Noticias del mercado

-

21:00

DJIA 18509.06 2.65 0.01%, NASDAQ 5027.24 -6.82 -0.14%, S&P 500 2160.92 -2.83 -0.13%

-

18:42

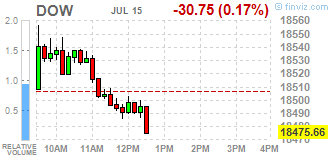

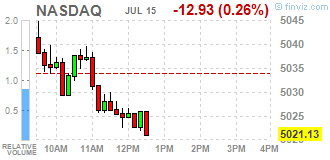

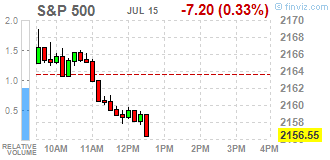

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes slightly fell on Friday, hitting new highs after strong U.S. retail sales data and a rise in biotech stocks, offset disappointing results from big banks. Retail sales rose more than expected in June as Americans bought motor vehicles and a variety of other goods, reinforcing views that economic growth picked up in the second quarter.

Most of Dow stocks in negative area (20 of 30). Top looser - Microsoft Corporation (MSFT, -0,87%). Top gainer - UnitedHealth Group Incorporated (UNH, +0,77%).

Almost of all S&P sectors in negative area. Top looser - Basic Materials (-0,6%). Top gainer - Industrial goods (+0,6%).

At the moment:

Dow 18411.00 -16.00 -0.09%

S&P 500 2152.50 -4.75 -0.22%

Nasdaq 100 4579.00 -11.00 -0.24%

Oil 45.83 +0.15 +0.33%

Gold 1331.40 -0.80 -0.06%

U.S. 10yr 1.59 +0.06

-

18:00

European stocks closed: FTSE 6665.00 10.53 0.16%, DAX 10058.70 -9.60 -0.10%, CAC 4366.47 -19.05 -0.43%

-

17:46

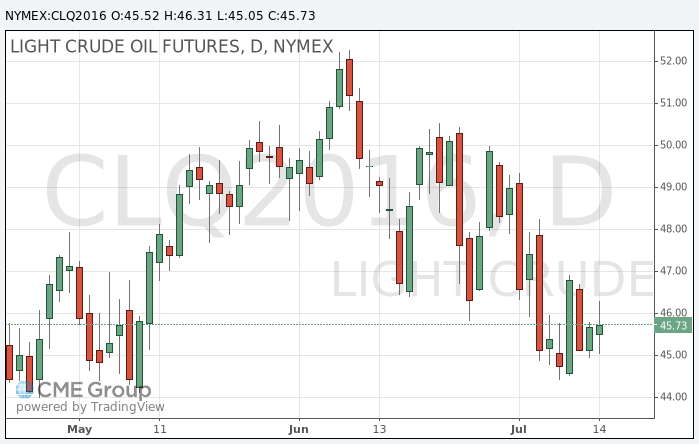

Oil rose moderatly

Oil prices rose as more positive than expected Chinese economic data reinforced expectations for oil demand in the country.

Oil demand this year is stable due to relatively low prices on the world market against the backdrop of continuing oversupply. Oil traders are closely watching China, in order to understand whether the consumption growth is not slowing down against a background of doubt in the sustainability of economic growth in this country.

The growth of China's GDP in the 2nd quarter, as in the 1st quarter amounted to 6.7%. Economists believe that growth will be slightly less.

However, some analysts have pointed out that oil production in China continues to decline due to aging fields and reduced investment.

"Oil production in China is significantly less than the amount of its consumption, and the only way to compensate for this gap - to increase oil imports," - said Gao Jian of SCI International.

Concerns about unexpected supply disruptions in various regions of the world continue to support prices. Exxon Mobil Corp. reported that its unit in Nigeria has suspended oil exports due to some problems. Earlier, local rebels attacking oil facilities led to the production decline.

Meanwhile, Libyan oil exports remains well below historic highs due to the contradictions between the various regional groupings, despite a recent agreement to merge competing oil companies in the country. "In the short term supply of oil in Libya is unlikely to grow sufficiently to affect the world markets", - ClearView Energy Partners LLC. The company does not rule out that "for many years" may be necessary to restore Libya's substantial oil production.

Meanwhile, signs that the global oversupply is reducing more slowly than expected, caping price increases.

In the US, production goes down after low prices led producers to reduce investment in new drilling, but oil and petroleum products stocks worldwide are redundant.

In June, the global oil supply increased by 600,000 barrels per day to 96 million barrels a day, according to a recent report from the International Energy Agency (IEA).

The cost of August futures for US light crude oil WTI rose to 46.31 dollars per barrel.

September futures price for Brent crude rose to 48.05 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:37

WSE: Session Results

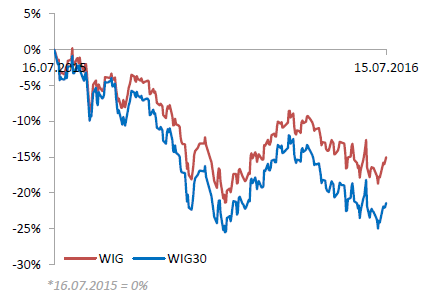

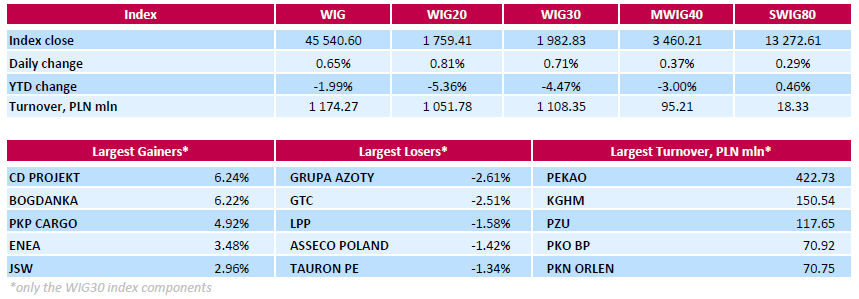

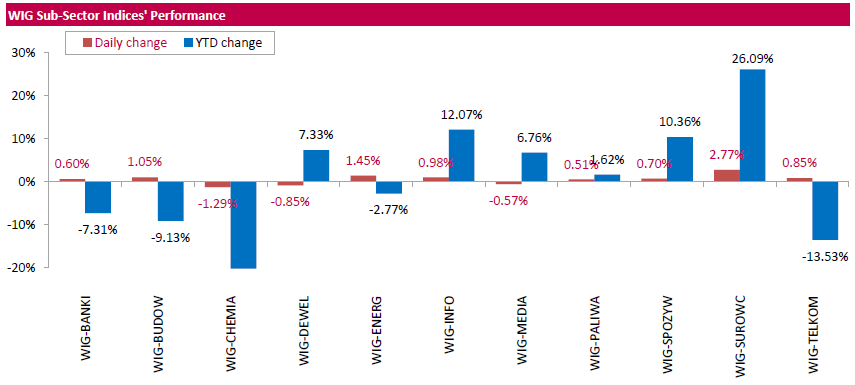

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 0.65%. 8 out of 11 sectors in the WIG rose, with materials (+2.77%) outperforming.

The large-cap companies' measure, the WIG30 Index, surged by 0.71%. Within the index components, the advancers pack was led by videogame developer CD PROJEKT (WSE: CDR) and thermal coal miner BOGDANKA (WSE: LWB), which climbed by 6.24% and 6.22% respectively. Other biggest advancers were railway freight transport operator PKP CARGO (WSE: PKP), genco ENEA (WSE: ENA), coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), which added between 2.58% and 4.92%. On the other side of the ledger, the session's weakest performers were chemical producer GRUPA AZOTY (WSE: ATT) and property developer GTC (WSE: GTC), which lost 2.61% and 2.51% respectively.

