Noticias del mercado

-

22:16

U.S.: Net Long-term TIC Flows , May 41.1

-

22:08

Major US stock indexes finished trading in the green zone

Major stock indexes Wall Street gained slightly on Monday amid better-than-expected quarterly results report.

In addition, it became known that the index of builders confidence in the market of newly built, single-family homes in July fell by one point to 59 from June's reading of 60. "Over the past six months, the confidence builders remained in a relatively narrow range of positive, consistent with the continuing gradual housing market recovery that is underway, "said NAHB Chairman Ed Brady. "Nevertheless, we are still hearing reports from our members about the weakness in some markets, largely due to regulatory restrictions and the lack of land and labor."

Oil prices fell by about 2%, as the increase in oil and gasoline has strengthened concerns about oversupply. Today, the company Genscape reported that oil reserves in the terminal Cushing, Oklahoma, rose by 26,460 barrels for the week ended July 15th. Meanwhile, Morgan Stanley experts said they expected soon to a significant reduction in demand for oil from the refinery, which will eventually lead to an increase in reserves and will have a significant pressure on prices. Also at Morgan Stanley noted that it is still expected to change the balance of demand and supply of oil by mid-2017.

DOW index components finished trading in different directions (17 black, 13 red). Outsider were shares of Merck & Co. Inc. (MRK, -1,06%). More remaining stocks grown E. I. du Pont de Nemours and Company (DD, + 1,32%).

Almost all sectors of the S & P showed an increase. The leader turned out to be the technology sector (+ 0.9%). Decreased only the industrial goods sector (-0.1%).

At the close:

Dow + 0.08% 18,532.06 +15.51

Nasdaq + 0.52% 5,055.78 +26.19

S & P + 0.23% 2,166.79 +5.05

-

22:01

U.S.: Total Net TIC Flows, May -11.0

-

21:00

Dow +0.11% 18,536.00 +19.45 Nasdaq +0.61% 5,060.46 +30.87 S&P +0.27% 2,167.54 +5.80

-

19:36

Wall Street. Major U.S. stock-indexes little changed

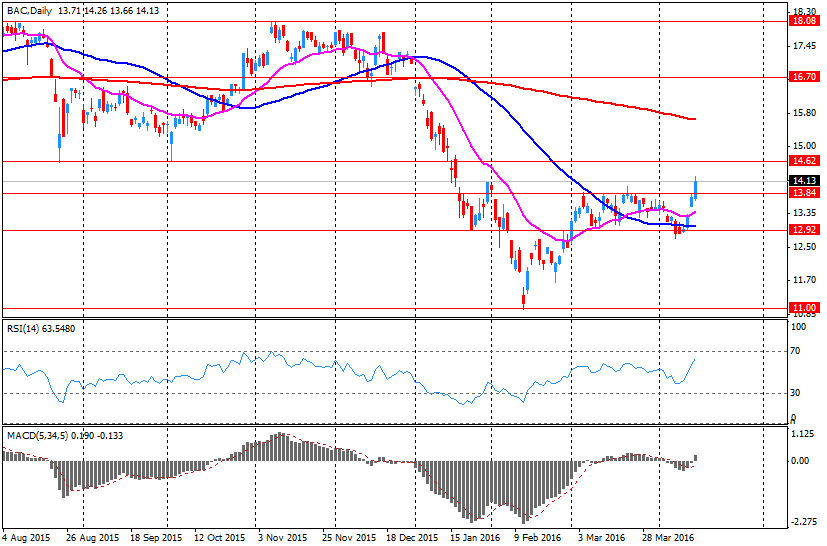

Major U.S. stock-indexes eked out gains on Monday as Bank of America's better-than-expected profit boosted optimism about the U.S. quarterly earnings season, but not by enough to send the Dow and the S&P 500 to fresh highs.

Dow stocks mixed (15 vs 15). Top looser - Caterpillar Inc. (CAT, -1,43%). Top gainer - The Home Depot, Inc. (HD, +1,15%).

S&P sectors also mixed. Top looser - Industrial Goods (-0,2%). Top gainer - Technology (+0,7%).

At the moment:

Dow 18440.00 +23.00 +0.12%

S&P 500 2158.50 +5.75 +0.27%

Nasdaq 100 4611.50 +32.25 +0.70%

Oil 45.93 -0.72 -1.54%

Gold 1328.50 +1.10 +0.08%

U.S. 10yr 1.58 -0.0

-

18:00

European stocks closed: FTSE 100 6,695.42 +26.18 +0.39% CAC 40 4,357.74 -14.77 -0.34% DAX 10,063.13 -3.77 -0.04%

-

17:53

Oil prices fell today

Oil prices have fallen about 2 percent, as the increase in oil and gasoline has strengthened fears of another major oversupply.

Today, the company Genscape reported that oil reserves in the terminal Cushing, Oklahoma, rose by 26,460 barrels for the week ended July 15th.

Meanwhile, Morgan Stanley experts said they expected to a significant reduction in demand for oil from the refinery, which will eventually lead to an increase in reserves and will have a significant pressure on prices. Also Morgan Stanley noted that it is still expected a change in the balance of demand and supply of oil by mid-2017.

The attempted coup in Turkey hardly affected the market, as the Bosphorus in Istanbul, which handles about 3 percent of the world's oil supply mainly from the Black Sea and Caspian region, resumed its work after a short break.

Friday's data from Baker Hughes continue to influence, which showed that the number of drilling rigs in the US increased by 6 to 357, increasing the third consecutive week and the sixth week of the last seven. Renewed growth spawned rumors that the volume of oil production in the country could soon begin to grow, reinforcing fears of a oversupply of oil.

Meanwhile, Commodity Futures Trading Commission showed that funds reduced their bullish bets on Brent crude to the lowest level in four months.

The cost of the September futures on US light crude oil WTI fell to 45.80 dollars per barrel.

September futures price for Brent fell to 46.95 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:39

