Noticias del mercado

-

22:09

US stocks closed

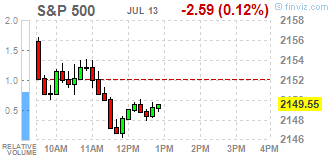

The S&P 500 Index eked out a third straight closing record, overcoming a drop in the price of crude that dragged energy shares lower as a let-up in the U.K.'s political turmoil kept demand for risk assets alive.

The S&P 500 Index added less than half a point after a 10-day surge restored almost $2 trillion to the value of shares. Energy producers led losses after crude sank below $45 a barrel amid an unexpected increase in fuel stockpiles. Treasuries advanced, halting the biggest two-day decline this year, as the U.S. auctioned 30-year bonds at the lowest yield on record. Copper rose along with precious metals.

While calm has returned to global markets amid higher confidence that the Brexit vote won't hamper growth, rallies in stocks lost momentum on Wednesday as investors looked for fresh signs that sluggish expansion isn't eroding corporate profits. America's largest lenders begin reporting Thursday. Risk assets had been in demand on speculation central banks will boost stimulus even as the American economy shows signs of accelerating..

The S&P 500 added less than 0.1 percent at 4 p.m. in New York, edging higher to a third-straight record close. So-called defensive groups that pay higher dividends climbed the most, with telephone, consumer-staples and utility companies rising at least 0.5 percent. Energy shares led declines out of 10 groups, while retailers and banks also retreated.

-

21:01

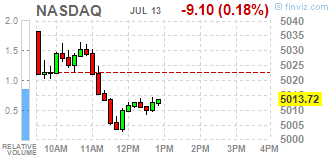

DJIA 18372.70 25.03 0.14%, NASDAQ 5013.43 -9.39 -0.19%, S&P 500 2152.70 0.56 0.03%

-

20:00

U.S.: Federal budget , June 6 (forecast 24)

-

19:00

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed after a three-day record-setting rally, U.S. stocks took a breather on Wednesday, with investor focus now on corporate reports to see if the higher valuations are justifiable. A strong U.S. jobs report on Friday, easing political tension in Japan and Britain and increased prospects of central banks providing stimulus post Britain's vote to leave the European Union, calmed nerves and boosted faith in equities.

Most of Dow stocks in positive area (17 of 30). Top looser - The Home Depot, Inc. (HD, -1,03%). Top gainer - UnitedHealth Group Incorporated (UNH, +0,97%).

Almost of all S&P sectors in negative area. Top looser - Basic Materials (-1,1%). Top gainer - Utilities (+0,3%).

At the moment:

Dow 18260.00 -4.00 -0.02%

S&P 500 2143.00 -2.75 -0.13%

Nasdaq 100 4567.75 -2.00 -0.04%

Oil 44.93 -1.87 -4.00%

Gold 1343.70 +8.40 +0.63%

U.S. 10yr 1.47 -0.04

-

18:00

European stocks closed: FTSE 6670.40 -10.29 -0.15%, DAX 9930.71 -33.36 -0.33%, CAC 4335.26 3.88 0.09%

-

17:46

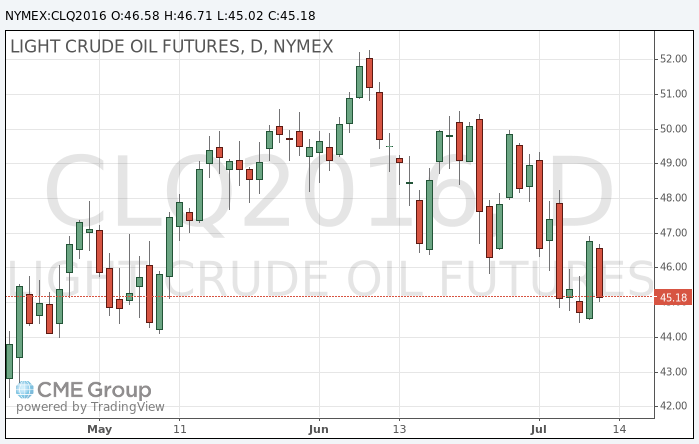

Oil quotes continue to fall after inventory data

Oil prices fell more strongly after the US Department of Energy reported a decrease in oil reserves and a strong increase in stocks of petroleum products, including gasoline and diesel fuel. Oil production in all US states except Alaska and Hawaii declined slightly, but this decline was offset by an increase in oil production in Alaska.

In the week of July 2-8 fell stocks of gasoline and other petroleum products rose unexpectedly..In the weekly department report oil inventories fell by 2.5 million barrels to 521.8 million barrels, but remained at a very high level by historical standards for a given period of the year. The average forecast of analysts anticipated a decline in stocks by 3.3 million barrels.

Oil reserves in the terminal Cushing (Oklahoma), which supply of oil traded on NYMEX, fell by 232,000 barrels to 63.9 million barrels.

Gasoline stocks rose by 1.2 million barrels to 240.1 million barrels. Analysts had expected gasoline stocks to fall 900,000 barrels.

Distillate stocks rose by 4.1 million barrels barrels to 153 million barrels. This rate is still above the upper limit of the average range for this time of the year. Analysts expected distillate stocks compared to last week will not change.

The utilization of refining capacity fell by 0.2 percentage points to 92.3%. Analysts suggested that the figure will rise by 0.5 percentage points.

Earlier, oil fell after the International Energy Agency (IEA) warned that oversupply on world markets threatens to price recovery.

IEA, coordinating energy policies in industrialized countries, reported that stockpiles continued to rise in June, bringing the oil in floating storage to a high of over 7 years.

Despite the pessimistic outlook of rising oil prices, the IEA raised its forecast of demand for black gold in 2016 and 2017 0.1 million barrels per day to 1.4 and 1.3 million barrels per day, respectively.

Credit Suisse on Wednesday raised its forecasts of an average cost of WTI crude oil in 2016 and 2017 to $ 43.59 and $ 55.00 per barrel, respectively, $ 36.91 and $ 52.88 per barrel.

Forecasts of the average cost of Brent crude oil in 2016 and 2017 have been revised upward to $ 44.53 to $ 37.77 per barrel in 2016 and $ 56.25 to $ 54.25 per barrel in 2017.

