Noticias del mercado

-

22:13

U.S. stocks rose

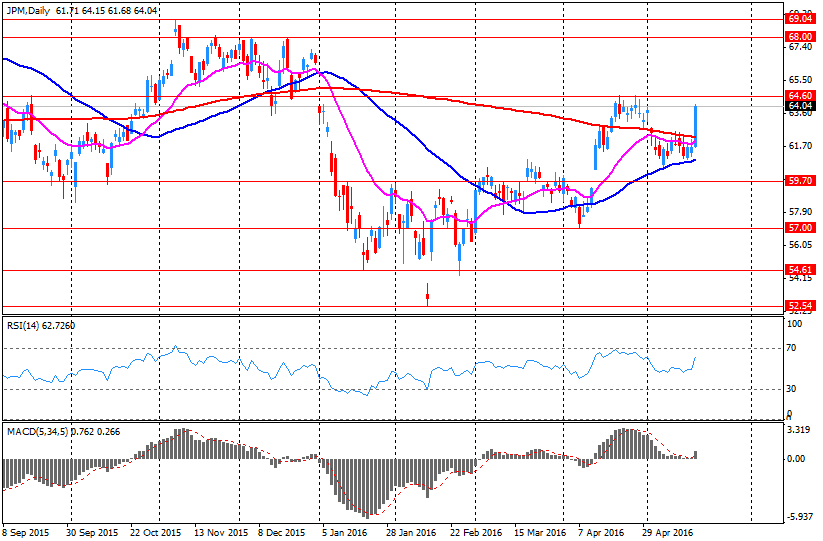

U.S. stocks rose to extend all-time highs, with the S&P 500 Index marking its longest winning streak in four months, as speculation grew for looser global monetary policies while a better-than-forecast profit from JPMorgan Chase & Co. boosted optimism for bank earnings.

JPMorgan climbed 1.5 percent to pace gains in banks, adding fresh momentum to a post-Brexit-vote rally that vaulted equities to records for the first time in more than 13 months. Citigroup Inc. increased 2.6 percent. Yum! Brands Inc. advanced 2.9 percent after its earnings beat estimates and the restaurant-chain operator raised its outlook. Industrial companies extended their longest stretch of gains since 2014.

Global equities climbed Thursday as speculation grew that Japan's Prime Minister Shinzo Abe is contemplating so-called helicopter money, which involves the central bank directly funding government spending. The Bank of England left its key rate at a record low and signaled it's readying stimulus for August as the economy reels from Britain's vote to leave the European Union.

U.S. share prices have added almost $2 trillion since June 27, an amount that ranks among the biggest increases in equity value, as easing concern about economic growth and optimism over earnings combines with speculation the Federal Reserve will hold off raising rates. The S&P 500 has climbed in 10 of the last 12 days, rising 8.2 percent to erase a 5.3 percent plunge following the Brexit referendum.

Injecting a cautionary note into the run-up today, the chief executive of the world's largest asset manager said the current rally may not be justified and won't last unless earnings pick up. "If we don't see better-than-anticipated corporate earnings I think the rally will be short lived," BlackRock Inc.'s Laurence D. Fink said in an interview.

-

21:01

DJIA 18506.45 134.33 0.73%, NASDAQ 5033.63 27.90 0.56%, S&P 500 2163.44 11.01 0.51%

-

18:28

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes scaled new highs on Thursday as JPMorgan's strong results set an upbeat mood for earnings and spurred a rally in financial stocks. While the Bank of England unexpectedly left interest rates unchanged, investors saw hope after the central bank signaled there would be a stimulus program in August, once the impact of Britain's vote to leave the European Union had been assessed.

Most of Dow stocks in positive area (27 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -0,14%). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,49%).

Almost of all S&P sectors in positive area. Top looser - Utilities (-0,6%). Top gainer - Financial (+1,1%).

At the moment:

Dow 18429.00 +141.00 +0.77%

S&P 500 2158.25 +12.25 +0.57%

Nasdaq 100 4587.75 +26.50 +0.58%

Oil 45.62 +0.87 +1.94%

Gold 1329.90 -13.70 -1.02%

U.S. 10yr 1.53 +0.07

-

18:03

European stocks closed: FTSE 6654.47 -15.93 -0.24%, DAX 10068.30 137.59 1.39%, CAC 4385.52 50.26 1.16%

-

17:36

WSE: Session Results

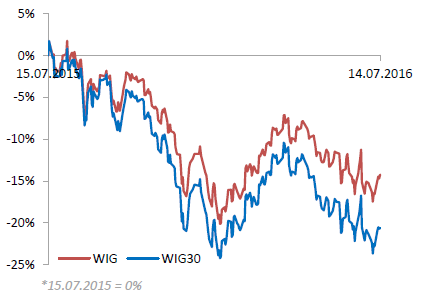

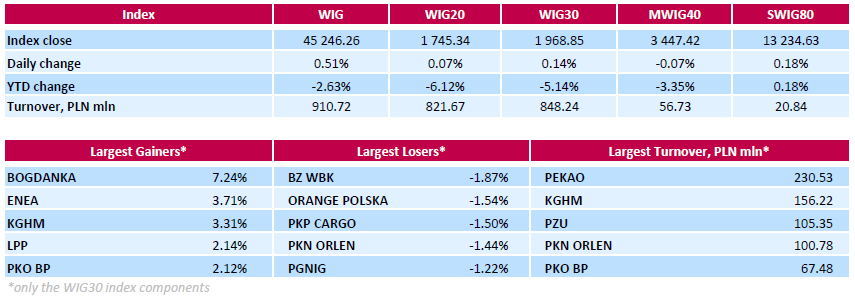

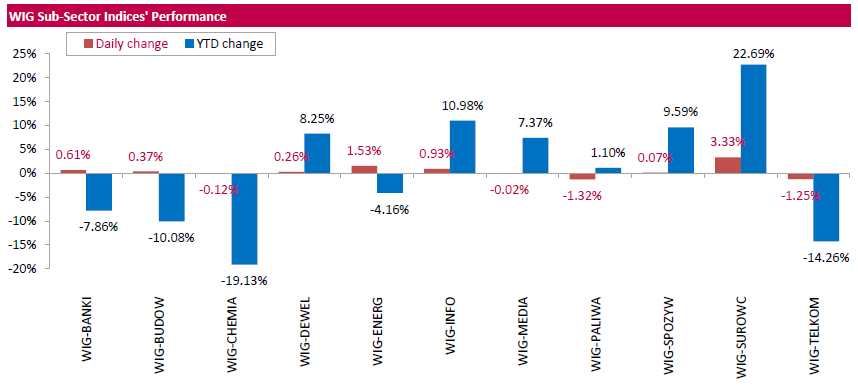

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, added 0.51%. Sector-wise, materials (+3.33%) fared the best, while oil and gas sector (-1.32%) posted the worst result.