WSE: Session Results

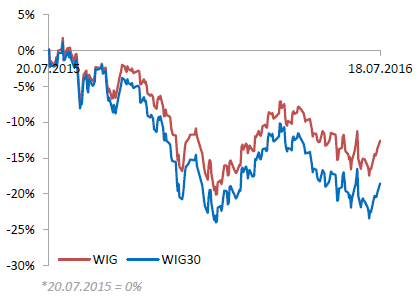

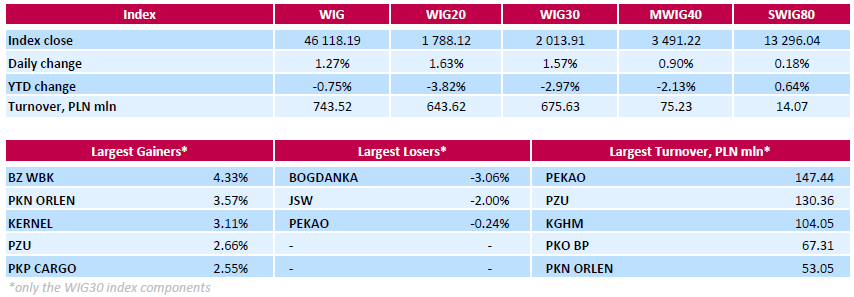

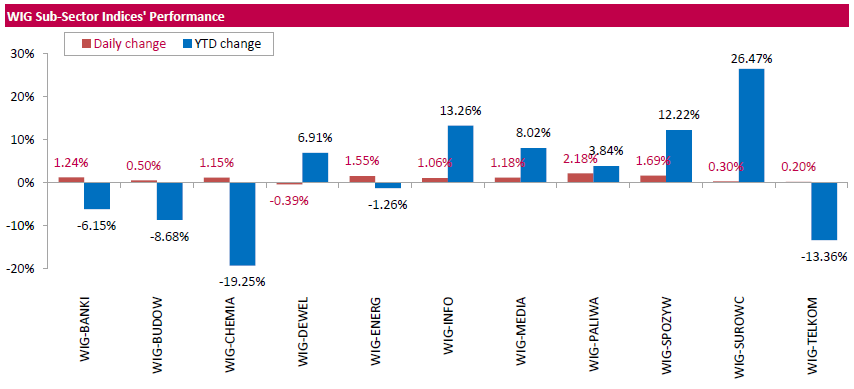

Polish equity closed higher on Monday. The broad market measure, the WIG Index, surged by 1.27%. Developing sector (-0.39%) was sole decliner within the WIG Index, while oil and gas (+2.18%) outpaced.

The large-cap stocks' benchmark, the WIG30 Index, grew by 1.57%. There were only three decliners among the index components. Thermal coal miner BOGDANKA (WSE: LWB) recorded the biggest drop of 3.06%, retreating after last week's energetic bounce. Other underperformers were coking coal producer JSW (WSE: JSW) and bank PEKAO (WSE: PEO), falling by 2% and 0.24% respectively. On the other side of the ledger, bank BZ WBK (WSE: BZW) topped the list of outperformers, climbing by 4.33%. It was followed by oil refiner PKN ORLEN (WSE: PKN), agricultural producer KERNEL (WSE: KER) and insurer PZU (WSE: PZU), jumping by 3.57%, 3.11% and 2.66% respectively.

-

17:30

Gold price show a negative dynamic

Gold prices fell slightly today, helped by renewed risk appetite. In addition, some investors opted to take profits after a sharp rise on Friday, which was caused by the news of the military coup attempt in Turkey.

On Sunday, the Turkish government announced the full restoration of control over the country and the economy after the failed military coup. Over the weekend, the government arrested some 6,000 military and judges, who are suspected of involvement in the coup.

"Gold has always received support during the political turmoil, however, the rise in prices does not last long and quotes will soon return to their former positions, which is what happened today. However, because of the events in Turkey, investors for a while forget about Brexit", - said, ActivTrades analyst Carlo De Kase. Recall, gold has risen in price for two weeks after the vote for Britain's withdrawal from the European Union.

Gold pressure also indicates the strengthening of the dollar.

Meanwhile, Commodity Futures Trading Commission showed that in the week to July 12, money managers and speculators reduced their bets on a record rise in prices for the first time in the last five weeks.

The cost of the August gold futures on the COMEX fell to $ 1330.0 per ounce.

-

16:54

Venezuela’s inflation will be around 1,600% next year - Marketwatch

While most advanced economies struggle to lift inflation, none would want Venezuela's situation: Consumer-price inflation is forecast to hit 480% this year and top 1,640% in 2017, according to the International Monetary Fund.

A shortage of medical supplies means infants and other sick patients are dying of treatable illnesses. Soldiers guard empty grocery store shelves. Inflation is so bad, the government has had to order bolivars by the planeload.

As Caracas extends its declared state of economic emergency, it's no wonder many economists say the nation will soon have to ask the IMF for a bailout. It's gotten so bad, the government this week handed over control of food stocks to the military, ceding even more power to the armed forces.

But Venezuela, whose government severed ties with the IMF nearly a decade ago under its former socialist autocratic leader, Hugo Chávez, hasn't tried to restore relations with the world's emergency lender.

"There has been no change in Venezuela's relationship with the fund," IMF spokesman Gerry Rice said Thursday. While the IMF has urged Caracas to reestablish a relationship, "the Venezuelan authorities have not contacted us," he said.

-

16:36

US housing market index from NAHB slightly decreased in July

Confidence in the Builders Index for single-family homes fell in Jully by one point to 59 from June's reading of 60 according to the Housing Market Index (HMI) of the National Association of Home Builders / Wells Fargo, released today.

"Over the past six months, the confidence of builders remained in a relatively narrow range of positive, consistent with continued gradual recovery of the housing market, which is well underway," said NAHB Chairman Ed Brady. "Nevertheless, we are still hearing reports from our members about the weakness in some markets, largely due to regulatory restrictions and the lack of land and labor."

"Economic fundamentals suggest the continuation of slow, sustainable growth in the housing market," said NAHB Chief Economist Robert Dietz. "Creating jobs is sustainable, mortgage rates are at historically low levels and the formation of households grow. These factors should help attract more buyers to the market over time."

All three components were slightly lower in July. The component measuring current expectations of sales and customer traffic fell by one point each to 63 and 45, respectively. The index measuring sales expectations over the next six months, showed a decline of three points to 66.

Three-month moving averages for the regional HMI values remained remarkably resilient. North-East Indices, the Midwest and the South remained unchanged at 39, 57 and 61, respectively. In the West, the index rose by one point to 69.

-

16:00

U.S.: NAHB Housing Market Index, July 59 (forecast 60)

-

15:49

Nigeria Militants attack PPMC crude pipeline in Warri

-

15:47

WSE: After start on Wall Street

From the morning the Warsaw market is clearly controlled by demand side, which naturally enjoys the bulls camp. The reasons for joy may derive from comparison today's preserve of our parquet against neutral Euroland. It is also needed to add the strength of the zloty and stronger performance of the debt market in Poland.

The market in the US, as well as trading in Euroland, took off flat. It is worth to remember, that the S&P500 is still at the top of the bull market and the demand not really can afford at this point to allow for a moment of hesitation, as taught by the experience of previous years, market participants can quickly and willingly accede to increase activity on the short side of the market.

-

15:45

Bank of America Merrill Lynch on the dynamics of oil prices. Expects WTI at 59$

Bank of America Merrill Lynch noting that the dynamics of oil in recent weeks looks like a normal correction after a good growth. The bank pay attention to the fact that the movement is also justified by seasonal factors, and consider it as a buying opportunity. In BoAML believe that oil is firmly entrenched at levels above $ 40 a barrel, and a recession in the world economy or a shock on the supply side, for example in Libya's production recovery (production recession risks such offset risks in Venezuela and Algeria) or substantial progress in building production in Iran (BoAML believes that Iran's production of the second half of 2017 to reach 3.9 million. b / d), can justify the return of the bear market in the next year. In this scenario, the average price of Brent crude in 2017 could reach $ 37 per barrel.

Meanwhile, the incoming data suggest that global oil supply is reduced, and minimize the investment plans of oil companies, coupled with increasing demand gives reason to say that everything is going to ensure that in the future we are facing a significant shortage of "black gold". BoAML estimated that world oil demand this year will show growth of 600,000 barrels per day, while production in the third quarter will be reduced by 300,000 barrels per day compared to 2015. The main scenario, according to the bank, is the growing demand for 1.2 mln. barrels per day next year. If Brexit will lead to further growth of the dollar and the weakening of global economic growth, the growth in demand of 0.7 million barrels a day is probably to ocur, and it will give a reason for the decline of Brent price to $ 52 a barrel -. Currently BoAML adheres to such a forecast for the fourth quarter of this year and expects an increase to $ 61 in 2017. The forecasts for the price of WTI crude oil is $ 51 and $ 59 respectively.