-

17:26

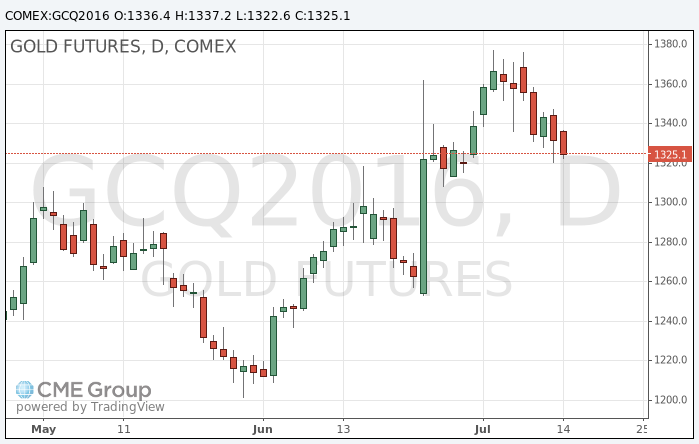

Gold price little changed for the day

Gold becomes moderatly cheaper in the course of today's trading, and preparing to finish in the red the first week of the last seven against the backdrop of improving risk appetite and strengthening of the dollar.

Asian stock markets rose to an eight-month high after encouraging data from China, while European shares fell after the attack in the south of France, which killed 84 people.

After six weeks of growth, the longest rally since March 2014, gold have fallen by 2.5 percent since the beginning of this week after strong data on new jobs in non-agricultural sector of the US and reduced risks about Brexit.

"Investors are taking profits, and now $ 1,300 is a new level of support for gold prices, - said a senior strategist at ING Bank Hamza Khan -. Wider political events such as elections in the US, followed by the French and German elections next year, will be enough to support gold, even if other assets will rise in value in a low interest rate and the search for yield. "

The dollar is preparing to finish the week gaining more than 5 percent against the yen.

Three Fed officials on Thursday said that should not rush to increase US interest rates, in spite of signs that the US economy has reached almost full employment.

The assets of the world's largest gold exchange-traded fund SPDR Gold Trust fell 0.25 percent to 962.85 tonnes on Thursday.

Traders in Asian fixed sold gold reserves after the increase in prices last week to a maximum of more than two years, and jewelers in India continue to offer huge discounts.

The cost of the August gold futures on the COMEX fell to $ 1322.6 per ounce.

-

17:03

Wall-Street: Citigroup (C) and JPMorgan Chase & Co (JPM) beats expectations. Citi earned $ 4.3 billion from trading in the 1st quarter

Despite the decline in quarterly revenue and profit, the banks results were better than Wall Street expectations.

Citigroup Inc. on Friday reported a better-than-expected results, despite the 14% decline in profits compared to the same period last year.

In the second quarter, excluding adjustments, the bank's profit fell to $ 4 billion from $ 4.65 billion a year earlier, as the ultra-low interest rates continue to put pressure on profits in the industry. CEO Michael Korbat said in a statement that the results "demonstrate our ability to generate solid earnings in a challenging and changing environment."

Earnings per share were $ 1.24, versus $ 1.10 expected by analysts polled by Thomson Reuters. These expectations have decreased in the beginning of the year and continued to decline after the Brexit vote.

Citigroup's revenue also slightly exceeded expectations and amounted to $ 17.55 billion, compared with analysts' estimates of $ 17.47 billion. However, the revenue decreased by 8% compared to the same period last year, showing the second consecutive quarterly decline. Over the past six quarters, Citigroup showed revenue growth only once.

The last eighteen months have been relatively calm for Citigroup, which paid for legal services and regulations faced for many years. In general, the profit was better than the expectations of Mr. Korbata last month, when he said that second-quarter earnings will be flat compared with the first quarter. In the first quarter profit totaled $ 3.5 billion.

Last year the bank received the largest annual profit in almost ten years, but this year the price of its stocks taken a beating. Mr. Korbat said that the stock price has fallen in part because of misconceptions about the emerging markets, where Citigroup has a large presence, as well as the history of the bank during the financial crisis.

Citigroup results followed a pattern similar to J.P. Morgan Chase & Co: a jump in trading activity in bonds and currencies, as well as a decline in investment banking activities.

In the last quarter, Citigroup trading income increased by 15% to $ 4.3 billion from $ 3.7 billion a year earlier. Citigroup's revenue from trading bonds, currencies and commodities increased by 14%.

Investment banking revenue fell to $ 1.22 billion from $ 1.29 billion a year earlier.

Profit consumer business fell by 18%.

Block Citi Holdings, where the bank keeps business and loans, which he wants to sell, continues to receive less profit. Together with the profit, assets continued to decline to $ 66 billion from $ 125 billion a year earlier.

Expenses decreased by 5%, to $ 10.4 billion from $ 10.9 billion a year earlier, although the decline was less than the drop in revenue of 8%. The bank has cut 8% of its jobs and 4% of its branches.

This year, the bank's shares fell 14%.

Currently, shares of Citigroup Inc. (C) traded at $ 44.46 (+ 0.02%)

-

16:33

United States: the volume of inventories continued to rise in May

The US Commerce Department said that inventories increased again by the end of May, slightly speeding up the pace compared to April and exceeding the average forecast. Meanwhile, analysts believe that investment in inventories again will put pressure on economic growth in the second quarter.

According to the data, the volume of inventories increased in May by 0.2 percent after rising 0.1 percent in April, which has not been revised. Economists had expected the reserves, a key component of gross domestic product to rise by 0.1 percent.

Retail stocks except for the cars that go into the calculation of GDP, increased by 0.4 percent after falling 0.2 percent in April. However, the latter growth is likely to reflect the higher price. Against this background, analysts say it is unlikely that May data change will be an incentive for GDP growth adjusted for inflation.

Inventories icontributed to the growth of GDP in the first quarter of 2015 and were the reason for slowing down in each of the last three quarters. Companies have accumulated a record amount of reserves in the first half of 2015, which is ahead of demand. Although the pace of accumulation slowed down, the volume of inventories remained high in the second half of 2015 and the first quarter of 2016.

Also, the Ministry of Commerce reported that the volume of manufacturing sales rose 0.2 percent in May after rising 0.8 percent in April. The ratio of inventories to sales was 1.40 months in May, unchanged compared to April. This is a relatively high ratio and implies that the companies will continue to place fewer orders for the goods.

-

16:17

US consumer sentiment unexpectedly worsened in July

Preliminary results presented by Thomson-Reuters and Institute of Michigan, revealed: the mood among US consumers have deteriorated significantly in July, beating analysts' estimates, and reached its lowest level since March of this year.

According to the data, consumer sentiment index fell to 89.5 points compared with a final reading of 93.5 points in June. According to average estimates, the index should remain at the level of 93.5 points. Recall, this figure represents the results of a consumer survey on the subject of confidence in the current economic situation. The survey involved 500 respondents. With the help of this report, it appears the desire of consumers to spend their money. The index is a leading indicator of consumer sentiment. The indicator is calculated by adding 100 to the difference between the number of optimists and pessimists, expressed as a percentage.