The large-cap stocks' measure, the WIG30 Index, advanced 0.14%. Thermal coal miner BOGDANKA (WSE: LWB) kept its position as a growth leader among the large-cap stocks, gaining a further 7.24%. Overall, LWB added more than 25% after four consecutive days of growth. Other major advancers were genco ENEA (WSE: ENA), copper producer KGHM (WSE: KGH), clothing retailer LPP (WSE: LPP) and bank PKO BP (WSE: PKO), surging by 2.12%-3.71%. On the other side of the ledger, the session's biggest laggards were bank BZ WBK (WSE: BZW), telecommunication services provider ORANGE POLSKA (WSE: OPL) and railway freight transport operator PKP CARGO (WSE: PKP), dropping by 1.87%, 1.54% and 1.5% respectively.

-

17:11

WSJ poll: half of the economists do not expect the Fed raising rates until December

- One economist expects the Fed raising rates in July.

- 23% of economists expect the Fed to raise rates in September.

- Economists do not expect a significant impact of Brexit on US economic growth in 2016.

- Brexit Effect hurt production in the US, but it will help construction, the net effect will be negligible.

- Forecasts for economic growth in 2016 have not changed, 2%.

- The probability of a recession in the next 12 months increased to 22% from 21%, to its highest level since December 2012.

-

16:36

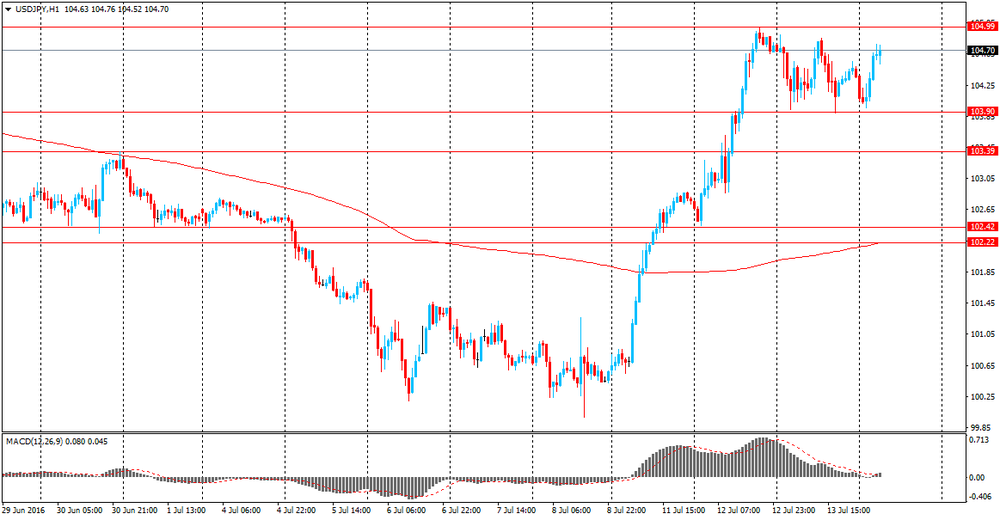

USD/JPY en-route to 108 - BNPP

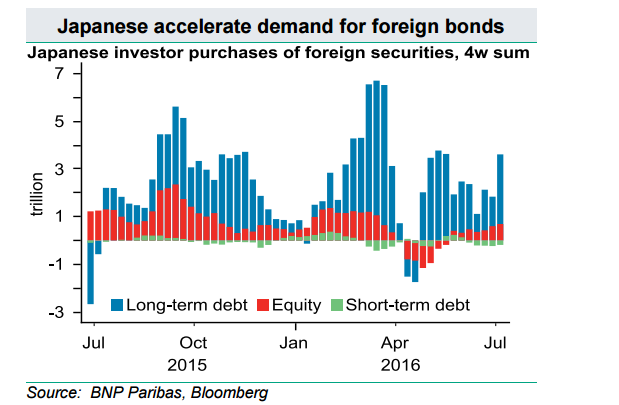

"Japanese investors bought a record JPY 2.55trn of foreign bonds last week and JPY 221bn of foreign stocks. By contrast, foreigners bought just JPY 27.4bn of Japanese bonds and JPY 306.8bn of Japanese stocks.

The data is consistent with our view that "Abenomics" is being resuscitated as extra-low yields in Japan push investors into higher-yielding assets especially abroad. Our 4-week moving sum measure has accelerated sharply over the past four weeks (see chart). We stressed yesterday that higher US yields (10-years in particular) are pulling USDJPY higher - a key factor driving Japanese investors abroad.

On this front, this week's barrage of Fed rhetoric could continue to boost US yields given that markets have pushed back expectations for Fed tightening so aggressively during the first few months of 2016. Our rates strategists forecast US Treasury yields rising to 1.60% (1.49% now) by year-end and we see USDJPY at 108 in coming months".

BNPP targets USD/JPY at 108 by end of Q3, and 110 by end of Q4.

-

16:14

The probability of a RBNZ rate cut has increased

The probability of a rate cut by the Central Bank of New Zealand rate rose on a surprise announcement of the imminent revision of forecasts for the economy.

The Central Bank of New Zealand said that next week will release an unscheduled assessment of the economy. This prompted traders to increase the chances of reducing the interest rate during the August meeting of the Central Bank.

The assessment, which will be published on July 21 and will not include a review of the official interest rate, will be presented for a longer than usual period of political decisions, said the Reserve Bank of New Zealand. Also the Central Bank said that they decided to publish an updated economic assessment due to the 11-week gap between the hearing on June 9, and the next meeting on August 11. After these the chances of lowering the interest rate of the Central Bank by 0.25 per cent in August, increased to more than 60 percent from 40 percent the previous day.

Doubts about the rate cut in August increased after the deputy governor Grant Spencer said last week that the central bank needs to carefully consider the risks to financial stability in the decision to change the monetary policy.

"The revision of economic forecasts will provide another opportunity to express dissatisfaction with the current exchange rate of the national currency - said Darren Gibbs, chief economist for New Zealand in Deutsche Bank AG -. Central Bank would like to see the depreciation of the New Zealand dollar."

-

15:55

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1000 (EUR 922m) 1.1150 (739m)

USDJPY: 104.00 (USD 352m) 105.50-70 (380m)

GBPUSD: 1.2900 (GBP 352m) 1.3500 (588m)

AUDUSD: 0.7550 (AUD 203m)

USDCAD 1.2900 (USD 325m) 1.3000 (255m) 1.3100 (370m)

NZDUSD 0.7050 (NZD 325m)

-

15:40

WSE: After start on Wall Street

Behind us, a solid beginning of the session on Wall Street. The freedom with which the Americans acquire a new records of seemingly endless bull market is impressive. After Friday's improving of record from May of the last year, this week brings a further strengthening of the market. Similarly today.

