Noticias del mercado

-

23:59

Schedule for today, Tuesday, Jul 12’2016:

(time / country / index / period / previous value / forecast)

06:00 Germany CPI, m/m (Finally) June 0.3% 0.1%

06:00 Germany CPI, y/y (Finally) June 0.1% 0.3%

14:00 U.S. JOLTs Job Openings May 5.788

14:00 U.S. Wholesale Inventories May 0.6% 0.1%

-

17:35

Nintendo earned $7.5 bln in two days after Pokemon Go was released

According to reuters the shares of Japan's Nintendo Co Ltd soared again on Monday, bringing market-value gains to $7.5 billion in just two days as investors cheered the runaway success of Pokemon GO - its first long-awaited venture in mobile gaming.

The game, which marries a classic 20-year old franchise with augmented reality, allows players to walk around real-life neighborhoods while seeking virtual Pokemon game characters on their smartphone screens - a scavenger hunt that has earned enthusiastic early reviews.

In the United States, by July 8 - two days after its release - it was installed on more than 5 percent of Android devices in the country, according to web analytics firm SimilarWeb.

It is now on more Android phones than dating app Tinder and its rate of daily active users was neck and neck with social network Twitter, the analytics firm said. The game is also being played an average of 43 minutes a day, more time spent than on WhatsApp or Instagram, it added.

-

17:19

Fed spokesman George: The US economy was "stable"

- the June employment data was "welcome news".

- expects to see "a fairly steady growth".

- consumer spending is strong, but the weak investment.

-Investment holding up outside of manufacturing and energy.

- the labor market has grown at a remarkable pace.

- the economy is close to full employment.

- the labor market recovery is not equally reflected amoung workers.

- rates are too low given progress in economy.

-

16:56

French Finance Minister: Portugal does not deserve sanctions because of the budget deficit

"Portugal has made significant progress in dealing with the budget deficit reduction and therefore does not deserve EU sanctions on public finances", - French Finance Minister Michel Sapin said. "The European Commission has the right to initiate disciplinary proceedings, but I do not see the need for the conduct of sanctions against Portugal.", - Said Sapin at a press conference.

Recall, on Thursday, the European Commission launched formal disciplinary proceedings against Spain and Portugal due to their excessive deficits in 2014 and 2015. These procedures may result in fines for the two countries before the end of July. Such sanctions have never been used, and it remains unclear whether they will be applied at this time. The EU Council will decide on the recommendations of the Commission at its next meeting on July 12th.

-

16:19

ECB bought €16.10bn (€9.73bn previous) in QE

-

16:17

Eurogoup head Dijsselbloem: There will be no big solutions for Italian banks

-

Italian bank problems are not an acute crisis.

-

EU has clear rules on aiding banks and there's a limited role for the Eurogroup.

-

Brexit will have consequences for the European economy.

-

It is important Spain and Portugal take budget action.

-

-

16:01

U.S.: Labor Market Conditions Index, June -1.9

-

15:49

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1000 (EUR 627m) 1.1075 (369m) 1.1100 (903m) 1.1150 (538m)

USDJPY 101.15 (USD 361m) 101.50 (200m) 102.00 (594m)

AUDUSD 0.7500 (AUD 628m) 0.7515 (509m) 0.7550 (280m) 0.7575 (323m)

USDCAD 1.3100 (USD 320m)