The cost of the August futures for US light crude oil WTI fell to 44.84 dollars per barrel.

September futures price for Brent fell to 46.17 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:43

WSE: Session Results

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, lost 0.27%. Except for banking sector (-2.02%) and oil and gas (-0.08%) every sector in the WIG Index rose, with materials (+3.71%) outperforming.

The large-cap stocks' measure, the WIG30 Index, fell by 0.25%. Within the WIG30 Index components, bank PEKAO (WSE: PEO) was hit the hardest, tumbling by 6.39% on the announcement that Italy's biggest bank by assets UniCredit raised €749 mln by placing a 10 percent stake in its Polish subsidiary at a 6 percent discount to the previous session's closing price. Sources familiar with the matter said that most of the stake was sold to foreign investors. After the sale of the stake, UniCredit still holds about 40 percent of PEKAO. Other major losers were FMCG-wholesaler EUROCASH (WSE: EUR), bank MBANK (WSE: MBK) and insurer PZU (WSE: PZU), declining by 3.19%, 2.65% and 2.25% respectively. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB), chemical producer GRUPA AZOTY (WSE: ATT) and copper producer KGHM (WSE: KGH) recorded the strongest daily results, climbing by 6.68%, 5.55% and 4.07% respectively.

-

17:24

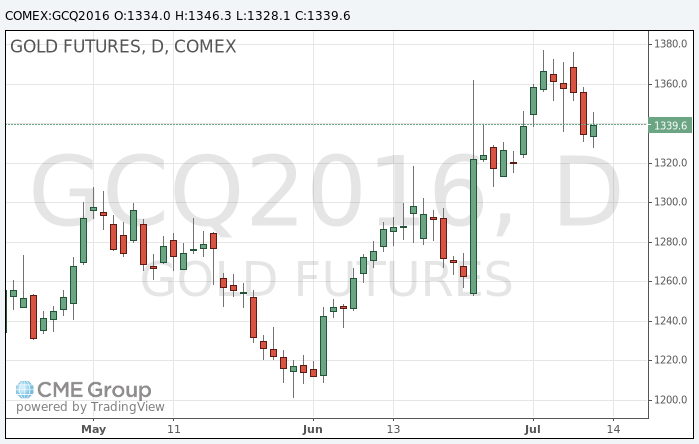

Gold price moderate increase

Gold rises in price during today's trading, recovering from a low of nearly two weeks as prospects for further economic stimulation led to an increase in investor' activity on the background of a stable dollar.

Easing monetary policy is beneficial to gold and shares, because low interest rates encourage investors to opt for assets that do not depend on interest income.

"The price of gold may continue to receive support from the uncertain prospects for the UK and Europe after the vote for Brexit, as well as from any of quantitative easing, which also means lower interest rates", - said an analyst at Natixis Bernard Dada.

Gold has risen in price by about $ 100 per ounce after the United Kingdom voted in favor of withdrawal from the European Union, and investors were quick to shift money into safer assets.

Asian and European stocks on Wednesday very close to the year highs, and the dollar has not changed against a basket of six currencies.

But, in spite of the data on jobs, the Fed will not rush to raise interest rates, said two of its officials.

The assets of the world's largest gold exchange-traded fund (ETF) SPDR Gold Trust on Tuesday fell by 1.63 percent to 965.22 tons, this is the strongest one-day drop since 2 December.

The cost of the August gold futures on the COMEX rose to $ 1346.3 per ounce.

-

16:49

Crude oil supplies fell by a less-than-expected 2.5 million barrels

According to marketwatch, oil futures extended their earlier losses Wednesday after the U.S. Energy Information Administration reported that domestic crude supplies fell by a less-than-expected 2.5 million barrels for the week ended July 8. The American Petroleum Institute late Tuesday had reported a 2.2 million-barrel climb, according to sources, while analysts polled by S&P Global Platts expected a decline of 3.25 million barrels. Gasoline supplies rose 1.2 million barrels, while distillate stockpiles jumped by 4.1 million barrels last week, according to the EIA. August crude CLQ6, -2.33% fell 92 cents, or 2%, from Tuesday's settlement to $45.88 a barrel on the New York Mercantile Exchange. Prices traded at $46.25 before the data.

-

16:30

U.S.: Crude Oil Inventories, July -2.546 (forecast -3.25)

-

16:08

Bank of Canada: Inflation is on track to return to 2% in 2017. USD/CAD down 100 pips so far

The Bank of Canada announced that it is maintaining its target for the overnight rate at +0.50%.The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 percent.

Inflation in Canada is on track to return to 2 per cent in 2017 as the complex adjustment underway in Canada's economy proceeds. The fundamentals remain in place for a pickup in growth over the projection horizon, albeit in a climate of heightened uncertainty.

In this context, the forecast for the global economy has been marked down slightly from the Bank's April Monetary Policy Report (MPR). Global GDP growth is projected to be 2.9 per cent in 2016, 3.3 per cent in 2017, and 3.5 per cent in 2018. In particular, after a weak start to 2016 the US economy is showing signs of a rebound, with a healthy labour market and solid consumption growth. In the wake of Brexit, global markets have materially re-priced a number of asset classes. Financial conditions, already accommodative, have become even more so.

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:50

WSE: After start on Wall Street

The Wall Street began today's session from the area of yesterday's close, however the DJIA and the S&P500 indices reached new records of all time. The lack of major shifts at the opening was encouraged by neutrally performing exchanges of Euroland. It is worth to remember that the S&P500 is at new levels after amplification of the last days, where in addition to the completion of opportunities over a 2-year consolidation are also some risks. The Wall Street now operates during the season of quarterly results, which always bring with them a dose of hype and technical credibility of the charts decreases. It does not change the fact that the market broke out with several months of consolidation and there is a question about the range increases.

On the Warsaw market, we still have to deal with the weakness of Pekao (WSE: PEO). The company has already lost 6.5 percent, and the lack of any reflection from the bottom of the session weakens index of the largest companies.