On the wave of this optimism indexes in Europe returned to their morning highs (from before the BoE surprise decision about the lack of easing in the UK).

Today, on the horizon there are no events that could disrupt this optimism, so the final phase of the session in Europe may be strong.

-

15:33

U.S. Stocks open: Dow +0.71%, Nasdaq +0.68%, S&P +0.63%

-

15:27

Before the bell: S&P futures +0.75%, NASDAQ futures +0.66%

U.S. stock-index futures rose as speculation grew for looser global monetary policies while a better-than-forecast profit from JPMorgan Chase & Co. boosted optimism for bank earnings.

Global Stocks:

Nikkei 16,385.89 +154.46 +0.95%

Hang Seng 21,561.06 +238.69 +1.12%

Shanghai Composite 3,053.92 -6.77 -0.22%

FTSE 6,701.66 +31.26 +0.47%

CAC 4,395.78 +60.52 +1.40%

DAX 10,085.63 +154.92 +1.56%

Crude $45.66 (+2.03%)

Gold $1,323.60 (-1.49%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

69.07

-0.01(-0.0145%)

4992

3M Co

MMM

180.2

0.99(0.5524%)

687

ALCOA INC.

AA

10.79

0.08(0.747%)

119174

Amazon.com Inc., NASDAQ

AMZN

747.9

5.27(0.7096%)

19367

American Express Co

AXP

63.55

0.45(0.7132%)

24194

AMERICAN INTERNATIONAL GROUP

AIG

54.45

0.64(1.1894%)

7109

Apple Inc.

AAPL

97.4

0.53(0.5471%)

102204

AT&T Inc

T

42.51

-0.08(-0.1878%)

21688

Barrick Gold Corporation, NYSE

ABX

20.4

-0.68(-3.2258%)

199415

Boeing Co

BA

131.05

0.94(0.7225%)

3630

Caterpillar Inc

CAT

80.44

0.75(0.9412%)

3820

Chevron Corp

CVX

107.01

0.36(0.3376%)

2765

Cisco Systems Inc

CSCO

29.91

0.16(0.5378%)

7016

Citigroup Inc., NYSE

C

44.5

1.17(2.7002%)

201571

Deere & Company, NYSE

DE

82.46

-0.50(-0.6027%)

650

Exxon Mobil Corp

XOM

95.09

0.21(0.2213%)

22241

Facebook, Inc.

FB

117.35

0.57(0.4881%)

102863

Ford Motor Co.

F

13.55

0.07(0.5193%)

113990

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.13

0.17(1.3117%)

307018

General Electric Co

GE

32.48

0.12(0.3708%)

44892

General Motors Company, NYSE

GM

30.75

0.12(0.3918%)

8493

Goldman Sachs

GS

160.99

3.07(1.944%)

16271

Google Inc.

GOOG

720.75

3.77(0.5258%)

4863

Home Depot Inc

HD

134.5

0.94(0.7038%)

1900

HONEYWELL INTERNATIONAL INC.

HON

119.5

0.45(0.378%)

100

Intel Corp

INTC

35.38

0.37(1.0568%)

11481

International Business Machines Co...

IBM

157.5

-0.52(-0.3291%)

795

Johnson & Johnson

JNJ

123.25

0.25(0.2033%)

464

JPMorgan Chase and Co

JPM

64.9

1.74(2.7549%)

629613

McDonald's Corp

MCD

123.99

1.17(0.9526%)

1978

Merck & Co Inc

MRK

60.01

0.46(0.7725%)

246

Microsoft Corp

MSFT

54

0.49(0.9157%)

23540

Pfizer Inc

PFE

36.45

0.14(0.3856%)

8166

Procter & Gamble Co

PG

86.7

0.81(0.9431%)

58278

Starbucks Corporation, NASDAQ

SBUX

56.96

0.48(0.8499%)

5447

Tesla Motors, Inc., NASDAQ

TSLA

224.17

1.64(0.737%)

26895

The Coca-Cola Co

KO

45.8

0.06(0.1312%)

6870

Travelers Companies Inc

TRV

118.59

0.59(0.50%)

100

Twitter, Inc., NYSE

TWTR

18

0.26(1.4656%)

155948

UnitedHealth Group Inc

UNH

142.08

0.60(0.4241%)

623

Verizon Communications Inc

VZ

55.8

-0.20(-0.3571%)

5316

Visa

V

78.03

0.57(0.7359%)

3732

Wal-Mart Stores Inc

WMT

73.92

0.30(0.4075%)

810

Walt Disney Co

DIS

100.51

0.63(0.6308%)

987

Yahoo! Inc., NASDAQ

YHOO

37.85

0.21(0.5579%)

8385

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Procter & Gamble (PG) upgraded to Buy from Neutral at UBS; target raised to $96 from $85

Downgrades:

Other: -

14:45

Producer price index in US increased in June

The Producer Price Index for final demand increased 0.5 percent in June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.4 percent in May and 0.2 percent in April. On an unadjusted basis, the final demand index advanced 0.3 percent for the 12 months ended in June, the largest 12-month increase since moving up 0.9 percent in December 2014.

In June, the advance in the final demand index was led by prices for final demand services, which rose 0.4 percent. The index for final demand goods advanced 0.8 percent.

Prices for final demand less foods, energy, and trade services rose 0.3 percent in June after declining 0.1 percent in May. For the 12 months ended in June, the index for final demand less foods, energy, and trade services increased 0.9 percent. -

14:42

US initial unemployment claims continue to decline

In the week ending July 9, the advance figure for seasonally adjusted initial claims was 254,000, unchanged from the previous week's unrevised level of 254,000. The 4-week moving average was 259,000, a decrease of 5,750 from the previous week's unrevised average of 264,750.

There were no special factors impacting this week's initial claims. This marks 71 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

-

14:30

U.S.: PPI excluding food and energy, m/m, June 0.4% (forecast 0.1%)

-

14:30

U.S.: PPI, m/m, June 0.5% (forecast 0.3%)

-

14:30

Canada: New Housing Price Index, MoM, May 0.7% (forecast 0.2%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, June 1.3% (forecast 1%)

-

14:30

U.S.: PPI, y/y, June 0.3% (forecast -0.1%)

-

14:30

U.S.: Initial Jobless Claims, 254 (forecast 265)

-

14:30

U.S.: Continuing Jobless Claims, 2149 (forecast 2128)

-

14:25

European session review: the pound rose sharply after Bank of England hold rates

The following data was published:

(Time / country / index / period / previous value / forecast)

Switzerland 7:15 producers and import price index m / m in June 0.4% 0.2% 0.1%

7:15 Switzerland PPI and import, y / y in June -1.2% -1%

11:00 UK Bank of England Interest Rate Decision 0.5% 0.25% 0.5%

11:00 UK Bank of England's decision in terms of assets purchase program 375 375 375

11:00 UK Bank of England Minutes of the meeting

The yen depreciated considerably against the dollar and came close to the psychological level of Y106.00. The main reason for the weakening of the yen were the statements of Japanese politicians. Initially, Prime Minister Abe adviser Hamad pointed out that the need for action by the Bank of Japan depends on the recovery of the stock market and the decline of the yen by 29 July. "Now I can not say with absolute certainty whether the Bank of Japan will soften the policy on July 29 as reduction of supply and growth in demand in the labor market means that there is no need to discuss easing policies at every meeting." - said the politician.

