Noticias del mercado

-

22:08

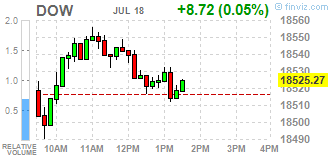

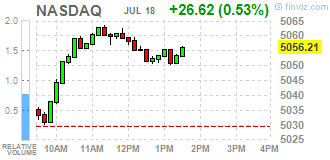

Major US stock indexes finished trading in the green zone

Major stock indexes Wall Street gained slightly on Monday amid better-than-expected quarterly results report.

In addition, it became known that the index of builders confidence in the market of newly built, single-family homes in July fell by one point to 59 from June's reading of 60. "Over the past six months, the confidence builders remained in a relatively narrow range of positive, consistent with the continuing gradual housing market recovery that is underway, "said NAHB Chairman Ed Brady. "Nevertheless, we are still hearing reports from our members about the weakness in some markets, largely due to regulatory restrictions and the lack of land and labor."

Oil prices fell by about 2%, as the increase in oil and gasoline has strengthened concerns about oversupply. Today, the company Genscape reported that oil reserves in the terminal Cushing, Oklahoma, rose by 26,460 barrels for the week ended July 15th. Meanwhile, Morgan Stanley experts said they expected soon to a significant reduction in demand for oil from the refinery, which will eventually lead to an increase in reserves and will have a significant pressure on prices. Also at Morgan Stanley noted that it is still expected to change the balance of demand and supply of oil by mid-2017.

DOW index components finished trading in different directions (17 black, 13 red). Outsider were shares of Merck & Co. Inc. (MRK, -1,06%). More remaining stocks grown E. I. du Pont de Nemours and Company (DD, + 1,32%).

Almost all sectors of the S & P showed an increase. The leader turned out to be the technology sector (+ 0.9%). Decreased only the industrial goods sector (-0.1%).

At the close:

Dow + 0.08% 18,532.06 +15.51

Nasdaq + 0.52% 5,055.78 +26.19

S & P + 0.23% 2,166.79 +5.05

-

21:00

Dow +0.11% 18,536.00 +19.45 Nasdaq +0.61% 5,060.46 +30.87 S&P +0.27% 2,167.54 +5.80

-

19:36

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes eked out gains on Monday as Bank of America's better-than-expected profit boosted optimism about the U.S. quarterly earnings season, but not by enough to send the Dow and the S&P 500 to fresh highs.

Dow stocks mixed (15 vs 15). Top looser - Caterpillar Inc. (CAT, -1,43%). Top gainer - The Home Depot, Inc. (HD, +1,15%).

S&P sectors also mixed. Top looser - Industrial Goods (-0,2%). Top gainer - Technology (+0,7%).

At the moment:

Dow 18440.00 +23.00 +0.12%

S&P 500 2158.50 +5.75 +0.27%

Nasdaq 100 4611.50 +32.25 +0.70%

Oil 45.93 -0.72 -1.54%

Gold 1328.50 +1.10 +0.08%

U.S. 10yr 1.58 -0.0

-

18:00

European stocks closed: FTSE 100 6,695.42 +26.18 +0.39% CAC 40 4,357.74 -14.77 -0.34% DAX 10,063.13 -3.77 -0.04%

