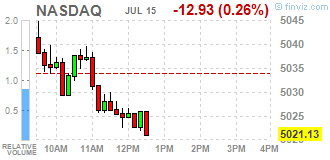

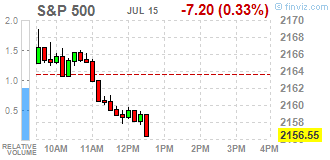

DJIA 18509.06 2.65 0.01%, NASDAQ 5027.24 -6.82 -0.14%, S&P 500 2160.92 -2.83 -0.13%

-

18:42

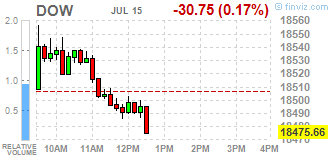

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes slightly fell on Friday, hitting new highs after strong U.S. retail sales data and a rise in biotech stocks, offset disappointing results from big banks. Retail sales rose more than expected in June as Americans bought motor vehicles and a variety of other goods, reinforcing views that economic growth picked up in the second quarter.

Most of Dow stocks in negative area (20 of 30). Top looser - Microsoft Corporation (MSFT, -0,87%). Top gainer - UnitedHealth Group Incorporated (UNH, +0,77%).

Almost of all S&P sectors in negative area. Top looser - Basic Materials (-0,6%). Top gainer - Industrial goods (+0,6%).

At the moment:

Dow 18411.00 -16.00 -0.09%

S&P 500 2152.50 -4.75 -0.22%

Nasdaq 100 4579.00 -11.00 -0.24%

Oil 45.83 +0.15 +0.33%

Gold 1331.40 -0.80 -0.06%

U.S. 10yr 1.59 +0.06

-

18:00

European stocks closed: FTSE 6665.00 10.53 0.16%, DAX 10058.70 -9.60 -0.10%, CAC 4366.47 -19.05 -0.43%

-

17:37

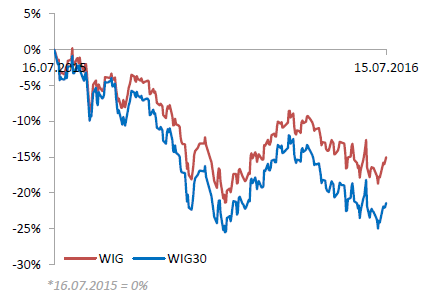

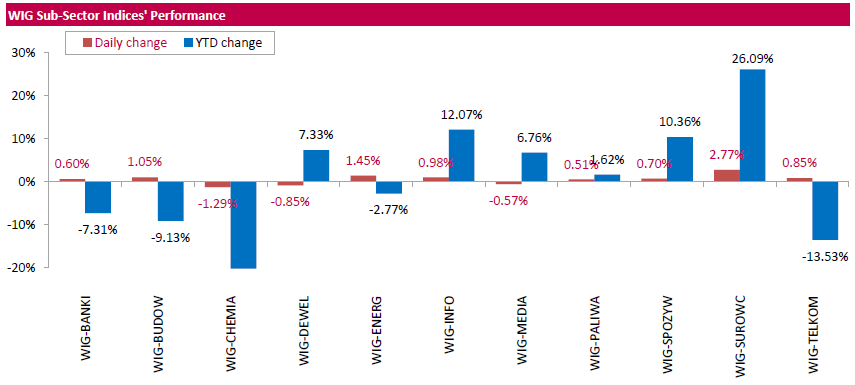

WSE: Session Results

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 0.65%. 8 out of 11 sectors in the WIG rose, with materials (+2.77%) outperforming.

The large-cap companies' measure, the WIG30 Index, surged by 0.71%. Within the index components, the advancers pack was led by videogame developer CD PROJEKT (WSE: CDR) and thermal coal miner BOGDANKA (WSE: LWB), which climbed by 6.24% and 6.22% respectively. Other biggest advancers were railway freight transport operator PKP CARGO (WSE: PKP), genco ENEA (WSE: ENA), coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), which added between 2.58% and 4.92%. On the other side of the ledger, the session's weakest performers were chemical producer GRUPA AZOTY (WSE: ATT) and property developer GTC (WSE: GTC), which lost 2.61% and 2.51% respectively.

-

17:03

Wall-Street: Citigroup (C) and JPMorgan Chase & Co (JPM) beats expectations. Citi earned $ 4.3 billion from trading in the 1st quarter

Despite the decline in quarterly revenue and profit, the banks results were better than Wall Street expectations.