-

15:32

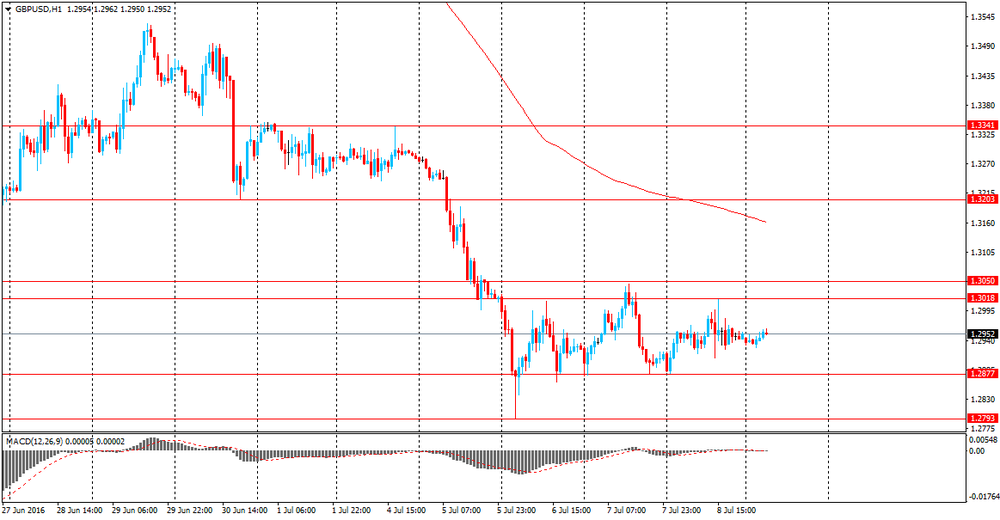

GBP weakness - Credit Suisse

"In the week that has followed, the rate of decline in both pairs puts us well on course to meet these targets.

In the case of GBP, BoE Chief Carney has gone out of his way to both warn of the bleak outlook for the UK economy and to assure markets that the central bank will do everything possible to counteract this with liquidity injections and fresh easing measures. The market has also taken a clear message that a weaker GBP will be a welcome addition to the list of ameliorative tools available. Indeed, with the UK political establishment in disarray and the wider public mood one of bitterness and recrimination, one of the few sources of agreement seems to be the idea that a weaker GBP is helpful at this time.

We will not go over once again our underlying reasons for GBP weakness based on fundamentals and balance of payments. Rather, we will emphasize that the monetary policy and political environment that is materializing is supportive of our view.

Importantly, "wishful thinking" ideas popular last week focusing on the possibility of a second referendum or Article 50 never being triggered have taken a back seat given the consistent commentary from leading figures in the ruling Conservative Party arguing in favor of pushing on and implementing the referendum outcome.

Also hurting GBP has been more direct pain in the form of the gating of a number of commercial property funds. As well as highlighting the worrying possibility of both a property price shock and stretched investor positions in the sector, we note concerns about the exposures of the UK and European banking systems".

-

14:35

Canadian housing starts increased in June

The standalone monthly SAAR for all areas in Canada was 218,333 units in June, up from 186,709 units in May. The SAAR of urban starts increased by 18.1 per cent in June to 202,702 units. Multiple urban starts increased by 26.7 per cent to 142,819 units in June and the single-detached urban starts increased by 1.7 per cent to 59,883 units.

In June, the seasonally adjusted annual rate of urban starts increased in British Columbia, Ontario, and in the Prairies, but decreased in Atlantic Canada, and Québec.

Rural starts were estimated at a seasonally adjusted annual rate of 15,631 units.

"Overall, June saw housing starts pick up pace in Canada, bolstered by apartment construction in Ontario - especially new condo construction in Toronto's downtown core," said Bob Dugan, CMHC Chief Economist. "However, elsewhere in the country, construction activity slowed as apartment construction eased in Quebec. Housing starts are also trending down in Alberta as a result of high inventories in the new and existing home markets of that province."