-

17:39

WSE: Session Results

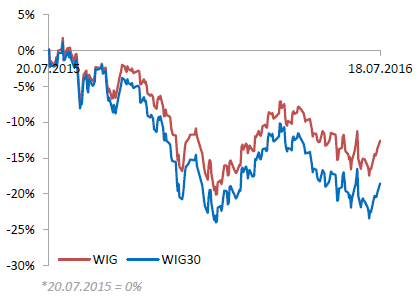

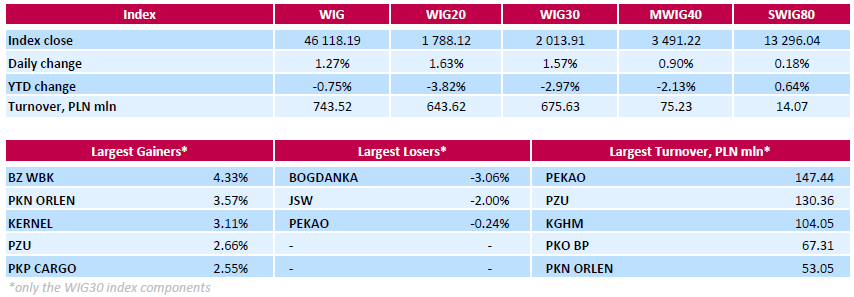

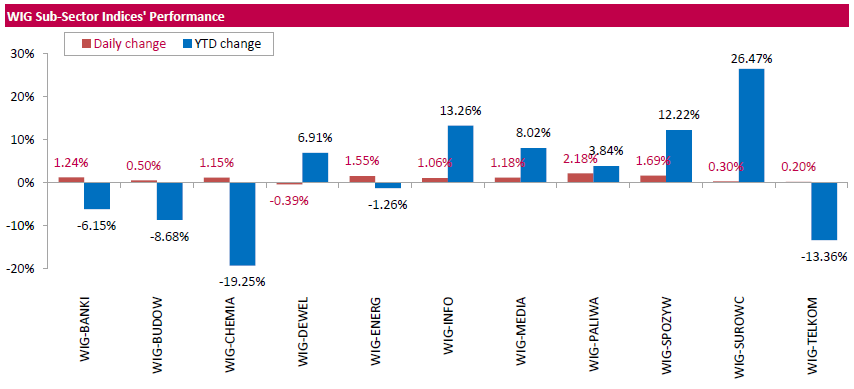

Polish equity closed higher on Monday. The broad market measure, the WIG Index, surged by 1.27%. Developing sector (-0.39%) was sole decliner within the WIG Index, while oil and gas (+2.18%) outpaced.

The large-cap stocks' benchmark, the WIG30 Index, grew by 1.57%. There were only three decliners among the index components. Thermal coal miner BOGDANKA (WSE: LWB) recorded the biggest drop of 3.06%, retreating after last week's energetic bounce. Other underperformers were coking coal producer JSW (WSE: JSW) and bank PEKAO (WSE: PEO), falling by 2% and 0.24% respectively. On the other side of the ledger, bank BZ WBK (WSE: BZW) topped the list of outperformers, climbing by 4.33%. It was followed by oil refiner PKN ORLEN (WSE: PKN), agricultural producer KERNEL (WSE: KER) and insurer PZU (WSE: PZU), jumping by 3.57%, 3.11% and 2.66% respectively.

-

15:47

WSE: After start on Wall Street

From the morning the Warsaw market is clearly controlled by demand side, which naturally enjoys the bulls camp. The reasons for joy may derive from comparison today's preserve of our parquet against neutral Euroland. It is also needed to add the strength of the zloty and stronger performance of the debt market in Poland.

The market in the US, as well as trading in Euroland, took off flat. It is worth to remember, that the S&P500 is still at the top of the bull market and the demand not really can afford at this point to allow for a moment of hesitation, as taught by the experience of previous years, market participants can quickly and willingly accede to increase activity on the short side of the market.

-

15:32

U.S. Stocks open: Dow +0.04%, Nasdaq +0.11%, S&P +0.07%

-

15:14

Before the bell: S&P futures +0.22%, NASDAQ futures +0.22%

U.S. stock-index futures rose, erasing losses triggered by the failed military coup in Turkey.

Global Stocks:

Nikkei Closed.

Hang Seng 21,803.18 +143.93 +0.66%

Shanghai Composite 3,043.91 -10.39 -0.34%

FTSE 6,690.58 +21.34 +0.3%

CAC 4,352.44 -20.07 -0.5%

DAX 10,048.08 -18.82 -0.2%

Crude $45.50 (-0.98%)

Gold $1326.60 (-0.06%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

736.05

0.61(0.0829%)

27438

AMERICAN INTERNATIONAL GROUP

AIG

54.08

-0.36(-0.6613%)

100

Cisco Systems Inc

CSCO

29.95

0.13(0.436%)

1006

Citigroup Inc., NYSE

C

44.42

0.09(0.203%)

20198

Deere & Company, NYSE

DE

83.53

0.12(0.1439%)

100

Exxon Mobil Corp

XOM

94.82

-0.30(-0.3154%)

925

Facebook, Inc.