Honda added that the Bank of Japan does not need to further dig deeper into negative territory rates, as it may intensify concerns about the banking system. In addition, Honda has paid attention to the exchange rate of the national currency, saying that a weak yen helps fight deflation. In addition, he said that he wants to see even a small declin in the yen.

It is worth emphasizing, the markets are priceing in the likelihood of further easing by the Bank of Japan on the monetary policy meeting on July 28-29, as evidenced by the fall in the yield of Japanese government bonds.

A certain pressure on the yen continues to have the sharp revision of forecasts for GDP and inflation. Explaining this decision, the Government pointed to the a increase in uncertainty about the global economy, weak domestic consumption and sluggish investment.

The pound rose against the dollar significantly, updating the maximum of the current month. The main support to the currency was provided by results of the Bank of England meeting. Despite forecasts, the Central Bank decided to leave the interest rate unchanged at 0.5%. The minutes of the meeting noted that the number of votes cast in favor of keeping the key was 8, and the number of votes cast in favor of raising the key rate, amounted to 1. Also in the report it was said that most members of the Committee are expected easing in August. "The committee members previously discussed the different possible packages of measures, but the degree of additional incentives will depend on the August forecasts and need a detailed analysis of all the policy options.", - reported in the minutes. "Economic activity is likely to weaken after the referendum. Recently uncertainty revealed a sharp drop in household confidence indicators and the business community, however, some companies have postponed investment and personnel decisions".

Positive impact on the pound have also had statements by the new British Chancellor Philip Hammond. He said he would do whatever is necessary to stabilize the economy and give confidence to the financial markets after the British voted for Brexit. Hammond said that the country does not need an emergency budget, and added that the government will monitor the economic situation during the summer before the announcement of the fiscal plans in the autumn statement.

The dollar fell against the euro, approaching to a minimum on 5 July. Against the background of an empty calendar for the euro area on the bidding affect risk appetite. In addition, the euro was guided by the dynamics of the pound, which today is the main topic of discussion .

EUR / USD: during the European session, the pair has risen to $ 1.1165

GBP / USD: during the European session, the pair rose to $ 1.3476

USD / JPY: during the European session, the pair rose to Y105.86 -

13:50

Orders

EUR/USD

Offers 1.1125-30 1.1150 1.1170 1.1185 1.1200 1.1230 1.1250

Bids 1.1085-90 1.1050 1.1030 1.1000 1.0975-80 1.0950 1.0930 1.0900

GBP/USD

Offers 1.3250 1.3275-80 1.3300 1.3320 1.3350-60 1.3375 1.3400 1.3420-25 1.3450 1.3480 1.3500

Bids 1.3200 1.3180 1.3150 1.3130 1.3100 1.3080 1.3050 1.3030-35 1.3000-10

EUR/GBP

Offers 0.8420-25 0.8450 0.8470 0.8485 0.8500 0.8520-25 0.8575-80 0.8600

Bids 0.8380 0.8350 0.8300 0.8285 0.8250 0.8230 0.8200

EUR/JPY

Offers 116.85 117.00 117.30 117.50 118.00

Bids 116.25 116.00 115.50 115.00 114.85 114.50 114.20 114.00

USD/JPY

Offers 105.75-80 106.00 106.30-35 106.50 106.70 107.00

Bids 105.30 105.00 104.80 104.50-60 104.20 104.00 103.80 103.50 103.30 103.00

AUD/USD

Offers 0,7635 0.7650 0.7670 0.7700 0.7720 0.7750-55

Bids 0.7600-0.7590 0.7575 0.7550 0.7520 0.7500 0.7480 0.7450-55

-

13:42

-

13:29

Major stock indexes in Europe show a positive trend

European stocks traded with a moderate increase. Positive impact on the dynamics of trade had statements by the new British Chancellor Philip Hammond. He said he would do whatever is necessary to stabilize the economy and give confidence to the financial markets after the British voted for withdrawal from the European Union structure. In addition, Hammond said that the country does not need an emergency budget, adding that the government will monitor the economic situation during the summer before the announcement of the fiscal plans in the autumn statement.

At the same time, investors are gradually shifting their focus from political risk to the prospects for corporate reporting. Alcoa Inc. in the US and European companies, including Daimler AG and Burberry Group Plc reported better than expected financial results, signaled the start of a strong earnings season.

Today's oil prices rebound after yesterday's fall of more than 4 percent as improved market sentiment, pushing at the European energy companies to the highest level since November 4 last year.

The composite index of the largest companies in the region Stoxx Europe 600 rose 1 percent, cutting the losses suffered after the British announcement of the referendum results, to 2.1 percent.

All 19 industry groups of Stoxx Europe 600 index show an increase. automakers and mining companies are at the head of growth.

The cost of recruiting company Hays Plc jumped 10 percent after the statements that the amount of profit in 2016 may exceed the expert evaluation.

SEB AB quotes climbed 1.3 percent after the lender said second-quarter profit beating analysts' forecasts.

Shares of insurance company Storebrand ASA rose 5.8 percent, as the company reported an increase in premiums and net profit in the 2nd quarter.

At the moment:

FTSE 6,741.34 +70.94 + 1.06%

CAC 4,387.54 +52.28 + 1.21%

DAX 10,081.53 +150.82 + 1.52%

-

13:17

Minutes of the Bank of England: The decision to keep the key rate at 0.5% was made at a ratio of 8-1 votes

- The number of votes cast in favor of keeping the key rates unchanged, was 8.

- The number of votes cast in favor of cuting the key rate was 1.

- Most members of the Committee are expected easing in August.

- Committee members previously discussed the different possible packages of measures.

- The extent of the additional incentives will depend on the August forecasts.

- We need a detailed analysis of all the policy options.

- In the short term weakening of the pound will increase inflation.

- Longer-term prospects depend on inflation expectations.

- Economic activity is likely to weaken after the referendum.

- The Bank of England pointed to the sharp drop in household confidence indicators and the business community.