-

14:27

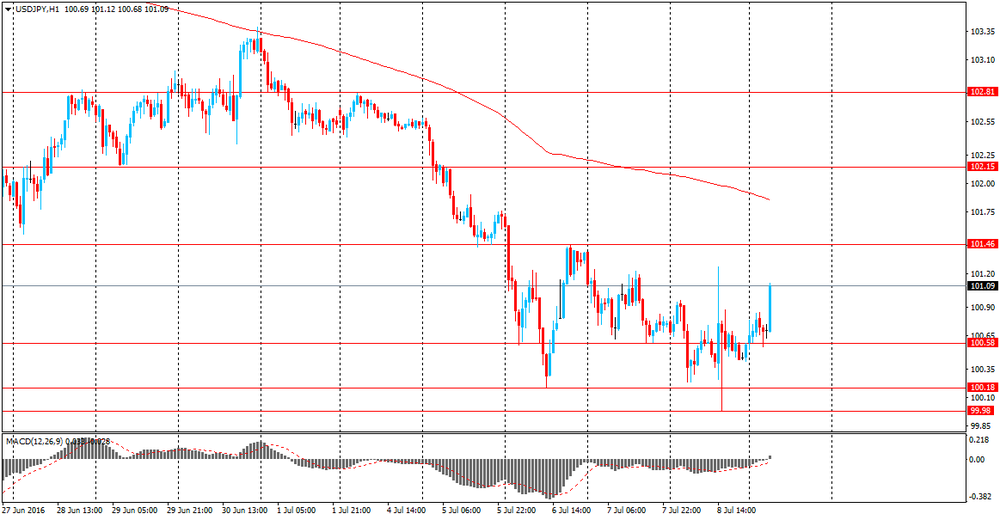

European session review: Yen declined substantially amid expectations of new economic stimulus measures

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Japan Change in orders for equipment (preliminary data), y / y -24.7% -19.9%

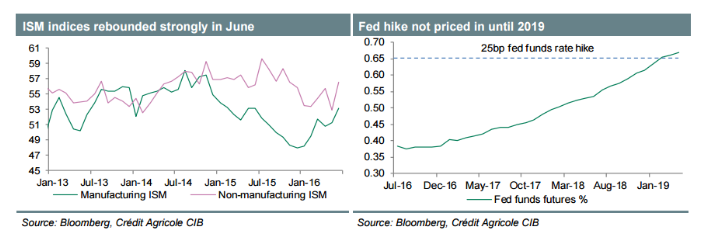

The dollar weakened slightly against the euro, returning to session lows. Nevertheless, the overall demand for the US currency remained elevated after the publication of strong US labor market data on friday. Recall, the number of people employed in non-agricultural sectors increased by 287 000 (maximum increase since October 2015). The data for May was revised down to 11 000 to 38 000. The unemployment rate rose 0.2% to 4.9%. Economists had forecast employment growth of 175,000 and an increase in unemployment to 4.8%. The level of participation in the labor force increased by 0.1% to 62.7%. Meanwhile, the average hourly wage increased by only 2 cents, or 0.1%. Experts point out that recent data have convinced investors the stability of world's largest economy, despite the fact that the Fed will not raise rates in the near future. Now the interest rate futures on the Fed indicate 23 percent chance of rate hike in December.

The British pound recovered approaching 8 July high. Support was provided by some media that claims Andrea Leeds will make a statement about the withdrawal from the race. After the referendum, the head of the Bank of England Carney said that to support the economy will probably require an easing of monetary policy during the summer. Thus, Carney signaled that the Central Bank may lower interest rates. He added that the Bank of England has a number of other tools to protect the economy and banking system, which may indicate a resumption of the bond purchase program. After the unexpected results of the referendum, analysts expect a prolonged period of uncertainty and volatility. However, many predict a recession, increasing inflation. Most likely, the Central Bank may consider a rate cut to 0.25% an adequate measure, and so leaving room for further policy easing. Tomorow we can find which one are more likely.

The yen fell about 200 pips against the US dollar, reaching 5 July low. The reason for such dynamics are reports that the Japanese government is preparing to take measures to stimulate the economy. Today, Japanese Prime Minister Shinzo Abe said that on July 12, he intends to instruct the Minister to prepare a comprehensive economic revival of economic measures to remedy the situation. The need for measures to stimulate the Japanese economy has been discussed for a long time, but all were waiting for the upper house election results, which took place this Sunday.