Citigroup Inc. on Friday reported a better-than-expected results, despite the 14% decline in profits compared to the same period last year.

In the second quarter, excluding adjustments, the bank's profit fell to $ 4 billion from $ 4.65 billion a year earlier, as the ultra-low interest rates continue to put pressure on profits in the industry. CEO Michael Korbat said in a statement that the results "demonstrate our ability to generate solid earnings in a challenging and changing environment."

Earnings per share were $ 1.24, versus $ 1.10 expected by analysts polled by Thomson Reuters. These expectations have decreased in the beginning of the year and continued to decline after the Brexit vote.

Citigroup's revenue also slightly exceeded expectations and amounted to $ 17.55 billion, compared with analysts' estimates of $ 17.47 billion. However, the revenue decreased by 8% compared to the same period last year, showing the second consecutive quarterly decline. Over the past six quarters, Citigroup showed revenue growth only once.

The last eighteen months have been relatively calm for Citigroup, which paid for legal services and regulations faced for many years. In general, the profit was better than the expectations of Mr. Korbata last month, when he said that second-quarter earnings will be flat compared with the first quarter. In the first quarter profit totaled $ 3.5 billion.

Last year the bank received the largest annual profit in almost ten years, but this year the price of its stocks taken a beating. Mr. Korbat said that the stock price has fallen in part because of misconceptions about the emerging markets, where Citigroup has a large presence, as well as the history of the bank during the financial crisis.

Citigroup results followed a pattern similar to J.P. Morgan Chase & Co: a jump in trading activity in bonds and currencies, as well as a decline in investment banking activities.

In the last quarter, Citigroup trading income increased by 15% to $ 4.3 billion from $ 3.7 billion a year earlier. Citigroup's revenue from trading bonds, currencies and commodities increased by 14%.

Investment banking revenue fell to $ 1.22 billion from $ 1.29 billion a year earlier.

Profit consumer business fell by 18%.

Block Citi Holdings, where the bank keeps business and loans, which he wants to sell, continues to receive less profit. Together with the profit, assets continued to decline to $ 66 billion from $ 125 billion a year earlier.

Expenses decreased by 5%, to $ 10.4 billion from $ 10.9 billion a year earlier, although the decline was less than the drop in revenue of 8%. The bank has cut 8% of its jobs and 4% of its branches.

This year, the bank's shares fell 14%.

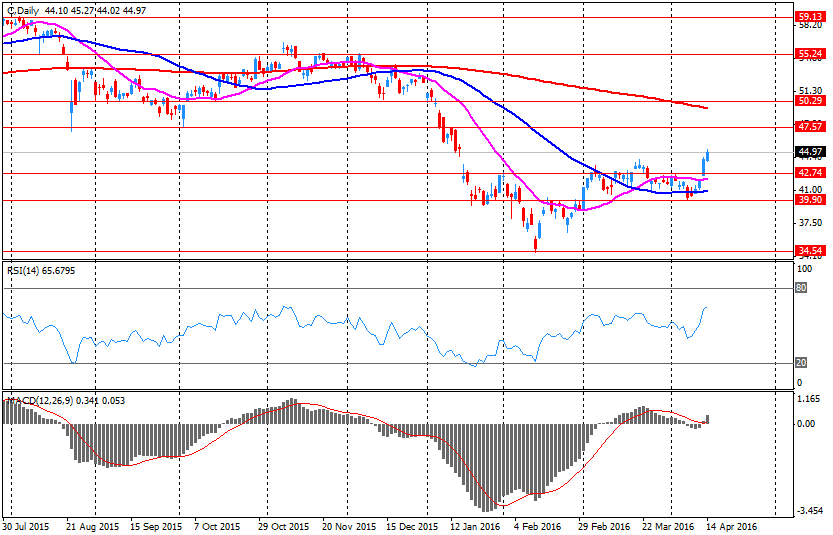

Currently, shares of Citigroup Inc. (C) traded at $ 44.46 (+ 0.02%)

-

15:48

WSE: After start on Wall Street

The Americans started the trade of the appointment with the next, the sixth in a row in the last days of the record of endless bull market.

Published today the results of Citi were slightly better than expected and Wells Fargo actually in line with expectations. After yesterday's good report of JP Morgan will be difficult for some serious, positive reaction, while the financial sector gained 0.9 percent yesterday and was the strongest on Wall Street. In the package of other data from the US, the June retail sales have decided that the data should be assessed as exceeding expectations. The result was a slight strengthening of the dollar.