- some companies have postponed investment and personnel decisions

-

13:12

Bank of England holds rates at 0.50% in an unexpected move. Gbp/Usd up over 220 pips. Time to sell?

-

13:09

WSE: Mid session comment

The first half of today's trading did not brought any major changes with respect to the opening. The bulls side tried to light approach, but still the behavior of the WSE remaining in the shadow of that observed in the environment, which today surprises very positively. Contracts in the US gain about 0.9% and the German DAX is rising by almost 1.5%.

The Warsaw market for some time is not too strong, and this week waiting for Friday's decision by the Fitch agency is an additional negative factor. Other agencies have already changed the rating level (S& P) or attitude (Moody's), so the last Fitch will certainly be under pressure to also make some changes. Regardless of this, the attitude of foreign investors remain very cautious and it inhibits demand, the consequences of which may be seen on the market every day.

KGHM shares recovered quite well of the dividend cut today. Worse in this respect cope PKN Orlen, which, not counting the "after-Braxit" slump, for a while may have the lowest since March quotations.

At the halfway point of the session, the WIG20 index was at the level of 1,735 points (-0,49%) and with turnover in the amount of PLN 365 mln.

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.25%)

-

13:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

12:29

Bank of England’s important meeting up next

The Bank of England is set to hold its first monetary policy meeting after Britons voted to exit the European Union.

Markets now expect a reduction in the key interest rate from a record low. The decision will be announced along with the minutes of the meeting.

Economists expect a 25 basis points reduction in rates from 0.50 percent. The monetary stimulus is forecast to be left unchanged at GBP 375 billion at this meeting but anything could happen.

-

12:17

The EU is moving forward on the issue of granting China the status of market economy

The European Union is moving ahead with the process of China as a market economy for the development of trade, but is concerned about the glut of production. This was stated by a senior representative of the European Commission.

"We are in favor of free trade, but as long as overproduction hurts fair trade, it is very difficult to implement this free trade, -. Said Katainen, EC vice president of employment, growth, investment and competitiveness -. We are ready to fulfill our legal obligation, but we are not naive. " He told reporters that the EU is committed to negotiations with China on how to solve the problem of excess capacity.

"The EU expects increased investment from China in infrastructure projects", - said Katainen, who was in Hong Kong after attending the two-day EU-China summit in Beijing. He added that the British referendum results will not have any impact on the investment. "Brexit has no effect on investments in Europe. Of course, the overall uncertainty is always negative for investment and economic growth."

-

11:52

RICS survey: sentiment in the housing market in Britain deteriorated after Brexit

Unexpected outcome of the British referendum had a direct impact on the UK housing market, causing a sharp drop in interest from buyers and reduce index future sales at the fastest pace in recent years. This was reported on the results of studies of the Royal Institution of Chartered Surveyors (RICS).

The balance of housing prices dropped in June to +16 against +19 in May. While economists had expected a more significant reduction (up to 10), the latest reading was the lowest since January last year. In general, the results of RICS study adds evidence that the outcome of the referendum is already having a noticeable impact on the economy.

Purchases of new homes fell at the fastest pace since mid-2008, roughly when Britain was in recession. Meanwhile, the rate of future sales fell at the fastest pace since the beginning of this statistic, ie from 1998. We also learned that the balance among respondents expecting the fall in housing prices in the next three months, rose to its highest level in a little over five years.

"Recent data suggest that activity will remain weak in the coming months, but a critical impact awaits us in the future, and it will depend on the ability of the economy to cope with the uncertainty of Brekzita." - Said the chief economist at RICS Simon Rubinson.

The results of the RICS Research officials interested in the Bank of England, which is expected today will reduce interest rates to a new record low of 0.25 per cent, to help ease the shock to the UK economy from Brexit.

-

11:26

US Treasury Secretary, Jack Lew:

-

highly integrated EU-UK relationship needed

-

US remains committed to US-EU trade pact

-

financial markets are orderly, functioning

-

US wants to uphold strong relationship with UK

-

highly integrated EU-UK relationship needed

-

US remains committed to US-EU trade pact

-

financial markets are orderly, functioning

-

US wants to uphold strong relationship with UK

-

-

11:01

Review of financial and economic press: The new head of the Ministry of Finance Britain is Philip Hammond

D/W

EU leaders call for the new British prime minister not to defer Brexit

EU leaders called on the new British Prime Minister Theresa May not to delay the opening of the negotiations on the country's withdrawal from the EU. On Wednesday, 13 July, the Chairman of the European Council, Donald Tusk, one of the first to congratulate Theresa May to the beginning of work as prime minister and expressed hope for fruitful cooperation.

Boris Johnson will be the head of the Ministry of Foreign Affairs

Former Mayor of London and one of the leaders will be the Ministry of Foreign Affairs of the United Kingdom. In this position he was appointed Wednesday, July 13, by the new prime minister Theresa May.

Newspaper. ru

The new Ministry of Finance of Britain is Philip Hammond

UK Finance Minister George Osborne has resigned and left the government, reports Reuters. He was replaced by ex-Foreign Minister Philip Hammond, appointed the new leader of the Conservative Party byTheresa May.

BBC

Nintendo's shares rose by more than 50% after the release of Pokemon Go

After the release of Pokemon Go Nintendo shares of the Japanese company in less than a week soared in price.

Theresa May takes time out to prepare for the Bexit negotiations

New British Prime Minister Theresa May said that its government will need additional time before it will be ready to commence negotiations on the country's withdrawal from the European Union.

-

10:34

UK Finance Minister Philip Hammond: extraordinary budget is not planned for the UK

- London as a financial center is characterized by increased resistance

- Saving investments - the key task after Brexit

- Investments halted

- The autumn statement will provide fiscal plans.

- I foresee difficulties in the short term

- Think about the pace of deficit reduction

- Extraordinary budget is not planned for the UK

-

10:20

Oil prices on the rise

This morning, New York crude oil futures WTI rose by 1.52% to $ 45.43 per barrel. At the same time, crude oil futures for Brent rose by + 1.32% to $ 46.87 per barrel. Thus, the black gold is gaining on the background of excess oil on the world markets, strong demand and a significant reduction of oil production by countries outside OPEC. The reserves of black gold in the United States fell last week, but not as much as analysts had expected. EIA reported that crude oil inventories fell by 2.5 million barrels last week while analysts had expected a reduction of almost 3 million barrels.

-

09:45

Swiss producer and import prices rose

The Producer and Import Price Index rose in June 2016 by 0.1% compared with the previous month, reaching 99.9 points (base December 2015 = 100). Whereas the Producer Price Index declined by 0.2%, the Import Price Index rose by 0.8%. The slight increase of the overall index is due in particular to higher prices for petroleum products. Compared with June 2015, the price level of the whole range of domestic and imported products fell by 1.0%. These are the findings of the Federal Statistical Office (FSO).