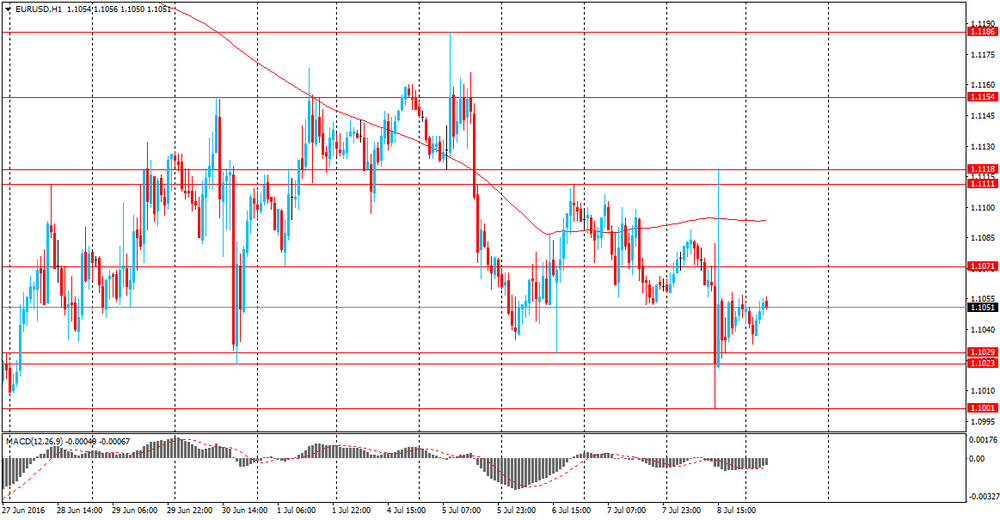

EUR / USD: during the European session, the pair fell to $ 1.1014, but then was bid to $ 1.1060.

GBP / USD: during the European session the pair fell to $ 1.2849 and then rebounded to $ 1.3017.

USD / JPY: during the European session, the pair rose to Y102.47.

-

14:14

Canada: Housing Starts, June 218.3

-

13:45

Orders

EUR/USD

Offers 1.1055-60 1.1085 1.1100 1.1120-25 1.1150 1.1170 1.1185 1.1200

Bids 1.1000 1.0975-80 1.0950 1.0930 1.0900 1.0885 1.0850

GBP/USD

Offers 1.2985 1.3000 1.3020 1.3035-40 1.3060 1.3075 1.3100 1.3130 1.3150

Bids 1.2900 1.2875-80 1.2855 1.2835 1.2800 1.2750 1.2700

EUR/GBP

Offers 0.8550 0.8585 0.8600 0.8620-25 0.8650 0.8700-05 0.8760

Bids 0.8500-10 0.8485 0.8470 0.8450 0.8400 0.8385 0.8350

EUR/JPY

Offers 112.20 112.50 112.80 113.00 113.30 113.50 113.80 114.00

Bids 111.80 111.50 111.20 111.00 110.80 110.50 110.00 109.50

USD/JPY

Offers 101.75-80 102.00 102.20 102.50 102.80-85 103.00

Bids 101.20 101.00 100.85 1100.50 100.25-30 100.00 99.85 99.50

AUD/USD

Offers 0.7585 0.7600 0.7650 0.7670 0.7700 0.7720 0.7750-55

Bids 0.7540 0.7520 0.7500 0.7480 0.7450-55 0.7425 0.7400

-

13:38

UK: Andrea Leadsom has just announced her withdrawal from the PM race. Gbp/Usd up 150 pips

- Theresa May may be best placed to negotiate Brexit talks.

- I do not believe I have sufficient support to lead a strong and stable govt.

-

12:20

Osborne will try to convince US investors to stay with Britain

British Finance Minister George Osborne said that today will meet with some of the largest Wall Street investors to persuade them to continue investing in Britain, despite the recent results of the referendum.

The pound collapsed to 31-year low against the dollar and now many investors warn that Britain, which until then was the fifth-largest economy in the world, is faced with the uncertainty of long-term trade investment.