-

15:49

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (E419m), 1.1100 (E411m), 1.1120 (E302m), 1.1150 (E407m)

USD/JPY: 102.00 ($440m), 106.00 ($850m)

GBP/USD: 1.3100 (Gbp405m)

AUD/USD: 0.7350 (A$340m), 0.7375-80 (A$390m)

EUR/JPY: 112.50 (E260m)

EUR/GBP: 0.8200 (E292m)

-

15:32

U.S. Stocks open: Dow +0.21, Nasdaq +0.21%, S&P +0.19%

-

15:32

Germany issued 10-year government bonds with a negative yield for the first time

Germany issued 10-year government bonds with a negative yield for the first time, on Wednesday, becoming the first euro area country to do so.

The coupon rate on the bond, known as the Bund, was zero percent. The German 10-year bonds are seen as the benchmark for European bond markets.

The country sold more than EUR 4 million at a yield of minus 0.05 percent at the auction, the Bundesbank said.

The sale reflects investors' willingness to own safe-haven debt amid the lingering concerns over the "Brexit" negotiations.

Negative rate imply investors holding the Bund will receive less than what they paid when the debt matures. In the current volatile environment, investors are increasingly willing to settle for lower return.

-

15:05

Before the bell: S&P futures +0.17%, NASDAQ futures +0.25%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,231.43 +135.78 +0.84%

Hang Seng 21,322.37 +97.63 +0.46%

Shanghai Composite 3,060.21 +10.83 +0.36%

FTSE 6,691.75 +11.06 +0.17%

CAC 4,356.06 +24.68 +0.57%

DAX 9,986.76 +22.69 +0.23%

Crude $46.40 (-0.85%)

Gold $1342.50 (+0.54%)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.76

0.07(0.6548%)

120350

ALTRIA GROUP INC.

MO

69.05

0.18(0.2614%)

782

Amazon.com Inc., NASDAQ

AMZN

747.14

-1.07(-0.143%)

10090

Apple Inc.

AAPL

97.6

0.18(0.1848%)

46895

AT&T Inc

T

42.49

0.08(0.1886%)

9620

Barrick Gold Corporation, NYSE

ABX

21.24

0.62(3.0068%)

187076

Boeing Co

BA

130.81

-0.00(-0.00%)

704

Caterpillar Inc

CAT

79.87

0.07(0.0877%)

4570

Chevron Corp

CVX

106.85

0.07(0.0656%)

7720

Cisco Systems Inc

CSCO

29.56

-0.05(-0.1689%)

1665

Citigroup Inc., NYSE

C

43.3

-0.14(-0.3223%)

19966

E. I. du Pont de Nemours and Co

DD

65.94

0.00(0.00%)

1332

Exxon Mobil Corp

XOM

94.74

-0.21(-0.2212%)

770

Facebook, Inc.

FB

118.2

0.27(0.2289%)

39692

Ford Motor Co.

F

13.45

-0.00(-0.00%)

26361

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.83

-0.07(-0.5426%)

724154

General Electric Co

GE

32.27

0.01(0.031%)

19565

General Motors Company, NYSE

GM

30.61

0.01(0.0327%)

352

Goldman Sachs

GS

156.97

0.05(0.0319%)

1285

Google Inc.

GOOG

721.4

0.76(0.1055%)

2225

Home Depot Inc

HD

134.82

-0.02(-0.0148%)

180

Intel Corp

INTC

35.1

0.16(0.4579%)

22134

JPMorgan Chase and Co

JPM

63.06

-0.14(-0.2215%)

22703

McDonald's Corp

MCD

122.25

0.00(0.00%)

126

Merck & Co Inc

MRK

59.4

-0.20(-0.3356%)

460

Microsoft Corp

MSFT

53.42

0.21(0.3947%)

7399

Nike

NKE

58.04

-0.02(-0.0344%)

400

Pfizer Inc

PFE

36.44

0.20(0.5519%)

3663

Starbucks Corporation, NASDAQ

SBUX

56.55

-0.93(-1.618%)

43980

Tesla Motors, Inc., NASDAQ

TSLA

225.83

1.18(0.5253%)

12507

Twitter, Inc., NYSE

TWTR

18.25

0.15(0.8287%)

43292

UnitedHealth Group Inc

UNH

139.86

0.00(0.00%)

600

Verizon Communications Inc

VZ

55.57

0.10(0.1803%)

6368

Visa

V

77.55

0.07(0.0903%)

3759

Yahoo! Inc., NASDAQ

YHOO

37.88

-0.01(-0.0264%)

1805

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:Microsoft (MSFT) reiterated at Outperform at RBC Capital Mkts; target $61

JMorgan Chase (JPM) initiated with a Sell at Berenberg

Morgan Stanley (MS) initiated with a Hold at Berenberg

Goldman Sachs (GS) initiated with a Hold at Berenberg

Citigroup (C) initiated with a Buy at Berenberg

Bank of America (BAC) initiated with a Buy at Berenberg

Amazon (AMZN) target raised to $915 at The Benchmark Company

-

14:35

US: import and export prices rise

U.S. import prices rose 0.2 percent in June, after rising 1.4 percent in May, the U.S. Bureau of Labor Statistics reported today. The June advance was driven by higher fuel prices which more than offset a decline in nonfuel prices. Prices for U.S. exports also increased in June, rising 0.8 percent following

advances of 1.2 percent in May and 0.4 percent in April. -

14:33

European session review: the pound waiting for the outcome of Bank of England's meeting

The following data was published:

(Time / country / index / period / previous value / forecast)

7:00 China Trade balance, bn June 49.98 46.64 46.56

9:00 Eurozone Industrial Production m / m in May 1.4% -0.8% -1.2%

9:00 Eurozone Industrial Production y / y in May 2.2% 1.4% 0.5%

The euro rose moderately against the dollar, recovering from declines in the first half of the session. Support for euro was the renewed investor demand for risky assets. In addition, the euro followed by the British pound, which is the main topic of traders on the eve of the scheduled for Thursday monetary policy meeting.