-

09:43

Major stock exchanges gaining in early trading: DAX 10,091.5 + 160.79 + 1.62%, FTSE 100 6,737.45 + 56.76 + 0.85%, CAC 40 4,388.91 + 53.65 + 1.24%

-

09:25

WSE: After opening

WIG20 index opened at 1740.03 points (-0.24%)*

WIG 45197.13 0.40%

WIG30 1964.89 -0.06%

mWIG40 3452.18 0.07%

*/ - change to previous close

The cash market opened with decrease of -0.24% to 1,740 points, what with the increasing of the WIG index and contracts clearly demonstrates the impact of severed dividends from PKN Orlen (WSE: PKN, PLN 2,00)and KGHM (PLN 1,50). The German DAX rises by almost 1.5%, while the US futures gain of 0.5%. The mood is very good, and in this context, the Warsaw Stock Exchange once again stands out from the pack, where the WIG20 could not break out of the level of 1,750 points, at which, from Monday's growth, we still are.

-

09:23

Today’s events:

- at 11:00 GMT Britain summary of the Monetary Policy.

- at 5:15 GMT FOMC member Dennis Lockhart will give a speech.

- at17:15 GMT FOMC members Easter George will deliver a speech.

- at 23:00 GMT FOMC members Robert Kaplan will deliver a speech.

-

09:15

Switzerland: Producer & Import Prices, y/y, June -1%

-

09:15

Switzerland: Producer & Import Prices, m/m, June 0.1% (forecast 0.2%)

-

08:49

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0,1%, FTSE 100 + 0,1%, CAC 40 + 0.2%

-

08:48

Asian session review: yen weakness

The yen fell against the US dollar. A certain pressure on the yen has had the dramatic revision of the forecasts for GDP growth and inflation by the Government of Japan. Explaining this decision, the Government pointed to the increase in uncertainty about the global economy, weak domestic consumption and sluggish investment companies. Now it is expected that in the current fiscal year ending March 30, GDP growth adjusted for inflation will be 0.9%. Earlier this year, GDP growth is expected at 1.7%. The forecast for inflation was reduced to 0.4% versus 1.2% previously. The Government also stated that in 2017 fiscal year forecasts GDP growth of 1.2% and a rise in inflation to 1.4%.

Pound, from the beginning of the trading session, strengthened against the US dollar caused by Gbp/Jpy cross rise and profit taking before BOE meeting later today. At its meeting on Thursday the Bank of England may cut interest rates to a new record low and introduce quantitative easing, to protect the economy from the earlier decision to leave the EU. On Tuesday, the head of the Bank of England Governor Mark Carney said that any negative consequences for the UK economy Brexit may force the central bank to act, reinforcing hopes for additional stimulus measures.

The Australian dollar has strengthened since the beginning of trading after the release of positive data on inflation expectations in July. However, in the course of trading the Australian currency began to fall on to the negative data on the labor market in Australia.

The level of unemployment in Australia rose to 5.8% in June, slightly above the previous value of 5.7%, and coincided with the forecast of economists. The growth rate indicates a lack of momentum of the labor market in the country. As a result, this leads to a weakening of the national economy.

In a report the Australian Bureau of Statistics say, the unemployment rate in June was the highest since February that increased the likelihood of lowering interest rates by the Reserve Bank of Australia at a meeting early next month.

Despite the rise in unemployment, the number of jobs in June increased by 7.9 thousand vs 10 000 expected. The number of jobs increased full-time by 38 400 and the number of jobs part-time decreased by 30 600. The proportion of the economically active population in June rose to 64.9% from 64.8% in May, the forecast assumes that it will amount to 64.8%.

In July, inflation expectations for consumer prices in Australia, published by the Melbourne Institute, increased by 3.7%, which is higher than the previous value of 3.5%. This indicator reflects the expectations of consumers with regard to future inflation over the next 12 months. The higher the expectations, the more they will produce a significant effect on the probability of RBA rate moves.

There are strong expectations in the market as to whether the RBA will lower rates in August, when the central bank will be able to get acquainted with for the second quarter inflation data.

The last time the rate decreased in May, when the RBA reacted to data showing very weak inflation in the first quarter.

Now RBA rate is at a record low of 1.75%, while still space for its decrease. In its decision to change the interest rate, the RBA will follow from the fact that expectations of low inflation is not entrenched.

EUR / USD: during the Asian session, the pair is trading in the $ 1.1090-1.1120 range.

GBP / USD: during the Asian session, the pair is trading in the $ 1.3100-1.3235 range.

USD / JPY: during the Asian session, the pair was trading in Y103.95-105.40 range.

-

08:35

New Zealand's consumer confidence decreased slightly in July

According to rttnews New Zealand's consumer confidence decreased slightly in July after improving in the previous month, the latest survey released by ANZ Bank and Roy Morgan showed Thursday.

The ANZ-Roy Morgan consumer confidence index fell to 118.2 in July from 118.9 in June. In May, the score was 116.2.

A reading above 100 indicates optimism, while below that shows pessimism.

The index measuring current conditions edged down to 122.5 in July from 122.7 a month ago. Similarly, the future conditions index slid to 115.5 from 116.4.

Consumers' expectations about the economy's prospects over the year ahead worsened to 4 in July from 9 in the preceding month. At the same time, their own financial expectations over the next twelve months rose to 29 from 24.

General inflation expectations eased to 3.3 percent in July from 3.8 percent a month ago. House price expectations rose once again, hitting yet another new high, led by Auckland.