-

15:32

U.S. Stocks open: Dow +0.04%, Nasdaq +0.11%, S&P +0.07%

-

15:14

Before the bell: S&P futures +0.22%, NASDAQ futures +0.22%

U.S. stock-index futures rose, erasing losses triggered by the failed military coup in Turkey.

Global Stocks:

Nikkei Closed.

Hang Seng 21,803.18 +143.93 +0.66%

Shanghai Composite 3,043.91 -10.39 -0.34%

FTSE 6,690.58 +21.34 +0.3%

CAC 4,352.44 -20.07 -0.5%

DAX 10,048.08 -18.82 -0.2%

Crude $45.50 (-0.98%)

Gold $1326.60 (-0.06%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

736.05

0.61(0.0829%)

27438

AMERICAN INTERNATIONAL GROUP

AIG

54.08

-0.36(-0.6613%)

100

Cisco Systems Inc

CSCO

29.95

0.13(0.436%)

1006

Citigroup Inc., NYSE

C

44.42

0.09(0.203%)

20198

Deere & Company, NYSE

DE

83.53

0.12(0.1439%)

100

Exxon Mobil Corp

XOM

94.82

-0.30(-0.3154%)

925

Facebook, Inc.

FB

117.2

0.34(0.2909%)

52558

Ford Motor Co.

F

13.57

-0.00(-0.00%)

43680

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.9

-0.21(-1.6018%)

82851

General Motors Company, NYSE

GM

30.8

0.03(0.0975%)

1653

Google Inc.

GOOG

721.01

1.16(0.1611%)

901

JPMorgan Chase and Co

JPM

64.2

0.02(0.0312%)

3215

Merck & Co Inc

MRK

59.2

-0.43(-0.7211%)

437

Microsoft Corp

MSFT

53.78

0.08(0.149%)

13439

Nike

NKE

57.87

-0.00(-0.00%)

7528

Pfizer Inc

PFE

36.67

-0.10(-0.272%)

8615

Starbucks Corporation, NASDAQ

SBUX

57.5

0.09(0.1568%)

650

Tesla Motors, Inc., NASDAQ

TSLA

219.74

-0.66(-0.2995%)

16620

The Coca-Cola Co

KO

45.7

0.07(0.1534%)

3380

Twitter, Inc., NYSE

TWTR

18.28

0.20(1.1062%)

89329

Yahoo! Inc., NASDAQ

YHOO

37.83

0.11(0.2916%)

8042

Yandex N.V., NASDAQ

YNDX

21.56

0.13(0.6066%)

600

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Merck (MRK) downgraded to Market Perform from Outperform at BMO Capital; target $62

Other:Intel (INTC) target raised to $36 from $34 at RBC Capital Mkts

Intel (INTC) target raised to $40 from $38 at Canaccord Genuity

Yandex N.V. (YNDX) initiated with a Buy at HSBC Securities

-

14:35

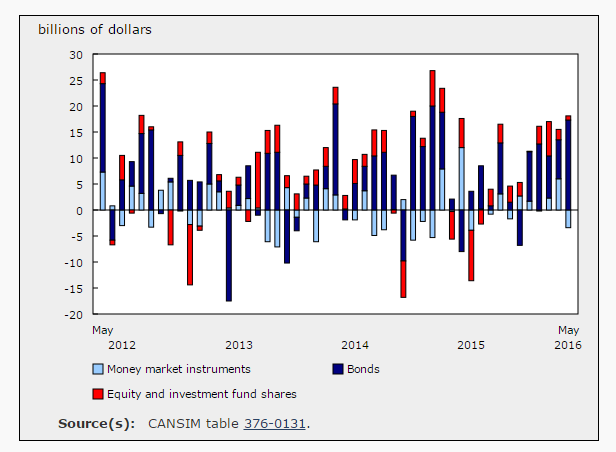

Foreign investment in Canadian bonds totalled $17.3 billion in May

Foreign investment in Canadian securities remained high at $14.7 billion in May, led by acquisitions of federal government bonds on the secondary market. At the same time, Canadian investors added $5.1 billion of foreign securities to their holdings, mainly equities.

Foreign investors continued to invest in Canadian securities at a strong pace in May, adding $14.7 billion to their holdings. This activity was on par with the average investment recorded in the previous four months. Foreign investment during the month focused on Canadian bonds. Since the beginning of the year, foreign acquisitions of Canadian securities have totalled $74.6 billion, compared with $66.2 billion for the same period in 2015.

Foreign investment in Canadian bonds totalled $17.3 billion in May, the largest investment since March 2015. Foreign investors acquired $9.8 billion of federal government bonds, mainly secondary market purchases of Canadian dollar denominated instruments. Foreign investors also added $5.4 billion of federal government enterprises bonds to their holdings, principally new issues. In addition, foreign investment in Canadian private corporate bonds amounted to $2.6 billion, a seventh consecutive month of investment in these instruments. Canadian long-term interest rates were down 12 basis points in May.

-

14:33

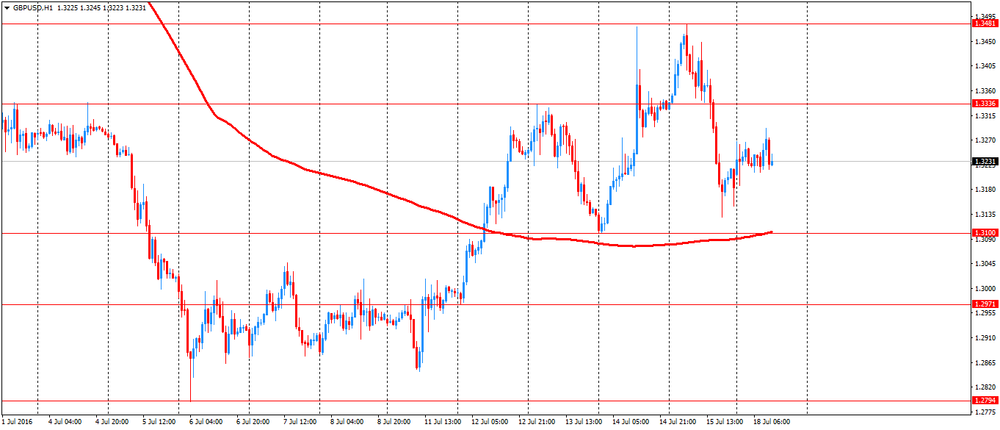

European session review: pound rose

The following data was published:

(Time / country / index / period / previous value / forecast)

8:15 Speech UK member of the Committee on Monetary Policy Bank of England Martin Vila

10:00 Germany's Bundesbank Monthly Report

The British pound rose to session highs after Bank of England official Martin Weale said that he was not sure that he would support lowering the interest rate at the August meeting of the central bank.

Weale said that he would like to see a robust confirmation of the impact of Brexit before the rate cut next month.

"Uncertainty indicates that we should wait for more solid evidence before making any changes to the policy", - he said.

"Unlike the events of 2008, I have the feeling that there are no significant signs of financial panic."

The comments during a speech in London, in contrast with the majority of other officials of the Bank of England, responsible for the policy of the central bank.

Minutes had clearly demonstrated the intention of the bank to ease monetary policy next month to counter the adverse economic impact of Brexit.

