Noticias del mercado

-

17:46

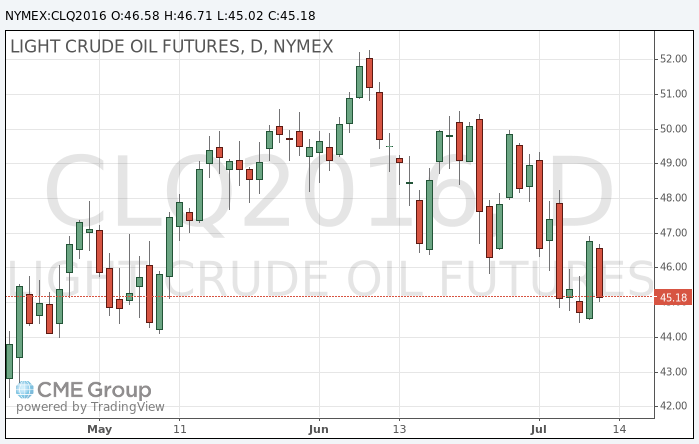

Oil quotes continue to fall after inventory data

Oil prices fell more strongly after the US Department of Energy reported a decrease in oil reserves and a strong increase in stocks of petroleum products, including gasoline and diesel fuel. Oil production in all US states except Alaska and Hawaii declined slightly, but this decline was offset by an increase in oil production in Alaska.

In the week of July 2-8 fell stocks of gasoline and other petroleum products rose unexpectedly..In the weekly department report oil inventories fell by 2.5 million barrels to 521.8 million barrels, but remained at a very high level by historical standards for a given period of the year. The average forecast of analysts anticipated a decline in stocks by 3.3 million barrels.

Oil reserves in the terminal Cushing (Oklahoma), which supply of oil traded on NYMEX, fell by 232,000 barrels to 63.9 million barrels.

Gasoline stocks rose by 1.2 million barrels to 240.1 million barrels. Analysts had expected gasoline stocks to fall 900,000 barrels.

Distillate stocks rose by 4.1 million barrels barrels to 153 million barrels. This rate is still above the upper limit of the average range for this time of the year. Analysts expected distillate stocks compared to last week will not change.

The utilization of refining capacity fell by 0.2 percentage points to 92.3%. Analysts suggested that the figure will rise by 0.5 percentage points.

Earlier, oil fell after the International Energy Agency (IEA) warned that oversupply on world markets threatens to price recovery.

IEA, coordinating energy policies in industrialized countries, reported that stockpiles continued to rise in June, bringing the oil in floating storage to a high of over 7 years.

Despite the pessimistic outlook of rising oil prices, the IEA raised its forecast of demand for black gold in 2016 and 2017 0.1 million barrels per day to 1.4 and 1.3 million barrels per day, respectively.

Credit Suisse on Wednesday raised its forecasts of an average cost of WTI crude oil in 2016 and 2017 to $ 43.59 and $ 55.00 per barrel, respectively, $ 36.91 and $ 52.88 per barrel.

Forecasts of the average cost of Brent crude oil in 2016 and 2017 have been revised upward to $ 44.53 to $ 37.77 per barrel in 2016 and $ 56.25 to $ 54.25 per barrel in 2017.

The cost of the August futures for US light crude oil WTI fell to 44.84 dollars per barrel.

September futures price for Brent fell to 46.17 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:24

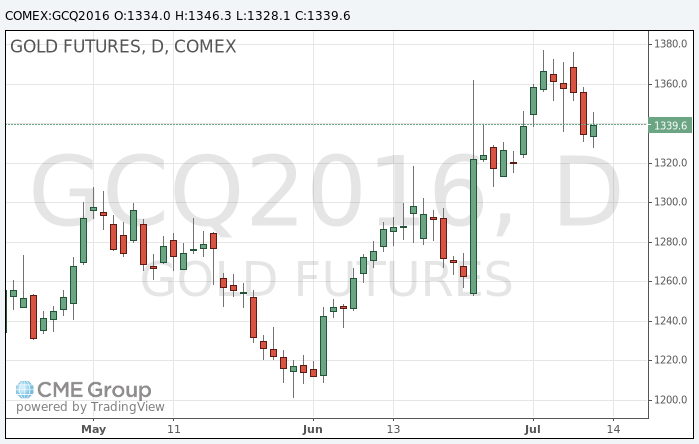

Gold price moderate increase

Gold rises in price during today's trading, recovering from a low of nearly two weeks as prospects for further economic stimulation led to an increase in investor' activity on the background of a stable dollar.

Easing monetary policy is beneficial to gold and shares, because low interest rates encourage investors to opt for assets that do not depend on interest income.

"The price of gold may continue to receive support from the uncertain prospects for the UK and Europe after the vote for Brexit, as well as from any of quantitative easing, which also means lower interest rates", - said an analyst at Natixis Bernard Dada.

Gold has risen in price by about $ 100 per ounce after the United Kingdom voted in favor of withdrawal from the European Union, and investors were quick to shift money into safer assets.

Asian and European stocks on Wednesday very close to the year highs, and the dollar has not changed against a basket of six currencies.

But, in spite of the data on jobs, the Fed will not rush to raise interest rates, said two of its officials.

The assets of the world's largest gold exchange-traded fund (ETF) SPDR Gold Trust on Tuesday fell by 1.63 percent to 965.22 tons, this is the strongest one-day drop since 2 December.

The cost of the August gold futures on the COMEX rose to $ 1346.3 per ounce.

-

16:49

Crude oil supplies fell by a less-than-expected 2.5 million barrels

According to marketwatch, oil futures extended their earlier losses Wednesday after the U.S. Energy Information Administration reported that domestic crude supplies fell by a less-than-expected 2.5 million barrels for the week ended July 8. The American Petroleum Institute late Tuesday had reported a 2.2 million-barrel climb, according to sources, while analysts polled by S&P Global Platts expected a decline of 3.25 million barrels. Gasoline supplies rose 1.2 million barrels, while distillate stockpiles jumped by 4.1 million barrels last week, according to the EIA. August crude CLQ6, -2.33% fell 92 cents, or 2%, from Tuesday's settlement to $45.88 a barrel on the New York Mercantile Exchange. Prices traded at $46.25 before the data.

-

10:59

Oil is trading lower

This morning, New York crude oil futures for WTI fell by -1.18% to $ 46.25 per barrel. At the same time, Brent crude oil futures fell -1.42% to $ 47.76 per barrel. Thus, the black gold is lower on the API data output background. US crude oil inventories last week rose by 2.2 million barrels - up to 523.1 million barrels, while analysts had expected an increase of 3 million barrels.. Official data on the level of oil inventories in the US will be published later. The price was also influenced by the strengthening of the dollar and the desire of some market participants to lock in profits after the rally on Tuesday became the strongest since the beginning of April.

-

10:33

IEA: 2017 oil demand rising by a further 1.3m bpd due to India, China

- stocks close to topping out but are at such elevated levels that they remain a major dampener on prices.

- OECD commercial inventories built in May and June to a new record high, floating storage is at highest level since 2009.

- European oil demand has surprised on the upside but is unlikely to last due to Brexit uncertainty.

- IEA raises estimate of 2016 global oil demand growth by 0.1m bpd from last month's report to 1.4m bpd.

- 2017 oil demand rising by a further 1.3m bpd due to India, China.

- very high oil stocks present a threat to price stability despite oil market balancing underway.

-

00:31

Commodities. Daily history for Jul 12’2016:

(raw materials / closing price /% change)

Oil 46.62 -0.38%

Gold 1,333.70 -0.12%

-