Eurostat Statistical Office reported a seasonally adjusted volume of industrial production in the euro area fell in May by 1.2% after rising 1.4% in the previous month. Experts predicted a decrease of 0.8%. Among the EU countries, industrial production decreased by 1.1% after rising 1.5% in April. On an annual basis, industrial production increased by 0.5% in the euro area and by 1.1% in the EU. It was expected that production in the euro zone will grow by 1.4% after rising 2.2% in April. Among the Member States, the largest decline in industrial production was recorded in the Netherlands (-7.8%), Portugal (-4.4%), Greece (-4.3%) and Romania (-4.0%). The increase was recorded in Lithuania (+ 3.9%), Latvia (+ 2.4%), Slovenia (+ 0.6%) and Malta (+ 0.3%).

The pound traded mixed against the dollar, while remaining a relative tight range. The positive impact for the currency was a decrease in uncertainty around Brexit influenced by recent changes in the UK Government. Meanwhile, against the backdrop of the lack of British data the pair is focused on the dynamics of stock markets and the overall mood of the players.

Investors are also waiting for the meeting of the Bank of England, which is scheduled for tomorrow. After the referendum, the head of the Central Bank Carney considering the possibility of easing monetary policy. It is likely that steps will be taken at the upcoming meeting. It is expected that the Central Bank to lower interest rates 0.25% for the first time since March 2009.

The yen fell against the dollar, returning to the opening levels. Earlier today, the yen strengthened after Japan Esihide Suga denied media reports that Prime Minister Abe is considering "helicopter money" (direct purchases of government bonds by the Central Bank to finance government spending or tax cuts). In addition, he said that the government plans to carry out large-scale stimulus measures in order to overcome deflation.

A certain pressure on the yen has had a dramatic revision of the forecasts for GDP growth and inflation by the Government of Japan. Explaining this decision, the Government pointed to the increase in uncertainty about the global economy, weak domestic consumption and sluggish investment. Now it is expected that in the current fiscal year which ends March 30, GDP growth adjusted for inflation will be 0.9%. Earlier this year, GDP growth is expected at 1.7%. The forecast for inflation was reduced to 0.4% versus 1.2% previously. The Government also stated that in 2017 forecasts GDP growth of 1.2% and a rise in inflation to 1.4%.

EUR / USD: during the European session, the pair has risen to $ 1.1080

GBP / USD: during the European session, the pair is trading in the $ 1.3219- $ 1.3330 range

USD / JPY: during the European session, the pair rose to Y104.85

-

14:30

U.S.: Import Price Index, June 0.2% (forecast 0.5%)

-

14:00

Orders

EUR/USD

Offers 1.1075-80 1.1100 1.1130 1.1150 1.1170 1.1185 1.1200

Bids 1.1030 1.1000 1.0975-80 1.0950 1.0930 1.0900

GBP/USD

Offers 1.3280 1.3300 1.3320 1.3350 1.3375 1.3400 1.3420-25 1.3450 1.3480 1.3500

Bids 1.3220-25 1.3200 1.3185 1.3150 1.3130 1.3100 1.3080 1.3050 1.3030-35 1.3000

EUR/GBP

Offers 0.8380 0.8400 0.8420 0.8450 0.8485 0.8500

Bids 0.8300 0.8285 0.8250 0..8230 0.8200 0.8150

EUR/JPY

Offers 115.50 115.80 116.00 116.30 116.50

Bids 115.00 114.85 114.50 114.20 114.00 113.80-85 113.50 113.00

USD/JPY

Offers 104.50 104.85 105.00 105.30 105.50

Bids 104.00 103.80 103.50 103.30 103.00 102.80 102.40-50 102.20 102.00

AUD/USD

Offers 0.7630 0.7650 0.7670 0.7700 0.7720 0.7750-55

Bids 0.7575-80 0.7555-60 0.7540 0.7520 0.7500 0.7480 0.7450-55 0.7425 0.7400

-

13:59

Russian inflation slowed to 9% in June - Central Bank

The trend inflation in RF slowed to 9% compared to 9.3% in May according to Bank of Russia.

The trend inflation largely reflects the dynamics of core inflation.

"If present trends continue dynamics of prices and monetary aggregates, we expect a further gradual decline in inflation trend estimates", - stated in the comments of the Central Bank.

At the same time, the risks of deviations of inflation from the target at the end of 2017 remain. The trend inflation remains at a high level and decreases slowly, said the Bank of Russia.

The regulator started to publish an assessment of the trend of inflation in June 2015 According to the CBR, the assessment of the trend in inflation can be viewed as a long-term component of inflation and can serve as a reliable benchmark with respect to the implementation of monetary policy in comparison with the more volatile actual rate of inflation.

The indicator of the trend of inflation is taken into account by the Bank of Russia in making key interest rate decisions.

-

13:13

WSE: Mid session comment

The morning phase of the session came to the end. Today we have to deal with more than the average volume of trading, while almost PLN 700 million was made on the shares of Pekao (WSE: PEO) and on the other companies from the WIG20 index falls slightly above PLN 200 million. As far as turnover is now more than satisfactory, the variability is already at several points and the WIG20 index fluctuates around the level of 1,750 points.

-

12:53

Major stock indices in Europe show a slight increase

European stocks traded in the green zone for a fifth straight session, continuing to recover from the collapse caused by the British referendum results. Positive impact on the market had the financial statements of companies in the region, as well as the reduction of political uncertainty in the UK.

As previously reported, the new leader of the ruling party in Britain was the current head of the Ministry of Internal Affairs Theresa May, which will replace David Cameron as prime minister. Cameron stressed that the new prime minister is ready to provide full support. Recall, May advocated the preservation of the country within the EU, Earlier policies gained the support of more than half of the total number of representatives of the Conservative Party in the Parliament.

A slight pressure on the indices after the euro area economic data. Eurostat Statistical Office reported the seasonally adjusted volume of industrial production in the euro area fell in May by 1.2% after rising 1.4% in the previous month. Experts predicted a decrease of 0.8%. Among the EU countries, industrial production decreased by 1.1% after rising 1.5% in April. On an annual basis, industrial production increased by 0.5% in the euro area and by 1.1% in the EU. It was expected that production in the euro zone will grow by 1.4% after rising 2.2% in April. Among the Member States, the largest decline in industrial production was recorded in the Netherlands (-7.8%), Portugal (-4.4%), Greece (-4.3%) and Romania (-4.0%). A increase was recorded in Lithuania (+ 3.9%), Latvia (+ 2.4%), Slovenia (+ 0.6%) and Malta (+ 0.3%).