The Bank of England kept interest rates at 0.5%, which was a surprise to the markets.

On Friday, the chief economist of BOE Andrew Haldane said the bank should respond "urgently and dramatically" in order to support the economy and build confidence.

However, the removal of financial constraints, not necessarily imply a reduction in the rate. Bank of England may also choose to increase the quantitative easing or launch new measures to stimulate lending.

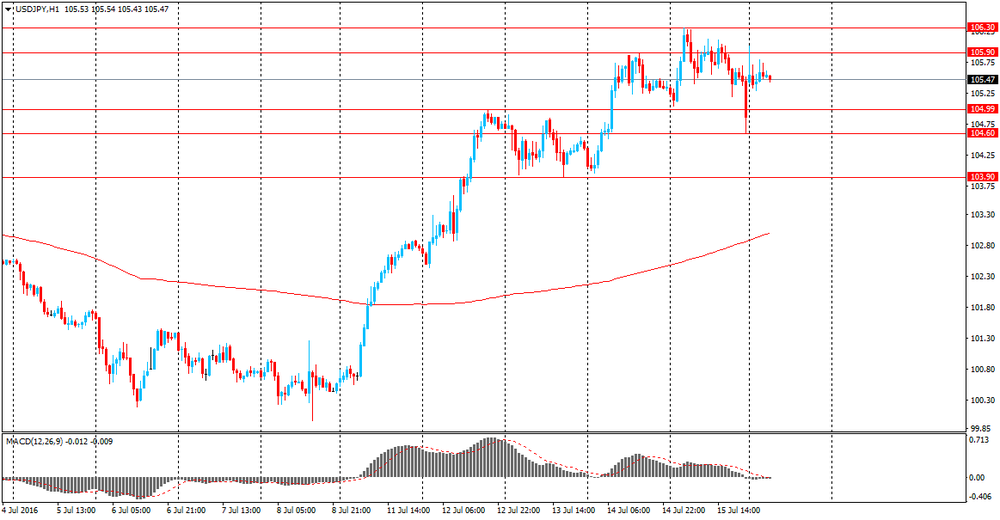

The yen weakened as the Turkish government regained control of the country after a failed coup attempt on Friday.

Initially, investors flocked to the yen on reports of a coup, but on Monday most of the transactions were closed.

On Sunday, the Turkish government announced the full restoration of control over the country and the economy after the collapse of an alleged military coup on Friday. Over the weekend, the government arrested some 6,000 military and judges, who are suspected of involvement in the failed coup.

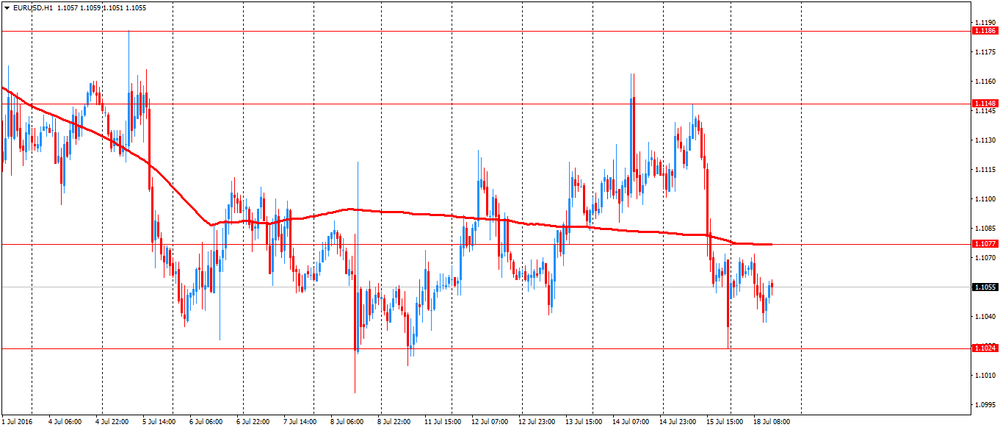

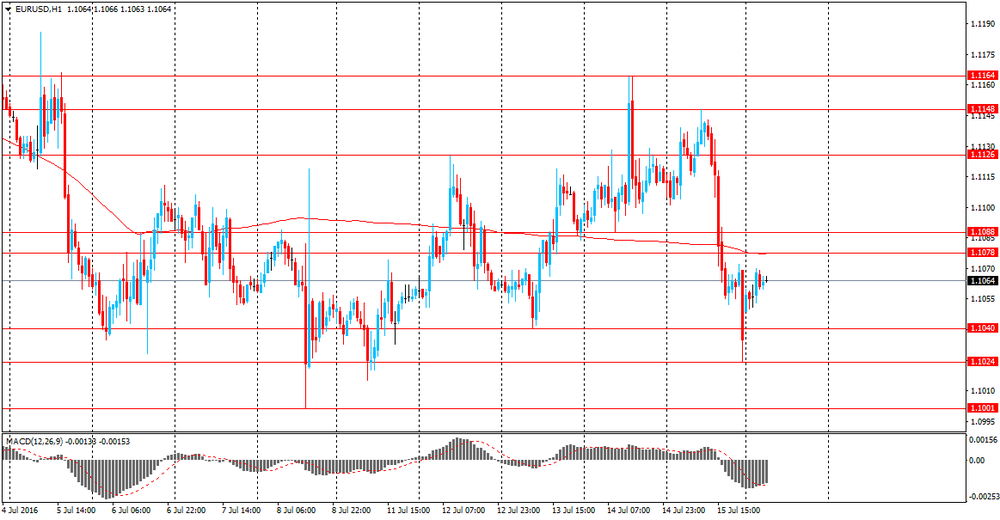

EUR / USD: during the European session, the pair fell to $ 1.1937, but then retreated slightly