-

08:32

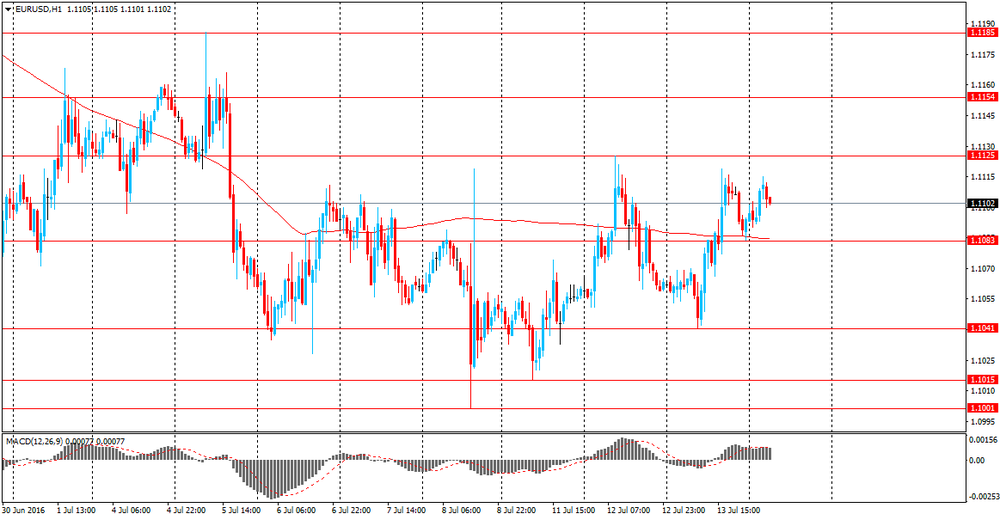

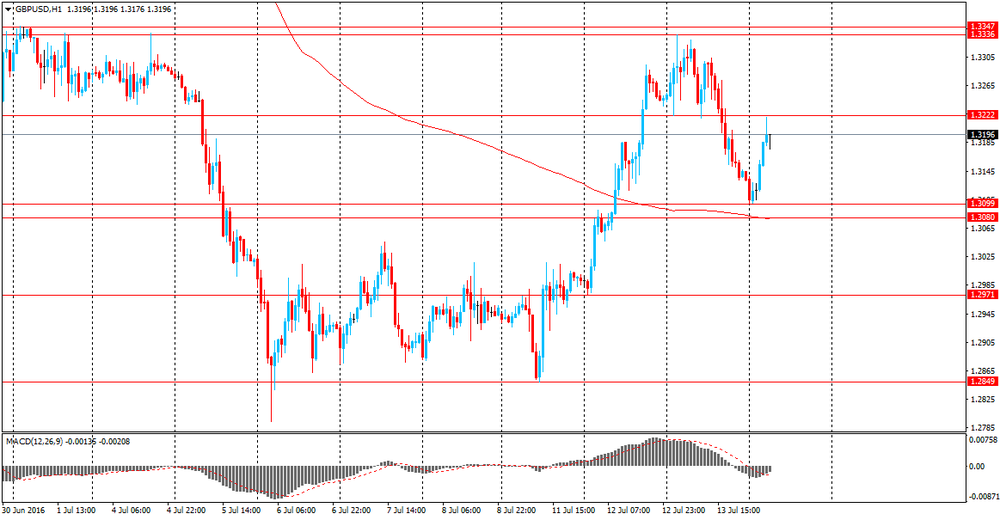

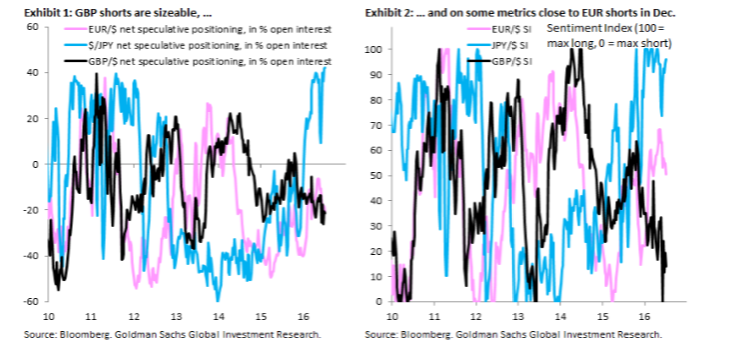

Positioning ahead of Bank of England - Goldman Sachs

"A persistent preoccupation of the foreign exchange market is positioning, especially ahead of key risk events like today's Bank of England meeting.

Exhibit 1 shows that speculative shorts in GBP/$ are 21.5 percent of open interest according to the CFTC's Commitment of Traders Report (CoT), the most sizeable short Sterling positioning (versus the Dollar) since early 2015. Our preferred metric - the Sentiment Index - transforms net positioning (in contracts) into an index between 0 and 100 based on min and max positioning on a three-year rolling window. Our Sentiment Index shows that Sterling shorts are comparable now to EUR/$ shorts ahead of the December ECB, which - on a disappointing meeting - caused a violent short-squeeze in EUR/$

There is no doubt that the build-up in speculative short positioning ahead of tomorrow's Bank of England meeting increases event risk into the meeting. But - especially in the case of the Pound after the Brexit vote - it is important to look at the bigger picture, which is that FX positioning can be a momentum or a contrarian signal.

Today's we updates those estimates and finds that stretched short speculative positioning in both cases still has a momentum signal, meaning that it tends to signal further weakening in these currencies versus the Dollar. On a four-week horizon our estimates put further GBP/$ downside at -1.0 percent, while on an eight-week horizon they put downside (cumulatively) at -2.4 percent, an estimate that is statistically different from zero.

In short, stretched short positioning for EUR/$ and GBP/$ has a momentum signal on average, suggesting further downside for Cable.

Our result obviously doesn't mean that a hawkish surprise from the Bank of England wouldn't matter. Obviously it would,which in many respects the December ECB meeting was a reminder of. But our economists do not forecast a repeat of that ECB meeting, which disappointed the market on action (the deposit rate was cut just 10bp with no signal for further easing, even after President Draghi had talked about "urgency" in bringing up inflation two weeks before) as well as on rhetoric.

Instead, even if the BoE stands pat, they expect dovish dissents from two MPC members and the minutes to be "exceptionally" dovish, essentially pre-announcing a rate cut and QE (leaning towards credit easing) for the August 4 meeting. The kind of about-turn that can fundamentally disorient the market, as it did for the ECB in December, is thus unlikely. As such, we see the momentum signal dominating short-term event risk into tomorrow, in line with our 3-month GBP/$ forecast of 1.20".

-

08:27

Moody's Investors Service says that Australian banks are facing a growing number of headwinds

Moody's Investors Service says that Australian banks are facing a growing number of headwinds due to increasing household leverage and persistently low interest rates, which are increasing the banks' sensitivity to shocks.

"These headwinds could, over time, put pressure on the credit profiles of Australia's major banks, particularly in the context of their very high ratings," says Frank Mirenzi, a Moody's Vice President and Senior Analyst.

"Whilst solvency and liquidity buffers have improved in recent years, the path of future balance sheet strengthening is likely to be slower than in previous years -- at a time when risks continue to rise," adds Mirenzi.

Moody's conclusions were contained in a just-released report on Australian banks, titled, "Australian Banks: Rising Leverage And Cyclical Challenges Pose Risks".

Moody's says that the weak state of the operating environment is reflected in Australia's accommodative monetary policy, characterized by a historical low in the Reserve Bank of Australia's (RBA) policy rate. This is likely to persist over the next 12 months.