-

15:33

U.S. Stocks open: Dow +0.23%, Nasdaq +0.17%, S&P +0.21%

-

15:28

Before the bell: S&P futures +0.13%, NASDAQ futures +0.05%

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 16,497.85 +111.96 +0.68%

Hang Seng 21,659.25 +98.19 +0.46%

Shanghai Composite 3,053.68 -0.33 -0.01%

FTSE 6,638.74 -15.73 -0.24%

CAC 4,362.73 -22.79 -0.52%

DAX 10,041.32 -26.98 -0.27%

Crude $46.09 (+0.90%)

Gold $1330.70 (-0.11%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.71

0.00(0.00%)

46556

ALTRIA GROUP INC.

MO

68.99

0.07(0.1016%)

730

Amazon.com Inc., NASDAQ

AMZN

743

1.80(0.2428%)

3936

American Express Co

AXP

63.24

-0.37(-0.5817%)

293

AMERICAN INTERNATIONAL GROUP

AIG

53.76

-0.64(-1.1765%)

400

Apple Inc.

AAPL

98.62

-0.17(-0.1721%)

44388

AT&T Inc

T

42.8

0.03(0.0701%)

2930

Barrick Gold Corporation, NYSE

ABX

21.33

-0.14(-0.6521%)

81694

Caterpillar Inc

CAT

80.05

-0.01(-0.0125%)

721

Cisco Systems Inc

CSCO

29.82

0.06(0.2016%)

1092

Citigroup Inc., NYSE

C

44.98

0.53(1.1923%)

864589

Exxon Mobil Corp

XOM

95.14

0.19(0.2001%)

1791

Facebook, Inc.

FB

117.45

0.16(0.1364%)

48665

Ford Motor Co.

F

13.6

0.01(0.0736%)

11299

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.1

0.15(1.1583%)

100706

General Electric Co

GE

32.66

0.03(0.0919%)

13743

General Motors Company, NYSE

GM

30.57

-0.19(-0.6177%)

771

Goldman Sachs

GS

162.55

0.01(0.0062%)

3497

Google Inc.

GOOG

721.16

0.21(0.0291%)

1163

Home Depot Inc

HD

135

0.46(0.3419%)

2040

Intel Corp

INTC

35.12

-0.08(-0.2273%)

8244

International Business Machines Co...

IBM

159.4

-0.88(-0.549%)

2467

Johnson & Johnson

JNJ

123.2

0.02(0.0162%)

500

JPMorgan Chase and Co

JPM

64.38

0.26(0.4055%)

22887

Microsoft Corp

MSFT

53.86

0.12(0.2233%)

5841

Pfizer Inc

PFE

36.85

-0.07(-0.1896%)

11739

Procter & Gamble Co

PG

86

0.13(0.1514%)

548

Starbucks Corporation, NASDAQ

SBUX

57.6

0.01(0.0174%)

4725

Tesla Motors, Inc., NASDAQ

TSLA

221.46

-0.07(-0.0316%)

3823

The Coca-Cola Co

KO

45.8

0.11(0.2408%)

3797

Twitter, Inc., NYSE

TWTR

17.94

-0.02(-0.1114%)

31903

United Technologies Corp

UTX

105

-0.14(-0.1332%)

284

Visa

V

77.44

-0.70(-0.8958%)

6560

Wal-Mart Stores Inc

WMT

73.7

-0.00(-0.00%)

355

Walt Disney Co

DIS

99.81

-0.16(-0.1601%)

1586

Yahoo! Inc., NASDAQ

YHOO

38.11

0.15(0.3952%)

2650

Yandex N.V., NASDAQ

YNDX

22.29

0.32(1.4565%)

1658

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:Microsoft (MSFT) reiterated at an Outperform at BMO Capital; target $57

-

14:33

Company News: Wells Fargo (WFC) posts Q2 financials in line with analysts' estimates

Wells Fargo reported Q2 FY 2016 earnings of $1.01 per share (versus $1.03 in Q2 FY 2015), in-line with analysts' consensus estimate of $1.01.

The company's quarterly revenues amounted to $22.162 bln (+4% y/y), generally in-line with consensus estimate of $22.092 bln.

WFC fell to $48.45 (-1.00%) in pre-market trading.