Also presented in the report the results of studies have shown:

Index of 12-month inflation expectations in July was + 2.8% vs. + 2.6% in June

Index of 5-year inflation expectations in July, 2.6% against 2.6% in June

Preliminary expectations index in July fell from 82.4 to 77.1 (lowest from September 2014). The forecast was at 83.0

Preliminary current conditions index in July fell to 108.7 from 110.8 in June. It was expected to decline to 109.9

-

16:15

Bank of Italy lowers GDP growt

-

GDP: below 1% from 1,1% previous estimate

-

Growth may have slowed slightly in the Spring months

-

Italian economy may grow around 1% next year (prior forecast was 1.2%)

-

Risks may increase if financial market tensions spread

-

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, July 89.5 (forecast 93.5)

-

16:00

U.S.: Business inventories , May 0.2% (forecast 0.1%)

-

15:48

WSE: After start on Wall Street

The Americans started the trade of the appointment with the next, the sixth in a row in the last days of the record of endless bull market.

Published today the results of Citi were slightly better than expected and Wells Fargo actually in line with expectations. After yesterday's good report of JP Morgan will be difficult for some serious, positive reaction, while the financial sector gained 0.9 percent yesterday and was the strongest on Wall Street. In the package of other data from the US, the June retail sales have decided that the data should be assessed as exceeding expectations. The result was a slight strengthening of the dollar.

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1000 (EUR 1.5bln) 1.1085 (695m) 1.1100 (443m) 1.1200 (806m)

USDJPY: 104.00 (USD 1.1bln) 105.00 (350m) 105.50 (1.6bln)

GBPUSD: 1.2950 (GBP 603) 1.3000 (626m) 1.3500 (451m)

AUDUSD: 0.7520 (AUD 820m) 0.7530 (252m)

USDCAD 1.3000 (USD 300m) 1.3150 (500m) 1.3200 (289m)

EURGBP 0.8275 (EUR 351m)

AUDJPY 79.60 (AUD 4.3bln)

-

15:33

U.S. Stocks open: Dow +0.23%, Nasdaq +0.17%, S&P +0.21%

-

15:28

US industrial production well above forecasts

Industrial production in June grew at the fastest monthly rate in eleven months, on the back of strong auto and utility output. The Federal Reserve said Friday that industrial production grew 0.6% in June, topping the MarketWatch-compiled economist consensus for 0.5% growth. This is the fastest growth since last July. In addition, May's decline was revised to a 0.3% fall from an initially reported 0.4% drop.

Despite the gains, the factory sector is still struggling. For the second quarter as a whole, industrial production fell at an annual rate of 1%, its third consecutive quarterly decline and the fifth out of the past six. Compared to a year ago, production was down 0.7%. Manufacturing has been hurt by the strong dollar, the drop in oil prices, and the sluggish global economy.

Economists believe the sector has bottomed but signs of an upturn have proven elusive. There is concern that the Brexit vote could increase business uncertainty. The dollar has risen sharply against the British pound since the referendum in late June.

Utilities output jumped 2.4% in June due to hot weather in the month and capacity utilization rose to 75.4% in June from 74.9% in May. - Marketwatch

-

15:28

Before the bell: S&P futures +0.13%, NASDAQ futures +0.05%

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 16,497.85 +111.96 +0.68%

Hang Seng 21,659.25 +98.19 +0.46%

Shanghai Composite 3,053.68 -0.33 -0.01%

FTSE 6,638.74 -15.73 -0.24%

CAC 4,362.73 -22.79 -0.52%

DAX 10,041.32 -26.98 -0.27%

Crude $46.09 (+0.90%)

Gold $1330.70 (-0.11%)

-

15:15

U.S.: Capacity Utilization, June 75.4% (forecast 75%)

-

15:15

U.S.: Industrial Production (MoM), June 0.6% (forecast 0.2%)

-

15:15

U.S.: Industrial Production YoY , June -0.7%

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.71

0.00(0.00%)

46556

ALTRIA GROUP INC.

MO

68.99

0.07(0.1016%)

730

Amazon.com Inc., NASDAQ

AMZN

743

1.80(0.2428%)

3936

American Express Co

AXP

63.24

-0.37(-0.5817%)

293

AMERICAN INTERNATIONAL GROUP

AIG

53.76

-0.64(-1.1765%)

400

Apple Inc.

AAPL

98.62

-0.17(-0.1721%)

44388

AT&T Inc

T

42.8

0.03(0.0701%)

2930

Barrick Gold Corporation, NYSE

ABX

21.33

-0.14(-0.6521%)

81694

Caterpillar Inc

CAT

80.05

-0.01(-0.0125%)

721

Cisco Systems Inc

CSCO

29.82

0.06(0.2016%)

1092

Citigroup Inc., NYSE

C

44.98

0.53(1.1923%)

864589

Exxon Mobil Corp

XOM

95.14

0.19(0.2001%)

1791

Facebook, Inc.

FB

117.45

0.16(0.1364%)

48665

Ford Motor Co.

F

13.6

0.01(0.0736%)

11299

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.1

0.15(1.1583%)

100706

General Electric Co

GE

32.66

0.03(0.0919%)

13743

General Motors Company, NYSE

GM

30.57

-0.19(-0.6177%)

771

Goldman Sachs

GS

162.55

0.01(0.0062%)

3497

Google Inc.

GOOG

721.16

0.21(0.0291%)

1163

Home Depot Inc

HD

135

0.46(0.3419%)

2040

Intel Corp

INTC

35.12

-0.08(-0.2273%)

8244

International Business Machines Co...

IBM

159.4

-0.88(-0.549%)

2467

Johnson & Johnson

JNJ

123.2

0.02(0.0162%)

500

JPMorgan Chase and Co

JPM

64.38

0.26(0.4055%)

22887

Microsoft Corp

MSFT

53.86

0.12(0.2233%)

5841

Pfizer Inc

PFE

36.85

-0.07(-0.1896%)

11739

Procter & Gamble Co

PG

86

0.13(0.1514%)

548

Starbucks Corporation, NASDAQ

SBUX

57.6

0.01(0.0174%)

4725

Tesla Motors, Inc., NASDAQ

TSLA

221.46

-0.07(-0.0316%)

3823

The Coca-Cola Co

KO

45.8

0.11(0.2408%)

3797

Twitter, Inc., NYSE

TWTR

17.94

-0.02(-0.1114%)

31903

United Technologies Corp

UTX

105

-0.14(-0.1332%)

284

Visa

V

77.44

-0.70(-0.8958%)

6560

Wal-Mart Stores Inc

WMT

73.7

-0.00(-0.00%)

355

Walt Disney Co

DIS

99.81

-0.16(-0.1601%)

1586

Yahoo! Inc., NASDAQ

YHOO

38.11

0.15(0.3952%)

2650

Yandex N.V., NASDAQ

YNDX

22.29

0.32(1.4565%)

1658

-

14:43

Canadian manufacturing sales down 1% in May

Manufacturing sales declined 1.0% to $49.9 billion in May, the third decrease in five months. The decline in May reflected lower sales of motor vehicles and petroleum and coal products.

Sales fell in 15 of 21 industries, representing nearly 70% of total Canadian manufacturing.

Constant dollar sales were down 2.1%, indicating that a lower volume of manufactured goods was sold in May.

Motor vehicle sales fell 4.2% to $5.6 billion in May, while sales of motor vehicle parts declined 2.3%. The declines in both industries were partly as a result of supply interruptions associated with the earthquake in Japan in April.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:Microsoft (MSFT) reiterated at an Outperform at BMO Capital; target $57

-

14:38

Retail sales in US rose more than forecasts

According to Bloomberg. sales at U.S. retailers rose more than forecast last month in a broad advance that shows consumers delivered for the economy in the second quarter.

The 0.6 percent increase in June retail receipts exceeded the highest estimate in a Bloomberg survey and followed a 0.2 percent gain the previous month that was smaller than previously estimated, Commerce Department figures showed Friday. So-called core sales, used to calculate gross domestic product, rose a larger-than-projected 0.5 percent for a second month.