"We now have to do everything that we can so that UK is the most attractive place in the world to do business," - said Osborne. - Stronger relationships with our trading partners are currently the top priority. We will continue to be a beacon for free trade, democracy and security. "

Osborne also said that he would like to strengthen trade ties with the United States, Canada and Mexico. At a meeting with Osbourne last week, five US investment banks have promised that they will try to help London retain its first place as an international financial center. However, one of the banks at the meeting warned that the uncertainty regarding the future trade relations with the EU complicate further investment.

Osborne's visit to New York will be the first of a series of trade missions in the world's key financial and political centers, including Singapore and China later this month. Later this week he will also need to meet with US Treasury Secretary Jack Lew in London and will hold talks with the finance ministers of other EU member states in Brussels.

-

12:13

UK PM Cameron: UK facing massive productivity challenge

-

we must recognize we are now in a new reality and we must make it work.

-

must focus on trade and investment like never before.

-

only 11% of UK companies actually export.

-

only 5% of what the UK produces goes to fast growing markets like China.

-

-

12:02

Bank of France: GDP grew 0.2% in Q2

The research results published by the Bank of France showed that the country's economy probably expanded by a weaker pace in the second quarter. Gross domestic product is expected to have risen 0.2 percent in the 2nd quarter, which corresponds to the previous forecast.

In addition, data showed that business sentiment indicator in the manufacturing sector remained unchanged in June at 97 points. Business leaders said they expect a slight increase in activity in July. At the same time, the indicator of confidence in the services sector fell to 97 points from 98 points a month earlier. In construction the business confidence index remained unchanged - at the level of 97 points. Construction activity declined in June, but is forecast to improve slightly in July.

-

11:12

Review of financial and economic press: German expert fear the reduction in sales of electric vehicles

D/W

German experts fear the reduction of sales of electric vehicles

Sales of electric vehicles may be reduced due to the incorrect information on the cruising range of manufacturers of such machines. The actual mileage of these vehicles are often 20-40 percent less than the manufacturers claimed.

Chief Economist of Deutsche Bank, David Folkerts-Landau required to allocate € 150 billion to support the European banking system. In an interview with the newspaper "Welt am Sonntag", he said that financial institutions in Europe are in need of recapitalization. According to him, in 2008 the United States presented a plan of improvement of the banking sector worth hundreds of billions of dollars.

Prime Minister of Australia declared victory in parliamentary elections

More than a week after the parliamentary elections Prime Minister Malcolm declared himself the winner. Earlier, the opposition Labour Party admitted defeat, despite the fact that the final election results are not yet announced.

Newspaper. ru

G20 Ministers adopted a strategy of growth in world trade

G20 Trade Ministers adopted a strategy for world trade growth in order to achieve the goal of increasing world's GDP by an additional 2%.

Obama said the need to avoid damage to the economy from Brexit

US President Barack Obama said that is needed to reduce the damage to the global economy, reports Reuters. "It is important that none of the parties tightened position to such an extent that it caused damage to the global economy, which in some places is still pretty shaky," - he said.

The number of drilling rigs in the United States was the highest for the year

In the United States the number of drilling in the shale deposits continue to grow, which is the highest level since the summer of last year, reports Bloomberg referring to Baker Hughes Inc.

The head of US Treasury will visit EU capitals to discuss Brexit

US Treasury Secretary Jack Lew will visit Paris, London, Brussels and Berlin, to hold meetings on the economic impact of Brexit. This was reported on the official website of the US Treasury.

-

10:46

Oil down moderatly so far

This morning, New York crude oil futures for WTI fell 0.66% to $ 45.11 per barrel. At the same time, Brent oil futures were down 0.56% to $ 46.50 per barrel. Thus, the black gold is decreases, against the background of slowing fuel demand in the Asian market, and weekly data on the number of drilling rigs in the United States. Baker Hugers reported an increase in the number of workers in the United States oil rigs. The total number of the world's working drilling also increased in June compared to May. Iran has also lowered its oil prices in the Asian market as compared to the previous month due to lower demand from refineries in the region.