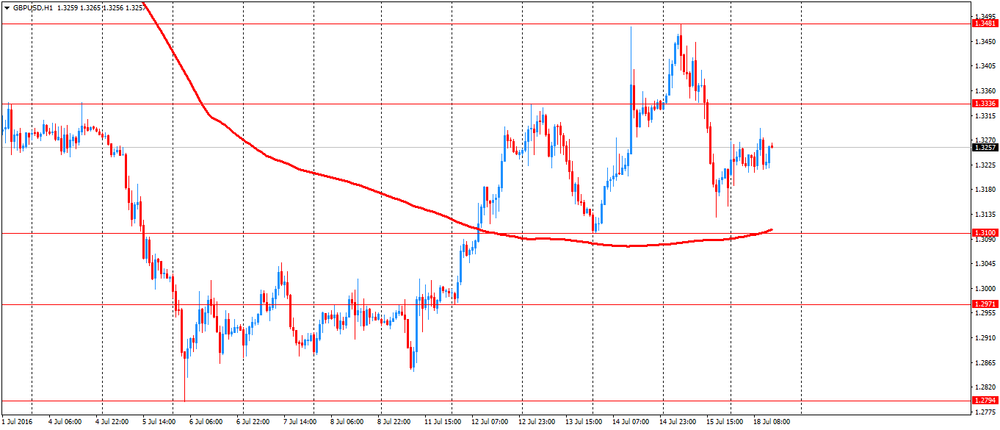

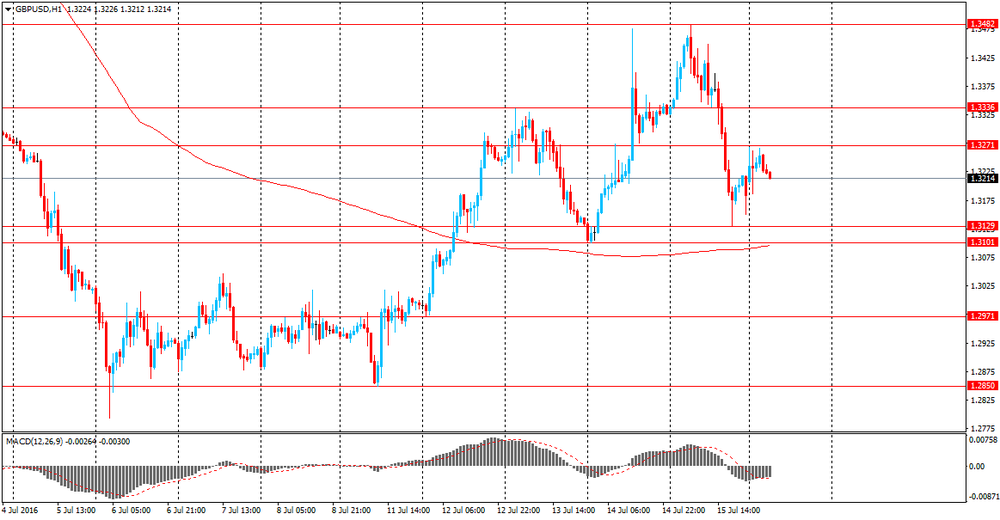

GBP / USD: during the European session, the pair rose to $ 1.3291

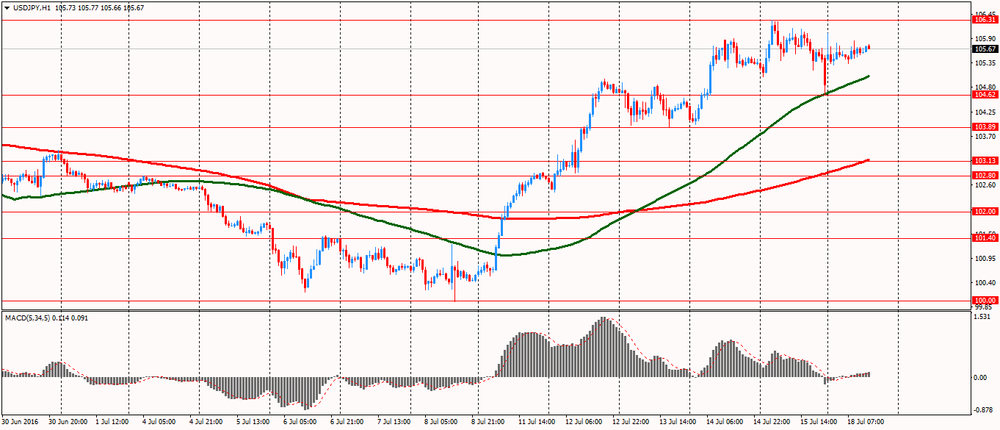

USD / JPY: during the European session, the pair rose to Y105.85

-

14:30

Canada: Foreign Securities Purchases, May 14.73

-

14:21

UK Prime Minister, May: not expecting a detailed Brexit discussion with Merkel or Hollande this week

- spoke to Softbank CEO yesterday regarding ARM deal

- the deal is good for UK economy and workers

- Softbank have promised to double the workforce

- deal is in the national interest

- all future foreign takeovers to be judged on whether it is in the national interest

*via forexlive

-

14:21

Orders

EUR/USD

Offers : 1.1075-80 1.1100 1.1125-30 1.1150 1.1170 1.1185 1.1200

Bids: 1.1030 1.1000 1.0975-80 1.0950 1.0930 1.0900

GBP/USD

Offers : 1.3270-75 1.3290-1.3300 1.3320 1.3350 1.3380 1.3400 1.3420-25 1.3450 1.3480 1.3500

Bids: 1.3220 1.3200 1.3180 1.3150 1.3130-35 1.3100 1.3060 1.3020 1.3000

EUR/GBP

Offers : 0.8365 0.8380-85 0.8400 0.8420-25 0.8450 0.8470 0.8485 0.8500

Bids: 0.8325-30 0.8300 0.8285 0.8255-60 0.8230 0.8200 0.8150

EUR/JPY

Offers : 117.00 117.20 117.50 117.70 118.00 118.25 118.50 119.00

Bids: 116.50 116.25 116.00 115.50 115.00 114.60 114.00

USD/JPY

Offers : 106.00-05 106.30-35 106.50 106.70 107.00 107.50

Bids: 105.30-35 105.00 104.80 104.50-60 104.20 104.00 103.80 103.50 103.30 103.00

AUD/USD

Offers : 0.7600 0.7620 O.7635 0.7650-55 0.7680 0.7700 0.7720 0.7750-55

Bids: 0.7575 0.7550 0.7530 0.7500 0.7480 0.7450-55

-

13:45

Major stock indices in Europe trading mixed in a quiet session

European stocks traded mixed on the news of the failure of the military coup in Turkey and M&A deals.

Investors are cautiously watching developments in Turkey after the failed attempt of a military coup last weekend.

On Sunday, the Turkish government announced the full restoration of control over the country and the economy after the collapse of an alleged military coup on Friday evening to overthrow President Erdogan.

Over the weekend, the government arrested some 6,000 military and judges, who are suspected of involvement in the coup

At the same time, oil prices traded without major dynamics, fluctuating between growth and decline, amid signs of continued recovery of drilling activity in the US.

The composite index of Europe's largest enterprises Stoxx 600 rose by 0.14% - to 338.39 points.

Quotes of British ARM Holdings jumped 43%, as the Japanese mobile operator SoftBank bought the company for $ 32 billion, which means a premium on close of trading last Friday, about 43%.

Shares of oil services group SBM Offshore, based in the Netherlands, grew by 12% after reaching an agreement on the settlement of an investigation of bribery in Brazil.

The price of shares of the largest Italian bank Unicredit SpA increased by 3%, Intesa Sanpaolo - by 1.6%.

Norwegian Marine Harvest ASA, the world's leading producer of Atlantic salmon, added 2.4%. The company expects to reduce the catch of fish this year, which is likely to lead to further price increases, which, in June, updated the historical maximum.

At the same time the market value of the Swedish Ericsson AB decreased by 2.9%. According to the newspaper Svenska Dagbladet, Ericsson, probably overstated revenue figures.

The course of the securities of the largest operator of container traffic in Germany's Hapag-Lloyd AG fell by 10% due to the announcement of the expected reduction of profit in 2016.

At the moment

FTSE 6692.39 23.15 0.35%

DAX 10057.54 -9.36 -0.09%

CAC 4360.68 -11.83 -0.27%

-

13:23

Company News: Bank of America (BAC) Q2 EPS beat analysts’ estimate

Bank of America reported Q2 FY 2016 earnings of $0.36 per share (versus $0.45 in Q2 FY 2015), beating analysts' consensus estimate of $0.33.

The company's quarterly revenues amounted to $20.600 bln (-7.2% y/y), generally in-line with consensus estimate of $20.519 bln.

BAC rose to $13.70 (+0.29%) in pre-market trading.