A prolonged period of job creation and slowly improving wage gains are providing households with the means to keep spending. Consumers are key to shaping the growth path for the world's largest economy as global demand remains lackluster and threatens to damp business investment.

"The U.S. consumer is the backbone of the economic recovery," Bob Keiser, vice president of financial market research at S&P Global Market Intelligence in New York, said before the report. "We're creating jobs and we're growing wages. That's a very solid fundamental backdrop for consumption and retail sales."

-

14:36

Dollar bid after inflation and retail sales data

The Consumer Price Index for All Urban Consumers increased 0.2 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.0 percent before seasonal adjustment.

For the second consecutive month, increases in the indexes for energy and all items less food and energy more than offset a decline in the food index to result in the seasonally adjusted all items increase. The food index fell 0.1 percent, with the food at home index declining 0.3 percent. The energy index rose 1.3 percent, due mainly to a 3.3-percent increase in the gasoline index; the indexes for natural gas and electricity declined.

The index for all items less food and energy increased 0.2 percent in June. The shelter index rose 0.3 percent, and a broad array of indexes also increased, including medical care, education, airline fares, motor vehicle insurance, and recreation. In contrast, the indexes for used cars and trucks, apparel,

communication, and household furnishings and operations all declined in June.

The all items index rose 1.0 percent for the 12 months ending June. This is the same increase as for the 12 months ending May, but smaller than the 1.7 percent average annual increase over the past 10 years. The index for all items less food and energy rose 2.3 percent for the 12 months ending June, a larger increase than the 2.2 percent rise for the 12 months ending May, and above the average annual rate of 1.9 percent over the past 10 years. -

14:33

Company News: Wells Fargo (WFC) posts Q2 financials in line with analysts' estimates

Wells Fargo reported Q2 FY 2016 earnings of $1.01 per share (versus $1.03 in Q2 FY 2015), in-line with analysts' consensus estimate of $1.01.

The company's quarterly revenues amounted to $22.162 bln (+4% y/y), generally in-line with consensus estimate of $22.092 bln.

WFC fell to $48.45 (-1.00%) in pre-market trading.

-

14:30

U.S.: NY Fed Empire State manufacturing index , July 0.55 (forecast 5)

-

14:30

U.S.: CPI, Y/Y, June 1% (forecast 1.1%)

-

14:30

U.S.: Retail sales, June 0.6% (forecast 0.1%)

-

14:30

U.S.: CPI, m/m , June 0.2% (forecast 0.3%)

-

14:30

U.S.: Retail sales excluding auto, July 0.7% (forecast 0.4%)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, June 2.3% (forecast 2.3%)

-

14:30

U.S.: Retail Sales YoY, June 2.7%

-

14:30

U.S.: CPI excluding food and energy, m/m, June 0.2% (forecast 0.2%)

-

14:30

Canada: Manufacturing Shipments (MoM), May -1% (forecast -0.7%)

-

14:26

Company News: Citigroup (C) Q2 EPS beat analysts’ expectations

Citigroup reported Q2 FY 2016 earnings of $1.24 per share (versus $1.45 in Q2 FY 2015), beating analysts' consensus of $1.10.

The company's quarterly revenues amounted to $17.548 bln (-9.9% y/y), generally in-line with consensus estimate of $17.483 bln.

C rose to $44.90 (+1.01%) in pre-market trading.

-

14:22

European session review: US dollar fell against the euro

The following data was published:

(Time / country / index / period / previous value / forecast)

12:00 Eurozone trade balance, without seasonal adjustment in May 27.5 23 24.6

12:00 Eurozone Consumer Price Index m / m in June 0.4% 0.2% 0.2%

12:00 Eurozone Consumer Price Index y / y (final data) June -0.1% 0.1% 0.1%

12:00 Eurozone Consumer Price Index, the base value, y / y (final data) June 0.8% 0.9% 0.9%

15:00 UK BOE Speech Mark Carney

Euro rose moderately against the dollar, approaching yesterday's highs. Some support for the single currency had inflation statistics for the euro area, which coincided with forecasts. The statistical agency Eurostat reported that in June, consumer prices in the eurozone rose by 0.2% after rising 0.4% in May. Meanwhile, annual inflation rose in June by 0.1% after falling 0.1% the previous month. Last change (MoM and YoY) in line with expectations and preliminary estimate. Recall that in June 2015, annual inflation was 0.1%. The base index, which excludes energy and food prices, rose 0.9% year on year, confirming the forecasts and coincided with the previous estimate. Recall that in May, the index increased by 0.8%. Among the EU countries, annual inflation remained unchanged in June, after falling 0.1% in May. A year earlier the rate was 0.1%. Experts point out that despite the improvement, inflation is now just as far from the target of the ECB, as well as two years ago, when the first stimulus measures have been taken. However, during July meeting ECB not be likely to change the parameters of monetary policy and will continue to focus on the implementation of the stimulus package, announced in March this year.

Trading dynamics also affected by expectations of the US data sets, namely retail sales, consumer price inflation, industrial production and consumer confidence. In the latest statement the Fed's monetary policy stated that household spending rising and inflation is below the target level, partly reflecting the drop in energy prices and import prices excluding energy.

The British pound depreciated significantly against the dollar, returning to the opening levels of the session. The decline was caused by the release of the pound weak data on the UK, as well as statements by the representatives of the Central Bank of England. Office for National Statistics reported that the volume of construction fell sharply in May, during the preparations for the referendum on membership in the European Union. Last update indicates that the sector could put pressure on economic growth in the second quarter. The report showed that in May, the volume of production in the construction sector decreased by 2.1% compared to April. Analysts had expected that the volume of construction to decrease by 1.1% after rising 2.8% in April (revised from + 2.5%). Housing construction fell by 3.2 percent in May, recording the biggest drop since February, 2014. The ONS said that the volume of construction should increase by 1.9 percent in June, in order to avoid impact on economic growth in the second quarter. However, experts note that such growth looks unlikely. In addition, data showed that construction fell by 1.9 percent after declining 0.6 percent in annual terms in April. Economists had expected a decline of 3.5 percent.

However, today the Bank of England representative Haldane noted that in August is need a substantial easing of monetary policy. "The referendum significantly increased economic uncertainty, which will put pressure on costs in the foreseeable future, - the politician said -. The economy is likely to slow, and slowing down can cause a significant increase in unemployment, however, there is no reason to predict the financial crisis." In addition, Haldane said that inflation may exceed the target level, but it is unlikely that inflation will stabilize at a high level

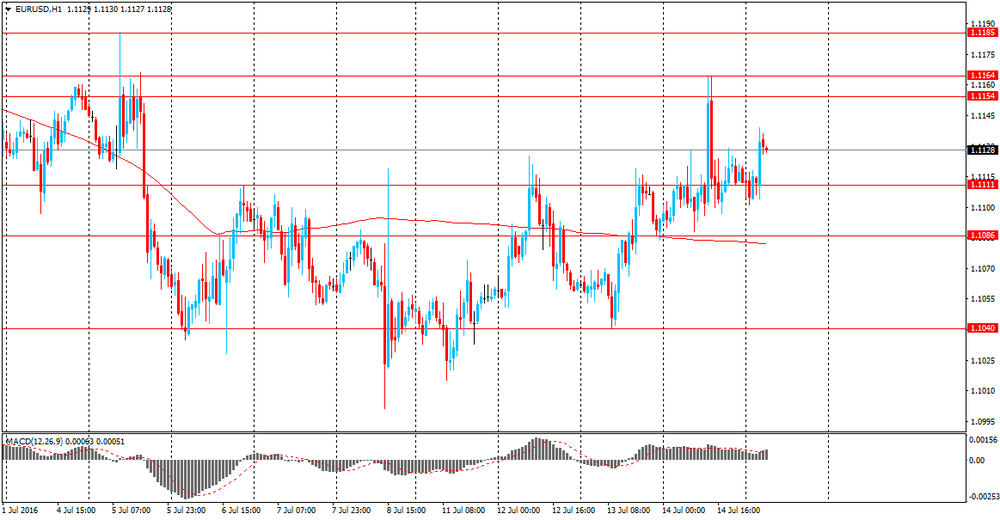

EUR / USD: during the European session, the pair rose to $ 1.1148, but then retreated slightly