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 627m) 1.1075 (369m) 1.1100 (903m) 1.1150 (538m)

USD/JPY 101.15 (USD 361m) 101.50 (200m) 102.00 (594m)

AUD/USD 0.7500 (AUD 628m) 0.7515 (509m) 0.7550 (280m) 0.7575 (323m)

USD/CAD 1.3100 (USD 320m)

-

10:18

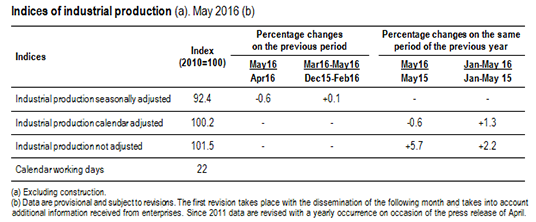

Italian industrial production down 0.6% in May

The index measures the monthly evolution of the volume of industrial production (excluding construction). With effect from January 2013 the indices are calculated with reference to the base year 2010 using the Ateco 2007 classification (Italian edition of Nace Rev. 2).

In May 2016 the seasonally adjusted industrial production index decreased by 0.6% compared with the previous month. The percentage change of the average of the last three months with respect to the previous three months was +0.1.

The calendar adjusted industrial production index decreased by 0.6% compared with May 2015 (calendar working days in May 2016 being 22 versus 20 days in May 2015); in the period January-May 2016 the percentage change was +1.3 compared with the same period of 2015.

The unadjusted industrial production index increased by 5.7% compared with May 2015.

-

09:25

UFC sold for $4 billion

According to lasvegasnow.com the Las Vegas-based UFC, a mixed-martial arts empire, has been sold for $4 billion; and this time, it's for real.

Stories about a possible sale have surfaced for the last two months, but each time the purported deals collapsed. However, this time, 8 News Now has learned, the papers were signed on Saturday.The price tag makes this the largest single deal in the history of sports, according to sources close to the situation.

Lorenzo and Frank Fertitta, the brothers who own 80% of UFC, originally purchased the sports network for $2 million. The Fertittas will retain a small percentage in the new ownership group.

The new owners include an alphabet-soup partnership of WME (William Morris Endeavor), the internationally known talent agency, IMG (International Management Group) a global sports and entertainment company based in New York, and MSD, a private equity group headed by Michael Dell. Also involved as a strategic partner is KKR, a global investment firm.

According to persons familiar with the deal, Lorenzo Fertitta will remain as chairman of UFC for 6-8 weeks during the transition but will step down after that. UFC president Dana White, who currently owns 9% of the organization, will continue in his role with UFC and will have a smaller ownership stake.

-

09:07

Today’s events:

At 14:00 GMT FOMC members Easter George will deliver a speech.

Also during the day the ECB president Mario Draghi will deliver a speech, ECB board member Benoit Coeure will deliver a speech and the Eurogroup meeting will start.

-

08:52

Asian session review: yen plummeted

The yen fell sharply after today's press conference in which Japanese Prime Minister Shinzo Abe said that Japan preparing to take measures to stimulate the economy. Abe said that on July 12, he intends to instruct the Minister of economic recovery to prepare comprehensive economic measures to remedy the situation.

"In order to secure the support of domestic demand we implement complex bold economic measures" - Abe said.

The need for measures to stimulate the Japanese economy has been discussed for a long time, but all were waiting for the results of upper house election of the Japanese parliament, which took place this Sunday. The ruling coalition headed by Shinzo Abe received two thirds of the seats, the same number they already have in the lower house.

To some extent the yen was influenced by the negative data on orders for products of Japanese engineering. In May, orders for engineering products decreased by 1.4% after falling by -11.0% in April, while analysts had expected an increase of 2.6%. In annual terms, the orders also declined from -2.8% in April to -11.7% in May.