-

13:17

WSE: Mid session comment

The Warsaw Stock Exchange presents today a very good form, which in part may be due to a shift of part of resources from Turkey to Polish. Strengthening of the Polish currency is continued and the Warsaw Stock Exchange came out to new highs. Medium and smaller companies are also on the gain, and the indexes have a new local maxima. At the same time in Europe the situation is not so successful, the German DAX slightly lost (0.2%) and is located at session minima. Generally improves the situation in emerging markets and this in turn means that the environment can favor the Warsaw parquet. It remains an open question whether the politicians will not throw a roadblocks in the market - till the end of July the topic of foreign currency mortgage loans should be resolved.

In the mid-session the WIG20 index was at the level of 1,789 points (+ 1.70%).

-

13:11

Earnings Season in U.S.: Major Reports of the Week

July 18

Before the Open:

Bank of America (BAC). Consensus EPS $0.33, Consensus Revenue $20518.78 mln.

After the Close:

IBM (IBM). Consensus EPS $2.89, Consensus Revenue $20063.32 mln.

Yahoo! (YHOO). Consensus EPS $0.10, Consensus Revenue $836.80 mln.

July 19

Before the Open:

Goldman Sachs (GS). Consensus EPS $3.05, Consensus Revenue $7484.56 mln.

Johnson & Johnson (JNJ). Consensus EPS $1.68, Consensus Revenue $17985.79 mln.

UnitedHealth (UNH). Consensus EPS $1.89, Consensus Revenue $45040.45 mln.

After the Close:

Microsoft (MSFT). Consensus EPS $0.58, Consensus Revenue $22135.10 mln.

July 20

After the Close:

American Express (AXP). Consensus EPS $1.72, Consensus Revenue $8365.82 mln.

Intel (INTC). Consensus EPS $0.53, Consensus Revenue $13547.05 mln.

July 21

Before the Open:

General Motors (GM). Consensus EPS $1.48, Consensus Revenue $37185.91 mln.

Travelers (TRV). Consensus EPS $2.07, Consensus Revenue $6131.06 mln.

After the Close:

AT&T (T). Consensus EPS $0.72, Consensus Revenue $40741.18 mln.

Starbucks (SBUX). Consensus EPS $0.49, Consensus Revenue $5338.87 mln.

Visa (V). Consensus EPS $0.67, Consensus Revenue $3655.01 mln.

July 22

Before the Open:

General Electric (GE). Consensus EPS $0.46, Consensus Revenue $31573.67 mln.

Honeywell (HON). Consensus EPS $1.64, Consensus Revenue $10136.24 mln.

-

12:59

-

12:00

Fitch expects a further cut in interest rates this year alongside news fiscal stimulus from Bank of Japan

- prospects of faster fiscal consolidation in Japan seem remote.

- recurring stimulus over several years risks further undermining of public finances.

- macroeconomic performance and outlook remain a weakness.

- expects a further cut in interest rates this year alongside news fiscal stimulus.

- expects gross general govt debt to GDP to continue rising 1-2pp per year through to 2024 from 245% at end-2016.

-

11:34

Bank of England Martin Weale: the demand is likely to decline more than the offer

- The interest rate in August depends on production cuts

- After the exit from the EU revenue likely will decline

- not sure if he will back rate cuts in Aug

- no sense that businesses/households are panic stricken

- avoiding market disappointment is not a reason to cut rates

- to ease policy output weakness would need to be big enough to "more than compensate" for likely inflation overshoot

- wage growth outstripping productivity weighs against fine-tuning rate cut

-

11:01

Oil is gaining in early trading

This morning, New York crude oil futures WTI rose by 0.11% to $ 46.69 per barrel. At the same time, crude oil futures for Brent rose by + 0.27% to $ 47.74 per barrel. Thus, the black gold is up on the background of a weakening dollar and the situation after the military coup in Turkey. The key oil hub Bosphorus Strait, which accounts for about 3 percent of global supply, mainly from the Black and Caspian Seas, has been reopened to tankers on Saturday after a traffic stop for a few hours due to Friday's attempted military coup. The upbeat economic data from the US and China - the world's biggest economies, published on Friday, also supported the prices.

-

10:41

Westpac expects NZD / USD at 0.67 in 3 months

Inflation data in New Zealand released today disappointed investors, which led to a decrease of NZD / USD and although the pair is currently attempting to rise, sentiment remains bearish.

Westpac analists expects the New Zealand currency to remain under pressure as the situation in the economy of New Zealand will force the RBNZ to apply dowish signals and possibly to mitigate the monetary policy at the next meeting, which is scheduled for August 11th. Westpac expect a rate cut to 2.0%, as well as the fall of NZD/USD to $ 0.67 in the three-month term.

-

10:20

Softbank confirms purchase of UK's Arm Holdings

-

purchase price around $31bln

-

paying GBP 17 for each share, premium of 43%

-

interim dividend of 3.78 pence per Arm share

-

HQ of Arm to stay in Cambridge, UK

-

Arm board will unanimously recommend the deal to shareholders

-

-

10:00

Review of financial and economic press: the situation in Turkey can cause negative effects on the oil market

D/W

United Kingdom is planning to leave the EU in January 2019

The British Government is planning the country's exit from the European Union in early 2019. Minister Liam Fox in charge of the new government for the negotiations with the EU on trade agreements, in an interview with Sunday Times called the approximate date for Brexit January 1, 2019. David Davis, the appointed head of the Ministry of Brexit cases, previously also called the date - the end of 2018 or beginning of 2019.

Steinmeier hopes Clinton's victory in the US presidential election

German Foreign Minister Frank-Walter Steinmeier hopes Hillary Clinton's victory in the US presidential election. "I think it will bring all that America needs in the current situation", - said Steinmeier in an interview with Bild am Sonntag, published on Sunday, July 17th.

newspaper. ru

Britain will retain access to the EU market after Brexit

David Davis said that Britain will retain access to the EU single market after Brexit, according to Reuters. According to him, it is still not clear whether the prices for goods and services will increase in connection with the withdrawal from the EU.

FT: The situation in Turkey can cause negative effects on the oil market

The attempted coup that took place in Turkey, could have a negative effect on the global oil market, writes the Financial Times. "Turkey is an important transport hub for oil and gas supplies. If there are supply disruptions, it will have a tangible effect on the oil market".

RBC

Reuters named a new chief economist of the World Bank

New chief economist of the World Bank is expected to be a professor of economics at New York University's Paul Romer. It is reported by Reuters, citing two sources familiar with the bank's decision.

Dangerous Deutsche Bank: to become the second German bank Lehman Brothers

In June, the IMF named Deutsche Bank the most risky financial institution in the world. Experts believe that the bank is unlikely to repeat the fate of Lehman Brothers, but if it does happen, the consequences for the global financial system can be catastrophic.

-

10:00

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1045 (EUR 558m) 1.1070 (565m) 1.1150 (484m) 1.1210 (645m)

USD/JPY: 107.00 (USD 430m)

USD/CHF -.9750 (USD 200m) 0.9850 (270m)

USD/CAD 1.2960-65 (USD 400m)

NZD/USD 0.7200 (NZD 375m)

-

09:50

Morgan Stanley cut China's GDP forecast for 2016 and 2017

Morgan Stanley cut GDP forecast for China on 2016 and 2017. Published data on China's GDP last week, industrial production, retail sales and credit growth have influenced the decision of Morgan Stanley to revise its forecast for China's GDP. Thus, according to new forecasts in 2016 GDP will grow by 6.4%, although previously the bank had forecast +6.5%.