FB

117.2

0.34(0.2909%)

52558

Ford Motor Co.

F

13.57

-0.00(-0.00%)

43680

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.9

-0.21(-1.6018%)

82851

General Motors Company, NYSE

GM

30.8

0.03(0.0975%)

1653

Google Inc.

GOOG

721.01

1.16(0.1611%)

901

JPMorgan Chase and Co

JPM

64.2

0.02(0.0312%)

3215

Merck & Co Inc

MRK

59.2

-0.43(-0.7211%)

437

Microsoft Corp

MSFT

53.78

0.08(0.149%)

13439

Nike

NKE

57.87

-0.00(-0.00%)

7528

Pfizer Inc

PFE

36.67

-0.10(-0.272%)

8615

Starbucks Corporation, NASDAQ

SBUX

57.5

0.09(0.1568%)

650

Tesla Motors, Inc., NASDAQ

TSLA

219.74

-0.66(-0.2995%)

16620

The Coca-Cola Co

KO

45.7

0.07(0.1534%)

3380

Twitter, Inc., NYSE

TWTR

18.28

0.20(1.1062%)

89329

Yahoo! Inc., NASDAQ

YHOO

37.83

0.11(0.2916%)

8042

Yandex N.V., NASDAQ

YNDX

21.56

0.13(0.6066%)

600

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Merck (MRK) downgraded to Market Perform from Outperform at BMO Capital; target $62

Other:Intel (INTC) target raised to $36 from $34 at RBC Capital Mkts

Intel (INTC) target raised to $40 from $38 at Canaccord Genuity

Yandex N.V. (YNDX) initiated with a Buy at HSBC Securities

-

13:45

Major stock indices in Europe trading mixed in a quiet session

European stocks traded mixed on the news of the failure of the military coup in Turkey and M&A deals.

Investors are cautiously watching developments in Turkey after the failed attempt of a military coup last weekend.

On Sunday, the Turkish government announced the full restoration of control over the country and the economy after the collapse of an alleged military coup on Friday evening to overthrow President Erdogan.

Over the weekend, the government arrested some 6,000 military and judges, who are suspected of involvement in the coup

At the same time, oil prices traded without major dynamics, fluctuating between growth and decline, amid signs of continued recovery of drilling activity in the US.

The composite index of Europe's largest enterprises Stoxx 600 rose by 0.14% - to 338.39 points.

Quotes of British ARM Holdings jumped 43%, as the Japanese mobile operator SoftBank bought the company for $ 32 billion, which means a premium on close of trading last Friday, about 43%.

Shares of oil services group SBM Offshore, based in the Netherlands, grew by 12% after reaching an agreement on the settlement of an investigation of bribery in Brazil.

The price of shares of the largest Italian bank Unicredit SpA increased by 3%, Intesa Sanpaolo - by 1.6%.

Norwegian Marine Harvest ASA, the world's leading producer of Atlantic salmon, added 2.4%. The company expects to reduce the catch of fish this year, which is likely to lead to further price increases, which, in June, updated the historical maximum.

At the same time the market value of the Swedish Ericsson AB decreased by 2.9%. According to the newspaper Svenska Dagbladet, Ericsson, probably overstated revenue figures.

The course of the securities of the largest operator of container traffic in Germany's Hapag-Lloyd AG fell by 10% due to the announcement of the expected reduction of profit in 2016.