Report on new orders, published by the Cabinet of Ministers of Japan, reflects the total amount of orders for engineering products, placed in large companies. This formal contracts concluded between consumers and producers, for the supply of goods and services. This report is considered the best leading indicator of capital spending in the area of enterprise and a decline indicates a deterioration in business confidence and, therefore, is a negative for the economy of Japan.

As noted in the report orders for engineering products continued to decline in June amid rising yen as well as consequences of the April earthquake.

Also, according to a preliminary report published by the National Association of Machine Tool Japan, orders for machinery and equipment fell on June 19.9%, after declining by -24.7% in May. This indicator points to reflect commercial and general economic conditions in Japan.

US dollar since the beginning of the session strengthened slightly against the Australian and New Zealand dollars. The US Labor Department reported on Friday that the number of people employed in non-agricultural sectors increased by 287,000, the largest increase since October last year. The data for May were revised down to 11 000 to 38 000. The unemployment rate rose by two tenths of a percentage point to 4.9 per cent, as more people entered the labor force. Economists had forecast employment growth of 175,000, while it was expected that the unemployment rate will rise to 4.8 percent. The level of participation in the labor force increased by 0.1 percent to 62.7 percent. Meanwhile, the average hourly wage increased by only 2 cents, or 0.1 percent in June. Experts note that the most recent data on the labor market proves that the economy will recover growth after a weak first quarter, but a slow wage growth is likely to force the Fed policy makers to be cautious on the issue of raising rates. Prior to the publication of the report the futures interest rate the Fed pointed to a 19 percent chance of a rate hike in December, but now the probability of such a step was increased to 26 percent.

On Sunday, China published data on inflation. As it became known, the consumer price index published by the National Bureau of Statistics of China, fell by -0.1% in June, after falling -0.5% in May. Analysts had expected a decline to -0.3%. In annual terms, the consumer price index in China was 1.9%, above expectations of 1.8%, but lower than the previous value of 2.0%.

CPI growth in June was the slowest since January this year.

Food prices were up by + 4.6% after rising 5.9% in May. The target rate of inflation is around 3% on an annualized basis.

Also, China's National Bureau of Statistics said the producer price index, which measures the rate of inflation for manufacturers, dropped by -2.6% in June, after declining 2.8% in May. Analysts had expected a decline to -2.5%.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1035-50 range.

GBP / USD: during the Asian session, the pair is trading in $ 1.1.2925-80 range.

USD / JPY: rose to 101.92 from 100.59.

-

08:30

The IMF has improved the outlook fo Russian GDP in 2016

The International Monetary Fund has again revised the economic outlook for Russia. This year's contraction of the Russian economy is ecpected at 1.2% of GDP, and in the future - an increase of 1.0%.

In April this year, the expected depth of the recession in Russia was estimated at 1.8% for 2016, and in May - 1.5%.

Current adjustments were made on the basis of the regular annual review of the Russian economy, conducted by specialists of the Fund in accordance with the statutory requirements of the organization. These results are discussed at the end of June in a meeting of the IMF Board of Directors.

Forecast for 2017 remains the same as in May.

The Russian authorities are even more optimistic. According to the official forecast of Ministry of Economic Development, a decline in GDP of 0.2% will be observed in 2016.

-

08:18

Bullish USD vs EUR - Credit Agricole

"We remain broadly bullish on the USD, as the dollar should benefit from both its traditional safe haven credentials as well as an attractive growth profile, at least by the low standards of many other G10 economies.

With most of the USD gains against the GBP already in place, we are shifting our focus towards potential USD outperformance versus the EUR, which faces significant EU political and banking sector headline risk, as well as the commodity-bloc currencies that are only starting to feel the negative global economic repercussions of Brexit.

The week ahead will be light in terms of US economic data until the June retail sales report on Friday".