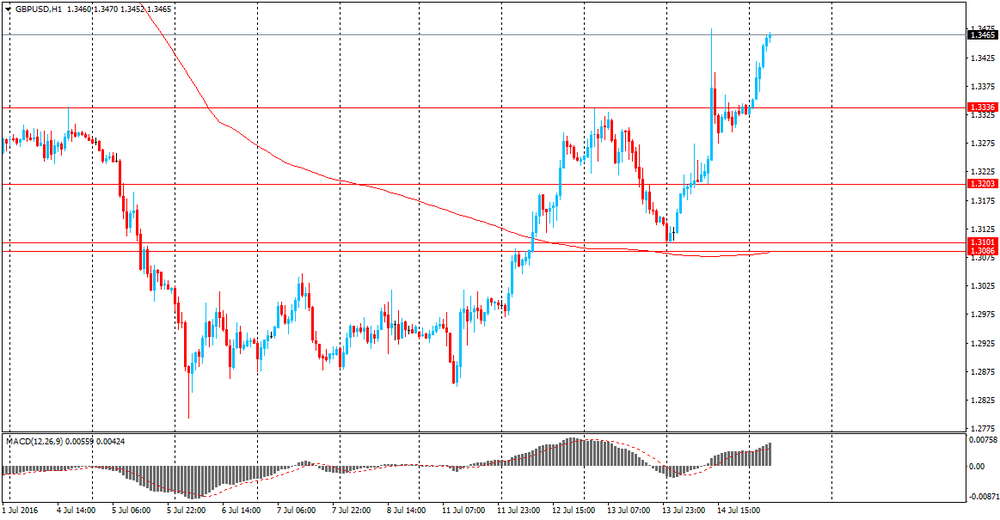

GBP / USD: during the European session, the pair fell to $ 1.3343 from $ .3481

USD / JPY: during the European session, the pair traded in a narrow range

-

14:00

Orders

EUR/USD

Offers 1.1140-45 1.1170 1.1185 1.1200 1.1230 1.1250

Bids 1.1100 1.1080-85 1.1050 1.1030 1.1000 1.0975-80 1.0950 1.0930 1.0900

GBP/USD

Offers 1.3380 1.3400 1.3420-25 1.3450 1.3480 1.3500 1.3520 1.3550

Bids 1.3350 1.3335 1.3320 1.3300 1.3280 1.3250 1.3220 1.3200 1.3180 1.31501.31301.3100

EUR/GBP

Offers 0.8355-60 0.8385 0.8400 0.8420-25 0.8450 0.8470 0.8485 0.8500

Bids 0.8300 0.8285 0.8255-60 0.8230 0.8200 0.8150

EUR/JPY

Offers 118.00 118.50 119.00 119.50 119.85 120.00

Bids 117.20 117.00 116.80 116.50 116.25 116.00 115.50 115.00

USD/JPY

Offers 106.00 106.30-35 106.50 106.70 107.00 107.50

Bids 105.30-35 105.00 104.80 104.50-60 104.20 104.00 103.80 103.50 103.30 103.00

AUD/USD

Offers 0,7635 0.7650 0.7670 0.7700 0.7720 0.7750-55

Bids 0.7600-0.7590 0.7575 0.7550 0.7520 0.7500 0.7480 0.7450-55

-

13:53

Bank of England Governor, Mark Carney due to speak about climate change and the financial markets, in Toronto

-

13:03

WSE: Mid session comment

The morning phase of the session in Warsaw was developed entirely in mind of bulls. After the morning strengthening and reaching a week maximum, the market for the next trading hours did not give up the external pressure in the form of declines in the major European markets and calmly maintained similar to the maximum levels. This means that the demand took control and bulls are the favored side for the second half of the session. The drop in the DAX by 0.6 percent is accompanied by an increase in the WIG20 by 0.7 percent.

At the halfway point of the session the WIG20 index was at the level of 1,757 points (+0,67%).

-

12:39

Major stock indexes in Europe show a negative trend

European stocks traded in the red zone after a long period of growth since the terrorist attack in France put pressure on shares of tourist agencies. The negative impact on the market also had a weak financial statements of some companies in the region.

"The attack in Nice is truly a terrible event, but in terms of market reaction, these types of shocks are generally short-lived, -. Said Michael Kappler, an expert Mittelbrandenburgische Sparkasse -. The fall of shares is also associated with a partial profit-taking after rising over the past few days. Now in the center of attention again, are central banks - investors are waiting for signals on how they are going to cope with the consequences of Brexit. Financial statements of European and American companies, also affects the dynamics of trading.

Market participants also drew attention to the data on the euro zone and Britain. The statistical agency Eurostat reported that in June, consumer prices in the eurozone rose by 0.2% after rising 0.4% in May. Meanwhile, annual inflation rose in June by 0.1% after falling 0.1% the previous month. Last Change (MoM and YoY) in line with expectations and preliminary estimate. Recall that in June 2015, annual inflation was 0.1%. The base index, which excludes energy and food prices, rose 0.9% year on year, confirming forecasts. Recall that in May, the index increased by 0.8%. Among the EU countries, annual inflation remained unchanged after falling 0.1% in May.

Meanwhile, the report submitted by the Office for National Statistics showed that in May, the volume of production in the construction sector decreased by 2.1% compared to April. Analysts had expected that the volume of construction to decrease by 1.1% after rising 2.8% in April (revised from + 2.5%). Housing construction fell by 3.2 percent in May, recording the biggest drop since February, 2014. In addition, data showed -1.9 percent after declining 0.6 percent in annual terms, construction output fell in May in April. Economists had expected a decline of 3.5 percent. In the period from March to May, construction decreased by 2.1% compared with the previous three months (December 2015 to February 2016 on. On an annual basis (March to May), construction fell by 1.7%.

The composite index of the largest companies in the region Stoxx Europe 600 companies fell by 0.4 percent.

Travel and leisure shares shows the largest decline among the 19 industry groups.

Shares of EasyJet Plc, Thomas Cook Group Plc and hotel operator Accor SA fell at least 2.1 percent.

Capitalization of Swatch Group AG fell 12 percent as the company said that weak demand for watches in Hong Kong, France and Switzerland led to a decrease in the volume of profits. Meanwhile. Peer Richemont price fell by 4.8 percent.

Shares of precious metals producers Fresnillo Plc and Randgold Resources Ltd., which rose in price against the background of increasing demand for safe-haven assets after Brexit today fell by at least 2.4 percent.

The cost of Swedish Orphan Biovitrum AB rose 3.7 percent after reports that the amount of quarterly profit and sales surpassed the expectations.

At the moment

FTSE 6,642.88 -11.59 -0.17%

CAC 4,359.76 -25.76 -0.59%

DAX 10,024.52 -43.78 -0.43%

-

12:10

Chinese Prime Minister, Lee: downward economic preasure remains

-

stable in H1 2016, performed in line with expectations.

-

government confident of meeting major targets for this year.

-

government debt ratio is low.

-

household savings are high.

-

plenty of tools available in the governments policy box.