For 2017 Morgan Stanley expect GDP growth at 6.2%, lower than the previous forecast of 6.4%.

-

09:43

Major stock exchanges trading mixed: DAX 10,094.94 + 28.04 + 0.28%, FTSE 100 6,661.86-7.38-0.11%, CAC 40 4,378.69 + 6.18 + 0.14%

-

09:19

WSE: After opening

WIG20 index opened at 1764.85 points (+0.31%)*

WIG 45741.46 0.44%

WIG30 1992.96 0.51%

mWIG40 3464.69 0.13%

*/ - change to previous close

From the morning there is no greater anxiety on the markets and after a slight weakening of the zloty and the Turkish lira after the start of trading in around midnight the currency are strengthen.

European markets from early morning are on the green side. Events in Turkey do not make much impression on anyone, and the Nicea also did not leave much trace on Friday. The market in Turkey losing more than 2%.

-

09:15

Today’s events:

At 08:15 GMT the Bank of England Member of the Commission Martin Vail will deliver a speech

At 10:00 GMT, Germany will publish a monthly report of Bundesbank

-

08:47

Asian session review: gaps after failed Turkish coup

The New Zealand dollar fell after data on inflation in New Zealand. New Zealand Consumer Price Index in the second quarter rose 0.4%, after rising 0.2% in the first quarter. Analysts had expected an increase of 0.5%. The CPI year on year was below analysts forecast of 0.5% and 0.4%

According to the report rising gasoline prices and rising prices in housing market, was partially offset by lower prices for meat and domestic flights. Excluding gasoline prices, the consumer price index rose 0.2% in the second quarter. Prices for housing and communal services increased in the second quarter by 1.0%. Growth due to increased prices for new homes by 2.1%.

The most significant contribution to the reduction in the consumer price index was a reduction in the price of meat by 2.7% and the decline in prices for domestic flights by 9.9%. Prices for exported goods and services rose by 0.6%. Prices of non-tradable goods and services rose by 0.3%

The US dollar strengthened against the Japanese yen during the Asian session, as a failed coup attempt in Turkey has led to buying of the dollar as a safe-haven currency. USD / JPY pair started a new week higher to Y105.70, also slightly stronger euro and the pound.

Turkish lira was able to recover a considerable part of the losses incurred on Friday, but analysts say caution about the future prospects of the currency. The coup, though failed, but pointed to a serious problem in Turkey, and the reaction of the Turkish authorities involves risks of increasing tensions in relations with the United States.

Earlier, the US dollar was supported by strong data on industrial production and retail sales. The data published by the Federal Reserve showed that industrial production in the US has grown strong by the end of June, exceeding the forecasts of experts and fully offset the decline in the previous month. The seasonally adjusted industrial production increased by 0.6% after falling 0.3% in May, which was revised in the direction of improvement from -0.4%. The last time a similar increase was recorded in July 2015. Economists had expected an increase of 0.2%. The report stated that in June there was a marked increase in vehicle production after the reduction in May. Mining - a category that includes the production of energy - increased for the second consecutive month, albeit only slightly. Total production in the manufacturing sector rose 0.4% in June, led by an increase in the production of automobiles and spare parts. Output in the utilities sector increased in June by 2.4% compared with the previous month, while mining rose 0.2%. In addition, data showed that the capacity utilization increased in June by 0.5 percentage points to 75.4%. Analysts had expected an increase to only 75%. Overall, industrial production fell by 0.7% in the 12 months to June. Production in the manufacturing sector increased by 0.4% per annum, and the yield in the field of communal services increased by 0.5%. Meanwhile, ore extraction increased by 10.5% compared to June 2015.

US retail sales showed strong growth in June, pointing to the strength of consumer spending, which ultimately should support for economic growth in the second half of this year. This was reported to the US Department of Commerce. According to data seasonally adjusted sales in retail stores and restaurants rose in June by 0.6% compared with the previous month, reaching $ 456.98 billion Meanwhile, sales in May were revised down -. To 0, 2% to 0.5%. Analysts had expected that sales will increase by only 0.1%. Excluding cars, retail sales rose by 0.7% compared to May, which was more than forecast (+0.4). Except for cars and gasoline, sales also rose by 0.7%. Compared with June 2015, the total volume of retail trade grew by 2.7%, which followed a 2.2% rise in May (revised from + 2.5%).

Now, investors' attention is directed, the European Central Bank, which on Thursday will the first referendum in the UK after a decision on monetary policy.

Economists say that the ECB is likely to refrain from further easing, but it can make changes to the bond buying program by expanding the list of available for the acquisition of assets.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1050-60 range

GBP / USD: during the Asian session, the pair is trading in $ 1.3190-1.3220 range

USD / JPY: during the Asian session, the pair was trading in Y105.30-60 range

-

08:28

No clear direction for GBP but will see new lows when the dust settles - Societe Generale

The week ahead sees house price data, CPI, PPI, unemployment, retail sales and a 'special' PMI release as well. If we've cleared enough of the shorts out, sterling could slip back. Weak data would convince markets that the failure to ease in July was just a temporary delay. On the other hand, if for some reason the data are OK, then who knows It's bound to be fascinating.

When all the dust settles, I think we'll see new lows for sterling and a steeper curve, but on a one-week view, it's hard to be confident of anything much in the UK.

The US sees minor data this week (housing starts, Philly Fed, existing home sales) and that won't be a driver of markets.

But US markets will be a driver, as equities remain well supported and bond yields are adjusting to equities. The dollar needs more real yield support (and needs the nominal rates market to get ahead of real rates/yields.

SocGen maintains a short GBP/USD from 1.3750 targeting 1.25.*

*This trade is recorded and tracked in eFXplus Orders.

-

08:23

WSE: Before opening

The most important information for investors seems to be the fact that the rating agency Fitch confirmed the rating for Poland and even did not change its perspective, which remained stable. This is a good news, though on Friday the behavior of the WSE and the Polish zloty indicated that investors do not care specially about this rating.

Friday's session on Wall Street ended with a relatively neutral and today's morning futures on the US indices grow by approx. 0.5%. Asian markets behave peacefully, the stock market in Tokyo is not working because of the holidays. Probably we will see today a reaction to a failed military coup in Turkey, in the morning it was seen on the zloty. The domestic currency opened up with upward gap indicating weakness, but quite quickly began to make up for the loss. Today's macro calendar remains empty and from this direction we should not expect an impulse to trade.

-

08:23

Turkish central bank to offer unlimited liquidity

"The Central Bank will provide banks with needed liquidity without limits," the CB said on its website. "The commission rate for the Intraday Liquidity Facility will be zero. "The CB said that banks would be allowed to place foreign exchange deposit as collateral without limits for needed Turkish lira liquidity. The move came after the dollar rose against the lira to its highest level in recent months on Friday night after the attempted coup, with the dollar reaching 3.05 Turkish liras, an increase of 5 percent. The bank emphasized that all measures would be taken to ensure financial stability "if deemed necessary.""Market depth and prices will be closely monitored," the bank said. The Central Bank added that it would increase the daily foreign exchange auction from the current $50 million if needed.

-

08:18

New Zeeland CPI lower in Q2. A rate cut is coming?