At the moment

FTSE 6692.39 23.15 0.35%

DAX 10057.54 -9.36 -0.09%

CAC 4360.68 -11.83 -0.27%

-

13:23

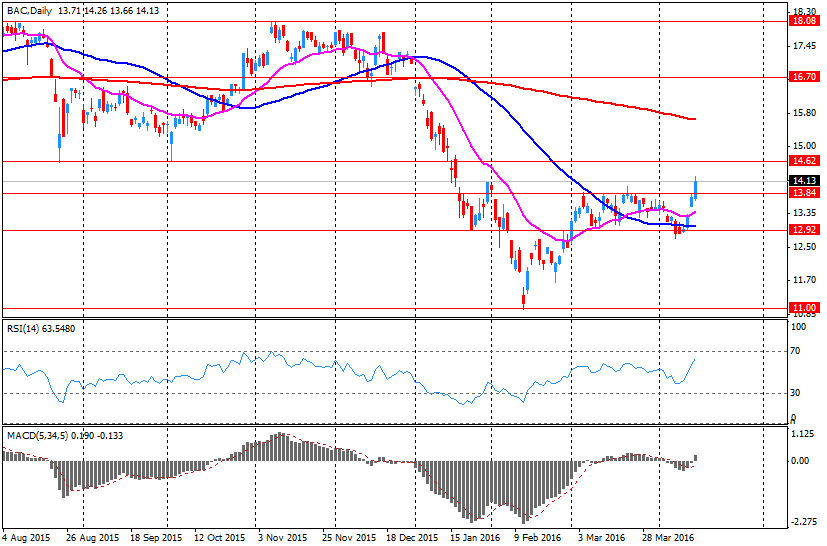

Company News: Bank of America (BAC) Q2 EPS beat analysts’ estimate

Bank of America reported Q2 FY 2016 earnings of $0.36 per share (versus $0.45 in Q2 FY 2015), beating analysts' consensus estimate of $0.33.

The company's quarterly revenues amounted to $20.600 bln (-7.2% y/y), generally in-line with consensus estimate of $20.519 bln.

BAC rose to $13.70 (+0.29%) in pre-market trading.

-

13:17

WSE: Mid session comment

The Warsaw Stock Exchange presents today a very good form, which in part may be due to a shift of part of resources from Turkey to Polish. Strengthening of the Polish currency is continued and the Warsaw Stock Exchange came out to new highs. Medium and smaller companies are also on the gain, and the indexes have a new local maxima. At the same time in Europe the situation is not so successful, the German DAX slightly lost (0.2%) and is located at session minima. Generally improves the situation in emerging markets and this in turn means that the environment can favor the Warsaw parquet. It remains an open question whether the politicians will not throw a roadblocks in the market - till the end of July the topic of foreign currency mortgage loans should be resolved.

In the mid-session the WIG20 index was at the level of 1,789 points (+ 1.70%).

-

13:11

Earnings Season in U.S.: Major Reports of the Week

July 18

Before the Open:

Bank of America (BAC). Consensus EPS $0.33, Consensus Revenue $20518.78 mln.

After the Close:

IBM (IBM). Consensus EPS $2.89, Consensus Revenue $20063.32 mln.

Yahoo! (YHOO). Consensus EPS $0.10, Consensus Revenue $836.80 mln.

July 19

Before the Open:

Goldman Sachs (GS). Consensus EPS $3.05, Consensus Revenue $7484.56 mln.

Johnson & Johnson (JNJ). Consensus EPS $1.68, Consensus Revenue $17985.79 mln.

UnitedHealth (UNH). Consensus EPS $1.89, Consensus Revenue $45040.45 mln.

After the Close:

Microsoft (MSFT). Consensus EPS $0.58, Consensus Revenue $22135.10 mln.

July 20

After the Close:

American Express (AXP). Consensus EPS $1.72, Consensus Revenue $8365.82 mln.

Intel (INTC). Consensus EPS $0.53, Consensus Revenue $13547.05 mln.

July 21

Before the Open:

General Motors (GM). Consensus EPS $1.48, Consensus Revenue $37185.91 mln.

Travelers (TRV). Consensus EPS $2.07, Consensus Revenue $6131.06 mln.

After the Close:

AT&T (T). Consensus EPS $0.72, Consensus Revenue $40741.18 mln.

Starbucks (SBUX). Consensus EPS $0.49, Consensus Revenue $5338.87 mln.

Visa (V). Consensus EPS $0.67, Consensus Revenue $3655.01 mln.

July 22

Before the Open:

General Electric (GE). Consensus EPS $0.46, Consensus Revenue $31573.67 mln.