-

-

11:46

Bank of England, Haldane: Material easing likely to be needed in August. GBP/USD down 100 pips so far

-

11:17

Trade balance surplus in Euro Zone

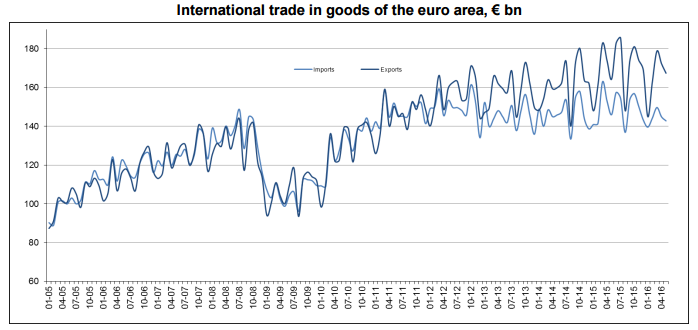

The first estimate for euro area (EA19) exports of goods to the rest of the world in May 2016 was €167.4 billion, an increase of 2% compared with May 2015 (€164.3 bn). Imports from the rest of the world stood at €142.8 bn, a fall of 2% compared with May 2015 (€146.0 bn). As a result, the euro area recorded a €24.6 bn surplus in trade in goods with the rest of the world in May 2016, compared with +€18.3 bn in May 2015. Intra-euro area trade rose to €139.4 bn in May 2016, up by 1% compared with May 2015.

-

11:14

Euro Area inflation up 0.2% in June

Euro area annual inflation was 0.1% in June 2016, up from -0.1% in May. In June 2015 the rate was 0.2%. European Union annual inflation was 0.0% in June 2016, up from -0.1% in May. A year earlier the rate was 0.1%, according to Eurostat figures.

In June 2016, negative annual rates were observed in thirteen Member States. The lowest annual rates were registered in Cyprus (-2.0%), Bulgaria (-1.9%) and Croatia (-1.2%). The highest annual rates were recorded in Belgium (1.8%), Sweden (1.2%) and Malta (1.0%). Compared with May 2016, annual inflation fell in two Member States, remained stable in eight and rose in seventeen.

The largest upward impacts to euro area annual inflation came from restaurants & cafés (+0.11 percentage points), rents and tobacco (both +0.06 pp), while fuels for transport (-0.41 pp), heating oil (-0.16 pp) and gas (-0.13 pp) had the biggest downward impacts.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, June 0.9% (forecast 0.9%)

-

11:00

Eurozone: Trade balance unadjusted, May 24.6 (forecast 23)

-

11:00

Eurozone: Harmonized CPI, Y/Y, June 0.1% (forecast 0.1%)

-

11:00

Eurozone: Harmonized CPI, June 0.2% (forecast 0.2%)

-

10:40

Construction output decreased 2.1% in UK

The reporting period for this release covers the calendar month of May 2016; therefore, the data refers to the period prior to the EU referendum.

In May 2016, output in the construction industry was estimated to have decreased by 2.1% compared with April 2016. Both all new work and repair and maintenance reported decreases, falling by 2.6% and 1.4% respectively.

Within all new work, there were decreases in all work types, except infrastructure. The main contribution to the decrease came from private new housing.

Within repair and maintenance (R&M) there were falls in all work types.

Compared with May 2015, output in the construction industry decreased by 1.9%.

The underlying pattern, as suggested by the 3-month on 3-month movement in output in the construction industry, decreased by 2.1%. This was the third consecutive month of 3-month on 3-month falls.

-

10:37

Oil is trading lower

This morning, New York crude oil futures for WTI fell by -1.12% to $ 45.13 per barrel. At the same time, Brent oil futures were down -1.41% to $ 46.70 per barrel. Thus, the black gold is down on fears of excess supply. The cost of black gold is partially restored after China reported GDP growth of 6.7% in the second quarter on an annualized basis. This result was slightly above forecasts. But in spite of this excess oil is reduced not as fast as many expected, evidenced by reports of the International Energy Agency and the Office of the US Energy Information, published this week.

-

10:10

Germany's manufacturing employment increased in May

Germany's manufacturing employment increased in May, provisional results from Destatis showed Friday.

Manufacturing employment increased 0.9 percent or about 49,000 in May from the prior year. Nearly 5.4 million people worked in local units of manufacturing.

The number of hours worked climbed 3.4 percent in May from a year earlier to 653 million. The earnings totaled EUR 23.9 billion, which was down by 0.2 percent from prior year.

-

10:00

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 1.5bln) 1.1085 (695m) 1.1100 (443m) 1.1200 (806m)

USD/JPY: 104.00 (USD 1.1bln) 105.00 (350m) 105.50 (1.6bln)

GBP/USD: 1.2950 (GBP 603) 1.3000 (626m) 1.3500 (451m)

AUD/USD: 0.7520 (AUD 820m) 0.7530 (252m)

USD/CAD 1.3000 (USD 300m) 1.3150 (500m) 1.3200 (289m)

EUR/GBP 0.8275 (EUR 351m)

AUD/JPY 79.60 (AUD 4.3bln)

-

09:47

Review of financial and economic press: Kazakhstan has reduced oil production

newspaper. ru

Kazakhstan to cut oil production

As a result of a cut in production by 2.4% in the first half of 2016 the volume of oil production was 32.975 million tons.

IMF chief called Brexit a "sobering shower" for the EU

the referendum results were a "sobering shower" for politicians in the EU, said the head of the International Monetary Fund, Christine Lagarde.

Theresa May has changed the UK Minister for Business

New British Prime Minister Theresa May has deprived Conservative Sajid Javid the post of Minister of State for Business, reports The Independent. It is noted that Javid was appointed head of the Department of Local Government. At the same time the new Minister of State for Business became Greg Clark.

The Bank of England kept its benchmark rate unchanged

The Bank of England kept interest rates at the same level regardless of the outcome of the referendum on withdrawal from the European Union, according to Reuters. The rate remained unchanged at 0.5%.

Britain will not impose a budget crisis due to Brexit

The new Minister of Finance Philip Hammond said that the new UK Government will not impose a budget crisis in connection with Brexit, but the final statement of the Ministry of Finance in this regard will be presented in the autumn, according to The Guardian.

-

09:23

Major stock markets down in early trading: DAX 10,016.76-51.54-0.51%, FTSE 100 6,632.13-38.27-0.57%, CAC 40 4,359.49-26.03-0.59%

-

09:17

WSE: After opening

WIG20 index opened at 1746.76 points (+0.08%)

WIG 45243.97 -0.01%

WIG30 1968.14 -0.04%

mWIG40 3446.01 -0.04%

*/ - change to previous close

Start of the cash market with virtually zero change on the WIG20 index may be considered as successful whereas the market yesterday was drawn up at the final fixing. Maintaining yesterday's value largely owe to shares of PKN Orlen, which after a weak session yesterday today grow by 0.8 percent. For now, the beginning of the session looks good, also in the context of the initial disadvantages of parquets in Euroland.