The composite index of the largest companies in the region Stoxx Europe 600 up 0.3 percent. Over the last four sessions of the index rose by about 5.5 percent.

"There is still a lot of uncertainty about what will happen to UK and how quickly these negotiations will unfold. But at the moment anxiety decreased and orporate reporting is very important to o convince investors that there is a space for the growth of shares of European companies - said Benno Galiker trader Luzerner Kantonalbank.

Burberry Group Plc shares rose 2.2 percent after the company reported that in the first quarter sales exceeded analysts' forecasts.

Shares of mining companies also traded in positive territory - Antofagasta Plc quotes and ArcelorMittal rose at least 2.7 percent.

Quotes Playtech Plc rose 4.6 percent against the backdrop of the Best Gaming Technology GmbH acquisitions for 138 million. Euro.

Shares of Italian lenders decreases after rising 20 percent in the past four days. Shares of UBI Banca SpA and Banco Popolare SC fell more than 3.4 percent.

At the moment:

FTSE100 6,693.35 +12.66 + 0.19%

CAC40 4,349.98 +18.60 + 0.43%

DAX 9,975.56 +11.49 + 0.12%

-

12:46

UK’s credit demand to worsen - Credit Conditions Survey

U.K. lenders expect the demand for secured credit from households to decline in near term, the Credit Conditions Survey from the Bank of England showed Wednesday.

Secured credit availability to households tightened slightly in three months to June. Lenders expected the availability to be little changed in the near term but the demand for secured credit to fall.

Respondents to the survey suggested that both the supply of and demand for unsecured credit continued to rise in the three months to mid-June.

Both cost and availability of credit to companies of all sizes was unchanged in the three months ahead of the EU referendum.

Lenders expect the availability of credit to the corporate sector to remain steady and the demand to fall back in the near term.

-

12:41

The Bank of Canada will not change the monetary policy today - Barclays Capital

We expect that in the course of today's meeting the Bank of Canada will leave unchanged its benchmark interest rate - at 0.5% in the accompanying statement, the Central Bank is likely to indicate that is monitoring the situation on global markets after Brexit and evaluate potential impact of this event on the Canadian economy. We believe that the Bank of Canada will keep unchanged its monetary policy at the moment, in spite of the increase in global risk aversion and a weakening outlook for global growth after the referendum in the UK. The Bank of Canada is likely to lower the growth forecast for the world economy after the shock of Brexit and slightly worsen its domestic growth forecast. The revised forecasts should also include the effects of forest fires in the Fort McMurray, which is expected to take away around 1.25 .% of the GDP growth in. Q2 Particular attention will be paid to the assessment of risks to inflation and expected growth, given the still low commodity prices - said Barclays.

-

12:10

Fitch Ratings: political uncertainty in Australia has increased after the elections

"Reliable long-term fiscal consolidation strategy remains a key factor for the sovereign rating of Australia, - noted Fitch's. It remains to be seen whether the financial outlook was changed due to a new balance of power in parliament."

"The lack of a strong electoral mandate can also exacerbate internal politics within the major parties and act as an additional source of political uncertainty. Potential internal political constraints on policy occur at a time when the economy is facing heightened risks."

-

11:38

Japan preparing for new economic stimulus: CPI estimate lowerd to +0.4%

- Japanese government lowered fiscal 2016 CPI estimate to +0.4% from +1.2%.

- government expects fiscal 2017 CPI at 1.4%.

- cuts fiscal 2016 GDP to +0.9% from +1.7% previous.

-

11:28

Review of financial and economic press: Ireland's GDP grew by more than 26%

D/W

Bernie Sanders officially supported Hillary Clinton

Bernie Sanders officially supported the candidacy of Hillary Clinton in her fight for the presidency. "I hope to do everything in my power to make sure that it will be the next president of the United States," - said the 74-year-old senator from Vermont.

EC has supported sanctions against Spain and Portugal

For the first time in the history of the EU, euro zone finance ministers supported the imposition of sanctions against EU Member States due to insufficient efforts to reduce the budget deficit. The efforts of Spain and Portugal, according to a statement released on Tuesday, 12 of July, significantly lower than those which had to be taken.

newspaper. ru

China Wanda Group buys European cinema chain for $ 1.2 billion

AMC Entertainment American cinema chain has signed an agreement to acquire the European network of Odeon & UCI in the investment fund Terra Firma for $ 1.2 billion, reports "Xinhua".

Ireland's GDP grew by more than 26%

Ireland Central Statistics Office revised its estimate of growth in GDP, resulting in a figure increased by almost three times. The increase is due to the transfer to Ireland headquarters of major international companies. Evaluation revised 7.8% GDP growth in 2015 to 26.3% of GDP, while both indicators are the best in Europe.

Spain hopes for "zero" sanctions from EU

Acting Minister of Economy Luis de Guindos said at a press conference that the authorities are planning to implement tax reform to reduce the budget deficit and avoid sanctions.

OPEC raised its forecast for oil production in Russia

Organization of Petroleum Exporting Countries (OPEC) in its June report raised the forecast for the level of oil production in Russia by 10 thousand barrels per day to 10.98 million barrels per day, which is higher than in 2015 by 140 thousand barrels.

RBC

Mercedes overtaken BMW in the number of cars sold

Mercedes-Benz in the first half of the year overtaken BMW in the number of cars sold. The company's goal - by 2020 to regain leadership in the segment of luxury cars, lost 11 years ago.

OPEC called Brexit risk for world oil demand

The exit of the UK from the EU after the referendum is a risk to the global economy and growth in demand for oil in Europe, OPEC said in its monthly report published on Tuesday.

-

11:07

Euro Area industrial production down 1.2% in May

In May 2016 compared with April 2016, seasonally adjusted industrial production fell by 1.2% in the euro area (EA19) and by 1.1% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In April 2016 industrial production rose by 1.4% in the euro area and by 1.5% in the EU28. In May 2016 compared with May 2015, industrial production increased by 0.5% in the euro area and by 1.1% in the EU28.