Honeywell (HON). Consensus EPS $1.64, Consensus Revenue $10136.24 mln.

-

09:43

Major stock exchanges trading mixed: DAX 10,094.94 + 28.04 + 0.28%, FTSE 100 6,661.86-7.38-0.11%, CAC 40 4,378.69 + 6.18 + 0.14%

-

09:19

WSE: After opening

WIG20 index opened at 1764.85 points (+0.31%)*

WIG 45741.46 0.44%

WIG30 1992.96 0.51%

mWIG40 3464.69 0.13%

*/ - change to previous close

From the morning there is no greater anxiety on the markets and after a slight weakening of the zloty and the Turkish lira after the start of trading in around midnight the currency are strengthen.

European markets from early morning are on the green side. Events in Turkey do not make much impression on anyone, and the Nicea also did not leave much trace on Friday. The market in Turkey losing more than 2%.

-

08:23

WSE: Before opening

The most important information for investors seems to be the fact that the rating agency Fitch confirmed the rating for Poland and even did not change its perspective, which remained stable. This is a good news, though on Friday the behavior of the WSE and the Polish zloty indicated that investors do not care specially about this rating.

Friday's session on Wall Street ended with a relatively neutral and today's morning futures on the US indices grow by approx. 0.5%. Asian markets behave peacefully, the stock market in Tokyo is not working because of the holidays. Probably we will see today a reaction to a failed military coup in Turkey, in the morning it was seen on the zloty. The domestic currency opened up with upward gap indicating weakness, but quite quickly began to make up for the loss. Today's macro calendar remains empty and from this direction we should not expect an impulse to trade.

-

07:44

Global Stocks

European stocks slipped Friday, with travel shares lower after a deadly terrorist attack left more than 80 people dead in Nice, France.

The Stoxx Europe 600 SXXP, -0.17% shed 0.2% to close at 337.92, partly erasing a 0.8% advance from Thursday.

Stocks in Europe were rallying earlier in the week on the prospect of more easing measures from global banks including the BOE and Bank of Japan, meant to ease concerns over slow global growth and the fallout from the Brexit vote.

U.S. stocks closed at their third-straight week of gains Friday, as the S&P 500 Index and the Nasdaq Composite Index retreated slightly on the session and the Dow Jones Industrial Average gained slightly for a fourth straight day of record closing highs. The Dow industrials DJIA, +0.05% rose 10.14 points, or less than 0.1%, to close at 18,516.55, a fresh closing high for the average, for a 2% weekly gain. The S&P 500 SPX, -0.09% slipped 2.01 points, or 0.1%, to close at 2,161.74, for a weekly gain of 1.5%. The Nasdaq COMP, -0.09% declined 4.47 points, or 0.1%, to finish at 5,029.59, for a weekly gain of 1.5%.

Stocks in Shanghai declined after posting three straight weekly gains, with developers leading losses on signs China's property market is cooling.

The Shanghai Composite Index slipped 0.1 percent at the midday break after dropping as much as 0.7 percent. Future Land Holdings Co. retreated the most in a week following data showing home-price gains tapered off last month as more cities imposed housing curbs. Yanzhou Coal Mining Co. slid for a fourth day, pacing losses for a measure of energy companies.

-

04:05

Hang Seng 21,749.94 +90.69 +0.42 %, Shanghai Composite 3,049.89 -4.40 -0.14 %

-

01:08

Stocks. Daily history for Jun Jul 15’2016:

(index / closing price / change items /% change)

Nikkei 225 16,497.85 +111.96 +0.68 %

Hang Seng 21,659.25 +98.19 +0.46 %

S&P/ASX 200 5,429.57 +17.96 +0.33 %

Shanghai Composite 3,053.68 -0.33 -0.01 %

FTSE 100 6,669.24 +14.77 +0.22 %

CAC 40 4,372.51 -13.01 -0.30 %

Xetra DAX 10,066.9 -1.40 -0.01 %

S&P 500 2,161.74 -2.01 -0.09 %

NASDAQ Composite 5,029.59 -4.47 -0.09 %

Dow Jones 18,516.55 +10.14 +0.05 %

-