-

09:04

Today’s events:

At 12:00 GMT the Bank of England Governor Mark Carney will deliver a speech

At 13:00 GMT Andy Haldane of the Bank of England will make a speech

At 14:00 GMT FOMC member James Bullard will give a speech

At 17:00 GMT FOMC members John Williams will deliver a speech

At 17:15 GMT FOMC member James Bullard will give a speech and the FOMC members Neil Kashkari will deliver a speech

-

08:51

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,4%, FTSE 100 -0,4%, CAC 40 -0.6%

-

08:50

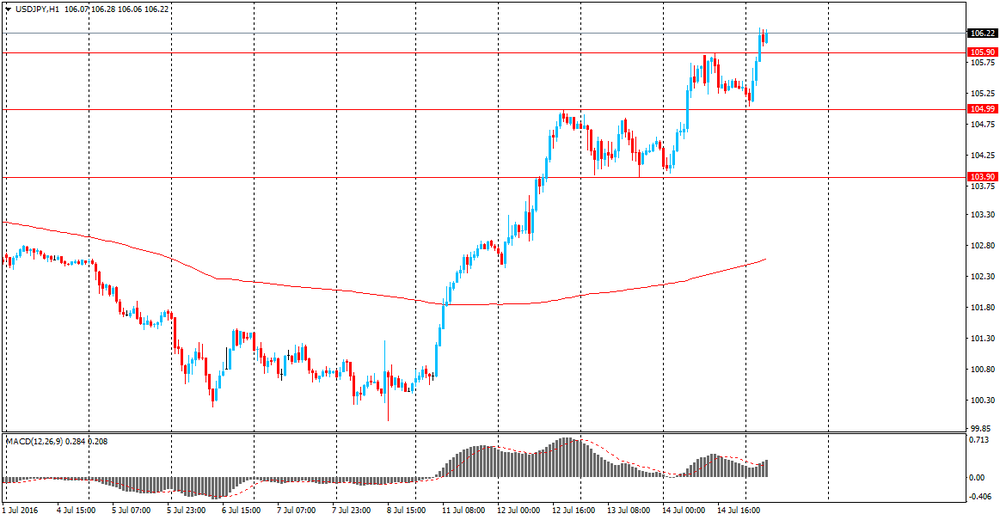

Asian session review: the dollar rose against the yen

Since the beginning of the trading session, the US dollar rose against the yen reaching Y106,23, the highest since June 24 after strong data on China's GDP, which increased risk appetite.

China's gross domestic product in the second quarter increased by 6.7% compared to the same period of the previous year. However, the figure was slightly above economists' expectations of 6.6%. Seasonally adjusted, GDP in the second quarter rose by 1.8% after rising 1.1% in the first quarter.

The growth of China's economy in the second quarter remained stable, indicating the positive impact of stimulus measures implemented by the Chinese government

China's central bank lowered interest rates six times since November 2014 in an attempt to support economic growth.

Also, the National Bureau of Statistics of China released data on industrial production and retail sales, according to which industrial production in China from January to June increased by 6.2% compared to the same period of the previous year of 6.0%. The indicator was higher than economists' forecast of 5.9%.

Retail sales in China increased by 10.6% in June, higher than the previous value, and analysts' expectations of 10% year on year.

Investment in China's urban sector in the first half of the current year increased by 9%, which is lower than the previous value of 9.6% and 9.4% of analysts' expectations. Reduced investments in the urban sector indicates a weakening of the pace of overall economic growth of China. As the economy of China has a major impact on the global economy, this indicator has a specific meaning for the Forex market.

The report by the National Bureau of Statistics of China said that in the first half the volume of investment in agriculture increased by 21.1%. Investments in industry increased by 4.4%. The inflow of investments in the services sector grew by 11.7%.

In China, in recent years there there has been a slowdown in the growth of investment in fixed assets. So, in 2011 the volume of investments increased by 31.8% and by the end of 2015 - only 10%.

Pound, during the session received support from the Bank of England meeting results. Despite the experts' forecasts, the Central Bank decided to leave the interest rate unchanged at 0.5%. The minutes of the meeting noted that the number of votes cast in favor of keeping the key was 8, and the number of votes cast in favor of raising the key rate, 1. Also in the report it was said that most members of the Committee are expected easing in August. "The committee members previously discussed the different possible packages of measures, but the degree of additional incentives will depend on the August forecasts, need a detailed analysis of all the policy options.". "Economic activity is likely to weaken after the referendum. Recently revealed a sharp drop in household confidence indicators and the business community, however, some companies have postponed investment and personnel decisions.".

EUR / USD: during the Asian session, the pair was trading in the $ 1.1100-25 range.

GBP / USD: during the Asian session, the pair is trading in the $ 1.3325-1.3420 range,

USD / JPY: during the Asian session, the pair rose to Y106.31

-

08:38

Whats next for Eur/Usd? - Morgan Stanley

"EURUSD has traded at a discount relative to real rate and yield differentials due to the EMU's financial sector weakness and uncertainties about the impact of Brexit on European economies.

Real yield differentials against GBP and the USD point in favour of the EUR and with domestic balance sheets weak, there will be no export of long-term capital sufficient to offset the Eurozone's current account surpluses without an FX adjustment.

Over recent weeks, the EUR has traded increasingly tight to the performance of the EMU's banking sector share prices indices. Italian bank shares have rebounded recently, increasing the chance of a EUR rally".

-

08:35

Investment in China's urban sector declined in June

Investment in China's urban sector in the first half of the current year increased by 9%, which is lower than the previous value of 9.6% and 9.4% analysts' expectations. This indicator published by China's National Bureau of Statistics estimates the total amount of money spent on business activity in the construction sector and for the purchase of fixed assets. It is a comprehensive index, which reflects the scope, pace and a proportional ratio of investments in fixed assets. Reduced investments in the urban sector indicates a weakening of the pace of overall economic growth of China. As the economy of China has a major impact on the global economy, this indicator has a specific meaning for the Forex market.

The report by the National Bureau of Statistics of China said that in the first half of the volume of investment in agriculture increased by 21.1%. Investments in industry increased by 4.4%. The inflow of investments in the services sector grew by 11.7%.

In China, in recent years there has been a slowdown in the growth of investment in fixed assets. So, in 2011 the volume of investments increased by 31.8% and by the end of 2015 - only 10%.

-

08:33

Retail sales in China increased slightly in June

Retail sales in China from January to June 2016 increased by 10.6% compared with the same period of last year (10%). Analysts had expected an increase of 10%

Retail sales - the indicator published by the National Bureau of Statistics of China that estimate the total amount of cash proceeds from the sale of consumer goods to end consumers. In calculating the index is takes into account the total of all consumer goods delivered by various industries for households and social groups through a variety of channels in the retail trade. This is an important indicator that allows to study the changes in the retail market in China and reflects the level of economic well-being. In general, its high levels are considered to be positive for the Chinese economy

According to the data released earlier, China's economic growth in the second quarter remained stable. This suggests that the stimulus measures implemented by the government may have some influence.

-

08:31

Options levels on friday, July 15, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1335 (3033)

$1.1268 (3190)

$1.1201 (1640)

Price at time of writing this review: $1.1125

Support levels (open interest**, contracts):

$1.1030 (3291)

$1.0960 (3427)

$1.0879 (7085)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 34234 contracts, with the maximum number of contracts with strike price $1,1200 (3190);

- Overall open interest on the PUT options with the expiration date August, 5 is 46828 contracts, with the maximum number of contracts with strike price $1,0900 (7085);

- The ratio of PUT/CALL was 1.37 versus 1.42 from the previous trading day according to data from July, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.3706 (503)

$1.3608 (1192)

$1.3511 (851)

Price at time of writing this review: $1.3434

Support levels (open interest**, contracts):

$1.3378 (305)

$1.3283 (332)

$1.3187 (284)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 21431 contracts, with the maximum number of contracts with strike price $1,3400 (1941);

- Overall open interest on the PUT options with the expiration date August, 5 is 18499 contracts, with the maximum number of contracts with strike price $1,2950 (2414);

- The ratio of PUT/CALL was 0.86 versus 0.87 from the previous trading day according to data from July, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:30

Federal Reserve of St. Louis President James Bullard: Fed should not hurry with rate increase

The president of the Federal Reserve Bank of St. Louis James Bullard said today that we should not rush to raise interest rates at the next Fed meeting in August. He said the central bank should take a wait and see attitude after the British decision to withdraw from the European Union.