-

08:27

Options levels on thursday, July 14, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1268 (3309)

$1.1240 (1711)

$1.1197 (1742)

Price at time of writing this review: $1.1112

Support levels (open interest**, contracts):

$1.1019 (3166)

$1.0953 (3339)

$1.0875 (7101)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 32781 contracts, with the maximum number of contracts with strike price $1,1200 (3309);

- Overall open interest on the PUT options with the expiration date August, 5 is 46404 contracts, with the maximum number of contracts with strike price $1,0900 (7101);

- The ratio of PUT/CALL was 1.42 versus 1.49 from the previous trading day according to data from July, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.3507 (808)

$1.3410 (1906)

$1.3314 (613)

Price at time of writing this review: $1.3244

Support levels (open interest**, contracts):

$1.3179 (235)

$1.3083 (194)

$1.2987 (627)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 21072 contracts, with the maximum number of contracts with strike price $1,3400 (1906);

- Overall open interest on the PUT options with the expiration date August, 5 is 18331 contracts, with the maximum number of contracts with strike price $1,2950 (2428);

- The ratio of PUT/CALL was 0.87 versus 0.88 from the previous trading day according to data from July, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

Advisor to the Prime Minister of Japan Hamada: Monetization can can cause recurrence of the cataclysm of the 1930s

- "helicopter money" discused with Bernanke.

- coverage of the state budget deficit in cash can cause uncontrolled government spending and inflation

- the need for action by the Bank of Japan on 29 July depends on the recovery of the stock market and the depreciation of the yen.

- not sure whether the Bank of Japan to soften the policy at the July meeting.

- supply reduction and an increase in demand in the labor market means that there is no need to discuss policy easing at each meeting

- corporate Japan should not rely on the assistance of the central bank.

-

08:11

Australian unemployment rate stable at 5,8%

The unemployment rate in Australia was a seasonally adjusted 5.8 percent in June, the Australian Bureau of Statistics said on Thursday.

That was in line with expectations, and up from 5.7 percent in May.

The Australian economy added 7,900 jobs in June to 11,939,600 - shy of expectations for 10,000 following the increase of 19,200 jobs in the previous month.

Full-time employment increased 38,400 to 8,198,900 and part-time employment decreased 30,600 to 3,740,700.

The participation rate came in at 64.9 percent - beating forecasts for 64.8 percent, which would have been unchanged.

Unemployment increased 9,900 to 734,200. The number of unemployed persons looking for full-time work decreased 9,200 to 496,700 and the number of unemployed persons only looking for part-time work increased 19,000 to 237,500.

Monthly hours worked in all jobs decreased 4.3 million hours to 1,640.0 million hours.

"The figures show that hours worked by employed people declined, but not by as much as in previous months. We are yet to see an increase in hours worked in 2016," said General Manager of the ABS' Macroeconomic Statistics Division, Bruce Hockman.

-

07:16

Global Stocks

European stocks scored a fourth consecutive win Tuesday, with investors hanging onto brighter prospects for further global stimulus efforts as the markets headed into a new earnings season.

The Stoxx Europe 600 SXXP, -0.13% rose 1.1% to close at 336.26, ending at the highest level since June 23rd, the day of the U.K.'s Brexit vote.

Investors are looking at the potential for an interest-rate cut by the Bank of England when it meets on Thursday. Mark Carney, Bank of England chief, was testifying at a Treasury committee to discuss the central bank's financial stability report.

U.S. stocks ticked up on Wednesday, just enough for the S&P 500 and Dow industrials to set record highs, with investors expecting upbeat earnings to keep the rally going.

Wall Street shares have quickly recovered the losses triggered by Britain's vote on June 23 to leave the European Union, driven by solid U.S. economic data.

Asian shares remained near an eight-month high on Thursday as investors bet the Bank of England will cut rates to ward off recession following Britain's vote to leave the European Union.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent, hovering near the highest level since November it reached on Wednesday. Japan's Nikkei .N225 added 0.8 percent.

Chinese stocks, however, were lower, with the CSI 300 index .CSI300 slipping 0.3 percent and the Shanghai Composite .SSEC down 0.4 percent. Hong Kong's Hang Seng .HSI was little changed.

-

04:04

Nikkei 225 16,282.67 +51.24 +0.32 %, Hang Seng 21,263.59 -58.78 -0.28 %, Shanghai Composite 3,054.53 -6.16 -0.20 %

-

03:35

Australia: New Motor Vehicle Sales (MoM) , June 3.1%

-

03:32

Australia: New Motor Vehicle Sales (YoY) , June 3.1%

-

03:31

Australia: Unemployment rate, June 5.8% (forecast 5.8%)

-

03:31

Australia: Changing the number of employed, June 7.9 (forecast 10)

-

03:00

Australia: Consumer Inflation Expectation, July 3.7%

-

01:04

Commodities. Daily history for Jul 13’2016:

(raw materials / closing price /% change)

Oil 45.11 +0.80%

Gold 1,345.00 +0.10%

-

01:03

Stocks. Daily history for Jun Jul 13’2016:

(index / closing price / change items /% change)

Nikkei 225 16,231.43+135.78+0.84%

Hang Seng 21,322.37+97.63+0.46%

S&P/ASX 200 5,388.54+35.32+0.66%

Shanghai Composite 3,060.21+10.83+0.36%

FTSE 100 6,670.4 -10.29 -0.15 %

CAC 40 4,335.26 +3.88 +0.09 %

Xetra DAX 9,930.71 -33.36 -0.33 %

S&P 500 2,152.43 +0.29 +0.01 %

NASDAQ Composite 5,005.73 -17.09 -0.34 %

Dow Jones 18,372.12 +24.45 +0.13 %

-

01:01

Currencies. Daily history for Jul 13’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1090 +0,24%

GBP/USD $1,3133 -0,87%

USD/CHF Chf0,9846 -0,40%

USD/JPY Y104,36 -0,37%

EUR/JPY Y115,79 -0,09%

GBP/JPY Y137,07 -1,25%

AUD/USD $0,7605 -0,17%

NZD/USD $0,7274 -0,26%

USD/CAD C$1,2981 -0,42%

-

00:30

New Zealand: Business NZ PMI, June 57.7

-

00:01

Schedule for today, Thursday, Jul 14’2016:

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation July 3.5%

01:30 Australia New Motor Vehicle Sales (MoM) June -1.1%

01:30 Australia New Motor Vehicle Sales (YoY) June 1.7%

01:30 Australia Changing the number of employed June 17.9 10

01:30 Australia Unemployment rate June 5.7% 5.8%

07:15 Switzerland Producer & Import Prices, m/m June 0.4%

07:15 Switzerland Producer & Import Prices, y/y June -1.2%

11:00United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom Bank of England Minutes

12:30 Canada New Housing Price Index, MoM May 0.3%

12:30 U.S. Continuing Jobless Claims 2124 2128

12:30 U.S. PPI, m/m June 0.4% 0.2%

12:30 U.S. PPI, y/y June -0.1% -0.1%

12:30 U.S. PPI excluding food and energy, m/m June 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y June 1.2% 1%

12:30 U.S. Initial Jobless Claims 254 265

-