The decrease of 1.2% in industrial production in the euro area in May 2016, compared with April 2016, is due to production of energy falling by 4.3%, capital goods by 2.3%, durable consumer goods by 1.4%, intermediate goods by 0.4% and non-durable consumer goods by 0.1%.

In the EU28, the decrease of 1.1% is due to production of energy falling by 3.3%, capital goods by 2.0%, durable consumer goods by 0.7%, intermediate goods by 0.5% and non-durable consumer goods by 0.3%. Among Member States for which data are available, the largest decreases in industrial production were registered in the Netherlands (-7.8%), Portugal (-4.4%), Greece (-4.3%) and Romania (-4.0%), while increases were recorded in Lithuania (+3.9%), Latvia (+2.4%), Slovenia (+0.6%) and Malta (+0.3%).

-

11:00

Eurozone: Industrial production, (MoM), May -1.2% (forecast -0.8%)

-

11:00

Eurozone: Industrial Production (YoY), May 0.5% (forecast 1.4%)

-

10:59

Oil is trading lower

This morning, New York crude oil futures for WTI fell by -1.18% to $ 46.25 per barrel. At the same time, Brent crude oil futures fell -1.42% to $ 47.76 per barrel. Thus, the black gold is lower on the API data output background. US crude oil inventories last week rose by 2.2 million barrels - up to 523.1 million barrels, while analysts had expected an increase of 3 million barrels.. Official data on the level of oil inventories in the US will be published later. The price was also influenced by the strengthening of the dollar and the desire of some market participants to lock in profits after the rally on Tuesday became the strongest since the beginning of April.

-

10:33

IEA: 2017 oil demand rising by a further 1.3m bpd due to India, China

- stocks close to topping out but are at such elevated levels that they remain a major dampener on prices.

- OECD commercial inventories built in May and June to a new record high, floating storage is at highest level since 2009.

- European oil demand has surprised on the upside but is unlikely to last due to Brexit uncertainty.

- IEA raises estimate of 2016 global oil demand growth by 0.1m bpd from last month's report to 1.4m bpd.

- 2017 oil demand rising by a further 1.3m bpd due to India, China.

- very high oil stocks present a threat to price stability despite oil market balancing underway.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0950 (EUR 718m) 1.1000 (941m) 1.1050 (1.2bln) 1.1075 (372m)

USD/JPY 102.00 (USD 855m)

GBP/USD 1.3300 (GBP 554m)

USD/CAD 1.3100 (USD 320m)

NZD/USD 0.7090 (NZD 200m) 0.7275 (200m)

-

10:10

Spain's consumer prices declined as estimated in June

Spain's consumer prices declined as estimated in June, final data from the statistical office INE showed Wednesday.

Consumer prices dropped 0.8 percent year-on-year in June, slower than the 1 percent decline seen in May. Inflation has remained negative for the sixth consecutive month in June.

Month-on-month, consumer prices moved up 0.5 percent, the same pace of decrease as seen in May.

The harmonized index of consumer prices decreased 0.9 percent annually, following a 1.1 percent drop in May. Prices have been falling since August 2015.

On a monthly basis, consumer prices gained 0.4 percent.

The statistical office confirmed CPI and HICP figures released on June 29.

-

09:49

China June yuan-denominated exports up 1.3 pct y/y, imports down 2.3 pct - Reuters

China's yuan-denominated exports rose modestly from a year ago in June while imports fell slightly, data showed Wednesday. Exports rose 1.3 percent from a year ago while imports declined 2.3 percent, according to Reuters, which cited customs data. China's yuan-denominated exports had risen 1.2 percent on-year in May, while imports had climbed 5.1 percent, figures showed last month. Dollar-denominated trade figures are expected shortly.

-

09:47

Major stock exchanges trading mixed: DAX 9,946.77-17.30-0.17%, FTSE 100 6,662.92-19.94-0.30%, CAC 40 4,333.27 + 1.89 + 0.04%

-

09:33

China: Trade Balance, bln, June 46.56 (forecast 46.64)

-

09:26

Today’s events:

At 08:30 GMT, Britain will publish a report on lending conditions

At 09:30 GMT Germany will hold an auction of 10-year bonds

At 10:00 GMT FOMC members Patrick T. Harker will deliver a speech

At 14:00 GMT Bank of Canada publish the report on monetary policy for the 3rd quarter, the Bank of Canada decision on the basic interest rate and the accompanying statement.

At 15:15 GMT Press conference of Bank of Canada

At 17:01 GMT the United States will hold an auction for 30-year bonds

At 18:00 GMT Economic Review Federal Reserve "Beige Book"

-

09:15

WSE: After opening

The first transactions on future market and changes in the prices of futures on European indices stand under the sign of the lack of large deviations. The market reached peaks of reflection, which appeared after the British referendum and which is a technical resistance. Growing turnover on the approach of the last days may suggest that bigger capital plays under closing of the Brexit gap with which have long ago coped markets in Euroland and emerging markets too.

WIG20 index opened at 1747.31 points (-0.40%)*

WIG 45160.39 0.04%

WIG30 1970.86 -0.01%

mWIG40 3444.38 0.37%

*/ - change to previous close

UniCredit sold 26.2 million shares of Bank Pekao (WSE:PEO) in an accelerated book-building process at a price of PLN 126 per share, for a total amount of Euro 749 mln. Today in the morning values of Pekao are losing more than 4%. The turnover on the PEO is now PLN 55 mln, for the whole WIG20 index is PLN 62 mln.

-

08:57

French CPI below forecasts - Insee

In June 2016, the Consumer Prices Index (CPI) rose by 0.1% over a month after +0.4% in May. Seasonally adjusted, it increased also by 0.1%. Year-on-year, the CPI increased by 0.2%, after a stability in May 2016.

This month-on-month increase in June came mainly from the strengthening of petroleum product prices for the fourth month in a row, and from the seasonal rebound in prices of some services at the edge of summer. It was partly offset by the seasonal decline in fresh food and manufactured product prices, with the beginning of summer sales.