Dallas Fed President Robert Kaplan suggested that the central bank should gradually tighten monetary policy to return the economy to normal conditions. "We should try to give up soft policy we should do it gradually".

According to Kaplan, the preservation of a low interest rate creates an imbalance that is difficult to quickly discern.

-

08:24

WSE: Before opening

Thursday's session on Wall Street ended with increases in most indices. The market responded positively to the earnings of the banking sector and the S&P500 reported on the new record of all time. At night, better than expected readings from China were published, regarding GDP, industrial production and retail sales. It may improve mood in early European trading. In the following hours investor's attention should move again on Wall Street, where there will be quarterly results of other banks - the most important are Wells Fargo&Company and Citigroup - which will compete for attention with readings of inflation (CPI) and retail sales.

On the Warsaw market the WIG20 index caught short of breath in the region of 1,750 points and in the area of the gap, which appeared on the chart after the reaction to the outcome of the referendum in the UK. This hesitation is partly the result of negative coincidences - the sale of Pekao by UniCredit and cutting of dividends from PKN and KGHM shares - but does not change the fact that the market does not seem to have the idea and the base on which may build further increases. In fact, there are many reasons for the increases. Good posture of emerging markets and records on Wall Street, however, losing to local factors, which again appears today in the form of a rating for Poland from Fitch.

-

08:16

Industrial production in China jumped 6.2 percent

Industrial production in China jumped 6.2 percent on year in June, the National Bureau of Statistics said on Friday.

That beat forecasts for 5.9 percent, and it was up from 6.0 percent in May.

Output added 0.4 percent on month.

The bureau also said that retail sales advanced 10.6 percent - beating expectations for 9.9 percent and up from 10.0 percent in the previous month.

Fixed asset investment gained .0 percent, shy of forecasts for 9.4 percent and down from 9.6 percent a month earlier.

-

08:12

China's economy expanded 6.7% in the second quarter

China's economy expanded 6.7% in the second quarter, the government reported Friday local time, matching Q1's year-over-year gain and just above views for a drop to 6.6%.

The last two quarters show the weakest growth since the start of 2009, but they suggest that the gradual deceleration may be ending, easing concerns about global growth that could upset financial markets.

Many economists also have doubts about the accuracy of Chinese data.

-

07:17

Global Stocks

Stocks across Europe advanced Thursday, remaining on higher ground after the Bank of England surprised markets by holding its key interest rate unchanged, in the central bank's first monetary-policy decision after the U.K.'s historic Brexit vote.

In a widely unexpected move, the Bank of England left unchanged its key interest rate at a record low of 0.5%. Markets had priced in the chances of the first rate cut since March 2009 as policy makers are seeing a "challenging" outlook for the British economy after the U.K.'s June 23 vote to exit the European Union.

U.S. stocks extended their run into the record books Thursday as the Dow industrials and the S&P 500 notched new closing highs.

Stronger-than-expected results from large financial institutions, including J.P. Morgan Chase, as well as upbeat economic data, powered the climb, which has added to a record run by stocks.

The S&P 500 SPX, +0.53% rose 11.32 points, or 0.5%, to close at 2,163.75, with the financial, materials, and tech sectors leading the gains. The benchmark index reached an intraday high of 2,168.99. The index closed at an all-time high for a fourth-straight day, its longest such streak since November 2014, according to Dow Jones data.

The Dow industrials DJIA, +0.73% advanced 134.29 points, or 0.7%, to close at 18,506.41, after touching an intraday high of 18,537.57. The blue-chip gauge has registered its third straight record close.

The Nasdaq Composite Index COMP, +0.57% advanced 28.33 points, or 0.6%, to finish at 5,034.06, for its highest close of 2016. For the year, the index is up 0.5%.

Asian shares extended gains to eight-month highs on Friday, on track for a solid weekly rise, as better-than-expected economic data from China lifted risk sentiment that was already buoyant after record highs on Wall Street.

China's economy grew 6.7 percent in the second quarter from a year earlier, steady from the first quarter and slightly better than expected as the government stepped up efforts to stabilize growth in the world's second-largest economy.

Industrial output and retail sales also beat forecasts, which helped alleviate fears of slowing momentum, though fixed-asset investment growth slipped and missed market expectations.

-

04:03

Nikkei 225 16,529.92 +144.03 +0.88 %, Hang Seng 21,550.68 -10.38 -0.05 %, Shanghai Composite 3,060.35 +6.33 +0.21 %

-

04:01

China: Fixed Asset Investment, June 9.0% (forecast 9.4%)

-

04:01

China: Fixed Asset Investment, June 9.0% (forecast 9.4%)

-

04:00

China: Industrial Production y/y, June 6.2% (forecast 5.9%)

-

04:00

China: GDP y/y, Quarter II 6.7% (forecast 6.6%)

-

04:00

China: Retail Sales y/y, June 10.6% (forecast 10.0%)

-

00:33

Commodities. Daily history for Jul 14’2016:

(raw materials / closing price /% change)

Oil 45.50 -0.39%

Gold 1,335.60 +0.26%

-

00:32

Stocks. Daily history for Jun Jul 14’2016:

(index / closing price / change items /% change)

Nikkei 225 16,385.89 +154.46 +1.0 %

Hang Seng 21,561.06 +238.69 +1.1 %

S&P/ASX 200 5,411.61 +23.07 +0.4 %

Shanghai Composite 3,053.92 -6.77 -0.2 %

FTSE 100 6,654.47 -15.93 -0.2 %

CAC 40 4,385.52 +50.26 +1.2 %

Xetra DAX 10,068.3 +137.59 +1.4 %

S&P 500 2,163.75 +11.32 +0.5 %

NASDAQ Composite 5,034.06 +28.33 +0.6 %

Dow Jones 18,506.41 +134.29 +0.7 %

-

00:31

Currencies. Daily history for Jul 14’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1112 +0,20%

GBP/USD $1,3326 +1,45%

USD/CHF Chf0,981 -0,37%

USD/JPY Y105,35 +0,94%

EUR/JPY Y117,09 +1,11%

GBP/JPY Y140,4 +2,37%

AUD/USD $0,7626 +0,28%

NZD/USD $0,7191 -1,15%

USD/CAD C$1,2898 -0,64%

-

00:00

Schedule for today, Friday, Jul 15’2016:

(time / country / index / period / previous value / forecast)

02:00 China Industrial Production y/y June 6.0% 5.9%

02:00 China Fixed Asset Investment June 9.6% 9.4%

02:00 China Retail Sales y/y June 10.0% 10.0%

02:00 China GDP y/y Quarter II 6.7% 6.6%

09:00 Eurozone Trade balance unadjusted May 27.5 23

09:00 Eurozone Harmonized CPI June 0.4% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) June -0.1% 0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) June 0.8% 0.9%

12:00 United Kingdom BOE Gov Mark Carney Speaks

12:30 Canada Manufacturing Shipments (MoM) May 1.0% -0.7%

12:30 U.S. Retail sales June 0.5% 0.1%

12:30 U.S. Retail Sales YoY June 2.5%

12:30 U.S. Retail sales excluding auto July 0.4% 0.4%

12:30 U.S. NY Fed Empire State manufacturing index July 6.01 5

12:30 U.S. CPI, m/m June 0.2% 0.3%

12:30 U.S. CPI, Y/Y June 1% 1.1%

12:30 U.S. CPI excluding food and energy, m/m June 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y June 2.2% 2.3%

13:15 U.S. Capacity Utilization June 74.9% 75%

13:15 U.S. Industrial Production (MoM) June -0.4% 0.2%

13:15 U.S. Industrial Production YoY June -1.4%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 93.5 93.5

14:00 U.S. Business inventories May 0.1% 0.1%

-