-

14:26

Company News: Citigroup (C) Q2 EPS beat analysts’ expectations

Citigroup reported Q2 FY 2016 earnings of $1.24 per share (versus $1.45 in Q2 FY 2015), beating analysts' consensus of $1.10.

The company's quarterly revenues amounted to $17.548 bln (-9.9% y/y), generally in-line with consensus estimate of $17.483 bln.

C rose to $44.90 (+1.01%) in pre-market trading.

-

13:03

WSE: Mid session comment

The morning phase of the session in Warsaw was developed entirely in mind of bulls. After the morning strengthening and reaching a week maximum, the market for the next trading hours did not give up the external pressure in the form of declines in the major European markets and calmly maintained similar to the maximum levels. This means that the demand took control and bulls are the favored side for the second half of the session. The drop in the DAX by 0.6 percent is accompanied by an increase in the WIG20 by 0.7 percent.

At the halfway point of the session the WIG20 index was at the level of 1,757 points (+0,67%).

-

12:39

Major stock indexes in Europe show a negative trend

European stocks traded in the red zone after a long period of growth since the terrorist attack in France put pressure on shares of tourist agencies. The negative impact on the market also had a weak financial statements of some companies in the region.

"The attack in Nice is truly a terrible event, but in terms of market reaction, these types of shocks are generally short-lived, -. Said Michael Kappler, an expert Mittelbrandenburgische Sparkasse -. The fall of shares is also associated with a partial profit-taking after rising over the past few days. Now in the center of attention again, are central banks - investors are waiting for signals on how they are going to cope with the consequences of Brexit. Financial statements of European and American companies, also affects the dynamics of trading.

Market participants also drew attention to the data on the euro zone and Britain. The statistical agency Eurostat reported that in June, consumer prices in the eurozone rose by 0.2% after rising 0.4% in May. Meanwhile, annual inflation rose in June by 0.1% after falling 0.1% the previous month. Last Change (MoM and YoY) in line with expectations and preliminary estimate. Recall that in June 2015, annual inflation was 0.1%. The base index, which excludes energy and food prices, rose 0.9% year on year, confirming forecasts. Recall that in May, the index increased by 0.8%. Among the EU countries, annual inflation remained unchanged after falling 0.1% in May.

Meanwhile, the report submitted by the Office for National Statistics showed that in May, the volume of production in the construction sector decreased by 2.1% compared to April. Analysts had expected that the volume of construction to decrease by 1.1% after rising 2.8% in April (revised from + 2.5%). Housing construction fell by 3.2 percent in May, recording the biggest drop since February, 2014. In addition, data showed -1.9 percent after declining 0.6 percent in annual terms, construction output fell in May in April. Economists had expected a decline of 3.5 percent. In the period from March to May, construction decreased by 2.1% compared with the previous three months (December 2015 to February 2016 on. On an annual basis (March to May), construction fell by 1.7%.

The composite index of the largest companies in the region Stoxx Europe 600 companies fell by 0.4 percent.

Travel and leisure shares shows the largest decline among the 19 industry groups.

Shares of EasyJet Plc, Thomas Cook Group Plc and hotel operator Accor SA fell at least 2.1 percent.

Capitalization of Swatch Group AG fell 12 percent as the company said that weak demand for watches in Hong Kong, France and Switzerland led to a decrease in the volume of profits. Meanwhile. Peer Richemont price fell by 4.8 percent.

Shares of precious metals producers Fresnillo Plc and Randgold Resources Ltd., which rose in price against the background of increasing demand for safe-haven assets after Brexit today fell by at least 2.4 percent.

The cost of Swedish Orphan Biovitrum AB rose 3.7 percent after reports that the amount of quarterly profit and sales surpassed the expectations.

At the moment

FTSE 6,642.88 -11.59 -0.17%

CAC 4,359.76 -25.76 -0.59%

DAX 10,024.52 -43.78 -0.43%

-

09:23

Major stock markets down in early trading: DAX 10,016.76-51.54-0.51%, FTSE 100 6,632.13-38.27-0.57%, CAC 40 4,359.49-26.03-0.59%

-

09:17

WSE: After opening

WIG20 index opened at 1746.76 points (+0.08%)

WIG 45243.97 -0.01%

WIG30 1968.14 -0.04%

mWIG40 3446.01 -0.04%

*/ - change to previous close

Start of the cash market with virtually zero change on the WIG20 index may be considered as successful whereas the market yesterday was drawn up at the final fixing. Maintaining yesterday's value largely owe to shares of PKN Orlen, which after a weak session yesterday today grow by 0.8 percent. For now, the beginning of the session looks good, also in the context of the initial disadvantages of parquets in Euroland.