Inflation in New Zealand was up 0.4 percent on year in the second quarter of 2016, Statistics New Zealand said on Monday.

That was beneath forecasts for 0.5 percent, although it was unchanged from the previous three months.

Housing-related prices continued to be the main upward contributor, up 3.3 percent in the year. This increase was influenced by higher prices for newly built houses, excluding land (up 5.6 percent), and rentals for housing (up 2.3 percent).

Transport prices made the largest downward contribution, down 5.3 percent in the year as prices for petrol and domestic air fares fell.

"Petrol prices were 8.1 percent lower than a year ago, despite the increase this quarter as international crude oil prices recovered from their February low," consumer prices manager Matt Haigh said. "Petrol makes up around 5 percent of the CPI basket."

Excluding petrol, the CPI showed a 0.8 percent increase on year.

On a quarterly basis, inflation was also up 0.4 percent versus expectations for 0.5 percent and up from 0.2 percent in the three months prior.

"Higher petrol and housing-related prices were countered by lower prices for meat and domestic air fares," Haigh said.

Petrol prices showed the largest upward contribution, up 5.3 percent in the June 2016 quarter. This follows falls of 7.7 percent in the March 2016 quarter and 7.0 percent in the December 2015 quarter.

The average price of one liter of 91 octane petrol was NZ$1.78 in the June 2016 quarter. This follows falls of 7.7 percent in the March 2016 quarter and 7.0 percent in the December 2015 quarter.

The average price of one liter of 91 octane petrol was NZ$1.78 in the June 2016 quarter, up from NZ$1.69 in the March 2016 quarter.

Excluding petrol, the CPI rose 0.2 percent in the June 2016 quarter.

Housing and household utilities prices rose 1.0 percent in the June 2016 quarter. This rise was influenced by higher prices for newly built houses, excluding land (up 2.1 percent), electricity (up 1.8 percent), and rentals for housing (up 0.6 percent).

Meat prices (down 2.7 percent) made the largest downward contribution for the latest quarter, followed by lower prices for domestic air fares (down 9.9 percent). Domestic air fares have fallen 14 percent since the December 2015 quarter.

-

08:10

Gaps after the failed Turkish coup

The US dollar strengthened against the yen during the Asian session, as investors sold safe-haven assets after a failed coup in Turkey. USD/JPY pair started the week higher to Y105.70, also slightly stronger were the euro and the pound.

Turkish lira was able to recover a considerable part of the losses incurred on Friday, but analysts say caution about the future prospects of the currency. The coup, though failed, pointed to a serious problem in Turkey, and the reaction of the Turkish authorities involves further risks increasing tensions in relations with the United States. There is no consensus regarding the course of the Turkish lira. Commerzbank believe that USD/TRY from current levels near 2.9696 will gradually return to 2.95, and possibly to 2.90. Goldman Sachs believe that now, when the storm of emotion has passed, investors will be engaged in the revision of its estimates of Turkish assets that are unlikely to be positive for the Turkish currency.

-

07:44

Global Stocks

European stocks slipped Friday, with travel shares lower after a deadly terrorist attack left more than 80 people dead in Nice, France.

The Stoxx Europe 600 SXXP, -0.17% shed 0.2% to close at 337.92, partly erasing a 0.8% advance from Thursday.

Stocks in Europe were rallying earlier in the week on the prospect of more easing measures from global banks including the BOE and Bank of Japan, meant to ease concerns over slow global growth and the fallout from the Brexit vote.

U.S. stocks closed at their third-straight week of gains Friday, as the S&P 500 Index and the Nasdaq Composite Index retreated slightly on the session and the Dow Jones Industrial Average gained slightly for a fourth straight day of record closing highs. The Dow industrials DJIA, +0.05% rose 10.14 points, or less than 0.1%, to close at 18,516.55, a fresh closing high for the average, for a 2% weekly gain. The S&P 500 SPX, -0.09% slipped 2.01 points, or 0.1%, to close at 2,161.74, for a weekly gain of 1.5%. The Nasdaq COMP, -0.09% declined 4.47 points, or 0.1%, to finish at 5,029.59, for a weekly gain of 1.5%.

Stocks in Shanghai declined after posting three straight weekly gains, with developers leading losses on signs China's property market is cooling.

The Shanghai Composite Index slipped 0.1 percent at the midday break after dropping as much as 0.7 percent. Future Land Holdings Co. retreated the most in a week following data showing home-price gains tapered off last month as more cities imposed housing curbs. Yanzhou Coal Mining Co. slid for a fourth day, pacing losses for a measure of energy companies.

-

07:08

Options levels on monday, July 18, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1245 (3691)

$1.1212 (1909)

$1.1162 (1523)

Price at time of writing this review: $1.1063

Support levels (open interest**, contracts):

$1.0945 (4069)

$1.0910 (3712)

$1.0871 (6861)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 35191 contracts, with the maximum number of contracts with strike price $1,1200 (3691);

- Overall open interest on the PUT options with the expiration date August, 5 is 47692 contracts, with the maximum number of contracts with strike price $1,0900 (6861);

- The ratio of PUT/CALL was 1.36 versus 1.37 from the previous trading day according to data from July, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.3508 (1379)

$1.3411 (1956)

$1.3315 (707)

Price at time of writing this review: $1.3242

Support levels (open interest**, contracts):

$1.3085 (383)

$1.2989 (1365)

$1.2892 (756)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 22654 contracts, with the maximum number of contracts with strike price $1,3400 (1956);

- Overall open interest on the PUT options with the expiration date August, 5 is 20294 contracts, with the maximum number of contracts with strike price $1,2950 (2399);

- The ratio of PUT/CALL was 0.90 versus 0.86 from the previous trading day according to data from July, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:05

Hang Seng 21,749.94 +90.69 +0.42 %, Shanghai Composite 3,049.89 -4.40 -0.14 %

-

01:08

Commodities. Daily history for Jul 15’2016:

(raw materials / closing price /% change)

Oil 46.28 +0.72%

Gold 1,337.70 +0.78%

-

01:08

Stocks. Daily history for Jun Jul 15’2016:

(index / closing price / change items /% change)

Nikkei 225 16,497.85 +111.96 +0.68 %

Hang Seng 21,659.25 +98.19 +0.46 %

S&P/ASX 200 5,429.57 +17.96 +0.33 %

Shanghai Composite 3,053.68 -0.33 -0.01 %

FTSE 100 6,669.24 +14.77 +0.22 %

CAC 40 4,372.51 -13.01 -0.30 %

Xetra DAX 10,066.9 -1.40 -0.01 %

S&P 500 2,161.74 -2.01 -0.09 %

NASDAQ Composite 5,029.59 -4.47 -0.09 %

Dow Jones 18,516.55 +10.14 +0.05 %

-

01:07

Currencies. Daily history for Jul 15’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1035 -0,70%

GBP/USD $1,3183 -1,08%

USD/CHF Chf0,9821 +0,11%

USD/JPY Y104,86 -0,47%

EUR/JPY Y115,69 -1,21%

GBP/JPY Y138,25 -1,56%

AUD/USD $0,7574 -0,69%

NZD/USD $0,7114 -1,08%

USD/CAD C$1,2966 +0,52%

-

00:47

New Zealand: CPI, y/y, Quarter II 0.4% (forecast 0.5%)

-

00:46

New Zealand: CPI, q/q , Quarter II 0.4% (forecast 0.5%)

-