-

08:12

Chinese inflation better than forecast

According to Bloomberg, the producer-price index in China fell 2.6 percent in June, compared with a 2.8 percent drop a month earlier, the National Bureau of Statistics said Sunday. The decline was the smallest since late 2014. The consumer-price index rose 1.9 percent from a year earlier, compared with a median economist estimate of 1.8 percent and a 2 percent gain in May.

Factory-gate deflation that has persisted since early 2012, and was at its worst late last year, has been easing amid a rebound in property sales and higher commodities prices. Economists surveyed by Bloomberg project producer prices will turn positive in 2018. That eases pressure on the People's Bank of China to provide more stimulus to fight deflation, according to Raymond Yeung, an economist at Australia & New Zealand Banking Group Ltd.

-

08:05

Mortgage loans in Australia declined in May

In May, the number of mortgage loans in Australia fell 1.0%, while analysts expected a 2.0% decline. April was revised from 1.7% to 1.4%.

Report on mortgages, published by the Australian Bureau of Statistics, traces the development trend in the housing market in Australia, and the level of consumer confidence, as large loans to purchase real estate is not taken into account. It is known that the decline is a negative factor for the Australian currency. Australian dollar slightly reacted to the publication of this index, though it remained under pressure from the start of trading.

Investment lending increased in May by 3.9% after a 4.3% decline in April. Previous value was also revised from -5.0%

Private loans have decreased 0.6% in May, after declining 0.2% in April.

-

08:00

Japan: Prelim Machine Tool Orders, y/y , -19.9%

-

07:59

Japan PM Abe to order new economic stimulus package - Nikkei. Gbp/Jpy up 130 pips so far

Nikkei reports that Japan PM Abe is set to order a new economic stimulus package on July 12, while considering additional JGB issuance. Headlines are crossing the screens via Bloomberg. The Japanese Yen has weakened across the board on the news.

-

07:05

Options levels on monday, July 11, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1258 (2764)

$1.1227 (1509)

$1.1175 (1642)

Price at time of writing this review: $1.1045

Support levels (open interest**, contracts):

$1.0978 (2939)

$1.0922 (2717)

$1.0852 (6386)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 29065 contracts, with the maximum number of contracts with strike price $1,1400 (2871);

- Overall open interest on the PUT options with the expiration date August, 5 is 41619 contracts, with the maximum number of contracts with strike price $1,0900 (6386);

- The ratio of PUT/CALL was 1.43 versus 1.88 from the previous trading day according to data from July, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.3210 (206)

$1.3113 (862)

$1.3018 (315)

Price at time of writing this review: $1.2955

Support levels (open interest**, contracts):

$1.2883 (519)

$1.2786 (1227)

$1.2690 (411)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 16561 contracts, with the maximum number of contracts with strike price $1,3400 (1220);

- Overall open interest on the PUT options with the expiration date August, 5 is 15239 contracts, with the maximum number of contracts with strike price $1,2950 (1943);

- The ratio of PUT/CALL was 0.92 versus 1.17 from the previous trading day according to data from July, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:31

Australia: Home Loans , May -1% (forecast -2%)

-

03:31

Australia: Home Loans , May -1.0% (forecast -2%)

-

03:31

Australia: Home Loans , May -1.0% (forecast -2%)

-

01:50

Japan: Core Machinery Orders, May -1.4% (forecast 2.6%)

-

01:50

Japan: Core Machinery Orders, y/y, May -11.7% (forecast -8.7%)

-

00:32

Currencies. Daily history for Jul 08’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1050 -0,10%

GBP/USD $1,2914 -0,08%

USD/CHF Chf0,983 +0,41%

USD/JPY Y100,57 -0,19%

EUR/JPY Y111,07 -0,34%

GBP/JPY Y130,26 +0,12%

AUD/USD $0,7568 +1,16%

NZD/USD $0,7303 +1,16%

USD/CAD C$1,341 +3,06%

-

00:00

Schedule for today, Monday, Jul 11’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans May 1.7% -2%

12:15 Canada Housing Starts June 188.6

14:00 U.S. Labor Market Conditions Index June -4.8

-