-

08:51

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,4%, FTSE 100 -0,4%, CAC 40 -0.6%

-

08:24

WSE: Before opening

Thursday's session on Wall Street ended with increases in most indices. The market responded positively to the earnings of the banking sector and the S&P500 reported on the new record of all time. At night, better than expected readings from China were published, regarding GDP, industrial production and retail sales. It may improve mood in early European trading. In the following hours investor's attention should move again on Wall Street, where there will be quarterly results of other banks - the most important are Wells Fargo&Company and Citigroup - which will compete for attention with readings of inflation (CPI) and retail sales.

On the Warsaw market the WIG20 index caught short of breath in the region of 1,750 points and in the area of the gap, which appeared on the chart after the reaction to the outcome of the referendum in the UK. This hesitation is partly the result of negative coincidences - the sale of Pekao by UniCredit and cutting of dividends from PKN and KGHM shares - but does not change the fact that the market does not seem to have the idea and the base on which may build further increases. In fact, there are many reasons for the increases. Good posture of emerging markets and records on Wall Street, however, losing to local factors, which again appears today in the form of a rating for Poland from Fitch.

-

07:17

Global Stocks

Stocks across Europe advanced Thursday, remaining on higher ground after the Bank of England surprised markets by holding its key interest rate unchanged, in the central bank's first monetary-policy decision after the U.K.'s historic Brexit vote.

In a widely unexpected move, the Bank of England left unchanged its key interest rate at a record low of 0.5%. Markets had priced in the chances of the first rate cut since March 2009 as policy makers are seeing a "challenging" outlook for the British economy after the U.K.'s June 23 vote to exit the European Union.

U.S. stocks extended their run into the record books Thursday as the Dow industrials and the S&P 500 notched new closing highs.

Stronger-than-expected results from large financial institutions, including J.P. Morgan Chase, as well as upbeat economic data, powered the climb, which has added to a record run by stocks.

The S&P 500 SPX, +0.53% rose 11.32 points, or 0.5%, to close at 2,163.75, with the financial, materials, and tech sectors leading the gains. The benchmark index reached an intraday high of 2,168.99. The index closed at an all-time high for a fourth-straight day, its longest such streak since November 2014, according to Dow Jones data.

The Dow industrials DJIA, +0.73% advanced 134.29 points, or 0.7%, to close at 18,506.41, after touching an intraday high of 18,537.57. The blue-chip gauge has registered its third straight record close.

The Nasdaq Composite Index COMP, +0.57% advanced 28.33 points, or 0.6%, to finish at 5,034.06, for its highest close of 2016. For the year, the index is up 0.5%.

Asian shares extended gains to eight-month highs on Friday, on track for a solid weekly rise, as better-than-expected economic data from China lifted risk sentiment that was already buoyant after record highs on Wall Street.

China's economy grew 6.7 percent in the second quarter from a year earlier, steady from the first quarter and slightly better than expected as the government stepped up efforts to stabilize growth in the world's second-largest economy.

Industrial output and retail sales also beat forecasts, which helped alleviate fears of slowing momentum, though fixed-asset investment growth slipped and missed market expectations.

-

04:03

Nikkei 225 16,529.92 +144.03 +0.88 %, Hang Seng 21,550.68 -10.38 -0.05 %, Shanghai Composite 3,060.35 +6.33 +0.21 %

-

00:32

Stocks. Daily history for Jun Jul 14’2016:

(index / closing price / change items /% change)

Nikkei 225 16,385.89 +154.46 +1.0 %

Hang Seng 21,561.06 +238.69 +1.1 %

S&P/ASX 200 5,411.61 +23.07 +0.4 %

Shanghai Composite 3,053.92 -6.77 -0.2 %

FTSE 100 6,654.47 -15.93 -0.2 %

CAC 40 4,385.52 +50.26 +1.2 %

Xetra DAX 10,068.3 +137.59 +1.4 %

S&P 500 2,163.75 +11.32 +0.5 %

NASDAQ Composite 5,034.06 +28.33 +0.6 %

Dow Jones 18,506.41 +134.29 +0.7 %

-