In June 2016, energy prices rose as strongly as in the previous month (+2.2%). Year-on-year, they declined by 3.1% (-5.7% in the previous month). The increase over the month was due to petroleum product prices which were still up sharply (+4.0% after + 4.1% in May; -6.1% year-on-year), as a result of the recovery of crude oil prices since the beginning of the year. In detail, the heat fuel prices continued to rise at a fast pace (+5.9% % in June after +8.5%; -11.2% year-on-year). In comparison, the motor fuel price increases were more limited: diesel increased by 4.7% in June (after +4.4% in May; -4.7% year-on-year) and gasoline by 2.6% (after +2.4%; -6.2% year-on-year). Moreover, gas prices were stable in June (-10.0% year-on-year), like electricity fares (+4.1% year-on-year).

-

08:33

WSE: Before opening

Tuesday's session on Wall Street ended with joint increases in the major indexes, it was a day of new records for the the DJIA and S&P500 indices. By sectors, best handle the fuel industry. The focus is earnings season in the US, which launched this week. Better-than-expected report was aluminum producer Alcoa, which the company published on Monday. Later in the week its quarterly reports publish among large US banks: JP Morgan on Thursday, on Friday Wells Fargo and Citigroup.

Positive market sentiment will help for price of crude oil. Brent price rose during the session by more than 2.5 percent and reached the level of $ 47.5. Earlier this week, oil prices fell to the lowest level in two months.

From the point of view of European markets closing of trading in the US will not be a surprise. No surprises sessions makes the US less inspiring, although new records of all time have a broader meaning, which may not be ignored and that raises questions about the medium-term consequences of increases of the first two sessions of the week.

Looking at the Warsaw market, the situation is somewhat more complicated. The environment of low interest rates in the US and around the world favors shares in emerging markets, but the ever-present question is, what are the consequences for the economies of Europe will Brexit have. There are also important factors in Poland about the form of changes in the pension system, which short-term effects are dangerous for the Warsaw Stock Exchange and the medium give hope to the output of the Warsaw market out of the shadows depending on the appetites of politicians for the funds accumulated in the pension funds.

-

08:33

Options levels on wednesday, July 13, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1258 (3016)

$1.1226 (1513)

$1.1177 (1650)

Price at time of writing this review: $1.1063

Support levels (open interest**, contracts):

$1.0996 (2964)

$1.0938 (3148)

$1.0865 (7061)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 30234 contracts, with the maximum number of contracts with strike price $1,1200 (3016);

- Overall open interest on the PUT options with the expiration date August, 5 is 45143 contracts, with the maximum number of contracts with strike price $1,0900 (7061);

- The ratio of PUT/CALL was 1.49 versus 1.53 from the previous trading day according to data from July, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.3607 (1163)

$1.3510 (888)

$1.3414 (1888)

Price at time of writing this review: $1.3284

Support levels (open interest**, contracts):

$1.3184 (228)

$1.3088 (178)

$1.2991 (690)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 20814 contracts, with the maximum number of contracts with strike price $1,3400 (1888);

- Overall open interest on the PUT options with the expiration date August, 5 is 18315 contracts, with the maximum number of contracts with strike price $1,2950 (2440);

- The ratio of PUT/CALL was 0.88 versus 0.98 from the previous trading day according to data from July, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:32

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,4%, FTSE 100 -0,4%, CAC 40 -0.4%

-

08:29

Asian session review: dollar depreciates against the yen

The US dollar fell against the yen during the Asian session, as investors took profits after recent gains. In addition, Suga said that the government plans to carry out large-scale stimulus measures in order to overcome deflation and that the BOJ will decide what measures of monetary policy are appropriate. Prime Minister Shinzo Abe plans to lower GDP growth forecast for the fiscal year ending March 2017 to 0.9% from 1.7%. The previous forecast was published in January. Abe Administration is likely to present a forecast assuming GDP growth next year at 1.2%.

According to final data released today by the Ministry of Economy, Trade and Industry of Japan, industrial production fell by 2.6% after a decline recorded in April to -2.3% in May. The annualized figure also shows a decline from 0.1% in April to -0.4% in May

Industrial production - an indicator that reflects the volume of production plants, factories and mining companies of Japan has attracted attention because it is the main indicator of the strength and health of the manufacturing sector. Japanese Ministry of Economy, Trade and Industry also reported that capacity utilization decreased by 2.4% in May after declining in April at -0.1%.

The euro is trading almost unchanged against the dollar, although the market is dominated by the desire of investors to take risks. The US dollar has stopped falling against other major currencies, as investors continue to focus on the upcoming meetings of the central bank on a background of high expectations of additional stimulus.

Investors expect the Bank of England, Bank of Japan and European Central Bank to announce new stimulus measures in the coming months. They intend to support growth and protect its economy from the effects of Brexit.

Market participants also believe that Brexit makes it unlikely that the Fed will tighten policy this year.

Federal Reserve Bank of Cleveland President Loretta Mester said that the results of the referendum in the UK have increased the uncertainty of the economic outlook. At the same time, she said, he US central bank have the opportunity to quietly take a decision on the future of interest rates.

The Canadian dollar during the session, cheaper after yesterday's growth, which contributed to the rise in oil prices. Oil has risen after the publication of forecasts of a stronger-than-expected reduction in oil production this year. Oil prices on the NYMEX rose about 4.5%, to $ 46.77 a barrel.

Investors are awaiting the outcome of today's meeting of the Bank of Canada's interest rate and publish a quarterly report on monetary policy, which will be published after the meeting.

Economists expect the central bank will leave rates unchanged at 0.5%. However, the market will be closely watching the performance of the Bank of Canada Stephen Poloz, special attention will be paid to the forecast for Canadian GDP this year after a slowdown in economic growth in the 2nd quarter.

-

08:20

GBP offers good levels to add to shorts - Citi

GBP: All eyes on the Bank of England Thursday where consensus looks for a cut, with most seeing it at 25bp. Squeeze offers good levels for adding shorts.

EUR: Investors expecting a market friendly response to recent turmoil in Italian banks (i.e. state bailout). Otherwise, anticipation of next week's ECB likely to dominate given absence of meaningful data. We prefer the short side in EUR-X's

AUD: Employment figures watched Thursday, but most likely to simply reinforce strong trend. We continue to see AUD as well placed vs. NZD and CAD.

-

08:16

Food prices in New Zealand added 0.4% in June

Food prices in New Zealand added 0.4 percent on month in June, Statistics New Zealand said on Wednesday - after sliding 0.5 percent in May.

Fruit and vegetable prices rose 4.2 percent on month, while meat, poultry, and fish prices fell 0.2 percent with lower prices for lamb.

Vegetable prices rose 8.4 percent in June, led by seasonally higher prices for cucumbers, capsicums, and lettuce.

Grocery food prices fell 0.7 percent, with lower prices for milk, cheese, and eggs.

On a yearly basis, food prices fell 0.5 percent after slipping 0.3 percent in the previous month.

Compared with June 2015, cheese prices were down 9.5 percent, fresh milk was down 3.9 percent, and yoghurt was down 9.2 percent.

"The average price of a kilo of cheddar cheese was $7.68 in June 2016, down from $9.12 in June 2015. This was the lowest price since September 2007," consumer prices manager Matt Haigh said.

Meat, poultry, and fish prices decreased 0.9 percent in the year. Lower prices for chicken (down 5.3 percent), processed meat (down 2.9 percent), and lamb (down 5.2 percent) were partly offset by higher prices for beef (up 4.3 percent).

Fruit and vegetable prices increased 2.0 percent over the year, with continued record high prices for avocados (up 146 percent), partly offset by lower prices for tomatoes (down 20 percent).

-

08:13

Japan's industrial production decreased more than estimated in May

Japan's industrial production decreased more than initially estimated in May, final data published by the Ministry of Economy, Trade and Industry showed Wednesday.

Industrial production fell a seasonally adjusted 2.6 percent monthly in May instead of a 2.3 percent drop reported earlier.

It was the first decline in three months. In April, production had risen 0.5 percent.

Shipments dipped 2.6 percent over the month, revised from a 2.3 percent fall in the flash report. At the same time, inventories rose 0.4 percent in May compared to a 0.3 percent gain previously reported.

On an annual basis, industrial production decreased 0.4 percent in May, which was corrected from a 0.1 percent slight drop reported initially.

The capacity utilization contracted at faster pace of 2.4 percent month-on-month in May, following a 1.0 percent decline in April. It was the second consecutive monthly fall.

-

08:12

Australia Consumer Confidence lower In July - Westpac

Consumer confidence in Australia took a hit in July, the latest survey from Westpac Bank and the Melbourne Institute revealed on Wednesday, sliding 3.0 percent to a reading of 99.1.

That follows the 1.0 percent in June to 102.2.

Analysts actually expected a bigger decline after the United Kingdom voted to leave the European Union, setting the stage for a modest recovery next month.

-

07:13

Global Stocks

European stocks scored a fourth consecutive win Tuesday, with investors hanging onto brighter prospects for further global stimulus efforts as the markets headed into a new earnings season.

The Stoxx Europe 600 SXXP, +1.06% rose 1.1% to close at 336.26, ending at the highest level since June 23rd, the day of the U.K.'s Brexit vote.

Meanwhile, investors are looking at the potential for an interest-rate cut by the Bank of England when it meets on Thursday. Mark Carney, Bank of England chief, was testifying at a Treasury committee to discuss the central bank's financial stability report.

The Dow Jones Industrial Average finished at a record on Tuesday, joining the S&P 500 index at an all-time closing high as a rally in oil prices and stronger-than-expected earnings from Alcoa Inc. AA, +5.42% vaulted stocks to new heights. The record for the the blue-chip benchmark comes a day after the S&P 500 index SPX, +0.70% set an all-time closing high. The Dow DJIA, +0.66% added 120.74 points, or 0.7%, to 18,347.67, ending at a record for the first time in nearly 14 months. The blue-chip index set an intraday high at 18,371.95. The S&P 500 SPX, +0.70% climbed 14.98 points, or 0.7%, to 2,152.14, a few points off its all-time intraday high of 2,155.49. The Nasdaq Composite COMP, +0.69% advanced 34.18 points, or 0.7% to 5,022.82, erasing its losses in 2016.

Asian shares came within reach of testing their 2016 peak on Wednesday as prospects of solid U.S. growth and accommodative economic policy in major markets whet investors' risk appetite damaged by uncertainty from Brexit.

Japan's Nikkei .N225 gained 1 percent. Australian stocks added 0.3 percent and South Korea's Kospi .KS11 rose 0.6 percent. New Zealand shares .NZ50 were little changed, hovering near a record high struck Tuesday. Shanghai .SSEC advanced 0.3 percent.

-

06:39

Japan: Industrial Production (YoY), May -0.4%

-

06:38

Japan: Industrial Production (MoM) , May -2.6%

-

04:06

Nikkei 225 16,316.52 +220.87 +1.37 %, Hang Seng 21,363 +138.26 +0.65 %, Shanghai Composite 3,059.85 +10.47 +0.34 %

-

02:31

Australia: Westpac Consumer Confidence, July -3%

-

00:31

Commodities. Daily history for Jul 12’2016:

(raw materials / closing price /% change)

Oil 46.62 -0.38%

Gold 1,333.70 -0.12%

-

00:31

Stocks. Daily history for Jun Jul 12’2016:

(index / closing price / change items /% change)

Nikkei 225 16,095.65 +386.83 +2.46 %

Hang Seng 21,224.74 +344.24 +1.65 %

S&P/ASX 200 5,353.22 +16.11 +0.30 %

Shanghai Composite 3,049.68 +54.76 +1.83 %

FTSE 100 6,680.69 -2.17 -0.03 %

CAC 40 4,331.38 +66.85 +1.57 %

Xetra DAX 9,964.07 +130.66 +1.33 %

S&P 500 2,152.14 +14.98 +0.70 %

NASDAQ Composite 5,022.82 +34.18 +0.69 %

Dow Jones 18,347.67 +120.74 +0.66 %

-

00:30

Currencies. Daily history for Jul 12’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1063 +0,03%

GBP/USD $1,3247 +1,92%

USD/CHF Chf0,9885 +0,60%

USD/JPY Y104,75 +1,90%

EUR/JPY Y115,90 +1,94%

GBP/JPY Y138,79 +3,82%

AUD/USD $0,7618 +1,14%

NZD/USD $0,7293 +1,03%

USD/CAD C$1,3035 -0,60%

-